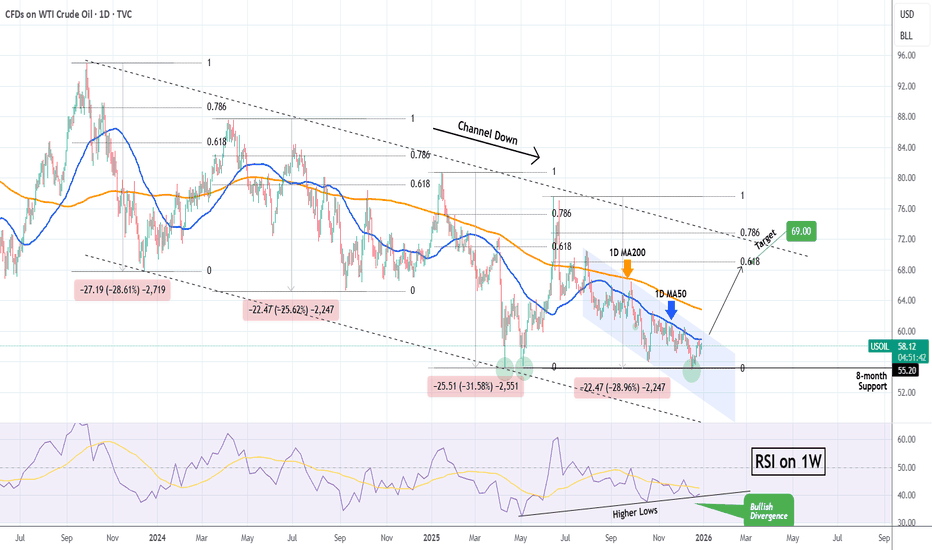

WTI OIL closing its first green month after 5 straight red.One month ago (December 30 2025, see chart below), we gave a strong long-term buy signal on WTI Oil (USOIL), as it hit its 8-month Support on a 1W RSI Bullish Divergence:

The price reacted very positively and is about to close its first green 1M candle after 5 straight red. This is why we bring you this time the same chart but on the 1M time-frame. At the same time pay close attention to the 1M MA200 (orange trend-line), which delivered the last strong rejection for the market, which last time closed a month above it exactly a year ago (Jan 2025).

This is why we stay firm on our $69.00 Target, which isn't only on the 0.618 Fibonacci retracement level (where all 3 previous Bullish Legs of the 2-year Channel Down retraced) but also below the long-term Resistance posed by the 1M MA200.

As a side-note, to get an idea of how bearish the market is on the long-term (and why a sell at the top of the Channel Down is later suggested), Oil hasn't closed a month above its 1M MA50 (blue trend-line) since July 2024.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oilsignals

New Analysis – West Texas Oil (WTI)Those who follow my work know that we have posted multiple oil analyses in a row,

all of them successful, closed with high reward ratios ✅

But let me be very clear:

❌ I’m not part of OPEC

❌ I’m not a politician

❌ I don’t have access to political or economic decisions

No one knows what’s really going on in Powell’s mind,

what Trump plans to do with Iran,

or what the future holds for Venezuela, Cuba, or others.

📌 These are market drivers,

but we have zero access to policymakers’ decision rooms.

We are simply small traders,

trying to extract profits from opportunities — nothing more.

🔎 In this analysis, after making solid profits,

I’m willing to risk a small portion of those gains.

This setup carries higher risk, and that’s fully intentional.

📉 At the moment,

we are sitting at a good area to sell oil.

🔁 If this level breaks,

as always,

I’ll wait for a pullback and look for a long position.

🎯 No bias, no predictions — just following the market.

🌹 Stay safe & stay profitable

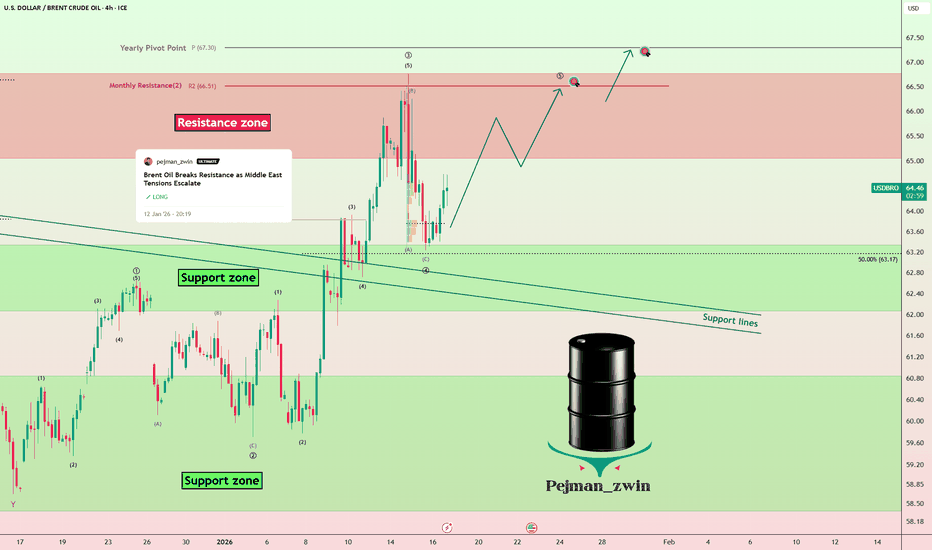

Middle East Risks Keep Brent Oil Bullish — Higher TargetsAs I expected in the previous idea , Brent Crude OIL( BLACKBULL:BRENT ) has risen and reached its targets, with a Risk-To-Reward: 2:01 (full target).

Brent Crude OIL is currently trading near the support zone($63.30-$62.00) and the support lines.

From an Elliott Wave perspective, it appears that Brent Crude OIL has completed main wave 4, and we can now expect the next impulsive wave for the main wave 5.

Additionally, news from the Middle East does not indicate a reduction in tensions, and we can expect potential surprises in the region. Therefore, I prefer to maintain long positions in Brent Crude OIL rather than short positions, and I’m looking for triggers to enter long.

I expect that Brent Crude OIL will once again target the resistance zone($66.80-$65.00) and potentially rise to around $66.47. The next target could be the yearly pivot point($67.30).

First Target: $66.47

Second Target: $67.30

Stop Loss(SL): $62.60

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌U.S. Dollar/Brent Crude OIL Analysis (USDCAD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Brent Oil M30 HTF Discount Reaction and Bullish Continuation📝 Description

BLACKBULL:BRENT crude oil has completed a corrective pullback after a strong impulsive rally and is now stabilizing above a key short-term demand zone. Price has reacted cleanly from the SSL and lower boundary of the recent range, suggesting buyers are defending this area and preparing for another leg higher toward premium liquidity.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the recent swing low and SSL

Preferred Setup:

• Entry: 65.015

• Stop Loss: Below 64.730

• TP1: 65.25

• TP2: 65.45

• TP3: 65.73

________________________________________

🎯 ICT & SMC Notes

• Sell-side liquidity sweep followed by bullish displacement

• Reaction from intraday support and SSL confirms demand

• No bearish break of structure after the pullback

• Upside targets aligned with prior highs and premium liquidity

________________________________________

🧩 Summary

As long as BLACKBULL:BRENT holds above the 64.75–64.90 support zone, the bullish continuation scenario remains favored. The current pullback appears corrective, with expectations of a rotation higher toward recent highs and upper liquidity pools.

________________________________________

🌍 Fundamental Notes / Sentiment

Oil sentiment remains constructive amid steady demand expectations and the absence of strong bearish catalysts. Short-term pullbacks into defended demand zones are likely to be viewed as buying opportunities rather than trend reversals.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

OILUSD : Higher Timeframe Bias vs Short-Term ReactionMonthly & Weekly structure remain bearish.

The current upside move appears driven by short-term geopolitical narratives, not a structural shift

I’m not chasing price

Key area of interest:

Daily FVG

4H FVG

iFVG

If price trades into this premium zone I’ll look for sell confirmation aligned with HTF bias

Crude Oil – Sell around 60.50, target 58.00-55.00Crude Oil Market Analysis:

Crude oil has shown some strength recently. Consider selling again at 60.50. The overall outlook for crude oil remains bearish. Short-term fluctuations only require focusing on one direction. The fundamentals of crude oil are unlikely to change the current trend. Previous buy opportunities only reached 62 before falling again.

Fundamental Analysis:

The surge in gold prices has provided various fundamental explanations, but these are all in the past. Current fundamentals and geopolitical factors are relatively ordinary, and no major data releases are scheduled for this week.

Trading Recommendation:

Crude Oil – Sell around 60.50, target 58.00-55.00

Crude Oil – Sell around 60.50, target 58.00-55.00Crude Oil Market Analysis:

Crude oil has recently returned to its previous range-bound pattern on the daily chart. This range-bound movement has lasted for several months. Consider selling crude oil at 60.50 today. The bearish outlook for crude oil remains unchanged, and this view can be maintained as long as the daily chart doesn't break 62.00. Pay attention to the upcoming inventory data.

Fundamental Analysis:

This week's data is mostly routine and will have little impact on the market. Geopolitical factors also have little influence.

Trading Recommendation:

Crude Oil – Sell around 60.50, target 58.00-55.00

Crude Oil – Sell near 60.50, target 58.00-55.00Crude Oil Market Analysis:

Continue to sell on rallies in crude oil. Yesterday's crude oil contract settlement was completed, and the new contracts offered no surprises to the market. Continue to sell at higher prices, focusing on the resistance level of 60.50. Crude oil has returned to its previous trading range, and it's almost certain that it will be difficult to break out of this range in the short term.

Fundamental Analysis:

Recent geopolitical news seems to have calmed down considerably, and the market hasn't fallen as a result. Pay attention to the Federal Reserve's new monetary policy.

Trading Recommendation:

Crude Oil – Sell near 60.50, target 58.00-55.00.

Crude Oil - Sell around 60, target 57.00-55.00Crude Oil Market Analysis:

Crude oil has finally fallen. We've been calling for a sell for months, and haven't given a single buy order. The recent rise in crude oil prices due to geopolitical factors will eventually lead to a fall back. Today, crude oil can be sold when it approaches 60. Crude oil is currently in a large range between 62 and 55 in the short term. We will adjust our strategy if it breaks through either side. Also, the crude oil contract delivery period is approaching.

Fundamental Analysis:

Yesterday's US initial jobless claims data was bearish for gold, but gold did not experience a significant drop; instead, it is undergoing a consolidation phase. Furthermore, several data points in the past two days have been bearish for gold.

Trading Recommendation:

Crude Oil - Sell around 60, target 57.00-55.00

Crude Oil – Sell near 62.00, target 60.00-56.00Crude Oil Market Analysis:

Yesterday, crude oil reached a high of over 62.00, but it hasn't broken through the major resistance level yet. The chart pattern suggests that without a break above this level, a buy breakout pattern is unlikely. Our strategy for today remains bearish; sell on rallies. The current price level is high, and there's significant downside potential. Sell crude oil near 62.00 today.

Fundamental Analysis:

Previously released data was mixed, with limited market impact. Furthermore, geopolitical factors have calmed down, putting downward pressure on gold and supporting the US dollar.

Trading Recommendation:

Crude Oil – Sell near 62.00, target 60.00-56.00

WTI OIL Relief pull-back expected on the short-term.WTI Crude Oil (USOIL) is trading within a short-term Channel Up on the 1H time-frame, being supported by the 1H MA50 (blue trend-line).

With the price approaching the 1D MA200 (red trend-line) and the 1H RSI hitting its Lower Highs trend-line, it is possible to see a technical pull-back in the form of a Bearish Leg for this Channel Up.

All Bearish Legs within this pattern declined by around the same level, with the lowest being -1.81%. Assuming a max extension on the 1D MA200, we can calculate a minimum -1.81% decline, targeting $61.20.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Crude Oil – Sell around 61.00, target 58.00-55.00Crude Oil Market Analysis:

Crude oil has started to strengthen in the past two days, breaking above 60. The chart pattern indicates a bottoming-out and rebound. Our strategy today remains to sell, as the pattern hasn't been broken yet. Pay attention to the 62 level; if it breaks, we'll consider a new strategy. Until then, we maintain a bearish outlook, and the current level presents a good opportunity to sell.

Fundamental Analysis:

Recent data releases have been rotating. Yesterday, new CPI data was released, and the difference appears small, limiting the market impact. Gold accelerated its rise after the data release.

Trading Recommendation:

Crude Oil – Sell around 61.00, target 58.00-55.00

Brent Oil Breaks Resistance as Middle East Tensions EscalateWith the start of the new week, Brent Oil( BLACKBULL:BRENT ) has continued its bullish trend.

Given the escalating tensions in the Middle East, a region that is crucial for global oil production, oil prices have risen accordingly.

Brent Oil has successfully broken through the resistance zone($63.30-$62.00) and resistance lines and is currently completing a pullback to these levels.

I expect that, given the potential for renewed tensions in the Middle East in the coming days and hours, the bullish trend in oil will continue, supported by both fundamental and technical analysis, and it will reach the targets set in the chart.

First Target: $64.91

Second Target: $65.77

Stop Loss(SL): $62.07

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌U.S. Dollar/Brent Crude OIL Analysis (USDCAD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

UKOILSPOT H| Bullish Bounce OffBased on the H1 chart analysis, we can see that the price has bounced off our buy entry level at 62.69, whic is a pullback support that aligns with the 50% and the 23.6% Fibonacci retracement.

Our stop loss is set at 61.92, which is a pullback support.

Our take profit is set at 3.80, which acts as a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Crude Oil – Sell around 58.50, with a target of 56.00-55.00Crude Oil Market Analysis:

Recent crude oil buying has been largely ineffective. Despite support from fundamentals and data, there has been little upward movement, only small fluctuations. Sell crude oil at 58.50 today. The chart pattern indicates short-term consolidation, with resistance around 60.00. A break above 62 might open new buying opportunities; otherwise, the outlook remains bearish.

Fundamental Analysis:

The previous ADP employment data has reassured the market, and expectations for the non-farm payrolls report have largely been priced in.

Trading Recommendation:

Crude Oil – Sell around 58.50, with a target of 56.00-55.00.

WTI OIL This is what separates a drop to $49 from a rally to $68WTI Crude Oil (USOIL) remains within its 2-year Channel Down since the September 25 2023 High, as well within a 'smaller' one (blue) since late July 2025.

What separates right now the market from a continuation of the latter's Channel Down downtrend and a rebound towards the long ones 1W MA100 (green trend-line), is the 8-month Support level of 55.20.

As you can see, this has recently held (week of December 15 2025) for the 3rd time since April 2025. However the 1D MA50 (red trend-line) keeps rejecting any 1W candle, maintaining the bearish trend of the (blue) Channel Down.

If it breaks and the market closes 2 straight 1W candles above it (1D MA50), then we expect a 2-3 month rally to test the 1W MA100 and the 0.618 Fibonacci level (like all previous Bullish Legs within the 2-year Channel Down did) at $68.00.

If on the other hand the market closes a 1W candle below the 8-month Support (55.20), we expect the continuation of the bearish trend until the 1W RSI touches its long-term Support Zone again. An early estimated Target on his is $49.00 but best to take profit when the 1W RSI this the Support Zone regardless of the price, as it has marked the last two major market bottoms (Lower Lows).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CRUDE OIL (WTI): Bullish Movement Confirmed

WTI Crude Oil will likely continue rising

after a liquidity grab below the underlined horizontal support.

A consequent cup & handle pattern formation provides a strong

bullish confirmation.

Goal will be 57.41

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI OIL Strong case for a 2-month rally.WTI Oil (USOIL) has been trading within a Channel Down since the September 28 2023 High. Since then, it as had four Bearish Legs (including the current one), which declined on a range of -25.62% to -31.58%. All subsequent rebounds (Bullish Legs) that followed, hit at least their 0.681 Fibonacci retracement levels.

Given that the price rebounded 2 weeks ago on the 8-month Support (55.20) and the 1W RSI has been on Higher Lows (i.e. Bullish Divergence) since May, we may see a new Bullish Leg emerging now.

The one condition that will confirm that will be the price breaking above the blue Channel Down. If that takes place, we will turn bullish for the next two months, targeting $69.00 (Fib 0.618).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

OIL, Crucial Wedge-Formation, Huge PLUNGE to Follow Next!Hello There!

Welcome to my new analysis of OIL. Within the recent high inflation development with continued rate hikes in a lot of economic fields, it has to be mentioned that OIL could be on the brink of major market disruptions especially when the rate hikes continue to rise further together with the DXY printing the next new highs. In this case, I have detected important underlying dynamics within the analytics dashboard and I have put them into perspective to determine what should be considered with OIL in the upcoming times.

As when looking at my chart now, OIL could since May 2023 recover from the crucial bearish wave lows nonetheless this wave does not have a fundamental open interest and volume backing and this is why it can turn any time especially when a massive bearish supply wave is entering the market because of grievous rate hikes and potential new supply-chain disruptions that are going to trigger a supply shortage. Taking these crucial factors into consideration a major bearish decline and bearish momentum acceleration may be just around the corner.

OIL has also formed this gigantic descending channel formation in which it has the major bearish distribution resistances within the upper boundary as marked. The most determining factor here is the massive ascending triangle formation that leads directly into the upper resistance zone and is now about to complete the wave count within the ascending triangle. This means, that as the wave-count directly approaches the crucial upper resistance zone it is going to lead to an increased bearish volatility breakout below the boundaries within the next times.

Once the gigantic ascending triangle formation has been completed it is going to activate the next bearish continuation below the 100EMA and 300EMA. Especially, once the price-action formed the breakouts below the levels this is going to massively accelerate the bearish dynamics towards the lower levels and continue into the bearish momentum direction.

The bearish price dynamic is going to continue till the final targets have been reached and in this case, it will be highly determining how the final targets are actually approached especially when the interest rates continue to rise together with supply-chain disruptions to accelerate this is going to trigger the next bearish waves even below the final target zones.

Taking all the factors into consideration and because of the gigantic ascending triangle, together with the underlying indications with the interest rate dynamic as well as the supply-chain disruptions dynamic I am keeping the symbol on my watchlist and I am going to re-evaluate the situation once important changes happened within the bearish formation.

In this manner, thank you everybody for watching my analysis of OIL. Support from your side is greatly appreciated.

VP

WTI OIL on its 1D MA50 again. Sell signal.Last week (December 17, see chart below) we gave a strong Buy Signal on WTI Crude Oil (USOIL) after it hit and rebounded on the 8-month Support.

The resulting rally easily hit our $58.50 Target and today the price tests the 1D MA50 (blue trend-line) for the first time since the previous Lower High of the 5-month Channel Down. This is an automatic technical Sell Signal as at the same time the 1D RSI is reversing near its 4-month Resistance Zone.

Our short-term Target is again the $55.20 Support.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇