$JPGDPQQ -Japan GDP (Q3/2025)ECONOMICS:JPGDPQQ

Q3/2025

source: Cabinet Office, Japan

- Japan’s GDP contracted 0.4% qoq in Q3 2025, reversing an upwardly revised 0.6% expansion in Q2, though the figure was slightly better than estimates of a 0.6% decline, preliminary data showed.

It marked the first quarterly drop since Q1 2024, due to subdued private consumption and a drag from net trade.

Government spending (0.5% vs 0.1%) and business investment (1.0% vs 0.8%) recorded their strongest gains in five quarters,

supported by front-loaded public works and corporate upgrades to production capacity.

The latest print comes as Prime Minister Sanae Takaichi’s administration prepares a stimulus package to ease rising living-cost pressures and support exporters facing higher U.S.

Quarterly

$GBGDPQQ - U.K GDP Growth Disappoints (Q3/2025)ECONOMICS:GBGDPQQ

Q3/2025

source: Office for National Statistics

- The UK economy grew 0.1% in Q3 2025,

easing from 0.3% in Q2 and falling short of market expectations of 0.2%.

Gains in investment, consumption, and net trade were partly offset by falling inventories. Annually, GDP rose 1.3%, slightly below expectations.

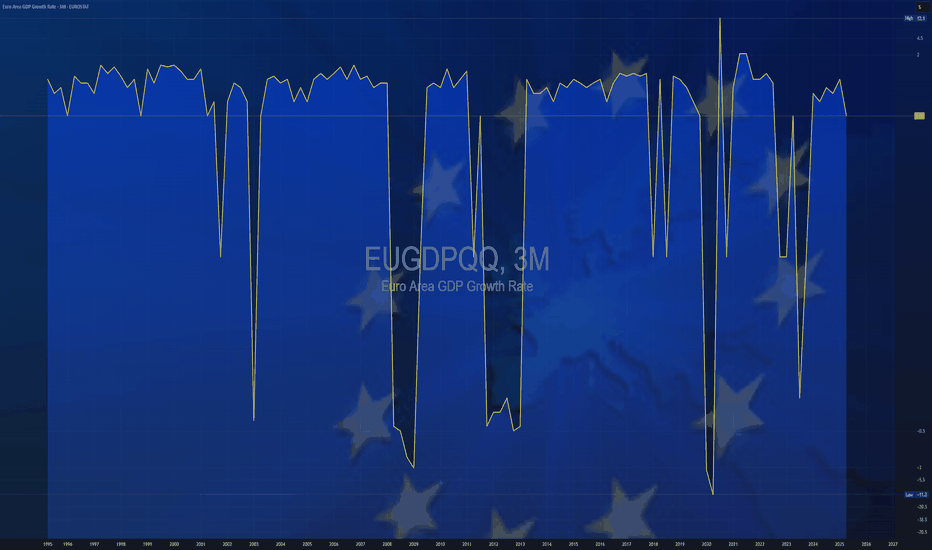

$EUGDPQQ -Europe GDP (Q3/2025)ECONOMICS:EUGDPQQ

Q3/2025 +0.2%

source: EUROSTAT

- The Eurozone economy expanded by 0.2% quarter-on-quarter in Q3 2025,

up from 0.1% in Q2 and slightly above market expectations of 0.1%, according to a flash estimate.

France grew 0.5%, exceeding expectations of 0.2%, driven by a sharp rise in exports, while Spain remained the best performer among the bloc’s largest economies, expanding 0.6% as expected, supported by strong household consumption and fixed investment.

Meanwhile, Germany stagnated due to a decline in exports, and Italy stalled, with the industrial sector contracting and services showing no growth.

On an annual basis, Eurozone GDP rose 1.3%, above expectations of 1.2%.

The better-than-expected figures ease pressure on the ECB to cut interest rates in the near term, supporting the view that the economy remains resilient despite geopolitical tensions and trade policy uncertainty.

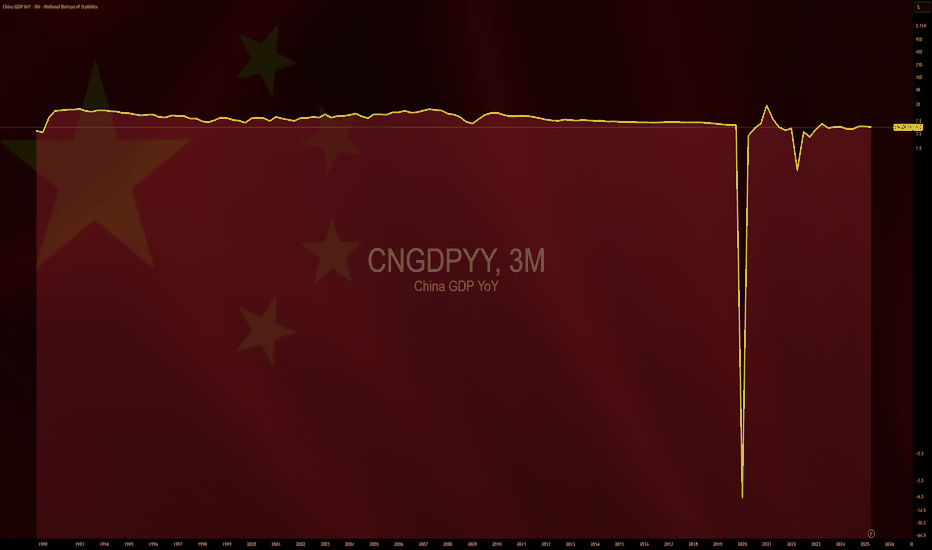

$CNGDPYY - China GDP (Q3/2025)ECONOMICS:CNGDPYY

Q3/2025

source: National Bureau of Statistics of China

- China’s economy expanded 4.8% year-on-year in Q3 2025, down from 5.2% in Q2,

marking its slowest pace since Q3 2024.

While in line with market expectations,

the GDP growth has lost momentum after a strong start to the year, pressured by U.S. trade tensions, a prolonged property slump, and soft consumer demand.

September data showed retail sales in China rose at their slowest pace in a year despite ongoing consumer subsidy programs, while the jobless rate edged down but remained near August’s six-month high.

Industrial output, however, grew at its fastest pace in three months ahead of Golden Week.

On the trade front, exports and imports beat forecasts as firms pushed into new markets and domestic demand was boosted by holiday spending.

China’s statistics bureau cautioned that risks and external headwinds persist, with the recovery’s foundation still fragile.

Still, it said that 5.2% growth in the first nine months lays a “solid foundation” for meeting a full-year target of around 5%.

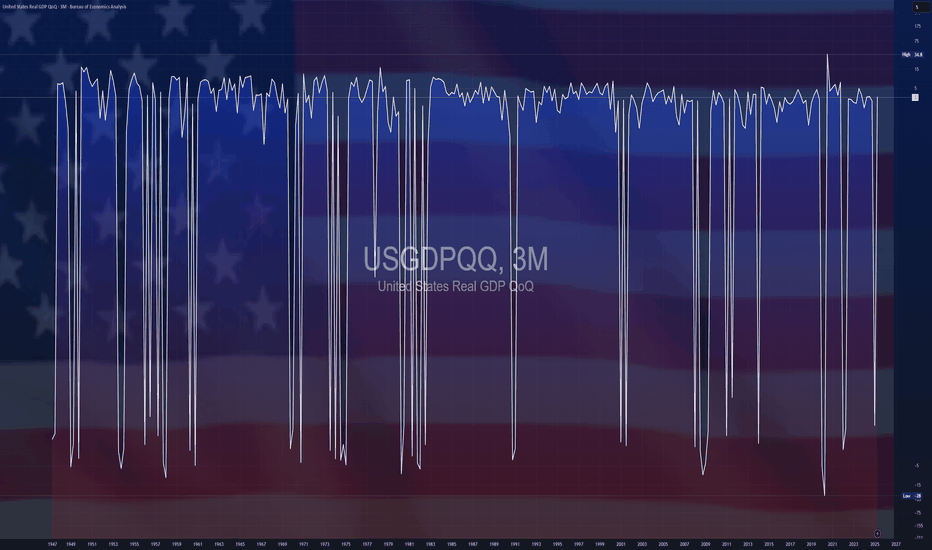

$USGDPQQ -U.S GDP Growth Rate Revised Sharply Higher (Q2/2025)ECONOMICS:USGDPQQ

Q2/2025

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 3.8% in Q2 2025,

much higher than 3.3% seen in the second estimate, and marking the strongest performance since Q3 2023.

The upward revision was driven mainly by stronger consumer spending.

$USGDPQQ -U.S GDP Growth Revised HigherECONOMICS:USGDPQQ

Q2/2025

source: U.S. Bureau of Economic Analysis

- United States GDP grew at a 3.3% annual rate in Q2/2025,

rebounding from a 0.5% drop in Q1, according to second estimates.

The upgrade from the initial estimate of 3% reflects upward revisions to investment and consumer spending that were partly offset by a downward revision to government spending and an upward revision to imports.

GBGDPQQ -Great Britain GDP (Q2/2025)ECONOMICS:GBGDPQQ

Q2/2025

source: Office for National Statistics

- The British economy grew 0.3% qoq in Q2 2025, slowing from a 0.7% expansion in Q1 but surpassing forecasts of just 0.1%, according to preliminary estimates.

The moderation partly reflects activity being brought forward to February and March ahead of April’s stamp duty changes and the announcement of new US tariffs.

In Q2, growth was fuelled by a 0.4% rise in services, led by computer programming and consultancy (+4.1%).

Construction climbed 1.2%, while production fell 0.3% due to utilities (-6.8%) and mining (-0.3%), partly offset by a 0.3% increase in manufacturing.

On the expenditure side, growth was driven mainly by a 1.2% rise in government consumption, particularly in health (vaccinations) and public administration and defence.

Gross capital formation increased on the back of higher changes in valuables, inventories, and alignment adjustments, but business investment slumped 4%.

Household spending rose a modest 0.1% and exports increased 1.6%, outpacing the 1.4% rise in imports.

$USGDPQQ -U.S Economic Growth Outpaces Forecasts (Q2/2025)ECONOMICS:USGDPQQ 3%

Q2/2025

source: U.S. Bureau of Economic Analysis

- The US economy grew at an annualized rate of 3% in Q2 2025,

sharply rebounding from a 0.5% contraction in Q1 and exceeding market expectations of 2.4% growth, largely driven by a decline in imports and a solid increase in consumer spending.

However, the gains were partly offset by weaker investment and lower exports.

$EUGDPQQ -Europe GDP (Q2/2025)ECONOMICS:EUGDPQQ

Q2/2025

source : EUROSTAT

- The Gross Domestic Product (GDP) In the Euro-Area expanded 0.10 percent in the second quarter of 2025 over the previous quarter.

GDP Growth Rate in the Euro Area averaged 0.37 percent from 1995 until 2025, reaching an all time high of 11.60 percent in the third quarter of 2020 and a record low of -11.10 percent in the second quarter of 2020.

$CNGDPYY -China GDP Growth Slows Less Than Expected (Q2/2025)ECONOMICS:CNGDPYY

Q2/2025

source: National Bureau of Statistics of China

- China’s economy expanded 5.2% yoy in Q2 2025, easing from 5.4% in the prior two quarters and marking the softest pace since Q3 2024.

Still, the latest reading narrowly beat estimates of 5.1%, supported in part by Beijing’s policy measures amid a fragile trade truce.

Growth momentum in H2 is projected to weaken further, due to headwinds from trade tensions, deflation risks, and a prolonged property slump.

SWDY Future ReboundSWDY stock is trying to peak up, but unfortunately, it's rebounding back from the resistance line 80.081. It had already broken the support line 78.989. In case of continuing, it'll break the support line 78.928 till reaching the support line 78.868. In case of rising, it'll breach the 1st resistance line at 79.199, the 2nd resistance line at 79.320, and the 3rd resistance line at 79.470, which is more recommended due to its Q1 Profit Rise, which achieved EGP 4.15 Billion versus EGP 3.98 Billion a year ago beside its Q1 revenue EGP 59.39 Billion versus EGP 45.25 Billion a year ago.

$JPGDBQQ -Japan's GDP Shrinks More than Expected (Q1/2025)$JPGDBQQ

Q1/2025

source: Cabinet Office, Japan

- Japan's GDP shrank 0.2% qoq in Q1 of 2025, compared with forecasts of a 0.1% fall and after a 0.6% growth in Q4, flash data showed.

It was the first GDP contraction in a year, amid worries over the impact of US trade policy under President Donald Trump.

On an annualized basis, the economy contracted 0.7%, worse than consensus of a 0.2% drop and a reversal from an upwardly revised 2.4% gain in Q4.

$USGDPQQ -U.S Economy Unexpectedly Contracts in Q1/2025ECONOMICS:USGDPQQ

Q1/2025

source: U.S. Bureau of Economic Analysis

-U.S economy shrank 0.3% in Q1 2025, the first contraction since Q1 2022,

versus 2.4% growth in Q4 and expectations of 0.3% expansion, as rising trade tensions weighed on the economy.

Net exports cut nearly 5 percentage points from GDP as imports jumped over 40%. Consumer spending rose just 1.8%,

the weakest since mid-2023, while federal government outlays fell 5.1%, the most since Q1 2022.

$USGDPQQ -United States GDP (Q4/2024)ECONOMICS:USGDPQQ 2.3%

Q4/2024

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and in line with the advance estimate.

Personal consumption remained the main driver of growth, increasing 4.2%, the most since Q1 2023, in line with the advance estimate.

Spending rose for both goods (6.1%) and services (3.3%).

Also, exports fell slightly less (-0.5% vs -0.8%) and imports declined slightly more than initially anticipated (-1.2% vs -0.8%), leaving the contribution from net trade positive at 0.12 pp.

Government expenditure also rose more (2.9% vs 2.5%).

Private inventories cut 0.81 pp from the growth, less than 0.93 pp.

On the other hand, fixed investment contracted more (-1.4% vs -0.6%), due to equipment (-9% vs -7.8%) and as investment in intellectual property products failed to rise (0% vs 2.6%).

Residential investment however, rose more than initially anticipated (5.4% vs 5.3%).

Considering full 2024, the economy advanced 2.8%.

$USGDPQQ -US Economy Slows More than ExpectedECONOMICS:USGDPQQ 2.3%

(Q4/2024)

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and forecasts of 2.6%.

Personal consumption remained the main driver of growth, but fixed investment and exports contracted.

Considering full 2024, the economy advanced 2.8%.

$CNGDPYY -China 2024 GDP Meets Official Target ECONOMICS:CNGDPYY

Q4/2024

- The Chinese economy expanded by 5.4% yoy in Q4 2024, topping estimates of 5.0% and accelerating from a 4.6% rise in Q3.

It was the strongest annual growth rate in 1-1/2 years, boosted by a series of stimulus measures introduced since September to boost recovery and regain confidence.

For full year, the GDP grew by 5.0%, aligning with Beijing's target of around 5% but falling short of a 5.2% rise in 2023.

$USGDPQQ -U.S GDP (Q3/2024)ECONOMICS:USGDPQQ

(Q3/2024)

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 3.1% in Q3, higher than 2.8% in the 2nd estimate and above 3% in Q2.

The update primarily reflected upward revisions to exports and consumer spending that were partly offset by a downward revision to private inventory investment.

Imports, which are a subtraction in the calculation of GDP, were revised up.

$USGDPQQ -U.S GDP (Q3/2024)ECONOMICS:USGDPQQ 2.8%

Q3/2024

source: U.S. Bureau of Economic Analysis

-The US economy expanded an annualized 2.8% in Q3 2024,

below 3% in Q2 and forecasts of 3%, the advance estimate from the BEA showed.

Personal spending increased at the fastest pace since Q1 2023 (3.7% vs 2.8% in Q2),

boosted by a 6% surge in consumption of goods (6% vs 3%) and a robust spending on services (2.6% vs 2.7%), mostly prescription drugs, motor vehicles and parts, outpatient services and food services and accommodations.

Government consumption also rose more (5% vs 3.1%), led by defense spending.

In addition, the contribution from net trade was less negative (-0.56 pp vs -0.9 pp), with both exports (8.9% vs 1%) and imports (11.2% vs 7.6%) soaring, led by capital goods, excluding autos. On the other hand, private inventories dragged 0.17 pp from the growth, after adding 1.05 pp in Q2.

Also, fixed investment slowed (1.3% vs 2.3%), led by a decline in structures (-4% vs 0.2%) and residential investment (-5.1% vs -2.8%).

Investment in equipment however, soared (11.1% vs 9.8%).

$EUGDPQQ -Europe's GDP (Q3/2024) ECONOMICS:EUGDPQQ 0.4%

Q3/2024

source: EUROSTAT

- The Eurozone GDP expanded 0.4% on quarter in the three months to September 2024,

the strongest growth rate in two years, following a 0.2% rise in Q2 and above forecasts of 0.2%

The German economy expanded 0.2%, surprisingly avoiding a recession, after a downwardly revised 0.3% decline in Q2.

GDP growth also quickened in France (0.4% vs 0.2% in Q2) and the Spanish economy remained robust (0.8% vs 0.8%).

In addition, the Portuguese economy grew 0.2%, the same as in Q2 while the GDP in Ireland (2% vs -1%) and Austria (0.3% vs 0%) rebounded and grew faster in Lithuania (1.1% vs 0.3%).

On the other hand, the Italian economy stalled, following a 0.2% rise in Q2 and Latvia remained in contraction (-0.4% vs -0.3%). Year-on-year, the Eurozone GDP expanded 0.9%, the best performance since the Q1 2023, compared to a 0.6% rise in the previous quarter and higher than forecasts of 0.8%.

The ECB expects the GDP in the Eurozone to expand 0.8% this year.

$CNGDPYY - China's GDP (Q3/2024)ECONOMICS:CNGDPYY Q3/2024

source: National Bureau of Statistics of China

-The Chinese economy expanded 4.6% YoY in Q3 of 2024,

compared with market forecasts of 4.5% and a 4.7% rise in Q2.

It marked the slowest annual growth rate since Q1 2023, amid persistent property weakness, shaky domestic demand, deflation risks, and trade frictions with the West.

The latest figures came as Beijing had intensified stimulus measures to boost economic recovery and rebuild confidence.

In September alone, there were some positive signs:

industrial output and retail sales both saw their largest increases in four months, and the urban jobless rate fell to a three-month low of 5.1%.

On the trade front, however, exports rose the least in five months while imports were sluggish. In the first three quarters of the year, the economy grew by 4.8%, compared with China’s full-year target of around 5%.

During the period, fixed investment rose by 3.4% yoy, topping consensus of 3.3%.