One Candle = One Decision – Simple & Powerful Price ActionOne Candle = One Decision is a pure price action concept where a single candle defines market intent.

This candle shows rejection, liquidity grab, and direction bias without using indicators.

The wick represents failed price acceptance, while the candle close shows who is in control — buyers or sellers.

Entry, stop loss, and trade direction are all derived from one single candle, making this setup clean, fast, and objective.

This method works best on ETH, BTC, GOLD, and Forex pairs across intraday and swing timeframes.

🕯️ How the Concept Works (Step-by-Step)

🔹 Step 1: Location Matters

The candle must form at:

Support / Resistance

Liquidity high or low

Previous high / low

Range extreme

Location gives the candle meaning.

🔹 Step 2: Candle Structure

The decision candle usually has:

Long wick (liquidity sweep)

Clear rejection

Strong close (body)

📌 Wick = rejection

📌 Close = decision

🔹 Step 3: Trade Execution Rules

✅ Bullish Setup

Long lower wick

Candle closes bullish or strong rejection

Entry on high break

Stop loss below wick low

Bias → Bullish continuation or reversal

❌ Bearish Setup

Long upper wick

Candle closes bearish or strong rejection

Entry on low break

Stop loss above wick high

Bias → Bearish continuation or reversal

🧠 Why This Strategy Works

Smart Money hunts liquidity first

Retail traders enter late

This candle shows real intent after liquidity grab

That’s why:

👉 One Candle = One Decision

⏱️ Best Timeframes

5m / 15m → Intraday

1H / 4H → Swing

Daily → High probability setups

📈 Markets Where It Works Best

ETH / BTC

XAUUSD (Gold)

EURUSD, GBPUSD

Indices & Crypto pairs

⚠️ Risk Management Tip

Risk max 1–2% per trade

Avoid news candles

One candle = one idea (no overtrading)

Community ideas

Bitcoin Price Update – Clean & Clear Explanation Bitcoin remains under short-term bearish pressure after a strong sell-off from the upper highs. Price is trading below the descending trendline, confirming bearish market structure. Recent candles show consolidation inside a minor rising channel, but momentum is weak and sellers are still active.

If price breaks below 76,000, downside could extend toward 75,700 and lower, continuing the bearish trend a strong reaction from support may lead to a pullback toward 78,700 – 79,500 a confirmed breakout above 81,000 would open the door for a move toward 83,000 – 83,200, the major supply zone.

Short-term bearish to neutral, with a potential relief bounce only if support holds. Best to wait for confirmation (support reaction or trendline break) before entering trades.

“If you come across this post, please like, comment, and share. Thanks!”

Gold Market Update: Reset Before the Next MoveGold Market Update: Reset Before the Next Move

Gold experienced sharp volatility after President Trump nominated Kevin Warsh as the next Federal Reserve Chair. The announcement triggered a brief risk-off reaction across markets, pushing gold more than 10% lower from the $5,600 high, while silver and other metals saw even steeper declines.

This selloff appears to be a reset after an extended and crowded rally, not a structural trend change. Precious metals were heavily stretched, and the Fed nomination acted as a catalyst for profit-taking. Importantly, long lower wicks on the daily candles suggest strong buying interest remains below current prices.

From a technical perspective, gold’s bullish structure is still intact. The breakout above $4,400 produced a $1,000 move that exceeded the $5,400 target and topped near $5,600. The violent drop that followed points to elevated volatility and the likelihood of a consolidation phase, potentially above the $4,400–$4,600 support zone.

As long as gold holds above $4,000, the broader bullish outlook remains valid. A decisive break below $4,000 would invalidate this view and signal the risk of a deeper correction.

The U.S. dollar has rebounded from recent lows, adding short-term uncertainty for gold, but its broader structure remains bearish. Longer term, ongoing geopolitical tensions, supply constraints, and continued central bank buying continue to favour gold.

Bottom line: this looks like a healthy correction and consolidation phase, setting the stage for the next major mov.

GOLD BUYS.We seen price drop more than 9% on Friday due to a rebound in the dollar. price fell into the 4,800.00 support area which aligned with the 61fib. I expect a bounce from this level into the (5,200.00, 5,250.00) area as the us government do not expect to open back up on Monday leaving uncertainty in the market.

I do believe that this could be our bottom before we continue to the 6,000.00 area, a well talked about area and exactly where the -27 fib level sits.

However I do see the base at around 4,300.00 so with how gold has been reacting I wouldn't be surprised if that could be a potential level also.

KFY — Compression Near Apex, Breakout Setting UpHello Everyone, followers,

Let's continue to another one :)

KFY - Korn Ferry

Let's drill down:

📊 Technical Overview

KFY is compressing inside a symmetrical triangle, with price coiling near the apex.

Moving averages are flattening, signaling energy buildup rather than weakness. It broke out down trend to up on Friday.

🔹 Key Levels

Support

67.00–67.20 → Lower triangle support

65.50 → Prior demand / invalidation level

Resistance / Targets

69.80–70.00 → Immidiate resistance

72.10 → 0.5 Fib

74.30–74.50 → 0.618 Fib / First Target

🔮 Outlook

This is a decision zone — expansion is likely once price continue to leave the triangle.

🎯 What I Expect

I’m watching for a confirmed break above 70, ideally with volume.

Failure to break could lead to another rotation toward triangle support. We could expect quick pull-back to break zone If so then I will decide what to to depends on price direction.

If you enjoy and like clean, simple analysis — follow me for more.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday to all and hopefully green trade day for next Week.

#SPX500 #NASDAQ #KFY #Trendanalysis

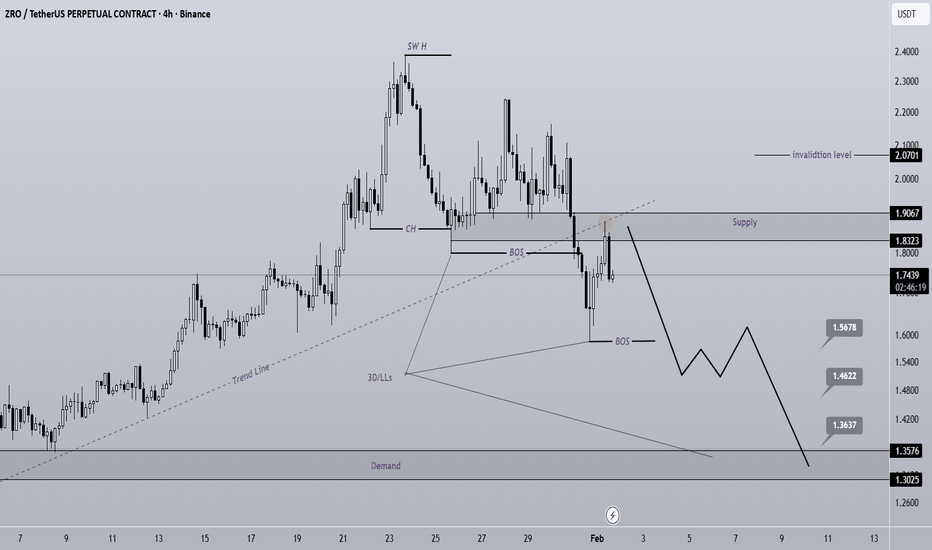

ZRO Sell/Short Signal (4H)📉 Bearish Market Structure Breakdown | Trendline Loss & Supply Zone Pullback Analysis

The price has recently lost a major trendline that had been respected for a long period of time and was acting as a key support to maintain the bullish trend. While the market was trading above this trendline, buyers were in control and the overall structure remained bullish. However, the recent breakdown below this level signals a potential shift in market sentiment.

In addition, a clear bearish Change of Character (CHoCH) has formed on the chart, indicating that sellers are starting to take control. Following this structure shift, the market has continued to print lower lows and lower highs (ZRO), which confirms the transition into a bearish market structure.

Currently, price action appears to be making a pullback toward the broken trendline and the nearby supply zone, which is a common behavior after a breakout. This area can now act as a strong resistance zone and may provide high-probability selling opportunities if bearish confirmation appears.

📌 Trade Entry Strategy:

Traders are advised to wait for a proper entry trigger, such as bearish candlestick patterns, lower timeframe structure breaks, or strong rejection from the supply zone. Entering only at confirmed and reliable levels can help improve risk-to-reward ratios and reduce unnecessary losses.

🎯 Targets & Risk Management:

All potential take-profit targets have been clearly marked on the chart based on previous support levels and market structure. Proper risk management is essential, and stop-loss placement should always be respected.

⚠️ Invalidation Level:

If a daily candle closes above the invalidation level, this bearish scenario will be invalidated. Such a move would indicate renewed bullish strength and may suggest a possible trend reversal.

📊 Conclusion:

This setup highlights a potential bearish continuation based on trendline breakdown, market structure shift, and pullback into supply. Traders should remain patient, wait for confirmation, and follow their trading plan carefully.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

BTC/USDT 1D 1️⃣ Market Structure

• Previously an ascending channel (higher lows + higher highs)

• A breakout from the channel occurred ➜ the structure changed to a downward one

• The current move is a downward impulse, not a correction

📉 This is no longer a healthy correction in an uptrend

⸻

2️⃣ Key Levels (what you marked)

🟢 Support Zones (now resistance)

• 84,300 – first support → broken

• 80,600 – key support → broken by an impulse

➡️ Both zones after retests = resistance

🔴 Downside Targets

• 75,150 – closest logical target (local low/demand)

• 69,950 – strong demand zone (weekly demand)

➡️ 75k very realistic, 70k possible with panic/news

⸻

3️⃣ Momentum & candles

• Long red impulse candles

• No lower wicks = sellers in full control

• No demand reaction after breaking 80.6k → market weakness

⸻

4️⃣ Stochastic RSI

• Entry into oversold

• BUT ❗

In a downtrend, the Stochastic RSI may stay at the bottom for a long time.

📌 This is not a signal to go long, but rather information that:

• Shorts should be careful of a short bounce

• Longs → scalp only, not swing

⸻

5️⃣ Scenarios (most important)

🔴 Baseline scenario (70–75%)

• Retest of 80–81k from below

• Rejection

• A drop to 75k

• A spike to the bottom is possible 70k

🟡 Alternative scenario (25%)

• Quick rebound to 84k

• Lack of volume

• Another bearish wave

➡️ Until price < 80.6k – BEARISH bias

Yen February view

- Where is price?

Price is in Area3 on the quarterly and area 4 on the monthly timeframe. February candle will open in area 4, making it a congestion entrance candle. Direction is turning up, slopes also up on the monthly, the qyarterly has still three months for the candle to form

- What is it doing?

February will be congestion entrance candle, notfying us that the next type of trading after the trend down up till now will be congestion action. The congestion entrance target is two PLDots back, limits of congestion action is the January candle low and high in this case

- What is next?

For the monthly to trade in congestion action, the weekly needs to trade between the dotted line and the block level which in this case is Jan candles low and high. Next week, there is strong support at the static ETOP where price will open and should continue to push price towards the congestion entrance target which should be reached within Feb. (0.006632).

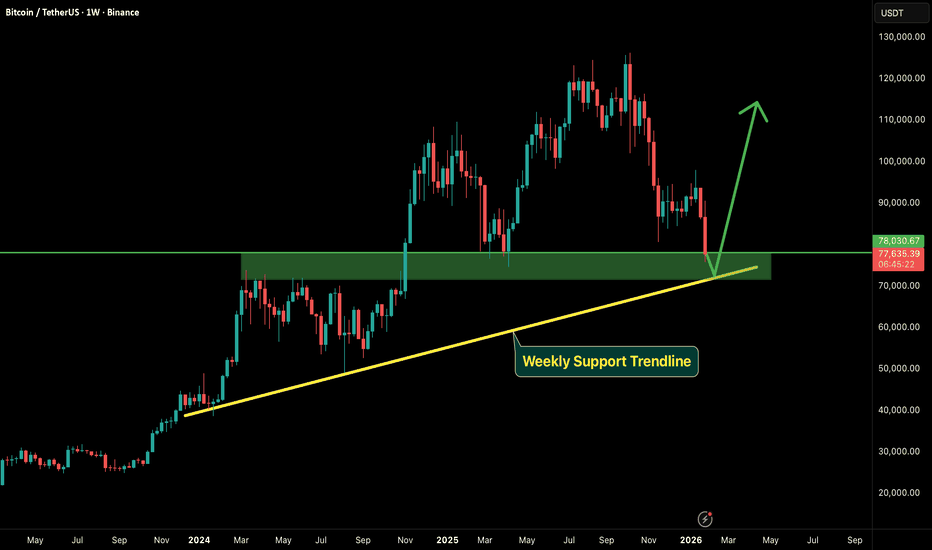

BITCOIN UPDATE – CRUCIAL ZONEHey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

BTC has reached a major confluence area 🔥

📌 Weekly support trendline($72k-$73k)

📌 Strong demand zone ($75K–$78K range)

This zone has acted as a launchpad in the past, and once again BTC is showing reaction from support 📈

🟢 Macro correlation to watch:

🔻 Gold & Silver are forming a top and have started correcting

Historically, whenever metals cool off, capital rotates into BTC 🚀

➡️ This strengthens the bounce probability from this region.

📊 What to expect:

As long as BTC holds above the weekly support, a strong upside move can follow.

❌ Invalidation:

Weekly candle close below $71K will invalidate this bullish view.

Patience + structure = edge

Stay disciplined. Stay profitable 💪

NQ Monthly/Weekly Analysis!Good Month/Week!

FA Analysis:

1- New FED's Head: Done!

Free money and rate cuts will come later. Meanwhile, market will make pressure of the FED and Sell the news.

2- High Risk:

2.1- USA Internal Affairs: Minnesota & ....

Market started paying attention to the situation in USA and high potential expansion to other areas.

Also, all Pool Results are showing Trump loosing support even from people who voted for him. So the impacts on the mid-election will be considerate.

2.2- Overseas Wars: Imminent one with Iran (most likely this week!)

Trump is using tariffs as a leverage to get what he wants from Europe and the rest of the world.

3- Macroeconomic factors:

3.1- Last Friday, Inflation data (i.e., PPI) showed an Overshoot. Market will pay a strong attention to the next Inflation data. Any other overshoot will jeopardize the free money and rate cuts.

3.1- Earnings Season:

So far, earnings were between inline and disappointing. So we won't get a push up from this side.

4- Upcoming weekly FA data:

The month will start with very relevant date from CBs, economic data, in particular NFP.

Good data will be considered good for equities and vice-versa for bad data.

In conclusion: Most of the above FA factors converge towards a Negative Outlook for US Equities/NQ .

TA Analysis

Monthly TF:

The Monthly candle is Bearish.

Price is below TL.

The target to achieve is 18800. It won't be straightforward!

Weekly TF:

Same as Monthly, we got a bearish Weekly close.

(From Yearly Outlook:

NQ is in the 1st wave down which comprises an Initial Wave, a Retrace, and an Impulsive Wave.

I mentioned that the Initial wave is very slow. Based on the Weekly chart, I think NQ has completed both the Initial Wave and the Retrace Wave.

From last week, NQ has started the Impulsive Wave. The Impulsive Wave is supposed to be very quick and insane.)

Daily TF:

The daily close is also bearish. Still price is within HH-HL. I think price will go south immediately to create a new LL.

In conclusion: All TFs are BEARISH. A continuation down is the least resistance.

(Note: Market might open with a down gap).

Happy Month/Week Everyone!

(Note: If you enjoy the analysis, give it a thumbs up and if you've a different view, please share it!)

EUR/USD: The Ultimate "Deep Discount" Trap?Is the Euro's bull run finally exhausted, or are we just witnessing a massive liquidity hunt? The 100 EMA and a massive Fair Value Gap are about to collide, creating a "Do or Die" zone for traders. If you missed the 1.2000 rally, this retracement might be your last chance to catch the next big wave—or get trapped in a freefall.

The Technical Narrative

The recent rejection from the 1.2050 highs wasn't just a pullback; it was a structural shift. We are currently tracking a Market Structure Shift (MSS) on the 4H timeframe. Price is gravitating toward the 1.1740 - 1.1770 Imbalance (FVG), which perfectly aligns with the 100 EMA.

The Setup: We expect a brief "dead cat bounce" into the 1.1890 supply zone (upper pink box) to trap early buyers before the final flush down to the demand zone.

The Kill Zone: Look for price exhaustion around 1.1750. This is the high-confluence area where institutional "Smart Money" is likely to reload.

🚨 Red Alert: The "Volatility Week"

This isn't a normal trading week. We are facing a "Perfect Storm" of macro data that could invalidate any technical setup in seconds:

ECB Rate Decision (Thursday): Any dovish hint from Lagarde will send the Euro straight into our FVG target.

NFP Friday: The ultimate USD mover. A strong labor report will be the catalyst for the final liquidity sweep.

Trading Advice: Don't be a hero during the news release. Let the market hunt the liquidity first, then join the trend once the dust settles at the 1.1750 support.

GBPCAD BUYwe seen price hit the top of the range at 1.88000, we seen price come back to take the gains back towards the end of the week as Canada held rates.

with strong data from the uk and with the us expected to not re-open their government, we should seen price push back to re-test the highs from last week.

EURUSD | FRGNT WEEKLY FORECAST | Q1 | W5 | Y26📅 Q1 | W5 | Y26

📊 EURUSD— FRGNT WEEKLY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

Intraday; The downside prevails,our performance

short position below 4.960 with targes at 4.650 & 4.670 in extention.

5.185.00 Resistance....

5.100.00 Resistance....

4.960.00 Resistance...

4.860.00 Last

4.650.00 Support

4.570.00 Support

4.480.00 Support

Comment

The RSI show downside momentum.

Alternative scenario

Above 4.960 look for further upside with 5.100 & 5.185 as targets

Silver Panic Drop → Distribution at 85 |Sell-Side Liquidity PlayOne day before this setup, Silver printed a heavy bearish displacement

from 121.6920 → 74.2869 — clear panic selling.

That move already told us one thing:

buyers were forced out, control shifted to sellers.

Now price has retraced and is distributing near 85.5144, forming a double top before the 0.5 Fibonacci retracement.

🧠 Trade Logic:

Strong bearish impulse = bearish bias

Retracement = corrective, not bullish

Double top near 85.5144 = early distribution

Entry taken before full 0.5 Fib

Stop-loss placed beyond 0.5 Fib (clean invalidation)

Target = sell-side liquidity below recent lows

This is not chasing price.

This is selling weakness after a panic move.

If price holds above 0.5 Fib → idea invalid.

If sellers stay in control → liquidity is the magnet.

👉 Like if you trade structure

👉 Comment if you see the same distribution

👉 Follow for clean, no-noise metals setups

TMP — Breakout Confirmed Above Previous HighHello Everyone, followers,

TMP - Tompkins Financial is next one :)

Let's drill down:

📊 Technical Overview

TMP has broken above its previous high, confirming trend continuation.

The breakout is supported by strong volume, increasing the probability that this move is valid.

🔹 Key Levels

Support

77.40–77.50 → Breakout retest zone

73.20 → 0.5 Fib + trend support

69.00 → Major structure support

Resistance / Targets

80.50 → Immediate breakout target

83.40 → 0.786 Fib

86.00 → Upper extension zone

🔮 Outlook

Trend strength favors continuation as long as price holds above the breakout level.

🎯 What I Expect

A brief consolidation above 77.5, followed by another push higher if buyers remain active.

Main expectation is bullish

If you enjoy and like clean, simple analysis — follow me for more.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday to all and hopefully green trade day for next Week.

#SPX500 #NASDAQ #TMP #Trendanalysis

USDJPY February 2026 fundamental analysisFundamental Case:

USD at 3.75% vs JPY at 0.75% creates 300bp spread—apparently compelling for USD carries. Yet JPY has depreciated only 0.86% in 2025, and only up 0.86% vs USD 2026-YTD despite 300bp differential. This suggests structural factors overwhelm yield attraction.

The reality: BoJ's real rates remain deeply negative (nominal rates insufficient relative to inflation realities), capital is flowing out of Japan (fiscal concerns, growth weakness), and structural USD demand for international trade outflows dominates yield considerations.

BoJ's Hawkish Pretense:

BoJ raised rates to 0.75% in December, the highest in 30 years. Yet the January decision held steady, with only one board member voting for 1.0% hike. This suggests BoJ's hawkishness is constrained by fiscal pressures (Takaichi's €783bn budget for FY2026) and political pressure (snap election Feb 8).

The October 2026 next rate hike—expected per ING—is likely just one more 25bp move, leaving real rates deeply negative. Insufficient to support yen in face of capital outflows.

Technical Position:

USD/JPY at 154.75 (Jan 31), down from highs in 2024. Wide range-bound trading expected, but with downside bias as Fed cuts accumulate.

Currency Intervention Risk:

Finance Minister Katayama has expressed "deep concern" about yen weakness, warning of "one-sided" movements. This suggests BoJ/MOF may consider intervention if depreciation accelerates, but political will for tightening is limited. Intervention, if deployed, would likely be modest/temporary.

Risk: BoJ snap election (Feb 8) could produce unexpectedly hawkish result supporting yen (very low probability). If global growth suddenly deteriorates (recession fears), JPY strength could spike as safe-haven demand rises. Fed could surprise hawkishly with forward guidance, supporting USD.

VERDICT: SELL | BoJ's structural weakness + Fed's expected cuts + capital outflows from Japan = downside bias for USD/JPY. 300bp rate spread insufficient to overcome structural flows. Wide range-bound trading expected (152-160 range likely), but Feb should test lower end as profit-taking occurs on USD strength rallies. Risk-reward unfavorable for longs

USDCHF February 2026 fundamental analysisFundamental Case:

USD at 3.75% vs CHF at 0% creates massive 375bp rate spread favoring USD. Yet USD/CHF is weakening, suggesting rate differentials are overwhelmed by other factors.

The key driver: CHF is emerging as the preferred safe-haven currency, particularly vs USD. Capital is rotating away from USD assets (depressed real yields, fiscal concerns, trade policy uncertainty) toward CHF assets (stability, predictability, strong current account).

SNB's apparent acceptance of franc appreciation (allowing intervention threshold to shift higher) signals policy comfort with stronger CHF. This removes traditional FX intervention floor that historically limited franc strength.

Technical:

USD/CHF at multi-decade lows, having fallen from 1.05+ in late 2024 to current 0.777253 (Jan 31). This is a multi-year structural decline, not a short-term pullback.

Safe Haven Flows:

Global investors hunting for refuge from US stagflation risks. CHF attracts defensive flows due to Switzerland's surplus economy and policy credibility.

Risk: If Fed surprises hawkishly with future guidance, USD/CHF could stabilize. If global risk aversion suddenly spikes, safe-haven flows could accelerate CHF strength, deepening USD/CHF decline. If SNB intervenes at lower threshold than signaled, franc strength could be capped.

VERDICT: SELL | Rate differential (375bp) overwhelmed by structural safe-haven flows into CHF. SNB's apparent comfort with franc appreciation limits support for USD/CHF. Multi-year downtrend intact. February likely sees continued weakness toward 0.75-0.76 levels

DXY February analysis

- Where is price?

Price is in Area3 on the quarterly and area 2 on the monthly timeframe. January candle is finished and February candle will also open in Area 2, below the current live EBOT which will become static EBOT on monday. Price is in c-wave down on the monthly time frame. Direction is down, slopes are down

- What is it doing?

On the monthly timeframe, price is in c-wave down, and opening below the static EBOT, price will usually find resistance there and continue the c-wave down to the exhaus areas. Direction is down and slopes are down, Areas 3-6 are down. For that to happen the weekly needs to find resistance at the next weeks EBOT and continue with the c-wave down.

- What is next?

The monthly will continue its c-wave down with strong resistance at the next months live PLdot (currently at 97.7 to the static PLdot at 98.52) and support at 94.828 - 94.663 which is the static Area 1 bottom and the quarterly 5-9 up. If the probable PLdot refresh has enough energy, then it might go in February to the extremely strong support at 91.5.

XAUUSD SETUP LOADING TRADE PLAN INSIDEPrice is currently approaching the marked resistance zone where selling pressure has previously entered the market. This area aligns with a strong rejection zone and overall bearish market structure. If price shows weakness or rejection from these marked levels, a downside move is expected.

Traders should wait for confirmation before entering positions and manage risk accordingly. A clear rejection from the marked levels could open the path for further downside continuation.