PNUT / USDT : Breakout from channel could ignite a strong rally

PNUT / USDT is moving cleanly within a descending channel and has now bounced from the mid-zone, heading towards the upper resistance line.

A confirmed breakout with volume could trigger a strong rally towards $0.18 - $0.22 in the coming days.

Watch for confirmation and manage risk wisely.

Pnutusdtlong

PNUTUSDT — That the Bottom? Liquidity Grab at Key Support Zone?📊 Overview

The PNUT/USDT (2D) chart is entering a critical phase after a long downtrend followed by a retest of a strong demand zone (yellow box). Current price stands at 0.1503 USDT, after forming an extreme wick down to 0.0660, then pulling back strongly — a clear sign of aggressive buyer reaction (liquidity sweep) from the same demand area seen in March–May earlier this year.

This structure often represents a major market turning point: it could either be a temporary bounce or the early stage of a medium-term reversal, depending on how price reacts within this zone.

---

📐 Structure and Key Pattern

1. Formed Pattern:

A potential Double Bottom is developing around 0.11–0.15.

The long lower wick indicates strong absorption of selling pressure.

Price remains in a horizontal accumulation phase after a sharp decline since late 2024.

2. Main Zone (Yellow Box):

Area between 0.11–0.17 serves as macro support and historical demand base.

It has been tested multiple times without a major breakdown candle.

This means buyers are still defending this level aggressively.

3. Key Signal:

Volume spiked during the liquidity sweep, followed by a strong close above support — a sign of a false breakdown or liquidity grab.

Such setups often become the early stage of an impulsive bullish move if confirmed by structure and volume.

---

🚀 Bullish Scenario (Potential Reversal)

Main condition: price must stay inside or above the yellow box and form a higher low on the 2D structure.

A 2D close above 0.1945 would confirm early reversal signs.

Momentum will strengthen if price breaks above 0.2629–0.3233, opening the path toward 0.4045–0.5000.

A breakout beyond these levels would mark the start of a new expansion phase after prolonged accumulation.

🎯 Bullish Targets:

1. 0.1945 → 0.2629 (minor breakout)

2. 0.3233 → 0.4045 (mid-term rally zone)

3. 0.5000+ (macro reversal confirmation)

Note: Strongest confirmation occurs when a 2D candle closes with full body and high volume above the first resistance.

---

⚠️ Bearish Scenario (Extended Breakdown)

If price fails to hold the yellow box, the bearish case remains valid.

A 2D close below 0.110 signals a loss of structural demand.

Downside targets lie at the 0.0660 wick low, with further risk toward 0.05 psychological zone if selling continues.

This would extend the downtrend and potentially lead to a final capitulation phase.

🎯 Bearish Targets:

1. 0.110 (breakdown confirmation)

2. 0.066 (wick low retest)

3. <0.05 (macro capitulation zone)

---

🧭 Conclusion

Currently, PNUT sits at a historical turning point.

Selling pressure appears exhausted, as shown by the deep wick and rapid buyer reaction.

However, without a confirmed breakout above 0.1945, a reversal cannot yet be declared.

The yellow zone remains the line between survival and collapse for the macro structure.

In other words:

> If PNUT holds the yellow zone, the market could witness one of the sharpest mid-cap altcoin rebounds.

But if this support fails, the next drop could be brutal — and fast.

---

🔖 Key Technical Levels

Current Price: 0.1503

Demand Zone (Strong Support): 0.11 – 0.17

Resistance 1: 0.1945

Resistance 2: 0.2629

Resistance 3: 0.3233

Resistance 4: 0.4045

Extreme Low: 0.0660

Historical High: 2.5000

---

#PNUT #PNUTUSDT #CryptoAnalysis #Altcoin #TechnicalAnalysis #SupportAndResistance #LiquiditySweep #ReversalZone #SwingTrade #CryptoTrading #MarketStructure #PriceAction #CryptoSetup

PNUUSDT — Descending Triangle Accumulation Zone: Major Breakout?🔎 Full Analysis

The PNU/USDT (1D) chart shows a clear Descending Triangle pattern that has been forming since May 2025. Price is currently trading around 0.2216 USDT, moving closer to the apex of the pattern — a sign that a big move is likely approaching.

⚙️ Pattern Details

Strong Support (Accumulation Zone): 0.19 – 0.24

This area has been tested multiple times and continues to attract buyers.

Descending Resistance: A downward sloping trendline from May’s high is pressing price lower, forming consecutive lower highs.

Characteristics: While this pattern is typically seen as a bearish continuation, it can also turn into an accumulation base if buyers step in with strong volume.

---

🚀 Bullish Scenario

Confirmation: Daily close above 0.3027 with strong volume.

Step-by-step targets:

First breakout level: 0.3027

Next targets: 0.3774 → 0.415 → 0.4403

Extended target if momentum accelerates: 0.5951

Measured Move Potential: A confirmed breakout projects a move toward 0.415 – 0.44 USDT.

Bullish Narrative: A breakout above the descending trendline could signal the start of a major reversal from long-term accumulation. Buyers regaining control may drive PNU/USDT back toward the 0.40 – 0.60 zone.

---

📉 Bearish Scenario

Confirmation: Daily close below 0.19 with high volume.

Step-by-step targets:

Conservative target: 0.10 USDT (chart low label)

Aggressive measured move target: 0.08 USDT

Bearish Narrative: If 0.19 fails as support, the descending triangle would act as a continuation pattern of the previous downtrend, potentially triggering a deeper breakdown toward 0.10 or even lower.

---

📌 Conclusion

PNU/USDT is at a critical decision point:

Bullish case: Breakout above the trendline could unlock a reversal and rally toward 0.40+.

Bearish case: Breakdown below 0.19 could extend the downtrend to 0.10 or lower.

With price approaching the apex, volatility is expected soon. Traders should wait for daily close + volume confirmation before committing to a position and apply strict risk management to avoid false breakouts.

---

⚡ Key Levels to Watch

Support zone: 0.19 – 0.24

Critical resistance: 0.3027

Breakout targets: 0.3774 → 0.415 → 0.4403 → 0.5951

Breakdown targets: 0.10 – 0.08

---

#PNUT #PNUTUSDT #PeanutTheSquirrel #TechnicalAnalysis #DescendingTriangle #CryptoAnalysis #Altcoin #Breakout #BearishOrBullish #CryptoTrading

PNUTUSDT UPDATE#PNUT

UPDATE

PNUT Technical Setup

Pattern : Bullish Falling Wedge pattern

Current Price: $0.2268

Target Price: $0.38

Target % Gain: 60.48%

Technical Analysis: PNUT has broken out of a falling wedge pattern on the daily chart, signaling bullish momentum. Price is retesting the breakout level, and a sustained close above resistance could fuel a move toward $0.38.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

PNUT/USDT – On the Edge of Rebound or Breakdown?📌 Overview:

PNUT/USDT is currently at a major inflection point, following a prolonged downtrend and months of consolidation. The price is once again testing the key demand zone that has acted as a solid support since February 2025. Will this be the beginning of a strong bullish reversal, or the start of a deeper breakdown?

---

🧠 Price Action & Market Structure:

Since peaking around $2.50, PNUT has undergone a sharp decline, now hovering near the critical support area of $0.21–$0.23.

This zone has repeatedly acted as a historical accumulation zone, providing strong bounce reactions in the past.

A potential double bottom pattern is forming – if confirmed, it could ignite a bullish trend.

Multiple resistance levels lie ahead, creating a clear roadmap for staged recovery if momentum shifts.

---

🔼 📈 Bullish Scenario – Potential Reversal in Sight:

If the support holds and bullish structure forms (e.g., bullish engulfing, morning star, or higher high breakout), we could see:

1. A strong rebound from the demand zone ($0.21–$0.23), signaling buyer strength.

2. Upside targets:

$0.3027 (initial resistance and trend reversal confirmation)

$0.4403

$0.5951 (strong historical resistance)

$0.7674 to $1.0797 (major psychological zones)

3. A breakout with strong volume and MA crossover (if used) would further validate the trend change.

---

🔽 📉 Bearish Scenario – Breakdown Risk:

If the support zone fails and price breaks below $0.21, the bearish trend could continue:

1. A clear breakdown below the demand zone opens room to:

$0.1700 (minor support)

$0.1300

$0.1000 (historical low and key psychological level)

2. This would invalidate the potential reversal and reinforce the broader distribution phase.

---

📊 Identified Patterns:

Range-Bound / Accumulation Phase: Price has moved sideways between $0.21–$0.44 since February, suggesting accumulation by long-term players.

Potential Double Bottom: Still forming – confirmation needed via a breakout of the neckline.

Descending Trendline Resistance: Remains overhead and may act as a strong barrier if price attempts to climb.

---

🧭 Key Things Traders Should Watch:

Monitor price reaction in the current demand zone over the next few candles.

Look for volume confirmation on any breakout.

Stay aware of Bitcoin’s trend and macro sentiment, as it may influence volatility in altcoins like PNUT.

---

📝 Conclusion:

PNUT/USDT is now trading at a crucial technical level. The price reaction here will determine the mid- to long-term direction of this asset. Traders should prepare for either a strong reversal or a significant breakdown. This area offers a strategic opportunity to assess both risk and reward potential.

#PNUTUSDT #CryptoBreakout #TechnicalAnalysis #AltcoinSetup #CryptoReversal #PriceAction #SupportAndResistance #CryptoUpdate #BullishVsBearish

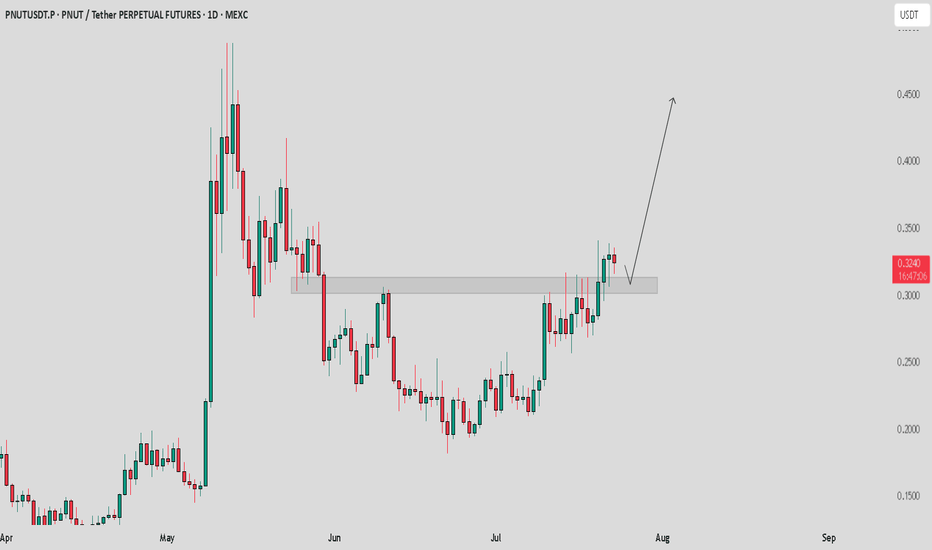

PNUT / USDT Breakout and retest analysisPnut/USDT - Breakout & Retest Analysis

Pnut/USDT has broken out from horizontal resistance, and a retest is currently in progress. If the retest holds, we can expect a strong move towards $0.4 - $0.5.

Bullish Scenario:

Successful retest and holding above the resistance zone should confirm further upside towards $0.4 - $0.5.

Bearish Scenario:

If price fails to hold the breakout level, we may see a pullback and retest of lower levels.

Pro Tip:

Avoid excessive longs. Wait for clear retest confirmation before entering.

Set proper risk management to protect your trades.

PNUT Just Broke Out – Can It Hold 0.2400?Pair: PNUT/USDT

Timeframe: 4H

Pattern: Symmetrical Triangle (Breakout Confirmed)

PNUT has broken out of the symmetrical triangle, showing early signs of bullish momentum. To confirm strength, price must now hold above the breakout zone near 0.2400.

Bullish continuation:

If it holds, we could see upside targets around 0.2700–0.3000 in the short term. Volume confirmation will be key.

Fakeout risk:

If PNUT fails to sustain above 0.2400, the breakout may fail. Stay patient for a clean retest or follow-through to avoid getting trapped.

Wait and manage risk wisely — the next few candles will confirm the move.

Falling Channel Breakout on PNUT/USDT – Next Stop: $0.76?📊 Pattern Analysis:

Falling Channel (Descending Channel): PNUT formed a clear falling channel from early May to late June 2025. This pattern typically signals a potential bullish reversal once a breakout occurs.

Confirmed Breakout: The price has successfully broken above the upper boundary of the falling channel, which is an early sign of a potential bullish trend.

Strong Support Zone: The horizontal zone around $0.20 – $0.26 USDT has acted as a solid demand base, as seen multiple times from March to June.

✅ Bullish Scenario:

If the breakout continues with momentum, the price could move upward gradually, aiming for the following resistance levels:

1. Target 1: $0.2986 – Minor resistance

2. Target 2: $0.3774 – Previous consolidation area

3. Target 3: $0.4403 – Major historical resistance

4. Target 4: $0.5951 to $0.7674 – Recovery zone from the falling channel

5. Extended Target (Long-Term): $1.0797 to $1.7957 (if a full rally occurs with strong bullish sentiment)

❌ Bearish Scenario:

If the price fails to hold the breakout and re-enters the channel:

Potential drop back to the support zone of $0.2000 - $0.1600

A breakdown below this range may lead to further downside toward $0.1300 to $0.1000 (previous historical low)

🔍 Summary:

The chart displays a classic bullish reversal pattern with a confirmed breakout from the falling channel.

The $0.26–$0.29 area now acts as a key confirmation zone. If the price holds above it and completes a successful retest, the bullish continuation is likely.

However, traders should stay cautious of false breakouts.

#PNUTUSDT #CryptoBreakout #AltcoinSeason #ChartAnalysis #BullishReversal #TechnicalAnalysis #BreakoutTrading #CryptoSignals #DescendingChannel

PNUT/USDT – Breakout Watch from Symmetrical TrianglePNUT/USDT – Breakout Watch from Symmetrical Triangle

Chart pattern: Symmetrical Triangle

Timeframe: 4-Hour

Published: June 20, 2025

PNUT/USDT is nearing the apex of a symmetrical triangle that has been forming over several weeks. The price is tightening between rising support and descending resistance, indicating a breakout is likely approaching soon.

Price is currently testing the upper boundary near 0.24. A breakout from this level with strong volume may trigger a bullish move, while rejection could keep price inside the range a little longer.

Bullish scenario

Entry: 4H close above 0.245 with volume

Target 1: 0.28

Target 2: 0.33

Stop-loss: Below 0.22

Bearish scenario

Entry: Break below 0.215

Target 1: 0.18

Target 2: 0.14

Stop-loss: Above 0.24

Wait for confirmation before acting — momentum will likely follow once the triangle breaks.

PNUTUSDT Forming Falling WedgePNUTUSDT is presenting a compelling falling wedge pattern, signaling a high-probability bullish reversal. This technical formation typically occurs after a sustained downtrend and is characterized by converging trendlines sloping downward. In the case of PNUTUSDT, the wedge is nearing its apex, indicating that a breakout is likely imminent. The setup is further supported by healthy volume levels, adding credibility to the expected move. Historically, falling wedges often lead to explosive upside moves, and this pair is currently projecting a potential gain of 90% to 100%+ if the breakout confirms.

Market interest in PNUTUSDT is steadily growing, as indicated by rising trading activity and increased visibility across community forums and social platforms. This surge in attention aligns with the volume spike seen during recent trading sessions — a classic precursor to bullish breakouts. As more investors start to take positions in anticipation of a breakout, price momentum can accelerate rapidly, creating ideal conditions for short- to mid-term gains.

From a technical standpoint, a confirmed breakout above the wedge’s upper resistance line could open the door to rapid price expansion, especially with limited overhead resistance. Traders should watch for confirmation signals such as strong bullish candlesticks, increasing volume, or a retest of the breakout level. PNUTUSDT is shaping up as an exciting opportunity for swing traders looking to capitalize on pattern-based moves in the altcoin space.

With bullish sentiment, clear technical structure, and improving market participation, PNUTUSDT could be on the verge of a significant breakout. It’s a setup that combines strong technicals with growing investor interest — a powerful combination in crypto trading.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

PNUT/USDT (4H) – Bull Flag Breakout Setup PNUT/USDT (4H) – Bull Flag Breakout Setup

Pattern: Bull Flag 📉📈

Timeframe: 4-Hour ⏱️

Pair: PNUT/USDT 💱

Published: June 10, 2025 📅

Technical Overview:

PNUT/USDT is forming a classic bull flag on the 4-hour chart following a strong impulsive rally. The price has been consolidating inside a descending channel — a typical continuation structure in bullish trends. Currently, the price is testing the upper trendline resistance, signaling potential breakout pressure building up 🔥

Potential Trade Setup:

Bullish Scenario ✅

Entry: On a confirmed breakout and close above the flag resistance (\~0.3000)

Targets:

* First target at 0.4200 🎯

* Second target at 0.5000–0.5200 zone 🎯

Stop-loss: Below recent swing low (\~0.2500) 🛑

Risk Management ⚠️

If PNUT gets rejected at the upper trendline and fails to break out, it could revisit the lower channel support near 0.2300. Look for a volume spike on breakout for added confirmation 📊

Conclusion:

PNUT is at a key decision point. A clean breakout above the descending channel could unlock a fresh bullish wave. As always, wait for confirmation and manage your risk accordingly 🔍📈

PNUT/USDT – Bull flag breakout attemptPNUT/USDT – Bull flag breakout attempt

PNUT is currently showing signs of breaking out from a bull flag pattern. This pattern typically indicates a continuation of the previous uptrend if confirmed with strong volume.

The price is testing the upper trendline of the flag. If it breaks and closes above this resistance, we may see bullish momentum ahead. However, a rejection from this zone could lead to consolidation or a short-term pullback.

Key levels to monitor:

* Breakout confirmation area

* Support near the flag base

* Volume activity for breakout strength

Keep a close watch — a successful breakout could lead to the next upward move.

BUY/LONG PNUTUSDT FOLLOWING D1 PEAKBUY/LONG PNUTUSDT FOLLOWING D1 PEAK

Hello,

I currently recommend a pair for you to BUY/LONG: PNUTUSDT.

Why should you BUY/LONG PNUTUSDT?

The D1 peak is still ongoing, with no signs of a confirmed D1 top for PNUT.

H4 is currently in a corrective pullback after rallying to form a peak at $0.49.

The likelihood of breaking above the recent H4 All-Time High (ATH) is high, making it a good opportunity for a LONG/BUY position.

So, what should we do?

Trend: BUY

Entry: When H4 corrects, the price is expected to return to around $0.3167. At this level, allocate your capital and enter a BUY position.

Close Buy: When H4 forms a peak (has a peak on H4).Alternatively, refer to the price levels on the chart.

Wishing you success!

#PNUT/USDT#PNUT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1595.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1633

First target: 0.1700

Second target: 0.1771

Third target: 0.1916

PNUTUSDT Ready to Rally!PNUTUSDT Technical analysis update

PNUTUSDT is breaking out of a wedge pattern on the daily chart after three months of formation. We also observed a bullish RSI divergence in the daily timeframe, along with a MACD bullish crossover a few days ago. A 50–100% move could be seen in the mid-term.

PNUT / USDT – Daily AnalysisBullish divergence spotted!

Price is printing lower lows, but RSI is making higher lows — a classic bullish divergence pattern. This signals potential trend exhaustion on the downside.

#PNUT is holding above a horizontal support level around 0.12–0.13 USDT, aligning with the divergence signal.

Volume is tapering off, indicating decreasing selling pressure.

RSI is currently around 37–38 and showing a higher low structure.

Key levels to watch:

Support: 0.1220–0.1300 USDT (current demand zone).

Resistance: 0.1650 USDT (local high), followed by stronger resistance at 0.2000–0.2200 USDT.

Scenario ideas:

If PNUT can hold above support and RSI continues climbing, we might see a relief rally towards the next resistance zones.

A breakdown below 0.1220 would invalidate this bullish setup and could lead to continuation of the downtrend. Still... bullish divergence then will become even more obvious....

Bias:

bullish short-term, watching for confirmation.

⚠️ Not financial advice. Always manage your risk!

#PNUT #Crypto #Altcoins #BullishDivergence #RSI #TradingView