#PYR/USDT — Critical Zone: Accumulation for Rebound or Breakdo#PYR

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.336, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.343

Target 1: 0.350

Target 2: 0.357

Target 3: 0.367

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Pyrlong

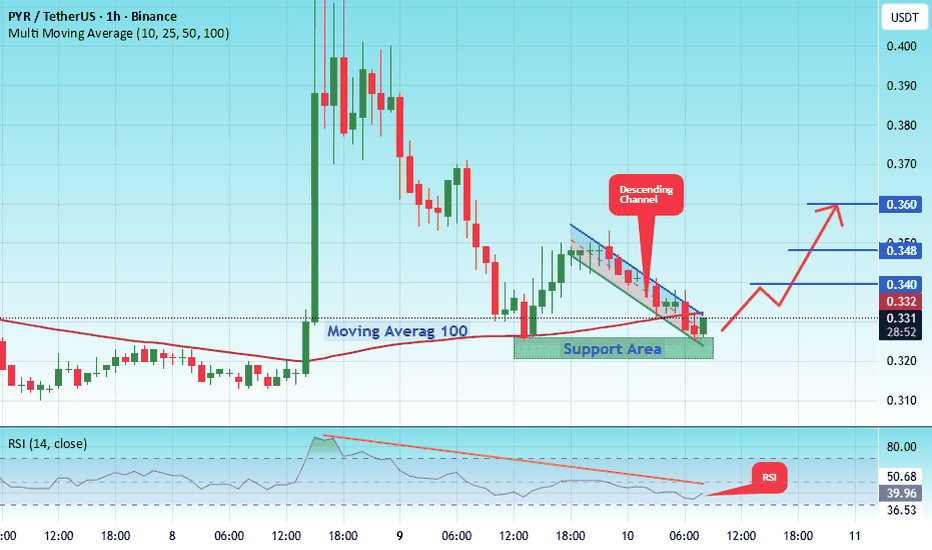

#PYR/USDT — Critical Zone: Accumulation for Rebound or Breakdo#PYR

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.323, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.330

First Target: 0.340

Second Target: 0.348

Third Target: 0.360

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#PYR/USDT — Critical Zone: Accumulation for Rebound or Breakdo#PYR

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.456. The price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.461

First Target: 0.472

Second Target: 0.482

Third Target: 0.497

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#PYR/USDT — Critical Zone: Accumulation for Rebound or Breakdo#PYR

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.346, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.354

Target 1: 0.363

Target 2: 0.374

Target 3: 0.391

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#PYR/USDT T — Critical Zone: Accumulation for Rebound or Breakd#PYR

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish trend in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.443, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.471

First Target: 0.486

Second Target: 0.505

Third Target: 0.526

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

#PYR/USDT — Critical Zone: Accumulation for Rebound or Breakdo#PYR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.633, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.658

First target: 0.672

Second target: 0.692

Third target: 0.710

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

PYR/USDT — Critical Zone: Accumulation for Rebound or Breakdown?PYR/USDT is now trading at a critical decision zone. After a prolonged downtrend since late 2024, the price has been consolidating inside the demand zone at 0.78 – 0.98 USDT. This area has repeatedly acted as a strong foundation to prevent deeper declines. With multiple retests, the market is approaching a tipping point: will PYR stage a significant rebound or break down into new lows?

---

🔎 Market Structure & Price Pattern

Long-Term Trend: Bearish, characterized by sharp declines and a series of lower highs since early 2025.

Mid-Term Trend: Sideways / Range-bound, with the lower boundary at 0.78–0.98 and upper boundary near 1.38.

Pattern Observed:

Potential Double/Triple Bottom formation at major support. If confirmed, this could signal accumulation before a trend reversal.

Failure to hold this zone, however, would turn the structure into a distribution breakdown, triggering new selling pressure.

---

📈 Bullish Scenario (Rebound Potential)

1. Price holds above 0.78 – 0.98 with a clear bullish reversal candle (engulfing / hammer / piercing line) on the daily timeframe.

2. Additional confirmation if daily close sustains above 1.045.

3. Step-by-step upside targets:

🎯 T1 = 1.181

🎯 T2 = 1.382

🎯 T3 = 2.148 (major mid-term resistance)

🎯 T4 = 2.592 – 3.458 if momentum extends further.

4. Bullish structure strengthens once a higher low forms after the rebound.

---

📉 Bearish Scenario (Breakdown Potential)

1. Price fails to hold and closes daily candle below 0.78.

2. A retest of the 0.78–0.98 zone as new resistance would confirm the bearish bias.

3. Downside targets:

⚠️ 0.60 (psychological support)

⚠️ 0.45 – 0.40 (deeper historical demand zone)

4. Such a breakdown will likely be accompanied by heavy sell volume, signaling panic selling and loss of key support.

---

📌 Conclusion & Strategy

The 0.78–0.98 zone is the golden decision point for PYR.

Bullish case: wait for a confirmed breakout above 1.045, with targets at 1.18–1.38.

Bearish case: breakdown below 0.78 opens room for a deeper sell-off.

Best strategy: stay patient, wait for confirmation, and let price action decide whether this zone becomes an accumulation base or a distribution top.

#PYR #PYRUSDT #CryptoAnalysis #Altcoin #SupportResistance #DemandZone #CryptoTrading #TechnicalAnalysis

PYR/USDT Breaking the Downtrend? Major Reversal Setup Toward $2+

📌 Analysis Summary:

PYR/USDT is currently at a critical juncture after enduring a prolonged downtrend since December 2024. However, early signs of a major trend reversal are emerging as selling pressure weakens and a bullish pattern begins to form.

The price action has shaped a classic Falling Wedge — a well-known bullish reversal pattern. The declining volume, narrowing price action, and strong support zone indicate that a breakout may be imminent.

📊 Pattern: Falling Wedge (Bullish Reversal)

Descending Trendline: Consistent lower highs since December 2024 now being tested.

Volume Contraction: Typical of the final phase of accumulation before a breakout.

Solid Support Base: Formed at the $0.78–$0.83 area, with multiple bounces.

This pattern suggests that although the price has been declining, bearish momentum is fading, paving the way for a potential sharp move upward.

🚀 Bullish Scenario (Upside Reversal):

If PYR can break above the descending trendline and close above $0.95 with strong volume, it would confirm the breakout and open the path toward these key resistance levels:

1. $1.045 – Initial breakout target.

2. $1.10 – Psychological resistance.

3. $1.181 – Former support turned resistance.

4. $1.300 – Consolidation zone from earlier.

5. $1.382 – Fibonacci-based extension.

6. $2.148 – Mid-term target and key historical resistance.

7. $2.592 – $3.458 – Long-term target if the bullish trend fully unfolds.

📍 A daily candle close above $1.10 with strong volume would be a solid confirmation of trend reversal.

🔻 Bearish Scenario (Failed Reversal):

If the price fails to break above the trendline and faces rejection:

A retest of the $0.83–$0.78 support zone is likely.

A breakdown below $0.78 may lead to deeper lows (not visible on this chart).

Bearish momentum would strengthen further if BTC or the broader market sentiment turns negative.

📍 Bearish confirmation would occur on a strong breakdown below $0.78 with increasing sell volume.

🎯 Strategy & Key Insights:

Watch for a clean breakout with volume above the descending trendline.

Ideal setup for breakout traders or mid-term swing traders.

Excellent risk/reward ratio near the bottom of a long downtrend.

📈 Summary of Potential Upside Targets:

Target Type Price Level

Initial Breakout $1.045

Breakout Confirmation $1.10

Extension Target $1.181 - $1.382

Mid-Term Target $2.148

Long-Term Potential $2.592 – $3.458

🔥 Final Thoughts:

PYR/USDT is sitting at the edge of a breakout from a long-term downtrend, and if this Falling Wedge pattern plays out, it could mark the beginning of a powerful bullish phase. The upside potential is massive, with targets over 100% above the current level. However, caution is still needed — a rejection at the trendline could invalidate the bullish thesis. Watch this chart closely!

#PYR #PYRUSDT #CryptoBreakout #AltcoinReversal #FallingWedge #TechnicalAnalysis #BullishSetup #CryptoTrading #BreakoutTrade #AltcoinSeason

#PYR/USDT#PYR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.05.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 1.06

First target: 1.08

Second target: 1.09

Third target: 1.11

#PYR/USDT#PYR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.100.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.130

First target: 1.174

Second target: 1.200

Third target: 1.259

#PYR/USDT#PYR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 1.13.

We are seeing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.165

First target: 1.19

Second target: 1.23

Third target: 1.28

#PYR/USDT#PYR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.07.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 1.08

First target: 1.11

Second target: 1.14

Third target: 1.187

#PYR/USDT#PYR

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 1.05, which acts as strong support from which the price can rebound.

Entry price: 1.18

First target: 1.27

Second target: 1.37

Third target: 1.48

#PYR/USDT#PYR

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.325

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.390

First target 1.464

Second target 1.529

Third target 1.615

#PYR/USDT#PYR

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.72

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.73

First target 1.80

Second target 1.85

Third target 1.19

#PYR/USDT#PYR

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.96

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 2.055

First target 2.16

Second target 2.26

Third target 2.37

Ready to launch upwards#PYR

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.44

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2.52

First target 2.70

Second target 2.80

Third target 3.03