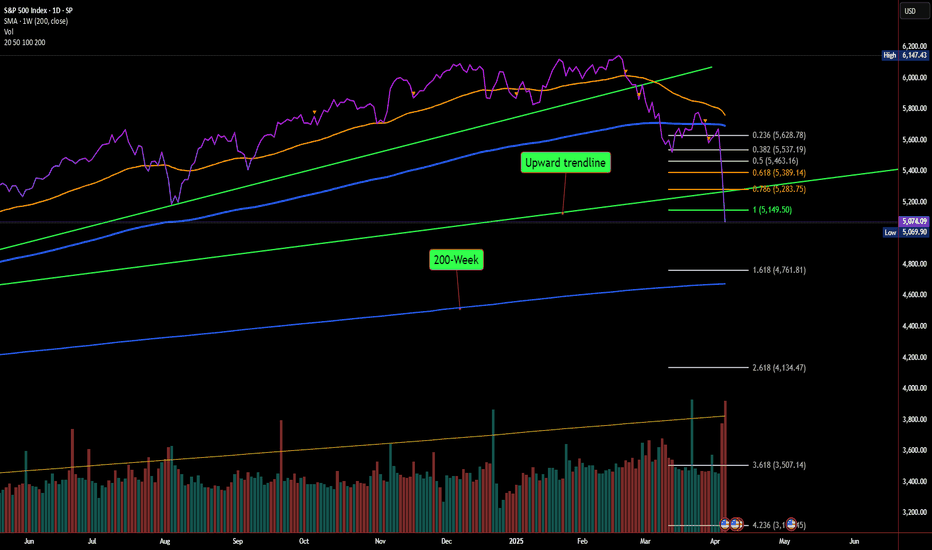

S&P 500 Breakdown: 4,790 Worst-Case Scenario in Play?Last week, I warned in this post that if sentiment worsened, the S&P 500 could head toward 4,790 as a worst-case scenario. Fast forward to today, and the index has officially lost the 5,149 support level, opening the door for further downside.

What Just Happened?

📉 Key Support Broken: The market just lost 5,149 (1.0 Fib retracement), which was a major line in the sand.

📉 Momentum Still Bearish: With no strong bounce, sellers remain in control, making 4,790 - 4,800 the next major target.

📉 Next Supports:

4,800 zone: A critical psychological level and my worst-case scenario target.

4,761 (1.618 Fib): A key confluence area for a potential bounce.

If the S&P 500 fails to reclaim 5,149 quickly, then the next downside targets are:

4,800 – A major area I highlighted last week.

4,761 – Aligns with the 1.618 Fib extension, adding confluence.

What Needs to Happen for a Rebound?

For bulls to take back control, the index must reclaim at least 5,149, or risk continued selling. A failed bounce could accelerate the move lower.

🚨 I called 4,790 as a worst-case target last week.