#NZDCAD: 600+ Pips Buying Opportunity! Dear traders,

🔺NZDCAD is currently in a steady bullish trend since our last area of interest. However, the price has made some corrections and then reversed, indicating a strong bullish intention. This is supported by a surge in bullish volume in the market.

🔺A possible entry point could be when the price makes a small correction around the previous lower low or from where it reversed. A stop-loss of 70-80 pips and a take-profit target of 0.89 would be ideal.

🔺Always remember to manage your risk while trading and conduct your own research alongside using our analysis as a secondary source of information.

Good luck and trade safely, fellow traders. ❤️✌️

NZDCADSIGNAL

#NZDCAD: Bulls To Continue Dominating While CAD plummet Dear Traders,

NZDCAD has been bullish for the last few weeks and is currently at a critical level. This suggests the price could move towards 0.8500. However, price has experienced a few corrections since the bullish trend began. We believe bulls will likely push the price to 0.8500 where strong resistance from bears is expected.

If you like our idea, please like and comment. Follow us for more!

Team Setupsfx_

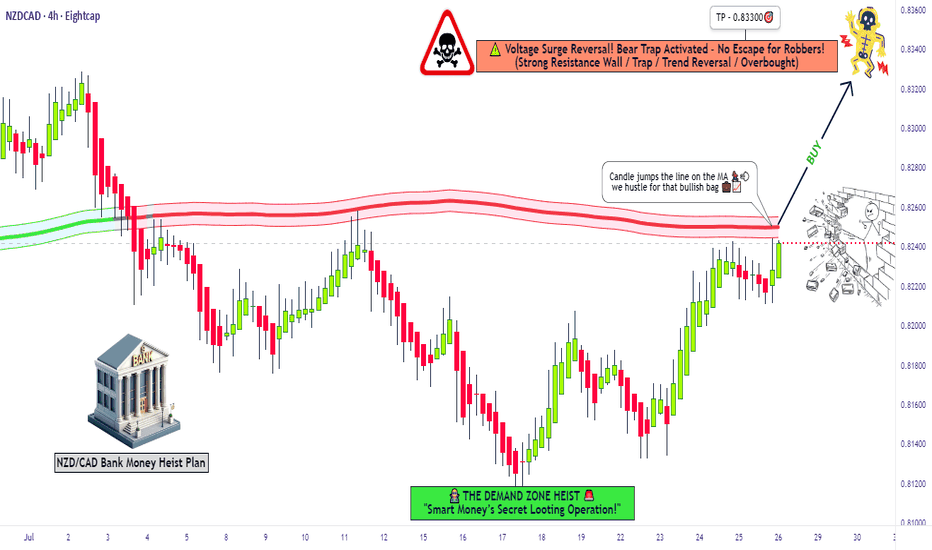

NZD/CAD Momentum Framework Signals Upside Risk🎯 NZD/CAD BREAKOUT SETUP | Moving Average Police Barricade Break! 💥

📊 Asset Overview

NZD/CAD - New Zealand Dollar vs Canadian Dollar

Forex Market | Day/Swing Trade Opportunity

🔥 THE THIEF'S MASTER PLAN

💎 Setup Type: Bullish Breakout Strategy

⏰ Timeframe: Day to Swing Trade

🎪 Current Price Zone: Pending order setup @ 0.82000

📈 ENTRY STRATEGY

🚀 Entry Point: ANY price level AFTER the Simple Moving Average (SMA) line breakout confirmation above 0.82000

Wait for the candle close above the barricade - patience pays, legends! 💪

🎯 PROFIT TARGET

💰 Target Price: 0.83000 (+100 pips potential)

⚠️ Why Exit Here? The Moving Average acts like a police barricade 🚧 - strong resistance zone + overbought conditions + potential bull trap + correction incoming = SMART EXIT STRATEGY

📢 Thief's Disclaimer: Dear Ladies & Gentleman (Thief OG's) 🎩 - I'm NOT recommending you set ONLY my TP. It's YOUR money, YOUR choice, YOUR rules! Make money, then TAKE money at your own risk! 💵✨

🛑 STOP LOSS

🔒 SL Level: 0.81000 (-100 pips risk)

⚡ Placement: ONLY after breakout confirmation - don't jump the gun!

📢 Thief's Disclaimer: Dear Ladies & Gentleman (Thief OG's) 🎩 - I'm NOT recommending you set ONLY my SL. Control your own destiny! Risk what you can afford, protect what you've earned! 🛡️

🌐 CORRELATED PAIRS TO WATCH

💵 NZD Pairs (Kiwi Power)

NZD/USD 🇳🇿🇺🇸 - Watch for USD strength/weakness impact

AUD/NZD 🇦🇺🇳🇿 - Trans-Tasman correlation (commodity currencies move together)

NZD/JPY 🇳🇿🇯🇵 - Risk-on/risk-off sentiment gauge

🍁 CAD Pairs (Loonie Watch)

USD/CAD 🇺🇸🇨🇦 - Inverse correlation to NZD/CAD

CAD/JPY 🇨🇦🇯🇵 - Commodity currency + oil price sensitivity

EUR/CAD 🇪🇺🇨🇦 - European economic impact on CAD

🔗 Correlation Key Points

✅ NZD & AUD = Commodity currency brothers (dairy, metals, agriculture)

✅ CAD = Oil-sensitive currency (crude oil prices = major driver)

✅ Risk Appetite = Both NZD & CAD rise when markets feel good, fall when fear strikes

✅ When USD/CAD falls → CAD strengthens → NZD/CAD may struggle

✅ When NZD/USD rises → Kiwi strengthens → NZD/CAD gets bullish fuel 🚀

📰 FUNDAMENTAL & ECONOMIC FACTORS

🌍 NEW ZEALAND FUNDAMENTALS (KIWI POWER 🥝)

💪 BULLISH FACTORS:

NZD has strengthened 2.77% over the past month and is up 5.32% over the last 12 months

Annual inflation rose to 3.1% in Q4 2024, above forecasts of 3% and exceeding the Reserve Bank's target band

Markets now price in an 80% chance of a rate hike by September, with roughly a 50% chance of a move in July

Manufacturing, services and tourism sectors look strong, pointing to economic recovery

RBNZ Hawkish Tilt: Easing phase appears over - potential rate hikes incoming! 🚀

GDP figures represent an upside surprise to the RBNZ's forecasts and imply less spare capacity in the economy than anticipated

📅 UPCOMING KEY DATA:

Building Permits: Already released (Nov data showed +2.8% MoM)

National Election: November 7, 2026 (political uncertainty watch 👀)

Next RBNZ Meeting: Monitor for hawkish signals on rate hikes

🥛 COMMODITY BOOST:

GlobalDairyTrade auction saw the overall index rise 6.3%, led by a 7.2% rise in whole milk powder prices

Dairy = New Zealand's #1 export → Price strength supports NZD 💎

🍁 CANADIAN FUNDAMENTALS (LOONIE WATCH 🇨🇦)

⚠️ BEARISH PRESSURES:

OIL PRICE WEAKNESS: Forecasts predict little change in world oil prices for 2026, with downward pressure due to global supply glut

VENEZUELAN COMPETITION: Western Canada Select traded at the widest discount compared to benchmark prices in 18 months following political upheaval in Venezuela

TARIFF THREATS: Trump threatened 100% tariffs on Canada (though later clarified by PM Carney)

Oil and gas drilling activity is falling in Western Canada and is expected to slide further in 2026

WTI Crude: Currently hovering around $60/barrel (down from $80+ in January 2025) 📉

⚡ BULLISH FACTORS:

Natural gas prices expected to strengthen to $3.30 per mmBTU this year from roughly $1.70 last year due to LNG Canada export terminal ramp-up

Strong employment data

Alberta & resource-rich provinces showing economic strength

🔑 KEY INSIGHT: CAD is HEAVILY oil-dependent. When oil struggles → CAD struggles → NZD/CAD RISES! 🚀

🎯 THE FUNDAMENTAL VERDICT

WHY THIS BULLISH SETUP MAKES SENSE:

✅ NZD = STRONG (Inflation rising, RBNZ turning hawkish, rate hike expectations, dairy prices surging)

✅ CAD = WEAK (Oil price struggles, Venezuelan competition, drilling activity falling)

✅ DIVERGENCE = OPPORTUNITY 💰

⚠️ RISK FACTORS TO MONITOR:

Trump tariff announcements (could strengthen USD and weaken both currencies)

Middle East tensions (could spike oil prices → help CAD)

China economic data (affects both commodity currencies)

RBNZ policy meeting surprises

🎨 THIEF TRADER STYLE WISHES & MOTIVATION 💎

"In the markets, patience isn't just a virtue - it's your edge. The best thieves don't rush through the vault, they wait for the perfect moment." 🏆

💪 REMEMBER OG's:

The market rewards discipline, not desperation

Your stop loss is your bodyguard - respect it! 🛡️

Profits are made in the waiting, not the wanting ⏳

Trade what you SEE, not what you THINK 👁️

🔥 THIEF TRADER COMMANDMENTS:

Plan your heist (trade) ✅

Execute with precision 🎯

Escape with your loot (profits) 💰

Live to steal another day 🏃♂️

✨ FINAL WISDOM:

"The market is an ATM for the disciplined, a casino for the desperate. Which one are you?" 🎰💸

📊 TRADE SAFE, THIEF STYLE! 💎🙌

Drop a 👍 if you're watching this setup!

Comment 💬 your targets below!

Follow for more Thief OG setups! 🔥

Is NZD/CAD Preparing for a Bullish Continuation Move?📈 NZD/CAD – Kiwi 🥝 vs Loonie 💰 – Bullish Opportunity (Swing / Day Trade)

Asset: NZD/CAD — New Zealand Dollar vs Canadian Dollar (Forex Cross) 🇳🇿🇨🇦

Current Price (live London time): ~0.8068-0.8070 (ranges today ~0.8034-0.8087) according to live FX data.

🚀 Trade Plan – Bullish Bias

Thief Layered Entry Strategy 🧠

We’re looking to accumulate long positions using multiple buy limit layers, not just one entry — true multi-layered execution:

💎 Layered Buy Orders:

➡️ 0.80300

➡️ 0.80500

➡️ 0.80800

(Add more layers if market structure supports it)

This strategy attempts better avg entry and reduces risk per layer.

🎯 Target / Take Profit

🎯 Primary Target: ~0.82000

This level aligns with expected technical resistance — moving averages + previous swing highs — offering a high-probability profit zone.

Note: Don’t feel obligated to only use my TP — manage partial profits on your rhythm. 📊

🚨 Stop Loss

❌ Thief SL: 0.79900

SL is below recent demand zone — keep disciplined risk management.

Note: Set SL based on your risk tolerance & position sizing — your money, your rules. 💼

📌 Trade Rationale (Technical + Structural)

👉 NZD/CAD is a volatile cross pair with significant moves during overlapping London + New York sessions.

👉 Technical structure shows demand around current zones with bullish divergence potential.

👉 Layering lowers execution risk and allows auto accumulation on pullbacks.

🔍 Correlated Pairs / Watchlist

These pairs behave in similar macro contexts — watch for strength/weakness shifts:

🔹 AUD/CAD — commodity vs commodity → signals commodity risk sentiment

🔹 NZD/USD — Kiwi relative strength vs USD influences NZD/CAD potential

🔹 CAD/CHF — CAD strength via broad risk trends

Correlation insight: when commodity prices (particularly oil) surge, CAD often strengthens which can weaken NZD/CAD. NZD dynamics are also linked to dairy/agriculture price strength.

📊 Fundamental & Economic Factors

Always check the real-time economic calendar before execution. Here’s what matters:

🕒 Key NZ Data (impact on NZD):

• RBNZ Interest Rate Decisions

• CPI / Inflation prints

• GDP growth reports

• Employment data

🕒 Key Canada Data (impact on CAD):

• Bank of Canada Rates & Monetary Policy

• CPI / Core inflation

• GDP & Employment changes

🔔 Commodities:

CAD has a strong correlation to oil & energy prices — rising oil = stronger CAD (could pressure NZD/CAD). NZD is influenced by agricultural export prices.

📈 High-impact news days:

• Central bank announcements

• CPI releases

• Employment figures

… can trigger volatility spikes — trade smart around these.

🧠 Execution Tips

⚖️ Use limit orders only to get layered execution

📈 Tweak layers if early price momentum changes

⏱️ Monitor London session liquidity — this pair tends to have tighter spreads & clearer moves then.

💬 Comment your entry zone & why

👍 Like + share if this idea gives value

🔔 Follow for more layered strategies + real-time fundamentals

#NZDCAD: Another Bearish Move Worth Around +700 Pips! Dear Traders,

We have identified a potential opportunity on the NZDCAD currency pair to reach another record low. The fundamentals and technical support align with our current view. The price has reversed in the daily time frame suggesting further downward movement. Our current target is a swing one.

If you are interested in our ideas please like and comment for further information. We welcome any suggestions you may have.

Follow for more.

Team Setupsfx_

Will NZD/CAD Extend Lower? Bearish Structure and Level Guide🎯 NZD/CAD BEARISH SWING TRADE | Multi-Layer Entry Strategy 📉

💱 Asset Overview

Pair: NZD/CAD (New Zealand Dollar vs Canadian Dollar)

Market: Forex

Trade Type: Swing Trade (Bearish Setup)

Timeframe: Multi-day to Multi-week

📊 Technical Analysis & Trade Setup

🔴 Bearish Confirmation Signals:

✅ Moving Average pullback indicating trend reversal

✅ Strong support level breakout confirmed

✅ Price action showing distribution pattern

✅ Momentum shifting to sellers' control

🎯 TRADE EXECUTION PLAN

📍 Entry Strategy: "THIEF Layering Method"

Multi-Limit Order Approach (Scaling into position):

🔹 Layer 1: Sell Limit @ 0.79500

🔹 Layer 2: Sell Limit @ 0.79250

🔹 Layer 3: Sell Limit @ 0.79000

💡 Note: You can add more layers based on your capital allocation and risk management strategy. This layering approach helps average your entry price and reduces timing risk.

🛑 Stop Loss Management

Thief's SL: 0.79600

⚠️ IMPORTANT DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's) - This is MY stop loss level based on my strategy. YOU MUST adjust your SL according to:

Your own risk tolerance

Your account size

Your trading strategy

Your position sizing

Trading is YOUR responsibility. Manage your risk accordingly!

🎯 Take Profit Target

Primary Target: 0.78200

📍 Target Reasoning:

Strong historical support zone

Oversold conditions expected

Potential bull trap area - ideal profit-taking zone

⚠️ IMPORTANT DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's) - This is MY target based on technical analysis. YOU decide when to take profits based on:

Your profit goals

Market conditions

Your trading plan

Risk-reward ratio

Secure your profits at YOUR comfort level!

🔗 Related Pairs to Watch (Correlation Analysis)

📈 Correlated USD Pairs:

1️⃣ NZD/USD (Kiwi Dollar Index)

Direct correlation with NZD/CAD

If NZD/USD weakens → supports our bearish NZD/CAD trade

Watch for: RBNZ policy signals, New Zealand economic data

2️⃣ USD/CAD (Loonie)

Inverse correlation with NZD/CAD

If USD/CAD strengthens → CAD strength supports our trade

Key factors: Oil prices (CAD is commodity-linked), BoC policy

3️⃣ AUD/CAD (Aussie/Loonie)

Strong correlation (both antipodean currencies)

Similar risk-on/risk-off behavior

Watch: Commodity prices, China economic data

4️⃣ AUD/NZD (Trans-Tasman Cross)

Shows relative strength between similar economies

If trending down → NZD weakness confirmed

Key for: Regional risk sentiment

🔑 Key Fundamental Factors to Monitor:

🇳🇿 New Zealand Drivers:

RBNZ interest rate decisions

Dairy prices (major export)

GDP & employment data

China economic health (largest trading partner)

🇨🇦 Canadian Drivers:

Bank of Canada policy stance

Crude oil prices (Canada's major export)

US economic data (largest trading partner)

Employment & inflation figures

🌍 Global Risk Sentiment:

Commodity price trends

Risk-on vs risk-off flows

US Dollar strength/weakness

Global growth outlook

⚡ Risk Management Reminders:

✔️ Never risk more than 1-2% of your account per trade

✔️ Use proper position sizing across all layers

✔️ Monitor correlations - avoid overexposure to similar trades

✔️ Set alerts for key technical levels

✔️ Be prepared to adjust if fundamentals shift

Trade at your own risk. Only invest capital you can afford to lose.

🔔 Follow for More Trade Ideas | 👍 Like if You Find Value | 💬 Share Your Thoughts Below!

Good luck, Thief OG's! Trade safe, trade smart! 💰📊

#NZDCAD: Bearish Move IS Likely To Continue! NZDCAD is in swing bearish move and likely to continue dropping hard. We have an potential selling opportunity in making, Please use accurate risk management while trading. If you like our ideas then please do like and comment and follow for more.

Good luck and trade safe as always.

Team Setupsfx_

#NZDCAD: Two Areas To Sell From! Swing SellThe NZDCAD has hit a critical level, and it might start going down from where we set our selling points. We also have two targets for when we should enter the market.

Good luck and trade safely!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

NZDCAD: Bearish Setup Signals Deeper Correction AheadNZDCAD has been struggling to break higher, repeatedly failing near a key resistance zone. The price action now shows a weakening structure with lower highs and a clear rejection from the supply area. With fundamentals also leaning in favor of CAD over NZD, the setup points toward a bearish continuation move.

Current Bias

Bearish – momentum is favoring sellers after multiple rejections near resistance.

Key Fundamental Drivers

NZD: Softness in dairy prices, weak global demand, and exposure to China’s slowdown weigh on the kiwi.

CAD: Oil prices remain a key driver for CAD, and despite volatility, Canada’s resource-backed currency has stronger fundamental support.

Relative Outlook: CAD’s commodity linkage and Canada’s recent labor and GDP data provide relative strength against NZD.

Macro Context

Interest Rates: The RBNZ is sidelined, while the BoC remains cautious but still has less urgency to cut aggressively given sticky wage growth.

Economic Growth: New Zealand faces sluggish growth tied to weaker exports, while Canada benefits modestly from energy demand.

Commodity Flows: Oil underpins CAD resilience; NZ dairy trade remains under pressure.

Geopolitical Themes: Tariffs and US-China trade tensions weigh disproportionately on NZD due to its export reliance.

Primary Risk to the Trend

A sharp drop in oil prices could weaken CAD and support NZDCAD. Similarly, an unexpected hawkish tilt from the RBNZ would challenge bearish bias.

Most Critical Upcoming News/Event

New Zealand CPI and RBNZ policy updates.

Canada GDP and employment figures.

Oil market data, especially inventories and OPEC+ signals.

Leader/Lagger Dynamics

NZDCAD is typically a lagger, moving in line with broader risk sentiment and commodity flows. It tends to follow CAD momentum (via oil) and NZD’s performance against USD.

Key Levels

Support Levels: 0.8020, 0.7965

Resistance Levels: 0.8089, 0.8145

Stop Loss (SL): 0.8145

Take Profit (TP): 0.7965

Summary: Bias and Watchpoints

NZDCAD currently carries a bearish bias as the pair continues to reject resistance near 0.8089–0.8145. With oil supporting CAD and NZD weighed down by weak trade fundamentals, sellers are in control. The setup favors a move toward 0.8020 and 0.7965, with SL placed above 0.8145 to protect against unexpected rebounds. Watch for oil price shifts and RBNZ commentary as the biggest potential trend disruptors.

NZDCAD- 400 PIPS SETUP NOT TO MISS!!Dear Traders, we have got good opportunity to sell NZDCAD at respected area, however, before we enter we got ensure that price comes to our area of entry, after that with stop loss above the horizontal trendline. Longer term bias is bearish in that sense, CAD is expected to bearish in longer term aim.

Let’s not miss this highly probable setup!

Please show support by following and liking the idea.

NZDCAD Kiwi Faces Pressure as Canadian Dollar Gains GroundNZDCAD has slipped back into a critical support zone around 0.8000, with momentum tilting against the Kiwi. The Canadian dollar continues to draw strength from resilient employment data and oil price stability, while the New Zealand dollar struggles under softer commodity demand and cautious RBNZ policy. The technical structure favors a downside continuation unless NZD fundamentals find new support.

Current Bias

Bearish – price action leans toward a breakdown below 0.8000 with room to target 0.7865.

Key Fundamental Drivers

NZD Weakness: Slower global demand, softer dairy exports, and RBNZ patience on rates weigh on the Kiwi.

CAD Strength: Canadian labor market surprise and oil stabilization support CAD.

Commodity Flows: Oil underpins CAD, while NZD lags on weaker agricultural trade signals.

Macro Context

Interest Rate Expectations: RBNZ signaling no urgency for hikes; BoC cautious but more growth-supportive, limiting dovish bias.

Economic Growth Trends: NZ facing slowing domestic demand; Canada seeing mixed but steady growth, with jobs data surprising positively.

Commodity Flows: Oil keeps CAD supported; dairy softens NZD.

Geopolitical Themes: Trade tensions (US-China tariffs) could hit NZ harder via Asia-Pacific exposure, while CAD benefits from US growth spillover.

Primary Risk to the Trend

A sudden rebound in Chinese demand or stronger-than-expected NZ CPI could reverse NZD losses.

Most Critical Upcoming News/Event

NZ CPI release – key for RBNZ rate expectations.

Canada CPI & retail sales – pivotal for BoC policy signals.

Leader/Lagger Dynamics

NZDCAD acts as a lagger, generally following moves in oil-driven CAD crosses and broader risk sentiment influencing NZD. It tends to mirror AUDCAD trends but with less direct commodity correlation.

Key Levels

Support Levels:

0.8000

0.7865

Resistance Levels:

0.8106

0.8160

Stop Loss (SL): 0.8160

Take Profit (TP): 0.7865

Summary: Bias and Watchpoints

NZDCAD bias is bearish, with the pair defending the 0.8000 handle but vulnerable to a breakdown toward 0.7865. Fundamentals support CAD strength via oil and jobs, while NZD is constrained by weak external demand and dovish policy. Stop loss sits above resistance at 0.8160, with profit-taking aimed at 0.7865. The key watchpoints will be NZ CPI and Canada’s CPI/retail sales – data that could redefine relative central bank stances and set the next leg of momentum.

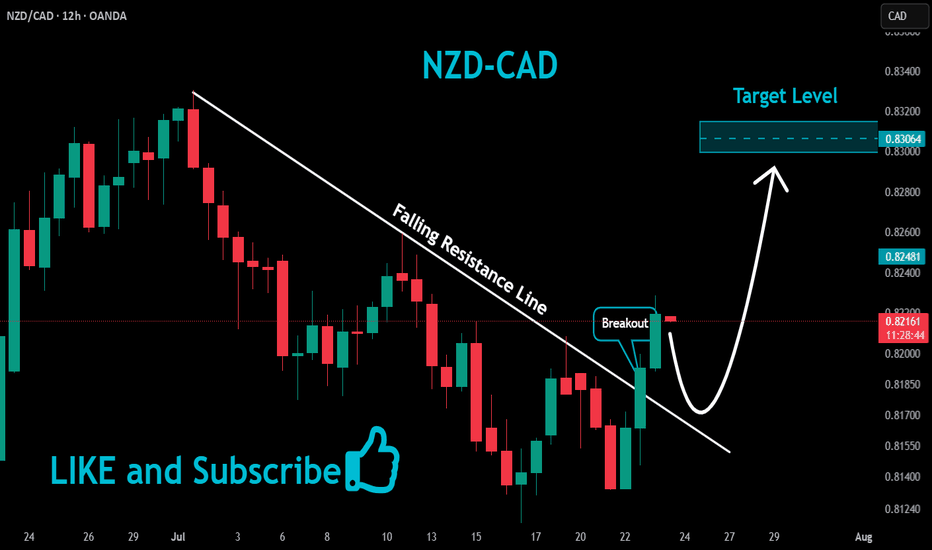

NZDCAD – Kiwi Momentum Builds, Eyeing 0.8320NZDCAD has rallied hard after breaking its bearish structure, and momentum remains firmly with the bulls. The pair is consolidating just under 0.8250, suggesting another leg higher could be in play. With the New Zealand dollar supported by commodity optimism and firm domestic data, while the Canadian dollar struggles under softer growth and oil market volatility, the backdrop favors continued upside.

Current Bias

Bullish – Trend is intact above 0.8190, with bulls targeting higher resistance levels.

Key Fundamental Drivers

New Zealand: Positive economic momentum (recent uptick in building consents and commodity prices) underpins NZD.

Canada: Weak labor market data and rising BoC rate-cut expectations weigh on CAD.

Commodities: Oil’s pullback limits CAD strength, while dairy and agricultural stability lend some support to NZD.

Macro Context

Interest rates: The RBNZ is less dovish than the BoC, keeping relative support under NZD.

Economic growth: Canada is slowing, while NZ shows resilience despite global headwinds.

Commodity flows: Oil softness pressures CAD, while NZ’s export-linked economy benefits from steady demand.

Geopolitical themes: Tariff risks and global risk sentiment swings influence commodity currencies, but CAD remains more exposed to downside via oil.

Primary Risk to the Trend

A sharp recovery in oil prices or a hawkish surprise from the Bank of Canada could reverse NZDCAD gains.

Most Critical Upcoming News/Event

BoC September decision & commentary – critical for CAD direction.

NZ GDP and RBNZ forward guidance – key for sustaining NZD momentum.

Leader/Lagger Dynamics

NZDCAD is more of a lagger, responding to moves in broader NZD crosses (like NZDUSD or EURNZD) and CAD drivers (oil, USDCAD). However, it can lead other CAD crosses if BoC policy expectations shift sharply.

Key Levels

Support Levels: 0.8190, 0.8145

Resistance Levels: 0.8270, 0.8320

Stop Loss (SL): 0.8145 (below key support and recent structure)

Take Profit (TP): 0.8320 (major upside target)

Summary: Bias and Watchpoints

NZDCAD bias is bullish, with SL at 0.8145 and TP at 0.8320. The Kiwi is supported by firmer domestic data and RBNZ credibility, while CAD weakness stems from soft jobs, BoC cut expectations, and oil struggles. The key risk is a CAD rebound on oil or a BoC surprise. Traders should watch the upcoming BoC decision and NZ data releases for confirmation. If momentum holds, a clean break of 0.8270 could open the door toward 0.8320.

Bearish Gameplan Activated – NZD/CAD Heist Operation💣 NZD/CAD “Kiwi vs Loonie” Forex Vault Robbery Heist Plan 🔫💰

Bearish Plan | Multiple Limit Orders | Scalping/Swing Style

🧠💼 Welcome to another high-stakes Thief Trader Heist – this time we're targeting the NZD/CAD vault. The Loonie's got weakness in its wings, and the Kiwi’s already flapping into the trap zone. Let's rob this pair clean!

📉 ENTRY – THE BREAK-IN

💼 "We ain't knocking... we entering ANY PRICE LEVEL!"

Layer your sell limit orders like traps in a museum – closest to recent highs on the 15m/30m/1H zones. Precision is profit. 🧨

🛑 STOP LOSS – EXIT ROUTE IF CAUGHT

🔐 0.81800 — placed at the swing high (4H chart level) for clean cutouts. Adjust based on your lot size & how many bags you carry 🧳📊

🎯 TARGET – VAULT LOCATION

🏁 0.80400 — that’s where we grab the loot and disappear like ghosts!

🎯 Day traders aim here.

🎯 Scalpers escape quicker with trailing SLs – grab and vanish!

⚙️ STRATEGY – THE THIEF’S TOOLKIT

🔹 Scalping? Only short!

🔹 Swinging? Ride the bearish tide 🌊

🔹 Use price traps, liquidity zones, fake breakouts – we exploit retail psychology 😈

🔹 Heist based on momentum, reversal patterns, exhaustion candles 🕵️♂️

📉 Sentiment shows retail stuck long 🪤

📈 Institutions flipping short 👀

📉 Trend = weak Kiwi, stronger Loonie boost from commodities

🚨 NEWS ALERT – STAY IN SHADOWS

Avoid high-impact news like CPI, BoC or RBNZ shocks. Thieves don’t rob during spotlight hours 🔦📉

🔥 Hit BOOST 💥 if you’re riding with the THIEF GANG 🔥

👑 Let’s make this plan viral, hit likes, share it, and rob the market clean 💰💸

Stay stealthy. Stay rich. Stay Thief. 🐱👤🕵️♂️💼

"NZD/CAD Reversal Play – Ride the Bullish Wave!🦹♂️💰 "THE KIWI-LOONIE HEIST: High-Voltage Forex Robbery Plan (NZD/CAD)" 💰🦹♂️

🌍 Attention all Market Pirates, Thieves & Profit Bandits! 🌍

🔥 Thief Trading Alert – NZD/CAD Bullish Heist Setup! 🔥

The "Kiwi vs Loonie" is setting up for a high-risk, high-reward robbery—and we’re locking in the master plan. Long entry is the play, but this ain’t for the weak hands. Overbought? Consolidation? Reversal trap? Perfect. That’s where we strike.

🎯 THE HEIST BLUEPRINT

🔑 ENTRY ZONE (Breakout & Retest Strategy)

"Wait for the 4H candle to CLOSE ABOVE 0.82600 (MA Breakout + Retest)."

Option 1: Place a BUY STOP above the MA (momentum confirmation).

Option 2: BUY LIMIT near recent swing lows (15M/30M precision).

🚨 Set an ALERT! Don’t miss the breakout—timing is everything.

🛑 STOP LOSS (Escape Route)

SL at 0.82000 (near swing low wick on 4H).

⚠️ Golden Rule: NO ORDERS BEFORE BREAKOUT! Wait for confirmation.

Adjust SL based on your risk, lot size, and multi-order strategy.

🎯 TARGETS (Profit Escape Plan)

Take Profit 1: 0.83300 (First resistance).

Or… Exit Early if the market turns shaky.

Scalpers: Long-only scalp plays! Use trailing SL to lock in gains.

⚡ THIEF TRADER PRO TIPS

✅ Fundamental Backing: Check COT reports, macro trends, intermarket signals.

✅ News Alert: Avoid new trades during high-impact news—protect open positions with trailing stops.

✅ Risk Management: Small lots, multiple entries = smarter heist.

💥 BOOST THE HEIST! (Let’s Get Rich Together) 💥

👉 Smash that 👍 LIKE button to fuel our next robbery plan!

👉 Follow for daily high-voltage setups.

👉 Comment "🚀" if you’re joining the heist!

🤑 NEXT HEIST COMING SOON… STAY TUNED, BANDITS! 🤑

🔥 WHY THIS TRADE? (Thief’s Edge)

Bullish momentum but trapped bears = perfect robbery setup.

Institutional levels + retail traps = our opportunity.

Not financial advice—just a well-planned theft. 😉

⚠️ Warning: Trading = Risk. Only play with funds you can afford to lose.

NZD/CAD THIEF TRADING ALERT: Bullish Loot Ahead – Are You In?🔥 NZD/CAD Heist: Bullish Loot Ahead! 🏴☠️💰

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba! 🚀

💸 The Master Plan:

Based on Thief Trading tactics (technical + fundamental analysis), we’re plotting a bullish heist on NZD/CAD ("Kiwi vs Loonie"). The vault is open—time to swipe the loot!

📈 Entry (Long Only):

Buy Limit Orders preferred (15-30min TF for pullbacks).

Aggressive? Enter anytime—just stick to the strategy!

🛑 Stop Loss (Protect Your Loot!):

Nearest swing low (4H TF) → 0.81500 (adjust based on risk & lot size).

Scalpers? Use trailing SL to lock profits!

🎯 Take Profit (Escape Before Cops Arrive!):

Primary Target: 0.83800 (or exit earlier if momentum fades).

⚠️ Warning (High Risk!):

Overbought? Yes. Bear traps? Likely.

Consolidation zone → trend reversal risk!

News releases? Avoid new trades—hedge or trail stops!

📊 Market Context:

Neutral trend (bullish bias forming 🐂).

Check: COT reports, macro trends, sentiment & intermarket signals BEFORE executing! 🔍 (go ahead to read 🔗🌏).

💥 Boost This Idea!

Hit 👍 LIKE & 🔔 FOLLOW to support the Thief Trading crew! More heists coming soon—stay tuned! 🚀

🚨 Reminder: Trade responsibly. This is NOT financial advice—just a risky, high-reward play. Manage your risk or get rekt!

BANK JOB: NZD/CAD LOOT GRAB (Swing Heist Plan) 🏦 "Market Heist: NZD/CAD Long Before Trap Closes! 💰

🦹♂️ Attention All Market Thieves!

(Hola! Oi! Salut! Hallo! Ahlan!) 🎭💸

🔥 Thief Trading Intel Confirmed!

The NZD/CAD "Kiwi vs Loonie" vault is primed for cracking! Our bullish heist blueprint targets the red zone - but we escape before the bears set their trap!

🔓 ENTRY: CRACKING THE SAFE

"Resistance wall at 0.83150 is the vault door!"

✔ Option 1: Buy Stop above resistance (breakout play)

✔ Option 2: Buy Limit at swing low (15m/30m pullback)

🔔 Pro Tip: Set breakout alerts - don't miss the heist!

🚨 STOP LOSS: POLICE EVASION PLAN

📍 Thief SL: 0.82200 (below 4H swing low & MA)

⚠️ Warning: No SL before breakout! You'll trigger the alarms!

💎 TARGET: ESCAPE WITH THE LOOT

🎯 Primary Take: 0.84400

💰 Scalpers: Long-only! Trail your SL like a getaway car!

📊 MARKET CONDITIONS

🐂 Bullish Trend (but overbought - time it right!)

🔍 Key Intel Needed: COT reports, macro data, sentiment

🌐 Full Briefing: Check bi0 linkss 👉🔗

🚦 RISK MANAGEMENT PROTOCOLS

• ❌ Avoid news event heists

• 🔒 Always use trailing stops

• 💣 Position size = explosive potential

🦾 SUPPORT THE SYNDICATE

💥 SMASH THAT BOOST BUTTON!

💬 Comment your heist results below!

🔔 Next job coming soon - stay tuned!

🤑 Remember thieves: Book profits before the cops arrive!

NZDCAD: Last Idea Running 300+ Pips, Next Big Opportunity OTW! Dear Traders,

Our last idea hit 340+ pips successfully, and we expect price to continue rising up, after touching our imbalance zone. That area remain a strong possible buying area for buyers. Once rejected at the area we can see strong rebound from our buying zone. 400-500 pips move is expected.

Good Luck and Trade Safe

**If you like our idea then please do like, comment and follow for more**

#NZDCAD: Great Time To Swing Sell! Comment Your View! NZDCAD is at a critical selling level, and we expect a significant drop. The chart shows potential price reversals, either continuing in our direction or rising to the red circle before reversing. A risk-managed trade could benefit from this.

Good luck and trade safely!

Much Love ❤️

Team Setupsfx_