Silver corrective pullback support retest at 9900The Silver remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 9900 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9900 would confirm ongoing upside momentum, with potential targets at:

11200 – initial resistance

11617 – psychological and structural level

12070 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 9900 would weaken the bullish outlook and suggest deeper downside risk toward:

9468 – minor support

9010 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 9900. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Community ideas

Dash Traders Are Walking into a Trap, Is the Next Big Collapse?Yello Paradisers! Are you watching what’s happening with #DASH right now? Because this move might be the last warning before a much deeper drop. We’ve spotted a series of red flags, and the chart is speaking loud and clear smart money is positioning, and it’s not on the bullish side, Even more importantly, #DASH swept the upper trigger line of buying climax. The price action on higher timeframes shows a clear bearish structure there is a major probability for the downside move.

💎#DASH breaks the lower trigger line of the buying climax, strongly suggesting that institutional players are offloading and preparing for more downside move according to volume spread analysis (VSA).

💎#DASH has swept the upper trigger line of the buying climax with Upthrust test, a key sign of manipulation. This is where weak hands are baited in before a reversal. The sweep confirms that institutional players are active and positioning on the bearish side, if momentum holds within the supply zone, the next probability of major target sits around 20 that could be tested soon which is a major support and structure level.

💎#DASH descending resistance remains intact, attempted to break above it but failed, there is a probability that sellers are still in control. As long as momentum stays below the Order Block and Fair Value Gap (FVG) zone, the probability of next logical move is down toward 37, a minor support level before lower targets.

💎If #DASH manages to break above the key resistance at 98 with a strong momentum candle, this whole bearish probability would be invalidated, and we could instead see a bullish continuation. As always, we let price confirm our bias.

Discipline is key, Paradisers! The charts may look volatile, but this is where professionals thrive and amateurs panic. Don’t let emotions guide your trades. Wait for clear confirmation and manage risk like a pro. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

BTC/USD: Major Support Breach and Bearish Momentum AnalysisBitcoin (BTC/USD) ne 15-minute timeframe par ek bari structural change dikhayi hai, jahan price ne pichle institutional support levels ko decisively breakdown kar diya hai. Market sentiment ab consolidation phase se aggressive downward expansion ki taraf shift ho chuka hai.

Technical Breakdown:

Major Support Breach: $85,150 ka critical support level, jo pehle do baar price ko hold kar chuka tha, ab toot chuka hai. Yeh market psychology mein bullish se bearish shift ki nishani hai.

Resistance Flip: Pichle foundational support zones ($86,500 aur $85,150) ab primary supply barriers (resistance) ka kaam karenge.

Current Market State: Bitcoin filhal $81,000 – $82,729 ki range mein trade kar raha hai.

Forecasted Path: "Break and Retest" sequence ke mutabiq, price mein $84,000 ke area tak ek minor relief bounce aa sakta hai, jiske baad mazeed girawat mutawaqqe hai.

Key Targets:

Primary Objective: $81,000 – Immediate local low aur liquidity pool.

Major Target: $80,000 - $80,500 – Ek aham psychological aur structural support zone.

Risk Management: Bearish outlook tab tak barkaraar rahega jab tak price $85,150 ke pivot level se niche hai.

Strategy Note: Maujooda bias "Sell on Strength" ka hai. Traders ko $84,000 ke resistance area par bearish confirmation (maslan rejection wicks) ka intezar karna chahiye taake $80,000 ke targets tak move ko pakra ja sake.

DeGRAM | BTCUSD dropped below $85k📊 Technical Analysis

● BTC/USD remains under a dominant descending resistance line, with multiple failed rebounds confirming a broader bearish market structure. The breakdown below the 86,000–88,000 resistance zone signals renewed downside momentum.

● Sideways consolidations and triangle formations have repeatedly resolved lower, while price is now accelerating toward the lower channel support near 80,000–78,000, reinforcing trend continuation.

💡 Fundamental Analysis

● Persistent tight liquidity conditions, cautious risk sentiment, and lack of strong inflows into crypto assets continue to pressure Bitcoin, supporting a medium-term bearish outlook.

✨ Summary

● Price stays capped below descending resistance.

● Medium-term downside toward 80,000–78,000 is favored while below 90,000.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

EURUSD— FRGNT FUN COUPON FRIDAY !Q1 | W4 | D30 | Y26📅 Q1 | W4 | D30 | Y26

📊EURUSD— FRGNT DAILY CHART FORECAST

FRGNT FUN COUPON FRIDAY !

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

GOLD and USD fundamental analysis and causality currentlyMacro-Financial Analysis of XAUUSD, XAGUSD, and the US Dollar Index: A Comprehensive Q1 2026 Fundamental Assessment

The global financial landscape in January 2026 is defined by a profound transition in the macro-economic regime, characterized by a shift from the post-pandemic recovery era into a period of acute geopolitical fragmentation, aggressive fiscal realignment, and a technological revolution centered on artificial intelligence. This environment has precipitated a historic divergence in the performance of hard assets versus traditional fiat instruments. While the US Dollar Index (DXY) grapples with a systemic crisis of confidence, gold (XAUUSD) and silver (XAGUSD) have ascended to unprecedented record highs, driven by a combination of sovereign de-dollarization, industrial scarcity, and a fundamental reassessment of global risk.

As of late January 2026, the primary catalysts for market momentum are rooted in the implementation of the One Big Beautiful Bill (OBBB) Act in the United States, a contentious pause in the Federal Reserve’s monetary easing cycle, and a worsening geopolitical climate involving territorial disputes over Greenland and the subsequent fracturing of Western trade alliances.1 These factors have created a "multi-dimensional polarization" in global markets, where fiscal stimulus and technological optimism coexist with deep concerns regarding debt sustainability and currency weaponization.5

The US Dollar Index (DXY): Fiscal Expansion and the Crisis of Confidence

The US Dollar Index, which serves as a benchmark for the greenback’s strength against a basket of six major currencies, is currently undergoing a period of intense structural pressure. In January 2026, the DXY slumped to 47-month lows, breaking below the pivotal 96.00 handle before attempting a tentative stabilization near 96.41.7 This depreciation marks a significant reversal from the elevated levels seen in early 2025, when the index frequently traded between 106.00 and 109.00.9

The fundamental drivers behind this dollar weakness are layered. At the surface level, weak consumer confidence data and dovish rhetoric from the executive branch regarding the benefits of a weaker currency for manufacturing competitiveness have triggered sentiment-driven sell-offs.7 Beneath these immediate triggers lies a complex fiscal story defined by the One Big Beautiful Bill Act and its impact on the long-term creditworthiness of the United States.

The Fiscal Impulse: One Big Beautiful Bill (OBBB) Act and Debt Sustainability

The OBBB Act, signed into law on July 4, 2025, represents the most significant overhaul of the US tax and spending code in the 21st century.3 By permanently extending the provisions of the 2017 Tax Cuts and Jobs Act (TCJA) and introducing new tax exemptions for tips, overtime, and senior citizens, the bill has created a massive fiscal impulse.10 While proponents of the bill, including the Council of Economic Advisers, suggest that the GDP could grow by over 5% in the short run due to these measures, more cautious analyses from the Congressional Budget Office (CBO) and Yale’s Budget Lab highlight severe long-term risks.12

The CBO projects that the OBBB will increase the federal deficit by $3.4 trillion over the next decade, a figure that rises to more than $4 trillion when accounting for additional interest on the national debt.10 This expansion of debt is occurring at a time when the US debt-to-GDP ratio is already on a path to reach 194% by 2054.14 The "crowding out" effect of this government borrowing is pushing real interest rates higher, as the market demands a larger term premium for holding long-dated US debt.14 Consequently, while the dollar may benefit from higher yields in a traditional "Dollar Smile" scenario, it is currently suffering from a "Dollar Smirk," where the fiscal deficit and policy uncertainty act as a drag on the currency’s attractiveness despite high nominal rates.15

OBBB Provision

10-Year Deficit Impact

Economic Objective

Long-term Consequence

Individual Rate Cuts

+$2.2 Trillion

Sustaining Consumer Spending

Erosion of Revenue Base

Standard Deduction Double

+$1.4 Trillion

Working Class Relief

Increased Debt Load

Business Expensing

+$646 Billion

Re-shoring Manufacturing

Short-term Capex Boost

Clean Vehicle Rollbacks

-$543 Billion

Fiscal Offset

Delayed Green Transition

Medicaid Reforms

-$917 Billion

Spending Reduction

Social Safety Net Pressure

Data compiled from.10

Federal Reserve Policy: The January 2026 Pause and Internal Dissension

The Federal Reserve’s January 28, 2026, policy decision to maintain the federal funds rate at a target range of 3.50% to 3.75% was widely expected but far from unanimous.2 This move represents the first pause after three consecutive 25-basis-point cuts in late 2025.19 The FOMC’s statement adopted a "hawkish tilt," upgrading its assessment of the labor market and economic growth to "solid" while acknowledging that inflation remains "somewhat elevated" at a core PCE rate of approximately 2.7% to 3.0%.2

However, the internal split within the committee—manifested by dissents from Governors Christopher Waller and Stephen Miran in favor of a rate cut—suggests that the Fed is struggling to balance its dual mandate.2 The "data-dependent" approach is complicated by the fallout from the late-2025 government shutdown, which skewed top-tier data and delayed the publication of key employment and inflation readings.2 Chair Jerome Powell has indicated that the Fed is "well-positioned" after previous cuts but faces a new inflationary challenge from tariffs, which he characterized as a "one-time price event" rather than a demand-driven trend.2

This monetary policy stance has significant implications for the DXY. If the Fed maintains a "higher-for-longer" posture while the Bank of Japan (BoJ) and Reserve Bank of Australia (RBA) continue their tightening cycles, the dollar may find localized support against those specific pairs.24 However, the broader trend remains bearish as investors price in the possibility that the Fed will eventually have to prioritize labor market stability over inflation as unemployment stabilizes near 4.5% to 4.6%.13

Commitment of Traders (COT) Analysis: US Dollar Index

Positioning data from the Commodity Futures Trading Commission (CFTC) as of late January 2026 confirms a deeply entrenched bearish sentiment toward the US dollar. Non-commercial traders, including large speculators and hedge funds, have maintained a net-short position in the DXY for the better part of seven months.28

Market Participant

Net Positioning (Jan 2026)

Trend from Previous Month

Sentiment Classification

Large Speculators

-38,000 contracts

Short exposure reduced by 75%

Cautiously Bearish

Asset Managers

Net Short

Flipped from long in early Jan

Institutionally Bearish

Non-Commercial

-6,418 contracts

Strengthening short conviction

Momentum Bearish

DXY Spot Level

96.41

Approaching 3-year lows

Technically Oversold

Data sourced from.8

The COT report highlights a critical vulnerability: while large speculators have reduced their absolute short exposure, asset managers have recently flipped to a net-short stance for the first time since October 2025.28 This alignment suggests that institutional capital is increasingly hedging against a further decline in the dollar, potentially driven by the "crowded" nature of long Euro and long Yen trades.26 Analysts note that if US economic data continues to surprise to the upside, particularly in terms of GDP growth or persistent service-sector inflation, these short positions could be vulnerable to a tactical squeeze.26

Gold (XAUUSD): The Sovereign Safe-Haven and Geopolitical Barometer

Gold has entered a historic bull market phase, surpassing the psychologically and technically significant $5,000 per ounce threshold in late January 2026.30 The metal’s ascent to a record high of $5,600 marks one of the strongest rallies in modern market history, with gains of approximately 30% year-to-date following a 65% surge in 2025.4 This "orderly rally" reflects a fundamental transformation in how the market values gold—shifting from a mere inflation hedge to a cornerstone asset used for protection against geopolitical fragmentation and currency weaponization.31

Geopolitical Fragmentation: The Greenland Dispute and NATO Tensions

The primary catalyst for the early 2026 surge in gold prices is the eruption of fresh geopolitical tensions centered on Greenland.1 The Trump administration's renewed focus on the strategic importance of the Arctic territory, coupled with threats of tariffs on countries that block US interests in the region, has unsettled international risk sentiment.1 This situation has effectively opened a new front in the global trade war, primarily aimed at Europe and raising serious questions about the future of NATO.1

Gold has absorbed this geopolitical stress directly, acting as a "barometer of global anxiety".31 Unlike crude oil, which has reacted cautiously to these headlines due to a well-supplied market, gold has pushed forcefully to record highs.33 This divergence suggests that investors are no longer solely concerned with supply-chain disruptions but are seeking a refuge from systemic political risk and the potential collapse of established diplomatic orders.31

De-Dollarization and the Central Bank Structural Bid

A more profound and long-term force driving gold is the accelerating trend of de-dollarization among emerging market (EM) central banks.31 These institutions have been aggressively diversifying their reserves away from the US dollar to hedge against the risk of financial sanctions and to protect their economic sovereignty.16

Net central bank purchases reached nearly 300 tons in the first eleven months of 2025, with China reporting a 14-month streak of continuous buying through December.31 This "structural bid" provides a permanent floor for gold prices, as sovereign demand is largely insensitive to the metal's high nominal price.31 Furthermore, wealth management platforms and institutional investors have begun re-integrating gold into multi-asset portfolios as a "diversified store of value" that outperforms US Treasuries in a period of fiscal instability.15

Driver Category

Momentum Influence

Underlying Mechanism

Future Outlook

Geopolitics

High (Upward)

Greenland Conflict/NATO Friction

Continued High Volatility

Monetary Policy

Moderate (Upward)

Fed Pause/Expectation of Cuts

Potential Tailwinds in H2 2026

Central Bank

Persistent (Upward)

De-dollarization in EM

Structural Long-term Support

ETF Inflows

Rising (Upward)

Retail & Institutional FOMO

Risk of Speculative Bubble

Fiscal Health

High (Upward)

OBBB Debt Load Concerns

Hedge against US Solvency

Data synthesized from.1

Commitment of Traders (COT) Analysis: Gold (GC) Futures

Positioning in the COMEX gold futures market reflects a high level of speculative commitment, though analysts caution that the market has not yet reached a state of "euphoric extreme".1

Managed Funds: This category of traders increased their net-long exposure by 11.5k contracts (9.4%) in mid-January, pushing their net exposure to range highs on a 3-month rank basis.1 The move was primarily driven by a rise in gross-long exposure (+12.4k contracts).1

Large Speculators: Speculative bulls added 27.7k contracts to their net-long positions, indicating a strong desire to chase the trend even at record price levels.1

Commercial Traders: In contrast, commercials (producers and end-users) are heavily on the short side, with approximately 24.7k short contracts versus 5k long.35 This is typical hedging behavior as producers lock in prices at historic highs to protect against a future correction.35

The divergence between commercials and speculators suggests that while the trend is firmly bullish, the physical market is beginning to build up a significant hedge wall, which could lead to sharp intraday reversals if geopolitical tensions show signs of de-escalating.31

Silver (XAGUSD): Industrial Nexus and the Market Squeeze

Silver has emerged as the standout performer of 2026, characterized by a parabolic rally that saw prices surge from approximately $31.60 to a record high of $120 per ounce in a single month.4 This 65% jump in January 2026, following a 150% gain in 2025, has outpaced gold significantly, compressing the gold-silver ratio to near 15-year lows of approximately 43:1, with Citigroup forecasting a further narrowing to 32:1.4

The fundamental drivers for silver are fundamentally different from gold. While silver retains its status as a monetary hedge and safe-haven, its primary momentum is now dictated by its role as an indispensable industrial metal for the twin revolutions of Green Energy and Artificial Intelligence.4

The AI Supercycle and Green Energy Revolution

Silver's unmatched electrical and thermal conductivity makes it critical for the high-performance hardware that underpins the AI boom.4

AI Infrastructure: Massive investments in data centers and high-frequency signal transmission require silver for specialized cooling systems and power delivery modules.6

Solar Photovoltaics (PV): The solar industry is currently in a state of crisis due to its reliance on silver paste.39 China's solar manufacturing sector, which accounts for the vast majority of global production, has seen input costs triple over the past year.39 Each standard solar cell requires specific silver paste formulations, and at $120 per ounce, the risk of "demand destruction" or a forced shift toward copper substitution is rising.32

Electric Vehicles (EVs): The average silver requirement per vehicle has multiplied as manufacturers shift to higher-voltage systems and advanced battery management.37

China’s Export Restrictions and the Supply Squeeze

A pivotal fundamental shift occurred in January 2026 when China implemented new export licensing requirements for refined silver.4 This policy, designed to protect domestic manufacturers and build strategic reserves, has created "artificial scarcity" in the global physical market.37 International buyers are now forced to compete for a dwindling pool of available supply in an increasingly illiquid market, where incremental demand changes have an outsized impact on price.37

On the supply side, silver production remains highly inelastic. Approximately 70% of silver is produced as a by-product of lead, zinc, and copper mining.37 Therefore, mining operations cannot easily ramp up silver production in response to higher prices without a corresponding increase in demand for the primary metals.37 This structural constraint, combined with China's export curbs, has set the stage for a classic "market squeeze".37

Silver Market Factor

Status in Q1 2026

Impact on Momentum

Price Target

$150 (Citi Forecast)

Bullish Bias

China Export Policy

Licensing Restrictions

Supply Scarcity

Industrial Usage

60% of Total Demand

Structural Tightness

By-Product Mining

Delayed Supply Response

Price Inelasticity

Solar PV Sector

Significant Cost Inflation

Potential Demand Destruction

Data sourced from.4

Commitment of Traders (COT) Analysis: Silver (SI) Futures

Despite the explosive move in price, the COT data for silver reveals a surprising level of caution among institutional futures traders, suggesting that the rally is being driven by the physical market and retail momentum rather than speculative futures length.

Managed Funds: Net-long exposure in silver futures fell to its least bullish level since February 2024 during the January rally.1 Funds are "clearly in no mood to chase this parabolic rally," perhaps fearing a bubble burst or being deterred by the volatility.1

Large Speculators: This group has also seen net-long exposure trend lower since its peak in mid-2025, suggesting a rotation out of futures and potentially into physical bullion or mining equities.1

Commercial Hedging: The silver rally has triggered massive "short covering" from industrial producers.32 As prices surged, those who had hedged future production at $30 or $40 per ounce faced severe margin calls, forcing them to buy back their short positions and adding further fuel to the upside momentum.32

This "inherently unstable" dynamic, where producers are being squeezed out of their hedges, suggests that the silver rally is driven by technical and physical factors that could reverse sharply if the supply-demand balance is restored.32

Treasury Yields and the 2026 Economic Outlook

The US Treasury market is providing critical context for the performance of the DXY and precious metals. As of late January 2026, the 10-year Treasury yield is at 4.24%, while the 2-year yield has softened slightly to 3.53%.41 This has resulted in a "bull steepening" of the yield curve, where shorter-term rates fall faster than long-term rates as the market anticipates eventually lower Fed policy while worrying about long-term fiscal deficits.14

The Yield Curve as a Recessionary Indicator

Historically, a negative spread between the 10-year and 2-year Treasury notes (the 10-2 spread) is a reliable leading indicator of a recession, with an average lead time of 48 weeks from the first inversion.41 The curve was continuously inverted from July 2022 through August 2024.41 In early 2026, the curve has un-inverted and is steepening—a phase that historically precedes the actual onset of a recession by an average of 18.5 weeks.41

This "un-inversion" is currently a major fundamental driver. If the market believes a recession is imminent despite the OBBB's short-term stimulus, the dollar will likely remain under pressure while gold benefits from flight-to-quality flows.16 However, if the stimulus successfully engineers a "soft landing" with 2.5% GDP growth, yields may stabilize at higher levels, potentially curbing the gold rally in the second half of 2026.17

Inflation Expectations: Core PCE and the Tariff Impact

Inflation expectations remain a point of contention between the Fed and the market. The University of Michigan survey indicates that consumers expect 3.4% inflation over the 5-to-10-year horizon, likely influenced by the perceived long-term impact of tariff policies and fiscal spending.43 Goldman Sachs, however, forecasts that core PCE inflation will fall to 2.1% by December 2026 as the "one-time" boost from tariffs fades and AI-driven productivity gains begin to exert downward pressure on prices.13

The divergence between high consumer inflation expectations and the Fed's target is a primary reason why bond yields have remained elevated.43 For gold and silver, this "sticky inflation" environment is highly favorable, as it keeps real interest rates from rising too aggressively even as nominal yields move higher.5

Global Monetary Divergence: DXY vs. Major Counterparts

The performance of the DXY in early 2026 is heavily influenced by the relative strength of its major components, particularly the Euro, the Yen, and the British Pound. A significant trend of monetary policy divergence is emerging, which is acting as a primary driver of currency momentum.

The Japanese Yen (USDJPY) and Intervention Risks

The Japanese Yen has become a source of intense volatility for the dollar. Suspected intervention by the Bank of Japan and the Ministry of Finance to buy the Yen and sell the Dollar has pushed the USDJPY from highs near 159 down toward 152.79.44 The BoJ is moving away from its decade-long accommodative stance, with historical highs in JGB yields (30-year at 3.35%) encouraging capital repatriation.25 This reversal of carry trades—where investors borrow in Yen to buy higher-yielding US assets—is a major headwind for the dollar and a tailwind for the Yen.17

The Euro (EURUSD) and the ECB Hold

The Euro has stabilized near 1.19 against the dollar as the European Central Bank (ECB) is expected to maintain its policy rate on hold despite falling inflation.8 This creates a yield differential advantage for the Euro as the Fed continues its pausing/easing cycle.24 However, the Euro faces its own risks from the Greenland-related trade war and the potential for structural drag from high energy costs.1

The British Pound (GBPUSD) and Economic Fragility

Sterling has reached four-year highs above 1.3850 against the dollar.7 This strength is somewhat paradoxical given the "sluggish" nature of UK GDP growth and rising unemployment.25 The Pound’s rally is largely a function of a "crisis of confidence" in the dollar rather than a surge in UK economic optimism.7 The Bank of England (BoE) is expected to continue a very gradual easing cycle, with a 25-basis-point cut anticipated in Q1 2026, though the market expects the BoE to remain more restrictive than the Fed in the long run.25

Currency Pair

Rate (Jan 29, 2026)

Central Bank Stance

Key 2026 Driver

DXY

96.41

Pause after Easing

Fiscal Deficit/OBBB

EURUSD

1.1932

On Hold

US-Europe Trade Friction

USDJPY

152.79

Gradual Tightening

JGB Yield Spikes/Intervention

GBPUSD

1.3772

Gradual Easing

Inflation Persistence

AUDUSD

0.6994

Potential Tightening

Metals Demand (Gold/Silver)

Data synthesized from.8

Industrial and Mining Fundamentals: The Foundation of Precious Metals Supply

The historic rally in gold and silver has fundamentally changed the economics of the mining industry, which in turn influences future supply expectations.

Mining Profitability and the Incentive for Expansion

With gold at $5,000+ and silver at $120, mining companies are experiencing record margins. For example, Hochschild Mining’s 2026 production forecast of 300,000 to 328,000 gold equivalent ounces is being achieved at all-in sustaining costs (AISC) of approximately $2,157 to $2,320 per ounce.39 This creates substantial operating margins that support aggressive capital allocation for project expansion.39

Furthermore, project valuations have been transformed. BMO analysis indicates that at current prices, the net present value (NPV) of marginal deposits can rise from $1.1 billion to $2.8 billion, making previously unviable projects economically attractive.39 However, the time lag for bringing new mining capacity online remains significant, typically ranging from 5 to 10 years, meaning that the current supply crunch in silver is unlikely to be resolved through new production in the near term.37

The Role of Secondary Supply and Recycling

As prices hit record highs, "recycling economics" become a critical component of fundamental analysis.37 High prices incentivize the scrap of electronics and jewelry, providing a secondary source of supply that can help dampen price volatility.37 In the silver market, the high cost of the metal is already forcing solar manufacturers to improve the efficiency of their "thrifting" processes—reducing the amount of silver required per cell—though the technical limits of this are being reached.32

Narrative Synthesis: The Road to 2027

The convergence of these fundamental drivers points toward a period of sustained volatility and structural change. The DXY is currently the victim of a "Sell America" sentiment that, while it has not yet materialized into a full-scale rout, has left the currency technically and fundamentally vulnerable.7 The dollar’s primary hope for a recovery lies in the potential for the OBBB Act to trigger a genuine economic boom that forces the Fed back into a tightening cycle, thereby widening yield differentials in the dollar’s favor.17

For gold, the path remains firmly upward as long as the Greenland geopolitical conflict persists and central banks continue to treat the metal as a "cornerstone asset" for the new financial order.1 The rally to $5,000 and beyond is not merely speculative; it is a repricing of risk in a world where the dollar-centric system is no longer the undisputed anchor.31

Silver, however, is the most volatile piece of the puzzle. Its surge to $120 is a "pure momentum trade" meeting "structural tightness".4 While the industrial demand from AI and solar PV provides a robust long-term floor, the extreme short-covering by producers and the potential for demand destruction at $150+ suggest that silver will be the site of the most intense market battles in 2026.32

Strategic Assessment and Market Forecasts

As we evaluate the fundamental landscape for XAUUSD, XAGUSD, and the DXY, several high-conviction themes emerge for the remainder of Q1 and Q2 2026.

The US Dollar Index: A Fragile Stabilization

The DXY is expected to remain in a range between 94.00 and 98.00 in the first half of the year.17 A break below 94.00 would likely signal a more systemic flight from US assets, potentially triggered by a worsening of the fiscal deficit or a failed Fed nomination process.7 Conversely, if the PCE inflation data for early 2026 comes in "well above 2.5%," as some analysts anticipate based on PPI trends, the Fed may be forced to adopt a more hawkish tone, providing a floor for the dollar.26

Gold: Consolidation at New Extremes

Gold’s rally to $5,600 has moved into a "territory of strategic hedge".4 While technical pullbacks toward $5,000 or $5,100 are possible if geopolitical headlines soften, the structural demand from central banks and the re-absorption of gold into mainstream institutional portfolios suggest that any correction will be short-lived.31 Goldman Sachs and JPMorgan both see gold as a "perfect tail risk hedge," with targets potentially reaching even higher if the AI bubble bursts or if the Greenland conflict escalates into a NATO-wide crisis.16

Silver: The Volatility Engine

Silver remains "gold on steroids".4 With physical scarcity driven by China's export licensing and the "by-product dependency" of mining, silver could feasibly reach the Citi target of $150 per ounce within the next quarter.4 However, traders must remain vigilant regarding the risk of "bubble behavior," particularly as managed funds exit their long positions and leaving the rally to be driven by producer short-covering and retail participation.1

Asset

Q1 2026 Target

Primary Bullish Catalyst

Primary Bearish Risk

DXY

94.50 - 97.00

Upside Inflation Surprises

Fiscal Deficit/Debt Concerns

XAUUSD

$5,400 - $5,800

Geopolitical (Greenland)

Peace Negotiations/NATO Calm

XAGUSD

$135 - $150

AI Infrastructure Demand

Solar Demand Destruction

10Y Yield

4.10% - 4.50%

Fiscal Supply Pressure

Recession Confirmation

Data synthesized from.1

In conclusion, the fundamental analysis of these three core assets reveals a global economy in flux. The US Dollar's historic dominance is being challenged by its own domestic fiscal policies and the emergence of strategic rivalries that have re-elevated hard assets to their traditional role as ultimate stores of value. For market participants, navigating 2026 requires a nuanced understanding of how technological change (AI) and geopolitical friction (Greenland/Trade Wars) intersect with the mechanics of the futures markets (COT Reports) and the realities of physical supply. The era of low-volatility, dollar-centric stability has given way to a multi-polar, commodity-driven landscape where resilience and security are the new primary variables in the global wealth equation.

PYPL Weekly: Earnings Catalyst + Bullish AccumulationPYPL QuantSignals V4 Weekly 2026-01-28

Katy AI: +3.82% upside → $56.22 target

Institutional Flow: Upside strike accumulation

Technical State: Oversold → asymmetric bounce potential

Catalyst: Q4 earnings window → short-cover risk

Structure: Defined-risk, event-driven setup

🎯 Key Price Levels

Current Price: ~$54.15

Immediate Support: $53.00–53.50

Breakout Level: $56.20+

Failure Zone: Below $52.80

🛠️ Trade Setup (Preferred)

▶️ Action: BUY CALLS

Primary Contract: $55 CALL

Alternate (Aggressive): $56 CALL

Expiration: This Friday (Weekly)

Ideal Entry: Pullbacks near $53.80–54.30

Trade Type: Event-driven / defined risk

🎯 Profit Targets

Target 1: $55.50 (partial trim)

Target 2: $56.20–56.50 (Katy AI target)

Stretch (Earnings Pop): $58.00

Risk Management:

Invalidation: Daily close below $52.80

Max Risk: 1–2% of account (premium only)

Rule: No averaging down

🧾 Options Flow Read

Put/Call Ratio: Neutral surface

Interpretation: Upside positioning ahead of the catalyst

Gold, Inflation, and the money velocity correlation.Good day traders and investors,

The “you’ll own nothing and be happy” Prophecy, no. Prediction, no. Planning, yes. It means, you’ll be priced out and there is nothing you can do about it.

Central planning at it’s finest, or worst, depending on your point of view. Make no mistake, these moves by Gold are direct result of central planning. Nothing is accidental.

Golds unprecedented rise should scare you, even if you own some. Golds rise to me is screaming the next wave of inflation is coming and will likely be twice as powerful from the previous wave. The money velocity could be a conferential confirmation. Money velocity is the rate of money moving and changing hands in the economy. It’s generally a very good thing, and healthy robust economy should have a very high velocity. However, there can be instances where it can be fueled by inflation, so it can be deceptive and that’s not so good. It could be rising because of higher prices. The last couple years the velocity was stagnate and going sideway. Just recently it started to up tick, exactly like in 2020 with golds rise. The lower version of the velocity chart which is the rate of change annually that came out of 2020 was the highest ever in recorded history. This could prove to be good or bad thing. If it catches support and keeps going higher along with inflation, it will not be a goof thing. However if inflation does get back into control then it would not be bad, as it would show accelerated growth in the economy (likely not, at least for now).

It wasn’t until after Gold found a top and went sideways while consolidated that inflation really came in. The market needed time to absorbed what happened. It realized products were to cheap, to how much money was out there and inflation took it’s course. History could repeat over the next couple years IMO. Bitcoin could get some of this pouring into it along with alts, just like back in 2021. It took time, a few months for it to come in and propel Bitcoin to it’s new highs. During golds run bitcoin was essentially just going sideways, then corrected to key market structure at 9.8k to 10k. Once it found support, it took off from there and didn’t stop until 70k. This could happen very similarly this time. A retest of 69k could be the bottom of the correction before it build up of pressure for the final run up either late this year or 2027.

This is my prediction from my analysis at this time. Let me know what you think down below.

I’ll leave you with a quote you may or may not know.

“Allow me to issue the currency of a nation and I care not who rules it”

Regards,

WeAreSat0shi

SOL/USD: ABC Correction Ending at SupportSOL/USD has completed a bullish impulsive move, finishing a full 5-wave structure to the upside. After the top of Wave 5, the market shifted into a corrective phase, forming a clear A-B-C correction. Price has now moved down into Wave C, which is testing a strong support zone between 121–119 (Fibonacci 0.618–0.786 area). This zone is important because corrections often end here. As long as price holds above ~119, the bias turns bullish, and a recovery toward 129–132 (Wave B / retracement area) is expected first, followed by a potential continuation higher. If price breaks and closes below 119 , the bullish recovery idea fails, and SOL could move lower toward the next support near 115 .

Buy zone: 121 – 119 (0.618–0.786 Fibonacci support)

Stop-loss: 118.50 (below Wave C low)

Target 1: 129.30 (0.382 retracement)

Target 2: 132.00 – 135.00 (prior structure resistance)

Stay tuned!

@Money_Dictators

Thank you :)

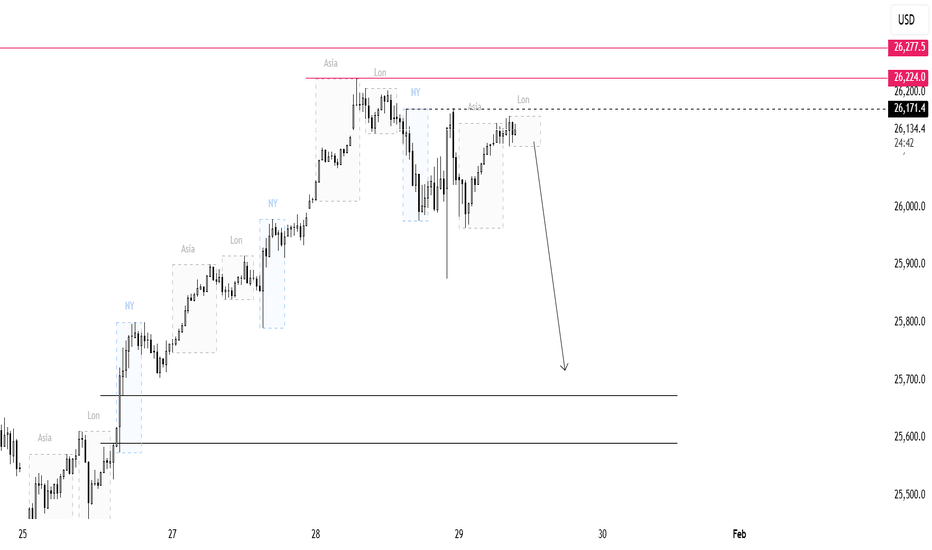

NQ ShortsAfter a huge bullish run this week, price is starting to slow down, with Yesterdays NY high just about taken out, Price opened today with a heavy sell off, retraced back and Asia highs have been taken, expecting a decent retracement before continuation. We have news today which may give us the liquidity to move lower. Trade Safe guys.

Apple H4 – Bullish Order Block Respect & RSI ConfirmationApple Inc (AAPL) H4 Bullish Order Block Respect

On the H4 timeframe, price previously showed a rapid upward move from an old bullish order block. After that, the market made a healthy pullback and again approached the same order block, showing clear respect, which is a strong sign of bullish continuation.

The RSI is also in a bullish structure, forming a higher low and supporting upward momentum, confirming buyers’ strength.

Trade Plan:

Entry: 252.80

First Target: 274.00, Upper side order block

Final Target: 288.7, Previous High / Recent ATH

Stop Loss: 236, order block

As long as price holds above the order block and RSI remains in the bullish zone, the overall bias stays bullish.

Pullbacks can be viewed as buying opportunities with proper risk management.

Disclaimer:

This analysis is for educational purposes only. It is not financial advice. Trading involves risk, so always do your own research and manage risk properly before taking any trade.

GOLD Will Grow! Long!

Here is our detailed technical review for GOLD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 5,020.46.

Taking into consideration the structure & trend analysis, I believe that the market will reach 5,216.72 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

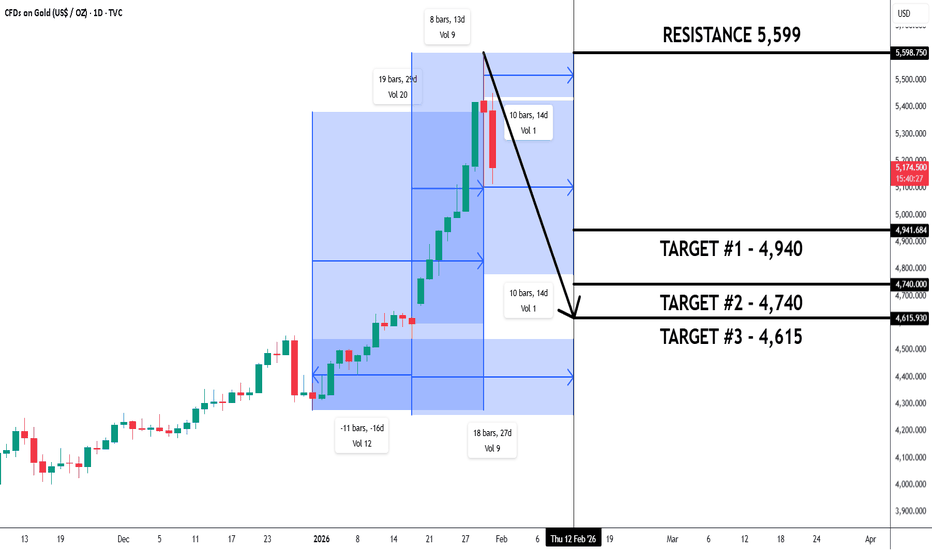

GOLD: BRACING FOR GRAVITY EFFECT AFTER AN EXTREME RALLYXAU/USD D1 - Gold remains bullish overall, but the current move is a correction after an extreme rally. Price may drop faster due to market gravity, with key downside zones at 4,940, 4,740, and 4,615 (Fibonacci cluster & gap area).

The vibrational date is around Feb 12, 2026. Focus is to wait and see the price action as we approach this date, especially around the highlighted levels.

Falling towards pullback support?NZD/CAD is falling towards the support level, which is a pullback support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.80900

Why we like it:

There is a pullback support that aligns with the 38.2% Fibonacci retracement.

Stop loss: 0.80094

Why we like it:

There is a pullback support that aligns with the 61.8% Fibonacci retracement.

Take profit: 0.82344

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

DAX.GER - LETS GOTeam Update – DAX Trade Plan

Eight hours ago, we went long on DAX and successfully hit our target.

Momentum has continued to hold, so we are taking the next setup.

New Long Position

Entry Zone: 24440–24455

Stop Loss: 23283

Targets Target 1: 24486–24515 - Take 30% partial. Move stop loss to breakeven

Target 2: 24555–24630

Expectation: Either during European market open, or Before the US market open

The structure is clean, liquidity is aligned, and continuation is highly probable.

LETS GO

$SPY & $SPX — Market-Moving Headlines Friday Jan 30, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Friday Jan 30, 2026

🌍 Market-Moving Themes

🛒 Mega Cap Save

AMZN and AAPL lift Nasdaq after hours as cloud demand and product certainty calm markets

📉 Goldilocks Inflation

Cooling PCE resets rate fears as yields fall and risk appetite broadens

🧠 AI Hardware Wins

Capex spending funnels into suppliers with NVDA and ANET leading on data center buildouts

🏥 Obesity Buyout Chatter

VKTX spikes on takeover rumors as pharma M and A focus returns to weight loss

📅 End of Month Flows

Window dressing dynamics dominate as January closes after a catalyst-heavy week

📊 Key U.S. Economic Data Friday Jan 30 ET

8:30 AM

- Producer Price Index Dec delayed: 0.3%

- Core PPI Dec delayed: 0.3%

- PPI YoY

- Core PPI YoY

9:45 AM

- Chicago Business Barometer PMI Jan: 44.0

1:00 PM

- Fed Gov Stephen Miran TV interview

1:30 PM

- St Louis Fed President Alberto Musalem speech

5:00 PM

- Fed Vice Chair for Supervision Michelle Bowman speech

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #PPI #Inflation #Earnings #AMZN #AAPL #AI #Macro #Markets #Stocks #Options

SOLANA SOLUSDTSolana is a high-performance blockchain platform designed for speed, scalability, and low transaction costs, using a hybrid Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus. Its ecosystem supports a wide range of decentralized applications (dApps) across DeFi, NFTs, gaming, DePIN, and AI.

Core Technology

Solana processes thousands of transactions per second (TPS) at sub-second finality and minimal fees, making it ideal for high-volume apps. PoH timestamps transactions for efficient ordering, combined with PoS for validation and staking rewards via SOL tokens. This addresses the blockchain trilemma of decentralization, security, and scalability.

Key Ecosystem Areas

DeFi: Hosts DEXs like Raydium and Orca, lending protocols like Kamino, and derivatives like Drift; over 80 projects enable yield farming and trading.

NFTs and Gaming: Supports marketplaces and games like Aurory (MMORPG) and Honeyland (farming sim) with fast, cheap NFT minting.

DePIN and AI: Includes Weather XM (weather data), Hivemapper (mapping), SHDW (storage), and AI platforms for on-chain data.

Infrastructure: Features oracles (Pyth, Chainlink), bridges (Wormhole), and staking (Jito, Marinade).

Top Projects by Activity and Market Cap

Active development leaders include Chainlink, Solana core, Wormhole, Drift, and Jito. Ecosystem market cap exceeds $200 billion, with prominent tokens like JUP, BONK, JTO, and MET.