NZD/USD Momentum Breakout Play – Swing Bias💎 Title: NZD/USD "THE KIWI" | Professional Breakout Blueprint 🚀

📊 Market Context: The Kiwi Resurgence

The NZD/USD is currently carving out a massive accumulation zone. After a period of consolidation, we are seeing the "Kiwi" show its true strength against a softening Greenback. This isn't just a move; it's a calculated heist on liquidity. 🥷

🏹 The Trade Plan: Bullish Breakout Execution

We are tracking a high-probability Bullish Continuation. The structure is screaming for a liquidity grab above the major psychological hurdles.

⚡ Entry Level: Look for high-volume confirmation after a clean Breakout & Retest of the 0.60700 resistance.

🎯 Primary Target (TP): Taking the bag at 0.61300. This zone aligns with strong historical resistance and a potential "trap" area where the "Police Force" (institutional sellers) might step in. Don't be greedy—hit and run.

🛡️ Thief Stop Loss (SL): Protect your capital at 0.60200. If the price breaks this floor, the setup is invalidated. Stay safe or stay broke.

🖇️ Correlations & Related Pairs to Watch

To trade the Kiwi like a pro, you must watch the "cousins" and the "boss":

OANDA:AUDUSD : High positive correlation. If the Aussie ( GETTEX:AUD ) leads the rally, the Kiwi ($NZD) usually follows. 🇦🇺🇳🇿

TVC:DXY (US Dollar Index): The enemy. If the TVC:DXY cracks its support, our Kiwi trade goes to the moon. 📉

OANDA:AUDNZD : Keep an eye on the cross; it tells us if New Zealand is truly outperforming its neighbor.

🌍 Fundamental & Economic Drivers (Feb 2026)

The macro landscape is shifting, and we are positioned to benefit:

RBNZ Stance: The Reserve Bank of New Zealand is holding steady at 2.25%, but with inflation remaining sticky, the market is starting to price in a "Hawkish Pivot" for late 2026. 🏦

US Labor Data: Upcoming US CPI and NFP reports are critical. Any signs of a softening US economy will provide the fuel for this NZD breakout. ⛽

Commodity Boost: Rising prices in dairy and soft commodities are providing fundamental support to the NZD's bottom line. 🥛

Thief Trader Style: Motivation & Logic

"In this market, you are either the thief or the victim. We don't hope; we execute." 🕯️

Note to the Ladies & Gentlemen (Thief OGs): I am not your financial advisor. My TP and SL are my own maps to the treasure. You can make money, but you must take money at your own risk. Use proper risk management or the market will take it all back. 💸

"The market is a bank that never closes—you just need the right key to the vault." 🗝️

Good luck, stay sharp, and let's secure the bag! 🥂

Nzdusdsignal

NZDUSD Buy Trading Opportunity SpottedH4 - Strong bullish move.

Currently it looks like a pullback is happening.

Until the two support zones hold I expect bullish continuation.

👉 If you enjoy this analysis, please Like, Follow, and Support the profile! Your engagement motivates us to share more quality setups.

NZDUSD: First Drop Around 150+ Pips Then 800+ Pips BuyDear traders,

I hope you’re all doing well. We have a great opportunity where we expect the price to drop around our target area. This area looks promising and safer than selling at the current price. We recommend waiting for the price to touch our target before considering a buy. Remember the market has been very volatile and risky. Consider all possibilities and whether you can afford to risk trading in this environment. Always maintain strong risk management to protect your accounts.

If you like our trading ideas, please like and comment. Also, follow us for up-to-date updates.

Team Setupsfx_

#NZDUSD: Final Drop Before Swing Bullish ReversalThe NZDUSD has dropped significantly in recent months without any proper bullish correction. Currently, the price is approaching a key level from which we believe it could finally reverse. However, as this is a swing setup, it might take months to complete. We wish you the best in trading and stay careful tomorrow.

Good luck,

Team Setupsfx_

#NZDUSD: 400+ Pips Trading Setup, Intraday+Swing TradeDear Traders,

I hope you enjoyed your weekend. We now have a fantastic opportunity to buy NZDUSD. The price is likely to continue its bullish momentum, allowing us to see a sustained uptrend from the current level. This is highly probable given the DXY’s potential further decline and NZD’s strong bullish trend over the past few weeks or months. We’ve identified two potential targets: an 400+ pip trading setup.

If you like our work, please consider liking and commenting on the idea for more.

Team Setupsfx_

NZD/USD Trend Shift Confirmed | Pullback → Reversal Setup📈 NZD/USD – “THE KIWI”

Forex Market Trade Opportunity Guide (Swing / Day Trade)

🧠 Market Bias

BULLISH 🟢

Bullish plan confirmed with:

🔺 Triangular Moving Average pullback

🕯️ Heikin Ashi Doji candle → momentum pause + reversal signal

🔄 Trend structure shift indicating buyers stepping in

This combination signals controlled accumulation, not emotional chasing.

🎯 Entry Strategy

Entry: Any price level

➡️ PLEASE NOTE: Thief Using Layer (or) Any Price Level Entry

🔹 Layering Strategy (Multiple Buy Limits):

📍 0.57400

📍 0.57500

📍 0.57600

📍 0.57700

➡️ You may increase or adjust layers based on your own risk management.

📌 Why layering?

It reduces emotional entries, improves average price, and aligns with institutional-style execution.

🛑 Stop Loss

Thief SL: 0.57300

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

Adjust your SL according to your own strategy, capital, and risk profile.

📎 This SL is a reference, not a recommendation.

🎯 Target / Exit Logic

Target: 0.58500

🚔 Moving Average acts as a “Police Barricade”

Strong dynamic resistance

Overbought conditions likely

Potential bull trap + corrective reaction

➡️ Kindly escape with profits near resistance zones.

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

I am not recommending using only my TP.

Profit-taking is your responsibility.

🔗 RELATED PAIRS TO WATCH (Correlation Insight)

💵 USD-Related

TVC:DXY (US Dollar Index):

⬇️ Weak DXY = ⬆️ NZD/USD bullish continuation

$EUR/USD:

Strength here often confirms USD weakness

$AUD/USD:

Strong positive correlation with NZD (commodity-linked currencies)

🧾 Commodity Link

$XAU/USD (Gold):

Risk-on flows into commodities often support NZD strength

📌 If AUD/USD and EUR/USD stay bid while DXY weakens, NZD/USD bullish bias strengthens.

🌍 ECONOMIC FACTORS TO CONSIDER BEFORE ENTRY

🇳🇿 New Zealand (NZD Drivers)

📊 RBNZ Interest Rate Decisions

📉 Inflation (CPI) trends

🥛 Dairy prices & export demand

🇨🇳 China growth data (key NZ trade partner)

🇺🇸 United States (USD Drivers)

🏦 Federal Reserve policy outlook

📈 CPI / Core PCE inflation data

👷 NFP & unemployment data

📉 Bond yields & risk sentiment

🌐 Macro Environment

Risk-ON → NZD strengthens

Risk-OFF → USD demand increases

📌 Always align technical bias with macro flow.

✅ Final Notes

✔️ Technical confirmation present

✔️ Structured risk via layering

✔️ Macro alignment improves probability

❌ No emotional entries

❌ No blind TP/SL copying

💬 If this setup aligns with your view, support with a LIKE ❤️ and SHARE your thoughts below.

📌 Trade smart. Trade disciplined. Let price do the talking.

Growth is gaining momentum: an upward wave in developmentIn its current phase, USDJPY is showing signs of gradual strengthening. After a period of consolidation, the upward movement is becoming more pronounced, and the wave structure points to the formation of a bullish scenario. Buyers maintain the initiative, limiting the depth of pullbacks.

The chart shows that the price is consolidating above local support zones, while the sequence of waves is taking on a clearer upward character. This dynamic creates the foundation for a new impulse and confirms interest in continued growth.

The fundamental backdrop also favors strengthening: demand for the dollar remains supported by expectations of a dovish Bank of Japan policy, which reinforces buyer positions and sustains upward movement.

As a result, the pair remains in a recovery phase, where the market’s next steps may confirm the formation of a sustainable bullish trend.

NZDUSD idea 12.11.2025For nzdusd I have the following scenario: sfp above the nearest high for a short at a price around 0.581 where the daily level and fibo 0.5 are nearby. for a possible long, I would like sfp below the low because it would mean a drop to the level of 0.552 where, among other things, the monthly level is also located, which will be essential.

NZD/USD Technical Setup – Demand Retest + Bullish Structure📈 NZD/USD "THE KIWI" Forex Money Looting Plan (Swing/Day Trade) 🥝💵

🛠️ Plan Overview

Bias: Bullish ✅

Reasoning: Demand Re-Test + Wyckoff Accumulation Phase (buyers confirmed their presence).

🎯 Entry Strategy (Thief Layer Style)

Our Thief Strategy = layered limit orders 🔑

Example buy layers:

0.59200

0.59300

0.59400

0.59500

(You can expand layers based on your risk appetite & market liquidity 📊).

⚡ This layered entry approach helps capture price dips while managing risk — OG Thief style!

🛡️ Stop Loss

Suggested SL: 0.59000 (below breakout structure).

⚠️ Note: Dear Ladies & Gentlemen (Thief OG’s), this SL is not a hard rule. Adjust it to match your own strategy & risk management.

🎯 Take Profit

Target zone: 0.60400 (strong resistance area).

Rationale: Price approaching overbought conditions + potential trap zone.

⚠️ Note: Exit is flexible — take profits on your own terms and protect your gains.

🔗 Related Pairs to Watch (Correlation Radar)

OANDA:AUDUSD → Highly correlated (both AUD & NZD are commodity currencies 📦).

OANDA:NZDJPY → Tracks Kiwi strength vs safe-haven flows 💴.

TVC:DXY (US Dollar Index) → Inverse correlation driver 💵.

OANDA:GBPNZD → Cross-check for Kiwi strength in broader FX spectrum.

Watching these helps confirm if Kiwi momentum is real or just a false breakout!

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDUSD #Forex #Kiwi #SwingTrade #DayTrade #Wyckoff #FXTrading #TradingPlan #LayeringStrategy #AUDUSD #DXY

Can NZD/USD Push Higher? Bullish Setup Explained!💹 NZD/USD "The Kiwi" Day Trade Plan 🥝✨

🎯 Plan Overview

This setup is designed with a bullish outlook on NZD/USD.

Think of it as a tactical layering strategy, where we sneak entries step by step (like clever market thieves 🎭), stacking multiple limit orders for precision.

Trend Context:

🔴 & 🟢 Moving Averages = Dynamic Levels (MA flips from resistance ➝ support 🔄)

📊 William %R = showing a golden bullish signal ✨

💥 Bulls & traders smashing through MA = momentum shift 🚀

🛠️ Trade Setup

Entry:

Layered buy limit orders at:

👉 0.59300 | 0.59400 | 0.59500 | 0.59600

(Scalable — add more layers if market structure allows 📈)

Stop Loss:

Recommended safety net: 0.59100

🛡️ Reminder: Adjust SL according to your own risk management & style.

Target:

🎯 Profit zone near 0.60400

⚠️ Key note: Resistance = “Police barricade 🚓” (strong supply zone + overbought risk).

Exit before the trap closes & secure the bag 💼.

🧠 Notes for Traders

This is a strategy-style setup, not financial advice.

SL/TP levels are flexible — adapt based on your own risk & money management rules.

Market = battlefield. Respect your plan, don’t get greedy.

🔗 Related Pairs to Watch

OANDA:AUDUSD (high correlation with NZD/USD — Aussie often shadows Kiwi moves 🪙)

OANDA:NZDJPY (risk sentiment driver — Kiwi strength shows here 🔥)

TVC:DXY (Dollar Index — strong inverse correlation ⚖️, watch USD tone for confirmation)

FX:EURUSD (broad USD flow impact 🌍)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NZDUSD #Forex #DayTrading #Kiwi #PriceAction #ForexStrategy #MarketAnalysis #SwingTrade #TechnicalAnalysis #FX

Ready to Rob the Kiwi? NZD/USD Bullish Breakout Plan🥝💚 NZD/USD Bullish Breakout Heist Plan 🟢💰 (Thief Trader Style)

🎭 Robbery Mission Activated – Code: Kiwi Uprising 💣📈

💥 Asset: NZD/USD

📍 Entry: 0.59400 (Breakout confirmed – the vault door’s open!)

🔐 Stop Loss: 0.58300 (Thief exit point – avoid the trap zone)

🎯 Target: 0.60500 (Cash-out point – grab the bags and vanish!)

🧠 Strategy: Layered Limit Orders a.k.a “Precision DCA Infiltration”

🧤 The Thief Trader is sneaking into the forex vaults once again — this time with eyes locked on Kiwi (NZD/USD). The bulls are loading up, and the breakout zone is showing green flags 🟢 — time to strike hard and clean 💰

🔥 Operation Details:

We’re stacking multiple limit orders like a pro thief would place decoys – distraction + precision = execution! Entry at 0.59400 is our main gate breach. Orders set in layers to trap liquidity zones below.

🚨 Stop Loss @ 0.58300 – tight enough to avoid getting caught, but wide enough to dodge fake traps.

🏆 Target: 0.60500 – that’s where the loot vault is sitting. Clean exit once we’re loaded with profits!

👀 Swingers & Scalpers Alert!

Only look LONG – no short robbing here!

🔁 Use trailing SL once in profit – protect your gold like a pro.

💡If cash is low – no panic, join the swing gang and glide in with patience & alerts. Smart robbers wait 🧠💼

📣 News Risk ⚠️

Avoid jumping during major news blast-offs.

Lock profits with trailing SL.

No panic entries — only sniper moves.🕵️♂️💥

❤️ Smash That BOOST Button 💥💪

Support the squad! More boosts = more heist plans, more clean money from the market streets 🚀📈

🎭 Stay sharp, rob smart — see you in the next plan, robbers 🤑🐱👤🎯

~ Thief Trader

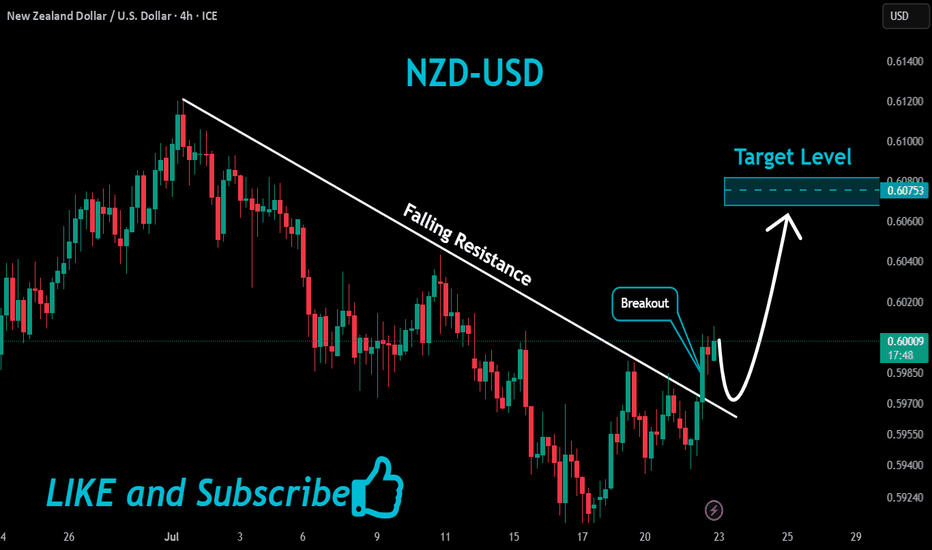

NZDUSD Massive Bullish Breakout!

HI,Traders !

#NZDUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

NZDUSD Trade Idea. Key Levels for a Potential NZD/USD Short📉 NZD/USD is trending strongly bearish, and I’ve just posted a new breakdown on TradingView 🎥. The current price action looks overextended, and the pair remains under heavy selling pressure 🔻.

I’m watching for a potential retracement into the Fibonacci 50%–61.8% zone 🔄 — the equilibrium area where I’ll be eyeing a possible short entry 🎯.

The video covers entry ideas, stop-loss placement, and target levels 🎯📍.

⚠️ This is not financial advice — for educational purposes only.

NZD/USD "Kiwi" Forex Vault Heist Plan!🌟 Yo, what's good? Salaam! Ciao! Konnichiwa! 🌟

Dear Cash Snatchers & Market Bandits, 🤑💰💸😎

Get ready to raid the NZD/USD "Kiwi" Forex Vault with the slickest 🔥Thief Trading Style🔥 Our tech-fueled, fundamental-backed heist plan is locked and loaded for a long-entry score. Stick to the chart’s sneaky blueprint and aim to slip out near the Red Zone—a high-stakes trap where overbought vibes, consolidation, and bearish bandits lurk. 🏆💸 Grab your loot and treat yourself, you sly foxes! 💪🎉

- 📈 Entry Point: The heist’s ON! 🕵️♂️ Lay low for the MA pullback at Institutional Buy Zone 1 (0.57700) or Buy Zone 2 (0.56000), then pounce for juicy bullish profits! 🚀

- 🛑 Stop Loss: Yo, ears up! 🗣️ If you’re setting a buy stop order, don’t touch that stop loss ‘til the breakout pops off. 📍 Stash it at the closest swing low on the 4H: Buy Zone 1 SL at 0.56500, Buy Zone 2 SL at 0.54500. Size it to your risk, lot, and multi-order game plan. Mess around, and you’re toast! 🔥

- 🎯 Target: Shoot for 0.62500 or ghost out early with the goods. 💰

- 👀 Scalper Crew: Long-side scalping only! Got deep pockets? Dive in. Tight budget? Roll with swing traders and slap on a trailing SL to shield your stash. 🧲

- 📊 Why It’s Lit: The Kiwi’s bullish run is powered by fundamentals, macro trends, COT reports, quant analysis, market vibes, and intermarket signals. Scope the full scoop from legit sources! 🌍🔗

⚠️ Heads-Up: News drops can flip the game! 📰 Stay sharp:

- Dodge new trades when news hits.

- Slap trailing stop-losses on to lock profits and cover your back.

💖 Fuel the heist! 💥 Smash that Boost Button to power up our Thief Trading Style squad. Swipe profits daily like a pro and roll with the slickest crew! 🏆🤝🚀 Catch you on the next big score, bandits! 🤑🐱👤😎

NZDUSD Distribution possible short 0.5800 & 0.5700#nzdusd distribution phase. 22nd april daily key reversal formed, early and advance indication for reversal. price started distribution. on 7th May also again formed daily key reversal bar. double confirmation for short in coming days. initial target is 0.5800 which may suspect support level and then correction before going down for another let. two possible scenario, first one may short directly, 2nd either may again retest upper area of distribution for sell which is more secure way. stop loss above 0.6035, target: 0.5800