QNT/USDT — Compression Phase Hints at an Explosive MoveQNT/USDT on the Weekly (1W) timeframe is currently in a long-term consolidation phase after a sharp decline from its ATH, followed by progressively tightening price action. The current structure indicates a major accumulation phase, where volatility continues to contract and buying and selling pressure remain in balance.

This area represents a critical decision zone for QNT’s next major move.

---

Pattern Explanation

Price is forming a Symmetrical Triangle on the weekly timeframe, characterized by:

Lower Highs (LH) → descending resistance trendline

Higher Lows (HL) → ascending support trendline

Price range narrowing toward the apex

This pattern is neutral by nature, but it often acts as a continuation pattern of the prior trend. A breakout from this structure may trigger a strong impulsive move.

---

Key Levels

Resistance Zones:

102 USDT → minor resistance / early breakout confirmation

131 USDT → mid-level resistance

159 – 194 USDT → major resistance & strong supply zone

Support Zones:

83 USDT → current support / reaction zone

69 USDT → structural support

40 USDT → extreme support / pattern invalidation level

---

Bullish Scenario

The bullish scenario will be confirmed if:

Price breaks and closes weekly above the resistance trendline

Supported by increasing volume

Upside potential:

Initial breakout → 102 USDT

Bullish continuation → 131 USDT

Major target → 159 – 194 USDT

If the breakout is valid, this symmetrical triangle may serve as a base for a long-term trend reversal.

---

Bearish Scenario

The bearish scenario occurs if:

Price breaks down and closes weekly below the support trendline

83 USDT support fails to hold

Downside potential:

Next support → 69 USDT

Further breakdown → 40 USDT

A drop below 40 USDT would invalidate the accumulation structure and open the door for a broader bearish continuation.

---

Conclusion

QNT is currently positioned at a critical level, forming a weekly symmetrical triangle. The market is “building energy” for its next major move.

Traders and investors are advised to wait for clear breakout or breakdown confirmation, as the next direction may define QNT’s trend for the coming months.

#QNT #QNTUSDT #CryptoAnalysis #WeeklyChart #SymmetricalTriangle #MarketStructure #Breakout #SupportResistance #Altcoin

Qntusdtlong

QNTUSDT Breakdown Loading? Yello Paradisers! Have you seen what’s forming on #QNT’s chart? A clean Head and Shoulders pattern is developing, and it’s signaling that a major move could be just around the corner.

💎The structure shows clear bullish exhaustion, with the left shoulder, head, and right shoulder all forming under weakening momentum. Price is now pressing directly against the neckline supports the final barrier before a potential trend reversal.

💎Adding fuel to the fire, #QNT has already broken below its ascending trendline, confirming that buyers are losing grip. If we get a confirmed close below the neckline with volume, the bearish setup becomes active, opening the door to more downside.

💎The first area to watch is 81.70, a minor support where short-term buyers may react. But the main downside target sits between 69.65 and 67.52, a strong historical demand zone and high-volume area that could attract heavier bids.

💎As long as QNT stays below 99.70, the bearish outlook holds. A reclaim of that level would invalidate the pattern and give bulls another shot at pushing higher.

Stay sharp, the setup is clean, but it’s also a classic trap zone.

MyCryptoParadise

iFeel the success🌴

#QNT/USDT — Rebound from Historical Zone or Breakdown into Aby#QNT

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 85.00. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 86.33

First target: 88.00

Second target: 90.85

Third target: 94.40

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

QNTUSDT — Rebound from Historical Zone or Breakdown into Abyss?The market has brought QNT/USDT back to one of the most decisive areas in its history — the 78–66 support block, a zone that has served as a major stronghold for long-term holders since 2021.

This isn’t just a technical level — it’s the battlefield where previous fake breakdowns turned into massive reversals and multi-month rallies.

Now, once again, price stands on this critical threshold, but this time the selling pressure feels heavier and more deliberate.

Interestingly, the higher-low structure formed since early 2024 remains intact, aligning perfectly with this same support zone — creating a powerful confluence between horizontal and ascending support.

This makes the current price action a true “make or break” moment for QNT on the weekly timeframe.

The deep wick that pierced below the yellow zone and was quickly pulled back up suggests a liquidity grab — a classic move used by smart money to shake out weak hands before a potential reversal.

But if we see a weekly close below 66, it could mark the beginning of a major structural breakdown toward the 40s.

---

Bullish Scenario:

If QNT manages to defend the 78–66 zone and prints a strong weekly close above 80, a major bullish reversal could be in play.

The first confirmation comes on a breakout above 100.28, which would open the path toward 135 → 159 → 193 as progressive upside targets.

Watch for bullish reversal patterns (hammer, engulfing) with rising volume — those would indicate accumulation and a shift toward expansion phase.

---

Bearish Scenario:

A weekly close below 66 would be a critical warning signal.

Such a breakdown could trigger a continuation move toward 40.6, the next key historical low and liquidity magnet.

Failure of buyers to defend this zone would likely turn the mid-term market structure decisively bearish.

---

Pattern & Technical Structure Summary:

Pattern: Long-term consolidation with an ascending support line since 2024.

Reversal Zone: 78–66 (yellow block).

Confluence: Horizontal + trendline support meet at the same region.

Main Resistances: 100 → 135 → 159 → 193 → 357.

Last Support if broken: 40.6.

Market Behavior: Long wicks show liquidity grabs; market is testing equilibrium before choosing direction.

---

Conclusion:

QNT stands in a golden zone between hope and collapse.

If history repeats, the 78–66 block could once again act as the launchpad for a strong bullish wave over the coming months.

But if this level fails for the first time since 2021, the market could enter an entirely new phase — where only disciplined traders with tight risk management will survive.

The next 1–2 weekly closes will decide QNT’s fate for the quarters ahead.

Watch volume, structure, and the reaction at this key zone carefully.

---

#QNT #Quant #QNTUSDT #CryptoAnalysis #TechnicalAnalysis #SupportZone #BreakoutOrBreakdown #PriceAction #CryptoTrading #SmartMoney #MarketStructure

QNT/USDT — Weekly Demand Zone: Major Rebound or Breakdown Ahead?QNT is currently retesting a historical demand zone in the range of $89.76 – $97.77 (Fibonacci 0.5–0.618 confluence). This level has repeatedly acted as a strong pivot point since 2022, and now the market faces yet another decisive moment.

---

🔎 Technical Analysis

Long-Term Trend: Since topping around ~$432, QNT has been in a broader downtrend forming lower highs. However, since 2023 the market has shifted into a sideways accumulation phase above the $80–$100 range.

Key Zone: The highlighted yellow zone ($89.76 – $97.77) is a pivotal demand area. Holding this level could trigger a strong rebound, but a breakdown below would expose much lower targets.

Nearest Resistances: $118.76 → $137.10 → $161.96 → $193.54

Extreme Supports: $70.00 → $40.82

---

✅ Bullish Scenario

Confirmation: A strong weekly close above the demand zone, followed by bullish continuation candles with volume.

Stage 1 Target: $118.76 (≈ +32% upside from $89.76)

Stage 2 Targets: $137.10 → $161.96 → $193.54 if momentum accelerates.

Pattern Outlook: Potential double bottom / re-accumulation structure on the weekly timeframe, waiting for breakout confirmation above key resistance.

---

⚠️ Bearish Scenario

Risk: A weekly close below $89.76 (0.618 Fib) would confirm breakdown of the demand zone.

Downside Targets: $70.00 as the next support, with a potential retest of the historical low at $40.82 if bearish pressure intensifies.

Pattern Outlook: A breakdown here could trigger long liquidation cascades and accelerate the bearish trend.

---

📌 Setup & Risk Management

Aggressive Entry: Scale in within the $89–$98 range, but only with daily/weekly bullish confirmation (pin bar / engulfing close).

Conservative Entry: Wait for a confirmed breakout + weekly close above $118.76 to validate trend reversal.

Stop Loss: Below $84 (under the 0.618 Fib + historical wick support).

Risk-to-Reward Example: Entry $94, stop $84, target $118.76 → R:R ≈ 2.48 : 1.

---

🎯 Conclusion

The $89.76 – $97.77 demand zone is the make-or-break level for QNT in the mid-term outlook:

Hold → potential rebound rally towards $118–$193.

Break → bearish continuation likely, with targets down to $70 or even $40.

QNT is at a critical crossroads: will this demand zone once again spark a rally, or will it finally give way to a deeper breakdown?

---

#QNT #QNTUSDT #Quant #Crypto #TechnicalAnalysis #PriceAction #Fibonacci #SupportResistance #CryptoTrading #SwingTrade

QNT Price Action Heating Up at Critical ZoneGETTEX:QNT attempted to break above its key resistance zone but ended up creating a fakeout, trapping late buyers at the top.

The sharp rejection dragged the price back down toward a strong support zone, which also aligns with the rising trendline.

This area is now a key decision point, if the price holds, a bullish reversal could follow. But if it breaks below, further downside is likely. This level will define QNT’s next major move.

DYOR, NFA

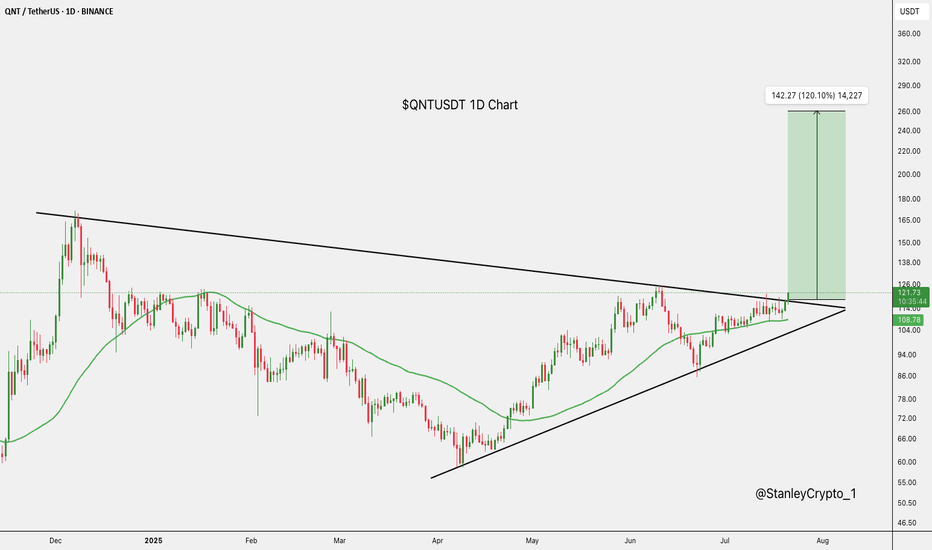

$QNTUSDT Breakout – 120% Move Ahead?GETTEX:QNT just broke out of a major triangle pattern that’s been building for months.

With this breakout above $121, the chart hints at a strong move ahead, possibly up to $260.

If it holds above the $108 zone, this could be the start of a big rally. One to watch closely.

DYOR, NFA

QNT Accumulating Under Resistance — Big Move Ahead?QNT is showing strength, but a key test lies ahead.

After breaking out of its previous downtrend (red line), QNT has formed a strong rising structure supported by the blue trendline.

The price is currently consolidating just below the key resistance zone, attempting to gather momentum. This is a classic sign of healthy price action — retesting higher levels while maintaining support.

As long as QNT holds the strong rising support line and the lower support zone, the bullish structure remains intact. A clear breakout above the resistance zone could trigger the next leg higher.

However, if price breaks below the rising support, we could see a pullback toward the lower zone for re-accumulation.

For now — it’s a wait and watch at the resistance. Bulls need to prove their strength.

DYOR, NFA

#QNT/USDT#QNT

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 86

Entry price 92

First target 98

Second target 103

Third target 110

Quant (QNT): Entering a Bullish ScenarioStrong Upside Potential

Quant (QNT) has officially entered a bullish phase, as the price refused to drop below $84, signaling a strong buying zone and market confidence. Currently trading at $106, QNT is showing momentum to easily break through key resistance levels at $130 and $170 in the coming months.

If the bullish trend continues, QNT could be on track to challenge its all-time high and potentially set a new record by the end of 2025.

Key Levels to Watch

Support Zone: $84 (strong rejection area, confirming bullish sentiment).

Short-Term Resistance: $130 (first breakout level).

Mid-Term Target: $170 (key area before testing new highs).

Long-Term Potential: New all-time high by late 2025, depending on market conditions and demand for QNT’s blockchain solutions.

Conclusion: QNT Positioned for a Major Breakout

With solid support at $84 and a strong push above $106, QNT is poised for a significant rally. The next major moves include breaking $130 and $170, which would set the stage for a new all-time high by the end of 2025.

#QNT/USDT#QNT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 92

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 43

First target 95

Second target 97

Third target 99

QNT Breaks Out! Is a 64% Rally on the Horizon?QNT/USDT has broken out of a descending triangle, signaling a potential bullish move. If the breakout holds, the price could target a 64% upside, as projected by the measured move.

Watch for a retest of the breakout level and triangle support for confirmation.

#QNT/USDT#QNT

The price is moving in a descending channel on the 4-hour frame and it was broken upwards

We have a trend to stabilize above the moving average 100

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards

We have a major support area in green at a price of 58.00

Entry price 63.90

First target 71.60

Second target 76.50

Third target 82.90

QNTUSDT Is a Bullish Breakout or Bearish Fakeout—What’s Next?Yello, Paradisers! Is #QNTUSDT gearing up for a powerful rally, or could we be on the brink of a deeper pullback? Here's what you need to know:

💎#QNT has shown signs of bullish strength by breaking above a key resistance level, which has now been retested as support. If the price continues to respect this support, it could signal a bullish continuation. The next critical step for confirmation is a break above $95.6, followed by a daily candle close above this level. If this happens, we could see QNT pushing toward its major resistance target in the next leg upward.

💎If the support fails to hold, there’s a risk of a fakeout, with QNT potentially dropping toward the $70 demand zone. This level is crucial for sustaining any bullish momentum. A rebound from here would be necessary to reclaim the support at $82, allowing the bullish scenario to remain in play.

💎Should QNT break below the $70 demand zone and close beneath it on the daily chart, it would invalidate the bullish outlook. This could lead to further downward pressure and a deeper correction in the coming sessions.

Remember, Paradisers, the market is a game of probabilities, not certainties. Always trade with clear confirmations, and never let emotions dictate your strategy. Play it smart and stay disciplined!

MyCryptoParadise

iFeel the success🌴

#QNT/USDT#QNT

The price is moving within a bearish channel pattern on the 12-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 68.00

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 75.00

The first target is 86.00

The second goal is 94.30

The third goal is 102.90