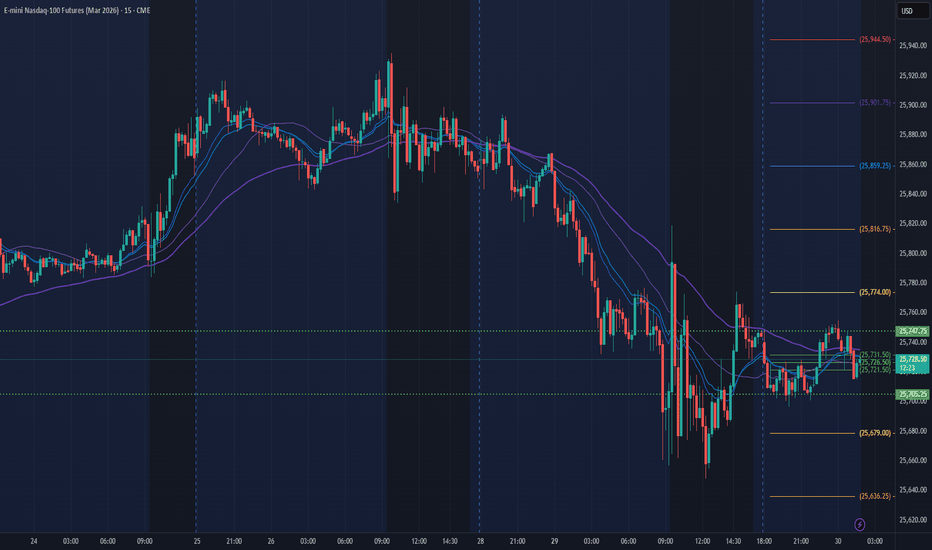

1/14 Pre-Market Read - Game plan Pre-market POIs / Game Plan (MNQ 15m)

Key context from the chart:

• We mapped the session range + prior levels and stacked POIs to create a clean “ladder” for targets.

• Important nearby references on your screenshot: Asia High ~25926, Asia Low ~25852.50, London High ~25878.75, London Low ~25701, PDL ~25803.25, and upside POIs.

My POI Ladder (targets)

Upside

• POI 1: 25,871.25

• POI 2: 25,920.50

• POI 3: 26,006.00

• POI 4: 26,083.50

• POI 5: 26,106.25

Downside

• Bear POI 1: 25,738.75

• Bear POI 2: 25,652.75

• Bear POI 3: 25,615.50

How I’m trading it today (simple rules)

Bullish idea

• If price reclaims/holds POI 1 (25,871) and starts holding above POI 2 (25,920) → I’m looking for step-ups into POI 3 (26,006) then POI 4/5.

• Best entries: retest/hold of POI after a breakout candle (confirmation > guessing).

Bearish idea

• If price loses PDL (~25,803) and can’t reclaim, that’s a warning.

• Break + hold below POI 1 (25,871) opens the door to Bear POI 1 (25,738) then Bear POI 2 (25,652).

What to watch at open

• Reaction at POI 1 / POI 2 (they’re your “decision levels”).

• Sweeps into a POI then immediate reclaim = reversal trigger.

• Clean hold above POI = continuation trigger.

Not financial advice — just my plan + levels from my system.

Orb

NQ Power Range Report with FIB Ext - 1/16/2026 SessionCME_MINI:NQH2026

- PR High: 25750.75

- PR Low: 25704.25

- NZ Spread: 104.0

No key scheduled economic events

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 336.46

- Volume: 21K

- Open Int: 272K

- Trend Grade: Long

- From BA ATH: -2.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

MNQ Premarket Plan (POI Map) — 1/15🚨 MNQ Premarket Plan (POI Map) — 1/15

Bias/Context: We’re pressing the 25,870–25,880 decision zone (POI1 / near PDH). This is where trend day continuation OR rejection can start.

📍 Upside POIs (targets)

• POI1 25,871.25

• POI2 25,920.50

• POI3 26,006.00

• POI4 26,083.50

• POI5 26,106.25

📍 Downside POIs (supports)

• 25,738.75 → 25,652.75 → 25,615.50

• then 25,554.50 / 25,538.00

• deeper: 25,502.25 → 25,450.25 → 25,388.00 → 25,357.75 (FVG mid)

• worst case: 25,295.75

✅ Gameplan

Bull case: Hold/reclaim above 25,871–25,879 → push 25,920.50 then 26,006.00. If momentum stays strong, runner toward 26,083.50–26,106.25.

Bear case: Rejection at 25,871/25,920 → break back under 25,738.75 → target 25,652.75 then 25,615.50. If weakness accelerates, look for the next shelves below.

Rules today: First 15m range + POI retests only. No chasing mid-candle. If spreads/volatility spike → size down.

NQ Power Range Report with FIB Ext - 1/15/2026 SessionCME_MINI:NQH2026

- PR High: 25615.25

- PR Low: 25563.50

- NZ Spread: 115.75

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Philadelphia Fed Manufacturing Index

08:45 | S&P Global Manufacturing PMI

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 331.29

- Volume: 29K

- Open Int: 273K

- Trend Grade: Long

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/14/2026 SessionCME_MINI:NQH2026

- PR High: 25913.75

- PR Low: 25886.50

- NZ Spread: 60.75

Key scheduled economic events:

08:30 | Retail Sales (Core|MoM)

- PPI

10:00 | Existing Home Sales

10:30 | Crude Oil Inventories

Temp 25% AMP margin requirement increase for expected economic news volatility

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 319.19

- Volume: 18K

- Open Int: 279K

- Trend Grade: Long

- From BA ATH: -1.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Liquidity Grab into Reversal (PDH / AM High → Sellside Move)1/13 Session Recap — Liquidity Grab into Reversal (PDH / AM High → Sellside Move)

Today’s price action gave a clean, teachable sequence:

Market Structure

• Price pushed into an upside resistance pocket (PDH + upper POI area / AM High zone).

• After the tag, the market showed rejection + displacement down, signaling the reversal was active.

• The rest of the session delivered a sellside expansion into lower levels.

What I looked for

1. Tag of key upside level (PDH / AM High region)

2. Rejection candles / failure to hold above level

3. Shift in momentum → continuation lower

Execution (Options)

I executed the move using QQQ puts and scaled:

• 626P (starter / main)

• 624P and 620P (adds as confirmation strengthened)

Outcome

✅ Clean reversal execution

✅ Scaled entries + profit-taking into the dump

✅ Net: +$165.68

Key takeaway

The edge was NOT predicting — it was waiting for price to reach the level, then reacting to confirmation.

(Educational only, not financial advice.)

NQ Power Range Report with FIB Ext - 1/13/2026 SessionCME_MINI:NQH2026

- PR High: 25954.00

- PR Low: 25893.50

- NZ Spread: 135.5

Key scheduled economic events:

08:30 | CPI (Core|MoM|YoY)

10:00 | New Home Sales

13:00 | 30-Year Bond Auction

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 329.14

- Volume: 26K

- Open Int: 277K

- Trend Grade: Long

- From BA ATH: -1.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/12/2026 SessionCME_MINI:NQH2026

- PR High: 25960.00

- PR Low: 25870.00

- NZ Spread: 200.75

Key scheduled economic events:

13:00 | 10-Year Note Auction

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 337.48

- Volume: 52K

- Open Int: 273K

- Trend Grade: Long

- From BA ATH: -2.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/9/2026 SessionCME_MINI:NQH2026

- PR High: 25727.25

- PR Low: 25671.75

- NZ Spread: 124.0

Key scheduled economic events:

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

Temp AMP Futures margins increase for pre-RTH news

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 323.62

- Volume: 23K

- Open Int: 267K

- Trend Grade: Long

- From BA ATH: -2.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/8/2026 SessionCME_MINI:NQH2026

- PR High: 25849.75

- PR Low: 25818.75

- NZ Spread: 69.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 327.27

- Volume: 21K

- Open Int: 273K

- Trend Grade: Long

- From BA ATH: -2.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Market Re-cap and structure of the dayMarket Type: Breakout → Trend Day Up

Bias: Bullish once PDH reclaimed

Result: + $128 | 4W / 1L

Key Levels I respected

PDH: 25,844.75

NY AM High: ~25,880

POI ladder acted as clean targets + reaction zones (POI4/5/6 area)

What price did today (simple)

Early AM was choppy / ORB filters blocked some entries (good… no forced trades).

Once price reclaimed PDH, it confirmed buyers.

Breakout pushed into NY AM High, then we got continuation candles = the edge window.

Later in the day, entries started showing “too late / low volume” → that’s the sign momentum is extended and risk increases.

My best trades / why they worked

✅ Took longs after PDH reclaim + strength candles

✅ Used POIs as targets, not hope

✅ Stayed with the trend during the best time window

The mistake (and the lesson)

❌ One late trade = reduced edge (post push / extension / “too late” conditions)

Rule reminder: If the system is warning “too late,” either size down or shut it down.

What I’m focused on next session

Wait for PDH reclaim + pullback continuation

Don’t chase after big candles

Trade the clean window, protect the green

NQ Power Range Report with FIB Ext - 1/7/2026 SessionCME_MINI:NQH2026

- PR High: 25844.75

- PR Low: 25815.50

- NZ Spread: 65.25

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

10:00 | ISM Non-Manufacturing PMI

- ISM Non-Manufacturing Prices

- JOLTs Job Openings

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 331.18

- Volume: 21K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

All Cylinders Firing: VWAP → Valid Entry → ORB → Expansion (MNQ/Today was one of those “all cylinder's firing” sessions — clean structure and clean execution.

✅ The Blueprint (A+ Sequence)

Retest to VWAP (white line)

Context Indicator prints “Valid Entry” (confirmation)

ORB breakout (market chooses direction)

ORB retest / pullback hold (best risk entry)

Expansion to the upside into targets/POIs

📌 MNQ Read (Structure)

Price respected VWAP/structure and gave a controlled move.

Once momentum started slowing near highs / volume cooled, it wasn’t “press for more” time — it was protecting profit time.

🎯 QQQ Execution (0DTE Scalps)

Took calls only when the sequence lined up with MNQ context.

No chasing. No forcing. Focused on retest entries and profit-taking into strength.

🎓 Teaching Moment

Breakouts are optional — the retest is the paycheck.

If we break ORB but can’t hold the retest, we wait.

If we break ORB and hold the retest with VWAP + Context aligned, we execute with confidence.

Not financial advice — educational purposes only.

NQ Power Range Report with FIB Ext - 1/6/2026 SessionCME_MINI:NQH2026

- PR High: 25598.75

- PR Low: 25560.75

- NZ Spread: 85.0

Key scheduled economic events:

09:45| S&P Global Services PMI

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 336.38

- Volume: 20K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/5/2026 SessionCME_MINI:NQH2026

- PR High: 25463.25

- PR Low: 25406.50

- NZ Spread: 126.75

Key scheduled economic events:

10:00 | ISM Manufacturing PMI

- ISM Manufacturing Prices

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 339.04

- Volume: 32K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -3.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/2/2026 SessionCME_MINI:NQH2026

- PR High: 25504.00

- PR Low: 25448.50

- NZ Spread: 124.0

Key scheduled economic events:

09:45 | S&P Global Manufacturing PMI

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 333.71

- Volume: 26K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/30/2025 SessionCME_MINI:NQH2026

- PR High: 25747.75

- PR Low: 25705.25

- NZ Spread: 95.0

Key scheduled economic events:

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 343.23

- Volume: 16K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/29/2025 SessionCME_MINI:NQH2026

- PR High: 25879.00

- PR Low: 25843.00

- NZ Spread: 80.5

No key scheduled economic events

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 353.46

- Volume: 21K

- Open Int: 270K

- Trend Grade: Long

- From BA ATH: -2.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/23/2025 SessionCME_MINI:NQH2026

- PR High: 25722.50

- PR Low: 25700.50

- NZ Spread: 49.0

Key scheduled economic events:

08:30 | Durable Goods Orders

- GDP

10:00 | CB Consumer Confidence

15:00 | New Home Sales

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 405.86

- Volume: 16K

- Open Int: 267K

- Trend Grade: Long

- From BA ATH: -2.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/22/2025 SessionCME_MINI:NQH2026

- PR High: 25675.00

- PR Low: 25632.25

- NZ Spread: 95.75

Key scheduled economic events:

10:00 | Core PCE Price Index (MoM|YoY)

Weekend gap up 0.23% (open)

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 425.74

- Volume: 25K

- Open Int: 269K

- Trend Grade: Long

- From BA ATH: -2.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/19/2025 SessionCME_MINI:NQH2026

- PR High: 25257.50

- PR Low: 25209.75

- NZ Spread: 106.75

Key scheduled economic events:

08:30 | Core PCE Price Index (MoM|YoY)

10:00 | Existing Home Sales

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 430.77

- Volume: 35K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -4.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/18/2025 SessionCME_MINI:NQH2026

- PR High: 24999.00

- PR Low: 24925.00

- NZ Spread: 165.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

- CPI (Core|MoM|YoY)

- Philadelphia Fed Manufacturing Index

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 426.70

- Volume: 36K

- Open Int: 266K

- Trend Grade: Long

- From BA ATH: -5.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/17/2025 SessionCME_MINI:NQH2026

- PR High: 25363.00

- PR Low: 25294.25

- NZ Spread: 154.0

No key scheduled economic events

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 414.92

- Volume: 32K

- Open Int: 246K

- Trend Grade: Long

- From BA ATH: -4.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone