Pltrlong

Palantir (PLTR) Bulls Preparing for Takeoff — Setup Explained💎 PALANTIR TECHNOLOGIES INC. (PLTR) — Swing Trade Profit Playbook 💎

Exchange: NASDAQ

Style: Swing Trade | Thief Layering Strategy | Bullish Pullback Setup

🧭 PLAN

We’re plotting a bullish pullback setup confirmed by the Hull Moving Average and a Heikin Ashi reversal doji — signaling that buyers are regaining strength and getting ready to dominate again. 💪📊

This setup thrives when the crowd is sleeping — that’s when the thief plans the perfect entry on discount zones! 🕶️💸

🎯 ENTRY STRATEGY — “THIEF LAYERING SYSTEM”

Instead of chasing green candles, this strategy stacks multiple buy limit layers to build position quietly and efficiently. Each layer grabs value from dip zones — just like a thief collecting gold coins on the way down! 🏴☠️💰

Layered Entry Plan:

🔹 1st Layer: $175 — early scout entry, feel the market reaction.

🔹 2nd Layer: $180 — main position loading zone near Hull MA support.

🔹 3rd Layer: $185 — continuation confirmation layer if trend holds.

🔹 4th Layer: $190 — momentum add-on for breakout confirmation.

👉 You can add more layers if volatility gives deeper discounts. Adjust according to your risk profile — precision is key, greed is optional! 🎯

🛑 STOP LOSS

This is the Thief SL at $165 — clean, disciplined, and below the recent structural support.

⚠️ Note to all Thief OG’s: This isn’t a fixed stop for everyone. Manage your own risk — move smart, stay stealthy. Every thief has their own escape route! 🏃♂️💨

💰 TARGET / TAKE PROFIT

Our main target is $220, where the “police force” (strong resistance) is waiting to trap late buyers. That’s our signal to escape with profits while the market gets noisy. 🚨💵

⚠️ Note: Don’t copy-paste my TP — adjust it based on your risk-reward ratio. The thief gets in, takes the bag, and disappears like smoke! 😎💨

🌐 CORRELATIONS & RELATED PAIRS TO WATCH

While executing this PLTR play, keep an eye on related movers:

💡 NYSE:AI (C3.ai): another AI data stock — often mirrors PLTR’s momentum.

⚙️ NASDAQ:NVDA (NVIDIA): strong leader in AI space; when NVDA rallies, PLTR usually follows.

📊 NASDAQ:QQQ (NASDAQ ETF): overall tech sentiment indicator — if QQQ pulls back, expect PLTR sympathy moves.

🧠 NASDAQ:META , NASDAQ:GOOG : big-data and AI-driven plays that set tone for broader sector trends.

Key Insight: When NASDAQ:QQQ or NASDAQ:NVDA show continuation strength, PLTR tends to respond aggressively due to its higher volatility factor. A synchronized move could amplify this setup’s reward potential! 💥📈

⚙️ MARKET CONTEXT

Palantir continues to benefit from the AI and defense analytics boom, showing stronger fundamentals and recurring government contracts. The chart recently cooled off, forming a healthy reaccumulation base, ideal for swing traders planning layered re-entries before the next push to $220+. ⚔️📊

🕶️ DISCLAIMER (READ BEFORE HEISTING)

This is a Thief-Style Trading Strategy — meant for fun and education.

Trade smart, manage your capital, and always protect your loot! 🧠💼

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#PLTR #Palantir #SwingTrade #ThiefStrategy #StockMarket #AI #BullishSetup #TechnicalAnalysis #HullMA #HeikinAshi #RiskManagement #NASDAQ #ProfitPlaybook

PLTR Weekly Call Alert: Strike $170 Ready to Soar!

🚀 **PLTR Weekly Call Alert | 2025-09-10** 🚀

**📈 Directional Bias:** Strong Bullish (70% Confidence) ✅

**Why This Trade?**

* 🔹 Daily RSI 60.1 & Weekly RSI 60.8 rising → momentum confirmed

* 🔹 Call/Put flow 2.03 → institutional call positioning

* 🔹 Breakout above prior weekly high (\$162.40)

* ⚠️ Weekly volume only 1.0x → weaker confirmation; requires active management

**💡 Recommended Trade:**

* **Instrument:** PLTR weekly CALL

* **Strike:** \$170 💰

* **Expiry:** 2025-09-12

* **Entry Price (Ask):** \$0.23

* **Direction:** LONG ✅

* **Position Size:** 1 contract (scale to account risk, high-gamma weekly scalp)

* **Entry Timing:** Market open

**🎯 Targets & Stops:**

* **Profit Target:** \$0.46 (+100%)

* **Stop Loss:** \$0.12 (\~48%)

* **Exit Rule:** Thursday EOD if neither stop nor target hit

**⚡ Key Risks:**

* High gamma & accelerating theta → short-duration trade

* Resistance cluster near \$169 → potential collapse if fails

* Thin options, bid-ask spreads → use limit orders, expect slippage

* Tail risk: negative headlines or market sell-offs

**💎 Trade Strategy:**

* Single-leg naked call

* Lower premium (\$0.23) for higher R/R

* Optional alternative: \$167.50 call @ \$0.41 for slightly higher delta and cost

**📊 JSON Snapshot:**

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 170.0,

"expiry": "2025-09-12",

"confidence": 0.70,

"profit_target": 0.46,

"stop_loss": 0.12,

"size": 1,

"entry_price": 0.23,

"entry_timing": "open",

"signal_publish_time": "2025-09-11 02:07:06 UTC-04:00"

}

```

💥 **TL;DR:** PLTR bullish weekly call. Buy \$170 at open, stop \$0.12, target \$0.46, exit Thursday EOD. Small size, high-gamma scalp — limited risk, strong momentum potential!

Palantir: Cooling Off After a Strong Bull Run & ATHPalantir: Cooling Off After a Strong Bull Run & ATH.

Palantir has recently taken a breather following an impressive upward rally. The stock surged from the $66 level on April 7th this year to reach a new all-time high of $190.

As expected, no asset moves parabolically upward forever without a retracement.

Over the past week, Palantir has been experiencing a pullback, with today’s session showing a decline of over 6%. The stock is currently trading around $161.

From a technical perspective, I am eyeing two potential entry zones — $160 and $150. Both levels align closely with the Fibonacci 50% and 61.8% retracement areas, making them significant points of interest for a possible rebound.

As always, I take a medium- to long-term approach to my trades, as patience is often the key to capturing real value in strong stocks.

If you found this analysis helpful, please like, comment, share, and connect with me. Let’s continue building a strong TradingView community together.

PLTR $162.5C — Smart Money Loading, Can Price Catch Up?"

# 🔥 PLTR Weekly Trade Setup (2025-09-07)

**Bias:** 📉 Neutral-to-Slight Bearish (price action)

**But...** 📊 Options Flow = Strongly Bullish (C/P 1.66)

**Conviction:** ⭐⭐ (50% speculative)

---

### 📊 Key Takeaways

* ❌ **Momentum:** Daily RSI 36.3 falling → bearish pressure

* ❌ **Volume:** 0.8× avg → no institutional confirmation

* ✅ **Options Flow:** Strongly bullish (C/P 1.66) → divergence vs price

* ✅ **Volatility:** Low (VIX \~15.2) → cheap calls, low gamma risk

* ⚖️ **Consensus:** Most models = *no trade*, but speculative call flow play is possible

---

### 🎯 Trade Plan (Speculative Flow Play)

* **Instrument:** \ NASDAQ:PLTR

* **Direction:** CALL (naked)

* **Strike:** \$162.50

* **Expiry:** 2025-09-12 (weekly)

* **Entry Price:** \$0.96 (ask)

* **Profit Target:** \$1.60

* **Stop Loss:** \$0.48

* **Size:** 1 contract (small, strictly sized)

* **Entry Timing:** Open

---

### 🧠 Rationale

* Options traders buying aggressively → possible **short-squeeze / bounce**.

* Weak volume + bearish RSI = technical headwind.

* This is a **tactical, high-risk punt**, not a conviction swing.

---

### ⚠️ Key Risks

* 📉 Downtrend may dominate → option decays fast.

* ⏳ 5 DTE = heavy theta decay midweek.

* 💸 Spread/slippage risk at open.

* 📰 Macro/news can flip flow instantly.

---

## 📌 TRADE DETAILS (JSON)

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 162.5,

"expiry": "2025-09-12",

"confidence": 0.50,

"profit_target": 1.60,

"stop_loss": 0.48,

"size": 1,

"entry_price": 0.96,

"entry_timing": "open",

"signal_publish_time": "2025-09-07 06:53:26 EDT"

}

```

---

🔥 **Summary:**

This is a **flow vs. trend battle.**

Price says bearish 📉, options traders say bullish 📈.

Take the \$162.5C as a **small-size speculative punt** → defined risk, fast exit.

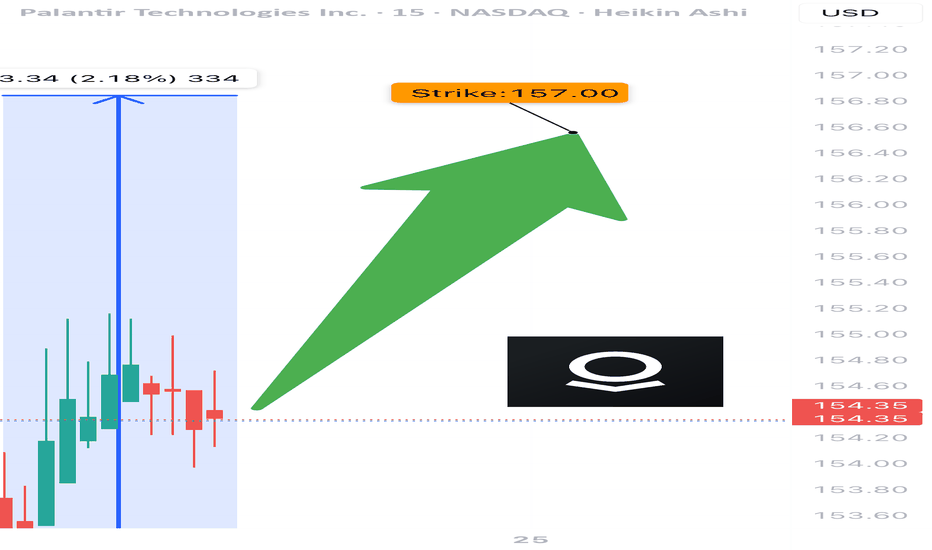

PLTR Bulls Eye $168 Target→Don’t Miss Out

🚀 **PLTR Swing Trade Setup | Weekly Bullish Trend vs. Daily Correction** 💎

📊 **TRADE DETAILS**

🎯 **Instrument**: \ NASDAQ:PLTR

📈 **Direction**: LONG

💰 **Entry Price**: 156.50 (limit, fill up to 157.00)

🛑 **Stop Loss**: 151.90

🎯 **Take Profit**: 168,00

📊 **Size**: 15% of portfolio

💪 **Confidence**: 60%

⏰ **Entry Timing**: Market Open (8/31)

⚖️ **R\:R ≈ 2.9** | Risk ≈ -4.6 / Reward ≈ +13.5

📌 **Rationale**

✅ Weekly trend still strongly bullish (EMA stack + MACD positive).

✅ Clear stop cluster at 152.55 (50 EMA).

✅ Tactical swing long if structure holds.

⚠️ Daily MACD still corrective + weak volume → size capped.

---

🔥 **Hashtags **

\#PLTR #OptionsTrading #SwingTrade #EarningsPlay #BullishSetup #StockMarket #TradingSignals #RiskReward #MomentumTrading #TradeIdeas

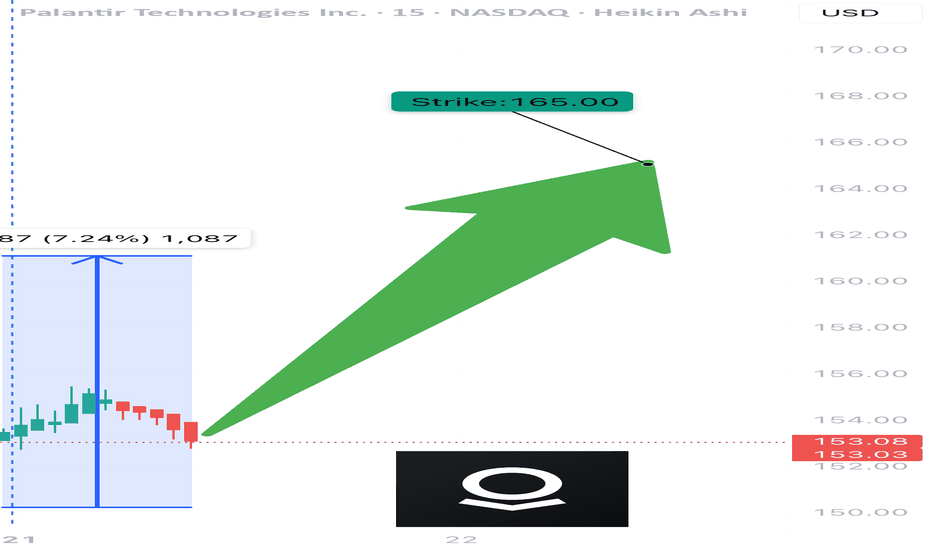

PLTR Weekly Options Setup | $165C Eyeing 75% Upside!

## 🚀 PLTR Weekly Options Play (Aug 25–29): Tactical Call Setup 🎯🔥

**Summary of Model Signals**

* **Mixed Views:** 2 bullish/neutral vs. 2 bearish/neutral → no full consensus.

* **Claude:** ✅ Bullish, calls at \$165 (OI cluster, daily RSI rebound).

* **Grok:** ❌ Bearish, puts at \$142 (institutional selling, weak RSI).

* **Gemini + Llama:** ⚖️ Neutral, no clear trade.

**Key Market Notes**

* 📊 2.2x weekly volume = high institutional activity.

* ⚡ Options flow neutral (C/P 1.04).

* 🌀 Daily RSI rebounding from oversold.

* 💎 Heavy call OI stacked \$160–\$170 (pinning/squeeze zone).

* 🛑 Risks: theta decay (4 DTE), gamma whipsaws, low VIX → possible chop.

---

### 📈 Trade Plan (Speculative, Small Size)

* 🎯 **Direction:** CALL (LONG)

* 🔑 **Strike:** \$165.00

* 💵 **Entry:** \$0.98 (ask)

* 🎯 **Target:** \$1.70 (+75%)

* 🛑 **Stop:** \$0.53 (–45%)

* 📅 **Expiry:** Aug 29, 2025

* 📏 **Size:** 1 contract (small/speculative)

* ⏰ **Timing:** Entry at open, exit by Thursday if no momentum.

* 📊 **Confidence:** 60% (moderate conviction, mixed models).

---

### 📊 TRADE DETAILS (JSON for coders/quant backtesters)

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 165.0,

"expiry": "2025-08-29",

"confidence": 0.60,

"profit_target": 1.70,

"stop_loss": 0.53,

"size": 1,

"entry_price": 0.98,

"entry_timing": "open",

"signal_publish_time": "2025-08-25 13:14:21 UTC-04:00"

}

```

---

### 🔖 Tags:

\ NASDAQ:PLTR #OptionsTrading #WeeklyOptions #CallOptions #TechStocks #MomentumTrading #StockMarket #TradingSetup 🚀📈🔥💎

Palantir - The unstoppable company!💣Palantir ( NASDAQ:PLTR ) is just too strong:

🔎Analysis summary:

Since mid 2022, Palantir managed to rally more than 2.500%, creating new all time highs every single month. Eventually this rally will slow down, but before this happens, Palantir could rally another +100%. This is a classic example of stock market behaviour and you should take advantage.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

PLTR CALL 170C —Don't Miss it

🚀 **PLTR Weekly CALL Alert!** 🚀

Momentum building 📈 | RSI rising | Favorable volatility ⚡

🎯 **Strike:** \$170 CALL

💵 **Entry:** 0.70 | 🎯 **Target:** 1.40 | 🛑 **Stop:** 0.35

📅 **Expiry:** Aug 19 | ⏰ **Entry:** Open

⚡ **Confidence:** 70%

Bulls in control + rising RSI = upside potential 💥📊

\#PLTR #OptionsTrading #WeeklyCalls #BullishMomentum #SwingTrade #TradeSetup #VIX #TechStocks

PLTR Weekly Options Outlook – Overbought & Losing🚨 PLTR Weekly Options Outlook (Aug 12, 2025) – Overbought & Losing Steam? 🚨

### **Market Sentiment**

* **Call/Put Ratio:** 0.81 → Neutral bias

* **Days to Expiration:** 3 → Gamma risk & fast time decay kicking in

* **VIX:** 15.3 → Low volatility = easier directional plays

### **RSI Check**

* **Daily RSI:** 75.3 → Overbought, trending **down**

* **Weekly RSI:** 81.5 → Overbought, trending **down**

* Momentum exhaustion likely → risk of **pullback/consolidation**

### **Volume & Options Flow**

* Weekly volume **+150%** → Institutional participation confirmed

* Options flow balanced (calls ≈ puts) → Hedging, not aggressive bets

### **Consensus Across Models**

✅ Agreement: Strong institutional flow, but RSI decline = caution

⚠ Disagreement:

* Some models → **No trade** (momentum exhaustion risk)

* Others → **Moderate bullish** (volume support)

### **Conclusion**

📉 Short-term bias: **Neutral → Slight Bearish** despite bullish volume

📊 **Confidence Level:** 65%

🚫 No naked calls recommended here — wait for better entry after a pullback

---

**💡 Key Risks:**

1. RSI exhaustion → bigger pullback possible

2. Volatility shift before expiration → premium decay risk

---

📌 **Tags:**

\#PLTR #OptionsTrading #WeeklyOutlook #StockAnalysis #GammaRisk #Overbought #RSI #VolumeAnalysis #InstitutionalFlow #TradingView

PLTR Bulls Unstoppable? Key Levels You Can’t Ignore! 🚀 PLTR Swing Trade Setup (2025-08-09) 🚀

**Bias:** 📈 **Cautious Bullish** — momentum strong, RSI hot, but volume light = high risk at highs.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:PLTR

* **Type:** CALL (LONG)

* **Strike:** \$212.50 (slightly OTM)

* **Entry:** \$0.85 (open)

* **Profit Target:** \$1.27 (+49%)

* **Stop Loss:** \$0.59 (-30%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 70%

**📊 Key Notes**

* RSI 84.2 → extreme overbought 🚨

* Multi-timeframe momentum ✅

* Weak volume = low institutional conviction ❌

* Resistance ahead — watch \$175-\$180 pullback zone for safer reload

* Mixed analyst models: some say “wait,” others say “small bullish”

PLTR Next Move? **PLTR — Weekly Trade Idea (Aug 8, 2025)**

🚀 **Strong Bullish Momentum** — Daily RSI: 81.2 / Weekly RSI: 79.0

📈 **Volume Surge** — +70% vs last week, strong institutional backing

📉 **Low Volatility** — VIX at 15.8 supports bullish setups

⚠️ **High Gamma Risk** — 0DTE options, rapid time decay today

**Trade Plan:**

* **Type:** Buy Call (190 Strike)

* **Expiry:** Aug 8 (0DTE)

* **Entry:** \$0.39 at open

* **Target:** \$0.78 (100% gain)

* **Stop:** \$0.16 (-40%)

* **Confidence:** 75%

* **Tip:** Manage size carefully; close before EOD to avoid decay crush

PLTR Earnings About To Print

## 🚨 PLTR Earnings Incoming: +80% Confidence Call Setup into AI Boom 🚀

**🧠 Palantir Technologies (PLTR) Earnings Analysis – August 8, 2025 (AMC)**

**📈 Position:** \$165 Call | 🎯 Entry: \$6.45 | 💰 Target: \$22.58 | 🛑 Stop: \$3.23

**🕒 Entry Timing:** Pre-Earnings Close | Expiry: Aug 8, 2025

---

### 🔍 Quick Breakdown:

* 📊 **Revenue Growth:** +39.3% TTM – AI sector leadership

* 💰 **Margins:** 80% Gross | 19.9% Operating | 18.3% Net

* 🧾 **EPS Beat Rate:** 88% | Avg Surprise: +10.7%

* 📉 **Debt-to-Equity:** 4.43 – watch rates & debt risk

* 📈 **RSI:** 66.88 – strong momentum, near breakout

* 📊 **Volume:** Above average – institutional accumulation

* 🧠 **Options Flow:** Heavy \$165/\$170 call OI = bullish gamma exposure

* 🛡️ **Support:** \$151.94 | 📌 Resistance: \$161.24

* 🔭 **Macro Tailwinds:** AI + defense demand + sector rotation into tech

---

### 🧠 Trade Thesis:

Strong fundamentals + bullish options flow + tech sector tailwinds = **High-probability breakout**

🧨 **IV Rank: 0.75** – Big move priced in

💡 Likely to squeeze if results exceed expectations

---

### 💼 Trade Setup (Recap):

```

💎 Ticker: NASDAQ:PLTR

🔔 Direction: Long Call

🎯 Strike: $165

💵 Entry: $6.45

🎯 Profit Target: $22.58 (250%+)

🛑 Stop Loss: $3.23

📅 Expiry: 2025-08-08

📆 Earnings: August 8 (AMC)

🧠 Confidence: 80%

```

---

### 📌 Hashtags for TradingView:

```

#PLTR #EarningsPlay #AIStocks #TechMomentum

#OptionsTrading #GammaSqueeze #CallOptions

#UnusualOptionsActivity #Palantir #EarningsSetup

#TradingViewIdeas #VolatilityPlay #RiskReward

#AI #DefenseStocks #SwingTrade

```

---

💬 **TL;DR:** PLTR earnings are set to rip. Revenue surging, margins healthy, call options stacked, and momentum rising. Are you in before the AI-driven explosion?

PLTR WEEKLY TRADE IDEA – AUG 2, 2025

📈 **\ NASDAQ:PLTR WEEKLY TRADE IDEA – AUG 2, 2025** 📈

⚡️ *Earnings Week Setup – Mixed Signals, But Bullish Flow*

---

🧠 **SENTIMENT SNAPSHOT**

• Call/Put Ratio: **2.29** = Bullish

• Volume Ratio: **1.1x** = Weak breakout support

• VIX: **20.38** = Normal vol, clean setups possible

📉 **RSI DIVERGENCE WARNING**

• Daily RSI: **56.3 (falling)** – losing steam

• Weekly RSI: **71.2 (overbought + falling)** – 🔻Bearish divergence

➡️ *Momentum fading, caution advised*

📊 **INSTITUTIONAL FLOW**

• Strong call buying ahead of earnings

• But... price not confirming = possible **profit-taking**

⚠️ **EARNINGS RISK ALERT**

• Earnings = this week

• Could inject volatility or invalidate setup – size small & use stop

---

🔥 **TRADE IDEA** 🔥

🟢 Direction: **CALL (LONG)**

🎯 Strike: **\$160**

💰 Entry: **\$6.80**

🏁 Target: **\$12.25** (80%+ gain)

🛑 Stop Loss: **\$3.40** (50% risk)

📆 Expiry: **08/08/2025**

⚖️ Confidence: **65%** (moderate risk, macro-backed)

⏰ Timing: **Buy Monday Open**

---

🔎 **STRATEGY TAGS**:

\#PLTR #WeeklyOptions #EarningsPlay #MomentumTrade #SmartMoneyFlow

---

📌 Final Thoughts:

Mixed momentum + strong call volume = **potential breakout**, but **momentum cracks** say **don’t chase blindly**. Small size, tight stop, defined risk = smart approach here.

🚀 *Save + Follow for more option setups each week!*

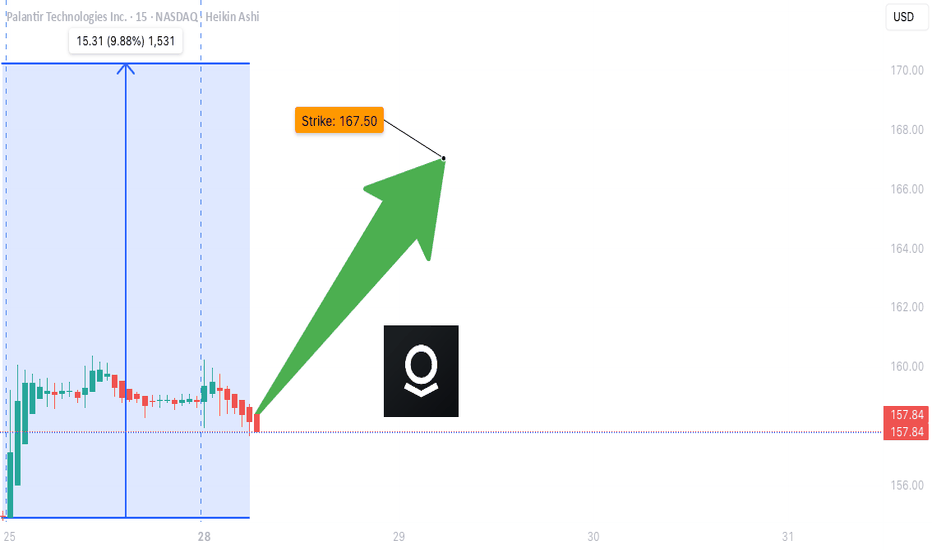

PLTR WEEKLY TRADE IDEA (07/28/2025)

**🚀 PLTR WEEKLY TRADE IDEA (07/28/2025) 🚀**

**Momentum is 🔥 but Volume is the Missing Ingredient**

---

📈 **Momentum Snapshot:**

* **Daily RSI:** 71.9 ⬆️ (🚨 Overbought but still rising)

* **Weekly RSI:** 76.7 ⬆️ (📢 Clear Bullish Strength)

➡️ *Strong upside pressure, but entering the overbought zone*

📉 **Volume Insight:**

* Weekly Volume = **0.8x last week**

⚠️ *Weak institutional conviction during the breakout = yellow flag*

🔍 **Options Flow Check:**

* **Call/Put Ratio:** 1.09 = *Neutral*

➡️ Balanced flow = *no aggressive buying yet*

🌪️ **Volatility Environment:**

* **VIX = 15.4**

✅ Favorable for directional trades — low IV supports premium growth

---

📊 **Model Consensus Recap:**

✅ Bullish RSI momentum (unanimous)

✅ Volatility ideal for long calls

⚠️ Volume flagged as a concern by some models

📌 Final stance: **MODERATE BULLISH**

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Buy CALL Option

* **Strike:** \$167.50

* **Expiry:** Aug 1, 2025

* **Entry Price:** \~\$0.74

* **Profit Target:** \$1.48 (🟢 2x return)

* **Stop Loss:** \$0.37 (🔻-50%)

📆 **Entry Timing:** Market Open Monday

📦 **Size:** 1 Contract

---

⚠️ **Key Risks to Watch:**

* 📉 Weak volume = possible consolidation before next leg up

* ⏳ Premium decay risk into expiry

* 📊 No strong institutional footprint = stay nimble

---

📌 **JSON FORMAT TRADE DETAILS (Automation Ready):**

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 167.50,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.48,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.74,

"entry_timing": "open",

"signal_publish_time": "2025-07-28 10:13:40 EDT"

}

```

---

🔥 TL;DR:

* Momentum is undeniable ✅

* Volume = suspect 🟡

* VIX = Green light for directional play ✅

💬 **\ NASDAQ:PLTR Bulls, are you ready or waiting for volume confirmation?**

\#PLTR #OptionsTrading #BullishSetup #UnusualOptions #MomentumPlay #TradingView #StockMarket

PLTR TRADE SIGNAL (07/24)

🚨 PLTR TRADE SIGNAL (07/24) 🚨

💥 Expiry in 1 day = HIGH GAMMA risk = BIG MOVES coming

🧠 Key Highlights:

• Call/Put Ratio: 1.40 → bullish options flow

• Strong institutional positioning 📈

• RSI cooling off = ⚠️ watch momentum

• Volume concerns → cautiously bullish

💥 TRADE SETUP

🟢 Buy PLTR $157.50 Call exp 7/25

💰 Entry: $0.59

🎯 Target: $0.89 (50%+)

🛑 Stop: $0.24

📈 Confidence: 65%

⚠️ Gamma + Time Decay = explosive but risky. Tight execution needed.

#PLTR #OptionsAlert #OptionsFlow #UnusualOptionsActivity #TechStocks #DayTrading #GammaSqueeze #TradingView #BullishSetup #CallOption

PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025

🔥 NASDAQ:PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025 🔥

Bullish Momentum + Strong Options Flow = Prime Setup 📈

⸻

📊 TRADE SETUP

🎯 Instrument: NASDAQ:PLTR

📈 Direction: CALL (LONG)

💵 Strike Price: $165.00

🟢 Entry Price: $0.59

🛑 Stop Loss: $0.30 (50% risk cap)

🎯 Profit Target: $1.18 (2x reward)

📅 Expiry: July 25, 2025 (Weekly)

📏 Size: 1 contract

💪 Confidence: 75%

⏰ Entry Timing: Market Open

⸻

📌 Why This Trade?

✅ RSI Strength: Daily RSI = 71.0 | Weekly RSI = 75.3 → Bullish continuation

✅ Weekly Range Positioning: Trading at 96.6% of weekly high

✅ Options Flow: Call/Put ratio = 1.47 — institutional bullish bias

✅ Strike Interest: Heavy OI @ $162.50 & $165.00 = strong magnet zones

🟡 VIX = 16.6 → Favorable volatility for short-term premium plays

⚠️ Volume is flat (1.0x) — no surge confirmation, so keep stops tight

⸻

🧠 Execution Plan

• Open position at the bell

• Mental stop at -50%, or ~$0.30

• Target 100% return = ~$1.18

• Exit ahead of Friday’s expiration unless the trade hits target early

⸻

💡 Key Levels to Watch

🔹 Resistance Zone: $155.68 – $156.59

🔹 Support Watch: Below $152 could break structure

🔹 Earnings Risk: Check calendar — volatility can spike unexpectedly

⸻

🏁 Verdict

• Momentum = 🔥

• Flow = 🚀

• Volume = 😐

➡️ Net Bias: MODERATE BULLISH — Risk-managed call with solid R:R

⸻

NASDAQ:PLTR Call @ $165 — Entry $0.59 → Risk $0.30 → Target $1.18 💥

Clean setup for disciplined bulls. Don’t overstay. Ride momentum. 🎯

⸻

#PLTR #OptionsTrading #WeeklyOptions #MomentumPlay #CallOptions #FlowTrade #TradingView #StockSignals #TradeSetup #RiskReward #SwingTrade #SmartMoneyFlow