PLTR $162.5C — Smart Money Loading, Can Price Catch Up?"

# 🔥 PLTR Weekly Trade Setup (2025-09-07)

**Bias:** 📉 Neutral-to-Slight Bearish (price action)

**But...** 📊 Options Flow = Strongly Bullish (C/P 1.66)

**Conviction:** ⭐⭐ (50% speculative)

---

### 📊 Key Takeaways

* ❌ **Momentum:** Daily RSI 36.3 falling → bearish pressure

* ❌ **Volume:** 0.8× avg → no institutional confirmation

* ✅ **Options Flow:** Strongly bullish (C/P 1.66) → divergence vs price

* ✅ **Volatility:** Low (VIX \~15.2) → cheap calls, low gamma risk

* ⚖️ **Consensus:** Most models = *no trade*, but speculative call flow play is possible

---

### 🎯 Trade Plan (Speculative Flow Play)

* **Instrument:** \ NASDAQ:PLTR

* **Direction:** CALL (naked)

* **Strike:** \$162.50

* **Expiry:** 2025-09-12 (weekly)

* **Entry Price:** \$0.96 (ask)

* **Profit Target:** \$1.60

* **Stop Loss:** \$0.48

* **Size:** 1 contract (small, strictly sized)

* **Entry Timing:** Open

---

### 🧠 Rationale

* Options traders buying aggressively → possible **short-squeeze / bounce**.

* Weak volume + bearish RSI = technical headwind.

* This is a **tactical, high-risk punt**, not a conviction swing.

---

### ⚠️ Key Risks

* 📉 Downtrend may dominate → option decays fast.

* ⏳ 5 DTE = heavy theta decay midweek.

* 💸 Spread/slippage risk at open.

* 📰 Macro/news can flip flow instantly.

---

## 📌 TRADE DETAILS (JSON)

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 162.5,

"expiry": "2025-09-12",

"confidence": 0.50,

"profit_target": 1.60,

"stop_loss": 0.48,

"size": 1,

"entry_price": 0.96,

"entry_timing": "open",

"signal_publish_time": "2025-09-07 06:53:26 EDT"

}

```

---

🔥 **Summary:**

This is a **flow vs. trend battle.**

Price says bearish 📉, options traders say bullish 📈.

Take the \$162.5C as a **small-size speculative punt** → defined risk, fast exit.

Pltrhold

PLTR Gamma Risk High – Is This the Perfect Time for Puts? 📉 PLTR One-Day Put Play – Failed Breakout Turns Bearish

**Sentiment:** 🔻 *Bearish to Neutral*

* **Daily RSI:** 72.7 ⬇️ (falling from overbought)

* **Weekly RSI:** 83.0 ⬇️ (weakening momentum)

* **Volume:** 0.8× last week → low institutional conviction

* **C/P Ratio:** 1.05 (neutral flow)

* **Gamma Risk:** HIGH — expiry in 1 day

* **Time Decay:** Accelerating ⚠️

---

### 📊 **Consensus Snapshot**

✅ All models agree momentum is fading

✅ Weak volume + falling RSI = bearish bias

⚠️ Gamma risk means tight stop-loss & active monitoring

---

### 🎯 **Trade Setup**

* **Type:** PUT (Short)

* **Strike:** \$177.50

* **Expiry:** 2025-08-15

* **Entry:** \$0.69

* **Profit Target:** \$1.00 (+45%)

* **Stop Loss:** \$0.35 (–50%)

* **Confidence:** 70%

* **Entry Timing:** Market open

---

💬 *This is a 24-hour bearish momentum play — watch price action closely.*

📌 *Not financial advice. DYOR.*

---

**#PLTR #OptionsTrading #PutOptions #TradingSignals #GammaRisk #StocksToWatch #DayTrading #OptionsFlow**

PLTR Bulls Unstoppable? Key Levels You Can’t Ignore! 🚀 PLTR Swing Trade Setup (2025-08-09) 🚀

**Bias:** 📈 **Cautious Bullish** — momentum strong, RSI hot, but volume light = high risk at highs.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:PLTR

* **Type:** CALL (LONG)

* **Strike:** \$212.50 (slightly OTM)

* **Entry:** \$0.85 (open)

* **Profit Target:** \$1.27 (+49%)

* **Stop Loss:** \$0.59 (-30%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 70%

**📊 Key Notes**

* RSI 84.2 → extreme overbought 🚨

* Multi-timeframe momentum ✅

* Weak volume = low institutional conviction ❌

* Resistance ahead — watch \$175-\$180 pullback zone for safer reload

* Mixed analyst models: some say “wait,” others say “small bullish”

PLTR Next Move? **PLTR — Weekly Trade Idea (Aug 8, 2025)**

🚀 **Strong Bullish Momentum** — Daily RSI: 81.2 / Weekly RSI: 79.0

📈 **Volume Surge** — +70% vs last week, strong institutional backing

📉 **Low Volatility** — VIX at 15.8 supports bullish setups

⚠️ **High Gamma Risk** — 0DTE options, rapid time decay today

**Trade Plan:**

* **Type:** Buy Call (190 Strike)

* **Expiry:** Aug 8 (0DTE)

* **Entry:** \$0.39 at open

* **Target:** \$0.78 (100% gain)

* **Stop:** \$0.16 (-40%)

* **Confidence:** 75%

* **Tip:** Manage size carefully; close before EOD to avoid decay crush

PLTR Earnings About To Print

## 🚨 PLTR Earnings Incoming: +80% Confidence Call Setup into AI Boom 🚀

**🧠 Palantir Technologies (PLTR) Earnings Analysis – August 8, 2025 (AMC)**

**📈 Position:** \$165 Call | 🎯 Entry: \$6.45 | 💰 Target: \$22.58 | 🛑 Stop: \$3.23

**🕒 Entry Timing:** Pre-Earnings Close | Expiry: Aug 8, 2025

---

### 🔍 Quick Breakdown:

* 📊 **Revenue Growth:** +39.3% TTM – AI sector leadership

* 💰 **Margins:** 80% Gross | 19.9% Operating | 18.3% Net

* 🧾 **EPS Beat Rate:** 88% | Avg Surprise: +10.7%

* 📉 **Debt-to-Equity:** 4.43 – watch rates & debt risk

* 📈 **RSI:** 66.88 – strong momentum, near breakout

* 📊 **Volume:** Above average – institutional accumulation

* 🧠 **Options Flow:** Heavy \$165/\$170 call OI = bullish gamma exposure

* 🛡️ **Support:** \$151.94 | 📌 Resistance: \$161.24

* 🔭 **Macro Tailwinds:** AI + defense demand + sector rotation into tech

---

### 🧠 Trade Thesis:

Strong fundamentals + bullish options flow + tech sector tailwinds = **High-probability breakout**

🧨 **IV Rank: 0.75** – Big move priced in

💡 Likely to squeeze if results exceed expectations

---

### 💼 Trade Setup (Recap):

```

💎 Ticker: NASDAQ:PLTR

🔔 Direction: Long Call

🎯 Strike: $165

💵 Entry: $6.45

🎯 Profit Target: $22.58 (250%+)

🛑 Stop Loss: $3.23

📅 Expiry: 2025-08-08

📆 Earnings: August 8 (AMC)

🧠 Confidence: 80%

```

---

### 📌 Hashtags for TradingView:

```

#PLTR #EarningsPlay #AIStocks #TechMomentum

#OptionsTrading #GammaSqueeze #CallOptions

#UnusualOptionsActivity #Palantir #EarningsSetup

#TradingViewIdeas #VolatilityPlay #RiskReward

#AI #DefenseStocks #SwingTrade

```

---

💬 **TL;DR:** PLTR earnings are set to rip. Revenue surging, margins healthy, call options stacked, and momentum rising. Are you in before the AI-driven explosion?

PLTR WEEKLY TRADE IDEA – AUG 2, 2025

📈 **\ NASDAQ:PLTR WEEKLY TRADE IDEA – AUG 2, 2025** 📈

⚡️ *Earnings Week Setup – Mixed Signals, But Bullish Flow*

---

🧠 **SENTIMENT SNAPSHOT**

• Call/Put Ratio: **2.29** = Bullish

• Volume Ratio: **1.1x** = Weak breakout support

• VIX: **20.38** = Normal vol, clean setups possible

📉 **RSI DIVERGENCE WARNING**

• Daily RSI: **56.3 (falling)** – losing steam

• Weekly RSI: **71.2 (overbought + falling)** – 🔻Bearish divergence

➡️ *Momentum fading, caution advised*

📊 **INSTITUTIONAL FLOW**

• Strong call buying ahead of earnings

• But... price not confirming = possible **profit-taking**

⚠️ **EARNINGS RISK ALERT**

• Earnings = this week

• Could inject volatility or invalidate setup – size small & use stop

---

🔥 **TRADE IDEA** 🔥

🟢 Direction: **CALL (LONG)**

🎯 Strike: **\$160**

💰 Entry: **\$6.80**

🏁 Target: **\$12.25** (80%+ gain)

🛑 Stop Loss: **\$3.40** (50% risk)

📆 Expiry: **08/08/2025**

⚖️ Confidence: **65%** (moderate risk, macro-backed)

⏰ Timing: **Buy Monday Open**

---

🔎 **STRATEGY TAGS**:

\#PLTR #WeeklyOptions #EarningsPlay #MomentumTrade #SmartMoneyFlow

---

📌 Final Thoughts:

Mixed momentum + strong call volume = **potential breakout**, but **momentum cracks** say **don’t chase blindly**. Small size, tight stop, defined risk = smart approach here.

🚀 *Save + Follow for more option setups each week!*

PLTR WEEKLY TRADE IDEA (07/28/2025)

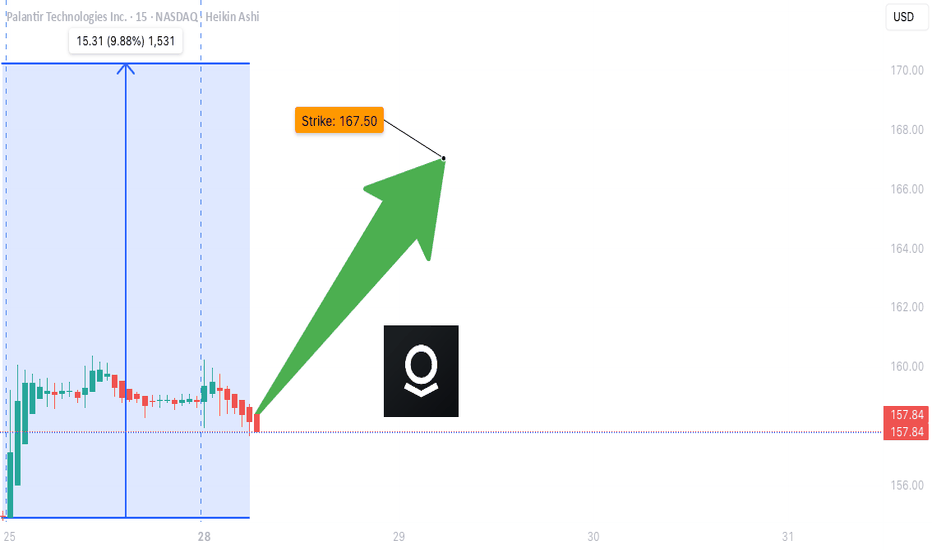

**🚀 PLTR WEEKLY TRADE IDEA (07/28/2025) 🚀**

**Momentum is 🔥 but Volume is the Missing Ingredient**

---

📈 **Momentum Snapshot:**

* **Daily RSI:** 71.9 ⬆️ (🚨 Overbought but still rising)

* **Weekly RSI:** 76.7 ⬆️ (📢 Clear Bullish Strength)

➡️ *Strong upside pressure, but entering the overbought zone*

📉 **Volume Insight:**

* Weekly Volume = **0.8x last week**

⚠️ *Weak institutional conviction during the breakout = yellow flag*

🔍 **Options Flow Check:**

* **Call/Put Ratio:** 1.09 = *Neutral*

➡️ Balanced flow = *no aggressive buying yet*

🌪️ **Volatility Environment:**

* **VIX = 15.4**

✅ Favorable for directional trades — low IV supports premium growth

---

📊 **Model Consensus Recap:**

✅ Bullish RSI momentum (unanimous)

✅ Volatility ideal for long calls

⚠️ Volume flagged as a concern by some models

📌 Final stance: **MODERATE BULLISH**

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Buy CALL Option

* **Strike:** \$167.50

* **Expiry:** Aug 1, 2025

* **Entry Price:** \~\$0.74

* **Profit Target:** \$1.48 (🟢 2x return)

* **Stop Loss:** \$0.37 (🔻-50%)

📆 **Entry Timing:** Market Open Monday

📦 **Size:** 1 Contract

---

⚠️ **Key Risks to Watch:**

* 📉 Weak volume = possible consolidation before next leg up

* ⏳ Premium decay risk into expiry

* 📊 No strong institutional footprint = stay nimble

---

📌 **JSON FORMAT TRADE DETAILS (Automation Ready):**

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 167.50,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.48,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.74,

"entry_timing": "open",

"signal_publish_time": "2025-07-28 10:13:40 EDT"

}

```

---

🔥 TL;DR:

* Momentum is undeniable ✅

* Volume = suspect 🟡

* VIX = Green light for directional play ✅

💬 **\ NASDAQ:PLTR Bulls, are you ready or waiting for volume confirmation?**

\#PLTR #OptionsTrading #BullishSetup #UnusualOptions #MomentumPlay #TradingView #StockMarket

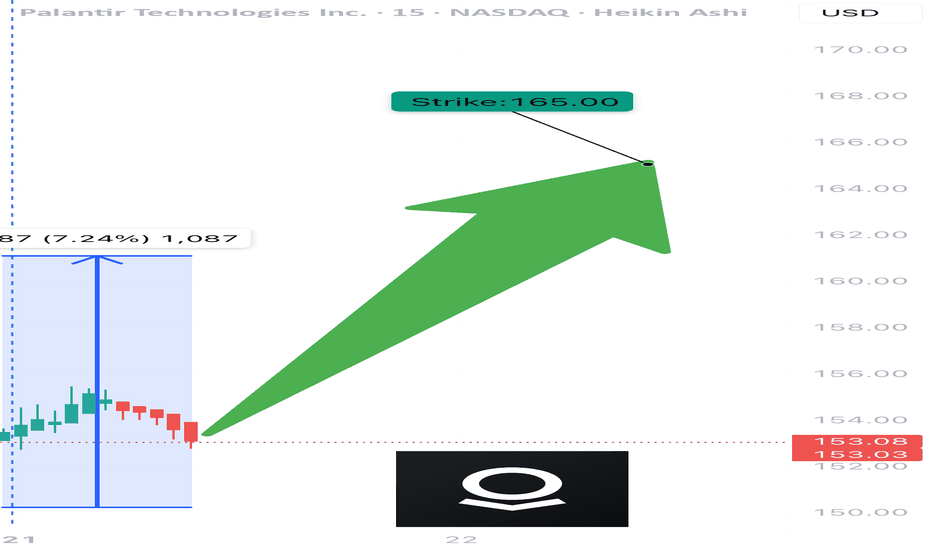

PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025

🔥 NASDAQ:PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025 🔥

Bullish Momentum + Strong Options Flow = Prime Setup 📈

⸻

📊 TRADE SETUP

🎯 Instrument: NASDAQ:PLTR

📈 Direction: CALL (LONG)

💵 Strike Price: $165.00

🟢 Entry Price: $0.59

🛑 Stop Loss: $0.30 (50% risk cap)

🎯 Profit Target: $1.18 (2x reward)

📅 Expiry: July 25, 2025 (Weekly)

📏 Size: 1 contract

💪 Confidence: 75%

⏰ Entry Timing: Market Open

⸻

📌 Why This Trade?

✅ RSI Strength: Daily RSI = 71.0 | Weekly RSI = 75.3 → Bullish continuation

✅ Weekly Range Positioning: Trading at 96.6% of weekly high

✅ Options Flow: Call/Put ratio = 1.47 — institutional bullish bias

✅ Strike Interest: Heavy OI @ $162.50 & $165.00 = strong magnet zones

🟡 VIX = 16.6 → Favorable volatility for short-term premium plays

⚠️ Volume is flat (1.0x) — no surge confirmation, so keep stops tight

⸻

🧠 Execution Plan

• Open position at the bell

• Mental stop at -50%, or ~$0.30

• Target 100% return = ~$1.18

• Exit ahead of Friday’s expiration unless the trade hits target early

⸻

💡 Key Levels to Watch

🔹 Resistance Zone: $155.68 – $156.59

🔹 Support Watch: Below $152 could break structure

🔹 Earnings Risk: Check calendar — volatility can spike unexpectedly

⸻

🏁 Verdict

• Momentum = 🔥

• Flow = 🚀

• Volume = 😐

➡️ Net Bias: MODERATE BULLISH — Risk-managed call with solid R:R

⸻

NASDAQ:PLTR Call @ $165 — Entry $0.59 → Risk $0.30 → Target $1.18 💥

Clean setup for disciplined bulls. Don’t overstay. Ride momentum. 🎯

⸻

#PLTR #OptionsTrading #WeeklyOptions #MomentumPlay #CallOptions #FlowTrade #TradingView #StockSignals #TradeSetup #RiskReward #SwingTrade #SmartMoneyFlow

I CALLED THE $PLTR TOP! Down 8% since. Here's where we are goingNYSE:PLTR

CALLED THE NYSE:PLTR TOP AS WELL! Down -8% since. Here's where we are going

The thesis explained below:

1.) Williams R% had a down slop if you drew a line from the 01JUL2024 top to the most recent 21OCT2024 top. It hit this top 4 times since the first one and everyone was lower indicating resistance and lower tops.

2.) You have a Multi-year CUP on the weekly without a handle formed. We need to form that handle before we go higher that coupled with valuation and the stock price getting ahead of the company's numbers is another reason that plays into this.

3.) The handle would be a perfect little handle with a Volume profile gap fill down to the next volume shelf at $36.50-$37.50.

4.) RSI was in overbought area and finding multiple tops with resistance. Also, it was hitting and rejecting off the same top as previous ATH's back in Jan2021.

5.) Double top on the stochastic and red through yellow downward.

6.) Just shows the date I called it out which was Sunday. Also, time stamped on my repost here. 😁

Thanks for reading! I hope you enjoyed my reanalysis of a thus far predicted pullback. It may not hit my target but that's not the point. The point is being able to realize when something is lining up to turn against you or turn with you to the upside. Also, to realize the fakeouts in the market like what I believe the pullback is on the NASDAQ:QQQ which I made an in depth video going into depth about just like this one. It's pinned on my profile if you haven't seen it yet.

LIKE l FOLLOW l SHARE

NFA

PShort

$PLTR Rapidly Approaching TP1NYSE:PLTR has been extremely bullish since Sept. 25 and has been in a strong uptrend after breaching the orange resistance level. The next key price target, the light blue resistance line, is rapidly approaching. PLTR is a war stock that is benefitting from the new Israel Palestine conflict. Other key events this week are September PPI inflation data and Fed meeting minutes on Wednesday October 11. I think the markets are likely to have some sideways price action on Tuesday in anticipation of the new inflation and fed data.

PLong

$PLTR Quarter 3 (Q3) AnalysisPLTR has been extremely bullish, and just received a $250 million contract from the US Army this week. I think PLTR has been a very bullish stock in 2023, and I believe PLTR will have a monster Q4 performance. My key price targets are $28.33 and $37. There is short-term resistance at $19.11, but I believe PLTR will break above $19 in Q4.

PLong

PLTR: Heading to 40+All signs point to up for PLTR. We are in the early stages of wave 3. Nice breakout of the inverse H&S formation on heavy volume.

PLong

PLTR would wait to close above 23.10 to go longPalentir tried to breakout on Friday. But close was weak. Now need to show bulls are in control. Close above 23.10 will likely take it to upside targets (resistances) at 26.30, 28 or 30. Support at trend line, 21.30, 20.90 and last 19.40. Close below 19.40 more downside.

P

What we can expect from PLTR?Hello Guys, I would like to introduce to you my idea about the future of PLTR . I am a holder of 1000 shares from 24.01$ and I am long till a minimum of 200$.

After the last week, we got few red days including yesterday, but as an Elliott wave trader, I can see an opportunity to jump in as like in AMC, I think we reached the bottom as you can see we already bounced few times from the support lane. After carefully checked the Fibonacci lvls, you can see that we bounced exactly from 61,8 for the 2nd wave of Elliot. The question is when we will start the Gamma Squeeze, maybe it will be on 19/3 ?!?, who knows. But in my opinion, the Gamma squeeze will be the 3 wave of the daily Elliot, till 81$ - 117$ range, It all depends to us, how long we will keep our Dimond hand.

Just HOLD Guys, we can make it <3

PLong

PLTR LongSo much confluence on this setup, with a good market sentiment and momentum i think it will have a huge run in no time. Very high watch for me, currently loading in the entry zone for starter position, will have a full position on the break of the wedge with volume. Happy trading :)

PLong

PLong