OXT/USDT — Decision Zone: Reversal or Breakdown?🔎 Overview

The OXT/USDT pair is currently sitting at a critical juncture. Since the 2021 peak, the price has been under consistent bearish pressure, forming a series of lower highs. On the other hand, from 2023 until now, OXT has repeatedly held the historical support zone at 0.0465 – 0.0600 (highlighted yellow box).

This area signals a potential accumulation phase, where long-term investors may view the price as “undervalued.” Simply put, the market is balancing between two extremes — a multi-year reversal (triple-bottom) or a breakdown into new lows.

---

🟢 Bullish Scenario — Reversal from Multi-Year Support

The accumulation zone (0.0465 – 0.0600) has held for more than 2 years, forming a potential triple-bottom structure.

A weekly close above 0.0731 would be the first signal of recovery momentum.

Stronger bullish confirmation comes at a breakout above 0.1078, which would mark the first higher high after years of decline.

Potential upside targets:

🎯 0.1555 (mid-level resistance)

🎯 0.2275 (major swing target)

🎯 0.3208 – 0.4268 (longer-term distribution zone if trend reversal extends).

If validated, this area could represent a “generational buy zone” for long-term investors.

---

🔴 Bearish Scenario — Breakdown & Continuation of Downtrend

Failure to defend 0.0465 with a confirmed weekly close below this level would invalidate the 2-year base.

A breakdown could trigger a capitulation wave, with price seeking new, lower support levels (not visible on current chart).

Psychologically, losing this long-held support could fuel panic selling, making the decline sharper than previous moves.

Bearish continuation is only confirmed with a weekly close below the yellow support box, not just a wick.

---

📐 Pattern & Structure

Main trend: Bearish since 2021 (lower highs remain intact).

Current structure: Multi-year range/consolidation → possible accumulation.

Formations:

Triple-bottom / Accumulation zone (if held).

Descending structure remains in play (as long as 0.1078 is not reclaimed).

Interpretation: OXT is at the psychological tipping point between “capitulation” or the early stage of a new trend.

---

⚖️ Conclusion

The 0.0465 – 0.0600 zone is the make-or-break area for OXT/USDT.

Bullish case: Multi-year reversal potential if weekly closes above 0.0731 → 0.1078.

Bearish case: Weekly close below 0.0465 = breakdown and continuation of long-term downtrend.

For swing traders and investors, the current area may offer the best risk-reward zone — but weekly close confirmation remains the key.

---

#OXT #Oxen #USDT #Crypto #AltcoinAnalysis #TechnicalAnalysis #SupportResistance #Accumulation #Breakout #TripleBottom #BearishVsBullish #SwingTrading

Oxtusdtanalysis

OXT/USDT — Accumulation Before a Breakout or Further Decline?📌 Overview

OXT/USDT is currently at a critical stage on the weekly chart, consolidating within the strong demand zone at 0.0465–0.0650 (yellow box) that has been tested multiple times since mid-2023. This area acts as the last line of defense for buyers before price enters uncharted multi-year lows. The macro structure remains in a long-term downtrend since the 2021 peak, but the base formation in this low zone opens up a significant opportunity for a medium-term relief rally if a breakout is confirmed.

---

1. Key Technical Levels

Main Support / Demand Zone (yellow box): 0.0465 – 0.0650

→ This is the “floor” that has been holding price for nearly two years.

Minor Support: 0.0500 (psychological & repeated reaction level)

Layered Resistance Levels:

0.0731 → 0.1078 → 0.1555 → 0.2275 → 0.3208 → 0.4268 → 0.6620 → 0.8305

---

2. Structure & Patterns

Macro Trend: A sequence of lower highs since 2021 → indicating the primary trend is still bearish.

Potential Pattern:

Base / Accumulation Range near multi-year lows → resembles an early rounding bottom, but not confirmed yet.

Possible spring pattern: brief drop below main support followed by a sharp reclaim.

Volume (not shown here): Often decreases near the bottom range, signaling sellers may be losing strength.

---

3. Bullish Scenario (Relief Rally Potential)

💡 Conservative confirmation:

Break & weekly close above 0.0731.

Step-by-step targets: 0.1078 → 0.1555 → 0.2275.

0.1078 is the key breakout pivot; clearing it could trigger large-scale short covering.

⚡ Aggressive setup:

False breakdown below 0.0465 (spring) followed by a quick weekly close back above 0.050–0.055.

Initial target: 0.0650, then 0.0731 if momentum continues.

Best suited for swing traders aiming for high risk/reward.

---

4. Bearish Scenario (Trend Continuation)

Clean weekly close below 0.0465 + failed retest (0.0465 turning into resistance).

Downside targets: 0.0400 then 0.0320.

Failure to break 0.0731 and forming another lower high would also indicate sellers remain in control.

---

5. Strategic Notes

The 0.0465–0.0650 zone is the final battleground between long-term buyers and sellers controlling the macro trend.

Patience is required on this 1W timeframe; valid breakouts may take several weekly candles to confirm.

Aggressive traders may consider entries within the yellow box with tight stops below 0.0465, while conservative traders can wait for a confirmed breakout above key resistance.

---

6. Key Takeaway

As long as price holds inside or above the yellow box, relief rally potential remains alive.

Breaking 0.0731 will be the first major signal of sentiment shift.

A breakdown below 0.0465 opens a new chapter in the long-term downtrend.

#OXT #OXTUSDT #OrchidProtocol #CryptoAnalysis #PriceAction #WeeklyChart #SwingTrade #SupportResistance #BreakoutSetup #CryptoTrading

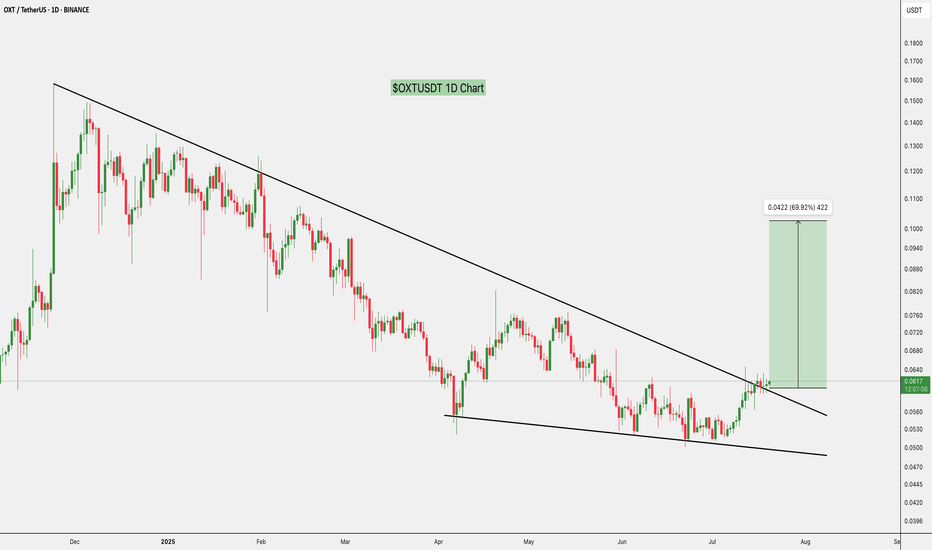

Oxt Technically So Amazing Oxt/USDT is showing promising signs. It looks like it's gearing up for a bullish move, and I anticipate the price to increase by 15-30% in the coming days. However, it's important to note that this is not financial advice, so please do your own research (DYOR) before making any decisions.

OXT COIN PRICE ANALYSIS AND POSSIBLE MOVES !!ASX:OXT Coin Short Term possible Scenerios Near Me !!

• Manipulation by whales expected under this project... Do trade carefully with proper stoploss & take profite and don't use upto 10% fund if you take trade.

• Like & retweet For more Free analysis.

LIKE AND FOLLOW US FOR MORE FREE ANALYSIS !!

OXTUSDT CwH Pattern | 75% Move ExpectedOXTUSDT CwH Pattern | 75% Move Expected on Handle Breakout

NOTE: Do your own analysis. Do proper risk and money management. Spot trading only.

Entry: 0.3910

TP1: 0.4326

TP2: 0.5072

TP3: 0.5889

TP4: 0.6865

SL: 0.3322

ROI: 68% - 75%

Risk: 15%

Do not use more than 10% Risk of your account.

Do not enter if you don't know how to trade.