OXT/USDT — Decision Zone: Reversal or Breakdown?🔎 Overview

The OXT/USDT pair is currently sitting at a critical juncture. Since the 2021 peak, the price has been under consistent bearish pressure, forming a series of lower highs. On the other hand, from 2023 until now, OXT has repeatedly held the historical support zone at 0.0465 – 0.0600 (highlighted yellow box).

This area signals a potential accumulation phase, where long-term investors may view the price as “undervalued.” Simply put, the market is balancing between two extremes — a multi-year reversal (triple-bottom) or a breakdown into new lows.

---

🟢 Bullish Scenario — Reversal from Multi-Year Support

The accumulation zone (0.0465 – 0.0600) has held for more than 2 years, forming a potential triple-bottom structure.

A weekly close above 0.0731 would be the first signal of recovery momentum.

Stronger bullish confirmation comes at a breakout above 0.1078, which would mark the first higher high after years of decline.

Potential upside targets:

🎯 0.1555 (mid-level resistance)

🎯 0.2275 (major swing target)

🎯 0.3208 – 0.4268 (longer-term distribution zone if trend reversal extends).

If validated, this area could represent a “generational buy zone” for long-term investors.

---

🔴 Bearish Scenario — Breakdown & Continuation of Downtrend

Failure to defend 0.0465 with a confirmed weekly close below this level would invalidate the 2-year base.

A breakdown could trigger a capitulation wave, with price seeking new, lower support levels (not visible on current chart).

Psychologically, losing this long-held support could fuel panic selling, making the decline sharper than previous moves.

Bearish continuation is only confirmed with a weekly close below the yellow support box, not just a wick.

---

📐 Pattern & Structure

Main trend: Bearish since 2021 (lower highs remain intact).

Current structure: Multi-year range/consolidation → possible accumulation.

Formations:

Triple-bottom / Accumulation zone (if held).

Descending structure remains in play (as long as 0.1078 is not reclaimed).

Interpretation: OXT is at the psychological tipping point between “capitulation” or the early stage of a new trend.

---

⚖️ Conclusion

The 0.0465 – 0.0600 zone is the make-or-break area for OXT/USDT.

Bullish case: Multi-year reversal potential if weekly closes above 0.0731 → 0.1078.

Bearish case: Weekly close below 0.0465 = breakdown and continuation of long-term downtrend.

For swing traders and investors, the current area may offer the best risk-reward zone — but weekly close confirmation remains the key.

---

#OXT #Oxen #USDT #Crypto #AltcoinAnalysis #TechnicalAnalysis #SupportResistance #Accumulation #Breakout #TripleBottom #BearishVsBullish #SwingTrading

OXTUSD

OXT/USDT — Accumulation Before a Breakout or Further Decline?📌 Overview

OXT/USDT is currently at a critical stage on the weekly chart, consolidating within the strong demand zone at 0.0465–0.0650 (yellow box) that has been tested multiple times since mid-2023. This area acts as the last line of defense for buyers before price enters uncharted multi-year lows. The macro structure remains in a long-term downtrend since the 2021 peak, but the base formation in this low zone opens up a significant opportunity for a medium-term relief rally if a breakout is confirmed.

---

1. Key Technical Levels

Main Support / Demand Zone (yellow box): 0.0465 – 0.0650

→ This is the “floor” that has been holding price for nearly two years.

Minor Support: 0.0500 (psychological & repeated reaction level)

Layered Resistance Levels:

0.0731 → 0.1078 → 0.1555 → 0.2275 → 0.3208 → 0.4268 → 0.6620 → 0.8305

---

2. Structure & Patterns

Macro Trend: A sequence of lower highs since 2021 → indicating the primary trend is still bearish.

Potential Pattern:

Base / Accumulation Range near multi-year lows → resembles an early rounding bottom, but not confirmed yet.

Possible spring pattern: brief drop below main support followed by a sharp reclaim.

Volume (not shown here): Often decreases near the bottom range, signaling sellers may be losing strength.

---

3. Bullish Scenario (Relief Rally Potential)

💡 Conservative confirmation:

Break & weekly close above 0.0731.

Step-by-step targets: 0.1078 → 0.1555 → 0.2275.

0.1078 is the key breakout pivot; clearing it could trigger large-scale short covering.

⚡ Aggressive setup:

False breakdown below 0.0465 (spring) followed by a quick weekly close back above 0.050–0.055.

Initial target: 0.0650, then 0.0731 if momentum continues.

Best suited for swing traders aiming for high risk/reward.

---

4. Bearish Scenario (Trend Continuation)

Clean weekly close below 0.0465 + failed retest (0.0465 turning into resistance).

Downside targets: 0.0400 then 0.0320.

Failure to break 0.0731 and forming another lower high would also indicate sellers remain in control.

---

5. Strategic Notes

The 0.0465–0.0650 zone is the final battleground between long-term buyers and sellers controlling the macro trend.

Patience is required on this 1W timeframe; valid breakouts may take several weekly candles to confirm.

Aggressive traders may consider entries within the yellow box with tight stops below 0.0465, while conservative traders can wait for a confirmed breakout above key resistance.

---

6. Key Takeaway

As long as price holds inside or above the yellow box, relief rally potential remains alive.

Breaking 0.0731 will be the first major signal of sentiment shift.

A breakdown below 0.0465 opens a new chapter in the long-term downtrend.

#OXT #OXTUSDT #OrchidProtocol #CryptoAnalysis #PriceAction #WeeklyChart #SwingTrade #SupportResistance #BreakoutSetup #CryptoTrading

ORCHID | OXT | Is one to keep your eyes on.ORCHID isn't a very well known coin (OXT), but it's one that you'll wanna keep your eyes on. It looks to me like it's about to make a spectacular move to the upside. Also, I posted the monthly chart in the comments below to give you a better overall perspective of the pattern within the pattern.

Good luck, and always use a stop-loss!

OXT Looks Bearish (4H)It seems that from the point where we placed the red arrow on the chart, OXT has entered a complex correction. This correction appears to be either a Diametric or a Symmetric pattern.

From the red zone, it can drop towards the specified targets.

Currently, it seems to be in the early stages of wave E.

When the first target is reached, make sure to secure some profits and move the stop-loss to the entry point.

A daily candle closing above the invalidation level will invalidate this analysis and the bearish outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#OX/USDT#OX

The price is moving in a bearish channel on a 4-hour frame and is holding it strongly and is about to break it upward

We have a bounce from the green support area at 0.3100

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that is about to break higher and supports the rise

Entry price is 0.3475

The first target is 0.3990

The second target is 0.4357

The third goal is 0.4811

OXTUSDT's Situation: What Shall we Expect!Hi.

COINEX:OXTUSDT

Chart is Speaking It Self!!!

Simple analysis...

It appears to be moving within a Ascending triangle on the shorter time frame. Currently, it is attempting a breakout. A breakout retest of the triangle would indicate bullish momentum. However, if there is a rejection and a breakdown of the triangle, a bearish move is also expected.

Stay awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

OXT SPOT SIGNAL WEEKLYHello dear traders,

In the OXT cryptocurrency on the weekly timeframe, with the breaking of the trend line and the current market conditions in the crypto market, we can expect a significant price growth in this currency. It can be said that this currency can be considered as a spot investment.

Thank you for your support. May you have a joyful and profitable journey.

OXT ANALYSIS (4H)The MAV symbol has a bullish structure and we see higher H's and L's.

Under the candles in the recent data, a liquidity pool has formed which may break soon.

The green range is a good place for buy/long.

If it reaches the green range, we enter the buy/long position. Do not use this analysis as a sell/short setup

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

OXT COIN PRICE ANALYSIS AND POSSIBLE MOVES !!ASX:OXT Coin Short Term possible Scenerios Near Me !!

• Manipulation by whales expected under this project... Do trade carefully with proper stoploss & take profite and don't use upto 10% fund if you take trade.

• Like & retweet For more Free analysis.

LIKE AND FOLLOW US FOR MORE FREE ANALYSIS !!

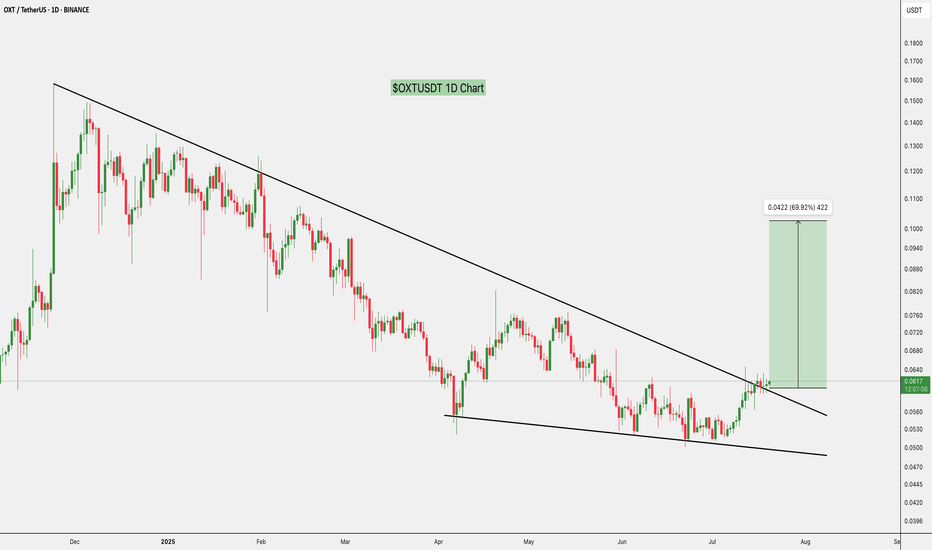

$OXT Performing Falling wedge in 1D ASX:OXT Performing Falling wedge in 1D Breakout Done

Falling Wedge

The falling wedge can either be a reversal or continuation signal.

As a reversal signal, it is formed at a bottom of a downtrend, indicating that an uptrend would come next.

As a continuation signal, it is formed during an uptrend, implying that the upward price action would resume. Unlike the rising wedge, the falling wedge is a bullish chart pattern.

In this example, the falling wedge serves as a reversal signal. After a downtrend, the price made lower highs and lower lows.

Notice how the falling trend line connecting the highs is steeper than the trend line connecting the lows.

If we placed an entry order above that falling trend line connecting the pair’s highs, we would’ve been able to jump in on the strong uptrend and caught some pips!

A good upside target would be the height of the wedge formation.

If you want to go for more pips, you can lock in some profits at the target by closing down a portion of your position, then letting the rest of your position ride.

Excitement around OXTIts looking like we finally broke out a multi month descending wedge. Will we keep going up? I certainly don't have a crystal ball, but if the break-away plays out, we can see a good pump to about 10 cent levels followed by a continuation to higher levels. Lets see where it goes and how many people fear getting left behind. -- Lets have another FOMO event!

📉 $OXT/USDT Falling Wedge Setup! 📉📈 Exciting news for #OXTUSDT traders! 🚀 The chart is forming a captivating Falling Wedge pattern, pointing towards a potential bullish reversal! 💹

📉 As the price has been marking lower highs and lower lows, the falling wedge pattern indicates a phase of consolidation and decreasing selling pressure.

🧩 Falling wedges often pave the way for upward breakouts, suggesting a potential trend reversal and the emergence of a new bullish phase.

💡 Keep a close eye on the wedge's resistance and support levels to anticipate the potential breakout direction.

📊 Technical indicators are showing promising signs of a potential reversal, adding further credibility to the bullish outlook.

🔔 Stay alert for a breakout above the upper trendline, as it may act as a signal for the start of a bullish trend. Remember to set your profit targets and stop-loss levels wisely.

📅 Always prioritize risk management and trade responsibly. Thorough research is key before making any trading decisions.

🚨 Don't miss the action with #OXT! 🚨 Let's see how this Falling Wedge unfolds! 🤞

(Note: This post is for informational purposes only and should not be considered as financial advice. Trading involves risks, and past performance is not indicative of future results. Always conduct your due diligence and seek professional advice when necessary.)

#CryptoTrading #TechnicalAnalysis #BullishSetup #TradeSmart #DYOR #CryptoMarket #ChartAnalysis #EmbraceTheWedge #BullishTrend 🚀💰📈

OXTUSDT to produce a new HHOXTUSDT has successfully broken out of its descending channel and is now trading near the 61.8% Fibonacci support level. This is a crucial area for the bulls, as it provides a potential launchpad for a rapid rally to the upside. However, for this rally to materialize, the recent LL must hold. If it does, we could see OXTUSDT making significant gains in the coming days.

OXTUSD - Reached Pinch Point in Descending Triangle & Broken OutFollowing on from an extended descending triangle (with a few good trades within!) we seem to have now reached a certain pinch point. From here the price has not only broken out the top edge of this aforementioned triangle, but we've received a Buy signal from our Crypto Tipster indicator; all good signs that a rise could be iminent!

Given the general bullish-ness of the whole crypto-sphere currently, another 10% gain on Orchid would not seem to unreasonable and take us up to the next level of resistance at around $0.085.

All in on OXT and here is why!Descending wedge with a measurement right to the top trend line Tracking the peaks. This is too perfect to be true. Can this happen during such an oversold market with FUD running rampant? Well, it wouldn't be the first time OXT took off out of no where to $1 leaving everyone on Coinbase with level 10 FOMO. While many people are speculating that BTC can see prices somewhere near 10 to 12k, there are pretty valid arguments that have been made suggesting 20k is likely the bottom. Ironically enough, BTC is also showing the same type of descending wedge on its daily chart. If BTC goes up, it would further incentivize OXT to take off with the upmost aggression.

I will also mention that at the current prices, we could be seeing a perfect level to make massive gains in the months to come. The market will turn tides and when that does, OXT will almost certainly plow through into, what i predict to be around .50 cents mid term and .80 cents to $1 long term.

OXT Getting ready for LIFT OFF!OXT is an interesting coin in that the charts have always been a little easier to read than most others. OXT is currently in its low ends of the price spectrum, which means people are scooping up coins prepping for the next run up. OXT tends to shoot up out of no where and as you can see in the chart, it seems to pop up roughly every 8 months. If this cycle continues, we may be in for a serious pump here soon. Could we see a pump to .50 cents or could we see a pump to $1 as it has done already in the past? I have a feeling that soon, and by soon i mean in the next month or two, we may be a huge rally on OXT.