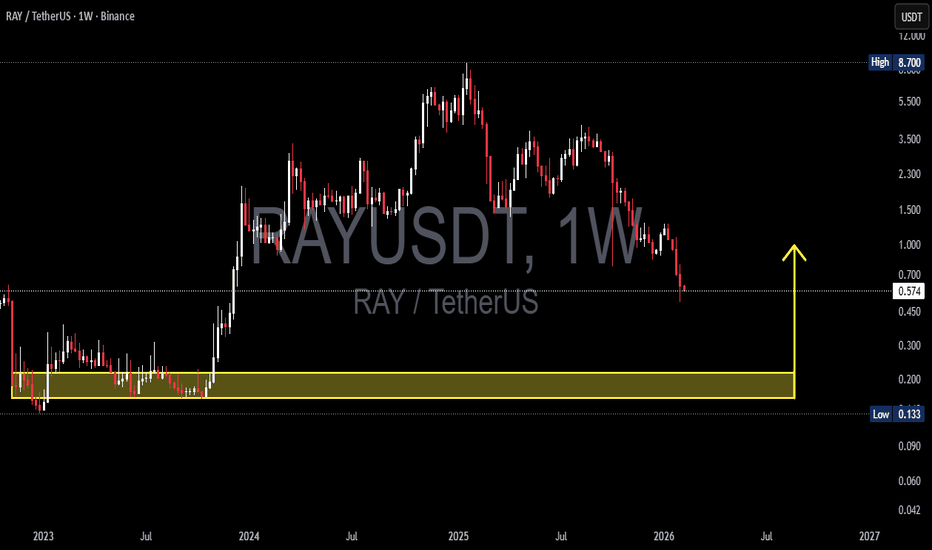

RAYUSDT — Testing Demand Zone?, Reversal or Breakdown Ahead?On the Weekly timeframe, RAYUSDT remains in a clear macro downtrend after forming its peak around the 8.7 USDT region. Following a distribution phase in the mid-range area (2 – 3.5), price continued declining gradually, forming consistent lower highs and lower lows.

Currently, price action is approaching a major historical demand / support zone that previously acted as the accumulation base before the massive 2024 rally.

Key zone:

0.215 – 0.160 USDT (Weekly Demand Block)

This area will determine whether the structure forms a macro bottom or continues into a deeper breakdown.

---

Pattern Explanation

1. Macro Distribution → Markdown Phase

After the parabolic rally, price entered distribution.

Wide consolidation range formed.

Support breakdown triggered further markdown.

2. Descending Structure

Characteristics visible on the chart:

Consecutive Lower Highs.

Gradual Lower Lows.

No significant bullish structure break yet.

3. Potential Double Bottom / Accumulation Base

If the demand zone holds, possible formations include:

Double Bottom.

Rounded Base.

Wyckoff Accumulation (Phase A–C).

The yellow zone acts as the last line of defense for buyers.

---

Key Levels

Resistance:

1.00 USDT — Psychological + minor structure.

1.50 USDT — Previous consolidation area.

2.30 – 3.50 USDT — Major supply zone.

5.50+ USDT — Macro distribution region.

Support / Demand:

0.573 USDT — Current reaction level.

0.215 – 0.160 USDT — Major Weekly Demand (Highlighted).

0.133 USDT — Absolute historical low.

---

Bullish Scenario

Bullish confirmation requires:

1. Price sweeps / taps the 0.215 – 0.160 demand zone.

2. Strong rejection appears (long wick / Weekly bullish engulfing).

3. Volume expansion at the lows.

4. Structure break above 1.00 USDT.

Potential upside targets:

Relief rally toward 1.00.

Continuation to 1.50.

Mid-term reversal toward 2.30 – 3.50.

If large accumulation occurs, the macro upside could expand significantly since this zone was the base of the previous rally.

---

Bearish Scenario

Bearish continuation triggers if:

1. Weekly close breaks below 0.160.

2. Demand zone fails to hold.

3. No significant volume reaction appears.

Implications:

Drop toward 0.133 (ATL retest).

If ATL breaks → downside price discovery.

Structure shifts into long-term markdown continuation.

The yellow zone would flip from demand into supply.

---

Conclusion

RAYUSDT is currently at a critical macro level.

Primary trend: Bearish.

Price is approaching major historical demand.

The 0.215 – 0.160 zone will decide reversal vs continuation.

Price reaction here will determine whether the market forms:

A macro bottom, or

A deeper bear market expansion.

Traders should wait for clear price action confirmation before taking large positions.

#RAYUSDT #RAY #Raydium #CryptoAnalysis #TechnicalAnalysis #Altcoins #SupportResistance #Wyckoff #CryptoTrading #Downtrend #Accumulation #MarketStructure #AltcoinSeason #CryptoChart

RAYUSDTPERP

RAY/USDT – Major Decision Zone at $0.85–$1.10RAY has returned to the same demand zone that triggered every major rally over the past 2 years.

Hold this zone = potential multi-month reversal.

Lose this zone = structural breakdown.”

---

Pattern & Market Structure Explanation

The weekly chart of RAY/USDT is showing one of the clearest macro setups:

1. Multi-Month Descending Triangle (Strong Bearish Pressure)

A clean series of lower highs forming a dominant descending trendline.

This trendline has rejected every bullish attempt since mid-2024 — clear seller dominance.

2. Titanium Demand Zone: $0.85–$1.10

This zone has been the launchpad of every major RAY rally in 2022, 2023, and 2024.

Every touch of this area resulted in strong upside acceleration.

Price is now retesting it again…

This is the most important test for RAY’s macro trend heading into 2025–2026.

3. Liquidity Sweeps Are Appearing

Sharp wicks below the zone followed by rapid rejections upward.

This behavior is typical before a major direction shift — markets clean liquidity first.

Suggests big positions are being prepared beneath the surface.

---

Bullish Scenario – If This Zone Holds, a Major Reversal Can Begin

Bullish Confirmation Triggers:

Weekly close back above $1.15–$1.20.

Breakout above the descending trendline (major signal).

Increasing buying volume during the breakout.

Upside Targets:

1. $1.50 – Early resistance & first momentum checkpoint.

2. $1.85 – Trend structure recovery.

3. $2.65 – Mid-range target if momentum sustains.

4. $3.40 – Strong resistance where larger moves often stall.

5. $7.20–$8.70 – Long-term targets if a macro breakout unfolds.

Bullish Narrative:

If this demand zone holds, we might not be looking at a minor bounce —

this could be the beginning of a fresh multi-month bullish impulse.

---

Bearish Scenario – If Support Breaks, the Structure Shifts Completely

Bearish Confirmation Triggers:

Weekly close below $0.85.

No quick reclaim on the following weekly candle.

Strong selling volume on the breakdown.

Downside Targets:

$0.55 – First structural support.

$0.35 – High liquidity area.

$0.133 – Historical low (capitulation zone).

Bearish Narrative:

If this long-term support finally breaks, RAY enters a new phase of macro weakness.

Demand is absorbed, and price enters an extended redistribution cycle.

---

Core Insight: “The Last Support”

The $0.85–$1.10 zone is not just a level — it is the foundation of RAY’s macro structure.

At this zone:

Smart money typically positions

Liquidity concentrates

Market sentiment is tested

Breakdown = major shift in long-term trend.

Hold + trendline breakout = potential start of a new bullish cycle.

This is why this zone is the single most important area on RAY’s chart in the past 2 years.

---

#RAY #RAYUSDT #CryptoAnalysis #CryptoOutlook #TechnicalAnalysis #DescendingTriangle #DemandZone #Altcoins #PriceAction #CryptoTrading

RAYUSDT Forming Falling WedgeRAY/USDT looks like it’s entering a pivotal phase right now. Technically, the price has been consolidating after a corrective pull-back, and what I’m watching is whether RAY can break above its recent consolidation high with volume supporting the move. The project sits within a high-visibility niche—decentralized exchange infrastructure on the Solana chain—where AMM + order book, deep liquidity, and protocol buy-backs are high-search keywords. On the fundamentals, RAY is benefiting from renewed interest thanks to increased token staking, reduced circulating supply via buy-backs, and a strong ecosystem growth posture.

From a strategic viewpoint, a clean breakout above resistance and confirmation with volume would be the trigger for me. If RAY closes above resistance and holds it, the next move could carry upside momentum. The reward potential looks favorable given the combination of structural base plus thematic strength in the Solana-DeFi space. Risk control is essential, so placing a stop just below the recent consolidation low or major support would allow a defined risk-to-reward.

Fundamentally, the token maps into current crypto market themes that are heavily trafficked: DEX dominance, Solana ecosystem expansion, tokenomics with buy-back, and staking rewards. Investors appear to be increasingly interested again, as on-chain metrics and trading volume suggest increased engagement. That alignment between narrative and structure adds weight to the bullish thesis.

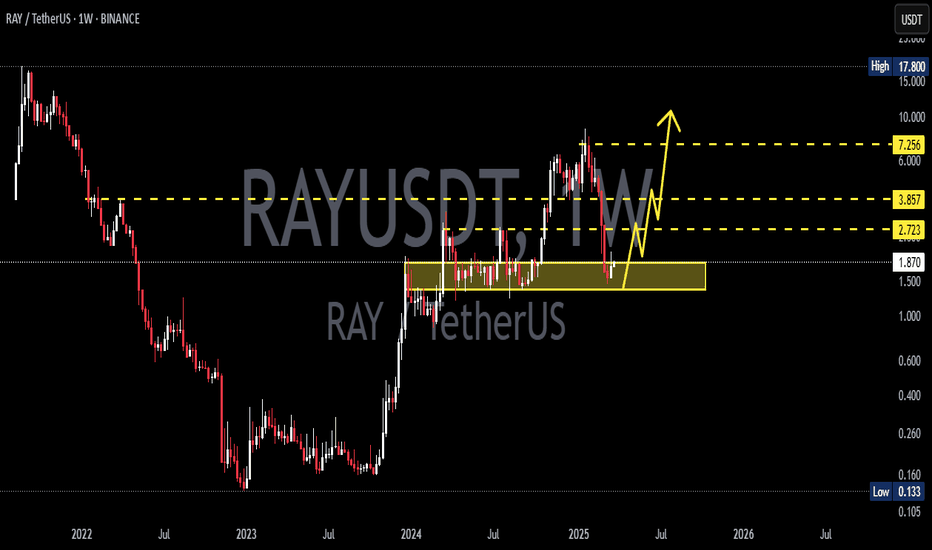

RAY/USDT — Critical Point: Accumulation or Breakdown New Lows?RAY is currently sitting at one of the most crucial structural zones, around the major support area of $1.50 – $1.96 (yellow box).

This area has acted as a key price pivot since mid-2024, where buyers and sellers have continuously battled for control.

After a sharp correction from the 2025 peak, price managed to hold above the main demand zone, with a long downside wick signaling liquidation or stop-hunt followed by immediate buying pressure.

This kind of reaction often represents a potential spring phase before a major trend reversal — if confirmed by a strong weekly close above support.

---

Structure & Pattern Analysis

Range Base / Accumulation Zone: The yellow block ($1.5 – $1.96) acts as a potential accumulation base, resembling a Wyckoff Accumulation pattern, where the spring phase (wick below support) might have just occurred.

Lower High Structure: The current structure still shows lower highs, but a confirmed higher low above $1.9 could signal a major trend reversal.

Key Resistance Levels: 2.72 – 3.67 – 7.25 – 12.68 – 16.66 – 17.80

→ These are progressive resistance targets for any mid-term bullish move.

---

Bullish Scenario

If RAY manages to close the weekly candle above $1.96 and hold, it would confirm:

A reclaim of the major demand zone.

Validation of the Wyckoff spring phase (accumulation completed).

The beginning of a mid-term trend reversal toward higher targets.

Bullish Targets:

1️⃣ $2.72 → First resistance / breakout trigger.

2️⃣ $3.67 → Range breakout confirmation.

3️⃣ $7.25 → Mid-term target zone (previous supply level).

A breakout with strong volume above $3.67 would likely trigger a larger markup phase, indicating the start of a new bullish cycle.

---

Bearish Scenario

If price fails to hold and closes weekly below $1.50, it would mean:

The main structural support has broken down.

Selling pressure could intensify toward $1.00 – $0.60.

In an extreme case, price might revisit its historical liquidity zone around $0.13.

Bearish Confirmation Signs:

Weekly close < $1.50.

Consecutive lower closes without recovery.

High-volume red candle (true capitulation, not just a sweep).

---

Technical Summary

RAY is standing at a macro decision zone — every upcoming weekly close will define whether:

The market is building a new base for the next bullish cycle,

or

Entering a continued bearish leg toward historical lows.

The area between $1.5–$1.9 is the “make or break zone.”

As long as the price doesn’t close below it, the mid-term bullish structure remains valid.

---

Trading Notes

Strong rejection candles within support = potential swing-buy opportunities (tight SL below wick).

Breakout above 2.72 with strong volume = confirmation for mid-term re-entry.

Be cautious of fakeouts — always wait for weekly candle closes before confirming bias.

---

#RAYUSDT #Raydium #CryptoAnalysis #WeeklyChart #MarketStructure #CryptoTechnical #SwingTrade #Wyckoff #DeFi #SupportZone #PriceAction #TrendReversal #AltcoinSetup #TradingViewAnalysis

RAYUSDT UPDATE#RAY

UPDATE

RAY Technical Setup

Pattern : Bullish Falling Wedge Breakout

Current Price: $3.68

Target Price: $4.59

Target % Gain: 30.04%

Technical Analysis: RAY has broken its falling wedge resistance on the 4H chart, showing bullish momentum and continuation potential. The breakout is backed by higher lows, rising volume, and a strong push above the trendline, with upside projection toward $4.59.

Time Frame: 4H

Risk Management Tip: Always use proper risk management.

#RAY Double Top Bearish Structure📊#RAY Double Top Bearish Structure 📉

🧠From a structural perspective, the goals of the bullish structure have all been achieved, and the target area overlaps with the blue resistance area, and we have built a bearish double top structure in the overlapping resistance area, so we are likely to enter the adjustment phase, be cautious about bullishness!

Let's see 👀

🤜If you like my analysis, please like 💖 and share 💬

BITGET:RAYUSDT.P

RAYSOL/USDT – READY TO BLAST OFF? PRIME LONG SETUPThis is where smart money is likely to reaccumulate before pushing price higher.

We're targeting internal liquidity levels and prior highs with a clean risk-reward structure.

Confirmation can come from a bullish reaction or engulfing candle within the zone.

Entry Zone: 2.25 – 2.28

Targets:

TP1: 2.365

TP2: 2.485

TP3: 2.660

Stop Loss: 2.151

DYOR:

This idea is for educational purposes and reflects a personal trading plan.

Always do your own research, use strict risk management, and wait for confirmation before executing.

#RAYDIUM #RAY #RAYSOL #RAYUSDT

Key Support Test – Will RAY Hold & Rally?$RAY/USDT chart shows a key retest of the breakout zone, which previously acted as resistance and is now a crucial support level. A successful bounce could confirm bullish continuation, while a breakdown may lead to further downside.

Additionally, the Stochastic RSI is signaling a bullish crossover at oversold levels, indicating potential upward momentum. If buyers hold this zone, RAY could see a strong rally.

DYOR, NFA

#RAY/USDT#RAY

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 4.10

Entry price 4.46

First target 4.60

Second target 4.75

Third target 4.92

#RAY/USDT#RAY

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 4.80

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.05

First target 5.31

Second target 5.62

Third target 6.01

RAYUSDT: Targeting Breakouts from Key Zones!RAYUSDT: Targeting Breakouts from Key Zones! 🚀

Key Levels to Watch:

Green Line & Blue Box: These are critical areas where I’ll monitor for upward breakouts on the hourly time frame.

Indicators in Sync: Confirmation from CDV and VWAP is essential to validate the move and strengthen the setup.

Why This Setup Matters:

RAYUSDT has shown potential for meaningful reactions from these zones. By combining price action with reliable tools like CDV and VWAP, I aim to capture high-probability entries with excellent R:R ratios.

My Trading Plan:

As price approaches these levels, I’ll shift to lower time frames, looking for bullish structure breaks. This approach minimizes risk while maximizing potential gains.

Want to learn how to use CDV, liquidity heatmaps, and volume profiles like a pro? DM me or check my profile for detailed training. If this analysis helps, don't forget to boost, comment, and follow. Let's crush it together! 💥

Let me tell you, folks, this is amazing. Nobody does analysis like I do. Believe me. If this helps you, don't forget to boost and comment! It’s a big deal, motivates me to share even more winning insights with you. Tremendous insights.

I keep my charts the best, clean, simple, and clear. You know it, I know it, clarity leads to better decisions. No question about it. My approach? Built on years of tremendous experience. Incredible track record. I don’t claim to know it all, but I spot high-probability setups like nobody else. Trust me.

Want to learn how to use the heatmap, cumulative volume delta, and volume footprint techniques I use to determine demand regions with stunning accuracy? Send me a private message—totally free, folks. That’s right. I help anyone who wants it, absolutely no charge. Unbelievable value.

Here’s the list, long list, great list, of some of my previous incredible analyses. Each one, a winner:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

And that’s just the start. The list goes on and on, folks. It’s a tremendous list, the best. I stopped adding because, frankly, it’s tiring. So many wins. People are amazed. You can check my profile and see for yourself, winning moves, all the time. Believe me, nobody does it better.

#RAY/USDT#RAY

The price is moving in a descending channel on a 1-day frame

It is adhering to it well and has completed the right shoulder

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 1.52

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2.05

First target 2.21

Second target 2.55

Third target 2.85

🚨#RAY/USDT Long#RAY

On the 4-hour frame, we have a bearish channel that the price is trading within, and we are about to break it

We have strong upward momentum that the price is expected to continue rising

The market during this period is expected to push many alternative currencies upward

Entry price is 1.18

The first goal is 1.28

Second goal 1.43

The third goal is 1.65

RAY / RAYUSDTGood Luck >>

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)

Raydium (RAY) formed bullish Gartley for upto 42.50% rallyHi dear friends, hope you are well, and welcome to the new trade setup of Raydium (RAY) with US Dollar pair.

Recently we caught almost 41% pump of RAY as below :

Now on a daily time frame, RAY has formed a bullish Gartely move for another bullish reversal move.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

80% for RAY, risky oneHello all, in the bear market there are some spikes and i am thinking about RAY to put some funds in for this trade. I am expecting at least 30%. This trade is risky one. Use stoploss and GL. PA looks very good for some spike upside10% for sure. Lets see

MANAGE YOUR RISK, NOT A FINANCIAL ADVICE

RAY can jump big from all time lows next weekRAY - definitely worth to watch with new weekly candle... can be nice gains if current weekly closes like this... we have beautiful volume = whales are in + all time lows stophunt of previous huge weekly bearish candle = lot of liquidity left in that big red body of candle - has to be taken... i think this could be easy profit, lets see...

NOT A FINANCIAL ADVICE,

MANAGE YOUR RISK

High RIsk RAYUSDTPERP $RAY Continuation ShortHigh RIsk RAYUSDTPERP $RAYUSDTPERP Continuation Short. TP and SL on chart. Move SL on TP. After TP2, trail with 0.5ATR step and 1.5ATR offset.

I won't be taking this trade.

RShort