FireHoseReel | Optimism Near Key Breakout Level as Volume Builds🔥 Welcome To FireHoseReel !

Let’s dive into Optimism (OP) analysis.

⛳️ OP Fundamental Overview

Optimism (OP) helps people use Ethereum faster and cheaper by reducing fees and speeding up transactions for DeFi, NFTs, and apps. Ranked around top 80 on CoinMarketCap, it’s a strong mid-cap Layer-2.

👀 OP 4H Overview

Optimism (OP) is trading inside a 4H range box and is currently positioned near the end of its bearish trend. A breakout above the descending curve trendline, followed by a break of the overhead resistances, could initiate a bullish 4H trend for OP.

📊 Volume Analysis

As price approached the curve trendline and the dynamic resistance at $0.2825, volume increased noticeably. This suggests that a breakout of this zone could lead to a fast and impulsive price move.

✍️ OP Trading Scenarios

🟢 Long Scenario:

A confirmed breakout above $0.2825 with increasing buy volume could allow price to break the top of the range and move toward the $0.3439 resistance.

🔴 Short Scenario:

A breakdown below $0.2518 could trigger a fast move toward a lower support level. Strong selling volume confirmation would be required.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

OP

There's also an interesting entry point on OptimismThere's also an interesting entry point on NASDAQ:OP #Optimism.

The trade is almost 1 to 5.

Entry: $0.4059

Take Profit: $0.5015

Stop Loss: $0.3849

It looks a lot like a false breakdown downward and growth along with Bitcoin and Ethereum is quite possible.

Short traders' liquidity has already accumulated.

#Crypto #Trading #DayTrading

OP Looks Bullish (6H)Based on the structure that OP has formed on the chart, it appears to be in a reaccumulation phase. It seems we are approaching the end of this phase.

Two entry zones have been identified for this asset, and we will enter gradually (in steps) within each zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this setup.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

OP - Accumulation Base, Eyes on $1 BINANCE:OPUSDT spent months in markdown, then shifted into a broad accumulation range. Momentum is stabilizing, and price is leaning toward the top of that box.

The first key hurdle is the $1 psychological level 🔑. It lines up with range resistance and a potential phase shift into markup if broken with a clean daily close.

As long as the range low holds, I’ll look for dips to get involved, targeting a retest of $1 and higher inside a developing markup phase 🚀. If price loses the range floor, I’ll step aside and wait for fresh confirmation ⏳.

What’s your plan here => buy the base and ride the breakout, or wait for a confirmed close above $1? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Will #OP Finally Explode or Is This Just Another Trap for Bulls?Yello, Paradisers! Is #Optimism gearing up for a breakout, or is this the final squeeze before bulls get dumped on hard? Let’s dissect what’s really happening on #OPUSDT:

💎After forming a clean ascending channel since mid-June, #OP has been respecting both the ascending support and ascending resistance zones. Price is currently sitting just below the key resistance zone around $0.83–$0.85, which was previously a support level before flipping into strong resistance. This makes it a major decision point for the next move.

💎If #OPUSD manages to break and close above the $0.85 resistance area with strong volume, and the 50EMA continues to hold as dynamic support, then we’re likely to see a push towards the moderate resistance around $1.059. If that level is cleared, the next logical upside target sits near $1.20, aligning with the strong resistance and peak on the volume profile.

💎As long as price holds above the Support Zone between $0.69 and $0.65, the bullish case remains valid. The structure continues to print higher lows, showing that buyers are defending the trendline support. A successful retest here could lead to a powerful bullish continuation.

💎However, if bulls lose control and #OPUSDT closes below the $0.650 support, the entire bullish setup would be invalidated. In that case, price could slide down toward the $0.50–$0.55 zone, especially if volume dries up. This would complete a potential head-and-shoulders pattern and trigger a shift toward a bearish structure.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

Buy Alert OP (Optimism) - August 27, 2025.NASDAQ:OP #Optimism 🩸 — Investors - Tier 1 | Optimism is a low-cost and lightning-fast Ethereum L2 blockchain | August 27, 2025.

We've analyzed the data on the cryptocurrency Optimism and concluded that now is an excellent entry point for a Spot position, with a potential upside of +22% from $0.70 to $0.86.

🚀 Why?

➖ 1. Limit Order on Coinbase: A major player has placed a limit sell order on the crypto exchange Coinbase at $0.86.

➖ 2. Liquidation Max Pain: For Optimism, the Max Pain level is at $0.8901, with the imbalance favoring short traders. Market makers will push the price upward to liquidate those positions, while limit orders above help large players secure their profits.

➖ 3. Chart Analysis: On the chart, we can see how the bullish candle from August 22, 2025, was engulfed, collecting stop-losses from long traders. This is a common manipulation tactic by big players to shake out as many leveraged positions as possible.

➖ 4. Altcoin Trend Shift: The trend for altcoins is gradually shifting from sideways accumulation to aggressive buildup and a growth phase (in other words, liquidations are being harvested on both sides right now, with a large player accumulating for an aggressive surge in Optimism's price—I suspect altseason could kick off in the coming months, though that word has become almost a curse 🙃).

In Summary:

We anticipate Optimism's rise from $0.70 to $0.86 (+22%) in the near term. Avoid leverage—stick to Spot positions only. After this upmove, expect a pullback to around $0.62, where you can build your core portfolio position and wait for altseason.

#OP (SPOT)BINANCE:OPUSDT

#OP/ USDT

Entry range (0.670- 0.760)

SL 4H close below 0.640

T1 1.000

T2 1.350

T3 1.600

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

TradeCityPro | OP Eyes Breakout in Prolonged Altseason Range 👋 Welcome to TradeCity Pro!

In this analysis, I want to review the OP coin for you — one of the Layer 2 projects whose token currently holds a market cap of $1.39 billion and is ranked 68th on CoinMarketCap.

📅 Daily Timeframe

On the daily timeframe, OP is moving within a range box between 0.521 and 0.920, which formed after a downtrend, and the price has been fluctuating in this box for several months.

🔑 One key resistance on this coin is 0.816, which can be used as a trigger for a long position.

📈 This trigger can also be used for spot buying, but given its Bitcoin pair, I prefer to take the position in futures and reserve spot buys for future triggers.

💥 For momentum confirmation of this position, we can use RSI’s entry into the Overbought zone, since RSI is currently near this area, and if it enters, it could support a strong upward move.

📊 The next long trigger is the breakout of 0.920. However, this trigger is not valid at the moment because the price hasn’t reacted to it for a long time, and in the future, if it does react, the level will likely change. In that case, I’ll update the analysis and give you the new trigger.

✔️ If OP declines, the first important support we have is 0.626. A close below this level could allow for a risky short position, but for shorts, I’ll personally wait for a break below 0.521.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

[Deep Dive] OP – Edition 4: Accumulated Pressure!Optimism (OP) may be quietly setting the stage for a classic reversal play — with structure, sentiment, and cycle theory all lining up.

After a sharp markdown throughout Q4 2024 and early 2025, OP has spent several months forming what appears to be a rounded accumulation base. And if history rhymes, a markup phase could be next.

🔍 Phase Breakdown

📉 Markdown

The aggressive downtrend sent OP tumbling from above $3 all the way to the $0.50–$0.60 support region, wiping out months of bullish structure and triggering capitulation.

📦 Accumulation

Since then, the price has been compressing sideways in a tight range, respecting the $0.50 psychological zone while creating a rounded bottom pattern. This sideways action — combined with declining volatility — suggests sellers are exhausted, and accumulation may be underway.

📈 Markup Potential

The current setup mirrors textbook market cycles, where markdown gives way to accumulation, followed by expansion. If OP breaks above the $0.70–$0.85 resistance zone with volume, the door opens for a rally toward $1.85 and even $2.00 — the next key supply zones.

⚙️ Fundamental Fuel

Optimism is more than just a Layer 2 — it’s the engine behind the Superchain vision. With OP Stack now powering not only Optimism but also chains like Base and Zora, the protocol is becoming the backbone of Ethereum’s scalability roadmap.

Recent key updates include:

- New governance structures via RetroPGF Round 3 distribution.

- Continued expansion of OP Stack rollups.

- Growth in on-chain activity and TVL thanks to Base's rapid adoption.

All of this adds up to strong long-term tailwinds — especially if Ethereum Layer 2 narratives reheat.

🧠 What to Monitor Next

🔍 Break above $0.85 = confirmation of phase shift.

📊 $0.50 remains the key invalidation level for the current bullish thesis.

🧨 Watch for volume spikes near resistance — they often precede explosive markups.

💬 Are we witnessing the calm before Optimism’s storm — or just another pause in a longer downtrend?

🔔 Disclaimer: This post is for educational and informational purposes only. It does not constitute financial advice. Always do your own research and manage risk carefully.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

$OP Fails to Hold Morning SpikeCurrently at $0.1554, NASDAQ:OP is trading just under its 50-period SMA (~$0.1580) and well below its 200-period SMA (~$0.2500) on the 30-minute chart. The stock gave up its early momentum after hitting resistance at $0.1700, sliding back toward support at $0.1440. Price remains stuck in a tight, low-volume range. Awaiting UltraBuy signal — charting tomorrow’s giants with UltraAlgo.

Optimism Op price analysis - be careful After the listing of #OP on the Korean exchange, known for its "pump events", we observe a surge in volume along with a breakout from the downtrend.

🐻 The current 6-hour candle on OKX:OPUSDT is attempting to form a pin bar — a potential reversal signal.

⚠️ High volumes often indicate the final phase of a move. Such pumps are usually short-lived — proceed with caution.

👌 Our previously published medium-term forecast for #Optimism remains relevant

________________

📚 Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves!

Optimism OP price analysisCurrently, the price of #OP does not look very optimistic (a little pun to start with )))

🟢 An optimistic forecast would be for the price of OKX:OPUSDT to rise to $1.40

🟡 But it looks like this growth will not happen now, but after a correction.

🔴 Correction: only to $0.57 or again to $0.45 — this is also an open question.

👌 Patience to holders and fans of the #Optimism project, the “microclimate” in the crypto market is improving — the time will come, and this coin will also be pumping...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

OPUSDT Forming Falling ChannelOPUSDT is currently exhibiting a promising setup that could lead to a significant bullish move. The chart shows that the price has broken out of a well-defined falling channel pattern, which often signals the end of a correction phase and the beginning of a potential uptrend. With the breakout confirmed and good volume supporting this move, there is a strong possibility of a 90% to 100% gain in the coming sessions, drawing the attention of traders looking for breakout plays.

Optimism (OP) has been a hot topic within the crypto community due to its role in scaling Ethereum through its layer 2 solution. The consistent development and growing adoption of the Optimism network have sparked investor interest, providing a fundamental backdrop that complements the bullish technical signals. Many traders see this breakout as an opportunity to get in early on a potential recovery rally.

The current price action suggests that OPUSDT may continue its upward trajectory if buying pressure remains strong and key resistance levels are cleared convincingly. Traders should watch for sustained volume spikes and possible retests of the breakout level, which can offer more confidence in the continuation of the bullish momentum. As always, risk management is essential when navigating such moves.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Optimism Extreme BUY: Easy 1277% Profits Potential—Can Go HigherOptimism is now moving within a "extreme BUY" zone. This is a price zone that was active only once between June and July 2022, one month only and then OPUSDT went on a massive rally. Total growth amounting to more than 1,111% from bottom to top.

This zone has been activated again for a little over one month and I believe it won't remain valid much longer. There is room for a new wave of growth but this time much more than 1,111%.

The target shown on the chart is a good one but I believe this trading pair/Cryptocurrency project can go higher when all is said and done.

Technical analysis —Bullish based on price action

On the 16-June week, 22-June specifically, Optimism (OPUSDT) hit its lowest price yet. 0.457. This is just a bit higher compared to the all-time low June 2022 at 0.396. We can easily say the bottom is in as this week the action is back above its 7-April 2025 low.

Higher targets

The next high target sits at $12, giving us a 2,078% potential for profits from current price. 0.551 at the time of writing.

Previous cycle vs current cycle

Optimism's first bullish cycle lasted 630 days. The next cycle, the one that is about to start now, can last an entire year, eight months... We are entering uncharted territory so it is hard to say.

One thing I can say based on TA is that this new wave will be much more steep compared to the last one. The climb will be really fast, it will be hard to adapt.

How to trade to maximize profits

The best way to approach this pair for sure success is by buying when prices are low, now. This would secure a smooth ride and happy profits on the way up.

If you are reading this now, your timing is awesome because we are looking at a bottom catch, this type of opportunity is only seen once every several years. For example, the last time OPUSDT traded this low was in mid-2022, three years ago. Once the bullish wave takes off, there is no going back. Once the bulls are in, low prices will be forever gone.

Thanks a lot for your continued support.

Namaste.

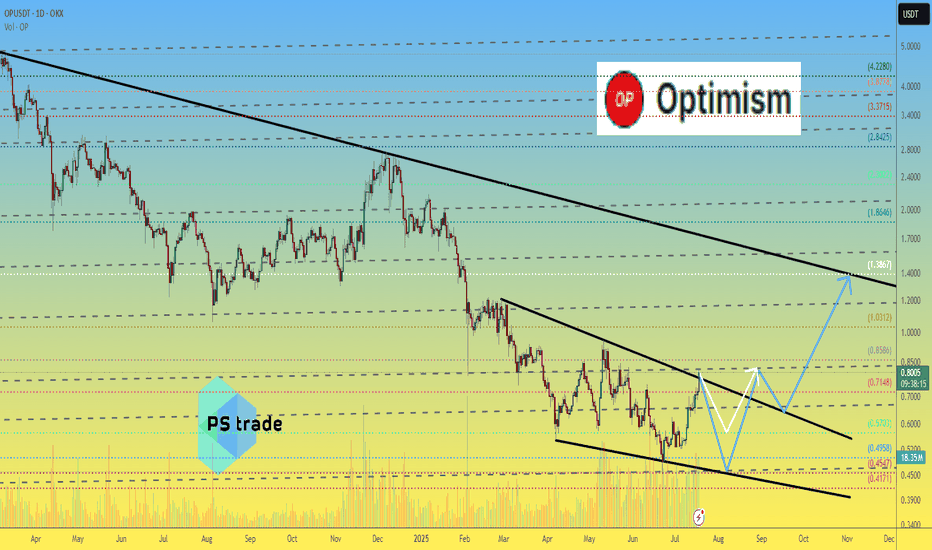

OP Roadmap (3D)The OP token has entered a bearish phase after completing a triangle pattern. We are currently in this bearish phase.

Such large bearish phases typically require a sweep of liquidity from key levels before ending. It appears that OP, after sweeping the liquidity below support levels, may reverse and enter a bullish phase.

The targets have been marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Everyone saw the drop. I saw the gapPrice nuked — but it didn’t break structure. It filled imbalance, paused, and now it's reloading beneath a stack of untouched FVGs. This isn't capitulation. It's orchestration.

The setup:

We’ve got layered 60-minute FVGs stacked from 0.61 to 0.66. That’s the destination — not the mystery. What matters is the origin. The rejection block around 0.58–0.59 has held clean, and we now have two bullish rejection wicks off that base.

Volume surged during the sweep — and fell on the retrace. That’s not distribution. That’s Smart Money filling.

Two entries — one outcome:

Entry 1: Tap into the red demand zone, wick the 0.58–0.579 region

Entry 2: Break and retest above minor FVG (0.60 reclaim confirmation)

Either way, the draw is the inefficiency stack above.

Execution Map:

Long from 0.579–0.583

SL: Below the base at 0.574

TP1: 0.615 (lower FVG)

TP2: 0.645 (full sweep)

Final: 0.660 liquidity run

Don’t fear the compression. That’s where the trap is set.

Final thought:

“Most traders fear price going sideways. I see it as silence before the algorithm speaks.”

The 2025 Bull Market: Do Not Sell Unless You See A New All-Time How long have you been in this market? You are about to embark on a journey; you are about to experience/enjoy the most sought after phase of the cryptocurrency market, the bull market.

If you've been around for less than four years, you've seen nothing like it. It will blow your mind.

You can see the numbers on the charts, past action and there you have your proof, but nothing can prepare you for the actual experience. Even if you've experienced previous bull markets, the actual event is mind-blowing. We are dying for you to try it. We cannot wait anymore... We just want you to earn, make money, share, have fun and enjoy. We, the Cryptocurrency family, deeply love you and wish for you amazing results.

Don't be shy. Do not be afraid. Buy everything up like it is the end of the world. Once bought, hold. Do not sell. I repeat, do not sell until prices are high, really high up. For example, looking at Optimism, OPUSDT, wait for a new all-time high before taking profits.

Thanks a lot for your continued support.

Leave a comment if you enjoyed the article, it will only take ten seconds.

Namaste.

OP/USDT Breakout Alert!!🚀 OP Breakout Alert – 100% Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

OP has successfully broken out from the falling wedge pattern on the daily timeframe, which historically signals a strong trend reversal. After retesting the breakout zone, price action looks ready for a fresh upside move!

🔹 Entry: CMP and add more up to $0.76

🎯 Targets:

→ $0.98

→ $1.21

→ $1.43

→ Final Target: $1.64

🛑 SL: $0.688

⚙️ Leverage: Low leverage (Max 5x)

📊 Structure:

Falling wedge breakout ✅

Retest holding strong ✅

Volume starting to pick up 📈

We’re watching closely—this setup has the potential to mimic the last 114% rally. Let's see how it unfolds! 🚀

💬 What’s your take on OP from here?

Optimism (OP) Falling WedgeBINANCE:OPUSDT is attempting a breakout from a 14 months long falling wedge.

A sustained break above the resistance in the near term would set the target at $3.80, just shy of the main $4.00-$4.80 supply zone.

Key Levels to Watch

• $0.55-$0.60: Main demand zone and invalidation point for the setup

• $1.00-$1.20: High Volume Node and key S/R dating back to June 2023.*

• $2.50-$2.80: High Volume Node and wedge high point.*

• $4.00-$4.80: Main supply zone.

* These could offer resistance and represent good levels for partial TPs.

Optimism Back Above Long-Term Support: Easy 480% PPI will base this entire analysis on a single signal, a break and recovery of support.

Optimism moved recently below its previous All-Time Low established October 2022. The break below this level only lasted a few days. A week closed below and immediately the next week a close happened above. This is a bullish signal. Support was tested and holds. It broke briefly but the fact that the action is back above it makes this situation a bullish one.

» As long as OPUSDT trades above 0.636, market conditions are strongly bullish.

This week we have a full green candle and the week closes today. This is a continuation of last week that closed at the top of the session, another bullish signal.

Some Altcoins are now producing three digits green in a single day, real projects. This type of action is only present in a bullish cycle. At the beginning of a bullish wave, in-between or at the top, never within a bearish cycle or bearish wave.

Bullish action is confirmed. Bullish reversal is confirmed. Higher prices will happen next.

» I have an easy target for you mapped on the chart for OPUSDT, 480%.

Thank you for reading.

There will be more... This target on the chart is only the start, we are set to experience growth long-term. You have not seen how the Altcoins market looks and feels when it grows for six months straight, it will be awesome, and then the bull run.

Namaste.

OP/USDT Major trend. 07 2024Logarithm. Time Frame 1 week. After the listing there were 3 cyclical pumping of the “participation” phase. PR, hype, connection of the majority in mass media. The reversal occurred with a typical breakout in the secondary trend of a triangle (first pumping) or a wedge (second pumping). Now the third wedge is forming, the price is near the dynamic Gann support (reaction from it), but still in the range of the descending wedge pattern.

On a line chart (liquidity, no slippage) the declines are cyclical at -63% each time according to the algorithm. Each successive top +55% of the previous secondary trend.

It is quite possible that something similar will happen again this time (not necessarily), but only ideally after holding dynamic fan support and breaking wedge resistance. I have purposely shown only medium-term targets after a trend break.

Gann's trend fan is plotted on the chart, i.e. dynamic support/resistance areas for the future.

Optimism customization - L2's blockchain scaling solution ETH Crypto funds have invested a total of $267 million.

Secondary trend Time frame 3 days