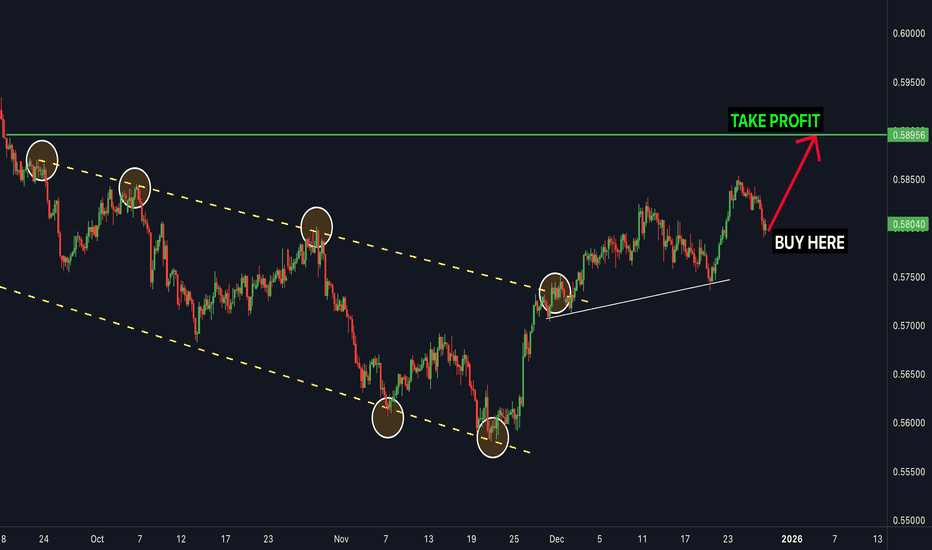

NZDUSD - TIME TO BUYNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD.

Nzdusdlong

TheGrove | NZDUSD buy | Idea Trading AnalysisNZDUSD is falling towards a support level which is a pullback support and could bounce from this level to our take profit.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity NZDUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

NZDUSD to find support market price?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5850 will confirm the bullish momentum.

The measured move target is 0.5900.

We look to Buy at 0.5800 (stop at 0.5765)

Our profit targets will be 0.5875 and 0.5900

Resistance: 0.5850 / 0.5875 / 0.5900

Support: 0.5800 / 0.5775 / 0.5750

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD - TIME TO BUY NOW - it's going upNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD now it's going up

#NZDUSD: Final Drop Before Swing Bullish ReversalThe NZDUSD has dropped significantly in recent months without any proper bullish correction. Currently, the price is approaching a key level from which we believe it could finally reverse. However, as this is a swing setup, it might take months to complete. We wish you the best in trading and stay careful tomorrow.

Good luck,

Team Setupsfx_

NZDUSD Forming Continuation StructureNZDUSD is showing a healthy bullish continuation structure after a strong impulsive move to the upside. The market previously printed a clean higher high sequence, confirming trend strength, followed by a controlled pullback inside a descending channel. This type of corrective price action typically reflects profit-taking rather than trend reversal, especially when momentum remains supported above key structure levels.

Technically, the recent breakout from the falling channel signals renewed buyer interest and continuation potential. Price respecting higher lows while compressing inside the channel indicates accumulation before expansion. As long as NZDUSD holds above the channel breakout zone, the bullish bias remains intact, with upside continuation favored toward previous highs and liquidity resting above the recent swing high.

From a fundamentals perspective, NZD strength is supported by stabilization in risk sentiment and expectations that New Zealand monetary conditions remain relatively firm compared to USD. Meanwhile, the US dollar has shown periods of weakness driven by shifting rate expectations, softer inflation components, and fluctuating risk appetite. This macro backdrop aligns well with the technical bullish structure now developing on NZDUSD.

Overall, market structure, momentum, and fundamentals are aligned for further upside continuation. Pullbacks into former resistance turned support may offer favorable risk-to-reward opportunities, while sustained price acceptance above current levels keeps the bullish scenario valid. As long as the higher low structure remains intact, NZDUSD stays positioned for continuation rather than reversal.

NZD/USD Trend Shift Confirmed | Pullback → Reversal Setup📈 NZD/USD – “THE KIWI”

Forex Market Trade Opportunity Guide (Swing / Day Trade)

🧠 Market Bias

BULLISH 🟢

Bullish plan confirmed with:

🔺 Triangular Moving Average pullback

🕯️ Heikin Ashi Doji candle → momentum pause + reversal signal

🔄 Trend structure shift indicating buyers stepping in

This combination signals controlled accumulation, not emotional chasing.

🎯 Entry Strategy

Entry: Any price level

➡️ PLEASE NOTE: Thief Using Layer (or) Any Price Level Entry

🔹 Layering Strategy (Multiple Buy Limits):

📍 0.57400

📍 0.57500

📍 0.57600

📍 0.57700

➡️ You may increase or adjust layers based on your own risk management.

📌 Why layering?

It reduces emotional entries, improves average price, and aligns with institutional-style execution.

🛑 Stop Loss

Thief SL: 0.57300

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

Adjust your SL according to your own strategy, capital, and risk profile.

📎 This SL is a reference, not a recommendation.

🎯 Target / Exit Logic

Target: 0.58500

🚔 Moving Average acts as a “Police Barricade”

Strong dynamic resistance

Overbought conditions likely

Potential bull trap + corrective reaction

➡️ Kindly escape with profits near resistance zones.

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

I am not recommending using only my TP.

Profit-taking is your responsibility.

🔗 RELATED PAIRS TO WATCH (Correlation Insight)

💵 USD-Related

TVC:DXY (US Dollar Index):

⬇️ Weak DXY = ⬆️ NZD/USD bullish continuation

$EUR/USD:

Strength here often confirms USD weakness

$AUD/USD:

Strong positive correlation with NZD (commodity-linked currencies)

🧾 Commodity Link

$XAU/USD (Gold):

Risk-on flows into commodities often support NZD strength

📌 If AUD/USD and EUR/USD stay bid while DXY weakens, NZD/USD bullish bias strengthens.

🌍 ECONOMIC FACTORS TO CONSIDER BEFORE ENTRY

🇳🇿 New Zealand (NZD Drivers)

📊 RBNZ Interest Rate Decisions

📉 Inflation (CPI) trends

🥛 Dairy prices & export demand

🇨🇳 China growth data (key NZ trade partner)

🇺🇸 United States (USD Drivers)

🏦 Federal Reserve policy outlook

📈 CPI / Core PCE inflation data

👷 NFP & unemployment data

📉 Bond yields & risk sentiment

🌐 Macro Environment

Risk-ON → NZD strengthens

Risk-OFF → USD demand increases

📌 Always align technical bias with macro flow.

✅ Final Notes

✔️ Technical confirmation present

✔️ Structured risk via layering

✔️ Macro alignment improves probability

❌ No emotional entries

❌ No blind TP/SL copying

💬 If this setup aligns with your view, support with a LIKE ❤️ and SHARE your thoughts below.

📌 Trade smart. Trade disciplined. Let price do the talking.

NZDUSD - TIME TO BUY NOWNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD now

NZDUSD to find buyers at previous support?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5800 will confirm the bullish momentum.

The measured move target is 0.5850.

We look to Buy at 0.5760 (stop at 0.5725)

Our profit targets will be 0.5835 and 0.5850

Resistance: 0.5800 / 0.5825 / 0.5850

Support: 0.5775 / 0.5760 / 0.5725

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

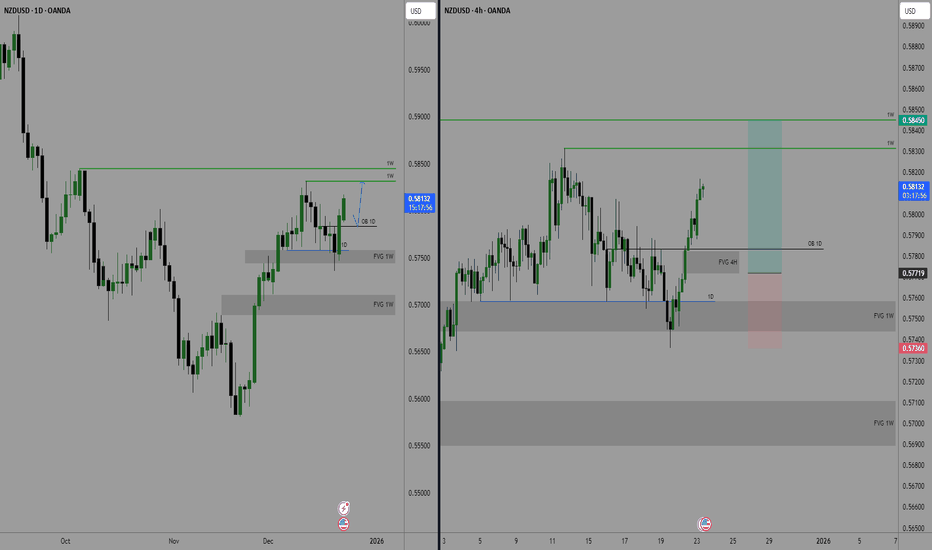

NZD/USD Building Bullish Structure From DemandDespite recent corrective moves, NZD/USD is developing a strong bullish foundation as price continues to respect the major demand zone at the bottom of the chart. Each rejection from this zone shows clear evidence of institutional buying, with long wicks and aggressive recoveries indicating that sellers are losing power.

The rounded-top and earlier distribution worked mainly as a liquidity sweep, pulling price back into areas where large buyers were waiting. Now, price is forming a higher-low structure, suggesting accumulation rather than continuation of the downtrend. The presence of the Fair Value Gap (FVG 4H) below acts as a completed rebalancing area, giving room for a clean bullish expansion.

If price maintains stability above the buyer zone (0.5690–0.5700), we can expect a progressive move toward the mid-range resistance at 0.5740, and eventually a push back into the upper supply zone around 0.5800, which becomes the primary bullish target. Fresh liquidity is building above recent highs, providing the fuel needed for an upside continuation.

Overall, the market shows signs of accumulation, higher lows, and smart-money support, favoring a bullish continuation as long as price remains above the major demand zone.

NZDUSD - buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD now

NZDUSD - Time to buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD Now

Growth is gaining momentum: an upward wave in developmentIn its current phase, USDJPY is showing signs of gradual strengthening. After a period of consolidation, the upward movement is becoming more pronounced, and the wave structure points to the formation of a bullish scenario. Buyers maintain the initiative, limiting the depth of pullbacks.

The chart shows that the price is consolidating above local support zones, while the sequence of waves is taking on a clearer upward character. This dynamic creates the foundation for a new impulse and confirms interest in continued growth.

The fundamental backdrop also favors strengthening: demand for the dollar remains supported by expectations of a dovish Bank of Japan policy, which reinforces buyer positions and sustains upward movement.

As a result, the pair remains in a recovery phase, where the market’s next steps may confirm the formation of a sustainable bullish trend.

Is NZD/USD Ready for a Bullish Drive? WMA Breakout Validated🎯 EUR/USD "THE FIBRE" BREAKOUT SETUP | Multi-Layer Entry Strategy 📊

📈 MARKET ANALYSIS | EUR/USD SWING/DAY TRADE

Asset: EUR/USD (The Fibre)

Bias: BULLISH ✅

Setup: Triangular Moving Average Breakout + Retest Confirmed

Strategy Type: Swing/Day Trade | Multi-Layer Entry (Thief Method)

🎯 TRADE PLAN BREAKDOWN

Entry Strategy: "THIEF LAYERING METHOD" 💰

This strategy uses multiple limit orders to scale into position:

📍 Multi-Layer Buy Limit Entries:

Layer 1: 1.16400

Layer 2: 1.16600

Layer 3: 1.16800

Note: You can add more layers based on your capital allocation and risk tolerance

🛑 Stop Loss:

Thief SL: 1.16200

⚠️ Adjust based on YOUR strategy and risk management plan

🎯 Take Profit Target:

Primary TP: 1.17600 (Strong resistance + potential overbought zone)

💡 Exit Strategy: Watch for trap patterns near resistance—secure profits wisely!

⚡ KEY TECHNICAL LEVELS

Entry Zone: 1.16400-1.16800 (Multi-layer accumulation)

Stop Loss: 1.16200 (Risk management level)

Target: 1.17600 (Resistance + overbought zone)

🔗 RELATED PAIRS TO WATCH (USD CORRELATION)

Monitor these pairs for confirmation and correlation analysis:

Direct USD Pairs:

GBP/USD (Cable) 📉 - Positive correlation with EUR/USD approximately 70-80%. When Cable moves higher, it typically confirms USD weakness across the board and supports EUR/USD bullish momentum.

USD/JPY 📊 - Inverse correlation, acts as a USD strength indicator. If USD/JPY drops below 150.00, it signals USD selling pressure which benefits EUR/USD longs.

USD/CHF 🇨🇭 - Inverse correlation, serves as a risk-off sentiment gauge. When USD/CHF falls, it indicates USD weakness and supports EUR/USD upside.

EUR Cross Pairs:

EUR/GBP 🇪🇺🇬🇧 - Measures EUR strength versus GBP. Rising EUR/GBP shows Euro outperformance and confirms EUR/USD bullish bias.

EUR/JPY 📈 - Risk appetite indicator. When EUR/JPY climbs, it signals risk-on sentiment which typically supports EUR/USD gains.

EUR/CHF - Euro zone stability measure. Stable or rising EUR/CHF indicates confidence in the Eurozone economy.

💡 Correlation Key Points:

USD Index (DXY) - Watch for weakness below 106.00 for EUR/USD bullish continuation. A breaking DXY confirms broad USD selling.

GBP/USD alignment - If Cable breaks higher simultaneously, this confirms USD weakness is widespread, not just EUR strength.

USD/JPY divergence - A drop below 150.00 signals significant USD selling pressure across all pairs.

Risk Sentiment - EUR/JPY rising equals risk-on environment which generally supports EUR/USD bullish moves.

⚠️ RISK DISCLAIMER

Dear Traders (OG Thief Gang),

This is NOT financial advice—educational analysis only

ADJUST YOUR SL/TP based on YOUR risk tolerance

Money management is YOUR responsibility

Take profits at YOUR comfort zone

Never risk more than you can afford to lose

Markets can be unpredictable—trade smart! 🧠

📊 WHY THIS SETUP WORKS

✅ Triangular MA breakout confirmed

✅ Retest of breakout level completed

✅ Multi-layer entry reduces timing risk

✅ Clear risk/reward ratio defined

✅ Correlation analysis supports directional bias

📌 Remember: The market rewards patience and discipline. Trade your plan, not your emotions! 🎯💪

NZDUSD: Bullish Push to 0.593?FX:NZDUSD is eyeing a bullish rebound on the daily chart , with price approaching a key support zone near cumulative sell liquidation, converging with downward short-term and long-term trendlines that could spark upside momentum if buyers defend the level amid recent consolidation. This setup hints at a reversal opportunity after the downtrend, targeting higher levels with strong risk-reward.🔥

Entry between 0.56060–0.56780 for a long position (entry at current levels with proper risk management is recommended). Target at 0.59300 . Set a stop loss at a close below 0.55680 , yielding a risk-reward ratio of approximately 1:2.5 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's potential recovery post-pullback.🌟

Fundamentally , NZDUSD is holding near 0.5723 as of November 28, 2025, after surging to 0.5715 following the RBNZ's 25 bps rate cut to 2.25% on November 27, with signals of no further easing ahead amid resilient labor markets and inflation concerns. The pair has risen about 2.65% since late last week from a low of 0.55910 on November 20, driven by renewed NZD strength and rising US rate cut bets that could weaken the USD further, though forecasts suggest testing support near 0.5675 with volatility persisting due to diverging central bank policies. 💡

📝 Trade Setup

🎯 Entry (Long):

0.56060 – 0.56780

🎯 Target:

• 0.59300

❌ Stop Loss:

• Daily close below 0.55680

⚖️ Risk-to-Reward:

• ~1:2.5 overall

👇 Share your thoughts below! 👇

NZDUSD - buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD Now

NZDUSD to find buyers at market price?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5800 will confirm the bullish momentum.

The measured move target is 0.5875.

We look to Buy at 0.5775 (stop at 0.5740)

Our profit targets will be 0.5850 and 0.5875

Resistance: 0.5800 / 0.5825 / 0.5850

Support: 0.5775 / 0.5750 / 0.5725

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD/USD Price Outlook – Trade Setup📊 Technical Structure

OANDA:NZDUSD NZD/USD is trading slightly softer around 0.5775, holding above the 0.5772–0.5776 support zone while repeatedly failing to sustain a break above the 0.5790–0.5794 resistance area. The pair remains range-bound ahead of major US employment data and the FOMC rate decision, with price action showing a tightening consolidation pattern.

As long as NZD/USD holds above the support band, dips may continue to attract buyers for another attempt toward the resistance zone. A clean break below 0.5769 would invalidate the bullish scenario and expose deeper downside. Conversely, a breakout above 0.5794 could trigger short-covering momentum toward higher levels.

🎯 Trade Setup

Idea: Buy dips near support and target a retest of the resistance zone.

Entry: 0.5772 – 0.5776

Stop Loss: 0.5769

Take Profit 1: 0.5790

Take Profit 2: 0.5794

Risk–Reward Ratio: ~1 : 2.12

Bullish bias remains valid as long as price holds above 0.5772–0.5776 A 30M/1H close below 0.5769 invalidates the setup.

🌐 Macro Background

Markets expect the Fed to cut rates by 25 bps on Wednesday, but traders fear a hawkish cut — meaning the Fed cuts once but signals fewer cuts ahead. This supports the USD in the short term, weighing on NZD/USD.

China, New Zealand’s largest trading partner, posted its largest trade surplus since June, reflecting stronger export performance. A strong China surplus is generally positive for the Kiwi, but this effect is being overshadowed by Fed-related USD strength.

Later today, traders will focus on the delayed US ADP four-week average and JOLTS job openings data. Stronger-than-expected numbers could further support the USD, while softer data may help NZD/USD stabilize near support.

🔑 Key Technical Levels

Resistance Zone: 0.5790 – 0.5794

Support Zone: 0.5776 – 0.5772

Invalidation Level: 0.5769 (30M/1H close below)

📌 Trade Summary

NZD/USD is consolidating below 0.5800 as markets await US employment data and the Fed decision. The technical structure supports buying dips into the support zone, targeting a move toward 0.5790–0.5794. A break below 0.5769 invalidates the bullish setup and suggests a shift in momentum.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

NZDUSD - great time to buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. Time to buy NZDUSD..

NZDUSD H1 | Bullish Bounce Off Key SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 0.5754

- Strong pullback support

- 38.2% Fib retracement

- 61.8% Fib projection

Stop Loss: 0.57339

- Swing low support

Take Profit: 0.57767

- Multi-swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com/uk ), Stratos Europe Ltd (tradu.com/eu ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com/en ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.