Falling towards pullback support?NZD/CAD is falling towards the support level, which is a pullback support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.80900

Why we like it:

There is a pullback support that aligns with the 38.2% Fibonacci retracement.

Stop loss: 0.80094

Why we like it:

There is a pullback support that aligns with the 61.8% Fibonacci retracement.

Take profit: 0.82344

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDCAD

NZDCAD Will Go Lower! Short!

Please, check our technical outlook for NZDCAD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.821.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.812 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

#NZDCAD: Bulls To Continue Dominating While CAD plummet Dear Traders,

NZDCAD has been bullish for the last few weeks and is currently at a critical level. This suggests the price could move towards 0.8500. However, price has experienced a few corrections since the bullish trend began. We believe bulls will likely push the price to 0.8500 where strong resistance from bears is expected.

If you like our idea, please like and comment. Follow us for more!

Team Setupsfx_

Bullish continuation?NZD/CAD is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 0.81236

1st Support: 0.80788

1st resistance: 0.82094

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

NZD/CAD Momentum Framework Signals Upside Risk🎯 NZD/CAD BREAKOUT SETUP | Moving Average Police Barricade Break! 💥

📊 Asset Overview

NZD/CAD - New Zealand Dollar vs Canadian Dollar

Forex Market | Day/Swing Trade Opportunity

🔥 THE THIEF'S MASTER PLAN

💎 Setup Type: Bullish Breakout Strategy

⏰ Timeframe: Day to Swing Trade

🎪 Current Price Zone: Pending order setup @ 0.82000

📈 ENTRY STRATEGY

🚀 Entry Point: ANY price level AFTER the Simple Moving Average (SMA) line breakout confirmation above 0.82000

Wait for the candle close above the barricade - patience pays, legends! 💪

🎯 PROFIT TARGET

💰 Target Price: 0.83000 (+100 pips potential)

⚠️ Why Exit Here? The Moving Average acts like a police barricade 🚧 - strong resistance zone + overbought conditions + potential bull trap + correction incoming = SMART EXIT STRATEGY

📢 Thief's Disclaimer: Dear Ladies & Gentleman (Thief OG's) 🎩 - I'm NOT recommending you set ONLY my TP. It's YOUR money, YOUR choice, YOUR rules! Make money, then TAKE money at your own risk! 💵✨

🛑 STOP LOSS

🔒 SL Level: 0.81000 (-100 pips risk)

⚡ Placement: ONLY after breakout confirmation - don't jump the gun!

📢 Thief's Disclaimer: Dear Ladies & Gentleman (Thief OG's) 🎩 - I'm NOT recommending you set ONLY my SL. Control your own destiny! Risk what you can afford, protect what you've earned! 🛡️

🌐 CORRELATED PAIRS TO WATCH

💵 NZD Pairs (Kiwi Power)

NZD/USD 🇳🇿🇺🇸 - Watch for USD strength/weakness impact

AUD/NZD 🇦🇺🇳🇿 - Trans-Tasman correlation (commodity currencies move together)

NZD/JPY 🇳🇿🇯🇵 - Risk-on/risk-off sentiment gauge

🍁 CAD Pairs (Loonie Watch)

USD/CAD 🇺🇸🇨🇦 - Inverse correlation to NZD/CAD

CAD/JPY 🇨🇦🇯🇵 - Commodity currency + oil price sensitivity

EUR/CAD 🇪🇺🇨🇦 - European economic impact on CAD

🔗 Correlation Key Points

✅ NZD & AUD = Commodity currency brothers (dairy, metals, agriculture)

✅ CAD = Oil-sensitive currency (crude oil prices = major driver)

✅ Risk Appetite = Both NZD & CAD rise when markets feel good, fall when fear strikes

✅ When USD/CAD falls → CAD strengthens → NZD/CAD may struggle

✅ When NZD/USD rises → Kiwi strengthens → NZD/CAD gets bullish fuel 🚀

📰 FUNDAMENTAL & ECONOMIC FACTORS

🌍 NEW ZEALAND FUNDAMENTALS (KIWI POWER 🥝)

💪 BULLISH FACTORS:

NZD has strengthened 2.77% over the past month and is up 5.32% over the last 12 months

Annual inflation rose to 3.1% in Q4 2024, above forecasts of 3% and exceeding the Reserve Bank's target band

Markets now price in an 80% chance of a rate hike by September, with roughly a 50% chance of a move in July

Manufacturing, services and tourism sectors look strong, pointing to economic recovery

RBNZ Hawkish Tilt: Easing phase appears over - potential rate hikes incoming! 🚀

GDP figures represent an upside surprise to the RBNZ's forecasts and imply less spare capacity in the economy than anticipated

📅 UPCOMING KEY DATA:

Building Permits: Already released (Nov data showed +2.8% MoM)

National Election: November 7, 2026 (political uncertainty watch 👀)

Next RBNZ Meeting: Monitor for hawkish signals on rate hikes

🥛 COMMODITY BOOST:

GlobalDairyTrade auction saw the overall index rise 6.3%, led by a 7.2% rise in whole milk powder prices

Dairy = New Zealand's #1 export → Price strength supports NZD 💎

🍁 CANADIAN FUNDAMENTALS (LOONIE WATCH 🇨🇦)

⚠️ BEARISH PRESSURES:

OIL PRICE WEAKNESS: Forecasts predict little change in world oil prices for 2026, with downward pressure due to global supply glut

VENEZUELAN COMPETITION: Western Canada Select traded at the widest discount compared to benchmark prices in 18 months following political upheaval in Venezuela

TARIFF THREATS: Trump threatened 100% tariffs on Canada (though later clarified by PM Carney)

Oil and gas drilling activity is falling in Western Canada and is expected to slide further in 2026

WTI Crude: Currently hovering around $60/barrel (down from $80+ in January 2025) 📉

⚡ BULLISH FACTORS:

Natural gas prices expected to strengthen to $3.30 per mmBTU this year from roughly $1.70 last year due to LNG Canada export terminal ramp-up

Strong employment data

Alberta & resource-rich provinces showing economic strength

🔑 KEY INSIGHT: CAD is HEAVILY oil-dependent. When oil struggles → CAD struggles → NZD/CAD RISES! 🚀

🎯 THE FUNDAMENTAL VERDICT

WHY THIS BULLISH SETUP MAKES SENSE:

✅ NZD = STRONG (Inflation rising, RBNZ turning hawkish, rate hike expectations, dairy prices surging)

✅ CAD = WEAK (Oil price struggles, Venezuelan competition, drilling activity falling)

✅ DIVERGENCE = OPPORTUNITY 💰

⚠️ RISK FACTORS TO MONITOR:

Trump tariff announcements (could strengthen USD and weaken both currencies)

Middle East tensions (could spike oil prices → help CAD)

China economic data (affects both commodity currencies)

RBNZ policy meeting surprises

🎨 THIEF TRADER STYLE WISHES & MOTIVATION 💎

"In the markets, patience isn't just a virtue - it's your edge. The best thieves don't rush through the vault, they wait for the perfect moment." 🏆

💪 REMEMBER OG's:

The market rewards discipline, not desperation

Your stop loss is your bodyguard - respect it! 🛡️

Profits are made in the waiting, not the wanting ⏳

Trade what you SEE, not what you THINK 👁️

🔥 THIEF TRADER COMMANDMENTS:

Plan your heist (trade) ✅

Execute with precision 🎯

Escape with your loot (profits) 💰

Live to steal another day 🏃♂️

✨ FINAL WISDOM:

"The market is an ATM for the disciplined, a casino for the desperate. Which one are you?" 🎰💸

📊 TRADE SAFE, THIEF STYLE! 💎🙌

Drop a 👍 if you're watching this setup!

Comment 💬 your targets below!

Follow for more Thief OG setups! 🔥

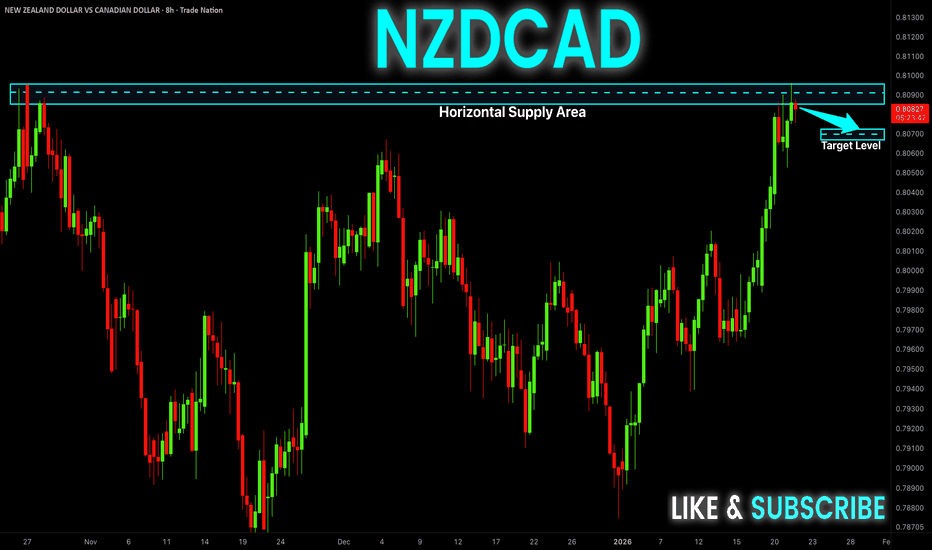

NZD/CAD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

Previous week’s green candle means that for us the NZD/CAD pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 0.812.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDCAD Will Fall! Sell!

Hello,Traders!

NZDCAD taps into a higher-timeframe supply zone after a strong impulsive push, signaling distribution and potential liquidity sweep. Expect bearish continuation toward internal demand as structure weakens. Time Frame 8H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Is NZD/CAD Preparing for a Bullish Continuation Move?📈 NZD/CAD – Kiwi 🥝 vs Loonie 💰 – Bullish Opportunity (Swing / Day Trade)

Asset: NZD/CAD — New Zealand Dollar vs Canadian Dollar (Forex Cross) 🇳🇿🇨🇦

Current Price (live London time): ~0.8068-0.8070 (ranges today ~0.8034-0.8087) according to live FX data.

🚀 Trade Plan – Bullish Bias

Thief Layered Entry Strategy 🧠

We’re looking to accumulate long positions using multiple buy limit layers, not just one entry — true multi-layered execution:

💎 Layered Buy Orders:

➡️ 0.80300

➡️ 0.80500

➡️ 0.80800

(Add more layers if market structure supports it)

This strategy attempts better avg entry and reduces risk per layer.

🎯 Target / Take Profit

🎯 Primary Target: ~0.82000

This level aligns with expected technical resistance — moving averages + previous swing highs — offering a high-probability profit zone.

Note: Don’t feel obligated to only use my TP — manage partial profits on your rhythm. 📊

🚨 Stop Loss

❌ Thief SL: 0.79900

SL is below recent demand zone — keep disciplined risk management.

Note: Set SL based on your risk tolerance & position sizing — your money, your rules. 💼

📌 Trade Rationale (Technical + Structural)

👉 NZD/CAD is a volatile cross pair with significant moves during overlapping London + New York sessions.

👉 Technical structure shows demand around current zones with bullish divergence potential.

👉 Layering lowers execution risk and allows auto accumulation on pullbacks.

🔍 Correlated Pairs / Watchlist

These pairs behave in similar macro contexts — watch for strength/weakness shifts:

🔹 AUD/CAD — commodity vs commodity → signals commodity risk sentiment

🔹 NZD/USD — Kiwi relative strength vs USD influences NZD/CAD potential

🔹 CAD/CHF — CAD strength via broad risk trends

Correlation insight: when commodity prices (particularly oil) surge, CAD often strengthens which can weaken NZD/CAD. NZD dynamics are also linked to dairy/agriculture price strength.

📊 Fundamental & Economic Factors

Always check the real-time economic calendar before execution. Here’s what matters:

🕒 Key NZ Data (impact on NZD):

• RBNZ Interest Rate Decisions

• CPI / Inflation prints

• GDP growth reports

• Employment data

🕒 Key Canada Data (impact on CAD):

• Bank of Canada Rates & Monetary Policy

• CPI / Core inflation

• GDP & Employment changes

🔔 Commodities:

CAD has a strong correlation to oil & energy prices — rising oil = stronger CAD (could pressure NZD/CAD). NZD is influenced by agricultural export prices.

📈 High-impact news days:

• Central bank announcements

• CPI releases

• Employment figures

… can trigger volatility spikes — trade smart around these.

🧠 Execution Tips

⚖️ Use limit orders only to get layered execution

📈 Tweak layers if early price momentum changes

⏱️ Monitor London session liquidity — this pair tends to have tighter spreads & clearer moves then.

💬 Comment your entry zone & why

👍 Like + share if this idea gives value

🔔 Follow for more layered strategies + real-time fundamentals

Could we see a reversal from here?NZD/CAD is reacting off the pivot and could reverse to the 1st support, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Pivot: 0.80824

1st Support: 0.80158

1st Resistance: 0.81161

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

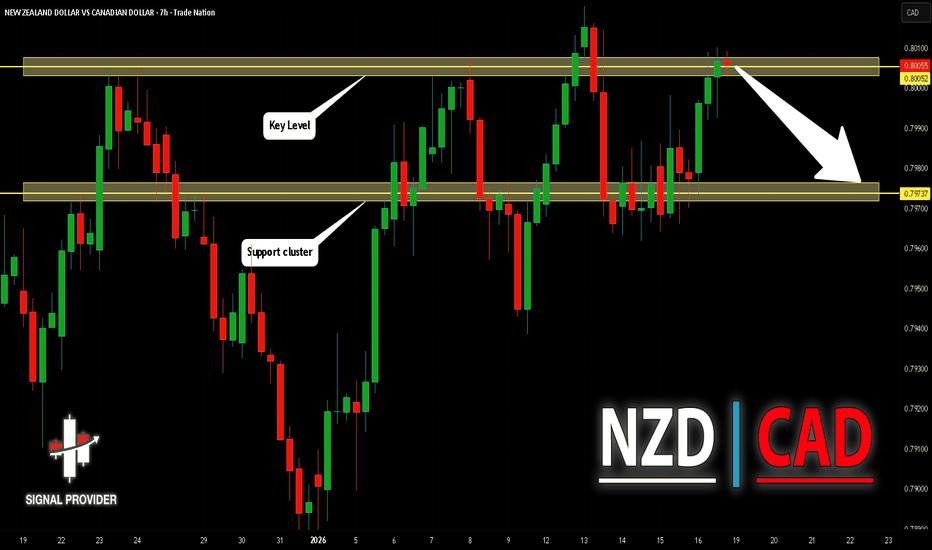

NZDCAD Is Very Bearish! Short!

Take a look at our analysis for NZDCAD.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.800.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.797 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

USDCAD: mid-term view🛠 Technical Analysis: On the 4-hour (H4) timeframe, USDCAD has undergone a significant bearish correction following a breakdown from its long-term Ascending channel. A "Global bearish signal" was confirmed in early December, leading to a sharp drop that pushed the price below all major moving averages (SMA 50, 100, and 200).

Currently, the pair is trading near the support at 1.37300. The price action suggests a "v-shaped" recovery attempt as the downward momentum slows down near this multi-month low. The analysis anticipates a technical reversal (mean reversion) back toward the previous breakout zone and the SMA 50, SMA 100 cluster, targeting the resistance around 1.39500.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy only after the price closes above the support of 1.37300 (approx. 1.37340).

🎯 Take Profit: 1.39500 (Resistance).

🔴 Stop Loss: 1.36175 (Below the most recent swing low).

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Bearish reversal off pullback resistance?NZD/CAD is rising towards the pivot, which acts as a pullback resistance and could reverse to the 1st support.

Pivot: 0.79988

1st Support: 0.78174

1st Resistance: 0.80291

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

NZD/CAD BEARS ARE GAINING STRENGTH|SHORT

NZD/CAD SIGNAL

Trade Direction: short

Entry Level: 0.798

Target Level: 0.796

Stop Loss: 0.799

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD-USD Free Signal! Buy!

Hello, Traders!

NZDCAD reacts into a refined horizontal demand zone after a strong bearish displacement. Sell-side liquidity has been swept, followed by clear smart money absorption and a bullish shift in internal structure. Expect continuation higher toward resting buy-side liquidity.

--------------------

Stop Loss: 0.7956

Take Profit: 0.7986

Entry: 0.7968

Time Frame: 2H

--------------------

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD Bearish Continuity | Supply Zone Re-Test & Fibonacci ConfFollowing a decisive break of the previous ascending trendline, NZD/CAD has shifted its local market structure to bearish. We are currently observing a corrective move back into a significant Supply Zone (0.79600 - 0.79650). This area aligns perfectly with the 0.236 - 0.382 Fibonacci retracement levels, acting as a primary point of interest (POI) for institutional sellers to reload.

Technical Breakdown

Market Structure: Shift from Bullish to Bearish on the Intraday (30m) timeframe.

Supply Zone: The grey-shaded block represents a previous consolidation area that acted as the catalyst for the recent impulsive drop.

Fibonacci Confluence: The projected retracement aims for the 0.382 level, providing a high-probability entry for the next leg down.

Targeting: Looking for a continuation toward the 1.618 Extension (0.78973), which aligns with major structural support.

The Execution Plan

Entry Trigger: Look for price rejection (wicking or bearish engulfing) within the 0.79620 zone.

Invalidation (SL): A sustained 30m candle close above 0.79771 (recent swing high) invalidates the bearish bias.

Take Profit (TP): Primary target at 0.79280 (1.0 Fib), with runners held for the 0.78970 extension.

Bullish bounce setup?NZD/CAD is falling towards the pivot, which is slightly above the 61.8% Fibonacci retracement, and could bounce to the 1st resistance.

Pivot: 0.79333

1st Support: 0.78954

1st Resistance: 0.79992

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

NZDCAD Will Go Down From Resistance! Short!

Here is our detailed technical review for NZDCAD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 0.797.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 0.791 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

Bullish reversal setup?NZD/JPY could fall towards the support level, which is an overlap support, and could bounce from this level to our take profit.

Entry: 0.79351

Why we like it:

There is an overlap support level.

Stop loss: 0.7907

Why we like it:

There is a pullback support level.

Take profit: 0.79841

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Falling towards key support?NZD/CAD is falling towards the pivot, which acts as an overlap support and could bounce to the 1st resistance.

Pivot: 0.79037

1st Support: 0.78682

1st Resistance: 0.79544

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

NZDCAD: Bullish Forecast & Bullish Scenario

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the NZDCAD pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDCAD Will Go Up From Support! Buy!

Here is our detailed technical review for NZDCAD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.791.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.797 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

NZD/CAD BULLS ARE STRONG HERE|LONG

Hello, Friends!

NZD/CAD pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 0.797 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅