FireHoseReel | Optimism Near Key Breakout Level as Volume Builds🔥 Welcome To FireHoseReel !

Let’s dive into Optimism (OP) analysis.

⛳️ OP Fundamental Overview

Optimism (OP) helps people use Ethereum faster and cheaper by reducing fees and speeding up transactions for DeFi, NFTs, and apps. Ranked around top 80 on CoinMarketCap, it’s a strong mid-cap Layer-2.

👀 OP 4H Overview

Optimism (OP) is trading inside a 4H range box and is currently positioned near the end of its bearish trend. A breakout above the descending curve trendline, followed by a break of the overhead resistances, could initiate a bullish 4H trend for OP.

📊 Volume Analysis

As price approached the curve trendline and the dynamic resistance at $0.2825, volume increased noticeably. This suggests that a breakout of this zone could lead to a fast and impulsive price move.

✍️ OP Trading Scenarios

🟢 Long Scenario:

A confirmed breakout above $0.2825 with increasing buy volume could allow price to break the top of the range and move toward the $0.3439 resistance.

🔴 Short Scenario:

A breakdown below $0.2518 could trigger a fast move toward a lower support level. Strong selling volume confirmation would be required.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

OPUSD

$OPUSD looks good for a long hereSince 2024, OP has been falling inside of a wedge, and it recently broke out and has now backtested it. We've also formed a capitulation low on Oct 6th, and now we look set to make a move higher.

I think we could see between a 2x-10x move from here potentially all the way up to the top of the range.

Let's see how it plays out over the comings weeks.

OP/USDT – On the Edge of Reversal or Final Breakdown?Optimism (OP) is standing at a critical crossroads after a long and steady downtrend that has persisted since mid-2024.

Price is now testing the major support zone between 0.405–0.476 (yellow block) — a historical demand area that once marked the beginning of a major rally in the past.

The deep wick below this area indicates a liquidity sweep, suggesting that larger players may have flushed out retail stop-losses before positioning for the next major move.

This zone is not just a number — it represents the psychological line between capitulation and accumulation.

While the macro structure still shows lower highs and lower lows, the reaction in this support range will determine whether a mid-term reversal can begin or if the macro downtrend continues.

---

Pattern & Structure Analysis

Main trend: Bearish, with continuous lower highs and lower lows.

Yellow block (0.405–0.476): Key historical demand zone that previously triggered strong accumulation.

Long wick below: Possible false breakdown or stop hunt, indicating liquidity absorption.

Potential setup: Early formation of a double-bottom pattern if price holds above 0.405 and reclaims higher resistance.

---

Bullish Scenario

If price strongly bounces from 0.405–0.476 and successfully closes above 0.6399 (5D timeframe), it could confirm the start of a mid-term reversal.

Initial target: 0.8754

Next target: 1.1797

Bullish confirmation: 5D close above 0.6399 with rising volume.

Invalidation: 5D close below 0.405.

This zone offers potential accumulation for swing traders, but confirmation from volume and structure is essential before committing.

---

Bearish Scenario

If OP fails to hold 0.405 and closes below this support zone, the bearish momentum will likely accelerate.

First target: 0.23 (previous liquidity sweep low).

Bearish confirmation: 5D close below 0.405 with strong selling volume.

Invalidation: 5D reclaim above 0.6399.

A clean breakdown would confirm a continuation of the macro downtrend, signaling a deeper capitulation phase.

---

Market Narrative

The 0.405–0.476 zone is where buyers and sellers face their final test.

This is the battlefield between smart money accumulation and bearish momentum exhaustion.

A strong bullish reaction here could indicate that smart money is stepping in, while a failure to hold could lead to the final flush before a long consolidation phase.

This is the zone that will define whether OP finds its true bottom or enters another leg down.

---

Technical Summary

Support zone: 0.405–0.476

Nearest resistance: 0.6399

Bullish targets: 0.8754 → 1.1797

Bearish target: 0.23

Main trend: Bearish

Timeframe: 5D (mid-term outlook)

---

#OP #Optimism #OPUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportAndResistance #CryptoTrading #MarketStructure #SupplyDemand #CryptoOutlook #BullishScenario #BearishScenario #AltcoinAnalysis

OP/USDT — Major Accumulation Zone: Larger Move is in the Making?

Optimism (OP) is currently consolidating within a major accumulation zone between 0.72–0.60, which has acted as a key macro support since the sharp decline from the 4.8–5.0 peak.

This range represents a crucial battleground between buyers and sellers — where selling pressure is fading and early signs of base formation are emerging.

---

Technical Structure

Current Phase: Sideways consolidation after a prolonged downtrend.

Yellow Zone (0.72–0.60): Strong demand area and macro support tested multiple times.

Key Resistance: 0.8858 — the upper boundary of the range that will define the next major direction.

Potential Pattern: Developing rectangle accumulation or rounded bottom base above demand.

Volume Behavior: Decreasing gradually, indicating quiet accumulation by long-term players (smart money phase).

---

Bullish Scenario

A confirmed breakout and close above 0.8858 would mark the end of accumulation and the start of a potential mid-term uptrend.

Projected upside targets:

1.20 → breakout validation zone

1.80 → main swing target

2.55 – 3.00 → mid-term expansion target if momentum continues

Additional confirmations:

Rising volume during breakout.

Successful retest of 0.8858 as new support.

Formation of higher lows above 0.72.

> “Reclaiming 0.8858 could transform this quiet range into the ignition point of a new bullish phase.”

---

Bearish Scenario

If the price closes below 0.60, the accumulation structure would fail and likely lead to a macro continuation to the downside.

Downside targets:

0.50 – 0.45 → minor support

0.3953 → major historical low and potential capitulation zone

Such a breakdown would confirm renewed selling dominance and a possible search for a new long-term bottom.

---

Conclusion

The 0.72–0.60 range is the critical decision zone for OP’s next major move.

As long as the price holds above this level, the bias remains neutral-to-bullish, supported by signs of accumulation.

A breakout above 0.8858 could mark the beginning of a new uptrend, while a breakdown below 0.60 would signal continuation of the broader downtrend.

> “Calm ranges like this often precede explosive moves — and OP is quietly building the foundation for one.”

---

#Optimism #OPUSDT #CryptoAnalysis #SwingTrading #TechnicalAnalysis #AccumulationZone #BreakoutSetup #Altcoins #CryptoMarket #Layer2 #PriceAction

OP Looks Bullish (6H)Based on the structure that OP has formed on the chart, it appears to be in a reaccumulation phase. It seems we are approaching the end of this phase.

Two entry zones have been identified for this asset, and we will enter gradually (in steps) within each zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this setup.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Will #OP Finally Explode or Is This Just Another Trap for Bulls?Yello, Paradisers! Is #Optimism gearing up for a breakout, or is this the final squeeze before bulls get dumped on hard? Let’s dissect what’s really happening on #OPUSDT:

💎After forming a clean ascending channel since mid-June, #OP has been respecting both the ascending support and ascending resistance zones. Price is currently sitting just below the key resistance zone around $0.83–$0.85, which was previously a support level before flipping into strong resistance. This makes it a major decision point for the next move.

💎If #OPUSD manages to break and close above the $0.85 resistance area with strong volume, and the 50EMA continues to hold as dynamic support, then we’re likely to see a push towards the moderate resistance around $1.059. If that level is cleared, the next logical upside target sits near $1.20, aligning with the strong resistance and peak on the volume profile.

💎As long as price holds above the Support Zone between $0.69 and $0.65, the bullish case remains valid. The structure continues to print higher lows, showing that buyers are defending the trendline support. A successful retest here could lead to a powerful bullish continuation.

💎However, if bulls lose control and #OPUSDT closes below the $0.650 support, the entire bullish setup would be invalidated. In that case, price could slide down toward the $0.50–$0.55 zone, especially if volume dries up. This would complete a potential head-and-shoulders pattern and trigger a shift toward a bearish structure.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

OP Secondary trend. Wedge. Reversal zones. 17 04 2025From the wedge breakout, the price reached the level of 2.857 (81%) and from it the trend reversal under the general trend of altcoins, breaking through the "neck" zone of the head and shoulders, thereby realizing this pattern on a large scale and reaching the reversal zone of the minimums of the level of 0.509. We went down to the range below along the fan. Consolidation above the dynamic support opens up the potential for movement to its resistance, I specifically put another meridian, as from it with a high degree of probability, even with the implementation of the bullish potential, there will be a significant pump / dump rollback. It just intersects with the previous consolidation of support, which in this case acts as resistance (those who previously bought in this zone will sell, thereby going into breakeven and stimulating the stop of the impulse and a rollback (logical probability).

Locally, again having formed on the fall, as before, a descending wedge in the secondary trend. It has not yet been fully formed, the price is not clamped. But, conditionally, the price is at the minimum zone. You can start gaining from the average price, or work on a breakthrough of the formation, observing risk and money management. If you are scared (it is always like this at the minimum zone) - then everyone is the same, and most refuse to buy, but willingly buy when the price is already expensive.

A breakthrough of this wedge is a corrective upward movement to the mirror resistance zone of the previous consolidation (highlighted in gray), if in general, a "revival of faith" is observed in alts.

Also after breakout of the wedge, if the market as a whole is bearish on alts, then they will make a cut (in this case, a repeated set) at the zone of minimums in a wide range of price slippage and the complete death of faith in the candy wrapper of "crypto whales", highlighted in green.

Buy Alert OP (Optimism) - August 27, 2025.NASDAQ:OP #Optimism 🩸 — Investors - Tier 1 | Optimism is a low-cost and lightning-fast Ethereum L2 blockchain | August 27, 2025.

We've analyzed the data on the cryptocurrency Optimism and concluded that now is an excellent entry point for a Spot position, with a potential upside of +22% from $0.70 to $0.86.

🚀 Why?

➖ 1. Limit Order on Coinbase: A major player has placed a limit sell order on the crypto exchange Coinbase at $0.86.

➖ 2. Liquidation Max Pain: For Optimism, the Max Pain level is at $0.8901, with the imbalance favoring short traders. Market makers will push the price upward to liquidate those positions, while limit orders above help large players secure their profits.

➖ 3. Chart Analysis: On the chart, we can see how the bullish candle from August 22, 2025, was engulfed, collecting stop-losses from long traders. This is a common manipulation tactic by big players to shake out as many leveraged positions as possible.

➖ 4. Altcoin Trend Shift: The trend for altcoins is gradually shifting from sideways accumulation to aggressive buildup and a growth phase (in other words, liquidations are being harvested on both sides right now, with a large player accumulating for an aggressive surge in Optimism's price—I suspect altseason could kick off in the coming months, though that word has become almost a curse 🙃).

In Summary:

We anticipate Optimism's rise from $0.70 to $0.86 (+22%) in the near term. Avoid leverage—stick to Spot positions only. After this upmove, expect a pullback to around $0.62, where you can build your core portfolio position and wait for altseason.

#OP (SPOT)BINANCE:OPUSDT

#OP/ USDT

Entry range (0.670- 0.760)

SL 4H close below 0.640

T1 1.000

T2 1.350

T3 1.600

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

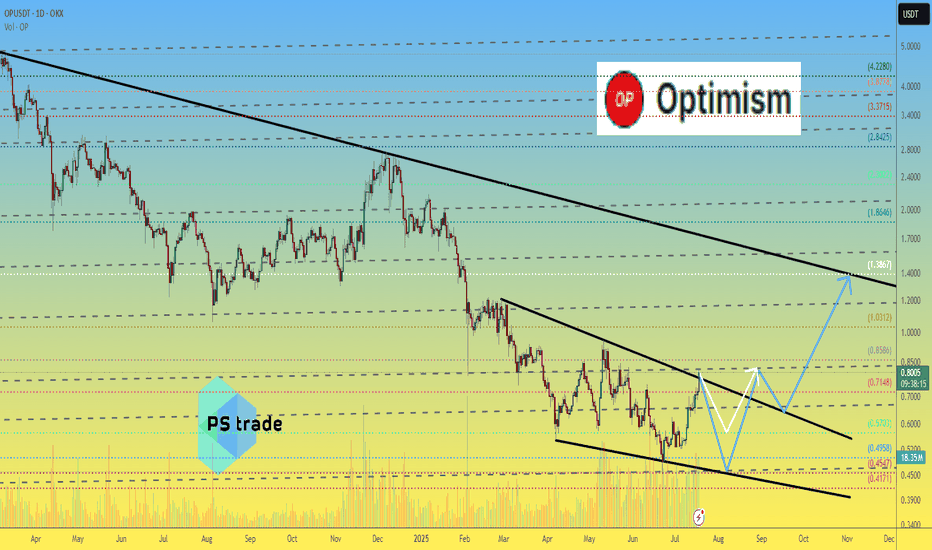

OP/USDT Technical Analysis – Approaching a Major Breakout Zone!Chart Overview: The OP/USDT pair on the 1D (Daily) timeframe is currently moving within a long-term descending trendline, forming a descending triangle or falling resistance channel since November 2024. The price is now approaching a critical point near the long-term resistance trendline (yellow line), which has been tested multiple times.

---

🟢 Bullish Scenario: Breakout Potential

If the price manages to break and close above the descending trendline resistance (currently near the $0.80–$0.85 zone), it would signal a strong bullish breakout. The next key resistance levels to watch (based on yellow dotted horizontal lines) are:

1. $0.9035 – minor resistance

2. $1.0203 – psychological level

3. $1.1836 – mid-term strong resistance

4. $1.7352 and $2.1248 – extended bullish targets

A confirmed breakout would ideally be supported by increasing volume and RSI momentum above 50.

---

🔴 Bearish Scenario: Rejection at Resistance

If the price fails to break the trendline and gets rejected, a downside move is likely to follow. Key support levels to watch are:

1. $0.7200 – current support

2. $0.6000 – minor support

3. $0.4577 – strong historical support (lowest level)

This would suggest continued bearish control and could extend the downtrend that has lasted over 8 months.

---

📊 Pattern Breakdown: Descending Trendline

Consistent lower highs since the peak near $2.77

The descending trendline is the main battle zone between bulls and bears

This pattern often leads to a breakout if buyers gain momentum

---

🎯 Conclusion & Strategy:

This is a critical zone for OP/USDT.

Traders should wait for breakout confirmation before entering long positions.

For breakout traders: consider a buy-the-breakout strategy with stop-loss below the trendline.

For short sellers: look for a rejection at resistance with targets at the nearest support levels.

#OPUSDT #CryptoAnalysis #Altcoins #TechnicalAnalysis #BreakoutTrade #Optimism #CryptoSetup #BullishScenario #BearishScenario #ChartPatterns

Optimism Op price analysis - be careful After the listing of #OP on the Korean exchange, known for its "pump events", we observe a surge in volume along with a breakout from the downtrend.

🐻 The current 6-hour candle on OKX:OPUSDT is attempting to form a pin bar — a potential reversal signal.

⚠️ High volumes often indicate the final phase of a move. Such pumps are usually short-lived — proceed with caution.

👌 Our previously published medium-term forecast for #Optimism remains relevant

________________

📚 Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves!

Optimism OP price analysisCurrently, the price of #OP does not look very optimistic (a little pun to start with )))

🟢 An optimistic forecast would be for the price of OKX:OPUSDT to rise to $1.40

🟡 But it looks like this growth will not happen now, but after a correction.

🔴 Correction: only to $0.57 or again to $0.45 — this is also an open question.

👌 Patience to holders and fans of the #Optimism project, the “microclimate” in the crypto market is improving — the time will come, and this coin will also be pumping...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

OP/USDT Weekly Reversal Zone: Strong Bounce ExpectedThe OP/USDT pair is currently showing strong signs of a potential trend reversal from a major long-term demand zone.

📊 Timeframe: 1W (Weekly)

🟨 Key Support Zone: 0.396 – 0.542 USDT

The price has revisited a historically strong support area that previously served as an accumulation zone since mid-2022. The recent bounce from this level reinforces the likelihood of a bullish reversal.

📈 Upside Targets (Resistance Levels):

1. Minor Resistances:

0.699

0.844

2. Mid-Term Target:

1.190 (key breakout confirmation level)

3. Long-Term Bullish Targets:

2.168

2.400

2.700

2.991

3.725

4.020

4.538

4.865 (Previous major high)

🛡️ Critical Demand Zone:

As long as price holds above the 0.396–0.542 range, bullish structure remains intact. A breakdown below this range could invalidate the setup.

🔄 Outlook:

The chart pattern suggests the formation of a higher low and a potential breakout in stages, supported by volume and positive sentiment. Watch the 0.699 and 0.844 levels for initial confirmation of buyer strength.

📌 Note:

This setup offers an attractive risk-reward ratio for mid to long-term traders watching for a trend reversal.

OP Roadmap (3D)The OP token has entered a bearish phase after completing a triangle pattern. We are currently in this bearish phase.

Such large bearish phases typically require a sweep of liquidity from key levels before ending. It appears that OP, after sweeping the liquidity below support levels, may reverse and enter a bullish phase.

The targets have been marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#OP/USDT#OP

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.817.

Entry price: 0.860

First target: 0.891

Second target: 0.916

Third target: 0.950

OP/USDT Major trend. 07 2024Logarithm. Time Frame 1 week. After the listing there were 3 cyclical pumping of the “participation” phase. PR, hype, connection of the majority in mass media. The reversal occurred with a typical breakout in the secondary trend of a triangle (first pumping) or a wedge (second pumping). Now the third wedge is forming, the price is near the dynamic Gann support (reaction from it), but still in the range of the descending wedge pattern.

On a line chart (liquidity, no slippage) the declines are cyclical at -63% each time according to the algorithm. Each successive top +55% of the previous secondary trend.

It is quite possible that something similar will happen again this time (not necessarily), but only ideally after holding dynamic fan support and breaking wedge resistance. I have purposely shown only medium-term targets after a trend break.

Gann's trend fan is plotted on the chart, i.e. dynamic support/resistance areas for the future.

Optimism customization - L2's blockchain scaling solution ETH Crypto funds have invested a total of $267 million.

Secondary trend Time frame 3 days

OP/USDT Secondary trend. Wedge. Pivot zones. 27 07 2024OP/USDT Secondary trend. Wedge. Pivot zones. 27 07 2024

Logarithm. Time frame 3 days. A descending wedge is forming. The price is near the dynamic Gann support (reaction from it), but still in the range of the descending wedge pattern. The reaction in this resistance zone will determine the trend for the near future.

On the chart, I have specifically shown the minimum percentages of the two key reversal zones for the trend to local resistance levels, for the potential of option A and B.

Major trend.

OP/USDT Major trend. 07 2024 Time frame 1 week.