Phbusdtlong

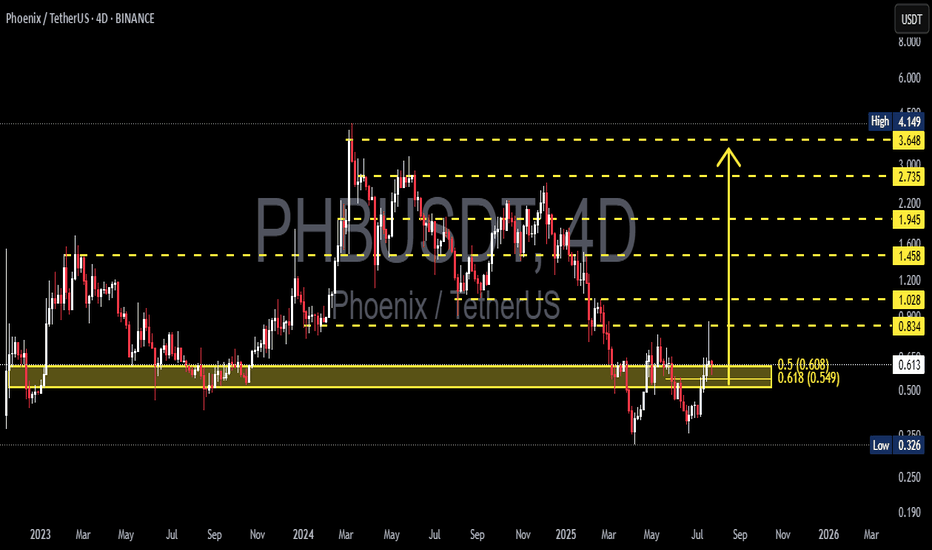

PHB/USDT — Holding the Demand Zone, Awaiting Major Breakout?Currently, PHB/USDT is consolidating within a critical demand zone at 0.52 – 0.62. This area has repeatedly acted as a strong floor since 2023, absorbing heavy sell-offs and showing signs of accumulation.

The market structure suggests that PHB is forming a range-base accumulation pattern, with 0.711 as the immediate breakout trigger. The next move will decide whether PHB transitions into a bullish expansion or breaks down into deeper bearish territory.

---

🔹 Structure & Price Pattern

Demand zone (0.52 – 0.62): A key support level where buyers continue to defend strongly.

Cluster highs near 0.711: A liquidity level and breakout confirmation point.

Layered resistances above: 0.834 → 1.028 → 1.458 → 1.945, serving as potential take-profit zones.

Deep wicks to 0.326 in the past: Indicate capitulation events, followed by strong reclaim — a bullish sign as long as demand holds.

---

🟢 Bullish Scenario

If PHB closes above 0.711 (4D candle) with volume confirmation, a breakout rally may follow.

Upside targets:

1. 0.834 (minor resistance)

2. 1.028 (psychological resistance)

3. 1.458 (major resistance, strong take-profit area)

A confirmed breakout signals the end of long consolidation and a possible start of a bullish phase.

---

🔴 Bearish Scenario

Failure to break 0.60–0.62 / 0.711 may push PHB back toward 0.55 – 0.52.

If 0.52 breaks on a 4D close, PHB risks a deeper drop toward:

1. 0.50

2. 0.45

3. 0.37 – 0.326 (historical low)

A breakdown below 0.52 would confirm that buyers lost control, re-opening a bearish trend.

---

📌 Trading Strategy & Risk Management

Swing traders: Consider long entries near 0.55–0.58 with targets at 0.711+.

Breakout traders: Wait for a confirmed close above 0.711 before entering, targeting resistances above.

Stop loss: Below 0.52 to protect against deeper downside.

Maintain a Risk:Reward ratio ≥ 1:2 and use 4D candle closes for confirmation to avoid fakeouts.

---

✨ Conclusion

PHB is at a make-or-break level:

Holding above 0.52–0.62 keeps bullish momentum alive, with breakout potential toward 0.834–1.458.

Losing this demand zone could open the path back to 0.37–0.326 lows.

This is a critical crossroads — a breakout could mark the start of a new bullish cycle, while a breakdown signals renewed weakness.

#PHBUSDT #PHB #Phoenix #CryptoAnalysis #PriceAction #AltcoinAnalysis #CryptoTrading #SupportResistance #DemandZone #Breakout #BullishScenario #BearishScenario #SwingTrading

PHB / USDT : Looking bullish..Waiting for box breakoutPHB/USDT has broken above its trendline resistance after a period of consolidation. This breakout is showing strong potential, and if momentum sustains, price could rally toward the $0.80–0.85 zone.

Best approach: Wait for confirmation on retest or a strong bullish candle with volume before entering to avoid fake breakouts. Always manage risk properly.

PHBUSDT Bounces from the Golden Pocket?🧠 Market Context & General Analysis

Phoenix (PHB) is currently at a critical juncture in its market structure. After a prolonged downtrend from its 2024 highs, price has now reacted strongly off a key Fibonacci Golden Pocket retracement zone (0.5–0.618), which also aligns with a historically respected demand area.

This level is not just a technical formality – it’s a zone where smart money typically enters, and historically it has provided reliable bullish reversals.

---

📍 Key Zones to Watch

🟨 Demand / Accumulation Zone:

0.549 – 0.608 → Fibonacci 0.5–0.618 + Historical support

⤷ Has been retested and shows early signs of a bullish reaction.

📈 Layered Resistance Zones (Fibonacci Targets):

0.834 → Minor resistance + potential double bottom neckline

1.028 → Previous structural resistance

1.200 → Psychological round level

1.458 → Key Fibonacci extension

1.945 – 2.735 – 3.648 → Mid/long-term Fibonacci targets

4.149 → All-Time High (ATH) on this chart

🔻 Major Support if Breakdown Occurs:

0.326 → Historical bottom / last line of defense

---

🧩 Pattern Formation: What’s Emerging on the Chart?

🔄 Potential Double Bottom:

Price structure is showing signs of a potential reversal formation in the form of a double bottom near the 0.55–0.61 zone. A confirmed breakout above the neckline at 0.834 would validate this bullish setup.

📉 Broken Downtrend Channel?:

PHB was previously trading in a downtrend channel. The current move suggests a possible breakout and the beginning of a trend shift or accumulation phase.

---

✅ Bullish Scenario: The Rise of the Phoenix

If the price holds above 0.608 and confirms with a strong breakout above 0.834, a bullish trend reversal could follow.

🚀 Short-term targets: 0.834 → 1.028

🔥 Mid-term targets: 1.200 → 1.458 → 1.945

🌕 Long-term potential: 2.735 – 3.648 – 4.149

Validation Key: Break above 0.834 with strong volume

Bullish confirmation candle: Bullish engulfing / Marubozu on 4D or Daily

---

⚠️ Bearish Scenario: Breakdown Threat Looms

If the price fails to hold the 0.549 support level, we could see a continuation of the downtrend, potentially targeting:

💀 First stop: 0.45 – 0.40 zone

🧊 Extreme case: Drop toward 0.326 (historical low)

Breakdown Confirmation:

Daily or 4D close below 0.549

Followed by selling volume and no quick recovery

---

🎯 Potential Trading Strategies (Not Financial Advice):

🟢 Bullish Swing Entry: Buy zone at 0.55–0.61

⤷ Targets: 0.834 – 1.028

⤷ Stop-loss: Below 0.52 (close basis)

🔴 Breakout Trade: Enter on breakout above 0.834 with volume

⤷ Targets: 1.200 – 1.945

⤷ Stop-loss: Below 0.80

🔵 Bearish Play / Re-entry: Short if break below 0.549

⤷ Targets: 0.40 – 0.326

⤷ Stop-loss: Above 0.60

---

🧲 Final Thoughts

PHBUSDT is in a make-or-break zone, sitting atop the Golden Pocket and showing early bullish momentum. If buyers step in and maintain the momentum, we could be witnessing the early stages of a significant market reversal.

However, failure to hold the key support at 0.549 would likely shift the sentiment back into bearish territory. Volume and confirmation candles will be the deciding factor for the trend’s next direction.

#PHBUSDT #PhoenixCrypto #AltcoinReversal #GoldenPocket #CryptoTA

#FibonacciLevels #BullishSetup #BearishBreakdown #ChartPatterns

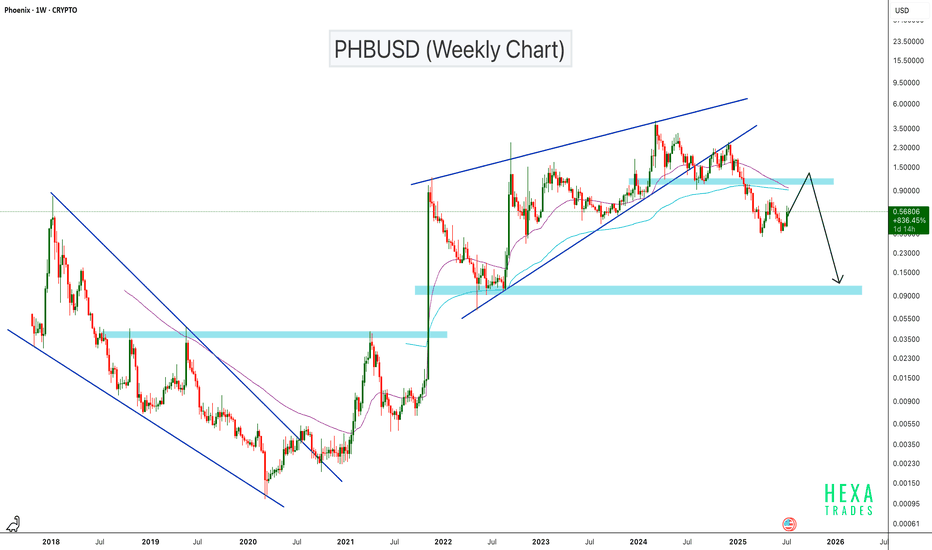

PHBUSD Breakdown: Rising Wedge Signals Bearish ContinuationPHBUSD has broken down from a rising wedge pattern on the weekly chart, signaling a potential trend reversal. The price is currently attempting a retest of the previous support zone at the $1.00–$1.20 level, which is now likely to act as resistance. If this retest fails, it could confirm a bearish continuation setup, with the next key support zone around $0.10. This level has previously acted as a major base and could serve as the next downside target

BINANCE:PHBUSDT AMEX:PHB

PHB/USDT trendline breakout alertPHB/USDT trendline breakout alert

PHB has broken above a key descending trendline, signaling a potential shift in momentum from bearish to bullish. Trendline breakouts often indicate the end of a correction or consolidation phase and the beginning of a new trend.

If PHB holds above the breakout level with increasing volume, it could lead to further upside. However, a drop back below the trendline may invalidate the breakout and signal a false move.

Key levels to watch:

* Retest of the broken trendline as support

* Immediate resistance overhead

* Volume confirmation for strength

Monitor PHB closely — this breakout could be the start of a trend reversal if confirmed.

PHB/USDT Breakout IdeaPHB/USDT has confirmed a breakout on the daily timeframe. This technical movement suggests that we could see a strong bullish trend in the coming days. Traders should watch for key support and resistance levels as this momentum develops. Remember, this is not financial advice; always do your own research (DYOR) before making any investment decisions.

PHBUSDT 1H TF (Divergence, Harmonic AB=CD)PHBISDT shows a price reversal pattern at 1H TF with divergence and harmonic AB=CD with 50% fib level shows a price target up to TP5. All TP's are taken at 1:1.

Trade Plan

Entry @ Buy Stop

Stop Loss @ LL

TP1 to TP5 @ 1:1 to 1:5

What do you think, will it hit TP5?