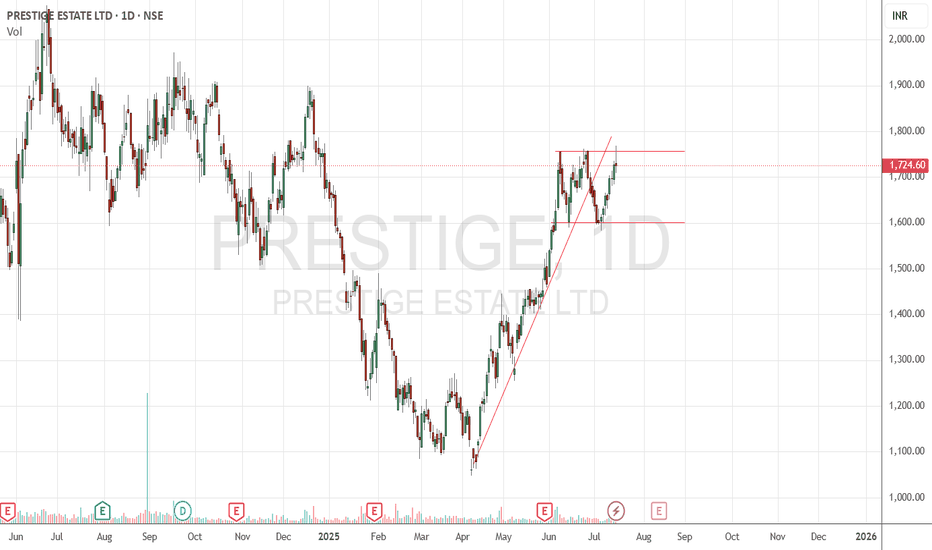

Prestige Estates: Weekly Trendline Breakout | Buy Setup 1,745BUY Setup 🏢

Entry: ₹1,737-1,745 (Current Level)

Target 1: ₹1,800-1,820

Target 2: ₹1,880-1,900

Target 3: ₹1,950-2,000 (Extended)

Stop Loss: ₹1,680

Technical Rationale:

Breaking above long-term descending trendline (from 2024 highs)

Price at critical resistance zone - potential breakout imminent

Weekly chart showing bullish momentum with +1.81% gain

Testing 1,745 resistance level - last major hurdle before rally

Strong support base at 1,000-1,200 zone visible

RSI around 65 on weekly - healthy momentum

Volume at 1.21M showing institutional interest

Real estate sector showing renewed strength

Multiple touches on trendline indicating strong resistance turned support

Risk-Reward: Strong 1:4+ ratio

Pattern: Descending channel breakout on weekly timeframe - highly reliable bullish signal

Strategy: Positional/swing trade - Book 30% at T1 (1,810), 30% at T2 (1,890), trail remaining with SL at 1,750 after T1 achieved

Key Levels:

Critical Resistance: 1,745-1,750 (breakout zone)

Support: 1,680, 1,620, 1,550

Timeframe: Weekly chart suggests this is a medium-term positional opportunity

Prestigeestates

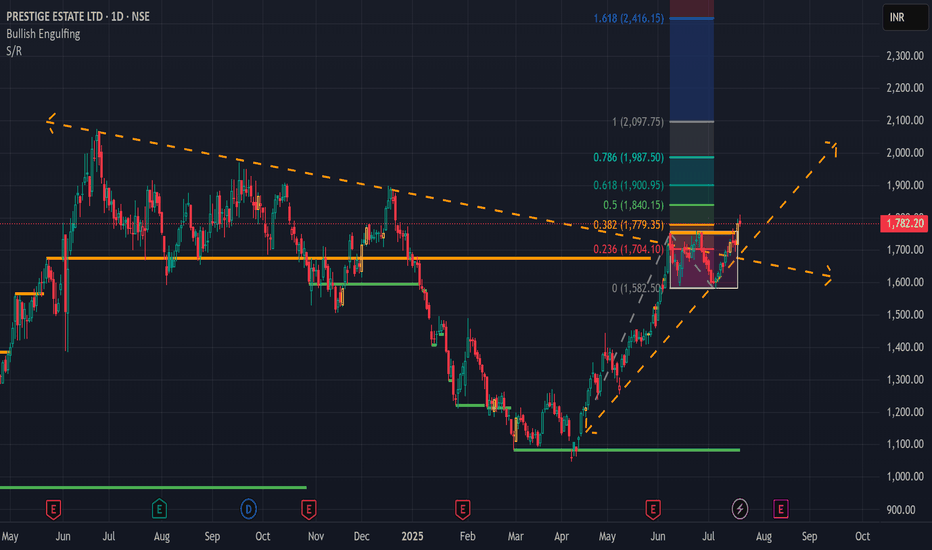

SWING IDEA - PRESTIGE ESTATESPrestige Estates , a leading Indian real estate developer, is showing a compelling opportunity for a swing trade.

Reasons are listed below :

Breakthrough of Resistance Zone : The 1350-1400 range had been a significant resistance zone, but the price recently broke through and achieved a weekly close above it, indicating a strong upward momentum.

0.5 Fibonacci Bounce : The price retraced to the 0.5 Fibonacci level and subsequently bounced back, suggesting this level is acting as strong support, reinforcing the potential for continued bullish movement.

Breakout from Consolidation Phase : The stock has broken out of a 4-month consolidation phase, signaling that it could be entering a new upward trend.

Bullish Marubozu Candle on Weekly Timeframe : Last week's marubozu candle (with minimal shadows) indicates strong buying pressure and supports the case for continued bullish momentum.

Trading Above 50 and 200 EMA on Weekly Timeframe : Prestige Estates is trading above both the 50-week and 200-week exponential moving averages, which is a robust signal of a prevailing uptrend.

Trading at All-Time High : The stock is currently trading at its all-time high, indicating strong bullish sentiment. However, traders should watch for potential pullbacks or resistance at this level.

Target - 1650 // 1800 // 1900

Stoploss - weekly close below 1300

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights