ORDI Update – Key level reactionORDI has pushed back into a key resistance zone after a prolonged range.

Price briefly broke above resistance but failed to hold, showing signs of a possible deviation rather than a clean breakout.

This level is now critical:

Hold above resistance → acceptance and continuation higher

Failure to hold → rejection back into the range, potentially towards support

This area will decide whether this move has real strength or was simply a liquidity sweep.

Will the breakout hold and continue, or will resistance step in again?

MrC

ORDI

ORDI – Daily Zoomed-In UpdatePrice is still trading below a key reclaimed level that previously acted as strong support.

This level is now acting as resistance and needs to be reclaimed for bullish continuation.

Recent price action shows a potential deviation below support, followed by acceptance back into the range.

If this deviation holds, it can act as a spring for a larger move.

Key idea:

No FOMO here.

Bullish continuation only makes sense after a clean reclaim and hold above resistance.

Key levels to watch:

Support: range lows / deviation area

Resistance: prior support level that must be reclaimed

Acceptance above resistance opens the path toward higher range targets.

Failure to reclaim keeps ORDI range-bound and vulnerable to another sweep lower.

Not financial advice. Always manage risk.

👍 Like if you’re still tracking ORDI

💬 Do you expect a clean reclaim or another deviation first?

MrC

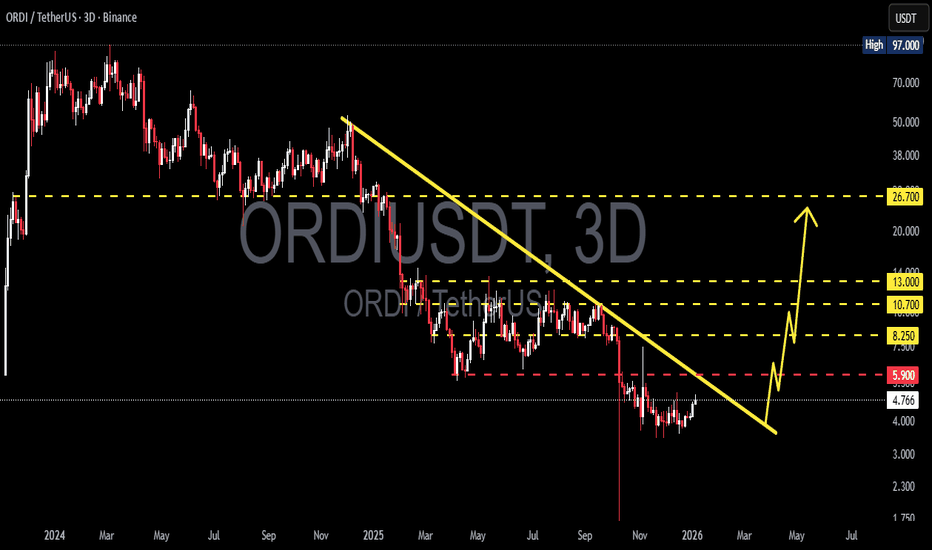

ORDI/USDT Final Support Zone — Reversal or Bearish Continuation?ORDI/USDT on the 3D timeframe remains in a medium-to-long-term bearish trend. Since peaking around $90–$97, price has consistently formed lower highs and lower lows, confirming strong seller dominance. Currently, price is trading near a major historical support zone after a sharp capitulation move.

---

Pattern & Technical Structure

1. Descending Trendline (Major Bearish Structure)

A well-defined descending trendline connecting multiple lower highs since late 2024.

As long as price remains below this trendline, the overall market structure stays bearish.

2. Bearish Continuation Formation

Step-by-step breakdown of key support levels:

$26.7 → $13.0 → $10.7 → $8.25

This structure indicates distribution and sustained selling pressure, not a healthy correction.

3. Potential Base Formation (Early Stage)

Price consolidation is visible around $4.75 – $5.90 with decreasing volatility.

This could be an early base formation, but no confirmed trend reversal yet.

---

Key Levels

Resistance Zones

$5.90 (minor resistance / previous breakdown level)

$8.25 (key supply zone)

$10.70 – $13.00 (major resistance cluster)

$26.70 (macro resistance)

Support Zones

$4.75 (current local support)

$3.80 – $4.00 (last demand zone)

A breakdown below this area could trigger further downside continuation.

---

Bullish Scenario

Price holds above $4.75 and forms a higher low.

A strong close above $5.90 signals early bullish momentum.

Strong confirmation comes with a breakout above the descending trendline, targeting:

$8.25

$10.70

$13.00

This scenario suggests a relief rally or early trend reversal, not a full bullish trend unless major resistance is reclaimed.

---

Bearish Scenario

Failure to hold above $4.75.

Strong breakdown toward $3.80 – $4.00.

Losing this zone would:

Confirm bearish continuation

Open the path for new lows

As long as price stays below the main trendline, bearish dominance remains intact.

---

Conclusion

ORDI/USDT is still in a primary bearish phase, but price is now trading in a critical decision zone. The $4.75 – $5.90 area acts as a key battle zone between buyers and sellers. Aggressive traders may watch for early reversal signals, while conservative traders should wait for confirmed trendline breakout before considering medium-term long positions.

---

#ORDI #ORDIUSDT #BRC20 #BitcoinEcosystem #CryptoTrading #TechnicalAnalysis #BearishMarket #TrendReversal #AltcoinAnalysis

ORDI Weekly AnalysisORDI is currently trading at a major higher timeframe support zone after a prolonged downtrend.

This level has acted as support multiple times in the past, making it an important area to monitor for potential price reactions.

Market structure remains bearish on the higher timeframe, but downside momentum is slowing down and price is starting to consolidate.

Key levels to watch:

Support at the current range low

Resistance at the previous breakdown level

Higher timeframe resistance above, as marked on the chart

If price holds support and manages to reclaim resistance, continuation toward the next resistance levels becomes possible.

If price fails to hold support, consolidation or further downside cannot be ruled out.

This analysis is based on market structure and support and resistance levels.

No predictions, only scenarios.

All levels and scenarios are clearly marked on the chart.

Questions or comments are welcome in the comments below.

MrC

ORDIUSDT Approaching the Big Breakout! The End of the Downtrend?ORDI/USDT is now at one of its most crucial moments of 2025.

After a sharp rebound from the $3–$4 zone, the price is approaching the main descending trendline that has rejected every major rally for months.

This is a make-or-break zone — where the market will decide whether a major reversal begins or if this is just another bearish trap before continuation down.

---

🧩 Technical Structure

Main trend: Strong downtrend since early 2025, forming a clear series of lower highs and lower lows.

Primary resistance: The yellow descending trendline connecting all major peaks.

Key support zone: $3.1 – $4.8 (strong demand area).

Key resistances: $6.0 (current level), $10.5, $13, $20, and major resistance at $49–$53.

Volume note: The latest rebound shows a strong volume spike, signaling renewed buyer interest.

---

⚡ Bullish Scenario – “The Reversal Awakening”

If ORDI can close a daily candle above the descending trendline, it would mark the first true breakout of this long-term downtrend — a potential start of a major trend reversal.

Bullish triggers:

Daily close above $7–$7.5 with solid volume.

Retest of the breakout zone holding as new support.

Strong continuation candles confirming breakout momentum.

🎯 Bullish Targets:

1. $10.50 — first resistance and conservative target.

2. $13.00 — medium-term target.

3. $20.00+ — next major target if the breakout sustains.

📈 A confirmed breakout here would officially break the mid-term downtrend structure.

---

💀 Bearish Scenario – “False Break & The Trap Zone”

If ORDI fails to break above the trendline and forms a rejection candle (long upper wick), it could trigger another bull trap.

This would signal that bears are still in control, pushing price back toward lower supports.

Bearish confirmation signs:

Rejection candle at the trendline with high volume.

No follow-through in the next session.

🎯 Bearish Targets:

$4.8 → $3.8 (short-term correction zone).

If $3.1 support breaks, expect further downside continuation.

⚠️ Bearish invalidation: A confirmed daily close above the trendline (breakout).

---

🧠 Pattern & Sentiment

Current structure forms a descending resistance breakout setup — a potential reversal pattern after months of decline.

The sharp rebound with volume may indicate early accumulation.

Market sentiment is shifting, but confirmation is key before declaring a trend change.

---

🧭 Strategy & Risk Management

Conservative Approach:

Wait for a daily close above the trendline.

Enter on the successful retest (trendline becomes support).

Place stop below the previous swing low (~$4.0).

First target $10.5, then $13.

Aggressive Approach:

Early entry near $6.0–$6.2 (anticipating breakout).

Tight stop below $5.0.

Add on confirmation after breakout.

💡 Remember: Volume confirmation is the key to validating any breakout.

---

🔮 Epic Summary

ORDI stands at the edge of transformation.

After a year-long downtrend, it’s now testing the same trendline that has rejected every rally before.

A clean breakout could mark the beginning of a powerful bullish phase, while a sharp rejection would confirm that bears are not done yet.

This isn’t just another resistance — it’s the decision zone for ORDI’s next major move.

---

#ORDI #ORDIUSDT #CryptoAnalysis #TechnicalAnalysis #Altcoin #CryptoTrading #BreakoutSetup #TrendlineBreakout #SupportResistance #BullishScenario #BearishScenario #ChartAnalysis #CryptoCharts

$ORDI/USDT pessimistic outlook, I do not invest anymore.I have invested and made good money trading SEED_DONKEYDAN_MARKET_CAP:ORDI for a while. I have ridden the rise and sold at $69, missing the peak and feeling bad at the time.

Now my sentiment about SEED_DONKEYDAN_MARKET_CAP:ORDI is very bearish, and I will explain why I will stop trading it. Here are several events that have happened and are red flags:

1. SEED_DONKEYDAN_MARKET_CAP:ORDI was created in March 2023 by Domo, an enigmatic blockchain analyst; he just posted it on Github, and it was adopted by the team developing Bitcoin code. Binance launched it nobody knows why,

2. SEED_DONKEYDAN_MARKET_CAP:ORDI does not have a proper website. The founder didn't make money out of it and is not supporting it.

3. SEED_DONKEYDAN_MARKET_CAP:ORDI does not have an identified legal entity, no budget, no tokenomics, no roadmap, and no ecosystem.

4. SEED_DONKEYDAN_MARKET_CAP:ORDI now has RUNE (not the Thorchain CRYPTOCAP:RUNE ), which has a questionable name and seems to be a modification of BRC-20 to make money out of it. I personally think that it is shady.

So SEED_DONKEYDAN_MARKET_CAP:ORDI is a VERY HIGH investment risk, manipulated by Binance, with no team, and no future, to be honest. Worse, RUNE seems to be a takeover by Casey Rodarmor, a Bitcoin dev, and the name he has chosen is not compatible with any exchange because it already exists with a top 50 token that is older and succesful!

What the hell is going on?

I think that $95 is the all-time high for this coin for its lifetime, which will dump into oblivion before the end of this bull run, with no fundamental attached to it, I do not see what can save it.

Of course, I might be wrong; some magic could happen, and some pump might occur, but the signs of imminent death are already showing. It has dumped 66%, one of the worst performances of all the top 100 cryptos since its ATH. It is not recovering.

Conclusion: Be very careful with this coin. It has been short-lived and is probably in the process of dying.

ORDI/USDT — Symmetrical Triangle: A Major Breakout?Currently, ORDI/USDT is consolidating tightly after a prolonged downtrend from the 52.880 peak. The chart is showing a symmetrical triangle, with a descending trendline pressing from above and a rising support line holding from below.

This pattern reflects a compression phase — volatility is narrowing, momentum is being stored, and a major breakout is likely to occur soon.

---

🔎 Pattern & Structure Details

Main trend: Long-term bearish since Dec 2024 (consistent lower highs).

Key support zone: 5.61 – 7.00 (highlighted yellow box), tested multiple times since April.

Key resistance zone: Descending trendline + horizontal resistance around 10.298.

Volatility: Shrinking significantly — the price is moving closer to the apex of the triangle, where breakouts usually happen with strong volume.

---

🟢 Bullish Scenario

1. Breakout confirmation: Daily close above 10.30 with high volume (clear break of descending trendline).

2. Initial targets: 11.58, then 13.17.

3. Extended targets (mid-term): If momentum continues, possible rally toward 20.43 – 23.38.

4. Risk Management: Place stop-loss below 8.0 or under the retest level in case of a false breakout.

---

🔴 Bearish Scenario

1. Breakdown confirmation: Daily close below 7.00 (falling out of the accumulation zone).

2. Initial target: 5.61 support.

3. If 5.61 breaks: Price could extend lower into the 4.0 – 5.0 psychological zone.

4. Risk Management: Stop-loss can be placed above 8.5 – 9.0 to avoid fake breakdowns.

---

⚖️ Conclusion

Neutral outlook until breakout: Symmetrical triangles are statistically neutral, but since it formed inside a broader downtrend, bearish continuation probability is slightly higher.

However, a breakout above resistance with strong volume could trigger a trend reversal and bring back mid-term bullish momentum.

Best approach: wait for confirmed breakout (daily close + volume) before taking positions.

---

ORDI is consolidating inside a symmetrical triangle. Key support zone: 5.61 – 7.00, key resistance: 10.30. The next breakout will set the direction:

🚀 Bullish: Break above 10.30 → targets 11.58, 13.17, even 20+.

🔻 Bearish: Drop below 7.00 → target 5.61, possibly 4.0.

Volatility is tightening — expect a big move soon. Trade with risk management, avoid FOMO.

#ORDI #ORDIUSDT #Crypto #PriceAction #Breakout #TechnicalAnalysis

ORDIUSDT Forming Falling WedgeORDIUSDT is currently displaying a classic falling wedge pattern on the charts, a formation typically associated with bullish reversals. This technical setup suggests that the recent downtrend may be nearing exhaustion, with potential for a strong upward breakout. The wedge has been forming with lower highs and lower lows converging toward a breakout point, and recent candles suggest bullish pressure is beginning to build. With good volume supporting the structure, the conditions look ripe for a breakout rally.

A breakout from this falling wedge could see ORDIUSDT gaining between 70% to 80% in the coming weeks, based on historical price action and wedge height projections. The increased investor interest and healthy trading volume add conviction to this scenario, making it an attractive setup for both short-term swing traders and long-term crypto investors. The asset appears to be forming a base, and if the breakout confirms above key resistance levels, it could rapidly advance toward new highs.

What further adds to the bullish thesis is the growing attention toward Ordinals and Bitcoin-native assets, of which ORDI is a prominent player. Market participants are gradually shifting focus back to unique infrastructure and innovation-driven tokens, and ORDIUSDT may benefit from this shift in sentiment. With bullish divergence on indicators and confirmation of a breakout, this could be a strong candidate for a high-risk, high-reward opportunity.

Traders should keep an eye on volume spikes and confirmation candles for a safer entry. As always, risk management is key in volatile conditions, but technically, ORDIUSDT shows a promising structure that deserves close monitoring.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ORDI (SPOT)BINANCE:ORDIUSDT

#ORDI/ USDT

Entry(6.450- 7.300)

SL 1D close below 6.100

T1 10.470

T2 17.000

T3 19.000

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

ORDI/USDT – Bullish Falling Wedge Formation!!Hey Traders — if you're into high-conviction setups with real momentum, this one’s for you.

ORDI is forming a bullish falling wedge pattern and is currently consolidating near crucial support. The price is showing initial signs of breakout potential.

Here's the trade plan:

Entry: $7.20–$7.70

Targets: $9.20 / $10.50 / $11.90

Stop Loss: $6.50 (Strict)

Excellent risk-to-reward opportunity here. Keep your stops tight and manage your risk wisely.

ORDIUSDT heading to weekly supportORDIUSDT is currently trending down after hitting the weekly resistance WR1.

The price is likely to head to weekly support WS1. This support is going to hold the price and provide the bounce.

I believe, the price is very likely to bounce from WS1 and then move upward and on this attempt it may break weekly resistance WR1.

I will share the update once we have the price bounce from WS1 and trading around WR1.

$ORDI Enters Key Fib Support, Watching for Bounce!!SEED_DONKEYDAN_MARKET_CAP:ORDI

It’s not forming any clear pattern, but based on the Fib retracement, price is currently sitting in the golden entry zone around the 0.5–0.618 level.

Also, the 100 MA, which previously acted as strong resistance, is now working as support.

This setup looks interesting because of the tight stop-loss and high reward potential.

I’ve entered the trade with this logic.

Let’s see how it plays out 👀

#ORDI #CRYPTOMOJO_TA

Ordinals Market Bottom, New 10X Bullish Wave In The MakingHere we have a true and perfect bottom. A rounded bottom.

The bottom is perfect because of the chart structure. First, there is a bullish wave, some bullish action. This is followed by a descent with a classic period of rest in-between the start and the end of the bearish move. After the down-wave is over, a perfect rounded bottom forms with a new All-Time Low. After the ATL, ORDIUSDT turns bullish. Classic sequence.

Here it is easy to appreciate how low Ordinals is trading compared to previous market phases, truly bottomed out. It is still trading below mid-November 2023. The only candle that is being matched right now is the first trading session in early November 2023 on the way up.

The same range was also active in February this year but this was part of the final descent.

The bottom leads to a recovery and the recovery will transform into a full blown bull market, growth long-term.

The targets on the chart are easy targets, it is likely that the new All-Time High in 2025 will end up being something higher than what is shown on this chart. Even if it doesn't go beyond, the second target amounts to more than 10X. Huge potential for growth.

Namaste.

ORDIUSDT — channel, high risks, high rewards.ORDI is the first BRC-20 token based on the Ordinals protocol on Bitcoin. Since its launch in March 2023, the token quickly gained popularity and a significant market cap, being integrated into the Bitcoin blockchain. This integration is made possible through the Ordinals protocol developed by Casey Rodarmor. The protocol allows inscriptions - text, images, audio, or video - to be made directly on satoshis, the smallest unit of Bitcoin, giving Bitcoin new functionality that was not originally envisioned. You can now create NFTs and other digital assets and trade them directly on the blockchain.

____________

The token was listed at a fortunate time - late 2023 - amid overall market growth and positive sentiment. At the time, everything looked promising, but now the price has dropped by 94% from the zones where “hype was being sold.”

🔻 Structure:

The token is moving within a large descending channel. Recently, the price tested the outer support of this channel.

A local downtrend channel was also broken - its retest and a rise within the main trend are possible.

📊 Scenarios:

Retest and upward movement as part of a correction.

Consolidation in the current zone with a possible breakout to the upside.

Further decline amid overall negative market sentiment.

💥 Risks:

The token is traded on all major exchanges, including Binance. However, if it gets delisted (which has been happening more often recently), this is the main risk: loss of liquidity!

🎯 Approach:

With such tokens, it’s crucial to distribute volume wisely and accept risk in advance. I mark out interesting zones and place limit orders accordingly.

Considering the overall market and news backdrop, the token does have bounce potential, especially now that faith in the project is nearly lost.

💭 Opinion:

From my years of experience, I’ll say it again: the goal isn’t to guess where the price will go - it’s to be ready for it. Not everyone will understand that, but then again, not everyone consistently makes money in this market.

_________

📌 Not financial advice. This material reflects personal observations and a risk management approach.

ORDI is printing a classic “dead-cat or genesis‐leg” decisionORDI is printing a classic “dead-cat or genesis‐leg” decision

🕞 60-Second Read

Trend on the 1-D chart is still structurally bearish but price (spot 8.34 USDT) just bounced +55 % off the March capitulation wick.

Hot-Zone #1 – 6.83 (V-Low): last defended demand, 18 % under spot.

Hot-Zone #2 – 11.74 (3 MP-High): first daily breaker sitting 41 % above spot.

Hot-Zone #3 – 23.24 → 30.62 (V-High ↔ MP-High): macro supply shelf where the next big void starts.

🎲 Probability Dashboard

HTF Trend & Market Structure – -2

Liquidity Map (voids above, un-retested pivots) – +1

Momentum (bull div & impulse) – +1

Derivatives Flow (funding near flat) – 0

Net Score = 0

Bear / Neutral / Bull odds ≈ 45 % / 25 % / 30 %

📈Trade Playbook

Strategy 1

1. Layered Limit Grid – Aggressive Counter-Trend Long

Entry layers (size %):

7.05 – 25 % of your allocated ORDIUSDT size

6.20 – 35 %

5.20 – 25 %

4.20 – 15 %

SL = 3.35

TP ladder:

11.74 – 25 % off-load

15.22 – 25 %

20.72 – 30 %

23.24 – 20 %

Weighted R:R ≈ 4.6

---

Strategy 2

2. Layered Limit Grid – Conservative Breakout Long

Trigger: daily close > 12.00, then place grid orders.

Entry layers (size %):

12.10 – 40 %

13.20 – 30 %

15.20 – 20 %

20.80 – 10 %

SL = 10.10

TP ladder:

23.24 – 30 %

30.62 – 30 %

37.65 – 25 %

48.25 – 15 %

Weighted R:R ≈ 4.9

Setup Logic

Price reclaimed minor breaker but sits inside a 72 % upside void to 11.74.

Three un-retested pivot highs (11.74 / 15.22 / 30.62) magnetise rallies.

Yearly BC 37.65 brackets with I-High 38.85 – high-timeframe liquidity pool.

Capitulation low left MP-Low 3.83 as invalidation reference for longs.

Risk Radar

BTC volatility spill-over could nuke thin ORDI order-books.

Macro: U.S. risk‐off headlines keep alt liquidity fragile.

Narrative: inscription / BRC-20 hype cycle cooling – watch volume.

ORDI is printing a classic “dead-cat or genesis‐leg” decision: defend 6.8 and bulls get an air-pocket run to 15 – 23; lose it and 3.8 is next. Trade the grid, not the hopium.

(Not financial advice – manage your own risk.)

ORDI Long SL -12.45%ORDI/USDT Long Setup

Reason:

Break of Internal Structure.

Strong Bullish Momentum.

Resting on Major Support.

Taken All possible Liquidity.

All technical indicators suggesting Strong bullish Wave

Best Regards,

The Panda

BINANCE:ORDIUSDT

OKX:ORDIUSDT

BITGET:ORDIUSDT.P

MEXC:ORDIUSDT.P

BLOFIN:ORDIUSDT

Breaking: Bitcoin Ordinals ($ORDI) Dips 6% Today- What Next?The Bitcoin inscription token Ordinals ( SEED_DONKEYDAN_MARKET_CAP:ORDI ) has plummeted drastically the start of this year. From an all time high of $96.17 SEED_DONKEYDAN_MARKET_CAP:ORDI tanked -90.5% losing more than half of its value currently trading at $9.69.

From the first week of February, SEED_DONKEYDAN_MARKET_CAP:ORDI has been on a consolidation channel before the Break of structure (BOS) at the $11 point that saw SEED_DONKEYDAN_MARKET_CAP:ORDI dipped to current market value.

For Ordinals ( SEED_DONKEYDAN_MARKET_CAP:ORDI ), in the case of further selling pressure, immediate support point lies in the 1 month low point but SEED_DONKEYDAN_MARKET_CAP:ORDI chart pattern shows signs of a bullish engulfing pattern. a trend reversal might be looming ahead and a breakout above the 38.2% Fibonacci Retracement pattern would validate the move.

With a total supply of 21 million, this cool off should be seen as a reprieve towards a massive surge in the long term.

ORDI Price Live Data

The live ORDI price today is $9.65 USD with a 24-hour trading volume of $132,216,659 USD. We update our ORDI to USD price in real-time. ORDI is down 4.79% in the last 24 hours, with a live market cap of $202,546,795 USD. It has a circulating supply of 21,000,000 ORDI coins and a max. supply of 21,000,000 ORDI coins.