NZD/USD Momentum Breakout Play – Swing Bias💎 Title: NZD/USD "THE KIWI" | Professional Breakout Blueprint 🚀

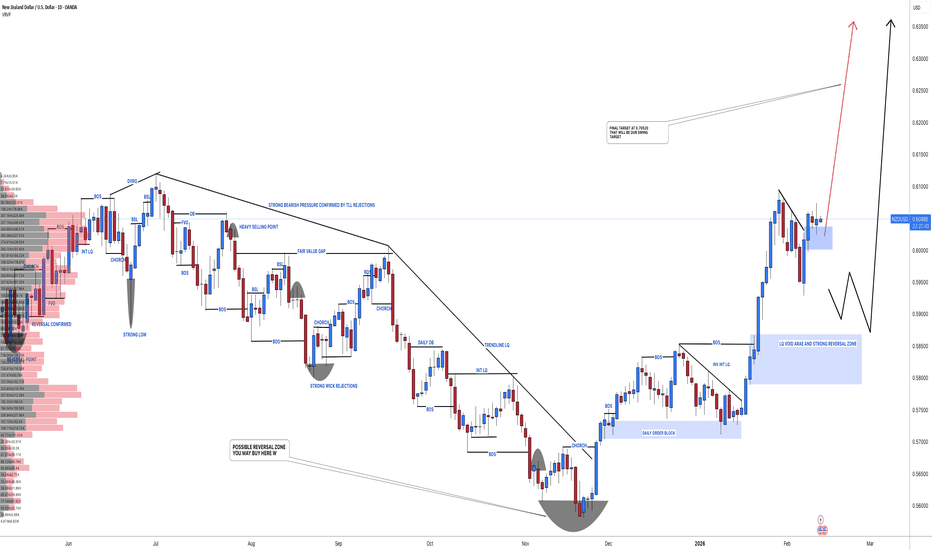

📊 Market Context: The Kiwi Resurgence

The NZD/USD is currently carving out a massive accumulation zone. After a period of consolidation, we are seeing the "Kiwi" show its true strength against a softening Greenback. This isn't just a move; it's a calculated heist on liquidity. 🥷

🏹 The Trade Plan: Bullish Breakout Execution

We are tracking a high-probability Bullish Continuation. The structure is screaming for a liquidity grab above the major psychological hurdles.

⚡ Entry Level: Look for high-volume confirmation after a clean Breakout & Retest of the 0.60700 resistance.

🎯 Primary Target (TP): Taking the bag at 0.61300. This zone aligns with strong historical resistance and a potential "trap" area where the "Police Force" (institutional sellers) might step in. Don't be greedy—hit and run.

🛡️ Thief Stop Loss (SL): Protect your capital at 0.60200. If the price breaks this floor, the setup is invalidated. Stay safe or stay broke.

🖇️ Correlations & Related Pairs to Watch

To trade the Kiwi like a pro, you must watch the "cousins" and the "boss":

OANDA:AUDUSD : High positive correlation. If the Aussie ( GETTEX:AUD ) leads the rally, the Kiwi ($NZD) usually follows. 🇦🇺🇳🇿

TVC:DXY (US Dollar Index): The enemy. If the TVC:DXY cracks its support, our Kiwi trade goes to the moon. 📉

OANDA:AUDNZD : Keep an eye on the cross; it tells us if New Zealand is truly outperforming its neighbor.

🌍 Fundamental & Economic Drivers (Feb 2026)

The macro landscape is shifting, and we are positioned to benefit:

RBNZ Stance: The Reserve Bank of New Zealand is holding steady at 2.25%, but with inflation remaining sticky, the market is starting to price in a "Hawkish Pivot" for late 2026. 🏦

US Labor Data: Upcoming US CPI and NFP reports are critical. Any signs of a softening US economy will provide the fuel for this NZD breakout. ⛽

Commodity Boost: Rising prices in dairy and soft commodities are providing fundamental support to the NZD's bottom line. 🥛

Thief Trader Style: Motivation & Logic

"In this market, you are either the thief or the victim. We don't hope; we execute." 🕯️

Note to the Ladies & Gentlemen (Thief OGs): I am not your financial advisor. My TP and SL are my own maps to the treasure. You can make money, but you must take money at your own risk. Use proper risk management or the market will take it all back. 💸

"The market is a bank that never closes—you just need the right key to the vault." 🗝️

Good luck, stay sharp, and let's secure the bag! 🥂

Nzdusdtrade

#NZDUSD:+1050 Pips Possible Intraday+Swing Buying OpportunityDear traders,

We have a great opportunity with NZDUSD. The price could hit 0.7050 soon. There are two buying options:

1. **Risky Option:** Buy at the red line marked with a blue zone. This is a risky zone but the current price momentum suggests it could work out well.

2. **Safer Option:** If the price takes out the sell-side liquidity and drops below the entry zone, it will fill the liquidity void. This area looks safe but the price could move earlier.

The target is 0.7040, which is a 1050 pips gain. You can adjust your take profit based on your risk management. Remember, this is a swing analysis mixed with intraday viewpoint so be prepared to hold the trade for a few days.

If you like our work, please like and comment for more analyses. As always, trade safely and smartly!🧠🏆

Team SetupsFX_❤️

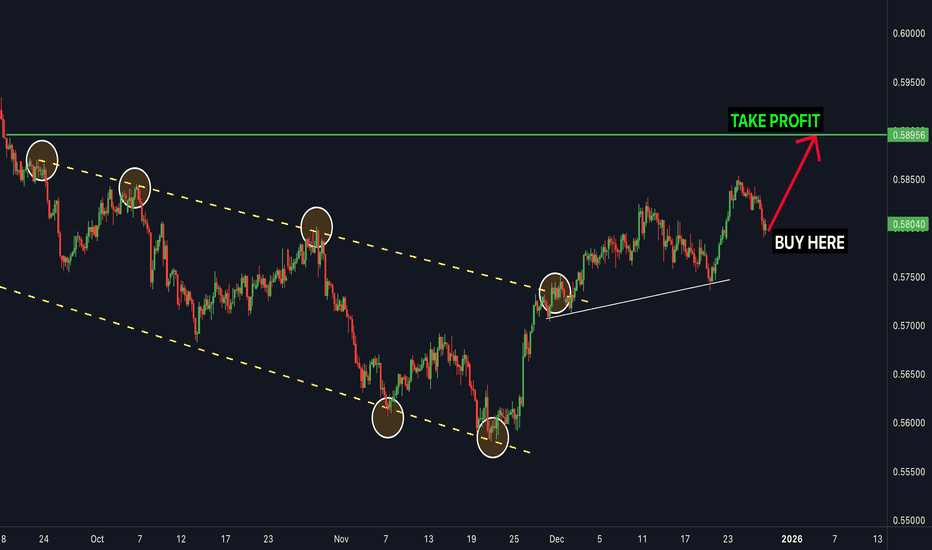

Time to buy NZDUSDNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD.

NZDUSD Breakout Incoming or Another Lower High Trap?NZDUSD has rallied straight back into a well-defined resistance and trendline compression zone, and this is exactly where clean trends either continue — or fail loudly. The bounce off support was strong, but the pair is still trading under descending structure, and the macro backdrop hasn’t really flipped in favor of sustained NZD strength yet. From my perspective, this is a decision area, not a momentum chase. Either we see acceptance above the ceiling and a squeeze higher, or this turns into a classic lower-high rejection with a rotation back into deeper demand.

Current Bias

Neutral to bearish

Short-term momentum is up, but price is testing a resistance cluster and descending structure. Unless price can break and hold above the upper resistance zone, the broader bias still favors rejection and another leg lower.

Key Fundamental Drivers

US side: US services PMI remains in expansion and policy is still restrictive. Even with softer ADP job growth, the Fed is not signaling fast easing — keeping USD supported on dips.

Fed expectations: Rate cuts are expected later, but timing is data-sensitive, especially inflation.

New Zealand side: NZ growth momentum remains soft relative to peers, with higher sensitivity to global risk and China-linked demand.

Risk sensitivity: NZD is one of the highest beta G10 currencies and struggles to outperform when global risk is mixed rather than trending.

Macro Context

Interest rate expectations: Fed on hold at restrictive levels; RBNZ tight but not shifting more hawkishly. Forward spread does not strongly favor NZD.

Economic growth trends: US activity is slowing but still expanding in services. China and Asia-linked demand signals are uneven — a headwind for NZD.

Commodity flows: No strong surge in soft commodities or global trade demand signals that would materially boost NZD.

Geopolitical themes: Elevated geopolitical tension keeps periodic safe-haven demand alive, indirectly favoring USD over high-beta currencies like NZD.

Primary Risk to the Trend

The biggest risk to the bearish bias is a broad USD selloff triggered by soft US CPI or weak labor data, which would compress yield expectations and fuel a breakout above resistance.

A strong global equity rally is the secondary upside risk for NZDUSD.

Most Critical Upcoming News/Event

US CPI

US labor market releases

China inflation and activity data

RBNZ communication

These will drive rate spread expectations and risk appetite — both critical for NZD.

Leader/Lagger Dynamics

NZDUSD is a clear lagger pair.

It typically follows:

AUDUSD direction

Equity indices and global risk tone

Broad USD moves led by EURUSD

It can influence:

NZD crosses like NZDJPY and EURNZD after the move is already underway.

It reacts more than it leads.

Key Levels

Support Levels:

0.5950 zone — near-term structure support

0.5850 area — secondary support band

0.5710–0.5720 major lower demand zone

Resistance Levels:

0.6060–0.6090 resistance zone (trendline + prior highs)

Above 0.6090 opens room for a squeeze leg higher

Stop Loss (SL):

Above 0.6090 for bearish setup invalidation

Take Profit (TP):

TP1: 0.5950

TP2: 0.5850

TP3: 0.5710 area

Summary: Bias and Watchpoints

NZDUSD is pressing into a heavy resistance and descending structure zone, and my bias stays neutral to bearish unless we see clean acceptance above 0.6090. The macro backdrop still leans USD-supportive with the Fed on hold and US services holding up, while NZD remains growth- and risk-sensitive. The key invalidation for the bearish view sits above the 0.6090 breakout area. Downside targets sit at 0.5950, then 0.5850 and potentially 0.5710 if risk sentiment weakens. The main event risk is US CPI — that print likely decides whether this becomes a breakout continuation or a lower-high rejection.

NZDUSD Buy Trading Opportunity SpottedH4 - Strong bullish move.

Currently it looks like a pullback is happening.

Until the two support zones hold I expect bullish continuation.

👉 If you enjoy this analysis, please Like, Follow, and Support the profile! Your engagement motivates us to share more quality setups.

NZDUSD - Time To BuyNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD now.

#NZDUSD: Final Drop Before Swing Bullish ReversalThe NZDUSD has dropped significantly in recent months without any proper bullish correction. Currently, the price is approaching a key level from which we believe it could finally reverse. However, as this is a swing setup, it might take months to complete. We wish you the best in trading and stay careful tomorrow.

Good luck,

Team Setupsfx_

#NZDUSD: 400+ Pips Trading Setup, Intraday+Swing TradeDear Traders,

I hope you enjoyed your weekend. We now have a fantastic opportunity to buy NZDUSD. The price is likely to continue its bullish momentum, allowing us to see a sustained uptrend from the current level. This is highly probable given the DXY’s potential further decline and NZD’s strong bullish trend over the past few weeks or months. We’ve identified two potential targets: an 400+ pip trading setup.

If you like our work, please consider liking and commenting on the idea for more.

Team Setupsfx_

NZDUSD - Time To BuyNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD now.

NZD/USD Price Outlook – Trade Setup📊 Technical Structure

OANDA:NZDUSD NZD/USD has surged into the 0.5964–0.5975 resistance zone after a sharp impulsive rally from the prior support base. Price is now stalling and consolidating beneath this key supply area, showing signs of bullish exhaustion.

The current structure suggests a potential mean-reversion pullback after an extended upside move. Failure to break and hold above the resistance zone increases the probability of a corrective decline toward the 0.5912–0.5900 support zone, which previously acted as a demand area and now aligns with a logical retracement target.

As long as price remains capped below the resistance band, the near-term bias favors a bearish continuation.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 0.5964 – 0.5975

Stop Loss: 0.5985

Take Profit 1: 0.5912

Take Profit 2: 0.5900

Risk–Reward Ratio: Approx. 1 : 2.62

📌 Invalidation

A sustained break and close above 0.5985 would invalidate the bearish setup and signal a continuation of the broader bullish trend.

🌐 Macro Background

NZD/USD has been supported by broad US Dollar weakness ahead of the Federal Reserve’s policy meeting, with the DXY slipping to a four-month low near 97.00. At the same time, stronger-than-expected New Zealand Q4 CPI at 3.1% YoY has opened the door for a potential RBNZ rate hike, further fueling the Kiwi’s upside.

However, with the Fed expected to hold rates steady this week and recent geopolitical tensions easing after President Trump softened his tariff stance, the US Dollar could stabilize in the near term. This macro backdrop supports the case for a technical pullback in NZD/USD after its steep rally into resistance.

🔑 Key Technical Levels

Resistance Zone: 0.5964 – 0.5975

Support Zone: 0.5912 – 0.5900

Bearish Invalidation: Above 0.5985

📌 Trade Summary

NZD/USD has rallied aggressively into a well-defined resistance zone and is showing signs of short-term distribution. As long as price remains below 0.5964–0.5975, the setup favours a sell-on-rallies approach, targeting a corrective move toward 0.5912–0.5900.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

NZDUSD: Latest Chart Analysis 07/01/2026 🔺As per our previous analysis, the price was expected to maintain a bullish trend until all our targets were met. However, we have observed a shift in price behavior, and the price has now reversed, initiating a bearish trend. This presents a favorable opportunity for us, as the price decline is attributed to a previously unaddressed liquidity void.

🔺The entry zone has been clearly indicated by a red box labeled "area needs to be filled." Given the current strong bearish momentum, our entry is anticipated to become active by Monday. Once the entry is activated, the stop loss can be positioned below the designated entry zone.

🔺We have identified three target points that we believe are likely to be achieved within the next couple of months. Kindly utilize this analysis for educational purposes exclusively, and we recommend setting your take-profit levels based on your own informed judgment.

🔺If you appreciate our efforts, please consider liking and commenting for more analyses of these type.

Team SetupsFX❤️🏆

NZDUSD - Time To Buy NowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD now.

NZD/USD > Bullish Continuation Scenario📊 NZD/USD — “THE KIWI”

Bullish Structure | Smart Money Pullback | Thief Layer Strategy 💼📈

Market: NZD/USD (Forex)

Trading Style: Swing / Day Trade

Bias: 🟢 Bullish continuation

🔍 Trade Plan Overview

NZD/USD is showing bullish structure strength with price holding above key demand zones. The market is respecting higher-lows, and pullbacks are being absorbed by buyers — a classic trend continuation environment.

This plan focuses on patience, scaling, and risk control, not prediction.

🎯 Entry Strategy — Thief Layering Method 🧠💰

Entry Style: Any price level using layered buy limits

Instead of chasing price, the Thief Strategy uses multiple limit orders to build a position during pullbacks.

📌 Buy Limit Layers (example):

0.57500

0.57800

0.58200

👉 You may add or adjust layers based on your own risk appetite and timeframe.

This method improves average entry price and reduces emotional execution.

🏁 Target Zone — Take Profits Like a Pro 🚨💵

🎯 Primary Target: 0.60000

Why this level matters:

Strong psychological resistance

Prior supply zone / overbought reaction area

Potential bull trap zone — police force (smart money) may defend here

📢 Action: Scale out profits. Don’t get greedy.

Money made = money secured.

🛑 Stop Loss — Capital Protection First 🧯

🔴 Thief SL: 0.57000

This stop is placed below key structure support.

⚠️ You are not required to use this exact SL — manage risk according to your system.

🧠 Risk Reminder (Read This)

Dear Ladies & Gentlemen (Thief OGs):

This is not financial advice.

You control your TP, SL, and lot size.

Trade smart, protect capital, and take profits responsibly.

🔄 Related Pairs to Watch (Correlation Check) 📊

Keep an eye on these USD & risk-sensitive pairs for confirmation:

AUD/USD 💵

→ Strong positive correlation with NZD/USD (commodity currencies)

DXY ( AMEX:USD Index) 💲

→ NZD/USD typically rises when DXY weakens

NZD/JPY 💴

→ Risk-on sentiment gauge (carry trade flow)

AUD/NZD 🇦🇺🇳🇿

→ Helps identify relative strength between AUD & NZD

📌 If USD weakens broadly, NZD/USD bullish probability increases.

🌍 Fundamental & Economic Factors (Live Market Focus) 📰

Key macro drivers influencing this setup:

🇳🇿 RBNZ (Reserve Bank of New Zealand)

→ Hawkish tone supports NZD

→ Dovish signals = short-term pullbacks

🇺🇸 US Dollar Sentiment

→ Fed rate expectations & inflation data drive USD strength/weakness

📉 US Inflation (CPI / PCE)

→ Lower inflation = USD weakness = NZD/USD bullish

📊 Risk-On / Risk-Off Flows

→ Equity strength supports NZD

→ Risk aversion strengthens USD & JPY

⏰ Session Focus: London → New York volatility overlap

(Watch high-impact red-folder news before entering)

✅ Final Thoughts

This is a structure-based bullish opportunity using layered execution, not emotional entries.

Let price come to you.

Let the market pay you.

💬 If this idea adds value, LIKE 👍 | COMMENT 💬 | FOLLOW 🚀

Trade safe. Trade smart.

— Thief Trader 🕶️📈

TheGrove | NZDUSD Buy | Idea Trading AnalysisNZDUSD is moving in an UP and broke Descending Triangle.

The chart broke through the dynamic Support line and we expect a decline in the channel after testing the current level which suggests that the price will continue to rise

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity NZDUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

NZD/USD Bearish Play — Trend Reversal + Structured Sell Zones🐻 BEARISH SWING TRADE SETUP | NZD/USD "The Kiwi"

Hey Traders! 👋 Here's a detailed swing trade analysis for the NZD/USD pair, focusing on a high-probability bearish continuation play. We're using a strategic layered entry method to optimize our risk.

📈 Trade Thesis & Market Context

A bearish structure is confirmed, and price is currently exhibiting a classic pullback towards a key dynamic resistance (Moving Average). This setup aims to capture the next leg down in line with the prevailing downtrend.

⚡ The "Thief" Layered Entry Strategy

This plan uses multiple limit orders to "scale in" to the position, averaging your entry price as the pullback unfolds.

🎯 Entry Zone (Sell Limit Orders):

Layer 1: 0.56500

Layer 2: 0.56400

Layer 3: 0.56300

💡 Pro Tip: You can increase or decrease the number of layers and adjust prices based on your own capital and risk management.

🚨 Risk Management (Your Responsibility!)

Stop Loss (SL): A suggested stop loss is above the recent structure at 0.56700.

⚠️ IMPORTANT NOTE: I am NOT recommending you use only my SL. You MUST adjust your stop loss based on your personal risk tolerance, account size, and strategy. The market is unpredictable; protect your capital first!

🎯 Profit Targets (Take Profit - TP)

Primary Target (TP): 0.55900

Rationale: This target aligns with a strong support zone, oversold conditions, and a potential liquidity pool ("trap"). The goal is to "escape" with profits before any significant bounce.

⚠️ REMINDER: Just like the SL, this is a suggested target. You are free to take profits earlier or adjust based on how price action develops. Manage your own trade!

🔍 Key Correlations & Pairs to Watch

Understanding the Kiwi's relationships is crucial for this trade's context.

AUD/USD ( OANDA:AUDUSD ): 🦘 The "Aussie" and "Kiwi" are highly correlated commodity brothers. A strong downtrend in AUD/USD often reinforces bearish momentum in NZD/USD.

USD/CNH ( FX:USDCNH ): 🇨🇳 China's economy is a major driver for New Zealand's exports (especially dairy). A stronger USD/CNH (weaker Yuan) can signal risk-off sentiment and pressure the NZD.

TVC:DXY (US Dollar Index): 🇺🇸 A strong overall US Dollar, as shown by a rising DXY, provides a strong tailwind for this bearish NZD/USD setup.

NZDUSD - Buy nowNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY NZDUSD now.

TheGrove | NZDUSD buy | Idea Trading AnalysisNZDUSD is falling towards a support level which is a pullback support and could bounce from this level to our take profit.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity NZDUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

NZDUSD - TIME TO BUYNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD.

NZDUSD – 4H Descending Channel AnalysisMarket Structure:

NZDUSD is in a higher-timeframe downtrend, forming consistent lower highs and lower lows. A clear descending channel is visible on the chart, supporting bearish continuation.

Price Action:

The recent upward move appears to be a pullback. Price has shown rejection near the upper boundary of the channel, indicating selling pressure.

Trade Bias:

Sell Zone:

0.5780 – 0.5810

Stop Loss:

0.5855

Take Profit Levels:

0.5720

0.5660

0.5600

Invalidation:

4H candle close above 0.5860

NZDUSD - TIME TO BUY NOW - it's going upNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD now it's going up

NZD/USD Trend Shift Confirmed | Pullback → Reversal Setup📈 NZD/USD – “THE KIWI”

Forex Market Trade Opportunity Guide (Swing / Day Trade)

🧠 Market Bias

BULLISH 🟢

Bullish plan confirmed with:

🔺 Triangular Moving Average pullback

🕯️ Heikin Ashi Doji candle → momentum pause + reversal signal

🔄 Trend structure shift indicating buyers stepping in

This combination signals controlled accumulation, not emotional chasing.

🎯 Entry Strategy

Entry: Any price level

➡️ PLEASE NOTE: Thief Using Layer (or) Any Price Level Entry

🔹 Layering Strategy (Multiple Buy Limits):

📍 0.57400

📍 0.57500

📍 0.57600

📍 0.57700

➡️ You may increase or adjust layers based on your own risk management.

📌 Why layering?

It reduces emotional entries, improves average price, and aligns with institutional-style execution.

🛑 Stop Loss

Thief SL: 0.57300

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

Adjust your SL according to your own strategy, capital, and risk profile.

📎 This SL is a reference, not a recommendation.

🎯 Target / Exit Logic

Target: 0.58500

🚔 Moving Average acts as a “Police Barricade”

Strong dynamic resistance

Overbought conditions likely

Potential bull trap + corrective reaction

➡️ Kindly escape with profits near resistance zones.

⚠️ Dear Ladies & Gentlemen (Thief OG’s),

I am not recommending using only my TP.

Profit-taking is your responsibility.

🔗 RELATED PAIRS TO WATCH (Correlation Insight)

💵 USD-Related

TVC:DXY (US Dollar Index):

⬇️ Weak DXY = ⬆️ NZD/USD bullish continuation

$EUR/USD:

Strength here often confirms USD weakness

$AUD/USD:

Strong positive correlation with NZD (commodity-linked currencies)

🧾 Commodity Link

$XAU/USD (Gold):

Risk-on flows into commodities often support NZD strength

📌 If AUD/USD and EUR/USD stay bid while DXY weakens, NZD/USD bullish bias strengthens.

🌍 ECONOMIC FACTORS TO CONSIDER BEFORE ENTRY

🇳🇿 New Zealand (NZD Drivers)

📊 RBNZ Interest Rate Decisions

📉 Inflation (CPI) trends

🥛 Dairy prices & export demand

🇨🇳 China growth data (key NZ trade partner)

🇺🇸 United States (USD Drivers)

🏦 Federal Reserve policy outlook

📈 CPI / Core PCE inflation data

👷 NFP & unemployment data

📉 Bond yields & risk sentiment

🌐 Macro Environment

Risk-ON → NZD strengthens

Risk-OFF → USD demand increases

📌 Always align technical bias with macro flow.

✅ Final Notes

✔️ Technical confirmation present

✔️ Structured risk via layering

✔️ Macro alignment improves probability

❌ No emotional entries

❌ No blind TP/SL copying

💬 If this setup aligns with your view, support with a LIKE ❤️ and SHARE your thoughts below.

📌 Trade smart. Trade disciplined. Let price do the talking.

NZDUSD - TIME TO BUY NOWNZDUSD was in a recent downtrend for the last few weeks and was struggling to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. NZDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY NZDUSD now