NZDUSD: First Drop Around 150+ Pips Then 800+ Pips BuyDear traders,

I hope you’re all doing well. We have a great opportunity where we expect the price to drop around our target area. This area looks promising and safer than selling at the current price. We recommend waiting for the price to touch our target before considering a buy. Remember the market has been very volatile and risky. Consider all possibilities and whether you can afford to risk trading in this environment. Always maintain strong risk management to protect your accounts.

If you like our trading ideas, please like and comment. Also, follow us for up-to-date updates.

Team Setupsfx_

Nzdusdbreakout

#NZDUSD: Final Drop Before Swing Bullish ReversalThe NZDUSD has dropped significantly in recent months without any proper bullish correction. Currently, the price is approaching a key level from which we believe it could finally reverse. However, as this is a swing setup, it might take months to complete. We wish you the best in trading and stay careful tomorrow.

Good luck,

Team Setupsfx_

#NZDUSD: 400+ Pips Trading Setup, Intraday+Swing TradeDear Traders,

I hope you enjoyed your weekend. We now have a fantastic opportunity to buy NZDUSD. The price is likely to continue its bullish momentum, allowing us to see a sustained uptrend from the current level. This is highly probable given the DXY’s potential further decline and NZD’s strong bullish trend over the past few weeks or months. We’ve identified two potential targets: an 400+ pip trading setup.

If you like our work, please consider liking and commenting on the idea for more.

Team Setupsfx_

NZD/USD Price Outlook – Trade Setup📊 Technical Structure

OANDA:NZDUSD NZD/USD has surged into the 0.5964–0.5975 resistance zone after a sharp impulsive rally from the prior support base. Price is now stalling and consolidating beneath this key supply area, showing signs of bullish exhaustion.

The current structure suggests a potential mean-reversion pullback after an extended upside move. Failure to break and hold above the resistance zone increases the probability of a corrective decline toward the 0.5912–0.5900 support zone, which previously acted as a demand area and now aligns with a logical retracement target.

As long as price remains capped below the resistance band, the near-term bias favors a bearish continuation.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 0.5964 – 0.5975

Stop Loss: 0.5985

Take Profit 1: 0.5912

Take Profit 2: 0.5900

Risk–Reward Ratio: Approx. 1 : 2.62

📌 Invalidation

A sustained break and close above 0.5985 would invalidate the bearish setup and signal a continuation of the broader bullish trend.

🌐 Macro Background

NZD/USD has been supported by broad US Dollar weakness ahead of the Federal Reserve’s policy meeting, with the DXY slipping to a four-month low near 97.00. At the same time, stronger-than-expected New Zealand Q4 CPI at 3.1% YoY has opened the door for a potential RBNZ rate hike, further fueling the Kiwi’s upside.

However, with the Fed expected to hold rates steady this week and recent geopolitical tensions easing after President Trump softened his tariff stance, the US Dollar could stabilize in the near term. This macro backdrop supports the case for a technical pullback in NZD/USD after its steep rally into resistance.

🔑 Key Technical Levels

Resistance Zone: 0.5964 – 0.5975

Support Zone: 0.5912 – 0.5900

Bearish Invalidation: Above 0.5985

📌 Trade Summary

NZD/USD has rallied aggressively into a well-defined resistance zone and is showing signs of short-term distribution. As long as price remains below 0.5964–0.5975, the setup favours a sell-on-rallies approach, targeting a corrective move toward 0.5912–0.5900.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

NZDUSD: Latest Chart Analysis 07/01/2026 🔺As per our previous analysis, the price was expected to maintain a bullish trend until all our targets were met. However, we have observed a shift in price behavior, and the price has now reversed, initiating a bearish trend. This presents a favorable opportunity for us, as the price decline is attributed to a previously unaddressed liquidity void.

🔺The entry zone has been clearly indicated by a red box labeled "area needs to be filled." Given the current strong bearish momentum, our entry is anticipated to become active by Monday. Once the entry is activated, the stop loss can be positioned below the designated entry zone.

🔺We have identified three target points that we believe are likely to be achieved within the next couple of months. Kindly utilize this analysis for educational purposes exclusively, and we recommend setting your take-profit levels based on your own informed judgment.

🔺If you appreciate our efforts, please consider liking and commenting for more analyses of these type.

Team SetupsFX❤️🏆

NZD/USD Price Outlook – Trade Setup📊 Technical Structure

OANDA:NZDUSD NZD/USD is trading slightly softer around 0.5775, holding above the 0.5772–0.5776 support zone while repeatedly failing to sustain a break above the 0.5790–0.5794 resistance area. The pair remains range-bound ahead of major US employment data and the FOMC rate decision, with price action showing a tightening consolidation pattern.

As long as NZD/USD holds above the support band, dips may continue to attract buyers for another attempt toward the resistance zone. A clean break below 0.5769 would invalidate the bullish scenario and expose deeper downside. Conversely, a breakout above 0.5794 could trigger short-covering momentum toward higher levels.

🎯 Trade Setup

Idea: Buy dips near support and target a retest of the resistance zone.

Entry: 0.5772 – 0.5776

Stop Loss: 0.5769

Take Profit 1: 0.5790

Take Profit 2: 0.5794

Risk–Reward Ratio: ~1 : 2.12

Bullish bias remains valid as long as price holds above 0.5772–0.5776 A 30M/1H close below 0.5769 invalidates the setup.

🌐 Macro Background

Markets expect the Fed to cut rates by 25 bps on Wednesday, but traders fear a hawkish cut — meaning the Fed cuts once but signals fewer cuts ahead. This supports the USD in the short term, weighing on NZD/USD.

China, New Zealand’s largest trading partner, posted its largest trade surplus since June, reflecting stronger export performance. A strong China surplus is generally positive for the Kiwi, but this effect is being overshadowed by Fed-related USD strength.

Later today, traders will focus on the delayed US ADP four-week average and JOLTS job openings data. Stronger-than-expected numbers could further support the USD, while softer data may help NZD/USD stabilize near support.

🔑 Key Technical Levels

Resistance Zone: 0.5790 – 0.5794

Support Zone: 0.5776 – 0.5772

Invalidation Level: 0.5769 (30M/1H close below)

📌 Trade Summary

NZD/USD is consolidating below 0.5800 as markets await US employment data and the Fed decision. The technical structure supports buying dips into the support zone, targeting a move toward 0.5790–0.5794. A break below 0.5769 invalidates the bullish setup and suggests a shift in momentum.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

NZD/USD Price Outlook – Trade Setup📊 Technical Structure

OANDA:NZDUSD NZD/USD holds firm above the 0.5738–0.5732 Support Zone, maintaining its short-term bullish structure. The pair has rebounded strongly from support and is now pressing toward the 0.5773–0.5780 Resistance Zone.

Price action shows a constructive sequence of higher lows on the 4H chart, indicating buyers are defending dips. As long as NZD/USD stays above 0.5732, the bullish outlook remains valid. A clean break above 0.5773 could open a move toward 0.5800+.

A 4H close below 0.5726 would invalidate the bullish structure.

🎯 Trade Setup

Idea: Buy dips toward support, targeting continuation toward resistance.

Entry: 0.5738 – 0.5732

Stop Loss: 0.5726

Take Profit 1: 0.5773

Take Profit 2: 0.5780

Risk–Reward Ratio: ≈ 1 : 3

Bias remains bullish above 0.5738–0.5732

🌐 Macro Background

NZD/USD rises toward 0.5750 as upbeat Chinese Services PMI data boosts risk sentiment. China remains New Zealand’s largest trading partner, making the Kiwi highly sensitive to Chinese economic performance. The November Services PMI beat expectations at 52.1, supporting NZD demand.

The Reserve Bank of New Zealand (RBNZ) delivered a widely expected 25bps rate cut last week but signalled that the easing cycle may be ending. This "less dovish" stance supported NZD on dips.

Meanwhile, US Dollar softness persists as Fed rate-cut expectations strengthen. Markets now price an 89% probability of a December rate reduction. Traders await ADP Employment and ISM Services PMI for further direction.

Overall, stronger Chinese data, a neutral-leaning RBNZ, and dovish Fed expectations favour NZD/USD upside on dips.

🔑 Key Technical Levels

Resistance Zone: 0.5773 – 0.5780

Support Zone: 0.5738 – 0.5732

Bullish Targets: 0.5773 / 0.5780

Invalidation: 4H close below 0.5726

📌 Trade Summary

NZD/USD maintains bullish momentum above the 0.5740 region, supported by upbeat Chinese data and a less-dovish RBNZ stance. With Fed rate-cut expectations weighing on USD, the setup favours buying dips toward support and targeting the 0.5773–0.5780 resistance zone. Structure remains bullish unless price closes below 0.5726.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

NZDUSD_2025-12-03_15-36-04 1.png

NZD/USD Price Outlook – Trade Setup📊 Technical Structure

FOREXCOM:NZDUSD NZD/USD is consolidating just below the 0.5600 handle after rebounding from multi-month lows near 0.5570. The broader structure remains bearish, with a clear sequence of lower highs and lower lows on the 4H chart.

Price is trading beneath the highlighted Resistance Zone at 0.5635–0.5642, while the Support Zone sits at 0.5577–0.5584. Recent candles show waning downside momentum (longer lower wicks, smaller bodies), hinting at short-term exhaustion, but the downtrend stays intact as long as price holds below the resistance band.

From a structural point of view, rallies into 0.5635–0.5642 are still viewed as areas where sellers may re-enter, targeting a retest of the 0.5584 region.

🎯 Trade Setup

Idea: Sell into resistance in line with the prevailing downtrend.

Entry: 0.5635 – 0.5642 (near Resistance Zone)

Stop Loss: 0.5651 (above resistance & recent swing high)

Take Profit 1: 0.5584 (top of Support Zone)

Take Profit 2: 0.5577 (support lows / extension target)

Risk–Reward Ratio: ≈ 1: : 3.07

Bias: Short-term bearish while NZD/USD trades below 0.5650. A 4H close above this level would invalidate the setup and suggest deeper correction toward 0.5700.

🌐 Macro Background

According to FXStreet’s latest commentary, NZD/USD is struggling to sustain moves above 0.5600, having fallen roughly 9% in less than four months as markets price in a dovish Reserve Bank of New Zealand (RBNZ) stance. Expectations are building for a 25 bps rate cut at Wednesday’s meeting, and the focus is now on the monetary policy statement for clues on further easing into 2026.

RBNZ side:

Markets widely expect one cut this week, with risks tilted toward a dovish message (more easing later if growth and inflation soften).

These expectations are acting as a headwind for the Kiwi, limiting any meaningful rebound despite oversold technical conditions.

USD side:

The US Dollar remains underpinned by reduced confidence in a December Fed rate cut, though upside is capped by upcoming heavy data (PCE, GDP, confidence).

Any stronger-than-expected US data would support the USD, reinforcing NZD/USD downside; softer data could trigger short-term squeezes higher but not necessarily a trend reversal unless the Fed narrative shifts clearly more dovish.

Overall, fundamentals still favour selling NZD on rallies, but the short-term oversold backdrop explains why price is hesitating under 0.5600 rather than collapsing straight to new lows.

🔑 Key Technical Levels

Resistance Zone: 0.5635 – 0.5642

Support Zone: 0.5577 – 0.5584

Intermediate Level: 0.5600 (psychological pivot)

Invalidation (bearish view): Sustained 4H close above 0.5650

📌 Trade Summary

NZD/USD remains in a downtrend, with 0.5635–0.5642 acting as a key supply area. The plan favours selling rallies into resistance, targeting a retest of 0.5584–0.5577, in line with RBNZ-driven Kiwi weakness and a still-supported USD.

Only a clear break above 0.5651 would suggest that bears are losing control and that a broader corrective recovery toward 0.5700 may be underway.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

NZD/USD: Explosion Wave or Kiwi's Last BreathNZD/USD: Explosion Wave or Kiwi's Last Breath

📈 Weekly Scenarios

Bullish scenario: NZD/USD holds the ~0.582-0.588 zone, then breaks upwards through resistance at ~0.598-0.605 → growth to these levels within the impulse wave.

Consolidation: The price may hang between ~0.588 and ~0.605, forming an accumulation zone until the next move.

Bearish scenario: A downward breakout below ~0.582 with volume → possible decline to ~0.560-0.554 within the correction wave.

✅ Conclusion

NZD/USD is at an important decision point: either a strong upward impulse starts, or a corrective wave reverses.

Key levels—0.582-0.588 (support) and 0.598-0.605 (resistance)—will determine the future path.

The wave structure currently allows for both scenarios; it's important to wait for confirmation through price reaction at the indicated levels.

#NZDUSD:DXY Gaining Its Strength Back, Is it end for the Bulls? The OANDA:NZDUSD DXY index shows a change in price character and momentum, indicating a possible price reversal for the shorter term. This aligns with our fundamental analysis, as there’s a likelihood of a China-US trade deal that could significantly influence the demand for the DXY.

There are two possible selling entries, allowing you to choose between a riskier or safer approach. Alongside these entries, we’ve set targets accordingly to your chosen entry.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

NZD/USD The Kiwi Heist Plan – Breakout or Bust?🦘 NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing/Day Trade) 🦘

🎯 MISSION: BEARISH (PENDING ORDER HEIST) 🎯

📍 THE ENTRY PLAN: THE BREAKOUT TRIGGER

⚡ MAIN ENTRY SIGNAL: Wait for the BREAKOUT & CLOSE below 0.58000! This is when the bank vault door gets cracked! ⚡

🧨 THIEF'S LAYERED ENTRY STRATEGY: Don't go all in! We use multiple SELL LIMIT orders to scale in like a pro. After the breakout, set your heist layers at:

1st Layer (Safe Loot): 0.58100

2nd Layer (Main Loot): 0.58200

3rd Layer (Ballsy Loot): 0.58400

🤑 You can add more layers based on your own risk appetite! This is the thief's way (DCA/Layering).

🛑 THE ESCAPE ROUTE: STOP LOSS

👮♂️ THIEF OG's STOP LOSS: Our getaway car is parked at 0.58800. Place your SL ONLY AFTER the 0.58000 breakout is confirmed!

📢 Attention all Thieves & Robbers: Adjust your final SL based on your own risk management, lot size, and how many layers you used! Protect your capital! 👊

💰 THE FINAL TARGET: CASH OUT & ESCAPE

🚨 Police Barricade Ahead! Don't get greedy! The mission is to escape with the stolen money at 0.57000! 🚨

🔊 THIEF'S LOOTING MANUAL (READ THIS!):

🚨 Set a CHART ALERT at 0.58000! Don't miss the heist signal!

📰 NEWS = POLICE PATROLS! Avoid opening new trades during high-impact news. It increases volatility and risk!

🔐 Manage Your Position! This is your key to survival. Use proper risk/reward ratios.

💖 SUPPORT THE HEIST CREW!

💥 SMASH THAT LIKE & BOOST BUTTON! 💥

It fuels our next robbery plan! Let's make stealing money from the market look EASY! 🤑🚀

I'll see you on the next heist, Thief! Stay sharp! 🐱👤🤝

NZD/USD 4H Chart Analysis – Key Levels and RSI InsightsThe NZD/USD pair is currently trading around 0.5861 after recently bouncing from the 0.5800 support zone. On the 4H chart, price action shows a strong rejection at the recent low, followed by a short-term bullish correction.

🔑 Key Technical Levels

Support Zone: 0.5800 – Strong buying pressure observed here.

Resistance Zone: 0.5900 – Price failed to break this level in the last attempt.

Current Price: 0.5861

📉 Trend Analysis

The ZigZag indicator highlights a dominant downtrend from above 0.6000, followed by a corrective move. The price is now consolidating between 0.5800 and 0.5900, suggesting indecision in the market.

📊 RSI Indicator (14)

The RSI is hovering around the 40–50 range, showing neutral momentum. Previously, RSI touched oversold levels near 30, sparking the recent bounce. As of now, there’s no clear overbought or oversold signal, meaning traders should watch closely for confirmation.

📌 Trading Plan

Bullish Scenario: A breakout above 0.5900 could open the path toward 0.5950 – 0.6000.

Bearish Scenario: If price breaks below 0.5800, the next target could be 0.5750.

✅ Conclusion

NZD/USD is in a consolidation phase after a strong downtrend. Traders should keep an eye on the 0.5800 support and 0.5900 resistance levels for the next directional move. RSI suggests neutrality, so waiting for a breakout or confirmation is wise before entering new trades.

Ready to Rob the Kiwi? NZD/USD Bullish Breakout Plan🥝💚 NZD/USD Bullish Breakout Heist Plan 🟢💰 (Thief Trader Style)

🎭 Robbery Mission Activated – Code: Kiwi Uprising 💣📈

💥 Asset: NZD/USD

📍 Entry: 0.59400 (Breakout confirmed – the vault door’s open!)

🔐 Stop Loss: 0.58300 (Thief exit point – avoid the trap zone)

🎯 Target: 0.60500 (Cash-out point – grab the bags and vanish!)

🧠 Strategy: Layered Limit Orders a.k.a “Precision DCA Infiltration”

🧤 The Thief Trader is sneaking into the forex vaults once again — this time with eyes locked on Kiwi (NZD/USD). The bulls are loading up, and the breakout zone is showing green flags 🟢 — time to strike hard and clean 💰

🔥 Operation Details:

We’re stacking multiple limit orders like a pro thief would place decoys – distraction + precision = execution! Entry at 0.59400 is our main gate breach. Orders set in layers to trap liquidity zones below.

🚨 Stop Loss @ 0.58300 – tight enough to avoid getting caught, but wide enough to dodge fake traps.

🏆 Target: 0.60500 – that’s where the loot vault is sitting. Clean exit once we’re loaded with profits!

👀 Swingers & Scalpers Alert!

Only look LONG – no short robbing here!

🔁 Use trailing SL once in profit – protect your gold like a pro.

💡If cash is low – no panic, join the swing gang and glide in with patience & alerts. Smart robbers wait 🧠💼

📣 News Risk ⚠️

Avoid jumping during major news blast-offs.

Lock profits with trailing SL.

No panic entries — only sniper moves.🕵️♂️💥

❤️ Smash That BOOST Button 💥💪

Support the squad! More boosts = more heist plans, more clean money from the market streets 🚀📈

🎭 Stay sharp, rob smart — see you in the next plan, robbers 🤑🐱👤🎯

~ Thief Trader

NZD/USD "KIWI HEIST" – BEARISH BANK ROBBERY!🦹♂️ NZD/USD "THE KIWI HEIST" – BEARISH BANK ROBBERY PLAN! 🚨💰

(Thief Trading Style – Short Entry Strategy for Maximum Loot!)

🎯 MASTER TRADING HEIST BLUEPRINT

🔥 Thief’s Technical & Fundamental Analysis Confirms:

NZD/USD is OVERBOUGHT + TREND REVERSAL!

Police (Bulls) set a TRAP near the Red Zone (Support) – Time to ESCAPE with profits before they catch us!

✔ Entry Point (Bearish Loot Grab):

*"The vault is UNLOCKED! Swipe SHORT anywhere – but for SAFER HEIST, use Sell Limit orders (15m/30m pullbacks). Pro Thieves use DCA/Layering for max gains!"*

✔ Stop Loss (Escape Route):

"SL at nearest 4H Swing High (0.60400). Adjust based on YOUR risk tolerance & loot size!"

✔ Target 🎯 (Profit Escape):

0.58900 (or exit earlier if cops (bulls) show up!)

⚠️ THIEF’S WARNING – NEWS & RISK MANAGEMENT

📢 High-Impact News = VOLATILITY TRAP!

Avoid new trades during news releases.

Trailing SL = Lock profits & evade market cops!

💥 SCALPERS & SWING THIEVES – QUICK NOTES:

Scalpers: Only quick LONG scalp plays (use Trailing SL!).

Swing Thieves: Hold for the BIG BEARISH LOOT! 🏦

📉 WHY NZD/USD IS BEARISH? (Thief’s Intel Report)

Overbought + Trend Reversal Signals!

Bulls (Police) losing strength at Resistance!

For FULL Intel (Fundamentals, COT Report, Sentiment, etc.) – Klickk 🔗!

🚀 BOOST THIS HEIST! (Like & Share for More Loot Plans!)

💖 "Hit 👍 BOOST to strengthen our THIEF SQUAD! More heists = More profits!"

📌 DISCLAIMER (Stay Safe, Thieves!):

This is NOT financial advice. Trade at your own risk & manage positions wisely!

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🎭

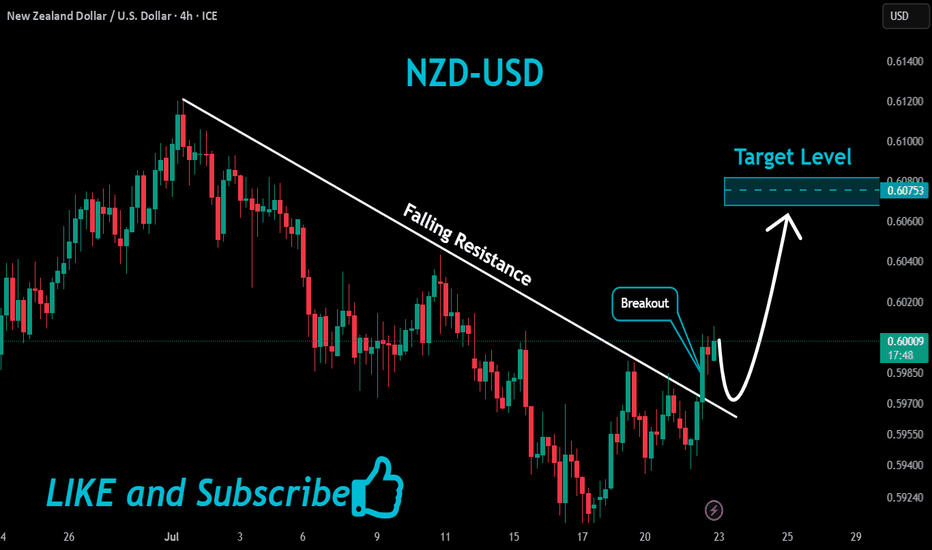

NZDUSD Massive Bullish Breakout!

HI,Traders !

#NZDUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

Is This the Next Big Heist? Thief Trader Eyes NZD/USD Long SetupThief Trader’s NZD/USD Heist Plan – Long Setup in Play!

🌍 **Hello Global Wealth Warriors!**

Hello, Bonjour, Ciao, Salut, Guten Tag, Ola!

📢 **Fellow Profit Pirates & Market Mavericks**, it’s time to set sail again! Get ready to loot the forex seas with our latest **Thief Trader Strategy** targeting the **NZD/USD (The Kiwi)** pair.

---

🔎 **Trade Overview**

💥 Setup: Long Entry Plan – Executing our cunning blueprint with Thief Trading's sharp technical & fundamental intel**.

🎯 Target: 0.62300 (or exit just before for safety).

⚠️ Danger Zone: Watch for traps at the RED Zone Level – signs of overbought conditions, consolidation, trend flips & bearish setups.

---

🟢 **Entry Signal** – *The Heist Begins!*

📈 **Primary Entry**:

> Breakout above **MA Line (0.60300)** = Bullish move → *Place a Buy Stop above ATR Line*

📉 **Pullback Option**:

> *Buy Limit* at recent swing low/high on **15 or 30-min TF**.

📌 **Pro Tip**:

Set an **Alert** on your chart to catch the breakout live. Timing is everything!

---

🛑 **Stop Loss – The Getaway Plan**

📍 **SL Recommendation**:

> Recent swing low on the **4H chart (0.59400)** for day/swing trades.

> 🎯 Customize your SL based on risk, lot size, and total orders.

---

🔐 **Scalpers vs. Swingers**

👀 **Scalpers**: Focus ONLY on long-side plays.

💰 Got deep pockets? Dive in.

😎 Otherwise, swing traders – this is your golden moment. Trail your SL to protect profits.

🌐 **Market Pulse** – Momentum Watch

📊 Kiwi is navigating a **MA Resistance Zone**, but bullish bias remains due to:

* **Fundamentals**

* **Macro Insights**

* **COT Reports**

* **Sentiment & Intermarket Trends**

* **Quant Analysis + Overall Score**

📎 Check the linkks for detailed breakdown.

📰 **News Warning!**

⚠️ Major releases ahead?

* Pause entries.

* Protect trades with **trailing SLs**.

---

🚨 **Join the Next Heist with Thief Trading!**

💥 Smash that **Boost** or **Like** to join our profit squad.

With **Thief Trader Style**, we dominate the markets DAILY.

Your support fuels our mission. ❤️💼

---

💸 Stay ready for the next move, money-makers.

🎯 Eyes on the chart – timing is profit.

NZD/USD "The Kiwi" Forex Bank Money Heist (Bullish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 1D timeframe (0.58400) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.60800

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸NZD/USD "The Kiwi" Forex Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZD/USD "The Kiwi" Forex Bank Money Heist (Short Term Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 0.60300

🏁Sell Entry below 0.58990

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 0.59000 for Bullish Trade

🚩Thief SL placed at 0.60000 for Bearish Trade

Using the 30mins period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 0.61500 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 0.57500 (or) Escape Before the Target

💰💵💸NZD/USD "The Kiwi" Forex Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check👉👉👉🔗🔗🌎🌏🗺

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NZDUSD potential 50 pip drop? NZDUSD 4h crossed the previous liquidity zone with strong false breakout giving a high probability for the price to form a potential inverted head & shoulder and may continue to drop to 0.5308 which may lead a 50 pip drop with market open as the market is in strong down trend.

A possible sell trade setup with market open is highly probable!

NZDUSD..SHORTPrice is nearing a critical level around .

** No setup, no trade. **

For me, a solid plan always comes before any prediction.

*****If the zone is broken and confirmed with a retest, I’ll adjust my plan accordingly for a possible reverse trade.

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP