EURUSD Long: Demand at 1.1720 Sets Up a Push Toward 1.1770Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. After forming a solid pivot low, EURUSD transitioned into a bullish trend, supported by a rising trend line that guided price action higher. Following this move, the market entered a consolidation range, signaling temporary balance before the next expansion phase. Price later broke out of the range to the upside, confirming renewed buyer strength. However, upon reaching the upper Supply Zone near 1.1770–1.1780, EURUSD experienced a fake breakout, followed by rejection and increased selling pressure. This rejection highlighted active sellers defending supply. Despite this, buyers managed to push price higher again, leading to another breakout attempt above supply, though momentum remained limited.

Currently, EURUSD is pulling back from the supply area and is trading near the Demand Zone around 1.1720, which aligns with the rising demand line and prior breakout structure. This zone represents a key decision area, where buyers may attempt to defend the bullish structure.

My scenario: as long as EURUSD holds above the 1.1720 Demand Zone, the broader bullish structure remains intact, and the pullback can be considered corrective. A strong reaction from demand could lead to another test of the 1.1770 Supply Zone. However, a decisive breakdown below demand would signal a loss of bullish control and open the door for a deeper corrective move. For now, price is at a critical level, with demand acting as the key area to watch. Manage your risk!

Range

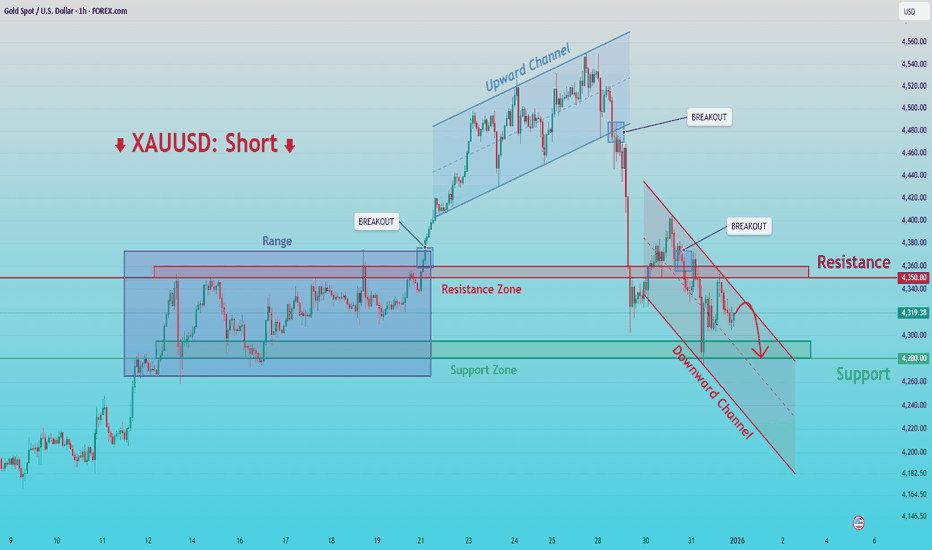

XAUUSD: Rejection at 4,350 Resistance Signals Further DownsideHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously traded within a well-defined upward channel, confirming a strong bullish structure during that phase. Price then broke down from the channel, signaling a loss of bullish momentum and a shift in market control. After the breakdown, Gold attempted to recover but was capped by a clearly defined Resistance Zone around 4,350, which previously acted as a key level during the range phase.

Currently, price formed a lower high and transitioned into a downward channel, confirming bearish continuation. Multiple breakout attempts above descending resistance were rejected, reinforcing seller dominance. The market is now trading below the former resistance, with structure favoring further downside pressure. Below current price, a Support Zone near 4,280 is visible, acting as the next key area where buyers may attempt to slow the decline.

My Scenario & Strategy

My primary scenario: as long as XAUUSD remains below the 4,350 Resistance Zone and continues to respect the downward channel, the bearish bias remains valid. Any pullbacks into resistance that show rejection can be viewed as short opportunities, with downside continuation toward the 4,280 Support Zone as the primary target.

However, a clean break and acceptance above resistance would invalidate the short scenario and suggest a potential shift back toward consolidation or recovery. Until then, structure favors sellers, with momentum aligned to the downside.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

BTCUSDT: Range Compression Signals Potential Break Above $90,100Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a broader consolidation after a strong bearish impulse earlier in the chart. Following the sell-off, price found a key support base around the 87,300 Support Zone, from which buyers stepped in and stabilized the market. Since then, Bitcoin has been moving inside a series of well-defined ranges, indicating compression and balance between buyers and sellers. Structurally, price is capped by a descending triangle resistance line, while at the same time respecting a rising trend line from below. This creates a tightening structure, suggesting a potential directional move ahead.

Currently, BTC is consolidating above the support zone and just below the 90,100 Resistance Zone, which has repeatedly rejected price in recent attempts. The latest pullbacks remain shallow and corrective, showing that sellers are struggling to push price back below support.

My Scenario & Strategy

My primary scenario as long as BTCUSDT holds above the 87,300 Support Zone, the structure remains constructive and biased toward a bullish resolution. A sustained hold above support could allow price to build momentum for another push toward the 90,100 Resistance Zone. A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside.

However, a decisive breakdown below the support zone would invalidate the bullish scenario and shift focus toward lower levels. For now, BTC remains compressed between support and resistance, with buyers defending structure and pressure building for a potential breakout.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

XAUUSD Short: Trend Line Break Signals Downside ContinuationHello traders! Here’s a clear technical breakdown of XAUUSD (3H) based on the current chart structure. Gold previously traded inside a well-defined range, indicating a phase of accumulation before buyers gained control. From this range, price broke out to the upside and followed a rising trend line, confirming a strong bullish impulse and a clear shift in market structure. The trend remained intact as price continued to form higher highs and higher lows.

Currently, gold is trading below the broken trend line and moving toward the Demand Zone near 4,320, which aligns with a previous breakout area and an important horizontal reaction level. Below this area lies the next Demand Zone around 4,270, which represents the next key downside target if selling pressure continues. The move lower appears impulsive, suggesting that the market is entering a corrective or reversal phase rather than a simple pullback.

My scenario: as long as XAUUSD remains below the Supply Zone and stays under the broken trend line, the bias favors sellers. I expect continuation to the downside toward the 4,320 Demand Zone, with a possible extension to 4,270 if bearish momentum remains strong. A strong bullish reaction from demand could lead to short-term consolidation, but without reclaiming the trend line, any upside remains corrective. Manage your risk!

BTCUSDT Long: Buyers Defend Channel Support, Upside in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a prolonged consolidation phase defined by a broad range, BTC established multiple internal breakouts, highlighting volatility but no clear directional dominance. This range acted as an accumulation zone, with price repeatedly reacting around key horizontal levels. From the lower boundary of the range, BTC formed a clear pivot low, which marked the start of a bullish recovery and shift in short-term market structure.

Currently, BTC is holding above the Demand Zone around 86,800, which aligns with prior range support and the lower boundary of the ascending channel. This area has already shown buyer reaction, reinforcing it as a key level for continuation. Price is now attempting to push higher toward the upper boundary of the channel.

My scenario: as long as BTCUSDT holds above the Demand Zone and respects the ascending channel support, the bias remains bullish. I expect buyers to defend this area and attempt a move back toward the 89,000 Supply/Resistance Zone as the first target. A clean breakout and acceptance above this level would confirm bullish continuation and open the path toward higher targets within the channel. A breakdown below demand would invalidate the long scenario. Manage your risk!

XAUUSD: Bullish Trend Remains Intact in Rising ChannelHello everyone, here is my breakdown of the current XAUUSD (Gold) setup.

Market Analysis

Gold has confirmed a bullish shift after breaking out of a prior triangle structure, where price was previously compressed between descending resistance and ascending support. This breakout marked a clear change in market structure and initiated a strong impulsive move higher. After the breakout, price transitioned into a consolidation range, indicating temporary balance before continuation.

Currently, XAUUSD established a clear upward channel, respecting both the lower channel support and the ascending trend line. This structure confirms sustained bullish momentum with higher highs and higher lows. Price has continued to trend higher and recently pushed into a key Resistance Zone, where the market is currently showing signs of reaction and testing supply. Below current price, the former resistance has flipped into a well-defined Support Zone, which aligns with the prior breakout level and the lower boundary of the upward channel. This area has already shown buyer response, reinforcing its importance as a demand zone within the bullish structure.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the Support Zone and respects the upward channel structure. I expect buyers to defend this area and attempt another push toward the Resistance Zone. A successful breakout and acceptance above resistance would confirm continuation of the bullish trend and open the path toward higher targets.

However, a strong rejection at resistance followed by a breakdown below the support zone would weaken the bullish structure and suggest a deeper correction or consolidation. For now, price action continues to favor buyers while the ascending structure remains intact.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

EURUSD Failed Break Above 1.1800 Opens Path to 1.1740Hello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD is trading within a broader bullish structure after breaking above a descending resistance formation earlier on the chart, signaling a clear shift in market control from sellers to buyers. Following this breakout, price entered a consolidation phase, forming a well-defined range, which reflected temporary balance before trend continuation. The subsequent upside breakout from this range, supported by a rising trend line, confirmed renewed bullish momentum and continuation of the upward structure. Currently, price is testing a key Resistance Level near 1.1800, where a fake breakout has already occurred, suggesting potential exhaustion of buyers at the highs. This resistance aligns with a descending resistance line, increasing the probability of seller reaction. Below current price, the former resistance has flipped into a Support Level around 1.1740, overlapping with the Buyer Zone and the previous breakout area, making it a critical demand region. My scenario: as long as price is rejected from the 1.1800 resistance, a corrective move toward 1.1740 is likely (TP1). A clean breakdown below support would open the door for a deeper pullback. A confirmed breakout above 1.1800 would invalidate the short bias and signal further upside. Please share this idea with your friends and click Boost 🚀

EURUSD Short: Failed Break 1.1800 - Demand at 1.1740 as TargetHello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. After a prolonged consolidation phase marked by a broad range, EURUSD formed a clear pivot low and transitioned into a bullish recovery. From that pivot point, price established a well-defined ascending channel, confirming a shift in market structure and sustained buyer control through higher highs and higher lows.

Currently, price is trading below a key Supply Zone near 1.1800, where a fake breakout occurred, indicating strong selling pressure at the highs. This rejection from supply suggests that buyers struggled to gain acceptance above resistance. Following the rejection, price broke below short-term structure and is now pulling back toward the 1.1740 Demand Zone, which aligns with prior breakout structure and the lower boundary of the ascending channel.

My scenario:as long as EURUSD remains below the 1.1800 Supply Zone, the risk of a bearish reaction stays elevated. A clear rejection from this resistance area, especially with bearish confirmation, would favor short positions, targeting a move back toward the 1.1740 Demand Zone as the first objective. Manage your risk!

XAUUSD Short: Rejected at Supply - Decline Toward 4,470 in FocusHello traders! Here’s a clear technical breakdown of XAUUSD (Gold, 3H) based on the current chart structure. Gold is trading within a well-defined bullish recovery after forming a clear pivot low on the left side of the chart. From that pivot point, price established a rising trend line, confirming that buyers have regained control and are steadily pushing the market higher.

Currently, price is trading between a major Supply Zone near 4,530 and a Demand Zone around 4,470. The recent pullback into the demand area appears corrective, not impulsive, suggesting profit-taking rather than a trend reversal. Buyers are defending this zone, which also aligns with prior breakout structure and short-term support.

My scenario: as long as Gold remains capped below the 4,530 Supply Zone, the risk of a bearish reaction stays elevated. Failure to break and hold above this resistance would confirm seller control at the highs and could trigger a corrective move lower. A clear rejection from the supply area may lead to a pullback toward the 4,470 Demand Zone as the first downside target. If price breaks below 4,470 with acceptance, it would signal a loss of bullish structure and open the door for a deeper correction toward lower support levels. A sustained hold below former demand would confirm a short-term bearish shift in momentum. For now, the focus is on price behavior at the supply zone, with rejection favoring a short scenario while resistance holds. Manage your risk!

BTCUSDT: Holding 87,300 Support Ahead of a 89,000 RetestHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a well-defined ascending channel, reflecting a sustained bullish structure after breaking out of the prior consolidation range. Earlier in the chart, price spent significant time moving sideways inside a broad range, capped by a resistance zone near 89,000 and supported by demand below. A decisive breakout from the range confirmed a shift toward bullish market conditions.

Recently, BTC pushed back into the 89,000 Resistance Zone, where selling pressure appeared again. The current reaction from resistance looks corrective, not impulsive, suggesting temporary rejection rather than a trend reversal. Price is consolidating just above support, indicating compression between support and resistance within the bullish channel.

My Scenario & Strategy

My primary scenario remains bullish as long as BTCUSDT holds above the 87,300 Support Zone. Continued defense of this area could lead to another attempt to test the 89,000 Resistance Zone. A clean breakout and acceptance above resistance would confirm continuation within the channel and open the door for further upside.

However, on the flip side, a decisive breakdown below the support zone and channel structure would weaken the bullish bias and signal a deeper corrective move toward lower levels. For now, price remains constructive, with buyers defending structure while BTC consolidates below resistance.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

XAUUSD Sellers Defend Resistance, Eyes on PullbackHello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold remains in a bullish structure after breaking above a descending resistance line, confirming a shift in control to buyers. Price then consolidated in a clear range, showing balanced market activity before continuing higher. The upside breakout from this range, supported by a rising trend line, confirms ongoing bullish momentum. Currently, XAUUSD is testing a key Resistance Level within the Seller Zone, where selling pressure may appear. Below, the former resistance has turned into a strong Support Level, aligned with the Buyer Zone near 4,440 and the previous breakout area. My scenario: as long as price remains below the Seller Zone and shows rejection from resistance, the bias turns bearish, with TP1 targeting a move back toward the Buyer Zone and trend-line support. A strong breakout and acceptance above resistance would invalidate the short scenario and suggest further upside continuation. Please share this idea with your friends and click Boost 🚀

BTCUSDT Bulls Defend Range Support, Eyes on $90,500Hello traders! Here’s my technical outlook on BTCUSDT (4H) based on the current chart structure. BTCUSDT previously broke down from a descending triangle structure, confirming bearish control and leading to a strong impulsive move lower. After this decline, price found a base and transitioned into a broad range, where buyers and sellers have been in relative balance. Multiple internal breakouts within the range highlight volatility but no clear trend dominance during this phase. Recently, price bounced from the lower boundary of the range and the rising Support Line, showing clear buyer reaction and a short-term shift in momentum. BTC is now trading above the key 87,300 Support Zone, which aligns with previous range support and a recent breakout level. The latest move higher looks constructive, with price attempting to challenge the upper part of the range. My scenario: as long as BTCUSDT holds above the 87,300 support area, the bias remains mildly bullish. A sustained move higher could lead to a retest of the 90,500 Resistance and TP1 near the range highs. Acceptance above resistance would open the door for further upside expansion. However, failure to hold support and a breakdown back into the lower range would invalidate the bullish scenario and favor renewed consolidation or downside. For now, the focus remains on support holding and reaction near resistance. Please share this idea with your friends and click Boost 🚀

EURUSD in Uptrend – Retest of Support Before Next PushHello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. EURUSD is trading within a clear bullish environment after transitioning from a prolonged consolidation phase into an impulsive upward move. Earlier on the chart, price was moving inside a range, indicating balance between buyers and sellers. This range was eventually resolved to the upside, confirming a shift in market control. Currently, price is trading above the Support Level around the 1.1750 area, which also aligns with the Buyer Zone and the former range high. This zone is acting as a key demand area after the breakout. The recent pullback appears corrective, with price retesting support rather than showing impulsive selling pressure. As long as EURUSD holds above this support zone, the bullish structure remains intact. My scenario: if buyers continue to defend the 1.1750 Buyer Zone, EURUSD could resume its upward move toward the 1.1800 Resistance Level and potentially extend toward the 1.1820 TP1. A clean continuation above resistance would confirm further upside momentum. However, a breakdown below the support zone would signal a deeper correction and weaken the bullish setup. For now, the structure favors buyers while price respects support. Please share this idea with your friends and click Boost 🚀

XAUUSD: Buyers Defend Structure – Retest 4,520 Resistance AheadHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a strong bullish structure after successfully breaking out of a descending triangle and confirming a shift in market control from sellers to buyers. The initial breakout was followed by a consolidation phase, forming a clear range where price moved sideways, indicating accumulation rather than distribution. After this range, XAUUSD resumed its bullish move and broke above the triangle resistance line, confirming continuation of the uptrend.

Currently, price is now trading above a rising trend line, which continues to act as dynamic support. Recently, gold tested the upper Resistance Zone around 4,520, where selling pressure appeared, leading to a short-term pullback. This pullback is unfolding toward the Support Zone near 4,430, which aligns with the prior breakout area and the ascending structure. As long as price remains above this support, the broader bullish trend remains intact and the move lower appears corrective.

My Scenario & Strategy

My primary scenario remains bullish while XAUUSD holds above the 4,430 support zone. I expect buyers to defend this area and push price higher for another attempt toward the 4,520 resistance zone.

Therefore, a clean breakout and acceptance above resistance would confirm bullish continuation and open the way for further upside expansion. However, a decisive breakdown below support would weaken the structure and signal a deeper correction. For now, price action continues to favor buyers as long as the ascending structure holds.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

BTCUSDT: Buyers Defend 86K Support, Upside in FocusHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT has shifted its structure after breaking out of a prolonged Downward Channel, signaling a loss of bearish control and the start of a stabilization phase. Following the breakout, price entered a broad range, bounded by a clear Resistance Zone around 90,300 and a Support Zone near 86,000. This range reflects market indecision after the strong sell-off.

Currently, price has formed a triangle structure, with descending resistance and ascending support lines, indicating compression and preparation for a directional move. Recently, BTCUSDT tested the lower boundary of the range and successfully defended the Support Zone, followed by a breakout from the short-term structure, suggesting renewed buyer interest. Current price action shows consolidation above support, favoring a bullish continuation scenario.

My Scenario & Strategy

My primary scenario is bullish as long as BTCUSDT holds above the 86,000 support zone. The recent pullback appears corrective within the broader recovery structure. I expect price to continue higher toward the range high and resistance zone around 90,300.

Therefore, a clean breakout and acceptance above this resistance would confirm bullish continuation and open the path for further upside expansion. However, a sustained breakdown below the support zone would invalidate the bullish setup and increase the risk of a deeper move lower. For now, structure and price behavior favor buyers while support remains intact.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

SOL & XRP - Decision Time at Weekly Structure!⚔️Both SOL and XRP are now sitting at a major weekly support zone , clearly marked in blue. This is not just a random level, it’s a key structural area that has defined direction in the past.

From here, the market is at a crossroads: 🔁

📉If this weekly support breaks , it would signal a loss of structure, opening the door for further long-term bearish continuation toward the green demand zone below.

📈On the other hand, for bulls to regain control, price must prove strength. That confirmation comes only with a break above the last major daily high, marked in red. Without that, any bounce remains corrective, not a trend reversal.

In short:

Structure is being tested.

Reaction matters more than prediction.

Do you think this support holds, or are we heading deeper into demand? 📊

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XAUUSD Maintains Support – Buyers Eye $4,560Hello traders! Here’s my technical outlook on XAUUSD (Gold, 2H) based on the current chart structure. Gold continues to trade within a well-defined ascending channel, confirming a sustained bullish market structure. After a prolonged consolidation phase (range) on the left side of the chart, price successfully broke above resistance, signaling a shift in control from sellers to buyers. This breakout marked the beginning of the current impulsive bullish leg. Following the breakout, price accelerated higher and is now approaching the Seller / Resistance Zone around 4,500–4,510, where selling pressure has started to appear. The recent pullback is bringing price back toward the Buyer Zone near 4,430, which aligns with the previous breakout level and the midline/support of the ascending channel. This confluence makes the area a key demand zone to watch. Structurally, the pullback remains corrective, with price still holding above channel support and the broader bullish trend intact. My scenario: as long as Gold holds above the 4,430 Buyer Zone, the bullish structure remains valid. A strong reaction from this area could trigger another push toward the 4,560 (TP1) and potentially higher if a clean breakout occurs. A decisive breakdown below the buyer zone would signal a deeper correction. For now, buyers remain in control while price respects the ascending channel. Please share this idea with your friends and click Boost 🚀

BTCUSD — Strong Supply Rejection & Bearish Continuation SetupBTCUSD is reacting strongly to the major supply zone, where sellers have stepped in multiple times, creating consistent price rejections. Each attempt to break above this level has failed, confirming that this zone is a high-pressure resistance area.

After the failed breakout, price formed a trapping area, indicating that smart money trapped late buyers before reversing the market. This is a classic sign of distribution, where buyers lose strength and sellers take control.

Additional bearish signals include:

Multiple wick rejections at resistance showing aggressive selling

Lower highs forming inside the range, signaling weakening bullish momentum

Break of internal structure, confirming sellers are gaining control

Absence of strong bullish volume, showing buyer exhaustion

Price now heading toward the nearest support and liquidity levels

With strong supply overhead and buyers losing momentum, market sentiment remains bearish, and BTCUSD is likely to continue drifting downward toward the demand zone area and the marked target level.

If this analysis helps you, hit like and drop your thoughts below!

XAUUSD Long: Demand Zone Holds, $4,540 in SightHello traders! Here’s a clear technical breakdown of XAUUSD based on the current chart structure. Gold previously completed a corrective phase after breaking above a descending resistance line, which marked a shift in market control from sellers to buyers. Following this breakout, price entered a consolidation Range, where the market absorbed supply and built a base before the next impulsive move higher. After leaving the range, XAUUSD accelerated into a strong bullish leg and formed an ascending channel, confirming sustained buying pressure. The breakout above the channel base was decisive, and price continued to print higher highs and higher lows. Recently, gold reached the Supply Zone around 4,500, where selling pressure appeared and caused a short-term rejection. This reaction pushed price back toward the Demand Zone near 4,430, which aligns with the channel support and previous breakout structure.

Currently, price is pulling back in a controlled manner within the bullish channel. The rejection from supply looks corrective rather than impulsive, suggesting profit-taking instead of trend reversal. Buyers are expected to defend the demand area as long as the channel structure remains intact.

My scenario: as long as XAUUSD holds above the 4,430 Demand Zone, the bullish structure stays valid. A strong reaction from this area could lead to another push toward the 4,500 Supply Zone, with a potential continuation toward 4,540 if a clean breakout occurs. A decisive breakdown below demand would invalidate the bullish setup and signal a deeper correction. For now, the bias remains bullish while price respects the ascending channel. Manage your risk!

BTCUSDT Holds Support - Retest of 88,900 Resistance LikelyHello traders! Here’s my technical outlook on BTCUSDT (2H) based on the current chart structure. Bitcoin is trading within a broader recovery phase after a prolonged corrective move. Earlier, price formed a base and broke out of a consolidation range, signaling that selling pressure was weakening and buyers were regaining control. Following the breakout, BTC pushed higher but faced resistance near 88,900, where selling pressure emerged and caused a pullback. Price then retraced toward the 87,300 Support Zone, which aligns with the previous breakout area and acts as a key demand level. The reaction from this zone remains constructive, suggesting the pullback is corrective rather than impulsive. Structurally, price continues to respect a rising support line, while attempts to break above resistance are ongoing. My scenario: as long as BTC holds above the 87,300 Support Zone, the bullish recovery remains intact. A strong reaction from support could lead to another push toward the 88,900 Resistance (TP1). A confirmed breakout above this level would open the door for further upside. A breakdown below support would signal a deeper correction. For now, the focus remains on the 87,300 support. Please share this idea with your friends and click Boost 🚀

XAUUSD: Rejection from 4,420 Resistance - Pullback Toward 4,350Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD continues to trade within a broader bullish structure, but the current price action signals a short-term corrective phase. After forming a strong upward impulse, gold established a well-defined upward channel, confirming buyer control. Price then broke above the previous consolidation range, which marked a continuation of bullish momentum.

Currently, XAUUSD pushed higher and reached the Resistance Zone around 4,410–4,420, a level that has historically acted as a strong supply area. At this zone, price showed clear rejection, with sellers stepping in aggressively and limiting further upside. This reaction suggests that supply is currently outweighing demand at these highs. As a result, price is now pulling back from resistance and moving toward the Support Zone around 4,350, which aligns with the previous breakout area and the lower boundary of the upward channel. This zone represents a key demand area where buyers have previously defended the trend. The recent breakout above this level followed by a retest further strengthens its importance.

My Scenario & Strategy

My scenario remains short-term bearish as long as XAUUSD stays below the 4,410–4,420 Resistance Zone and continues to show rejection from this area. I expect price to retrace toward the 4,350 Support Zone, where the next reaction will be crucial for determining continuation or deeper correction.

Therefore, A clean breakdown below the 4,350 Support Zone would confirm a deeper corrective move within the structure and could open the path toward lower demand levels along the channel support. However, if price reaches support and shows a strong bullish reaction, the broader bullish structure remains intact, and buyers may attempt another push toward the resistance highs. For now, the focus is on the corrective pullback, with 4,350 acting as the key level to watch.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

XAUUSD Short: Supply Zone Holds - Gold Slips Into CorrectionHello traders! Here’s a clear technical breakdown of XAUUSD (Gold) based on the current chart structure. Gold is still trading within a broader ascending trend, supported by a well-defined rising trend line from the pivot point. The market previously made an impulsive bullish move, but price has now reached a major Supply Zone around 4,350, where strong selling pressure emerged. This area has already produced a fake breakout, clearly signaling buyer exhaustion and the presence of aggressive sellers at higher levels. At the highs, price action shows hesitation and rejection inside the supply zone, indicating that bullish momentum is weakening rather than continuing. After the fake breakout, gold started to roll over, suggesting that the recent move was a liquidity grab rather than true continuation.

Currently, price is pulling back toward the 4,260 Demand Zone, which also aligns with the rising trend line and a previous breakout area. This zone represents the first key downside target and a critical decision area for the market. The move lower appears impulsive, supporting the idea of a corrective phase turning into a deeper pullback.

My scenario: as long as XAUUSD remains below the 4,350 Supply Zone, the short-term bias favors sellers. I expect continuation to the downside toward the 4,260 Demand Zone. A clean breakdown below this level would signal a loss of bullish structure and open the door for a deeper correction. However, a strong bullish reaction from demand could lead to consolidation or a temporary bounce. For now, the structure favors a short-term bearish correction, with 4,350 as key resistance and 4,260 as the main downside target. Manage your risk!

EURUSD: Rejection From Key Resistance - Support 1.1660 in FocusHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD is trading within a broader corrective structure, and the current price action suggests increasing bearish pressure near key resistance. Earlier, the pair formed a triangle structure, where price respected both the Triangle Resistance Line and the Triangle Support Line. Multiple breakouts occurred during this phase, but they failed to generate sustained bullish continuation, indicating weakening buyer momentum. After breaking out of the triangle, EURUSD moved higher and entered a consolidation range, where price paused and built liquidity. This range was later resolved to the upside, pushing price into the Resistance Zone around 1.1750. However, this move was followed by a fake breakout, signaling that buyers failed to maintain control above resistance. At the highs, a clear Head and Shoulders pattern has formed, with the left shoulder, head, and right shoulder developing directly under the descending trend line and within the resistance zone. This structure highlights strong seller presence and confirms rejection from higher levels. Price is now rolling over from resistance and starting to move lower.

Currently, EURUSD is pulling back toward the Support Zone around 1.1660, which aligns with previous breakout levels and horizontal demand. This area is acting as the nearest downside target, and price reaction here will be critical.

My Scenario & Strategy

My scenario is bearish as long as EURUSD remains capped below the 1.1750 Resistance Zone and the descending trend line. I expect continuation to the downside toward the 1.1660 Support Zone, which represents the next key level for buyers to attempt a defense. A clean breakdown below the support zone would confirm further bearish continuation and open the path for deeper downside movement.

However, if price reaches support and shows a strong bullish reaction, a short-term bounce or consolidation may occur. For now, the structure favors sellers, with 1.1750 as key resistance and 1.1660 as the main downside target.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.