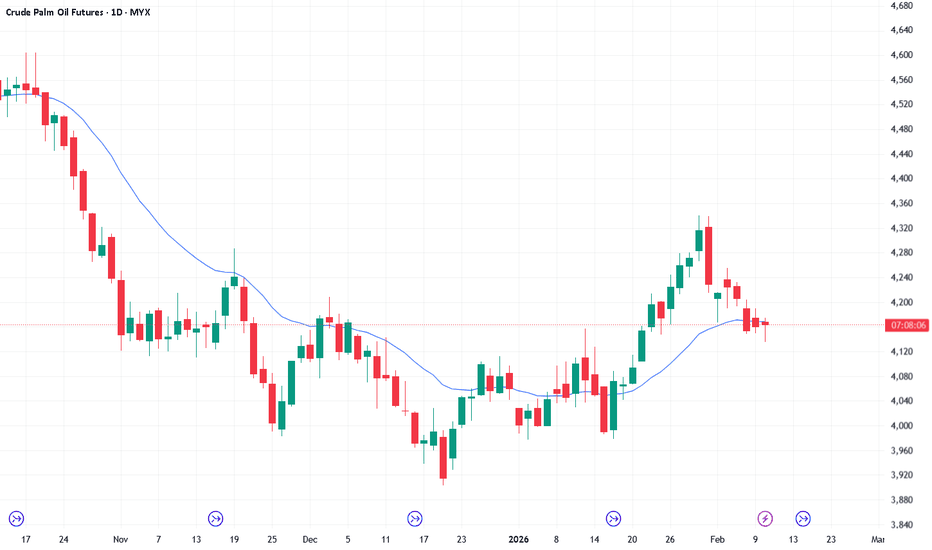

11/2/26 Strong Pullback Testing Prior Breakout Point

Tuesday’s candlestick (Feb. 10) was a big bear bar closing near its low, trading below the 2-day EMA.

In our last report, we stated that traders would observe whether the bears could create more follow-through selling below the 20-day EMA or if the market would stall around the 20-day EMA area, followed by a retest of the January high in the days ahead.

The market traded down to test the January 16 breakout point.

Bulls see the current pullback as a retest of the January 16 breakout point.

They see the current move as a three-legged sideways-to-down pullback and hope the market will reverse above the 20-day EMA.

Bulls need to create strong consecutive bull bars to show they are back in control.

Bears got a reversal from a double top bear flag (November 19).

They created consecutive strong bear bars below the 20-day EMA in a tight bear channel, indicating persistent selling.

If there is a pullback, bears want the 20-day EMA to act as resistance, followed by a second leg sideways to down to retest the current leg low (February 11).

Fundamentals:

• Production: Production for Feb will be down.

• Refineries: Not paying premiums vs spot futures - yet.

• Exports: ITS Feb first 5 days down 10.52

The bulls created a strong bull leg to test the September high, followed by a strong bear leg testing the top of the prior trading range.

The strong pullback indicates the bears are also active.

For Wednesday (February 11), traders will see if the bears can create more follow-through selling below the 20-day EMA.

Or will the market stall around the top of the prior trading range, followed by a retest of the 20-day EMA later this week?

Andrew

Palmoil

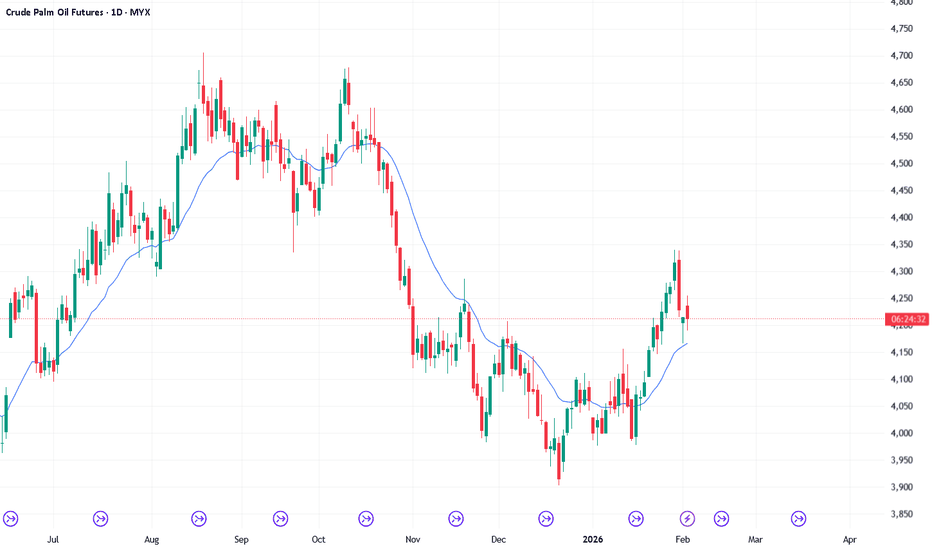

10/2/26 Can the 20-day EMA Act As Support?

Monday’s candlestick (Feb. 9) was an inside bear bar closing in its lower half and slightly below the 20-day EMA.

In our last report, we stated that traders would see if the bears could create more follow-through selling below the 20-day EMA, or if the market would stall around the 20-day EMA area, followed by a retest of the January high in the days ahead.

The market gapped higher at the open and traded sideways for most of the day.

Bulls see the current pullback as a retest of the January 13 breakout point.

They see the current move as a two-legged sideways-to-down pullback and want the 20-day EMA to act as a support level.

Bulls expect to get at least a small sideways to up leg to retest the prior leg high (Jan 29), even if it only forms a lower high.

Bears want a reversal from a double top bear flag (with November 19).

They need to create consecutive strong bear bars below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Feb will be down.

• Refineries: Not paying premiums vs spot futures - yet.

• Exports: ITS Feb first 5 days down 1.87%

The bulls created a strong breakout above the trading range, accompanied by follow-through buying.

The market formed a 50% pullback to the 20-EMA so far. The strong pullback indicates the bears are also active.

The market may still form a retest of the prior leg high (Jan 29), even if it only forms a lower high.

For Tuesday (February 10), traders will see if the bears can create more follow-through selling below the 20-day EMA.

Or will the market stall around the 20-day EMA area, followed by a retest of the January high in the days ahead?

Andrew

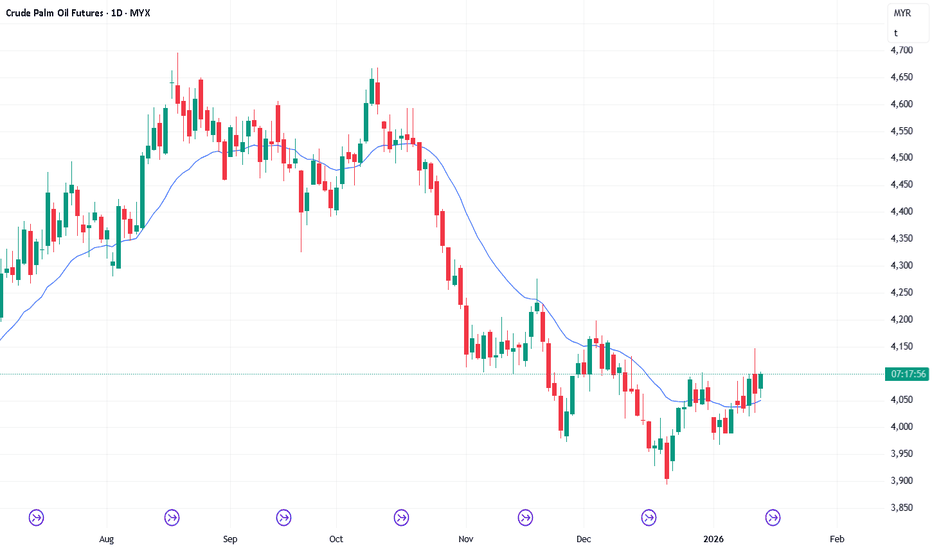

9/2/26 Can Bears Create FT Selling or 20-Day EMA Act As Support?

Friday’s candlestick (Feb. 6) was a bear bar closing near its low and below the 20-day EMA.

In our last report, we stated that traders would see if the bears could create more follow-through selling, testing the 20-day EMA or closing below it, or if the pullback phase would lack follow-through selling; overlapping candlesticks, prominent tails below bars, prominent bull bars

The market has traded down and formed a roughly 50% pullback from the January rally.

Bulls see the current pullback as a retest of the January 13 breakout point.

They see the current move as a two-legged sideways-to-down pullback and want the 20-day EMA to act as a support level.

Bulls expect to get at least a small sideways to up leg to retest the prior leg high (Jan 29), even if it only forms a lower high.

Bears want a reversal from a double top bear flag (with November 19).

They need to create consecutive strong bear bars below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Feb will be down.

• Refineries: Not paying premiums vs spot futures - yet.

• Exports: ITS Feb first 5 days down 1.87%

The bulls created a strong breakout above the trading range, accompanied by follow-through buying. The move is in a tight bull channel, indicating persistent buying.

The strong pullback indicates the bears are also active.

The market may still form a retest of the prior leg high (Jan 29), even if it only forms a lower high.

For Monday (February 9), traders will see if the bears can create more follow-through selling below the 20-day EMA.

Or will the market stall around the 20-day EMA area, followed by a retest of the January high in the days ahead?

Andrew

6/2/26 Can Bears Get More FT Selling In Pullback Phase?

Thursday’s candlestick (Feb. 5) was a bear inside bar closing in its lower half.

In our last report, we stated that traders would watch to see if the bears could create more follow-through selling, testing the 20-day EMA, or if the pullback phase would continue to lack follow-through selling; overlapping candlesticks, prominent tails below bars, prominent bull bars.

The market traded sideways for most of the day and is currently testing the 20-day EMA this morning.

Bulls want any pullback to be weak and sideways, lacking in follow-through selling.

They see the current move as a two-legged sideways-to-down pullback and want the 20-day EMA to act as a support level.

Bulls expect to get at least a small sideways to up leg to retest the current leg high (Jan 29), even if it only forms a lower high.

Bears want a reversal from a double top bear flag (with November 19).

They need to create consecutive strong bear bars below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Feb will be down.

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS Feb first 5 days - Bears want a reversal from a double top bear flag (with November 19).

They need to create consecutive strong bear bars below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Feb will be down.

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS Feb first 5 days -1.87%

The bulls created a strong breakout above the trading range, accompanied by follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

Odds slightly favor the first pullback to be minor, followed by a retest of the prior leg high (Jan 29), even if it only forms a lower high.

For Friday (February 6), traders will see if the bears can create more follow-through selling, testing the 20-day EMA or closing below it.

Or will the pullback phase continue to lack follow-through selling; overlapping candlesticks, prominent tails below bars, prominent bull bars?

If the pullback phase remains weak and sideways, the odds of a retest of the January 29 high will increase in the weeks ahead.

Bulls want a strong bull bar today, so the weekly candlestick closes with a bull body, while the bears want a strong bear bar, so the weekly candlestick closes near its low with a long tail above.

The weekly candlestick will control the longer-term trend.

Andrew

5/2/26 Can Bears Create More FT Selling or No Still?

Tuesday’s candlestick (Feb. 4) was a bear doji closing in its upper half with a long tail below.

In our last report, we stated that traders would observe whether the bears could create more follow-through selling, testing the 20-day EMA, or if the pullback phase would continue to lack follow-through selling, instead characterised by overlapping candlesticks, prominent tails below bars, and prominent bull bars.

The market traded sideways for most of the day but closed slightly higher than the prior day. So far, the pullback phase is sideways and overlapping.

Previously, bulls got a strong rally in a tight bull channel, testing the September high.

Bulls want any pullback to be weak and sideways, lacking in follow-through selling.

They want the 20-day EMA to act as a support level.

Bulls expect to get at least a small sideways to up leg to retest the current leg high (Jan 29), even if it only forms a lower high.

Bears want a reversal from a double top bear flag (with November 19).

They need to create consecutive strong bear bars below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Feb will be down.

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS Feb first 5 days - TBA

The bulls created a strong breakout above the trading range, accompanied by follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

Odds slightly favor the first pullback to be minor, followed by a retest of the prior leg high (Jan 29), even if it only forms a lower high.

For Thursday (February 5), traders will see if the bears can create more follow-through selling, testing the 20-day EMA.

Or will the pullback phase continue to lack follow-through selling instead - overlapping candlesticks, prominent tails below bars, prominent bull bars?

If the pullback phase remains weak and sideways, the odds of a retest of the January 29 high will increase in the weeks ahead.

Andrew

4/2/25 Can Bears Get More FT Selling or Fail To Do So?

Monday’s candlestick (Feb. 3) was a bull reversal bar closing near its high with a long tail below after gapping down at the open.

In our last report, we stated that traders would observe whether the bears could create a follow-through bear bar or if the pullback phase would lack follow-through selling instead.

The market gap down and tested near the 20-day EMA, but the bears did not get a strong follow-through bear bar.

Bulls got a strong rally in a tight bull channel, testing the September high.

Bulls want any pullback to be weak and sideways, lacking in follow-through selling.

They want the 20-day EMA to act as support.

Bulls expect to get at least a small sideways to up leg to retest the current leg high (Jan 29), even if it only forms a lower high.

Bears want a reversal from a double top bear flag (with November 19).

They hope the November 19 high will act as resistance.

They need to create consecutive strong bear bars below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Feb will be down.

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS Jan at +18%

The bulls created a strong breakout above the trading range, accompanied by follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

Odds slightly favor the first pullback to be minor, followed by a retest of the prior leg high (Jan 29), even if it only forms a lower high.

For Wednesday (February 4), traders will see if the bears can create more follow-through selling, testing the 20-day EMA.

Or will the pullback phase continue to lack follow-through selling instead - overlapping candlesticks, prominent tails below bars, prominent bull bars?

Andrew

3/2/26 Can Bears Create Strong FT Selling or No?

Friday’s candlestick (Jan. 30) was a big bear bar closing near its low.

In our last report, we stated that traders would see if the bears could maintain a strong bear bar closing near its low, or if the candlestick would close with a long tail and above the middle of its range.

The market traded lower and sold off near the end of the day to close near the low.

Bulls got a strong rally in a tight bull channel, testing the September high.

The next targets for the bulls are the 4400 and 4500 levels.

Bulls want any pullback to be weak and sideways, lacking in follow-through selling.

Bulls expect to get at least a small sideways to up leg to retest the current leg high (Jan 29), even if it only forms a lower high.

Bears want a reversal from a double top bear flag (with November 19).

They hope the November 19 high will act as resistance.

They need to create consecutive strong bear bars to show they are in control.

Fundamentals:

• Production: Production for Jan is down. Definitely down in Feb.

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS Jan rumored at +17%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

Odds slightly favor the first pullback to be minor, followed by a retest of the prior leg high (Jan 29), even if it only forms a lower high.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior. This has been reflected in recent prices.

For Tuesday (February 3), traders will see if the bears can create a follow-through bear bar.

Or will the pullback phase lack follow-through selling instead?

Andrew

30/1/26 Will the PB Candle Be Strong or Weak?

Thursday’s candlestick (Jan. 29) was a bull bar closing in its upper half with a prominent tail above.

In our last report, we stated that bulls needed to create a strong breakout above the November high. If there is a pullback, they want it to be weak and sideways. Or would the bears be able to finally create a pullback bar?

The market continued to trade slightly higher for the day. The market opened lower this morning, finally forming the pullback bar.

Bulls got a rally from a large wedge pattern (Jan 17, May 8, and Dec 19), a smaller wedge pattern (Nov 3, Nov 26, and Dec 19), and a double bottom bull flag (January 5 and December 16).

The next targets for the bulls are the 4400 and 4500 levels.

The market broke above the November high yesterday, but there was no follow-through buying today.

Bulls want any pullback to be weak and sideways, followed by a resumption of the trend.

Bulls expect to get at least a small sideways to up leg to retest the current leg high (Jan 29), even if it only forms a lower high.

Bears want a reversal from a double top bear flag (with November 19).

They hope the November 19 high will act as resistance.

They need to create consecutive strong bear bars to show they are in control.

Fundamentals:

• Production: Production for Jan - SPPOMA first 25 days -14.81%%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 25 days +9.97%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

Odds slightly favor the first pullback to be minor, followed by a retest of the prior leg high (Jan 29), even if it only forms a lower high.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior. This has been reflected in recent prices.

For Friday (January 30), traders will see if the bears can maintain a strong bear bar closing near its low.

Or will the candlestick close with a long tail and above the middle of its range?

The close today will also influence the weekly candlestick. Will it close with a long tail above and below the middle of its range, or in its upper half with a smaller tail?

Andrew

29/1/26 Can Bulls Get FT Above Nov High, or Minor Pullback?

Wednesday’s candlestick (Jan. 28) was a bull bar closing in its upper half with a small tail above and a long tail below.

In our last report, we stated that bulls needed to create a follow-through bull bar above the December high. If there is a pullback, they want it to be weak and sideways. Or would the bears be able to finally create a pullback bar?

The market continued to trade slightly higher in a tight bull channel.

Bulls got a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19), a smaller wedge pattern (Nov 3, Nov 26, and Dec 19), and a double bottom bull flag (January 5 and December 16).

The market has tested the November high this morning.

Bulls need a strong breakout with sustained follow-through buying above the November high to reach the next resistance around the 4330-50 area.

If there is a pullback, bulls expect to get at least a small sideways to up leg to retest the current leg high, even if it only forms a lower high.

Bulls want any pullback to be weak and sideways.

Bears want a reversal from a double top bear flag (with November 19).

They hope the November 19 high will act as resistance.

They need to create strong bear bars to show they are in control.

Fundamentals:

• Production: Production for Jan - SPPOMA first 25 days -14.81%%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 25 days +9.97%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior. This has been reflected in recent prices.

For Thursday (January 29), bulls need to create a strong breakout above the November high. If there is a pullback, they want it to be weak and sideways.

Or will the bears be able to finally create a pullback bar?

Odds slightly favor any pullback to be minor.

Andrew

28/1/25 Can Bulls Create a Breakout or Finally a Pullback?

Tuesday’s candlestick (Jan. 27) was a bull bar closing in its upper half with a prominent tail above.

In our last report, we stated that bulls needed to create a follow-through bull bar above the December high, or the market would trade higher but close with a long tail or a bear body instead.

The market continued to trade higher, and the bulls created a follow-through bull bar following the breakout above the December high.

Bulls got a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19), a smaller wedge pattern (Nov 3, Nov 26, and Dec 19), and a double bottom bull flag (January 5 and December 16).

The market has tested the measured move of 4250. The next target level for bulls is the November high.

Bulls need a strong breakout with sustained follow-through buying above the December high to reach the November 19 high.

If there is a pullback, bulls expect to get at least a small sideways to up leg to retest the current leg high, even if it only forms a lower high.

If there is a deep pullback, they want the 20-day EMA to act as a support level.

Bears want a reversal from a double top bear flag (with November 19).

They hope the November 19 high will act as resistance.

They need to create strong bear bars trading below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Jan - SPPOMA first 25 days -14.81%%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 25 days +9.97%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior. This has been reflected in recent prices.

For Wednesday (January 28), bulls need to create a follow-through bull bar above the December high. If there is a pullback, they want it to be weak and sideways.

Or will the bears be able to finally create a pullback bar?

Odds slightly favor any pullback to be minor.

Andrew

27/1/25 Bulls Need Follow-through Bull Bar Above December High

Monday’s candlestick (Jan. 26) was a bull bar closing in its upper half with a prominent tail above.

In our last report, we stated that bulls want a strong breakout above the December high, and traders will see if there will be short covering above this level, where potential stop-loss levels for bears are located. Or would the bears be able to create a pullback to retest the 20-day EMA?

The market continued to trade higher, closing above the December high.

Bulls got a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19), a smaller wedge pattern (Nov 3, Nov 26, and Dec 19), and a double bottom bull flag (January 5 and December 16).

The market has tested the measured move of 4250. The next target level for bulls is the November high.

Bulls need a strong breakout with sustained follow-through buying above the December high to reach the November 19 high. They need to create follow-through buying today.

If there is a pullback, bulls expect to get at least a small sideways to up leg to retest the current leg high, even if it only forms a lower high.

If there is a deep pullback, they want the 20-day EMA to act as a support level.

Bears want a reversal from a double top bear flag (with December 3 or November 19).

They hope the December 3 or November 19 highs will act as resistance.

If the market trades higher, they want the 4250 or the November 19 high to act as resistance.

They need to create strong bear bars trading below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Jan - SPPOMA first 25 days -14.81%%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 25 days +9.97%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior. This has been reflected in recent prices.

For Tuesday (January 27), bulls need to create a follow-through bull bar above the December high.

Or will the market trade high but close with a long tail or a bear body instead?

Andrew

26/1/25 Can Bulls Create a Strong BO Above December High?

Friday’s candlestick (Jan. 23) was a bear bar closing around the middle of its range with a long tail below.

In our last report, we stated that bulls want a strong bull bar so the weekly candlestick would close near its high and above the 20-day EMA, while Bears want a strong bear bar, so the weekly candlestick would close with a long tail and below the middle of the bar.

The market traded lower but reversed off its low towards the evening. The weekly candlestick was a bull bar closing in its upper half with a prominent tail above.

Bulls got a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19), a smaller wedge pattern (Nov 3, Nov 26, and Dec 19), and a double bottom bull flag (January 5 and December 16).

They want a measured move using the height of the trading range to the 4250 area.

Bulls need a strong breakout with sustained follow-through buying above the December high to reach the November 19 high.

If there is a pullback, bulls expect to get at least a small sideways to up leg to retest the current leg high, even if it only forms a lower high.

If there is a deep pullback, they want the 20-day EMA to act as a support level.

Bears want a reversal from a double top bear flag (December 3 and January 22).

They hope the December 3 high will act as resistance.

If the market trades higher, they want the 4250 or the November 19 high to act as resistance.

They need to create strong bear bars trading below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Jan - SPPOMA first 20 days -16%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 25 days +9.97%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

The move is in a tight bull channel, indicating persistent buying.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior.

For Monday (January 26), bulls want a strong breakout above the December high. Traders will see if there will be short covering above the December high, where potential stop loss levels for bears are located.

Or will the bears be able to create a pullback to retest the 20-day EMA?

Andrew

23/1/25 How Will The Weekly Candlestick Close?

Thursday’s candlestick (Jan. 22) was a bull bar closing in its upper half with a small tail above.

In our last report, we stated that traders would see if the bulls could create another strong follow-through bull bar, breaking above the December 3 high, or if the day would close with a long tail above and close below the middle of its range.

The market traded higher for the day, with slight profit-taking at the end of the day.

Bulls got a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19), a smaller wedge pattern (Nov 3, Nov 26, and Dec 19), and a double bottom bull flag (January 5 and December 16).

They need to create strong consecutive bull bars trading far above the 20-day EMA and above the top of the trading range to increase the odds of reaching the measured move, which is around 4250, using the height of the trading range. So far, this is the case.

The market tested the December high this morning (December 3). Bulls need a strong breakout with sustained follow-through buying to reach the November 19 high.

If there is a pullback, bulls expect to get at least a small sideways to up leg to retest the current leg high, even if it only forms a lower high.

They want the 20-day EMA to act as a support level.

The bears want a reversal from a double top bear flag (December 3 and January 22).

They hope the December 3 high will act as resistance.

If the market trades higher, they want the 4250 or the November 19 high to act as resistance.

They need to create strong bear bars trading below the 20-day EMA to show they are in control.

Fundamentals:

• Production: Production for Jan - SPPOMA first 20 days -16%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 20 days +11.38%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior.

For today (January 23), bulls want a strong bull bar so the weekly candlestick will close near its high and above the 20-day EMA. Bears want a strong bear bar, so the weekly candlestick will close with a long tail and below the middle of the bar.

Andrew

22/1/25 Bulls Need Strong BO Above December 3 High

Wednesday’s candlestick (Jan. 21) was a bull bar closing near its high.

In our last report, we stated that the sell-off on January 15 likely trapped bears. The market came back to the January 13 high area, allowing trapped bulls to exit. Would they exit? Or would the market get a sustained breakout above the trading range high instead?

The market experienced a strong breakout above the trading range high and the January 13 high, accompanied by follow-through buying.

Bulls got a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19), a smaller wedge pattern (Nov 3, Nov 26, and Dec 19), and a double bottom bull flag (January 5 and December 16).

They need to create strong consecutive bull bars trading far above the 20-day EMA and above the top of the trading range to increase the odds of reaching the measured move, which is around 4250, using the height of the trading range. So far, this is the case.

The market tested the December high this morning (December 3). Bulls need a strong breakout with sustained follow-through buying to reach the November 19 high.

If there is a pullback, bulls expect to get at least a small sideways to up leg to retest the current leg high, even if it only forms a lower high.

The bears want a reversal from larger a double top bear flag (December 3 and January 22).

They hope the December 3 high will act as resistance.

If the market trades higher, they want the 4250 or the November 19 high to act as resistance.

They need to create strong bear bars to show they are in control.

Fundamentals:

• Production: Production for Jan - SPPOMA first 15 days -16%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 20 days +11.38%

So far, the bulls created a strong breakout above the trading range with follow-through buying.

The bulls need sustained follow-through buying to increase the odds of reaching the measured move of 4250 or the November 19 high.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior.

For today (January 22), traders will see if the bulls can create another strong follow-through bull bar, breaking above the December 3 high.

Or will the day close with a long tail above and close below the middle of its range?

Andrew

21/1/25 Can Bulls Get A Strong Breakout With FT Buying?

Tuesday’s candlestick (Jan. 20) was a bull bar closing above the middle of its range with a small tail above.

In our last report, we stated that traders would continue to buy low and sell high around the edges of the 19-day trading range until there is a strong breakout with follow-through from either direction.

The market traded sideways to up for the day towards the top of the trading range.

Bulls hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They view the recent move as forming a double bottom bull flag (January 5 and December 16).

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control. So far, this is the case.

They need a strong breakout above the top of the trading range to increase the odds of reaching the measured move, which is around 4250, using the height of the trading range.

The bears want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA.

However, the move stalled around the January 5 low area, and the bears did not get follow-through selling.

They want the top of the trading range to act as a resistance area. If the market trades higher, they want the January 13 high to act as resistance.

Fundamentals:

• Production: Production for Jan - SPPOMA first 15 days -16%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 20 days rumored to be around +15%

The sell-off on January 15 likely trapped bears. The market is coming back to the January 13 high area, allowing trapped bulls to exit.

Will they exit? Or will the market get a sustained breakout above the trading range high instead?

The bulls need to create a strong breakout with sustained follow-through buying to increase the odds of reaching the measured move of 4250.

The market has been in a 19-day tight trading range. The market is trading near the top of the trading range, which can be a sell zone for trading range bears.

For now, traders will continue to buy low and sell high around the edges of the 19-day trading range until there is a strong breakout with follow-through from either direction.

As we approach February, the mechanics of the CNY festival and reduced working days will increasingly impact buying and selling behavior.

Andrew

20/1/25 Still Trading Range Behavior Until Strong Breakout

Monday’s candlestick (Jan. 19) was an inside doji trading around the high of the big outside bull bar.

In our last report, we stated that traders would continue to buy low and sell high around the edges of the 18-day trading range until there is a strong breakout with follow-through from either direction.

The market traded sideways in a small range and on a low-volume day.

Bulls hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They view the recent move as forming a double bottom bull flag (January 5 and December 16).

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They want the 20-EMA or the January 5 low to act as a support level.

The bears want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA.

However, the move stalled around the January 5 low area, and the bears couldn’t get follow-through selling.

They want the 20-day EMA to continue acting as a resistance area. If the market trades higher, they want the January 13 high to act as resistance.

They need to get a strong breakout below the January 5 low to increase the odds of a retest of the December low.

Fundamentals:

• Production: Production for Jan - SPPOMA first 15 days -16%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 20 days rumored to be around +15%

So far, the move up on January 12 trapped bulls, and the sell-off on January 15 trapped bears.

The market has been in an 18-day tight trading range. The market is trading around the middle of the trading range, which is an area of balance and a magnet.

For now, traders will continue to buy low and sell high around the edges of the 17-day trading range until there is a strong breakout with follow-through from either direction.

As we get closer to February, the mechanics of the CNY festival and lesser working days will increasingly have a larger influence on buying and selling behavior.

Andrew

18/1/25 Market in Middle of Trading Range, Balance Area

Friday’s candlestick (Jan. 16) was an outside bull bar closing near its high with a small tail above.

In our last report, we stated that traders would watch to see if the bears could create more follow-through selling below the 20-day EMA and below the January 5 low, or if the market would reverse back above the 20-day EMA instead; if they do, that would increase the odds of a reversal from a double bottom bull flag with the January 5 low.

The market traded up and closed above the 20-day EMA. The weekly candlestick was a bull doji, closing around the middle of its range, indicating a balance between the bulls and bears.

Bulls hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They view the recent move as forming a double bottom bull flag (January 5 and December 16).

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They want the 20-EMA or the January 5 low to act as a support level.

The bears want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA.

They need to get a strong breakout below the January 5 low to increase the odds of a retest of the December low.

They want the 20-day EMA to continue acting as a resistance area. If the market trades higher, they want the January 13 high to act as resistance.

Fundamentals:

• Production: Production for Jan - SPPOMA first 15 days -16%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 15 days +18.64%.

So far, the move up on January 12 trapped bulls, and the sell-off on January 15 trapped bears.

The market has been in a 17-day tight trading range. The market is trading around the middle of the trading range, which is an area of balance and a magnet.

For now, traders will continue to Buy Low, Sell High around the edges of the 17-day trading range until there is a strong breakout with follow-through from either direction.

Andrew

16/1/25 Can Bulls Reverse Above the 20-Day EMA?

Thursday’s candlestick (Jan. 15) was a big bear bar closing near its low.

In our last report, we stated that traders would watch to see if the bears could create strong follow-through selling below the 20-day EMA, or if the market would trade lower but close with a long tail, either above or below the middle of the day's range.

The market traded sideways to down for the whole day.

Bulls hope the selloff (Dec 19) will form a major higher low relative to May 2025.

They hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They view the current move as a breakout pullback and hope to get a double bottom bull flag with the January 5 low.

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They want the 20-EMA or the January 5 low to act as a support level.

The bears want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA.

They need to get a strong breakout below the January 5 low to increase the odds of a retest of the December low.

If the market trades higher, they want the 20-day EMA to continue acting as resistance.

Fundamentals:

• Production: Production for Jan - SPPOMA first 10 days -20%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 15 days +18.64%.

Today (Friday, Jan. 16), traders will watch to see if the bears can create more follow-through selling below the 20-day EMA and below the January 5 low.

Or will the market reverse back above the 20-day EMA instead? If they do, that would increase the odds of a reversal from a double bottom bull flag with the January 5 low.

Andrew

15/1/25 Can Bears Get Strong FT Selling Below 20-Day EMA?

Wednesday’s candlestick (Jan. 14) was a bear bar closing near its low with a long tail above.

In our last report, we stated that traders would watch to see if the bulls could create a strong retest and breakout above the January 13 high, or if the market would trade lower to retest the 20-day EMA again and close below it.

The market traded higher in the morning session, but sold off in the afternoon, testing the 20-day EMA and closing slightly below it.

Bulls hope the selloff (Dec 19) will form a major higher low relative to May 2025.

They hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They view the current move as a breakout pullback and hope to get a double bottom bull flag with the January 5 low.

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They want the 20-EMA or the January 5 low to act as a support level.

The bears want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA.

They need to get a strong breakout below the January 5 low to increase the odds of a retest of the December low.

If the market trades higher, they want the 20-day EMA to continue acting as resistance.

Fundamentals:

• Production: Production for Jan - SPPOMA first 10 days -20%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 10 days +29%.

Today (Thursday, Jan. 15), traders will watch to see if the bears can create strong follow-through selling below the 20-day EMA.

Or will the market trade lower but close with a long tail below and above the middle of the day's range instead?

Andrew

14/1/25 Bulls Need To Create Strong Consecutive Bull Bars

Tuesday’s candlestick (Jan. 14) was a bear bar closing below the middle of its range with long tails above and below.

In our last report, we stated that traders would watch to see if the bulls could create a strong breakout above the 13-day tight trading range around the 20-day EMA, or if the market would trade higher, but close with a long tail or a bear body instead - a breakout pullback or a possible breakout failure.

The market traded higher in the morning session, but sold off in the afternoon, testing the 20-day EMA. The market closed off its low in the last hour of the day, indicating the bears are not yet decisively strong.

Bulls hope the selloff (Dec 19) will form a major higher low relative to May 2025.

They hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They want a reversal from a lower low major trend reversal (relative to November 26) and now a smaller higher low major trend reversal (relative to December 25), followed by a measured move to around the 4200 area based on the height of the recent 13-day trading range.

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They view yesterday (Tuesday, Jan. 13) as a breakout pullback test of the 20-day EMA and hope it was a bear trap.

They want the 20-EMA to act as a support level. So far, this appears to be the case.

The bears got the third leg down to form the wedge pattern (November 13, November 26, and December 19).

They want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA, even if it only forms a higher low. The recent retest has a higher low (Jan 5).

If the market trades higher, they want the December 3 high area to act as resistance. They want another major lower high relative to January 3.

Fundamentals:

• Production: Production for Jan - SPPOMA first 10 days -20%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 10 days +29%.

Today (Wednesday, Jan. 14), traders will watch to see if the bulls can create a strong retest and breakout above the January 13 high.

Or will the market trade lower to retest the 20-day EMA again and close below it?

So far, the 20-day EMA continue to act as support, but the bulls have not yet shown decisive consecutive strong bull bars.

Andrew

13/1/25 Bulls Need Strong Breakout Above 13-Day Trading Range

Monday’s candlestick (Jan. 13) was an outside bull bar closing near its high with a prominent tail below.

In our last report, we stated that traders would watch to see if the bulls could create bull bars by trading above the 20-day EMA, or if the bears would be able to get follow-through selling below the 20-day EMA.

The market traded lower at the open, but the follow-through was limited. The market reversed higher and closed higher in the afternoon session.

Bulls hope the selloff (Dec 19) will form a major higher low relative to May 2025.

They hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They want a reversal from a lower low major trend reversal (relative to November 26) and now a smaller higher low major trend reversal (relative to December 25), followed by a measured move to around the 4200 area based on the height of the recent 13-day trading range.

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They want the 20-EMA to act as a support level. So far, this appears to be the case.

The bears got the third leg down to form the wedge pattern (November 13, November 26, and December 19).

They want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA, even if it only forms a higher low. The recent retest has a higher low (Jan 5).

If the market trades higher, they want the December 3 high area to act as resistance.

Fundamentals:

• Production: Production for Jan - SPPOMA first 10 days -20%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 10 days +29%.

Today (Tuesday, Jan. 13), traders will watch to see if the bulls can create a strong breakout above the 13-day tight trading range around the 20-day EMA.

Or will the market trade higher, but close with a long tail or a bear body instead - a breakout pullback or a possible breakout failure?

Andrew

12/1/25 Can Bulls Create Bull Bars or Fail to Do So?

Friday’s candlestick (Jan. 9) was a bear bar closing near its low with a long tail above.

In our last report, we stated that bulls want a strong bull bar so the weekly candlestick would close near its high, increasing the odds of next week trading at least a little higher, while bears want a strong bear bar so the weekly candlestick would close with a long tail above, perhaps with a bear body too.

The market traded higher for most of the day but reversed lower in the last 2 hours, closing the weekly candlestick with a bull body closing around the middle of its range and a long tail above.

Bulls hope the selloff (Dec 19) will form a major higher low relative to May 2025.

They hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They want a reversal from a lower low major trend reversal (relative to Nov 26) and now, a smaller higher low major trend reversal (relative to Dec 25)

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They want the 20-EMA to act as a support level.

The bears got the third leg down to form the wedge pattern (November 13, November 26, and December 19).

They want a retest of the December low from a double top bear flag (Dec 30 and 9 Jan) at the 20-day EMA, even if it only forms a higher low. The earlier retest has a higher low (Jan 5).

If the market trades higher, they want it to form a lower high and the market to reverse below the 20-day EMA.

Fundamentals:

• Production: Production for Jan - SPPOMA first 5 days -34%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 10 days +29%.

Today (Monday, Jan. 12), traders will watch to see if the bulls can create bull bars by trading above the 20-day EMA.

Or would bears be able to get follow-through selling below the 20-EMA instead?

Andrew

9/1/25 Bulls Want Strong Weekly Candlestick

Thursday’s candlestick (Jan. 8) was a bear doji closing below the middle of its range with a long tail above.

In our last report, we stated that traders would watch to see if the bulls could create a strong follow-through bull bar, closing far above the 20-day EMA, or if the market would trade higher but close with a long tail above.

The market traded higher but reversed to retest the 20-day EMA. The market closed slightly off its low.

Bulls hope the selloff (Dec 19) will form a major higher low relative to May 2025.

They hope to get a reversal from a large wedge pattern (Jan 17, May 8, and Dec 19) and a smaller wedge pattern (Nov 3, Nov 26, and Dec 19).

They want a reversal from a lower low major trend reversal (relative to Nov 26) and now, a higher low major trend reversal (relative to Jan 5)

They need to create strong consecutive bull bars trading far above the 20-day EMA to show they are back in control.

They want the 20-EMA to act as a support level.

The bears got the third leg down to form the wedge pattern (November 13, November 26, and December 19).

They want a retest of the December low, even if it only forms a higher low. So far, the retest has reached a higher low (Jan 5).

If the market trades higher, they want it to form a lower high and the market to reverse below the 20-day EMA.

Fundamentals:

• Production: Production for Jan - SPPOMA first 5 days -34%

• Refineries: Buying interest is there at these low prices. Not paying premiums vs spot futures - yet.

• Exports: ITS first 5 days +31%.

Today (Friday, Jan. 9), bulls want a strong bull bar so the weekly candlestick will close near its high, increasing the odds of next week trading at least a little higher.

Bears want a strong bear bar so the weekly candlestick will close with a long tail above, perhaps with a bear body too.

Andrew