Breaking; Plug Power Set to Install 5MW GenEcoPlug Power Installs 5MW GenEco Electrolyzer with Cleanergy Solutions Namibia for Africa’s First Fully Integrated Green Hydrogen Facility.

The Walvis Bay project plant, which officially opened in September, represents Africa’s first fully integrated commercial green hydrogen facility and will serve as the foundation for expanding hydrogen mobility across Namibia and neighboring markets.

Plug’s PEM GenEco electrolyzer is integrated directly at Cleanergy Solutions Namibia’s Hydrogen Dune site, which includes a 5MW solar park spanning more than 6.5 hectares and a 5.9 MWh battery energy storage system to produce renewable hydrogen off-grid. The locally generated hydrogen will support hydrogen-powered trucks, port and rail equipment, and small ships operating through the Port of Walvis Bay, while also supplying vehicles converted on site for dual-fuel operation using hydrogen and conventional fuels.

Financial Performance

In 2024, Plug Power's revenue was $628.81 million, a decrease of -29.45% compared to the previous year's $891.34 million. Losses were -$2.10 billion, 53.8% more than in 2023.

Analyst Summary

According to 13 analysts, the average rating for PLUG stock is "Hold." The 12-month stock price target is $2.15, which is a decrease of -2.27% from the latest price.

PLUG

Plug Power's AI Pivot: A Strategic RechargePlug Power is executing a high-stakes pivot from government-backed green hydrogen to the booming AI infrastructure market. We analyze the strategic, industrial, and technological drivers behind this potential turnaround.

A Strategic Pivot Amidst Headwinds

Plug Power (PLUG) has long promised a "green hydrogen revolution," but its stock performance tells a different story—plummeting 99% since its 1999 debut. Facing a cash crunch and a $364 million quarterly loss, management is now steering the company toward a new, voracious customer: Artificial Intelligence data centers .

This move is not merely opportunistic; it is a survival imperative. With the Trump administration recently canceling a vital $1.7 billion Department of Energy (DOE) loan, Plug Power has halted capital-intensive green hydrogen projects. Instead, it is monetizing assets to survive, signaling a shift from government-subsidized dreams to immediate commercial reality.

Geostrategy: Adapting to Policy Shifts

The cancellation of the DOE loan reflects a broader geopolitical shift. The new administration prioritizes immediate energy availability over subsidized decarbonization. By pivoting to the private sector, Plug Power is reducing its exposure to political risk.

This aligns with a "geostrategy of resilience." Data centers are a national critical infrastructure. By offering independent power generation, Plug positions itself as a guarantor of digital sovereignty, insulating tech giants from an increasingly fragile U.S. power grid.

Industry Trends: The AI Energy Crunch

The timing of this pivot addresses a critical market failure. Major analysts project that data center electricity demand will grow 16% in 2025 and double by 2030. AI-optimized servers consume nearly five times the power of standard racks, creating a bottleneck that utility companies cannot resolve quickly.

Plug’s recent letter of intent to sell electricity rights for $275 million confirms this demand. Tech giants are desperate for power *now*. Plug is capitalizing on this by selling its grid interconnection queue spots—effectively selling "time" to power-starved hyperscalers.

Innovation & Tech: PEM Fuel Cells vs. Diesel

Technologically, Plug holds a distinct advantage. Traditional data centers rely on diesel generators for backup, which are dirty, noisy, and maintenance-heavy. Plug’s **Proton Exchange Membrane (PEM) fuel cells** offer a superior alternative:

Instant Response: PEM cells ramp up power in seconds, matching the uptime requirements of mission-critical AI workloads.

Zero Emissions: This allows data centers to operate in urban zones with strict air quality mandates.

Energy Density: Hydrogen offers higher energy density than batteries, essential for facilities with limited real estate.

Business Models: Asset Monetization & Liquidity

Management is restructuring the business model from "build-and-own" to "asset-light." The $275 million liquidity injection from selling electricity rights provides a crucial runway. Rather than burning cash to build massive hydrogen plants, Plug is leveraging its existing technology stack—GenSure and ProGen systems—to generate immediate revenue.

This shift improves the cash conversion cycle. Selling backup power hardware to well-capitalized tech firms offers faster payment terms and lower capital risk than long-term utility projects.

Management & Leadership: A Decisive Course Correction

CEO Andy Marsh’s decision to suspend DOE-related activities demonstrates decisive leadership. A rigid adherence to the original "green hydrogen" roadmap would have been fatal without federal backing. By pivoting to the "AI trade," leadership is aligning the company with the only sector currently enjoying unlimited capital expenditure: Big Tech.

Conclusion: A Speculative Renaissance?

Plug Power remains a high-risk investment, but the investment thesis has fundamentally improved. The company is trading a dependency on government policy for a dependency on AI infrastructure growth—a far more robust driver. If Plug can successfully deploy its fuel cells as the standard for data center backup, it will transition from a speculative energy play to an essential component of the AI economy.

PLUG: recharged on the retest, or another fork with no voltage?PLUG tapped perfectly into the 1.85–2.00 zone - a clean confluence of the MA200, the ascending daily trendline, and the main support that launched the summer rally. Oscillators dipped into oversold, candles show buyer tails, and volume confirms defense of the level. As long as price holds above the trendline, the bullish scenario stands: breaking above 2.70 opens 3.36, and a move above 3.36 targets 4.58. The extended target at 6.56 requires a full breakout from the broader accumulation range.

Company: Plug Power is one of the key players in hydrogen fuel-cell technology, producing electrochemical systems, electrolyzers, and industrial energy solutions for logistics, manufacturing, and infrastructure.

Fundamentally , as of November 19, Plug remains pressured but gradually stabilizing. OPEX continues to decline, manufacturing efficiency improves, and the company expands partnerships in the green hydrogen ecosystem. Revenue volatility persists, but contraction slows, while new electrolyzer deployments build the future pipeline. Scaling production decreases unit costs, and margin improvements suggest the company is climbing out of the worst phase. Policy support and industrial demand keep hydrogen a long-term thematic growth story - though near-term risks remain.

Technically , the bullish structure holds above 1.85–2.00. A breakout above 2.70 activates 3.36, and strength above 3.36 brings the 4.58 target into play. Losing the MA200 risks a prolonged range, but current reaction shows buyers stepping in with precision.

Plug pretends it's collapsing, but really - it’s just plugging itself in for the next run.

PLUG | An Epic Run Is Incoming | LONGPlug Power, Inc. provides alternative energy technology, which focuses on the design, development, commercialization, and manufacture of hydrogen and fuel cell systems used primarily for the material handling and stationary power markets. Its fuel cell system solution is designed to replace lead-acid batteries in electric material handling vehicles and industrial trucks for some distribution and manufacturing businesses. The company was founded by George C. McNamee and Larry G. Garberding on June 27, 1997, and is headquartered in Slingerlands, NY.

$PLUG - Plug Power - $4.33 PTNASDAQ:PLUG consolidated to chart the $3.09 and found support like we initially targeted and rebounded to $3.95 before showing potential consolidation for additional entries.

Still holding a $4.31 RT to breakout to that $5.09 PT will potentially providing re-entry at $3.45 if it does consolidate again first.

$PLUG - Plug Power, Inc - $3.45 RT & Breakout?NASDAQ:PLUG looks to have broken out of its longer-term downward channels, showing strong volume, support, and momentum while re-attempting to break the $3.09s and push forward to our $3.49 PT.

This also comes after HC Wainwright maintains a BUY on NASDAQ:PLUG , raising its Price Target to $7. Not to include, the company just delivered its first 10-MegaWatt GenEco Electrolyzer Array to Gilp, a Portuguese Energy Company.

PLUG 1D - powered by a golden crossThe current PLUG chart highlights a key technical shift: the golden cross (MA50 crossing above MA200), usually seen as a potential mid-term reversal signal. Price has broken out of its downtrend structure and is retesting the breakout zone around 1.60–1.68, forming a possible accumulation base. Targets are defined step by step: first at 2.03 (major resistance and Fibo 1), second at 2.85 (Fibo 1.618), and third at 3.33 where strong volume and supply zone meet.

Fundamentally , Plug Power remains a high-risk play: heavy debt, negative cash flows, yet renewed investor attention thanks to green energy incentives.

The tactical view is clear: if the stock holds above 1.68, the road opens toward 2.03, and further breakout may accelerate momentum. A drop back below MA50, however, would invalidate the bullish case.

In short, the market is now deciding whether PLUG becomes a green-energy comeback star or just another unplugged socket.

PLUG: accumulation turning into breakout fuelPlug Power is slowly emerging from a long downtrend, building an accumulation structure after a trendline breakout. On the 4H chart, price is consolidating around 1.55–1.60 and gaining momentum. The first upside target is 1.90, where buyers will be tested. A strong breakout could open the way toward 2.90, where major resistance and higher volumes are located.

EMAs are starting to turn upward, confirming a potential trend change. The volume profile highlights strong interest around the current range, supporting the bullish case. The outlook remains positive as long as price holds above the 1.50 zone.

Fundamentally, Plug Power remains in focus with ongoing hydrogen energy projects. While the renewable sector faces macro pressures, improved demand and positive company news could act as catalysts for further growth.

PLUG Plug Power Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PLUG Plug Power prior to the earnings report this week,

I would consider purchasing the 6usd strike price in the money Calls with

an expiration date of 2027-1-15,

for a premium of approximately $0.0.49.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Plug Power (PLUG): Recovery Play or Terminal Decline?Plug Power Inc. (PLUG) , a company focused on green hydrogen and fuel cell technologies, stands as one of the most emblematic examples of a boom and bust cycle in the speculative clean energy sector.

It reached an all-time high of USD 75.49 in January 2021 , driven by market enthusiasm over the energy transition. However, since then, the stock has collapsed by more than 99% , hitting a low of USD 0.69 on May 16, 2025 . It currently trades below USD 2, reflecting a massive loss in market capitalization and deep investor distrust.

🧮 Fundamental Analysis

1. Business Model

Plug Power develops integrated systems for the generation, storage, and distribution of green hydrogen, mainly targeting logistics, mobility, and high-energy industrial sectors.

2. Financial Issues

Persistent losses: the company has been unprofitable for years. In 2024, it posted a net loss of over USD 700 million.

High operating costs and poor efficiency in hydrogen project execution.

Accounting concerns: the SEC flagged accounting issues in 2021 and 2022, further damaging institutional confidence.

3. Capital Dilution

Plug has repeatedly financed its operations through equity offerings, significantly diluting shareholders. Recent rounds were issued at very low prices, worsening the drop in share value.

4. Cash Position

As of June 2025, the company requires new capital to continue operations, facing the risk of issuing more shares or convertible debt under unfavorable terms.

⚠️ Key Risks

Delisting risk if the stock doesn’t remain above USD 1.00 in the short term.

Bankruptcy risk (Chapter 11) if no strategic financing or partnerships are secured.

The green hydrogen sector is still not cost-competitive without subsidies, and competition is fierce (Air Liquide, Linde, Bloom Energy, etc.).

✅ Opportunities

Potential to secure strategic alliances with utilities, automakers, or industrial partners.

Ongoing green subsidies from the U.S. and EU may offer short-term support.

Much of the negative outlook seems already priced in: current market cap is around USD 1.8 billion, with physical assets and contracts still in place.

📉 Technical Analysis

From its all-time low of USD 0.69, PLUG staged a strong rebound, gaining +294% to reach USD 2.03 on July 21, 2025 . It now trades in a consolidation zone between the 23.6% (USD 1.71) and 38.2% (USD 1.52) Fibonacci retracements , which may act as short-term technical support.

This is a high-risk, high-volatility stock , capable of generating outsized returns — or total losses. Strict risk management is essential.

Repeated Rejections at the 200-EMA

The 200-day exponential moving average (EMA 200) has acted as a dynamic resistance throughout PLUG’s multi-year downtrend. Over the past three years, the stock has attempted to break above it on at least three occasions — in 2022, 2023, and 2025 — but failed each time.

The most recent attempt, in July 2025, ended with a reversal after reaching USD 2.10, which also coincides with the 23.6% Fibonacci retracement from the all-time high. Unless the stock breaks above the 200-EMA with strong volume and an ascending price structure, the bearish trend remains intact.

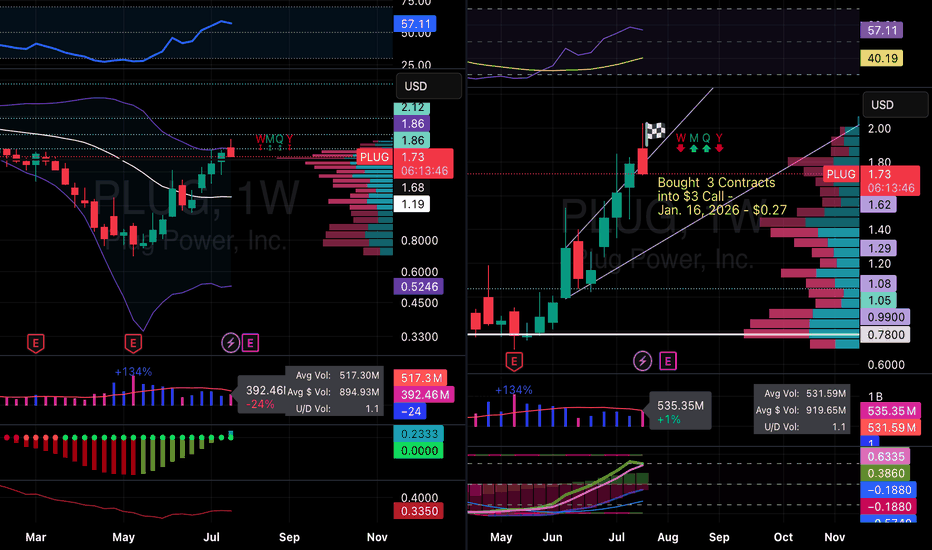

🧠 Speculative Position

We are currently positioned with a bullish options strategy targeting a speculative upside:

📈 Buy CALL USD 2.00 (exp. January 16, 2026)

🛡️ Sell CALL USD 5.00 (same expiration)

→ This forms a Bull Call Spread, limiting downside risk while maintaining a favorable risk/reward ratio.

🧾 Conclusion

Plug Power is no longer a fundamentally sound investment , but rather a high-risk speculative play , comparable to a synthetic long-term call option . If the company survives, restructures its balance sheet, and secures strategic partners, the upside could be substantial — but the risk of total capital loss remains very real .

🧭 Suitable only for experienced traders with speculative capital and disciplined technical execution.

Plugged InIn looking at the money flow for NASDAQ:PLUG , I see the EMAs 8 day and 21 day crossing into a new uptrend. The RSI is still below the overbought territory. The weekly is down with volume pouring in to get ready for the next leg. Sellers are slowing with the MACD. Looking ahead the money in the past has flowed into PLUG in the winter, therefore winter contracts look well priced and primed for the future growth based upon today's information. Let's see where it goes.

Remember do your own due diligence and research. Past performance doesn't equal future performance.

Plug Power: A Mirage or a Miracle?Plug Power (NASDAQ: PLUG), a key innovator in hydrogen energy solutions, recently experienced a significant surge in its stock value. This upturn is largely attributed to a strong vote of confidence from within the company: Chief Financial Officer Paul Middleton substantially increased his stake by acquiring an additional 650,000 shares. This decisive investment, following an earlier purchase, clearly signals robust conviction in Plug Power's future growth trajectory, despite prior market challenges. Analysts also reflect this cautious optimism, with an average one-year price target that suggests a significant upside potential from the current valuation.

A major catalyst for the renewed interest stems from Plug Power's expanded strategic collaboration with Allied Green Ammonia (AGA). This partnership includes a new 2-gigawatt (GW) electrolyzer project in Uzbekistan, part of a substantial $5.5 billion green chemical production facility. This facility will produce sustainable aviation fuel, green urea, and green diesel, positioning Plug Power's technology as foundational to large-scale decarbonization efforts. This initiative, backed by the Government of Uzbekistan, further solidifies a broader 5 GW partnership between Plug Power and AGA across two continents, highlighting the company's capability to deliver industrial-scale green hydrogen solutions.

While these strategic wins are promising, Plug Power continues to navigate financial headwinds. The company has faced recent revenue declines and currently reports significant annual losses and cash burn. To address capital needs, it is seeking shareholder approval to issue more shares. However, the substantial, multi-gigawatt contracts secured, particularly with Allied Green, underscore a strong future revenue pipeline. These projects affirm the critical demand for Plug Power's technology and its pivotal role in the evolving green hydrogen economy, emphasizing that the successful execution of these large-scale ventures will be key to long-term financial stability and sustained growth.

PLUG 1D Investment Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ volumed TE / T1 level

+ support level

+ biggest volume 2Sp-

+ weak test

+ first buying bar close level

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly Trend

"+ long impulse

+ support level

+ T2 level

+ biggest volume reaction bar

= below 1/2 correction"

Yearly CounterTrend

- short impulse

PLUG 1H Long Swing Conservative Trend TradeConservative Trend Trade

+ long impulse

+ 1/2 correction

+ volume zone

- strong approach

+ ICE level

+ support level

+ volumed Sp

Calculated affordable stop limit

1 to 2 R/R take profit

Daily Trend

"- short impulse

+ volumed TE / T1 level

+ support level

+ biggest volume 2Sp-

+ weak test"

Monthly Trend

"+ long impulse

+ support level

+ T2 level

+ biggest volume reaction bar

= below 1/2 correction"

Yearly CounterTrend

- short impulse

Will add more after successful test on 1H and / or after test completes on 1D.

PLUG power consolidation completed! Buy setupBuying now at discount levels near structural support. Expecting bullish thesis to be solidified once we recover above 1.9-2.2 levels.

Expecting fairly rapid progression to gap fill targets by 2026.

Strongly likely we see 6$ before summer 2025 & 10-12$ levels by end of yr

Planning to scale out of buy positions primarily at 10-12$ range. Will leave remainder for long term speculation for possible 14-20$ levels.

PLUG Powering Up For A Breakout?!Here I have NASDAQ:PLUG on the Daily Chart!

We can see that Monday, November 4th gave us a Very Bullish break to the Falling Resistance Price has been contained by forming the Wedge Pattern and with the Bullish Volume following the Break, gives this pattern a Bullish Bias after the strong decline since Jan. 2021.

The push for Greener and Cleaner way of Living and Transportation has the world in High Search for Electric Alternative means of fuel and along the pathway of Lithium and Rare Earth Metals is a new theory of Hydrogen powered Fuel Cells!

Currently Price is at $2.52, struggling with a Local Resistance Level after Price reached a new 4-Year Low @ $1.60, close to All Time Low @ .1155 visited in Jan. 2013. With the tight consolidation underneath the Falling Resistance followed with a Break candle and Close candle Above of the Falling Resistance, Confirms a Valid Break of said Falling Resistance and indicates Bullish Sentiment entering the market.

-Now, we must wait to see if Price decides to retest the Break of Falling Resistance around ( $2.25 - $2.20 ) and if Supported successfully, would generate a great Buying Opportunity!

-If Price does found Support here, I suspect Price we will run into Resistance @ ( $3.55 - $ 3.22 ) then will aim for the Fair Value Gap formed @ ( $5.58 - $5.14 )

Indicators:

- RSI Crossing 50

- Large Bullish Volume

Plug Power's Trend May Be Reversing Upward: First Target at $5NASDAQ:PLUG has lost 98% of its value since the beginning of 2021. Despite three corrections during this period, a trend reversal has not occurred.

However, the demand seen since September 2024 indicates that the price might be in a trend reversal phase.

If this is the case, the first price target is expected to be $5. Should the upward trend continue, the second target could be $7.5.

Target 28Following weekly chart.

Finally I got a bullish signal from my indicator, it's a nice time to buy before week close.

TP1 6.95

TP2 12.66

TP3 24

And Falling wedge break target 28

Also following EMA 100 which is 9.02 right now.

I will stop if the weekly close is under 2.21

Other than technical stuff, the company gets a huge loan guarantee, which supports technical insights.

Any comments on your side?