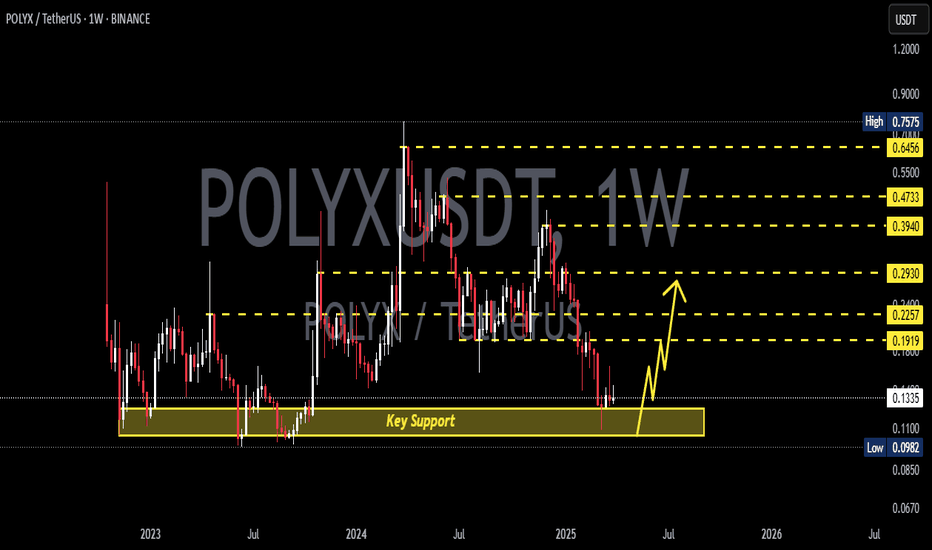

POLYX/USDT — Critical Support: Will It Bounce or Break Down?🔎 Overview

The POLYX/USDT (1W, Binance) chart is currently testing a major historical support zone around $0.0982 – $0.1267. This level has repeatedly absorbed selling pressure over the past two years, making it a psychological and technical pivot that could determine the next big move.

The macro structure is showing a series of lower highs, suggesting sustained selling pressure. At the same time, buyers are still defending this strong support zone, creating a battle zone between potential distribution and accumulation.

---

🏛 Pattern & Structure

Descending Triangle Bias (Bearish):

Lower highs combined with flat support → a distribution pattern, often leading to breakdowns if buyers fail.

Alternative Scenario — Double Bottom / Accumulation (Bullish):

If the support zone once again holds with strong bullish rejection, POLYX could build a base for a reversal rally.

👉 In short: POLYX is at a crossroad, awaiting weekly confirmation.

---

🚀 Bullish Scenario

Confirmation: Weekly close above $0.1710, or strong bullish rejection (hammer / engulfing) off support.

Targets:

1. $0.1919 (short-term resistance)

2. $0.2257 (key resistance)

3. $0.2930 (mid-term target)

4. $0.3940 – $0.4733 (major resistance, next swing zone)

Stop-loss: Below $0.0982 (invalidates the support).

---

🕳️ Bearish Scenario

Confirmation: Weekly close below $0.0982 → confirms breakdown of long-term support.

Implication: Support flips into resistance, potentially opening a deeper bearish phase.

Strategy: Avoid long entries if breakdown is confirmed. Look for retests (failed support → new resistance) as short setups.

---

🎯 Key Levels

Main Support: $0.0982 – $0.1267

Major Resistances: $0.1710 → $0.1919 → $0.2257 → $0.2930 → $0.3940 → $0.4733 → $0.6456

Historical Swing High: $0.7575

---

📝 Conclusion

POLYX is at a make-or-break zone:

If support holds → potential accumulation base for a recovery toward higher resistances.

If it fails → the descending triangle structure likely plays out, signaling a bearish continuation.

📌 For traders:

Aggressive: Consider scaling into small positions at support with tight SL.

Conservative: Wait for confirmation above $0.1710 before entering long.

Always apply risk management — this is a do or die zone for POLYX.

#POLYX #POLYXUSDT #CryptoAnalysis #Altcoins #TechnicalAnalysis #SupportAndResistance #BullishScenario #BearishScenario #WeeklyChart

Polyxusdtlong

#POLYX/USDT#POLYX

The price is moving in an ascending channel on a 1-day frame and sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 0.2130

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2400

First target 0.2991

Second target 0.3507

Third target 0.4109

POLYXUSDT.P LONG IDEAhi everyone, as you see on chart, it seems that there is a clear support line around 0.21550 . Also funding rate on binance is negative. it means short positions more than longs. thats why i want to set up long position. i will use 50x leverage in this set up.

entry : 0.21790

stop : 0.21469

take profit : 0.23834

remember that all the ideas belong me is only my idea and it is not financial advice.DYOR.

hope this idea usefull for you. have a nice day.