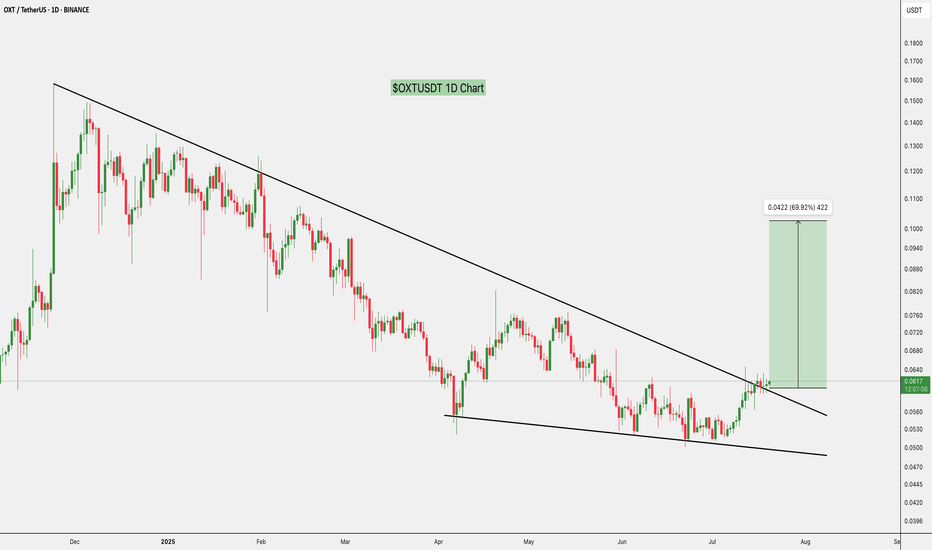

OXT/USDT — Decision Zone: Reversal or Breakdown?🔎 Overview

The OXT/USDT pair is currently sitting at a critical juncture. Since the 2021 peak, the price has been under consistent bearish pressure, forming a series of lower highs. On the other hand, from 2023 until now, OXT has repeatedly held the historical support zone at 0.0465 – 0.0600 (highlighted yellow box).

This area signals a potential accumulation phase, where long-term investors may view the price as “undervalued.” Simply put, the market is balancing between two extremes — a multi-year reversal (triple-bottom) or a breakdown into new lows.

---

🟢 Bullish Scenario — Reversal from Multi-Year Support

The accumulation zone (0.0465 – 0.0600) has held for more than 2 years, forming a potential triple-bottom structure.

A weekly close above 0.0731 would be the first signal of recovery momentum.

Stronger bullish confirmation comes at a breakout above 0.1078, which would mark the first higher high after years of decline.

Potential upside targets:

🎯 0.1555 (mid-level resistance)

🎯 0.2275 (major swing target)

🎯 0.3208 – 0.4268 (longer-term distribution zone if trend reversal extends).

If validated, this area could represent a “generational buy zone” for long-term investors.

---

🔴 Bearish Scenario — Breakdown & Continuation of Downtrend

Failure to defend 0.0465 with a confirmed weekly close below this level would invalidate the 2-year base.

A breakdown could trigger a capitulation wave, with price seeking new, lower support levels (not visible on current chart).

Psychologically, losing this long-held support could fuel panic selling, making the decline sharper than previous moves.

Bearish continuation is only confirmed with a weekly close below the yellow support box, not just a wick.

---

📐 Pattern & Structure

Main trend: Bearish since 2021 (lower highs remain intact).

Current structure: Multi-year range/consolidation → possible accumulation.

Formations:

Triple-bottom / Accumulation zone (if held).

Descending structure remains in play (as long as 0.1078 is not reclaimed).

Interpretation: OXT is at the psychological tipping point between “capitulation” or the early stage of a new trend.

---

⚖️ Conclusion

The 0.0465 – 0.0600 zone is the make-or-break area for OXT/USDT.

Bullish case: Multi-year reversal potential if weekly closes above 0.0731 → 0.1078.

Bearish case: Weekly close below 0.0465 = breakdown and continuation of long-term downtrend.

For swing traders and investors, the current area may offer the best risk-reward zone — but weekly close confirmation remains the key.

---

#OXT #Oxen #USDT #Crypto #AltcoinAnalysis #TechnicalAnalysis #SupportResistance #Accumulation #Breakout #TripleBottom #BearishVsBullish #SwingTrading

Oxtusdtsetup

OXT SPOT SIGNAL WEEKLYHello dear traders,

In the OXT cryptocurrency on the weekly timeframe, with the breaking of the trend line and the current market conditions in the crypto market, we can expect a significant price growth in this currency. It can be said that this currency can be considered as a spot investment.

Thank you for your support. May you have a joyful and profitable journey.

Oxt Technically So Amazing Oxt/USDT is showing promising signs. It looks like it's gearing up for a bullish move, and I anticipate the price to increase by 15-30% in the coming days. However, it's important to note that this is not financial advice, so please do your own research (DYOR) before making any decisions.

OXTUSDT CwH Pattern | 75% Move ExpectedOXTUSDT CwH Pattern | 75% Move Expected on Handle Breakout

NOTE: Do your own analysis. Do proper risk and money management. Spot trading only.

Entry: 0.3910

TP1: 0.4326

TP2: 0.5072

TP3: 0.5889

TP4: 0.6865

SL: 0.3322

ROI: 68% - 75%

Risk: 15%

Do not use more than 10% Risk of your account.

Do not enter if you don't know how to trade.