Nzdcadshort

#NZDCAD: Another Bearish Move Worth Around +700 Pips! Dear Traders,

We have identified a potential opportunity on the NZDCAD currency pair to reach another record low. The fundamentals and technical support align with our current view. The price has reversed in the daily time frame suggesting further downward movement. Our current target is a swing one.

If you are interested in our ideas please like and comment for further information. We welcome any suggestions you may have.

Follow for more.

Team Setupsfx_

Will NZD/CAD Extend Lower? Bearish Structure and Level Guide🎯 NZD/CAD BEARISH SWING TRADE | Multi-Layer Entry Strategy 📉

💱 Asset Overview

Pair: NZD/CAD (New Zealand Dollar vs Canadian Dollar)

Market: Forex

Trade Type: Swing Trade (Bearish Setup)

Timeframe: Multi-day to Multi-week

📊 Technical Analysis & Trade Setup

🔴 Bearish Confirmation Signals:

✅ Moving Average pullback indicating trend reversal

✅ Strong support level breakout confirmed

✅ Price action showing distribution pattern

✅ Momentum shifting to sellers' control

🎯 TRADE EXECUTION PLAN

📍 Entry Strategy: "THIEF Layering Method"

Multi-Limit Order Approach (Scaling into position):

🔹 Layer 1: Sell Limit @ 0.79500

🔹 Layer 2: Sell Limit @ 0.79250

🔹 Layer 3: Sell Limit @ 0.79000

💡 Note: You can add more layers based on your capital allocation and risk management strategy. This layering approach helps average your entry price and reduces timing risk.

🛑 Stop Loss Management

Thief's SL: 0.79600

⚠️ IMPORTANT DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's) - This is MY stop loss level based on my strategy. YOU MUST adjust your SL according to:

Your own risk tolerance

Your account size

Your trading strategy

Your position sizing

Trading is YOUR responsibility. Manage your risk accordingly!

🎯 Take Profit Target

Primary Target: 0.78200

📍 Target Reasoning:

Strong historical support zone

Oversold conditions expected

Potential bull trap area - ideal profit-taking zone

⚠️ IMPORTANT DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's) - This is MY target based on technical analysis. YOU decide when to take profits based on:

Your profit goals

Market conditions

Your trading plan

Risk-reward ratio

Secure your profits at YOUR comfort level!

🔗 Related Pairs to Watch (Correlation Analysis)

📈 Correlated USD Pairs:

1️⃣ NZD/USD (Kiwi Dollar Index)

Direct correlation with NZD/CAD

If NZD/USD weakens → supports our bearish NZD/CAD trade

Watch for: RBNZ policy signals, New Zealand economic data

2️⃣ USD/CAD (Loonie)

Inverse correlation with NZD/CAD

If USD/CAD strengthens → CAD strength supports our trade

Key factors: Oil prices (CAD is commodity-linked), BoC policy

3️⃣ AUD/CAD (Aussie/Loonie)

Strong correlation (both antipodean currencies)

Similar risk-on/risk-off behavior

Watch: Commodity prices, China economic data

4️⃣ AUD/NZD (Trans-Tasman Cross)

Shows relative strength between similar economies

If trending down → NZD weakness confirmed

Key for: Regional risk sentiment

🔑 Key Fundamental Factors to Monitor:

🇳🇿 New Zealand Drivers:

RBNZ interest rate decisions

Dairy prices (major export)

GDP & employment data

China economic health (largest trading partner)

🇨🇦 Canadian Drivers:

Bank of Canada policy stance

Crude oil prices (Canada's major export)

US economic data (largest trading partner)

Employment & inflation figures

🌍 Global Risk Sentiment:

Commodity price trends

Risk-on vs risk-off flows

US Dollar strength/weakness

Global growth outlook

⚡ Risk Management Reminders:

✔️ Never risk more than 1-2% of your account per trade

✔️ Use proper position sizing across all layers

✔️ Monitor correlations - avoid overexposure to similar trades

✔️ Set alerts for key technical levels

✔️ Be prepared to adjust if fundamentals shift

Trade at your own risk. Only invest capital you can afford to lose.

🔔 Follow for More Trade Ideas | 👍 Like if You Find Value | 💬 Share Your Thoughts Below!

Good luck, Thief OG's! Trade safe, trade smart! 💰📊

#NZDCAD: Bearish Move IS Likely To Continue! NZDCAD is in swing bearish move and likely to continue dropping hard. We have an potential selling opportunity in making, Please use accurate risk management while trading. If you like our ideas then please do like and comment and follow for more.

Good luck and trade safe as always.

Team Setupsfx_

#NZDCAD: Two Areas To Sell From! Swing SellThe NZDCAD has hit a critical level, and it might start going down from where we set our selling points. We also have two targets for when we should enter the market.

Good luck and trade safely!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

NZDCAD: Bearish Setup Signals Deeper Correction AheadNZDCAD has been struggling to break higher, repeatedly failing near a key resistance zone. The price action now shows a weakening structure with lower highs and a clear rejection from the supply area. With fundamentals also leaning in favor of CAD over NZD, the setup points toward a bearish continuation move.

Current Bias

Bearish – momentum is favoring sellers after multiple rejections near resistance.

Key Fundamental Drivers

NZD: Softness in dairy prices, weak global demand, and exposure to China’s slowdown weigh on the kiwi.

CAD: Oil prices remain a key driver for CAD, and despite volatility, Canada’s resource-backed currency has stronger fundamental support.

Relative Outlook: CAD’s commodity linkage and Canada’s recent labor and GDP data provide relative strength against NZD.

Macro Context

Interest Rates: The RBNZ is sidelined, while the BoC remains cautious but still has less urgency to cut aggressively given sticky wage growth.

Economic Growth: New Zealand faces sluggish growth tied to weaker exports, while Canada benefits modestly from energy demand.

Commodity Flows: Oil underpins CAD resilience; NZ dairy trade remains under pressure.

Geopolitical Themes: Tariffs and US-China trade tensions weigh disproportionately on NZD due to its export reliance.

Primary Risk to the Trend

A sharp drop in oil prices could weaken CAD and support NZDCAD. Similarly, an unexpected hawkish tilt from the RBNZ would challenge bearish bias.

Most Critical Upcoming News/Event

New Zealand CPI and RBNZ policy updates.

Canada GDP and employment figures.

Oil market data, especially inventories and OPEC+ signals.

Leader/Lagger Dynamics

NZDCAD is typically a lagger, moving in line with broader risk sentiment and commodity flows. It tends to follow CAD momentum (via oil) and NZD’s performance against USD.

Key Levels

Support Levels: 0.8020, 0.7965

Resistance Levels: 0.8089, 0.8145

Stop Loss (SL): 0.8145

Take Profit (TP): 0.7965

Summary: Bias and Watchpoints

NZDCAD currently carries a bearish bias as the pair continues to reject resistance near 0.8089–0.8145. With oil supporting CAD and NZD weighed down by weak trade fundamentals, sellers are in control. The setup favors a move toward 0.8020 and 0.7965, with SL placed above 0.8145 to protect against unexpected rebounds. Watch for oil price shifts and RBNZ commentary as the biggest potential trend disruptors.

NZDCAD- 400 PIPS SETUP NOT TO MISS!!Dear Traders, we have got good opportunity to sell NZDCAD at respected area, however, before we enter we got ensure that price comes to our area of entry, after that with stop loss above the horizontal trendline. Longer term bias is bearish in that sense, CAD is expected to bearish in longer term aim.

Let’s not miss this highly probable setup!

Please show support by following and liking the idea.

NZDCAD Kiwi Faces Pressure as Canadian Dollar Gains GroundNZDCAD has slipped back into a critical support zone around 0.8000, with momentum tilting against the Kiwi. The Canadian dollar continues to draw strength from resilient employment data and oil price stability, while the New Zealand dollar struggles under softer commodity demand and cautious RBNZ policy. The technical structure favors a downside continuation unless NZD fundamentals find new support.

Current Bias

Bearish – price action leans toward a breakdown below 0.8000 with room to target 0.7865.

Key Fundamental Drivers

NZD Weakness: Slower global demand, softer dairy exports, and RBNZ patience on rates weigh on the Kiwi.

CAD Strength: Canadian labor market surprise and oil stabilization support CAD.

Commodity Flows: Oil underpins CAD, while NZD lags on weaker agricultural trade signals.

Macro Context

Interest Rate Expectations: RBNZ signaling no urgency for hikes; BoC cautious but more growth-supportive, limiting dovish bias.

Economic Growth Trends: NZ facing slowing domestic demand; Canada seeing mixed but steady growth, with jobs data surprising positively.

Commodity Flows: Oil keeps CAD supported; dairy softens NZD.

Geopolitical Themes: Trade tensions (US-China tariffs) could hit NZ harder via Asia-Pacific exposure, while CAD benefits from US growth spillover.

Primary Risk to the Trend

A sudden rebound in Chinese demand or stronger-than-expected NZ CPI could reverse NZD losses.

Most Critical Upcoming News/Event

NZ CPI release – key for RBNZ rate expectations.

Canada CPI & retail sales – pivotal for BoC policy signals.

Leader/Lagger Dynamics

NZDCAD acts as a lagger, generally following moves in oil-driven CAD crosses and broader risk sentiment influencing NZD. It tends to mirror AUDCAD trends but with less direct commodity correlation.

Key Levels

Support Levels:

0.8000

0.7865

Resistance Levels:

0.8106

0.8160

Stop Loss (SL): 0.8160

Take Profit (TP): 0.7865

Summary: Bias and Watchpoints

NZDCAD bias is bearish, with the pair defending the 0.8000 handle but vulnerable to a breakdown toward 0.7865. Fundamentals support CAD strength via oil and jobs, while NZD is constrained by weak external demand and dovish policy. Stop loss sits above resistance at 0.8160, with profit-taking aimed at 0.7865. The key watchpoints will be NZ CPI and Canada’s CPI/retail sales – data that could redefine relative central bank stances and set the next leg of momentum.

NZDCAD is Holding Below the Support Hello Traders

In This Chart nzdcad HOURLY Forex Forecast By FOREX PLANET

today NZDCAD analysis 👆

🟢This Chart includes_ (NZDCAD market update)

🟢What is The Next Opportunity on NZDCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

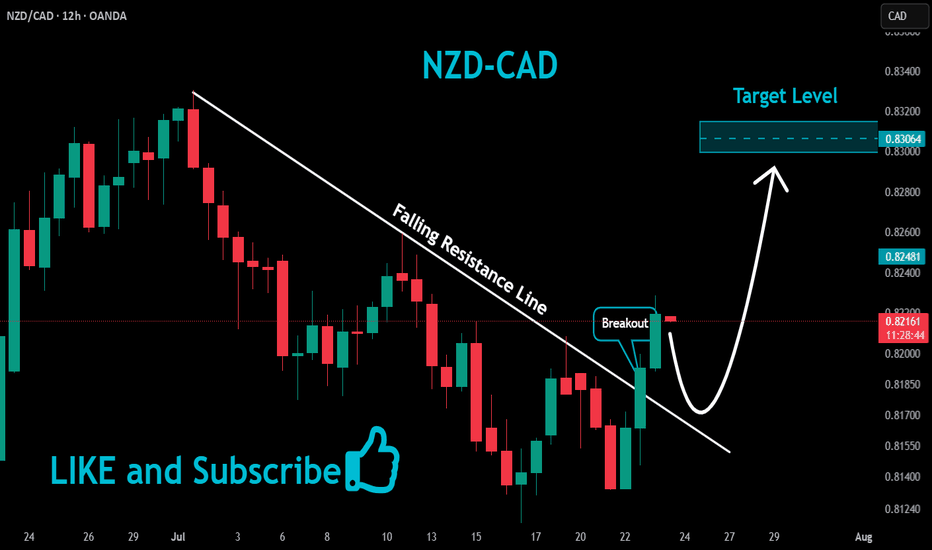

NZDCAD – Kiwi Momentum Builds, Eyeing 0.8320NZDCAD has rallied hard after breaking its bearish structure, and momentum remains firmly with the bulls. The pair is consolidating just under 0.8250, suggesting another leg higher could be in play. With the New Zealand dollar supported by commodity optimism and firm domestic data, while the Canadian dollar struggles under softer growth and oil market volatility, the backdrop favors continued upside.

Current Bias

Bullish – Trend is intact above 0.8190, with bulls targeting higher resistance levels.

Key Fundamental Drivers

New Zealand: Positive economic momentum (recent uptick in building consents and commodity prices) underpins NZD.

Canada: Weak labor market data and rising BoC rate-cut expectations weigh on CAD.

Commodities: Oil’s pullback limits CAD strength, while dairy and agricultural stability lend some support to NZD.

Macro Context

Interest rates: The RBNZ is less dovish than the BoC, keeping relative support under NZD.

Economic growth: Canada is slowing, while NZ shows resilience despite global headwinds.

Commodity flows: Oil softness pressures CAD, while NZ’s export-linked economy benefits from steady demand.

Geopolitical themes: Tariff risks and global risk sentiment swings influence commodity currencies, but CAD remains more exposed to downside via oil.

Primary Risk to the Trend

A sharp recovery in oil prices or a hawkish surprise from the Bank of Canada could reverse NZDCAD gains.

Most Critical Upcoming News/Event

BoC September decision & commentary – critical for CAD direction.

NZ GDP and RBNZ forward guidance – key for sustaining NZD momentum.

Leader/Lagger Dynamics

NZDCAD is more of a lagger, responding to moves in broader NZD crosses (like NZDUSD or EURNZD) and CAD drivers (oil, USDCAD). However, it can lead other CAD crosses if BoC policy expectations shift sharply.

Key Levels

Support Levels: 0.8190, 0.8145

Resistance Levels: 0.8270, 0.8320

Stop Loss (SL): 0.8145 (below key support and recent structure)

Take Profit (TP): 0.8320 (major upside target)

Summary: Bias and Watchpoints

NZDCAD bias is bullish, with SL at 0.8145 and TP at 0.8320. The Kiwi is supported by firmer domestic data and RBNZ credibility, while CAD weakness stems from soft jobs, BoC cut expectations, and oil struggles. The key risk is a CAD rebound on oil or a BoC surprise. Traders should watch the upcoming BoC decision and NZ data releases for confirmation. If momentum holds, a clean break of 0.8270 could open the door toward 0.8320.

NZD/CAD – Short Setup on False BreakoutThe pair is moving inside a descending channel. Price is now trying to move above the upper boundary.

The plan is that the market may form a false breakout above the previous highs and the channel line, and then return back into the blue range.

📌 Plan: establish a short position in the 0.826–0.8265 zone once a BC is confirmed.

Stop-loss: very wide, beyond 0.829

Take-profit: quoter-line of the channel around 0.8195

Risk/Reward: about 1:2

💡 Rationale: the descending channel structure remains intact. A breakout followed by a quick return would provide a clean short entry with limited risk.

Bearish Gameplan Activated – NZD/CAD Heist Operation💣 NZD/CAD “Kiwi vs Loonie” Forex Vault Robbery Heist Plan 🔫💰

Bearish Plan | Multiple Limit Orders | Scalping/Swing Style

🧠💼 Welcome to another high-stakes Thief Trader Heist – this time we're targeting the NZD/CAD vault. The Loonie's got weakness in its wings, and the Kiwi’s already flapping into the trap zone. Let's rob this pair clean!

📉 ENTRY – THE BREAK-IN

💼 "We ain't knocking... we entering ANY PRICE LEVEL!"

Layer your sell limit orders like traps in a museum – closest to recent highs on the 15m/30m/1H zones. Precision is profit. 🧨

🛑 STOP LOSS – EXIT ROUTE IF CAUGHT

🔐 0.81800 — placed at the swing high (4H chart level) for clean cutouts. Adjust based on your lot size & how many bags you carry 🧳📊

🎯 TARGET – VAULT LOCATION

🏁 0.80400 — that’s where we grab the loot and disappear like ghosts!

🎯 Day traders aim here.

🎯 Scalpers escape quicker with trailing SLs – grab and vanish!

⚙️ STRATEGY – THE THIEF’S TOOLKIT

🔹 Scalping? Only short!

🔹 Swinging? Ride the bearish tide 🌊

🔹 Use price traps, liquidity zones, fake breakouts – we exploit retail psychology 😈

🔹 Heist based on momentum, reversal patterns, exhaustion candles 🕵️♂️

📉 Sentiment shows retail stuck long 🪤

📈 Institutions flipping short 👀

📉 Trend = weak Kiwi, stronger Loonie boost from commodities

🚨 NEWS ALERT – STAY IN SHADOWS

Avoid high-impact news like CPI, BoC or RBNZ shocks. Thieves don’t rob during spotlight hours 🔦📉

🔥 Hit BOOST 💥 if you’re riding with the THIEF GANG 🔥

👑 Let’s make this plan viral, hit likes, share it, and rob the market clean 💰💸

Stay stealthy. Stay rich. Stay Thief. 🐱👤🕵️♂️💼

NZDCAD - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

No opposite signs.

Expecting pullbacks and bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

NZDCAD - Short Term Sell Trade Update!!!Hi Traders, on May 7th I shared this idea "NZDCAD - Looking To Sell Pullbacks In The Short Term"

I expected to see retraces and further continuation lower. You can read the full post using the link above.

Retrace and push lower happened as per the plan!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.