ORDIUSDT Forming Falling WedgeORDIUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout in crypto trading pairs like this one. The price has been consolidating within a narrowing range after a sharp downtrend, with recent lows around $7 suggesting that selling pressure is weakening while buyers are beginning to regain control near key support levels. With good volume confirming accumulation at these lower levels amid rising investor interest, the setup hints at a potential bullish breakout soon, especially as ORDI's ties to Bitcoin Ordinals and BRC-20 hype fuel renewed momentum. The projected move could lead to an impressive gain of 140% to 150%+ once the price breaks above the wedge resistance, turning recent corrections into explosive altcoin price action.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish for ORDIUSDT. Traders closely watching this crypto pair are noting the strengthening momentum as it nears a breakout zone around $8.77, with technical indicators like RSI showing oversold bounces and fib retracement levels holding firm. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal, particularly with recent signals hitting take-profit targets and bouncing from ascending supports.

Investors’ growing interest in ORDIUSDT reflects rising confidence in the project’s long-term fundamentals, including its role in blockchain scalability and Ordinals adoption, alongside current technical strength in this falling wedge setup. As of early November 2025, trading activity spikes underscore real demand, making this a high-conviction opportunity for those hunting bullish reversal patterns in altcoins. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg, with projections eyeing $16 to $21 zones for substantial medium-term gains as buying momentum accelerates.

✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Ordiusdtperp

ORDIUSDT Approaching the Big Breakout! The End of the Downtrend?ORDI/USDT is now at one of its most crucial moments of 2025.

After a sharp rebound from the $3–$4 zone, the price is approaching the main descending trendline that has rejected every major rally for months.

This is a make-or-break zone — where the market will decide whether a major reversal begins or if this is just another bearish trap before continuation down.

---

🧩 Technical Structure

Main trend: Strong downtrend since early 2025, forming a clear series of lower highs and lower lows.

Primary resistance: The yellow descending trendline connecting all major peaks.

Key support zone: $3.1 – $4.8 (strong demand area).

Key resistances: $6.0 (current level), $10.5, $13, $20, and major resistance at $49–$53.

Volume note: The latest rebound shows a strong volume spike, signaling renewed buyer interest.

---

⚡ Bullish Scenario – “The Reversal Awakening”

If ORDI can close a daily candle above the descending trendline, it would mark the first true breakout of this long-term downtrend — a potential start of a major trend reversal.

Bullish triggers:

Daily close above $7–$7.5 with solid volume.

Retest of the breakout zone holding as new support.

Strong continuation candles confirming breakout momentum.

🎯 Bullish Targets:

1. $10.50 — first resistance and conservative target.

2. $13.00 — medium-term target.

3. $20.00+ — next major target if the breakout sustains.

📈 A confirmed breakout here would officially break the mid-term downtrend structure.

---

💀 Bearish Scenario – “False Break & The Trap Zone”

If ORDI fails to break above the trendline and forms a rejection candle (long upper wick), it could trigger another bull trap.

This would signal that bears are still in control, pushing price back toward lower supports.

Bearish confirmation signs:

Rejection candle at the trendline with high volume.

No follow-through in the next session.

🎯 Bearish Targets:

$4.8 → $3.8 (short-term correction zone).

If $3.1 support breaks, expect further downside continuation.

⚠️ Bearish invalidation: A confirmed daily close above the trendline (breakout).

---

🧠 Pattern & Sentiment

Current structure forms a descending resistance breakout setup — a potential reversal pattern after months of decline.

The sharp rebound with volume may indicate early accumulation.

Market sentiment is shifting, but confirmation is key before declaring a trend change.

---

🧭 Strategy & Risk Management

Conservative Approach:

Wait for a daily close above the trendline.

Enter on the successful retest (trendline becomes support).

Place stop below the previous swing low (~$4.0).

First target $10.5, then $13.

Aggressive Approach:

Early entry near $6.0–$6.2 (anticipating breakout).

Tight stop below $5.0.

Add on confirmation after breakout.

💡 Remember: Volume confirmation is the key to validating any breakout.

---

🔮 Epic Summary

ORDI stands at the edge of transformation.

After a year-long downtrend, it’s now testing the same trendline that has rejected every rally before.

A clean breakout could mark the beginning of a powerful bullish phase, while a sharp rejection would confirm that bears are not done yet.

This isn’t just another resistance — it’s the decision zone for ORDI’s next major move.

---

#ORDI #ORDIUSDT #CryptoAnalysis #TechnicalAnalysis #Altcoin #CryptoTrading #BreakoutSetup #TrendlineBreakout #SupportResistance #BullishScenario #BearishScenario #ChartAnalysis #CryptoCharts

ORDI/USDT — Symmetrical Triangle: A Major Breakout?Currently, ORDI/USDT is consolidating tightly after a prolonged downtrend from the 52.880 peak. The chart is showing a symmetrical triangle, with a descending trendline pressing from above and a rising support line holding from below.

This pattern reflects a compression phase — volatility is narrowing, momentum is being stored, and a major breakout is likely to occur soon.

---

🔎 Pattern & Structure Details

Main trend: Long-term bearish since Dec 2024 (consistent lower highs).

Key support zone: 5.61 – 7.00 (highlighted yellow box), tested multiple times since April.

Key resistance zone: Descending trendline + horizontal resistance around 10.298.

Volatility: Shrinking significantly — the price is moving closer to the apex of the triangle, where breakouts usually happen with strong volume.

---

🟢 Bullish Scenario

1. Breakout confirmation: Daily close above 10.30 with high volume (clear break of descending trendline).

2. Initial targets: 11.58, then 13.17.

3. Extended targets (mid-term): If momentum continues, possible rally toward 20.43 – 23.38.

4. Risk Management: Place stop-loss below 8.0 or under the retest level in case of a false breakout.

---

🔴 Bearish Scenario

1. Breakdown confirmation: Daily close below 7.00 (falling out of the accumulation zone).

2. Initial target: 5.61 support.

3. If 5.61 breaks: Price could extend lower into the 4.0 – 5.0 psychological zone.

4. Risk Management: Stop-loss can be placed above 8.5 – 9.0 to avoid fake breakdowns.

---

⚖️ Conclusion

Neutral outlook until breakout: Symmetrical triangles are statistically neutral, but since it formed inside a broader downtrend, bearish continuation probability is slightly higher.

However, a breakout above resistance with strong volume could trigger a trend reversal and bring back mid-term bullish momentum.

Best approach: wait for confirmed breakout (daily close + volume) before taking positions.

---

ORDI is consolidating inside a symmetrical triangle. Key support zone: 5.61 – 7.00, key resistance: 10.30. The next breakout will set the direction:

🚀 Bullish: Break above 10.30 → targets 11.58, 13.17, even 20+.

🔻 Bearish: Drop below 7.00 → target 5.61, possibly 4.0.

Volatility is tightening — expect a big move soon. Trade with risk management, avoid FOMO.

#ORDI #ORDIUSDT #Crypto #PriceAction #Breakout #TechnicalAnalysis

ORDIUSDT Forming Falling WedgeORDIUSDT is currently displaying a classic falling wedge pattern on the charts, a formation typically associated with bullish reversals. This technical setup suggests that the recent downtrend may be nearing exhaustion, with potential for a strong upward breakout. The wedge has been forming with lower highs and lower lows converging toward a breakout point, and recent candles suggest bullish pressure is beginning to build. With good volume supporting the structure, the conditions look ripe for a breakout rally.

A breakout from this falling wedge could see ORDIUSDT gaining between 70% to 80% in the coming weeks, based on historical price action and wedge height projections. The increased investor interest and healthy trading volume add conviction to this scenario, making it an attractive setup for both short-term swing traders and long-term crypto investors. The asset appears to be forming a base, and if the breakout confirms above key resistance levels, it could rapidly advance toward new highs.

What further adds to the bullish thesis is the growing attention toward Ordinals and Bitcoin-native assets, of which ORDI is a prominent player. Market participants are gradually shifting focus back to unique infrastructure and innovation-driven tokens, and ORDIUSDT may benefit from this shift in sentiment. With bullish divergence on indicators and confirmation of a breakout, this could be a strong candidate for a high-risk, high-reward opportunity.

Traders should keep an eye on volume spikes and confirmation candles for a safer entry. As always, risk management is key in volatile conditions, but technically, ORDIUSDT shows a promising structure that deserves close monitoring.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

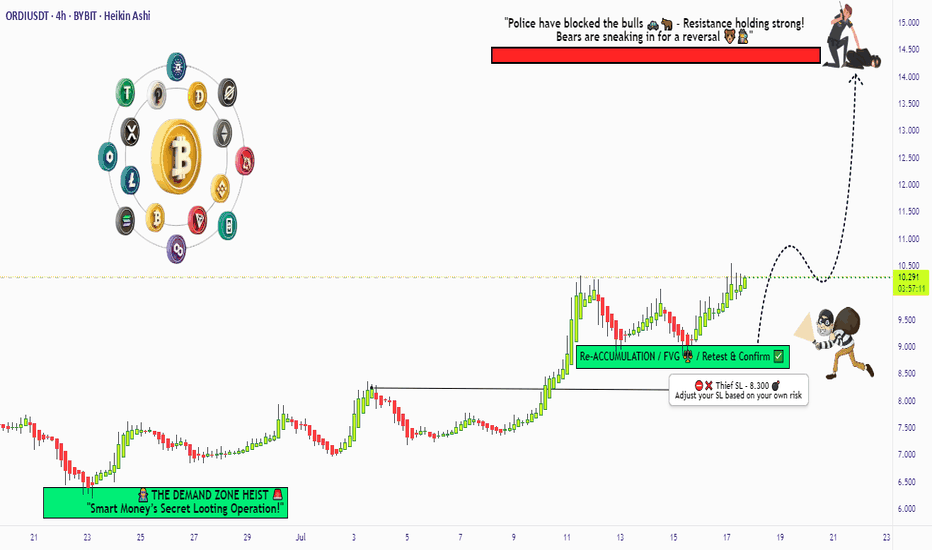

"ORDI/USDT: Pirate’s Treasure Trade! Bullish & Loaded"🚨 ORDI/USDT HEIST ALERT! 🚨 ORDI/USDT Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on ORDI/USDT. Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 8.300 (Nearest 4H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 14.400 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why ORDI/USDT? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

(🔔 Stay tuned for the next heist!) 🚀🤫

ORDIUSDT Forming Falling WedgeORDIUSDT is shaping up to be one of the more compelling opportunities on the crypto charts right now. The pair is forming a classic falling wedge pattern, which is widely regarded as a strong bullish reversal setup when spotted after a prolonged downtrend. This pattern often signals that selling pressure is fading and buyers are preparing to take control. With good volume building up, it’s clear that investors and traders are taking renewed interest in this project as it nears a potential breakout zone.

What makes ORDIUSDT even more interesting is the promising upside it could deliver if this falling wedge pattern confirms as expected. A projected gain of 70% to 80%+ makes this setup especially attractive for swing traders looking for medium-term positions with solid reward-to-risk ratios. The broader market sentiment is shifting, and coins with technically strong reversal setups like ORDIUSDT often outperform during such phases.

The community buzz and on-chain activity surrounding ORDI is also gaining traction, which adds further confidence to this bullish scenario. Many traders see the confluence of technical signals and increasing investor interest as a sign that this pair could soon break above its descending resistance line and rally aggressively. Keeping an eye on key resistance levels and volume spikes will be crucial to spot the right entry point.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ORDIUSDT Hanging by a Thread Before the Next Leg Down?Yello Paradisers! Are you ready for the next big move on #ORDIUSDT? Because if you’re not already positioned or thinking three steps ahead, this structure could catch you off guard. We’re seeing signs of exhaustion, and the market is setting up for another potential drop. Here’s what you need to know before it's too late.

💎#ORDIUSDT remains in a clear downtrend, printing consistent lower highs and lower lows. Each rally is weaker than the last, and buyers have failed to break above key resistance zones. After the most recent failed bounce into the 7.28–7.51 area—where support has now flipped to resistance—sellers regained control and pushed price back below the 21 EMA. This confirms the

bearish momentum remains dominant and is high probability to go further down.

💎The structure continues to print classic breakdown signals. Multiple breaks of structure (BOS) further validate the downtrend. As long as price remains under the 8.47 invalidation level, there's no technical reason to consider a bullish scenario. Any short-term bounce into resistance is more likely to be a selling opportunity rather than a reversal signal.

💎If price continues lower from here, we’re watching the support levels at 6.46 and then the major support level between 5.79–5.53. A sweep of those levels could trap late shorts, but until we see a confirmed shift in market structure, our bias remains bearish. Patience will be rewarded here.

💎This is a classic scenario where retail traders often get chopped up. The real move comes after both sides get squeezed. Don't be part of the noise.

Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. The downtrend is clear, but only disciplined traders will be able to extract profits here without emotional mistakes. Stay sharp, stay strategic, and above all—stay safe, Paradisers.

MyCryptoParadise

iFeel the success🌴

$ORDI Enters Key Fib Support, Watching for Bounce!!SEED_DONKEYDAN_MARKET_CAP:ORDI

It’s not forming any clear pattern, but based on the Fib retracement, price is currently sitting in the golden entry zone around the 0.5–0.618 level.

Also, the 100 MA, which previously acted as strong resistance, is now working as support.

This setup looks interesting because of the tight stop-loss and high reward potential.

I’ve entered the trade with this logic.

Let’s see how it plays out 👀

#ORDI #CRYPTOMOJO_TA

ORDI price has started to growToday, CRYPTO:ORDIUSD price has broken out quite nicely.

Considering that before that, OKX:ORDIUSDT price came and traded well in the $25-28 purchase zone, which was written about 5 months ago:

🛍 Those who are cautious can keep an eye on this asset and wait for a confident consolidation above $33

🍿 And the brave can take and wait for happiness in growth to $70)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Buy ORDI Technical Analysis of ORDIUSDT 📈

Key Price Levels:

- $40.65: Starting point of the downward trend.

- $32.42: Support level where the price bounced back after a decline.

- $34.54: Entry point for buyers to enter the market.

Entry and Exit Points:

- Entry Point: $34.54. This level can act as a strong support zone. Buying at this level may reduce risk and increase the potential for price growth. 🚀

- Exit Points:

- $36: First price target. 🎯

- $38.47: Second price target.

- $40.10: Third target, which may serve as a strong selling point.

- Stop Loss: $32.98. This level can be used as a stop-loss to manage risk effectively. ⚠️

Price Patterns:

In the ORDIUSDT chart, various patterns can be observed:

- Fork Pattern: Indicates a potential reversal move. 🔄

Support and Resistance:

- $32.42: Support level.

- $38.47 and $40.10: Resistance levels. ⬆️⬇️

This analysis can help traders make informed decisions regarding buying and selling ORDIUSDT and capitalize on market fluctuations. For further details, you can refer to platforms like TradingView or specialized cryptocurrency analysis websites.

ORDIUSDT Poised for a Major Move Bullish Breakout or Bearish ?Yello Paradisers! Are we on the brink of a bullish breakout, or are we facing a potential bearish breakdown with ORDIUSDT? This cryptocurrency has been navigating a descending channel for a while, and it’s now at a critical juncture.

💎#ORDIUSDT is currently testing a crucial demand zone at $34.30. This level is significant because if the price can sustain above it, we might see a bullish breakout from the descending channel. The upper expansion of the channel also hints at growing bullish sentiment. However, as always, caution is warranted.

💎 If the price fails to hold above $34.30, our focus will shift to the next support level at $25.18. A break below this level could signal a bearish shift, invalidating the current bullish setup and potentially leading to a more substantial decline. This scenario underscores the importance of being prepared for both outcomes.

Remember, disciplined and well-planned trading is the key to consistent success. Stay focused and trade smart, Paradisers!

MyCryptoParadise

iFeel the success🌴

ORDI/USDT Triangle Bullish arrow ( Buy ) The triangle pattern has broken through the resistance line on July 27, indicating a potential bullish price movement. This breakout suggests a shift in market sentiment towards a more positive outlook. Over the next 7 days, we could see the price potentially rise towards 53.0260. This target is derived by measuring the height of the triangle at its widest point and projecting that distance from the breakout point. Traders should watch for confirmation signals and consider this potential trend in their trading strategies.

ORDI: wait best for candle🟢 Buy Signal for ORDIUSDT 🟢

📍 Entry Point: 38.89 USDT

🎯 Target Prices:

- TP1: 39.50 USDT 🥇

- TP2: 41.90 USDT 🥈

- TP3: 45.73 USDT 🥉

- TP4: 50.35 USDT 🏆

- TP5: 55.65 USDT 🏆

🔴 Stop Loss: 34.76 USDT

📈 Technical Analysis:

After the price hit the support zone and pulled back to the downtrend line, a favorable position for entering a buy trade has been established. Multiple target prices have been set at different levels.

This analysis are based on the provided chart and may need revision with market changes. Always consider risk management and trade only with capital you can afford to lose. 📊💡

ORDI price is preparing powerful impulse, the question is where?The #ORDIUSDT price is in a long consolidation, trading volumes are falling, as is possible interest in it.

The delta of trading shows that sales are slightly higher than buying in the consolidation.

Perhaps this consolidation is a preparation for the continuation of super growth, as it was before with a similar but smaller pattern.

But personally, if we were to decide to buy SEED_DONKEYDAN_MARKET_CAP:ORDI , it would be not earlier than in the range of $25-28.

Or would you say that this is already an unrealistic price?)

Write your thoughts in the comments.