PEPE/USDT Pullback After Breakout — Next Move Loading!PEPE is consolidating after a clear structure shift from the previous downtrend. The descending trendline has already been broken and momentum has flipped, which is a good sign.

Price is now pulling back into a strong demand area. This looks like a healthy retracement, not weakness. As long as this zone holds, the bias stays bullish and PEPE has room to continue higher after consolidation.

If this demand fails, the structure becomes weak again and a deeper pullback is likely. Until then, this is simply a reset before the next move.

Pepesignals

Crypto: Risk on! Memes gonna lead, PEPE on the way!Crypto appears to have formed a local bottom, with reversal structures developing across the majority of major assets.

Bitcoin is currently constrained in terms of upside expansion, which increases the probability of capital rotation into altcoins. In this environment, select altcoins are likely to significantly outperform BTC on a relative basis.

Liquidity is stacked higher, and if momentum accelerates, the market may expand aggressively without offering deep pullbacks. From a positioning standpoint, this creates a clear choice: enter at current levels with defined risk, or remain patient and wait for a shallow retracement that may never materialize.

Meme coins are likely to lead the initial phase of the move. While they carry the highest risk profile in the market, they also offer the strongest short-term returns. These should be approached strictly as momentum trades — enter during expansion and exit into strength, as seen in previous cycles (PONKE being a recent example).

Follow for more trading ideas

PePe: Falling Wedge Breakout, Trendline BrokenHi,

PEPE formed a clear falling wedge, which is typically a bullish pattern.

Price has now broken the descending trendline with strong momentum, confirming the breakout.

Previous resistance zone is now acting as support

As long as price holds above this area, upside continuation is likely

A short pullback is possible before the next leg up

Breaking: $PEPE Spike 37% Gearing for 300% SurgeThe price of the notable memecoin on ethereum chain- CRYPTOCAP:PEPE saw its value rise by 37% for the past 24 hours breaking above a bullish symmetrical triangle setting the stage for 300% breakout albeit market drawback.

The memecoin has loss over 72% of its market value for the past 9 months consolidating in a tight symmetrical triangle pattern.

As of the time of writing, CRYPTOCAP:PEPE is up 16% with its RSI at 72, there is more room for CRYPTOCAP:PEPE to capitalise on the bullish symmetrical triangle pattern.

About Pepe

What Is PEPE?

PEPE is a deflationary memecoin launched on Ethereum. The cryptocurrency was created as a tribute to the Pepe the Frog internet meme, created by Matt Furie, which gained popularity in the early 2000s.

The project aims to capitalize on the popularity of meme coins, like Shiba Inu and Dogecoin, and strives to establish itself as one of the top meme-based cryptocurrencies. PEPE appeals to the cryptocurrency community by instituting a no-tax policy and being up-front about its lack of utility, keeping things pure and simple as a memecoin.

Pepe Price Data

The Pepe price today is $0.000006 USD with a 24-hour trading volume of $1,348,293,008 USD. Pepe is up 37.49% in the last 24 hours. The current CoinMarketCap ranking is #36, with a market cap of $2,406,442,835 USD. It has a circulating supply of 420,689,899,653,543 PEPE coins and a max. supply of 420,689,899,653,543 PEPE coins.

PEPE/USDT Trend Shift? Hull MA Break Signals Possible Upside🔥 PEPE/USDT – Hull Breakout Bullish Blueprint | Swing Trade Masterplan 🐸🚀

Asset: PEPE/USDT — “PEPE vs Tether”

Crypto Market Opportunity Blueprint (Swing Trade)

📈 PLAN — Bullish Plan confirmed with Hull Moving Average Breakout 💚⚡

Entry: YOU CAN ENTRY ANY PRICE LEVEL

Stop Loss: This is thief SL @ 0.00000440

Dear Ladies & Gentleman (Thief OG's) Adjust your SL based on your startergy & own risk.

PLACE SL AFTER THE BREAKOUT CONFIRMATION ONLY.

Note: Dear Ladies & Gentleman (Thief OG's) iam not recommended to set only my SL. its your own choice you can make money then take money at your own risk.

🎯 TARGET — Following SMA Resistance + Overbought Zone + Trap Alert ⚠️🔰

Simple Moving Average act as a strong resistance + overbought + trap is there

→ OUR target @ 0.00000570

Note: Dear Ladies & Gentleman (Thief OG's) iam not recommended to set only my TP. its your own choice you can make money then take money at your own risk.

📡 Related Pairs to Watch (Correlation + Key Points) 🔍📊

1️⃣ BINANCE:SHIBUSDT 🐕🔥

High correlation with meme-coin liquidity flows.

When SHIB pumps aggressively, PEPE usually follows due to risk-on behavior in the meme sector.

Watch for SHIB breakout above local resistance → signals strong liquidity returning to meme coins.

2️⃣ BINANCE:DOGEUSDT 🐶⚡

DOGE is the macro driver of meme-coin sentiment.

If DOGE shows HMA / SMA breakout, PEPE often mirrors with delayed volatility.

Large spikes in DOGE funding rates = PEPE momentum probability increases.

3️⃣ BINANCE:FLOKIUSDT 🐺💥

FLOKI often leads mid-cap meme rotation cycles.

When FLOKI rallies, PEPE tends to follow after short consolidation → swing traders use this correlation.

4️⃣ CRYPTO:WIFUSD (Solana Meme Leader) 🐕🦺🚀

A strong SOL ecosystem rally pulls meme funds from multiple exchanges.

PEPE benefits from cross-chain meme rotation once WIF volatility cools off.

5️⃣ BINANCE:BTCUSDT & BINANCE:ETHUSDT (Macro Drivers) 🧠📉📈

If BTC ranges & ETH strengthens → altcoins, esp. memes, get liquidity boost.

PEPE breakout success rate increases when:

BTC volatility is low

ETH shows positive funding rates

🧩 Summary for Traders (High Engagement Style)

PEPE preparing bullish continuation with Hull MA breakout 🔥

SMA resistance near target = take profits wisely

SL only after confirmation—Thief OG style 🕶️💼

Watch correlated meme-pairs for early signals

Liquidity rotation across SHIB → FLOKI → PEPE remains strong

PEPEUSDTWe are currently in a corrective phase after the latest bull trend. I believe the price is in the final steps of this downward correction, and if the market breaks above the 0.00000600 level, it could trigger a strong upward move in the next phase.

#pepe #pepeusdt CRYPTOCAP:PEPE KRAKEN:PEPEUSD BINANCE:PEPEUSDT

PEPE: Bearish Structure After Major Reversal PatternInitially, PEPE showed a powerful impulsive rally formed through an inverse Head and Shoulders reversal pattern. However, at the top a clear Head and Shoulders pattern has appeared, signaling a potential macro reversal.

Locally, the price is forming a bearish flag , which supports the continuation of the downtrend. Based on the current market structure, I do not recommend buying PEPE at these levels.

My expected downside target:

➡️ 0.000002 – 0.0000016 USDT zone

#PEPEUSDT: Big Move Is Coming, Comment Down Your ViewsI hope you are having a good weekend.

Let us focus on the current state of the cryptocurrency market. We have identified a key pattern in the BINANCE:PEPEUSDT which suggests a potential transition from an accumulation phase to a distribution phase.

We recommend waiting for price confirmation such as a break through the straight trend line and subsequent liquidity. Once this is confirmed, we suggest waiting for a price retracement and retesting the area which would serve as the second confirmation.

This is our analysis and not a guaranteed move. Please conduct your own research before making any changes.

Team Setupsfx_

PEPEUSDT Bullish setup 4HBINANCE:PEPEUSDT is showing early signs of a trend reversal on the 4H timeframe. Price has reclaimed the mid-band of the volatility channel and is holding above the short-term EMA ribbon – a key bullish confluence suggesting buyers are slowly regaining control. Momentum is shifting upward with higher lows building and volatility compression hinting at an upcoming expansion.

I’ve aligned my targets with the Fibonacci extension levels:

🔹 TP1 – 38.2% Fib: ~0.000004948

🔹 TP2 – 61.8% Fib: ~0.000005176

🔹 TP3 – 100% Fib: ~0.000005400–0.000005540 zone

As long as price stays above the lower channel support and maintains its ascending structure, the upside remains favored. A break and close above the mid-range resistance could accelerate the move toward the 100% Fib target at 54.

PEPE/USDT : BUY LIMITHello friends

Well, you can see that after the price fell, it was able to rise by buyers. Now we have an important area where this resistance needs to be broken for the trend to change and the price to rise.

This analysis is purely technically reviewed and is not a buy or sell recommendation, so avoid emotional behavior.

*Trade safely with us*

PEPE ($PEPE) Faces a Major Market Turning PointPEPE ( CRYPTOCAP:PEPE ) trades at $0.0447 after heavy weekly and monthly declines. Market sentiment across memecoins remains fragile, and PEPE now depends almost entirely on liquidity trends in Bitcoin and Ethereum. When the majors gain momentum, capital rotates into high-risk assets. When they stall, memecoins weaken. This dynamic shapes every PEPE cycle.

Launched in April 2023 with no roadmap or utility, PEPE remains driven purely by community strength, social buzz, and viral momentum. The formula has not changed: hype brings rallies, silence brings retracements. The community still influences every swing, and traders monitor whether new waves of attention can revive demand in a competitive memecoin landscape.

Market Drivers for PEPE in 2025

Two forces will determine whether PEPE stays relevant: memecoin sentiment and broader market conditions. If Bitcoin and Ethereum regain bullish structure, liquidity can quickly flow into PEPE. This effect has repeated in each cycle since the token’s launch. Social media hype adds fuel, especially during periods when traders chase volatility.

But competition grows. New memecoins appear daily, and capital rotates rapidly. Without fundamentals or utility, PEPE must rely on community engagement, visibility, and trader appetite for speculative moves.

Technical Outlook: Bears Still in Control

PEPE’s chart shows clear weakness. A confirmed head-and-shoulders structure points toward a target near $0.00000185, matching long-term accumulation zones identified by analysts. The crucial support at $0.0000059 broke and flipped into resistance, signaling continued bearish pressure until reclaimed.

Additional technical signals support this view:

Weekly imbalance partly filled

Multi-month liquidity swept

Lower-high structure intact

Support-to-resistance flip validates downside bias

A deeper drop of 60–70% remains possible if sellers maintain control. Yet long-term traders view this zone as an early accumulation area, similar to previous bottom formations that produced massive rallies. A decisive close above $0.0000059 would invalidate the bearish setup and signal a possible trend reversal.

PEPEUSDT - The real market indicator?Did you know that PEPE’s chart gave a very strong early signal of the massive crash that happened on October 10th?

It had formed a huge Head and Shoulders pattern, and the target of that pattern was exactly the lowest point reached on October 10th.

Not only that — there was also a massive Death Cross on the 3-day chart, where the 100 EMA crossed below the 25 EMA — a textbook bearish confirmation.

The result?

The pattern played out perfectly, leading straight to the crash on October 10th.

Now, if we use PEPE as a market indicator, things don’t look good — its main trendline (starting from October 23rd two years ago ) has broken, retested, and is heading lower, signaling more downside pressure.

So what do you think?

— have we officially entered a bear market? , or is PEPE just moving independently from the rest of the market?

Drop your thoughts in the comments 👇

Best Regards:

Ceciliones🎯

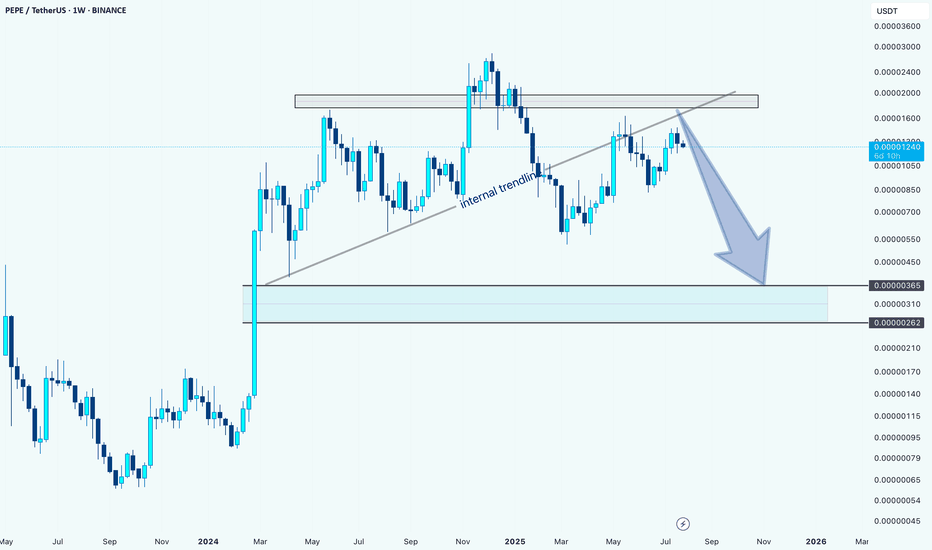

PEPEUSDT: Bearish Outlook After Internal Trendline BreakHello guys.

PEPE has tested the internal trendline multiple times and finally broke below it, signaling potential weakness. Price also failed to reclaim the key supply zone above.

Internal trendline broken

Rejection from a key supply zone

Potential move toward the demand zone around 0.00000262–0.00000365

Unless bulls reclaim the broken trendline and break above the recent highs, the bias remains bearish with a possible continuation to the downside.

BUY AND HOLDHello friends

Given the potential and good support that this currency has, with the growth of Ethereum, it can experience another upward rally. Now that the price has corrected, you can buy in steps with capital and risk management and move with it to the specified goals.

Note that the holding period is at least 3 months, so be patient and observe capital management.

*Trade safely with us*

PEPEUSD Can the 1W MA100 make it skyrocket?Pepe (PEPEUSD) has been trading within an aggressive Channel Up from its very first trading day. Since the May 2025 High though, it has been basically trading sideways, consolidation possibly before the next big move.

As long as the 1W MA100 (green trend-line) is holding (which has been tested just this week), there are more probabilities for this move to be upwards. The fact that the 1W CCI is approaching is -100.00 oversold barrier, further supports this notion.

The last similar consolidation at the bottom of this pattern was from Sep 2023 to Feb 2024 and delivered a massive Bullish Leg that breached the 2.618 Fibonacci extension. As a result, if the pattern doesn't break, we might see 0.00010 as this Cycle's Top.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

PEPE at the Edge of Disaster or the Start of a Monster Reversal?Yello Paradisers, is PEPE about to break free from its falling wedge or are we staring at another brutal sell-off? After weeks of pressure to the downside, price is now testing the $100–$105 demand zone. This level has been the battleground where bulls and bears repeatedly clash, and the move from here could decide the next big trend.

💎A confirmed breakout above descending resistance would validate the wedge pattern and open the path higher. The first target sits at $1184, with possible continuation into the $1240–$1271 supply zone as momentum builds. This would mark the beginning of a powerful shift in market structure.

💎On the other hand, failure to hold demand and a breakdown below $947 would invalidate the bullish setup completely. In that scenario, selling pressure would accelerate as trapped longs get forced out, driving price into deeper lows.

💎This is a textbook example of why patience is crucial. Jumping in too early means risking a trap, while waiting for confirmation allows you to act only on the highest-probability setups. The market is coiling for a big move, but only those who stay disciplined will come out on the winning side.

Trade smart, Paradisers. Consistency and patience always beat emotions. The winner circle is reserved only for those who know how to wait.

MyCryptoParadise

iFeel the success🌴