QQQ – Weekly Structure OverviewThesis

Weekly uptrend intact. Price is extended; next decision is breakout vs. consolidation near highs. We are next to the end of the long term bull trend.

Context

200WMA is rising and aligns with major support near 440 (long-term mean reversion / reset zone).

What I see

- Prior stress phases reverted toward the 200WMA (2022 and early 2025).

- Current structure is a rising consolidation near highs (compression).

What matters now

- Continuation remains favored while price holds above key trend support ($600 on chart).

- A clean weekly expansion above the consolidation keeps upside structure intact.

Buy / Accumulation zone

- Long-term accumulation zone: $440 area (200WMA + horizontal support confluence).

Targets

- Extension reference: 2.618 Fib $720s (measured upside within current structure).

Qqqforecast

WEEKLY QQQ (NQ-US100-USTECH) Outlook - Prediction (14 DEC)WEEKLY QQQ (NQ-US100-USTECH) Outlook - Prediction (14 DEC)

📊 Market Sentiment

Market sentiment has turned slightly bullish again following the FED’s rate cut decision. We saw the market react quickly after Powell’s speech. QE has restarted, and the FED stated it will buy $40 billion of Treasury bills over the next 30 days. This narrative supports the bullish case; however, $40B is relatively small compared to the overall size of the U.S. market.

At the same time, the bearish narrative is strengthening. Powell stated that “rates are now in a plausible range of neutral,” and the FED emphasized that it will assess incoming data until the January meeting. No decision has been made for January yet.

This keeps the market in a state of uncertainty and when the market lacks a clear narrative, it often turns bearish. Keep this in mind.

📈 Technical Analysis

QQQ hit the 629 level, as I pointed out last week. I am linking last week’s QQQ prediction below for reference.

Price ran the 629 level but could not close above it. After that, we saw selling pressure due to SPY and YM hitting all time highs and getting rejected. QQQ was the weaker index last week, which explains why we did not expand as much as SPY and why QQQ failed to reach all time highs.

I believe the expansion higher will resume, but first price needs to gather more energy before continuing upward.

📌 Prediction – Outlook

I am tracking three different scenarios:

Scenario 1 (Black Line) – Bullish:

Price runs the 610.5 level and closes above it. If this occurs, I will be buying calls, targeting 617.5 first, with a runner for higher levels.

Scenario 2 (Orange Line):

Price retraces to 610.5 and closes below, creating a deeper pullback. Price then reaches 605.5 and closes back above it. This would likely initiate bullish momentum.

In this case, I would be buying calls, targeting 610.5 first and 617.5 as the second target.

Scenario 3 (Red Line) – Bearish:

Price retraces to 610.5 and aggressively closes below. Price then continues lower toward 597.5 without showing strength.

If price later closes back above 597.5, I will look to buy calls.

Initial profit targets would be 605.5 and 610.5.

💬 For detailed insights and broader market context, please check my Substack link in profile.

For educational purposes only. This is not financial advice.

QQQ Structured Bullish Scenario • Compression Into MA Support📌 Asset: QQQ — Invesco QQQ Trust Series 1 (NASDAQ ETF)

🔎 Style: Swing / Day-Trade Profit Playbook

🎨 Theme: Bullish Pullback Setup using Triangular Moving Average + Layered Entry Strategy

📈 Bullish Pullback Plan — “Thief Layering Strategy” Edition 🕵️♂️💰

QQQ is pulling back into a Triangular Moving Average zone, forming a clean bullish reaction area. Price behavior shows controlled momentum, healthy retracement, and a potential continuation toward the upper supply zone.

To keep it fun — Thief OG Style is included but in TradingView-permitted language and friendly terms.

🎯 Entry Plan (Layered Limit Entries — “Thief Style but TV-Friendly”)

Using a layered entry method (multiple limit orders placed at different levels to reduce average cost and control risk):

Buy Limit Layer 1: 605

Buy Limit Layer 2: 610

Buy Limit Layer 3: 615

Buy Limit Layer 4: 620

(Traders may increase or reduce the number of layers based on their own strategy and risk tolerance.)

🛑 Stop Loss (Risk Control Zone)

📍 Proposed Risk Level: 600

This is shared for educational insight only — every trader must select their own SL depending on risk appetite.

🎯 Target Zone (Resistance + Police Force Zone 🚓😆)

Projected upside target: 650

The resistance zone has strong reaction history + signs of overbought conditions + possible liquidity traps.

So take profit smartly and exit with gains before “police force” catches late buyers.

(Again: this TP is optional — traders should decide their own TP levels.)

📚 Market Context & Correlation Watchlist 🔍🌐

QQQ is heavily correlated with major US tech indices & megacap tech stocks. Watching related pairs helps understand volatility, liquidity shifts, market strength, and trend momentum.

🔗 Related Pairs to Watch (Cross-Checks & Correlation Insight)

💠 NASDAQ:NDX / PEPPERSTONE:NAS100

Direct parent index of QQQ

Moves almost identically

Great for trend confirmation

💠 SP:SPX / AMEX:SPY

Broader market risk sentiment

If SPY + QQQ align in bullish direction → strength confirmed

💠 TVC:VIX

Volatility meter

Lower VIX supports bullish continuation

💠 NASDAQ:AAPL , NASDAQ:MSFT , NASDAQ:NVDA , NASDAQ:AMZN , NASDAQ:GOOGL

These top components control majority of QQQ weighting

Bullish tech megacaps = higher probability QQQ reaches target

💠 TVC:DXY (Dollar Index)

Strong USD = pressure on equities

Weak USD = supportive for QQQ rallies

💠 NASDAQ:TLT / US10Y

Bond yields inverse to growth stocks

Falling yields can provide additional bullish fuel for QQQ

🧠 Key Technical Points 🛠️🔥

Triangular MA acting as dynamic support

Healthy pullback with controlled selling

Layering entries reduces average cost & improves RR

Resistance zone at 650 aligns with prior structure

Megacaps still holding bullish bias

Volatility decreasing → favorable for continuation

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer

This is a thief-style trading strategy just for fun.

#QQQ #NASDAQ #ETF #SwingTrade #DayTrading #TechnicalAnalysis #TriangularMA #LayeringStrategy #LimitOrders #MarketAnalysis #TradingPlaybook #USMarkets #Stocks #TraderLifestyle #Investing #BullishSetup #TrendContinuation #RiskManagement #ChartAnalysis

Why I'm NOT Buying the Dip on QQQ (Yet)Many traders are trying to catch a falling knife on the Nasdaq right now. Here is why my system says "Wait."

Looking at the Quant Master system on the 4H timeframe:

Trend is King: The candles are Red. This means Price is below the Volatility Stop and below the institutional VWAP anchor. There is no "Green Light" to buy yet.

Beware the "Black" Zones: If the candles turn Black, it means volatility has spiked or momentum has died (Chop). I do not trade in Black zones. I am waiting for clear Blue structure.

The Exit Was Clear: If you look at the top of the chart, the system printed multiple Purple Triangles. This signaled that the trend was exhausted relative to its statistical baseline. If you didn't take profit there, the market took it for you.

The Plan:

I am sitting on my hands until price closes ABOVE the VWAP (Orange Line) and the Stop Loss line turns Blue.

Trade what you see, not what you think.

QQQ Bearish Pullback: Retest Toward 590–595 ZoneQQQ on the 1D chart has been trending higher for months, but the latest session printed a clean Bearish Engulfing with a ~1.86% drop and a break below the 20-day (around 614.50). That rejection left fresh supply near the recent high at 635 and flipped 610–615 into near-term resistance. Momentum has shifted short-term to the downside even as the broader structure remains bullish.

Primary path: a corrective leg toward the 590–595 demand zone. That area aligns with prior polarity and the 60-day moving average, with the lower Bollinger Band near 588 adding confluence. A sustained break below 610 would likely unlock that move, where buyers can attempt to stabilize price and rebuild trend structure.

Alternative: if buyers reclaim 622 on a daily close, the bearish signal is invalidated and the door reopens for a retest of 635. Conversely, if 590 fails decisively, the correction can extend toward the 120-day region around 570–575, signaling a deeper, medium-term reset.

This is a study, not financial advice. Manage risk and invalidations

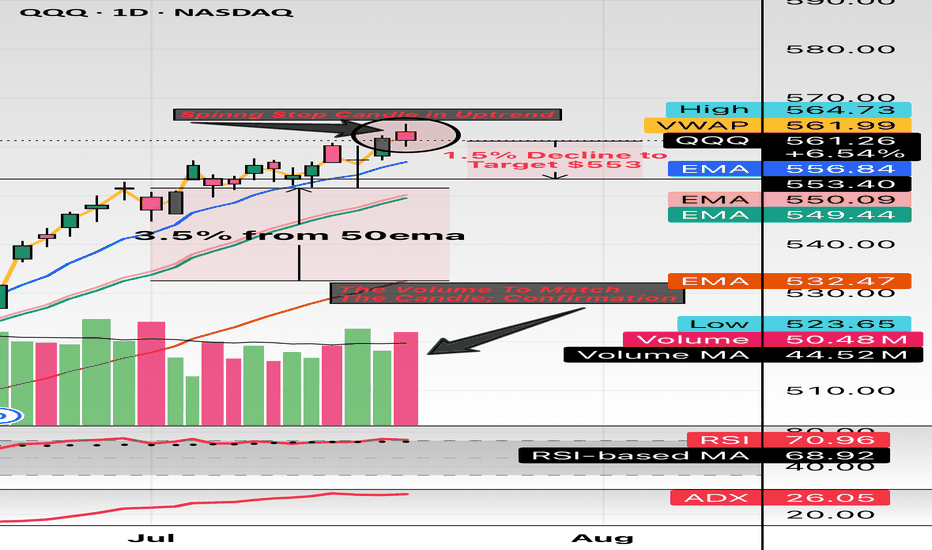

$QQQ this might the spot. Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY.

Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop candle and has volume to match. These candles usually take place (green or red) in downtrends or uptrends and provide pivotal indication. The market has major earnings this week (07/21/2025 to 07/25/2025) with names like Google, Tesla, General Dynamics, Verizon, Domino’s And so forth.

This week could be a catalyst to see some great volatility. I believe staying 3% from moving averages so I have noted 3.5% from the 50EMA and revisiting the 20EMA and 21EMA in the low $550 area. My target is $553 which is only a 1.4% move which can happen in one session in this environment while staying 3.5% above the 50EMA.

My trade idea will be $553p for 07/25/2025. Good luck!

WSL

2007 Top /2025 day 38td t-minus 2.5 days Major TOP The chart in focus is the 2007 chart we are now day 38 in the pattern and in 2007 we took 40td to make a new high And I have posted my models .I see the next rally to reach anywhere from 6035/on the low end to 6177 on the high end focus 6147 where Ax 1.618 = wave C or 3 Best of trades WAVETIMER

QQQ about to FLUSH?! Let's talk about it!I'm not saying it's over but you have to admit it does feel like we are going to see a decent size pullback...2-6% over the next few weeks on the NASDAQ:QQQ AMEX:SPY

- TVC:VIX back over 20

- US20Y hit 52 week high

- USDJPY starting to creep towards April lows

- $491.54 GAP to fill on NASDAQ:QQQ

- $447.58 Bigger GAP to fill on NASDAQ:QQQ

- Credit starting to become and issue

- Banks/ Credit companies tanked today

There is bullish pieces as well but we do look extended here and a healthy 2-6% would be welcomed...A break of $475 level spells trouble on QQQ.

THIS TIME IT'S DIFFERENT!🔥 THIS TIME IT'S DIFFERENT! 🔥

Can you see the shift?! VOLUME IS HERE—AND IT'S MASSIVE. 💪💰

Unlike those weak, fleeting rallies that got crushed under waves of red, this one is packed with bullish buyers and offside hedge funds READY TO SEND IT HIGHER. 🚀📈

Not to mention the last time we had this level of above average volume for this long was in October 2023 when we were coming out of a bear market and it was only the beginning of our ascent higher!

I'm not saying we can't have a pullback soon...I'm just simply saying the volume is here and it looks like dips will indeed be shallow.

ATH retest INBOUND!

Are you positioned for the move? 👀

AMEX:SPY NASDAQ:QQQ

$QQQ Inverse H&S ready to GO!NASDAQ:QQQ

We’ve spotted an Inverse Head & Shoulders breakout on the 1-hour chart, and we’re currently in the retest phase.

- Measured Move (MM): $483.55

- Measured Timeframe (MT): May 1st @ 7 PM

Let’s see if we can maintain momentum tomorrow and steer clear of any unexpected news or market shocks tonight.

Not financial advice

$QQQ Poised for Lift-Off: Flipping Resistance, Eyeing $470-$475!🚀 NASDAQ:QQQ Poised for Lift-Off: Flipping Resistance, Eyeing $470-$475! 🚀

As mentioned in my recent post, we’ve successfully flipped the $443.14 resistance into support—a key technical shift!

🔹 Momentum Building:

- Wr% Indicator: Making higher lows and advancing steadily towards the Red Barrier.

- Volume Gap: Still in play and ready to be filled.

With a higher low now established, I believe we’re set up for a potential move to $470-$475 next week.

📈 Let’s see how this plays out—exciting times ahead!

💡 Have an amazing weekend, friends!

Not financial advice

Island Bottom CONFIRMED on $QQQ IF we GAP up tomorrow!Island Bottom CONFIRMED on NASDAQ:QQQ IF we GAP up tomorrow!

I only believe we GAP up tomorrow IF there is news of China coming to the negotiation table with the U.S after they have raised the Reciprocal Tariffs to 104%.

If this doesn't happen then this isn't confirmed and we see a retest of $400 IMO!

I'm not playing this as a trade until we get confirmation! Too dangerous!

Not financial advice

How bad will it get? Let's talk about it!🌟 My Market Probabilities: 🌟

1⃣ 15% chance of a V-Shape recovery with a bottom at $410–$425

2⃣ 45% chance of a COVID-like Flash Crash resolving at

$385–$400

3⃣ 33% chance of a 2022-level bear market down to

$330–$350

4⃣ 5% chance of a 2008-level crash hitting $250–$260

5⃣ 2% chance of a crazy Dot.com-level crash dropping to $90–$110

💡 No matter which scenario unfolds, it’s a blessing in disguise! These dips create incredible opportunities to invest in great companies or indexes like the AMEX:SPY or NASDAQ:QQQ paving the way for massive, life-changing wealth over the years and decades to come.

🚀 Think long-term as an investor, friends, and stay focused on the bigger picture!