Purewyckoff

TECK GOING FOR MARKUP?This is an Atypical Trading Range Schematic #2

With possbile Copper Theme in play, im thinking to exploit this stock for some profit

It is possible that the Bar 11/2/26, An Upthrust

-I would consider to add if any probable Springboard in future

Position intiated as attached yesterday

WILL SUNCOR ENERGY CONT ITS MARK UP?This is a typical reaccmulation pattern of scehmatic #2 in wyckoff methode

i am interested with the Bar @ 4february26, high effort with low result

-i consider this as possiblity of absoprtion

With Springboard (red color) spotted,

Trigger bar today dictate for position intiation

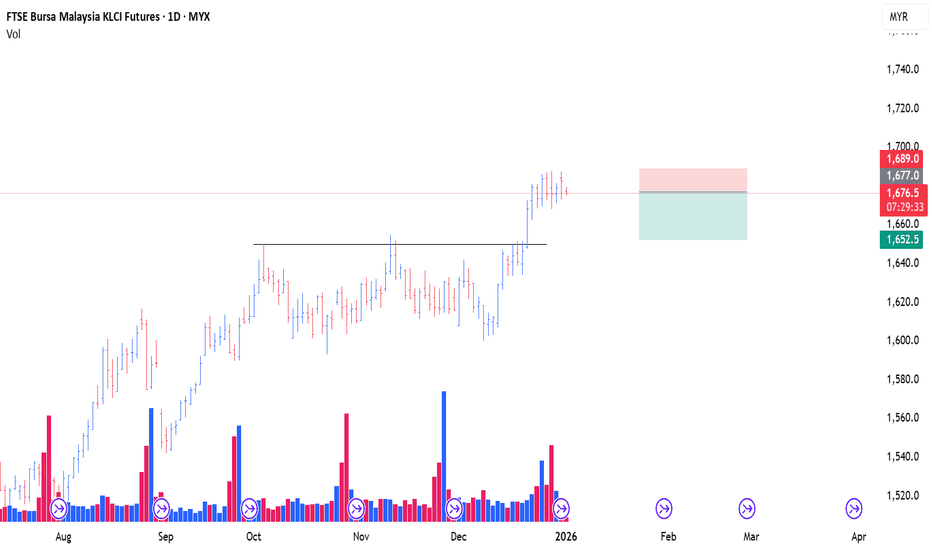

KLCI SELLThis is a continuation, update from my previous post -

I calculated the estimation projection for KLCI based 3rd Wyckoff Law @ late October 2025 :

Conservative Target : 1640 - 1676

Agressive Target : 1771

In a hindisght, i never thought that it would reach the agressive target

-im closely monitoring this level

Since october 2025, i have been on cash mostly.

With periodic swing in between around mid october, and %100 sitting + resting at the moment

Our attempt shorting the KLCI failed for 2x :

1/

2/

Based on my previous data, my timing for the top would always, be too early.

As always i am preparing for the next opportunity.

In stock market, nothing much has changed except the names of companies & players.

Histroy will always repeat.

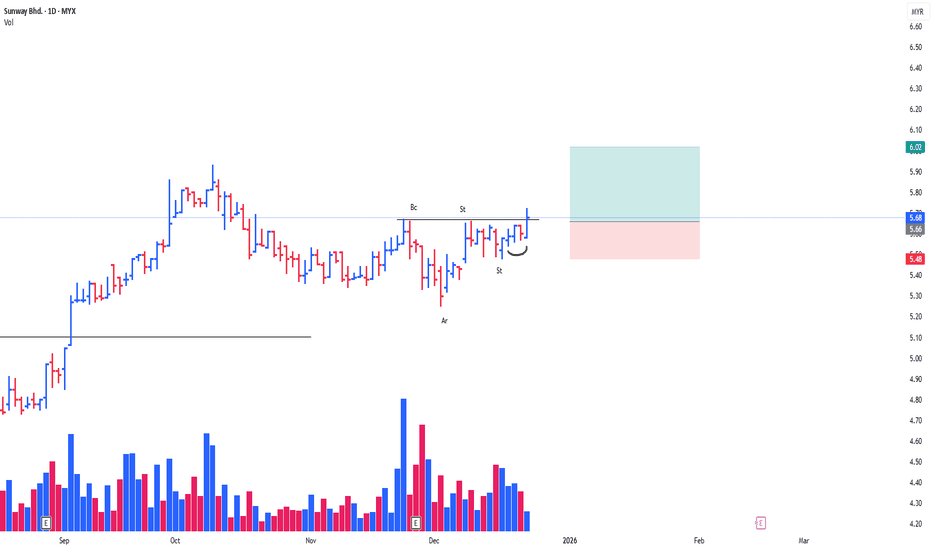

SCGBHD CONTINUE MARKING UPThis is continuation from previous post

-Kindly refer to link attached

Things has been escalated abruptly, past few days.

For SCGBHD, this is a rising bottom Re-Accmulation pattern , Typical Schematic #2.

I started my position @ 12/12/25, based on the feather's weight + SpringBoard + trigger bar

*red arrow

In case we melted down from here, we shorted FKLI :

given good traction, we continue adding position for SCGBHD @ 19/12 and 22/12 .

Currently at overweight position

Market 'feels' heavier with its 'selectiveness' .

I have other long positions , that have been working as well.

Im not sure if this trade is going to be the pareto trade, low expectation in the upcoming weeks/months.

In hindsight, we didnt perfectly covered the short. but we did, perfectly traded, our plan.

FKLI SHORT

This is continuation post from previous post:

Kindly refer to the link attached

We began shorting today

Current Long position for individual stocks dont showing any remarkable traction.

Market being too selective.

We reiterate our view, the current price behaviour, are pointing towards distribution esp with individual stocks, that exhibit Tape-Dominating Distributions

FKLI SHORTThis is a continuation from my previous post :

Kindly refer as attached

We started shorting yesterday, been looking for a good spot past few weeks.

-might add up today if sweet spots available

We view, the current price behaviour, are pointing towards distribution esp with individual stocks, that exhibit Tape-Dominating Distributions

Tight risk here

KLCI CONTINUE TO SELLThis is an update from my previous post

-Kindly refer to the link attached

Persistent weakening, Dominating tape of Weakness from Leaders.

I view all rallies as nothing more than a 'counter-trend' rally, in which ,

spots for the institutions to sell their positions

Bar @ 28/11/25 (red arrow), formed A spring-type action [/b ].

Penetrated the Ice-Line (bold black line)

- given today's incomplete bar (1/12/25), im still humbly bearish on market.

no position at the moment, 100% cash sitting.

Until condition improve, im sitting tight awaiting next opportunity.

In a Bear market, weakness beget more weakness

i always reminding myself : do not be confuse . As strength in weakness, during bear market, is different as compared to, strenght in weakness, during bull market.

**TradingView doesnt provide vol data for KLCI. Need to refer other source.

KLCI CONTINUE SELLThis is continuation from my previous thesis :

-Kindly refer to the link attached

As been mentioned, i look the level of 1640-1676 as probably be the end for 2025

Given the pathological and continuous soaring 'sepsis' of market leaders, i dont see any reason to get in :

-volatily around springboard too wide

-paroxysmall huge supply at any given time

-failure of 'Stage-Reversal'

-surge of laggards

I was forced to be cash since late October-Early Nov

In the mean time, my few last dipping toes didnt make any dime

I learned earlier that, during hard-ringgit times, i will just let others fighting for it.

meanwhile, i am sitting, disclipne, waiting for the easy-ringgit moment.

RAMSSOL MARKING UP

This is an Atypical Type of Re-Accmulation Trading Range

- Rising Bottom, #2 Schematic

Influx of demand for the past few days,

Along with formation of feather's weight (Black color line),

And the formation of SpringBoard (Red Color).

With Trigger Bar today,

Position initiated as attached.

PureWyckoff

MNHLDG (BULL) LATE STAGE CYCLE This is a continuation from my previous entry

-Kindly refer to the link attached

Entry based on assumption, that probably, trading range would unfolding from here on.

Bar @ 22nd & 23rd October would be considered as SpringBoard

-Hence, with Trigger Bar yesterday (24th October), position initiated with tight risk

It is either im getting stop from here onward, bcoz of Distribution or Possiblity of formation Trading Range #1 (Spring ) ***Purple Color Line

**Red Color line indicate Schematic #2 Trading Range

This is one of the leaders that i bought recently, since KLCI has been worsening past few weeks.

Usually , whenever a Leader Stock , has been undergoing 4th/5th Stepping Stone (aka Trading Range, or 'Base' for the Non-Wyckoffian) , it is a sign that probably the stock has reaching its late stage.

Some Stock Investors, would like to hold n enjoy the ride along the BuLL Run for The Leaders.

But i learnt that, with some 15-20% profit, compounding, will give me a much better return.

I simply cannot stomach for loss >6%. And i want to have good sleep.

Investing is a marathon, and it is demanding a lot from you, mentally.

Stress management is very important to stay long in this business.

JATI TINGGI GROUP GOING MARK-UP

Based on current trading range in the making,

this might be forming an atypical Re-accumulation #Schematic 2

I initiated my 1st position, on 30/10/25 in view of :

1/ Spring (specifically, Spring-Type Action) that preceded it

2/ SpringBoard Schematic #2 (Breakout of the downslope dotted line)

Added new position today,

with possiblity of another trigger bar in the background of SpringBoard Schmatic #1

**Red line

PureWyckoff

ITMAX TO CONT MARK UPThis is a Re-Accmulation of Schematic #2, Rising Bottom

From the pov of BUEC , my hypothesis for now, probably price would be making upward trajectory (Phase E)

Taking 23/9 as landmark for the Trigger Bar :

-This entry is an atypical type approach as compare to my original tactic

-Bar (or Candlestick) @ 24th + 25th + 26th + 29th + 30th September, would be considered as the

'Stage Reversal'

-This stage reversal , is also a type of SpringBoard

-To be more specific, SpringBoard Schematic #2

Tight risk here.

Pure Wyckoff

KLCI SELLThis is a continuation from my previous post

-Kindly refer to the link attached

Yesterday, leaders has been acting weird, consisting of pathological behaviours.

With lots of volatility and failed breakouts.

These kind of environment and background are the kind that i want to avoid the most.

As such, i was forced into cash and managed to book all profits.

Being a Stock Investor, i am fully devoted to the action of individual stocks, dictating my plan in the market.

-Probably @ level of 1640-1676 would be the end for this 2025

In the meantime, i am dipping toes incrementally if possbile.

Balancing between risk n the upside.

Staying cash is the prudent thing to do for me at the moment.

SCGBHD CONT ITS MARKING UPThis is a continuation trade from my previous entry

-Kindly refer to previous post (Link as attached)

SCGBHD is one of the Leader in this current Bull Market.

-Kindly refer to my post about KLCI Index

In a bigger context, for now, i see SCGBHD is currently in Mark-Up Phase.

I Re-Initiated position @ 2.35 today with an assumption that price is undergoing for Phase A :

1/ Purple Color line : Would be an imagination of a probable, Schematic #2 Of Re-Accumulation Trading Range

2/ Black Color line : Would be an imagination of a probable, Schematic #1 Of Re-Accumulation Trading Range

PureWyckoff

KLCI TO CONTINUE BULLISHThis is a continuation from my previous post

-Kindly refer to the link attached

Since 3/10/2025, KLCI has been dropping for about 3.3% from the peak.

Judging from the behaviour of current market leaders, i think KLCI most probably going to resume its uptrend from here (Black Box)

-or it could further, plummet, slightly below the Black box (lingering around EMA 50)

Im not sure, i have my own prediction but dont stick with it.

At this moment October 2025, i managed to pull up around 140% total ROI of my account

*(Heavy use of Margin )

For the Leadership stocks, they are acting very well at the moment

And based on Wyckoff Projection , looks like KLCI able to reach 1700-1750 at the end of 2025? Or early 2026?

Leaders mid bullrun October 2025 :

SCGBHD, PEKAT, MNHDLG

ITMAX (lead n rest)

KGB

FFB / KOPI (Cookie cutter)

Spritzer (Category Killer)

---> These are my top Leaders

SKBSHUT ON MARKING UPThis would probably a Type 2 # Schematic of Re-Accmulation

with on going phase D completion

My point of interest is inside the yellow box :

-Huge Bar (or candlestick) @ 28/8/25 with influx vol, signifying that underlying fundamentals might be changing as it attracted big demand

-Huge Bar, without subsequent feather's weight (or contraction), is a hazardous type of behaviour, that warrant me to monitor the subsequent event.

-This hazardous behaviour is what wyckoffian termed as 'Time-Compression'

Bar @ 19/9 & 22/9 formed a nice SpringBoard

-Hence position intiated today with the Trigger Bar on-board

PureWyckoff

EG GOING FOR MARK UPThis is a Rising Bottom, #2 Schematic of Accumulation

As you can see it, my point of interest would be over the yellow box area

That is where a Feather's Weight formed.

-a series of waves that undergone contraction, making higher high & higher low

Then, Springboard formed afterwrds.

-the final contraction :

(focus on 12th, 17th, 18th stepmber Bar, or Cadnlestick whatever that you prefer)

The bar on 17th Septmber, would be a Local Spring which further triggered me to initiate the position.

Thus, with a trigger bar yesterday, position initiated as attached

*added another position @ 1.30

I was away for some work yesterday didnt manage to update the opportunity as i always did

I pray for your success endeavour, my friends .

SUNCON MARKING UPThis is a Schematic #2 Re-Accmulation

The point of focus would be over the Stepping Stone area

*(Black Color, Shaded Area)

*SS (Stepping S)

-SS, bascially a temporary 'place' / 'phase' where, the price would be lingering around before continuing the markup.

The purple color arc **Purple Arrow, is a A type of Contraction.

-A Contraction, indicating that the market participant has been reducing.

-to be more specific, this is #1 schematic of SpringBoard

I initiated my position from the Trigger Bar @ 22/8/25 (RM 6.07)

Added another position today (RM 6.21)

MNHLDG TO CONTINUE MARK UPMy previous, last entry for MNHLDG got knocked out

*pls refer to the link

This is my new position for MNHLDG

In view of Local Spring Formation, along with Schematic #2 of SpringBoard (purple colored circle)

- i initiated the 1st position @ 22/8/25 (RM 1.51)

I added another position @ 25/8/25 (RM 1.56) in view of, probable successful test of The Local Spring

Nothing difficult here, straight to the points . Obvious setup.

Tight SL

PureWcykoff