NZD/JPY Bearish Confirmed , Short Setup To Get 100 Pips !Here is my 4H Chart on NZD/JPY , We Have A Fake Breakout and then the price Back below my old res with amazing bearish candle and we have a very good bearish Price Action on 2 And 4 Hours T.F Also the price playing very good around my res and i`m waiting the price to retest the broken area and giving me a good bearish price action on smaller time frames to can get a confirmation to enter , So i see it`s a good chance to sell this pair if it go up a little to retest the broken area and then we can sell it and targeting 100 to 200 pips . and if we have a daily closure again above my new res then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bearish Price Action .

3- Bigger T.F Giving Good Bearish P.A .

4 - Perfect 15 Mins Closure .

5- The Price Respect The Res Again .

Nzdjpysetup

Is NZD/JPY Setting Up for a Perfect Swing Trade Setup?🥝💴 KIWI vs YEN: The Ultimate Profit Heist Plan! (Swing/Day Trade Setup)

📊 Asset Overview

NZD/JPY | New Zealand Dollar vs Japanese Yen

Current Market Context: Price recently trading around 86.50, with recent volatility showing moves between 86.49 and 88.50

🎯 Trade Setup: BULLISH Bias

🚀 Entry Zones (Pick Your Poison)

1st Entry: @ 87.500 and above

For the aggressive OGs who love catching momentum

2nd Entry: Pullback & Retest @ 85.500+ (ATR Zone)

For the patient masterminds waiting for the clean retest

💡 Flexibility Note: You've got freedom anywhere above these levels — trade what you see, not what you feel!

🛡️ Stop Loss Zones (Guard Your Gold)

1st Entry SL: @ 86.500

Tight stop for momentum entries

2nd Entry SL: @ 85.000 (ATR Pullback Protection)

Wider net for retest entries

⚠️ Risk Disclosure: These are reference levels only! Adjust your stop loss based on YOUR risk tolerance and account size. This is your capital, your rules — manage it wisely!

💰 Target Zone (Escape with the Loot)

Primary Target: @ 89.500

🎪 What's Waiting There?

Strong resistance confluence

Overbought conditions likely

Potential liquidity trap zone

🏃💨 Exit Strategy: Don't get greedy! When you see profits, TAKE THEM. The market gives, but it also takes back. Scale out, lock gains, and live to trade another day.

📌 TP Flexibility: This target is guidance, not gospel. If you're in profit and want to secure gains earlier, DO IT! Your profit, your choice.

🔗 Related Pairs to Watch (Correlation Game)

Keep an eye on these correlated moves:

OANDA:AUDJPY | Sister Oceanic pair — moves together with NZD/JPY about 85% of the time

OANDA:NZDUSD | Kiwi strength indicator — if NZD/USD is bullish, it supports NZD/JPY upside

FX:USDJPY | The Yen boss — if USD/JPY rallies, JPY weakness helps NZD/JPY climb

OANDA:EURJPY | Risk sentiment gauge — risk-on = JPY weakness = NZD/JPY support

💵 Why These Matter:

All JPY crosses move on risk sentiment. When global markets are risk-on (stocks up, optimism high), JPY weakens and pairs like NZD/JPY, AUD/JPY, EUR/JPY rise. When fear hits (risk-off), JPY strengthens and these pairs drop. Watch the broader Yen picture!

Key Correlation Points:

✅ Strong correlation with commodity currencies (AUD, CAD)

✅ Inverse correlation with safe-haven flows (Gold, Bonds)

✅ Positive correlation with equity markets (S&P 500, Nikkei)

🧠 Technical Context

Bias: Bullish structure intact

Key Support: 85.000-85.500 (ATR zone)

Key Resistance: 89.500+ (profit-taking zone)

Strategy: Buy dips, sell rips, manage risk!

⚡ The Thief OG Mindset

This isn't financial advice — it's a treasure map. You decide if you want to dig. The market doesn't care about your feelings, your bills, or your dreams. It rewards patience, discipline, and ruthless risk management. Trade smart, not hard!

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

📜 Disclaimer

This is a "Thief Style" trading strategy shared purely for educational and entertainment purposes. This is NOT financial advice, investment guidance, or a recommendation to buy/sell any asset. Trading forex involves substantial risk of loss and is not suitable for all investors. Past performance does not guarantee future results. Always trade with money you can afford to lose, use proper risk management, and consult with a licensed financial advisor before making any trading decisions. By viewing this analysis, you acknowledge that all trading decisions are your own responsibility. Trade at your own risk! 🎲

#NZDJPY #ForexTrading #SwingTrading #DayTrading #KiwiYen #ForexSignals #TechnicalAnalysis #PriceAction #RiskManagement #ForexStrategy #CurrencyTrading #JPYPairs #ForexIdeas #TradingSetup #ForexCommunity #MarketAnalysis #ForexEducation #ThiefStyle #SmartMoney #ForexLife

NZDJPY: Testing Resistance, Bears Eye a PullbackNZDJPY has climbed into a key resistance zone, and momentum is beginning to stall. The pair’s recent strength has been driven by risk-on sentiment and a softer yen, but with the Bank of Japan inching toward policy normalization and New Zealand facing mixed economic signals, upside looks capped. A corrective move lower toward support is now back on the radar.

Current Bias

Bearish – price is rejecting resistance and showing early signs of reversal.

Key Fundamental Drivers

NZD: Limited support from softer domestic data and external risks tied to China’s economic slowdown.

JPY: BoJ is cautiously signaling eventual normalization, while Japanese yields remain elevated.

Risk Sentiment: Risk-off flows tend to support JPY as a safe haven, while NZD weakens during global growth concerns.

Macro Context

Interest Rates: RBNZ is on hold with limited room for tightening; BoJ signaling vigilance on FX moves and inflation, potentially supporting yen.

Economic Growth: NZ growth under pressure from weaker exports and housing, while Japan’s modest growth is paired with improving wage dynamics.

Commodities: Dairy and soft commodity weakness weigh on NZD.

Geopolitics: Trade war risks and Middle East tensions add volatility, generally favoring JPY safe-haven inflows.

Primary Risk to the Trend

A stronger-than-expected rebound in China or dovish BoJ commentary could weaken JPY, driving NZDJPY higher instead of rolling over.

Most Critical Upcoming News/Event

New Zealand Q3 CPI data and RBNZ commentary.

Japan’s BoJ policy outlook and wage growth updates.

Global risk sentiment shifts, especially around trade tariffs and geopolitical tensions.

Leader/Lagger Dynamics

NZDJPY is a lagger, usually following broader risk sentiment and moves in USDJPY. It often reflects global growth expectations, making it sensitive to China-linked headlines.

Key Levels

Support Levels: 87.44, 85.67

Resistance Levels: 88.57, 89.14

Stop Loss (SL): 89.14

Take Profit (TP): 85.67

Summary: Bias and Watchpoints

NZDJPY is leaning bearish as price stalls at resistance, with downside targets near 87.44 and 85.67 in focus. A stop loss above 89.14 protects against a breakout scenario. Fundamentally, safe-haven demand for the yen alongside weaker NZ growth drivers backs this bearish case. The most important watchpoints remain BoJ policy signals and New Zealand inflation updates, which could shift sentiment quickly.

NZD/JPY Made Clear Reversal Pattern,Long Setup To Get 100 Pips !Here is my 4H Chart On NZD/JPY , The price creating a very clear reversal pattern ( Inverted Head & Shoulders pattern ) and the price made a very good bullish price action now but the price still below my neckline. so we can enter a buy trade if we have a 4H Candle Closure above my neckline to confirm the pattern , and we can targeting from 50 to 100 pips with a decent stop loss , if we have not a 4H Closure above neckline this idea will not be valid anymore.

Reasons To Enter :

1- Perfect Touch For The Area .

2- Clear Bullish Price Action .

3- Bigger T.F Giving Good Bullish P.A .

4- Clear Reversal Pattern .

Is NZD/JPY Ready for Lift-Off? Breakout + Layered Entries🚀 NZD/JPY Swing Trade Plan | Thief Strategy Layers ⚡

NZD/JPY Market Snapshot 📊 | September 2, 2025

Exchange Rate 💸

24-Hour Change: +0.18% ⬆️

Trader Sentiment Outlook 😊😟

Retail Traders: 62% Long (Bullish) | 38% Short (Bearish)

Institutional Traders: 55% Long (Bullish) | 45% Short (Bearish)

Investor Mood 🌡️

Overall Mood: Neutral, leaning cautiously optimistic

Fear & Greed Index: 48/100 (Neutral with a slight greed tilt) 😐

Fundamental & Macro Score 📈

Fundamental Score: 60/100 (Moderately positive, supported by NZ economic stability)

Macro Score: 55/100 (Stable, though global uncertainties weigh)

Market Outlook 🐂🐻

Bias: Neutral with a slight Bullish lean

Key Driver: Expectations of Fed rate cuts supporting NZD strength vs JPY safe-haven flows.

📌 Trading Plan – Thief Layer Strategy 💎

Plan Type: Swing / Day Trade

Bias: Bullish (Pending Breakout Setup)

Breakout Entry Zone: Watch 87.100 ⚡

Set an alert on TradingView (OR) Your Personal Trading Platform to catch the breakout easily.

🔑 Thief Layer Entries (scaling in with limits):

86.600

86.800

87.000

(Add more layers if needed, but confirm with breakout above 87.100)

🛡️ Stop Loss (Thief Style): ~86.200

Place after breakout confirmation.

Adjust based on personal risk tolerance.

🎯 Target (Escape Plan):

Police barricade spotted at 88.400 🚓

Safer exit at 88.200 to lock in profit before resistance.

✨ Summary

NZD/JPY is showing bullish momentum with positive sentiment and macro support. The Thief Strategy focuses on layered limit entries + breakout confirmation, paired with disciplined SL & TP.

📌 Related Pairs to Watch 🔎

OANDA:AUDJPY

FX:USDJPY

OANDA:NZDUSD

OANDA:GBPJPY

#NZDJPY #Forex #SwingTrade #DayTrading #Breakout #TradingStrategy #ThiefMethod #JPY #NZD #FXAnalysis

Ready For The Kiwi To Run? NZD/JPY Bullish Setup Unfolding >🚨 NZD/JPY | “Kiwi vs Yen” Thief Layer Strategy 🎭 (Swing/Day Trade)

📝 Trade Idea: Bullish Breakout Pending Plan

Asset: OANDA:NZDJPY (Kiwi vs Yen)

Plan: Bullish (Pending Order Plan)

Breakout Trigger: Price breakout above 87.900⚡ — bullish candle close beyond Ichimoku Cloud confirms the plan activation.

Entry Style (Thief Layer Strategy):

Using layered buy-limit entries → (87.200), (87.500), (87.700), (87.900).

Layers are adjustable based on trader preference.

Tip: Set a TradingView alarm at breakout zone (87.900) to easily catch activation.

🛡️ Risk Management

Stop Loss (Thief SL): Suggested @86.700 (after breakout confirmation).

Adjust your SL according to your own strategy & risk.

Take Profit (Escape Target): First barricade @89.500.

Exit before resistance traps the move.

Reminder: SL/TP levels shared are for educational reference — please adapt to your own risk tolerance.

🔎 Why This Plan? (Thief Strategy + Market Data)

📊 Real-Time Market Data (Sep 9, 2025)

Spot Rate: 87.57 JPY per 1 NZD

Daily Change: +0.05% 📈

Trend: Slightly bullish intraday

😊😟 Trader Sentiment

Retail Traders → Long: 45% 🟢 | Short: 55% 🔴

Institutions → Long: 50% 🟢 | Short: 50% 🔴

Retail lean bearish, institutions balanced → setup may favor breakout traps.

😨😄 Fear & Greed Index

Current Level: 52 → Neutral 😐

Market mood balanced, no extreme fear/greed force at play.

📋 Fundamental Score → 60/100

NZD drivers: RBNZ steady policy + resilient commodity exports 🧀🌾

JPY drivers: BoJ normalization + strong wage growth 💴

Overall: Balanced, slight NZD edge from steady exports.

🌍 Macro Score → 55/100

Global risk appetite: Neutral 📊

Japan wage growth (+4.1% YoY) → supports JPY 💪

NZ exports stable despite weather risks ☁️

Macro balanced, no strong bias but breakout setups viable.

🐂🐻 Overall Outlook

Neutral-to-Bullish Bias: Fundamentals and macro are balanced, but Ichimoku breakout with thief layering adds bullish opportunity window.

📌 Related Pairs to Watch

OANDA:AUDJPY | OANDA:NZDUSD | FX:USDJPY | OANDA:CADJPY

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#NZDJPY #Forex #SwingTrade #DayTrade #Ichimoku #Breakout #LayerStrategy #KiwiVsYen #ThiefTrader

NZDJPY Massive Bullish Breakout !

HI,Traders !

#NZDJPY is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

NZD /JPY Ready To Go Up And Give Us 150 Pips , Are You Ready ?Here is my 4H Chart on NZD/JPY , We Have A Clear Breakout and the price closed above my old res and new support and we have a very good bullish Price Action on 1 And 2 Hours T.F Also the price trying to retest the area now and giving a good bullish price action on smaller time frames , , So i see it`s a good chance to buy this pair now and we can targeting from 70 to 150 pips . and if we have a daily closure again below my new res then this idea will not be valid anymore .

Entry Reasons :

1- Clear Breakout

2- Nice Retest

3- Perfect Price Action

Is NZD/JPY the Next Bullish Vault Breach? Target: 89.000💰 NZD/JPY – Thief's Layered Strike Plan | Bullish FX Heist 🚀💹

🌍 What’s up, Market Bandits?!

Welcome to the Thief Trader Vault — where trades aren't guessed… they're executed with stealth 🕵️♂️💼. Today's blueprint? We're cracking into the NZD/JPY vault with a layered limit order raid – the perfect setup for real FX tacticians.

🎯 Plan: Full Bullish Operation – Precision Infiltration 🔥

The Thief Method hits different — we don't chase price, we trap it.

We’re placing multiple limit orders like laser tripwires, stacked and ready to ambush price movement on the way to our vault 💣.

💸 Entry: ANY Price Level — Layered Style 😎

This ain’t “wait for confirmation” talk — this is calculated chaos:

🔹 Multiple limit orders, like a sniper grid

🔹 Let price dip, retrace, or fakeout — we’re in regardless

🔹 Stack 'em like bricks and let price come to YOU

🔑 “Smart thieves don’t knock — they build secret doors.”

🛡️ Stop Loss: 86.500 – Guard the Loot 🎯

No games. No leaks.

Set your SL at 86.500 – below structural defense lines.

🔒 Capital protection is king. Hit, grab, bounce.

🎯 Target: 89.000 – Vault Exit Point 💎

When we hit 89.000, we unload the bag 💼

Optional: Trail your SL and squeeze more juice if momentum breaks high.

🧠 “Exit with impact. Leave no trace.”

⚙️ Strategy Style – For Real Ones Only:

👟 Scalpers:

Tap in on micro pullbacks. Hit & run style.

🎯 Ride with momentum — no shorts, no detours.

🛠️ Swing Traders:

You’re the long-haul vault opener. Stay locked in.

Use patience as your weapon — let the plan cook.

🧠 Market Backing – This Isn’t Just Hype:

🔸 JPY showing weakness across risk pairs

🔸 Global sentiment leaning risk-on

🔸 Cross-market confluence backing NZD strength

🔸 Liquidity voids above — ripe for targeting

⚠️ Risk Management = Real Trader Behavior

🚨 Avoid jumping during high-impact news

🧱 Trail your SL if you're already in profit

📉 This ain't gambling. It's probability warfare

💬 Final Words – Boost The Bandit Blueprint 📣

🔥 SMASH that ❤️ if this plan speaks your language.

🔁 DROP a comment if you’re layering up with the crew.

We don’t follow the herd — we rob the market 🥷💹

📌 Stay silent. Stay sharp. Stay rich.

— Thief Trader 💼⚡

NZDJPY - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

"Trap or Opportunity? NZD/JPY Smart Pullback Play?"💼🎯 NZD/JPY – The Kiwi Vault Breakout | Thief Trading Style Forex Blueprint 🔓📈

🌟Hola! Hello! Ola! Bonjour! Hallo! Marhaba, Global Market Raiders!🌍✨

Welcome to the Thief Trading Style – where smart traders strategize, strike, and secure the bag. This is not your regular trade idea... this is a market infiltration plan – a tactical move on the NZD/JPY pair, aka the Kiwi vs Yen Battle Zone.

🎯 Plan Overview – Operation: Kiwi Vault Breakout

Using a mix of technical heatmaps, smart money concepts, and macro insight, this chart outlines a bold plan for Long Position scalpers and swing tacticians.

💹 The current trend shows signs of bullish momentum, with price eyeing the upper yellow zone – a known resistance pocket where liquidity pools and trap setups often play out.

📈 Entry Strategy – The Gate Is Open

Buy Limit zones:

☑️ Watch the 15/30 min timeframe for pullbacks to nearest swing low/high.

☑️ Ideal for scalpers & swing traders aiming for precise entries.

🧠 “Enter like a shadow, exit like thunder.”

🛑 Stop Loss – Secure Your Capital

Place SL at:

☑️ Recent swing low/high (Based on 4H structure – approx. 87.200)

☑️ Adjust according to your lot size, capital exposure, and position count

Remember, SL is not fear — it's discipline.

🎯 Target – Precision Exit

🎯 TP Zone: 88.900

⚠️ Optional: Exit earlier based on reaction to key levels, or trail your stop to lock gains.

💡 "Profit isn't greed, it's your reward for precision."

⚡Trader Roles – Choose Your Mode

👀 Scalpers:

Only trade the long bias. No short-circuiting the plan.

Use trailing stops to guard gains and surf the momentum waves.

📈 Swing Traders:

You’re in for a full ride — ride the wave till the next institutional block.

Stay patient, and let price develop before jumping in.

🔍 Analysis Backdrop – What’s Fueling the Move?

The bullish push is backed by:

🔸 Positive fundamental & macro signals

🔸 Institutional positioning (check COT Reports)

🔸 Intermarket correlation strength

🔸 Market sentiment score

📊 Want full breakdowns? Dive into COT, Macro Reports, Quant Flow & more → 🔗🔗🔗 Klick

📰 Risk Reminder – News Volatility Warning

🚨 Avoid new entries during major data releases

🔒 Protect open positions with trailing SLs

⚙️ Manage risk – trading is about probability, not certainty

💬 Final Words – Boost the Blueprint

💥Hit “Like” if you vibe with this strategy and support the community of tactical traders.

This plan is designed to bring clarity, structure, and a bit of swagger to your chart screen.

See you in the next setup – stay sharp, stay stealthy. 💼🧠💪

Disclaimer:

This idea is for educational purposes only and not investment advice. Please evaluate your own risk tolerance and market understanding before entering any trades.

nzdjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

NZD/JPY "Kiwi vs Yen" Forex Bank Heist (Day Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Crossing previous high (86.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 30mins timeframe (84.800) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 88.000

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/JPY "Kiwi vs Yen" Forex Bank Heist (Day Trade Plan) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

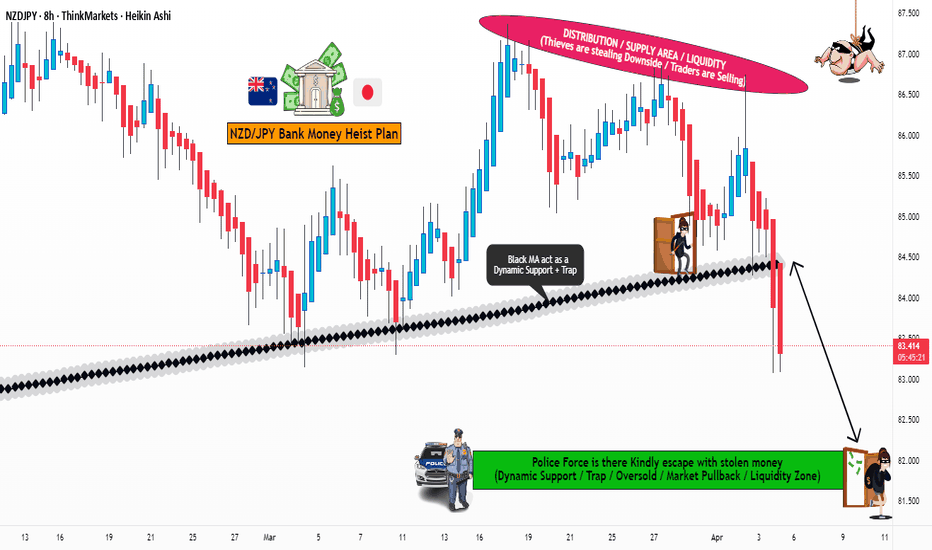

NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (85.500) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 82.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💸💵NZD/JPY "Kiwi vs Yen" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/JPY "Kiwi vs Yen" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (85.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (83.800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 87.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

NZD/JPY "Kiwi vs Yen" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

⭐☀🌟Fundamental Analysis⭐☀🌟

Fundamental analysis focuses on economic and political factors influencing NZD (New Zealand Dollar) and JPY (Japanese Yen).

New Zealand (NZD):

Interest Rates: The Reserve Bank of New Zealand (RBNZ) sets the Official Cash Rate (OCR). As of early 2025, assume the OCR is around 4.5% (based on prior tightening cycles). Higher rates typically support NZD, but if inflation is cooling (e.g., below 3%), rate cuts could loom, pressuring NZD downward.

Economic Data: Key drivers include dairy prices (a major export), GDP growth (projected ~2% in 2025), and employment (assume ~4% unemployment). Weak dairy prices or slowing growth could weaken NZD.

Trade Balance: NZ relies heavily on exports to China. If China’s economy slows in 2025, NZD may face headwinds.

Political Stability: New Zealand is stable, so no major political risk unless unexpected elections or policy shifts occur.

Japan (JPY):

Interest Rates: The Bank of Japan (BOJ) has historically kept rates near zero (e.g., 0.1% in 2024). If 2025 sees a shift to 0.5% due to inflation pressures (e.g., above 2%), JPY could strengthen, but gradualism is likely.

Economic Data: Japan’s GDP growth is slow (~1%), with deflation risks fading. Strong export data (e.g., machinery, autos) supports JPY.

Safe-Haven Status: JPY gains in risk-off scenarios (e.g., geopolitical tensions or equity sell-offs).

Yen Carry Trade: Low rates make JPY a funding currency. If global risk appetite rises, JPY weakens as traders borrow yen to buy higher-yielding assets like NZD.

NZD/JPY Impact: Higher NZD yields vs. JPY favor bullishness, but JPY strength could emerge if global risk aversion spikes or BOJ tightens unexpectedly.

⭐☀🌟Macro Economics⭐☀🌟

Macro factors extend beyond fundamentals to broader economic cycles:

Global Growth: Assume 2025 global GDP growth is ~3%. Strong growth favors NZD (commodity currency), while slowdowns boost JPY (safe haven).

Inflation Trends: NZ inflation cooling (e.g., 2.5%) vs. Japan’s rising (e.g., 2%) could narrow the yield gap, pressuring NZD/JPY lower.

Monetary Policy Divergence: RBNZ pausing or cutting vs. BOJ tightening could shift NZD/JPY bearish.

Commodity Prices: NZD benefits from rising dairy, meat, and lumber prices. A commodity rally supports bullish NZD/JPY.

Currency Intervention: Japan may intervene if JPY weakens past 150 vs. USD (NZD/JPY less directly affected but still relevant).

⭐☀🌟Global Market Analysis⭐☀🌟

Equity Markets: Bullish global stocks (e.g., S&P 500 up 5% YTD) favor NZD (risk-on) over JPY (risk-off).

Bond Yields: Rising NZ 10-year yields (e.g., 4.8%) vs. Japan’s (e.g., 1%) support NZD/JPY upside.

Forex Trends: If USD/JPY is climbing (e.g., 148), JPY weakness could lift NZD/JPY. Conversely, USD/NZD strength signals NZD weakness.

Geopolitical Risks: Tensions (e.g., U.S.-China trade war escalation) boost JPY, capping NZD/JPY gains.

⭐☀🌟COT Data (Commitment of Traders)⭐☀🌟

COT reports from the CFTC show speculative positioning:

NZD Futures: If net long positions are rising (e.g., +10,000 contracts), bulls dominate. Net short (-5,000) signals bearish pressure.

JPY Futures: Heavy net short positions (e.g., -50,000) indicate JPY weakness (carry trade unwind risk). Net long suggests safe-haven buying.

NZD/JPY Inference: Bullish if NZD longs increase and JPY shorts persist; bearish if reversed.

Note: Exact COT data requires real-time access (e.g., CFTC release March 7, 2025). Check the latest report for precision.

⭐☀🌟Intermarket Analysis⭐☀🌟

NZD Correlations: Positive with AUD (0.8 correlation) and commodity indices (e.g., CRB). AUD/NZD strength or commodity rallies lift NZD/JPY.

JPY Correlations: Negative with equities (-0.7 vs. Nikkei). Equity declines strengthen JPY, pressuring NZD/JPY.

Gold: Rising gold prices signal risk-off, favoring JPY over NZD.

⭐☀🌟Quantitative Analysis⭐☀🌟

Technical Levels:

Support: 83.50 (50-day SMA), 82.00 (200-day SMA).

Resistance: 85.00 (psychological), 86.50 (Fibonacci 61.8% retracement from prior high).

RSI: At 55 (neutral), no overbought/oversold signal.

Bollinger Bands: Price near upper band (e.g., 84.80) suggests potential pullback.

Volatility: Implied volatility (e.g., 10% annualized) indicates moderate moves ahead.

Probability: 60% chance of testing 85.50 if bullish, 55% chance of 83.00 if bearish (based on historical ranges).

⭐☀🌟Market Sentiment Analysis⭐☀🌟

Retail Sentiment: If 70% of retail traders are long NZD/JPY (contrarian signal), a reversal may loom.

News Sentiment: Positive NZ economic releases vs. Japan’s cautious BOJ tone could tilt sentiment bullish.

⭐☀🌟Positioning (Next Trend Move)⭐☀🌟

Short-Term (1-4 weeks):

Bullish Target: 85.50 (break above 85.00 resistance).

Bearish Target: 83.50 (support test).

Medium-Term (1-3 months):

Bullish Target: 86.50 (if risk-on persists).

Bearish Target: 82.00 (200-day SMA breach).

Long-Term (6-12 months):

Bullish Target: 88.00 (multi-year resistance).

Bearish Target: 80.00 (if global recession hits).

Trend Direction: Mildly bullish short-term unless risk-off spikes.

⭐☀🌟Overall Summary Outlook⭐☀🌟

Current Price: 84.500.

Bias: Mildly bullish short-term due to NZD yield advantage and risk-on sentiment, but JPY strength could cap gains if global risks rise.

Key Drivers: RBNZ vs. BOJ policy, commodity prices, global risk appetite.

Prediction: Bullish to 85.50 short-term (70% probability) if equities hold; bearish to 83.00 (60% probability) if JPY safe-haven flows dominate.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/JPY Giving Amazing Bullish P.A , Best Place To Buy Cleared !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

NZD/JPY At The Best Place To Buy It And Get +250 Pips !The price at a very interesting area to buy it , it`s an old support , it pushed the price very hard last time , so i will enter a buy trade with 250 pips target if i have a very good 4H Closure !

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

NZD/JPY "Kiwi vs Japanese" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Japanese" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 89.200

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 90.200 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental & Macro Outlook 📰🗞️

Based on the fundamental & macro analysis, I would expecting a bullish outlook for NZD/JPY "Kiwi vs Japanese" Forex Market

Fundamental Analysis

1. Interest Rate Differential: The Reserve Bank of New Zealand (RBNZ) has maintained a hawkish tone, while the Bank of Japan (BoJ) remains dovish. This interest rate differential can make NZD/JPY more attractive to investors.

2. Inflation Rates: New Zealand's inflation rates have been relatively high, while Japan's inflation rates remain low. Higher inflation in New Zealand can lead to higher interest rates, making NZD/JPY more attractive.

3. Economic Growth: New Zealand's economic growth has been steady, while Japan's economy has shown signs of improvement. A stronger Japanese economy can lead to a weaker NZD/JPY.

4. Trade Balance: New Zealand's trade balance has been in deficit, while Japan's trade balance has been in surplus. A worsening trade balance in New Zealand can lead to a weaker NZD/JPY.

Macroeconomic Analysis

1. Global Risk Appetite: NZD/JPY is considered a risk pair, meaning it performs well when global risk appetite is high. A decrease in global risk appetite can lead to a weaker NZD/JPY.

2. Central Bank Policies: The BoJ's monetary policy remains more dovish than the RBNZ's. A more dovish BoJ can lead to a weaker JPY, making NZD/JPY more attractive.

3. Geopolitical Tensions: Geopolitical tensions, particularly between the US and North Korea, can lead to a safe-haven flow into JPY, weakening NZD/JPY.

4. Commodity Prices: New Zealand is a major exporter of commodities, so higher commodity prices can lead to a stronger NZD, making NZD/JPY more attractive.

Upcoming Economic Events

1. RBNZ Monetary Policy Statement (February 22): A hawkish tone from the RBNZ can lead to a stronger NZD and a bullish NZD/JPY.

2. BoJ Monetary Policy Meeting (March 10): A dovish tone from the BoJ can lead to a weaker JPY and a bullish NZD/JPY.

3. New Zealand GDP (March 16): A strong GDP reading can lead to a stronger NZD and a bullish NZD/JPY.

Conclusion

Based on the analysis above, the outlook for NZD/JPY is slightly bullish. The interest rate differential, inflation rates, and commodity prices are all supportive of a stronger NZD. However, geopolitical tensions and a potential safe-haven flow into JPY can lead to a weaker NZD/JPY.

Market Sentiment Indicators

1. FX Sentiment Index: 54% of traders are long on NZD/JPY, while 46% are short. (Source: FXStreet)

2. Retail Trader Sentiment: 60% of retail traders are long on NZD/JPY, while 40% are short. (Source: IG Client Sentiment)

3. Speculative Positions: The latest CFTC data shows that speculative positions are net long on NZD/JPY. (Source: CFTC)

Market Sentiment Analysis

The market sentiment indicators suggest that the majority of traders are bullish on NZD/JPY. This could be due to the interest rate differential between New Zealand and Japan, as well as the recent strength in commodity prices.

However, it's essential to note that market sentiment can be a contrarian indicator. If the majority of traders are long on NZD/JPY, it may indicate that the market is due for a correction.

Disclaimer---Sentiment & Fundamental analysis is subjective and based on publicly available data. It should not be considered as investment advice. Trading forex involves risk, and you could lose some or all of your investment. Always do your own research and consider multiple sources before making a trade.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂