XRP/USDT | Bullish Breakout + Structure Holding📈 XRP/USDT — Bullish Breakout Pathway Activated!

RIPPLE vs TETHER | Crypto Market Trade Opportunity (Day / Swing)

🔍 Market Overview

XRP/USDT is showing strong bullish intent after a confirmed moving average breakout followed by a healthy retest. Price structure remains constructive, suggesting momentum continuation if buyers maintain control above key zones.

This setup is designed for both Day Traders & Swing Traders, with a layered entry strategy for risk-controlled positioning.

🧭 Trade Plan – Bullish Bias

✅ Trend Direction: Bullish

✅ Confirmation: Moving Average Breakout + Retest

✅ Momentum: Buyers defending structure with volume stability

🎯 Entry Strategy (Layered Execution)

📌 Entry Type: Flexible / Any price level entry using Layering Method

Thief Layer Strategy (Bullish Limit Zones):

🟢 Buy Limit 1: 2.0500

🟢 Buy Limit 2: 2.1000

🟢 Buy Limit 3: 2.1500

➡️ Traders may add or adjust layers based on personal risk management and timeframe.

This approach helps average entries efficiently during pullbacks while aligning with the higher-timeframe trend.

🏁 Target Zone

🎯 Primary Target: 2.4000

📊 Rationale:

Moving Average acting as dynamic resistance (Police Force Zone)

Market currently showing overbought behavior near resistance

Possible liquidity trap & correlation pressure expected near highs

💡 Action: Partial profits recommended near resistance zones to protect gains.

🛑 Stop Loss (Risk Control)

🔴 Stop Loss: 2.0000

⚠️ This SL is based on structure invalidation, not emotion.

Each trader may customize SL placement according to account size and risk tolerance.

📌 Risk Disclaimer

Dear Ladies & Gentlemen,

This trade plan is not financial advice.

You are free to secure profits or manage risk according to your own strategy and discipline.

🔗 Related Pairs to Watch (Correlation Insight)

Monitoring correlated assets helps confirm strength or weakness in XRP:

COINBASE:XRPUSD 💵 – Dollar-based momentum confirmation

BINANCE:BTCUSDT 🟠 – Overall crypto market direction & risk sentiment

BINANCE:ETHUSDT 🔷 – Altcoin flow & capital rotation signal

CRYPTOCAP:USDT.D 📉 – Tether dominance (falling dominance = bullish for alts)

📌 Key Insight:

If BTC & ETH remain stable or bullish, XRP continuation probability increases.

Rising USDT dominance may signal temporary risk-off behavior.

🌍 Fundamental & Economic Factors to Monitor

📰 Crypto-Specific Drivers

Ripple ecosystem updates & adoption news

Regulatory clarity surrounding XRP

On-chain volume & wallet activity trends

🌐 Macro & Economic Factors (Global)

U.S. Dollar strength (DXY impact on crypto liquidity)

Central bank tone (risk-on vs risk-off sentiment)

Crypto ETF flows & institutional participation

📆 High-Impact Events to Watch

Major U.S. macroeconomic releases

Central bank statements affecting risk assets

Sudden volatility in BTC dominance

📌 Pro Tip: Always check economic calendars & crypto news feeds before entry or scaling.

⭐ Final Note

This setup combines technical structure, layered execution, correlation analysis, and macro awareness — built for disciplined traders who respect both profit and protection.

👍 If this idea adds value, boost with a like

💬 Share your execution thoughts in comments

🔔 Follow for more structured market pathways

Trade smart. Manage risk. Let structure lead. 🚀

Ripplebreakout

Will XRP Price Fall to $2 Again or Will This Explosion Save It?XRP is trading at $2.06 after two failed attempts to break the $2.20 resistance this week. The altcoin is now drifting toward the familiar $2.02 support level, which previously acted as a strong rebound point.

If XRP sees renewed investor confidence and a bounce from $2.02, the price could climb back to $2.20. A successful breakout above this resistance may open the door to $2.26, supported by the potential volatility surge indicated by the squeeze.

However, a breakdown remains a risk. Losing the $2.02 support would place $2.00 in immediate danger. A fall below that threshold could push XRP toward $1.94 or even $1.85, invalidating the bullish outlook and signaling deeper correction potential.

How Can XRP ETFs Prevent Price Crash To $2 This Month?XRP trades at $2.14 and currently rests on key support at the same level. The asset has been locked in a downtrend for nearly a month, struggling to break out despite periodic attempts. Without external catalysts, XRP risks drifting lower as bearish momentum persists.

However, XRP may avoid a deeper decline as the likelihood of ETF approval increases. Bloomberg ETF analyst Eric Balchunas noted that the SEC released guidance allowing issuers to speed up filing effectiveness, likely to clear regulatory backlog. Bitwise’s XRP ETF is reportedly next in line, and any progress could improve market sentiment instantly.

If bullish momentum continues and ETF expectations strengthen, XRP could climb to $2.28 and then $2.36, breaking free from its downtrend. If momentum weakens or ETF decisions face delays, XRP may resume its slide and potentially drop 6.8% to reach $2.00. This would invalidating the bullish thesis.

XRP Profits at 12-Month Low, But New Investors Eye Price RevivalAt the time of writing, XRP trades at $2.26, down 10% over the past 24 hours. The altcoin continues to face resistance amid broader bearish market sentiment. However, strong support remains near the $2.27 mark, offering hope for a potential recovery.

If XRP maintains this key support level, it may move sideways in the short term, with possible rebounds to $2.35 or $2.45 as buyers regain confidence. This consolidation could set the stage for a stronger move upward later in November.

However, if selling pressure intensifies, XRP could fall below $2.27, slipping through $2.23 and hitting $2.13. Such a drop would invalidate the bullish scenario and confirm a deeper corrective phase.

Will XRP Form a Death Cross or Repeat July 2025 Rally?At the time of writing, XRP trades at $2.55, holding slightly above the crucial $2.54 support level. The altcoin needs renewed bullish activity to break through resistance at $2.64, which would confirm upward momentum.

If the Death Cross materializes, XRP could face a short-term correction, possibly dropping toward $2.35 or lower. Such a decline might trigger short-lived selling as traders react to the technical setup.

Conversely, if investor maturity continues to grow, XRP could replicate its July 2025 breakout. A successful push above $2.64 could propel the token toward $2.75 and potentially $2.85. This would invalidate the bearish outlook and reigniting bullish sentiment

XRP Whales’ $500 Million Accumulation Pushes Price Past $2.5At the time of writing, XRP trades at $2.65, attempting to establish $2.64 as a new support floor. The token has climbed more than 12% in the past week, marking one of its strongest short-term rallies in months.

If bullish sentiment continues, XRP could extend its rise toward the $2.75 resistance level. Investor support, particularly from whales, may help drive the asset closer to the $3.00 mark, signaling a broader recovery phase.

However, if XRP faces renewed selling or bearish market cues, it could retrace to $2.54 or even $2.35. Such a decline would invalidate the current bullish outlook and suggest short-term exhaustion among investors.

Ripple vs Tether — Can Bulls Escape the Resistance Trap?📌 TradingView Idea Description (XRP/USDT Thief Strategy)

Asset: XRP/USDT — “Ripple vs Tether”

Market: Crypto Wealth Strategy Map (Swing/Day Trade)

Bias: 🔵 Bullish Setup

🗺️ Trading Plan

Entry Style (Thief Layer Strategy):

Multiple buy-limit layered entries →

✅ 2.8000

✅ 2.8500

✅ 2.9000

✅ 2.9500

(Layers can be increased based on your own risk tolerance)

Stop Loss (Thief SL):

@ 2.7000 (personal setup — adjust as per your own risk appetite)

Target Zones:

🎯 Primary Target: 3.1500 → Key resistance zone + overbought condition + potential bull trap (take profits smartly).

🎯 Secondary Target: 3.3500 → Strong resistance cluster (“police barricade” zone) + overbought trap risk (partial/exit profits advised).

⚠️ Important Notes

👥 Dear Ladies & Gentlemen (Thief OGs):

I’m not recommending my exact stop loss or target — these are my personal levels.

Manage your own risk responsibly: “Make money, then take money at your own risk.”

This strategy is built around layered entries for flexibility in volatile markets.

🔍 Correlation & Related Pairs to Watch

Ripple (XRP) often shows sentiment correlation with broader altcoin momentum and BTC’s dominance. Key pairs worth monitoring for confirmation:

BINANCE:BTCUSDT → Bitcoin drives overall crypto market liquidity.

BINANCE:ETHUSDT → Strong ETH moves can influence Ripple flows.

BINANCE:XLMUSDT → Stellar often mirrors or diverges from XRP due to similarity in use cases.

BINANCE:ADAUSDT → Watch ADA for altcoin sentiment correlation.

Monitoring these pairs can give early signals of potential XRP strength or weakness.

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

📜 Disclaimer

This is a “Thief Style” Trading Strategy, shared for educational & entertainment purposes only.

Not financial advice. Trade responsibly — risk management is your best weapon.

#XRP #Ripple #Crypto #Altcoins #USDT #TradingStrategy #SwingTrade #DayTrade #LayeredEntries #ThiefStrategy

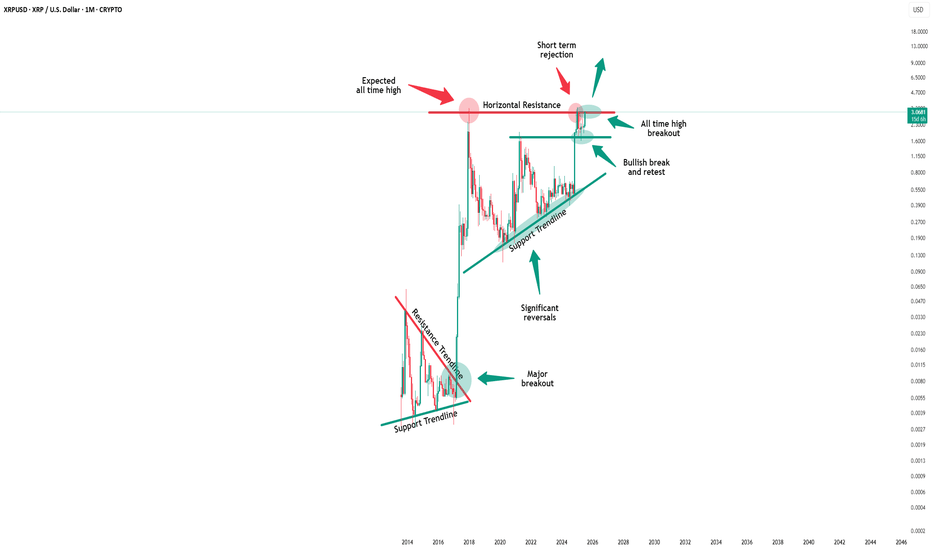

Xrp - This chart is only bullish!💰Xrp ( CRYPTO:XRPUSD ) is pointing higher:

🔎Analysis summary:

Yes, Xrp has been consolidating for the entire year of 2025. But looking at obvious market structure, Xrp is preparing for another move higher. And even if we see a -50% correction, the path of least resistance remains towards the upside. This bullrun is clearly not over.

📝Levels to watch:

$2,0, $3,0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

XRP Selling Hits 3 Year High As Whales Dump $5 Billion In 4 DaysAt the time of writing, XRP trades at $2.44, hovering just below the $2.45 support level. If bearish momentum persists and investor confidence weakens further, the altcoin could slide to $2.35 or even $2.27 in the coming days.

This would make recovery increasingly challenging for XRP, which needs to climb back toward $2.85 to reclaim its recent losses. Sustained selling activity, particularly from large holders, could delay this process and push prices lower.

However, if selling pressure eases and investors begin accumulating once again, XRP could rebound. A push above $2.54 and $2.64 could pave the way toward $2.75, signaling renewed market optimism and invalidating the bearish outlook.

XRP/USDT — Breakout Pending! Will Thief Layers Unlock Profits?🔥 XRP/USDT "RIPPLE VS TETHER" Thief Plan (Swing/Day Trade)

🎯 Trade Setup

Plan: Bullish (Pending Order Plan)

Entry: Breakout at 328 SMA ➝ $3.0000 ⚡

🛎 Set alarm in TradingView to catch the breakout easily.

Thief Strategy = Layered Entries:

$2.9300

$2.9500

$2.9800

$3.0000

(You can increase layers based on your own strategy).

Stop Loss: Thief SL ➝ $2.8800 (after breakout). Adjust SL to your risk preference.

Target (TP): Escape before trap ➝ $3.2000.

Note: Targets & stops are flexible. Risk management is your responsibility.

📊 XRP/USDT Real-Time Data (10 Sept 2025)

Current Price: $2.97

24h Change: -1.11%

Trading Volume: High (4.4B+ XRP traded)

📈 Retail & Institutional Sentiment

Retail Sentiment (Greed 60/100)

Optimism on ETF speculation & rebound momentum.

High social/media buzz fueling greed.

Institutional Sentiment (Neutral–Cautious)

Whales accumulated 340M XRP near $3.20–$3.30 = long-term confidence.

But $1.9B liquidations since July = short-term caution.

😨 Fear & Greed Index

XRP-Specific Score: 60/100 🟢

Volatility: Greed

Volume: Greed

Whale Activity: Extreme Fear (selling pressure)

Order Book: Extreme Greed (buying demand)

Overall Crypto Market: 51/100 (Neutral)

📉 Fundamental & Macro Analysis

Fundamental Score: 7/10

✅ ETF approval speculation (Grayscale/Franklin Templeton).

✅ Ripple expanding RLUSD stablecoin into Africa.

⚠️ Risks: SEC lawsuit uncertainty + Ripple’s centralization issue.

Macro Score: 6/10

Global crypto cap $3.85T (+2.5% weekly), but under 50D avg.

U.S. inflation release = key volatility trigger this week.

🐂 Why This Thief Plan?

Bullish Case (60%)

ETF approval hype (90%+ probability).

Whale accumulation + strong institutional positioning.

Historical September strength (+87% avg. gains).

Bearish Case (40%)

Resistance failure at $3.20.

Whale sell-offs + profit taking.

Crypto-wide sentiment still neutral.

💎 Key Takeaways

High volatility expected around ETF & macro news.

Short-term breakout = fast profit chance with thief layering.

Long-term = bullish bias if ETF approvals confirmed.

👀 Related Pairs to Watch

$BTC/USD (Overall market direction)

$ETH/USD (Altcoin leader)

$SOL/USD (Key altcoin sentiment)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#XRP #Ripple #Crypto #CryptoTrading #USDT #Bitcoin #Ethereum #ThiefTrading #SwingTrade #DayTrading #Breakout #TradingView

XRP ETF Approved, But Price Hurts—Will Big Players Act?At the time of writing, XRP trades at $2.84, just under the $2.85 resistance. A flip of this barrier into support would likely signal the beginning of a reversal, strengthening bullish sentiment. Traders are closely watching this zone for confirmation.

If support from LTHs holds, XRP could climb toward $2.94 in the short term. Breaching this level would pave the way for a further rise to $3.02, signaling broader recovery potential and invalidating near-term bearish concerns.

However, if market conditions worsen or LTHs shift their strategy to selling, XRP could lose momentum. The altcoin risks sliding toward $2.75 or even deeper to $2.64, putting bullish expectations in jeopardy and prolonging the consolidation phase.

XRP Technical Setup | Bullish Confirmation or Resistance Trap?🕵️♂️ XRP/USDT – "RIPPLE VS TETHER" Wealth Strategy Map 💰⚡

Idea Type: Swing/Day Trade

Market Mood: Bullish confirmed ✅

📊 Plan Breakdown

📈 Setup: Bullish bias confirmed with TMA (Triangular Moving Average) breakout ➕ pullback.

🕯️ Extra Confirmation: Heikin Ashi Doji → Bull Reversal spotted.

🎯 Execution Style: Thief Strategy = Layered limit order entries (stealthy stacking style).

🎯 Entry Plan (Layering Method)

Multiple buy layers placed around these zones:

💎 3.0400

💎 3.0600

💎 3.0800

💎 3.1000

🔑 Traders can add or reduce layers depending on personal risk preference.

🛑 Stop Loss (Thief’s Shield)

Suggested defense line around 3.0000.

⚠️ Note to Thief OGs: SL is personal. Manage risk wisely, protect your capital.

🎯 Target (The Escape Plan 🚪💨)

Overhead zone = Electric Shock Fence ⚡ (major resistance + overbought trap).

Suggested escape target: take profit before getting trapped at resistance zone.

⚠️ Reminder: Not financial advice — adapt targets to your style.

🔍 Related Pairs to Watch (Correlation Check)

💵 BITSTAMP:BTCUSD → Bitcoin often leads XRP momentum.

💵 BITSTAMP:ETHUSD → Ethereum trend can mirror altcoin sentiment.

💵 COINBASE:XLMUSD → Stellar has historic correlation with XRP moves.

💵 CRYPTOCAP:USDT.D (Tether Dominance) → Watching stablecoin flows gives clues about liquidity shifts.

👑 Thief Notes:

Dear Ladies & Gentlemen (Thief OG’s) 🕶️💼

This map is for educational & strategic illustration.

I’m not recommending you to strictly follow my SL/TP.

Manage your own layers, steal the opportunity, and escape with your own timing.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#XRP #XRPUSDT #Crypto #CryptoTrading #SwingTrade #DayTrade #LayeringStrategy #HeikinAshi #TMA #Altcoins #ThiefTrader

Xrp - The path remains bullish!🔔Xrp ( CRYPTO:XRPUSD ) will still head higher:

🔎Analysis summary:

Looking at the overall picture, Xrp has still been consolidating for the past eight years. This does not mean however, that Xrp cannot break out and head much higher in the future. It simply all just comes down to an all time high breakout, together with the potential bullish triangle breakout.

📝Levels to watch:

$3.0, $1,7

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

XRP Up 4% as Fed Rate Cut Bets as Bulls Eye $3.00 BreakoutTitle: XRP Climbs 4% as Fed Rate Cut Bets Hit 99% — Bulls Eye $3.00 Breakout While Institutional Flows Dictate the Range

XRP extended its recent upside, gaining roughly 4% intraday as market-implied odds of a Federal Reserve rate cut surged to 99%. The move sent XRP back to the critical psychological level at $3.00, where it briefly tagged the handle before consolidating. While support has held firmly above $2.88, repeated failures near $2.99 underscore how institutional flows are increasingly dictating short-term ranges, with systematic and high-frequency participants leaning on predefined liquidity pockets. The big question now: Can bulls engineer a clean break and weekly close above $3.00 to unlock a sustained trend toward $3.30–$3.60?

Below, we unpack the macro catalyst driving crypto risk appetite, the microstructure of XRP’s order flow around $3.00, the key technical levels to watch on multiple timeframes, and how sector stories—from stablecoin settlement initiatives to real-estate tokenization narratives—might reinforce or derail momentum. We also briefly revisit the regulatory overhang and expert takes on whether the Ripple lawsuit paradoxically protected crypto market structure at a fragile moment.

1. Macro Tailwind: Fed Cut Probability at 99% Reignites Risk Appetite

• Policy backdrop: Markets now price a near-certainty of a 25-basis-point rate cut at the Fed’s September 17 meeting, according to interest-rate derivatives and futures-implied probabilities. In crypto, such a setup typically marginally lowers the discount rate on long-duration risk assets, boosts liquidity appetite, and narrows the opportunity cost of holding non-yielding tokens.

• Liquidity impulse: Crypto has historically responded positively to dovish inflections, especially when dovish signals coincide with risk-friendly cross-asset flows—softening yields, a weaker dollar, and compression in credit spreads. While a 25 bp cut is modest in isolation, the signaling effect—especially if paired with data-dependent guidance—can keep speculative positioning skewed to the upside.

• Caveat: With a 99% probability already priced, the risk of a “buy the rumor, sell the news” reaction grows. If the Fed underwhelms on forward guidance or flags stickier inflation risks, crypto could see a fast fade from local highs. That puts heavy emphasis on the path of real yields and the post-meeting press conference tone.

2. Market Microstructure: Institutions Framing the $2.88–$2.99 Range

• Range mechanics: XRP has established a resilient support shelf above $2.88, with responsive buying stepping in on each probe lower. Conversely, the $2.99–$3.00 area continues to attract supply. This behavior often reflects larger players managing liquidity with tight stop-clusters and iceberg orders near round numbers.

• Repeated failures near $2.99: Such failures typically indicate either (a) active distribution by larger holders who prefer to offload inventory into strength, or (b) systematic strategies (quant funds, HFT) sweeping micro-liquidity into offers and resetting the book to keep price contained until a new exogenous catalyst hits.

• Order book dynamics: Thick sell walls near $3.00 can be both a magnet and a lid. The magnet effect pulls price upward during risk-on waves, while the lid effect stalls rallies unless buyers are willing to consume stacked liquidity. A clean break often requires a combination of momentum ignition (positive macro headline, cross-asset tailwind) and absorption of passive offers.

3. Technical Landscape: Higher Lows Intact, $3.00 the First Gate

Intraday and hourly structure

• Trend context: XRP is trading above $2.90 and the 100-hour Simple Moving Average, keeping the immediate trend biased to the upside. A bullish trend line supports price near $2.93 (Kraken spot data), with a near-term defense zone down to $2.86–$2.88.

• Key intraday bullets:

o XRP price is facing hurdles and struggling to clear the $3.00 resistance.

o The price is trading above $2.90 and the 100-hourly SMA.

o A bullish trend line is forming with support near $2.930 on the hourly chart.

o The pair could continue to rise if it holds above the $2.860–$2.88 zone.

• Alternative micro-view: In earlier sessions, price action emphasized the $2.90–$2.92 band as an initial pivot. Dip wicks into $2.86–$2.87 have been bought, aligning with the 100-hourly SMA and trend-line confluence around $2.865–$2.93.

Momentum and RSI

• RSI stance: Hourly RSI has remained constructive, avoiding deep oversold prints even on pullbacks. That supports the “higher lows” narrative. If RSI holds above the midline on dips while price defends the trend line, bulls retain the initiative.

• Breakout momentum: A decisive hourly or 4-hour close above $3.00, followed by a successful retest holding $2.97–$2.99 as new support, would likely tilt momentum accounts long and invite fresh breakout buyers. Such a confirmatory structure reduces the probability of a false break.

Higher timeframes

• Daily chart context: The market is coiling beneath a psychological barrier. A daily close above $3.00 with expanding volume would project toward $3.15–$3.20 initially, then $3.30—a level that aligns with measured move projections from prior range widths.

• Pattern watch: A narrowing descending triangle under $3.00 has formed over recent sessions. While descending triangles are often bearish continuations, in crypto they can also resolve upward when macro tailwinds are strong. The critical tell is whether buyers keep front-running higher lows into the apex.

4. Scenario Map: Paths Above and Below $3.00

Bullish continuation (probability improves on Fed follow-through)

• Trigger: Clean 4-hour close above $3.00, ideally accompanied by rising volume and positive breadth across large-cap alts.

• Upside targets:

o $3.15–$3.20: First resistance band from prior supply and extension targets based on the local range height.

o $3.30: Key magnet if momentum persists; confluence with measured move from the $2.88–$2.99 box.

o Stretch target $3.45–$3.60: Requires continuation flow, favorable macro tone, and sector risk-on. A path to $3.60 likely needs cumulative breadth improvement and rotation from BTC or ETH dominance.

• Market structure tells:

o Flip of $3.00 to support on retests.

o Shallow pullbacks that hold the 20- and 50-period MAs on 1-hour/4-hour frames.

o Momentum divergence avoidance on RSI and MACD.

Neutral consolidation (base-building under resistance)

• Behavior: Price oscillates between $2.88 and $3.00, with volatility compressing. This can be constructive if it resolves higher. Watch for absorption at $2.92–$2.95: sustained bid depth indicates smart-money accumulation.

• Risks: Choppy stop-runs against both sides. Patience and disciplined entries near range extremes become important.

Bearish fade (news or liquidity shock)

• Triggers: Disappointing Fed guidance, risk-off in equities, or an adverse regulatory headline.

• Downside levels:

o $2.88: First defense. A clean break opens $2.86–$2.85 (trend-line and 100-hourly SMA cluster).

o $2.82–$2.80: Next liquidity shelf; loss of this area would weaken the intermediate uptrend.

o $2.72–$2.75: High-volume node from prior consolidation, potential swing-long reload zone if broader trend remains constructive.

5. Order Flow and Liquidity: What to Watch Around $3.00

• Liquidity pockets: Expect resting offers at $2.99–$3.02 and stop clusters just beyond. A burst through $3.02–$3.05 often reflects stop-fuel rather than sustained demand. The follow-through test is whether bid support appears on the first retest.

• VWAP and session profiles: Monitor intraday VWAP alignment. If price holds above session VWAP after the breakout, it signals strong participation; repeated reversion below VWAP suggests weaker conviction.

• Funding and perp basis: Elevated long funding rates without spot confirmation can forewarn of squeezes. A healthy breakout typically shows rising spot volumes and moderate-perp leverage.

6. Cross-Asset Check: Is Crypto-Wide Breadth Confirming?

• BTC and ETH: If Bitcoin holds or advances alongside XRP, breakouts tend to stick better. Conversely, a BTC pullback from resistance or ETH weakness can sap liquidity from alts and render XRP breakouts vulnerable.

• Dollar and yields: A softer DXY and benign real-yield backdrop would reinforce crypto appetite. Watch the 10-year real yield. A re-acceleration higher could cap upside in risk assets.

• Equities and credit: Positive equity momentum and stable credit spreads are supportive. Risk-off rotations often tighten crypto ranges or trigger downside wicks.

7. Narrative Catalysts: From RLUSD Payments to Real-Estate Tokenization

• RLUSD payments angle: Reports of an electric car maker tapping RLUSD for payments has refocused attention on enterprise-grade settlement rails and Ripple-adjacent stablecoin strategies. If RLUSD or similar fiat-linked tokens embed more deeply into commercial workflows, network effects could lift transactional relevance for XRP and related liquidity pools. Watch for on-chain settlement volumes and treasury adoption headlines.

• Real estate tokenization: The idea that real estate could unlock the next parabolic leg for XRP hinges on two levers: (a) tokenized asset issuance/settlement requiring high-throughput, low-cost rails; (b) institutional-grade custody and compliance frameworks. If pilot programs scale—fractionalized property claims, escrow automation, and cross-border closings—liquidity migration to chains and bridges that interoperate with Ripple ecosystem tools could grow. Concrete KPIs to track include tokenized asset market cap growth, settlement finality times, and custodial integrations with major brokers.

• Payments and remittances: Continued traction in corridors—especially where FX frictions are high—can underpin a fundamental bid for liquidity tokens. Macro volatility tends to increase remittance volumes, indirectly supportive for settlement networks if fees and speed remain competitive.

8. Regulatory Overhang: Did the Ripple Case “Save Crypto” or Just Buy Time?

• Expert discourse: Some analysts argue that the Ripple lawsuit, by forcing clarity on the application of securities laws to token distributions and secondary market activity, reduced systemic legal uncertainty at a critical juncture. The view is that the case delineated boundaries that prevented broader enforcement spillover into secondary liquidity for many assets.

• Counterpoint: Others caution that the landscape remains fragmented. Jurisdictional differences and evolving interpretations keep headline risk alive. Markets may have priced in a partial détente, but precedent is not monolithic, and appeals or parallel actions can re-introduce volatility.

• Trading implication: Regulatory catalysts tend to be binary and gap-inducing. Position sizing around major court dates and policy announcements should reflect that asymmetry.

9. Strategy Playbook: Traders’ Checklist Into and After the Fed

For breakout traders

• Entry logic: Wait for a 4-hour close above $3.00, then look for a retest of $2.97–$2.99 holding as support. Confirmation improves if the retest coincides with an intraday VWAP reclaim and rising spot volume.

• Risk: Place invalidation below the retest low or below $2.93 (trend-line confluence), depending on risk tolerance. Avoid chasing if funding spikes and spot-volume confirmation is lacking.

• Targets: Scale at $3.15–$3.20; trail remainder toward $3.30. Only pursue $3.45–$3.60 if momentum and breadth broaden.

For range traders

• Buy-response zones: $2.86–$2.88 with tight stops if trend line and 100-hour SMA remain supportive.

• Sell-response zones: $2.99–$3.00 if order flow shows absorption and lack of follow-through; cover quickly on decisive breaks.

• Tools: Footprint charts, delta, and cumulative volume profiles to gauge absorption vs. initiative buying.

For swing traders

• Thesis: As long as daily closes hold above $2.82–$2.85, the medium-term bias remains constructive. A weekly close above $3.00 turns the path of least resistance up toward $3.30–$3.60 over coming weeks, contingent on macro tone.

• Invalidations: A daily close below $2.80 suggests a breakdown from the base, opening risk to $2.72–$2.75.

10. Risk Management: Practical Guardrails

• Volatility budgeting: Size positions based on realized volatility. Consider scaling rather than all-in entries around binary macro events.

• Correlation traps: Avoid over-concentration in alts that move in lockstep. If you’re long XRP into the Fed, offset with cash or lower-beta exposures.

• Leverage discipline: Elevated funding and crowded longs can unwind fast. Keep leverage modest and stops hard, especially near psychological levels like $3.00.

• News reaction function: Predefine responses to three scenarios—dovish surprise, baseline cut with cautious guidance, or hawkish tilt. Adjust exposure automatically rather than emotionally.

11. What the Tape Is Saying Now

• Price behavior: XRP has surged through $2.88, probed $2.92, and repeatedly tested $2.99–$3.00. Each dip toward $2.86–$2.90 has found buyers, aligning with the 100-hourly SMA and ascending trend line near $2.93.

• Participation: The best breakouts in XRP historically come on broad-based alt strength and rising spot participation. Watch whether volumes cluster on green candles during NY hours; institutional involvement often intensifies then.

• Sentiment skew: Elevated expectations around the Fed cut can create asymmetry—good news may be “priced in,” while any disappointment can trigger fast downside to first supports.

12. Price Levels Summary

• Immediate resistance: $3.00, then $3.02–$3.05. A strong break above targets $3.15–$3.20 and $3.30.

• Immediate support: $2.93 trend-line, then $2.90, with a stronger shelf at $2.86–$2.88. Below that, $2.82–$2.85 and $2.72–$2.75.

• Momentum markers: RSI holding above midline on pullbacks; MACD on 1-hour/4-hour staying positive; rising OBV on rallies.

13. Frequently Asked Questions

Q: Why does $3.00 matter so much?

A: It’s a psychological round number clustered with offers, stop orders, and optionality hedging. Breaking and holding above it often forces systematic strategies to rebalance, creating momentum.

Q: How reliable is the Fed cut catalyst for crypto?

A: Cuts tend to support risk assets if they signal easier financial conditions ahead. However, when odds are near 100%, the market demands supportive guidance to avoid a fade. It’s the path of policy, not the single step, that matters.

Q: Could XRP reach $3.60 on this leg?

A: It’s possible if $3.00 flips to support, $3.15–$3.30 clears with volume, and macro remains benign. Realistically, $3.15–$3.30 is the first major test; $3.45–$3.60 would likely need follow-through and broader alt strength.

Q: How do institutional flows “dictate” the range?

A: Large players anchor liquidity at key levels, providing both buy-side and sell-side depth. They often fade extremes unless a meaningful catalyst forces them to move, resulting in repeated tests and rejections around known levels.

Q: Is the descending triangle bearish?

A: By textbook definition, yes. But crypto often violates textbook patterns when macro liquidity turns supportive. The resolution depends on who runs out of patience first—sellers defending the ceiling or buyers stepping up on higher lows.

14. Bottom Line

• The setup: XRP is coiled just beneath $3.00 after a 4–5% push, with $2.88–$2.93 acting as a dependable springboard. The hourly trend remains constructive above the 100-hour SMA, and RSI supports further upside if pullbacks stay shallow.

• The catalyst: A near-certain Fed cut anchors the macro bid, but with odds already near 99%, sustained upside likely requires reassuring forward guidance or a concurrent broad-based crypto risk-on.

• The trigger: A decisive close and hold above $3.00 is the primary unlock. If achieved, $3.15–$3.20 and then $3.30 come into view, with $3.45–$3.60 reserved for stronger momentum phases.

• The risk: Failure to clear $3.00 followed by a loss of $2.86–$2.88 would hand control back to sellers and invite a deeper test toward $2.80–$2.75.

As XRP consolidates under $3.00 and the descending triangle narrows, the next directional move will likely hinge on whether institutional sellers maintain the lid or capitulate to momentum post-Fed. Traders should remain flexible, respect key levels, and let the tape confirm the path.

XRP Could Hit All-Time High In September 2025BINANCE:XRPUSDT is trading at $2.81 , maintaining support above $2.74 at the time of writing. The altcoin’s ability to move toward its all-time high depends heavily on investor sentiment. Market participation will play a decisive role in whether XRP sustains momentum or faces pressure from renewed selling activity.

The Ichimoku Cloud indicates bullish momentum could be developing, offering a potential boost for BINANCE:XRPUSDT . This technical signal suggests favorable conditions for upward price action. If sustained, the altcoin may climb 29.8% to retest its all-time high of $3.66, a level that has remained unbroken since previous market cycles.

If investors remain cautious, BINANCE:XRPUSDT may struggle to hold its current position. A break below $2.74 would expose the token to additional losses. Continued selling pressure could push the price down to $2.54 , weakening support levels and invalidating the bullish outlook that is currently forming for XRP.

XRP Price Struggles Below $3 As Outflows Reach 9-Month HighAt the time of writing, BINANCE:XRPUSDT trades at $2.87, remaining stuck under the $2.95 resistance level. The altcoin has attempted to reclaim the $3.00 threshold for the past two weeks but has repeatedly failed to close above it, highlighting the weakness in bullish momentum.

The Chaikin Money Flow (CMF), a metric tracking capital inflows and outflows, has dropped to a nine-month low. This decline confirms that outflows are currently overwhelming inflows, a bearish sign for XRP's short-term outlook .

Given these conditions, BINANCE:XRPUSDT could face further declines. A drop toward $2.74 remains likely if selling pressure continues, with the asset consolidating above this zone.

If investor sentiment shifts, BINANCE:XRPUSDT could attempt recovery. Reclaiming $2.95 as support would provide momentum to test higher levels. A successful breakout above $3.07 and later $3.12 would invalidate the bearish thesis.

$950 Million XRP Moved Off Exchanges – Price Impact ExplainedBINANCE:XRPUSDT current price is at $3.01 after losing the support at $3.07. The decline in price is largely due to a lack of bullish momentum, compounded by broader market negativity. Without a clear catalyst, XRP might face further consolidation as the market waits for stronger buying signals.

Investors are still actively accumulating BINANCE:XRPUSDT , as reflected in the declining exchange net position. The indicator currently sits at a 5-month low, signaling net outflows from exchanges. In the past week alone, over 312 million XRP worth approximately $950 million has been bought by holders, showing optimism toward the asset's potential recovery.

In the coming days, BINANCE:XRPUSDT may test the $2.91 support level , marking a potential 2-week low. A drop below this level is unlikely, suggesting that this range could act as a temporary consolidation zone. As long as the price holds within this range, the market may await clearer direction.

However, if BINANCE:XRPUSDT reclaims the $3.12 support , the cryptocurrency could recover its recent losses. This would depend on continued accumulation by investors, as well as sustained optimism for a price rebound. Only with this renewed interest would XRP be able to push for higher levels.

The Path to $30 XRP: Why This Bull Cycle Could Be DifferentIs a $30 XRP Price a Real Possibility for This Bull Cycle? A Deep Dive into the Perfect Storm Required

The cryptocurrency market is once again buzzing with audacious predictions, and at the heart of many speculative discussions is XRP, the digital asset native to the XRP Ledger. Following historical patterns of explosive, 10x or greater gains in previous bull markets, a vocal portion of the investment community is eyeing a monumental target: $30 per XRP by the end of the current cycle, potentially by mid-2026. This would represent an unprecedented surge, catapulting its market capitalization into the trillions and reshaping the hierarchy of the digital asset world.

While some market analyses project a climb toward the $34 mark, citing long-term technical patterns, the path to such a valuation is fraught with immense challenges and requires a "perfect storm" of legal, technological, and market-wide catalysts. This article will dissect the fervent bull case for a $30 XRP, weigh it against the significant bearish headwinds, and offer a balanced perspective on what it would take for such a dream to become a reality.

The Bull Case: Charting a Course to the Stratosphere

The optimism surrounding XRP is not unfounded but built on a combination of historical precedent, bullish technical setups, fundamental developments, and favorable macroeconomic tailwinds. The argument for a parabolic rise is multi-faceted, weaving together past performance with future potential.

Echoes of Bull Runs Past

History is a powerful psychological driver in financial markets, and for seasoned crypto investors, it often rhymes. XRP has a documented history of parabolic advances during bull cycles. In past market-wide rallies, the asset has demonstrated an ability to multiply its value in spectacular fashion, delivering gains that far outpace many of its peers. Proponents of a new all-time high believe these past performances are a prelude to future potential. They argue that the asset is coiled for another breakout and that a tenfold gain from its recent highs is not just possible, but consistent with its historical behavior during periods of market euphoria.

Technicals Flashing Green

Several technical analysts have laid out a roadmap that could, in theory, lead to astronomical prices. These analyses focus on long-term chart patterns that have been developing over several years.

One of the most cited bullish patterns is a massive, seven-year double-bottom structure. In technical analysis, a double-bottom is a classic reversal pattern that indicates a major shift from a downtrend to an uptrend. A breakout from such a long-term formation is often considered a powerful signal of sustained upward momentum. Some chart interpretations suggest that a confirmed breakout from this pattern, followed by a successful retest of the breakout level as new support, could launch the price on a trajectory toward the $30-$34 range.

Furthermore, other analytical frameworks like Elliott Wave theory are being applied to forecast XRP's potential path. This theory posits that markets move in predictable, repetitive wave patterns driven by investor psychology. According to some of these models, XRP may be in the midst of a powerful "Wave 3" surge, which is typically the longest and most powerful wave in an uptrend. These projections offer various potential price targets, with the most ambitious scenarios pointing to a price corridor between $27 and $30.

The End of a Legal Saga

Perhaps the most significant fundamental development has been the resolution of the nearly five-year-long legal battle with the U.S. Securities and Exchange Commission (SEC). For years, this lawsuit cast a long shadow over XRP, creating immense uncertainty and suppressing its price while the rest of the market soared.

The landmark court ruling, which determined that programmatic sales of XRP on public exchanges do not constitute securities transactions, provided crucial legal clarity. The subsequent finalization of this matter has removed a massive overhang, boosting investor confidence and, more importantly, paving the way for greater institutional adoption. With the legal ambiguity resolved in the United States, exchanges that had delisted the asset can relist it, and financial institutions that were hesitant to engage with XRP now have a clearer regulatory framework to operate within. This legal victory is widely seen as a foundational catalyst for the next phase of growth.

The Promise of a Spot ETF

Following the watershed moment of the successful launch of spot Bitcoin ETFs, the market is overwhelmingly optimistic about a spot XRP ETF. The precedent has been set, and many believe an XRP ETF is not a matter of if, but when. Market sentiment suggests a very high probability of approval by late 2025 or early 2026.

A spot ETF would be a game-changer for accessibility. It would allow traditional investors, wealth managers, and large institutions to gain exposure to XRP through their existing, regulated brokerage accounts, without the complexities of managing private keys or using cryptocurrency exchanges. The resulting inflows of capital could be substantial. If an XRP ETF were to capture even a fraction of the capital that flowed into Bitcoin ETFs, it would create immense buying pressure and could significantly propel the price. Some forecasts suggest an approved ETF alone could be the primary driver of a rally toward the high double-digits, a figure that aligns with the most bullish technical targets.

Ecosystem Growth and Utility

Beyond speculation and market structure, the XRP Ledger itself is evolving. Proponents argue that its underlying utility is growing, providing a fundamental basis for a higher valuation.

A key area of growth is the tokenization of Real-World Assets (RWAs). The XRPL is gaining traction as an efficient and low-cost platform for creating digital representations of tangible and financial assets. The value of tokenized assets on the ledger has seen explosive growth, driven by institutional interest in bringing assets like U.S. Treasuries, real estate, and private credit onto the blockchain.

Simultaneously, the Decentralized Finance (DeFi) ecosystem on the XRPL is expanding. While still nascent compared to competitors, its Total Value Locked (TVL) has been steadily increasing. The introduction of new stablecoins, including an upcoming offering from Ripple itself and the integration of established stablecoins, is expected to further enhance the ledger's utility for payments, trading, and other decentralized financial applications. This growing utility, bulls argue, will eventually be reflected in the price of the native asset, XRP.

The Bear Case: The Immense Hurdles on the Path to $30

While the bull case is compelling, the journey to $30 is littered with formidable obstacles. A sober analysis reveals that such a price target may be more of a dream than a realistic probability for this cycle, requiring a suspension of disbelief regarding market dynamics and valuation principles.

The Staggering Market Cap Requirement

The single greatest argument against a $30 XRP is the sheer market capitalization it would require. This is not a matter of opinion, but of simple mathematics. With a total supply of 100 billion tokens, a price of $30 per XRP translates to a market capitalization of $3 trillion.

To put this number into perspective:

• Bitcoin's all-time high market cap is approximately $1.4 trillion.

• The entire cryptocurrency market at its absolute peak valuation was around $3 trillion.

• Ethereum, the second-largest cryptocurrency, reached a peak market cap of roughly $550 billion.

For XRP to reach a $3 trillion valuation, it would need to become more than twice as valuable as Bitcoin has ever been. It would have to single-handedly equal the value of the entire crypto asset class during the peak of the last bull run. This would require an unprecedented and arguably unrealistic inflow of capital into a single altcoin within one market cycle, an event for which there is no historical precedent.

The Glaring Valuation Disparity

A major red flag for fundamentally-oriented investors is the massive disconnect between XRP's market capitalization and the actual economic activity occurring on its ledger. A common metric used to gauge this is the market-cap-to-TVL ratio. Even at more modest valuations, XRP's market cap has often been thousands of times greater than the Total Value Locked in its DeFi ecosystem.

This indicates that the valuation is overwhelmingly driven by speculation on future utility rather than current, tangible use. While the promise of RWA tokenization is exciting, the current on-chain metrics remain weak in comparison to the asset's valuation. Critics point out that daily trading volumes on the ledger's decentralized exchange can be surprisingly low, and nascent sidechain projects have yet to gain significant traction or attract substantial capital. This stark contrast with platforms like Ethereum, where a robust and multi-billion dollar DeFi ecosystem provides a much stronger fundamental underpinning for its valuation, suggests XRP may be significantly overvalued on a utility basis.

Intense Competition

Ripple and XRP do not operate in a vacuum. The problems they aim to solve are being tackled by a host of powerful and innovative competitors.

In the cross-border payments arena, where XRP was a pioneer, it now faces a crowded field. Traditional systems like SWIFT have not stood still, upgrading their services to improve speed and transparency. More importantly, the rise of stablecoins presents a formidable challenge, as they offer a stable unit of account for remittances and have seen massive adoption. Furthermore, a new wave of fintech solutions and central bank digital currencies are all vying for a piece of the global payments market.

As a smart contract platform, the XRP Ledger is competing in the brutal Layer 1 blockchain race. It is up against the entrenched network effects of Ethereum and the high-speed, rapidly growing ecosystems of alternatives like Solana, all of which are battling for developers, users, and capital.

Tokenomics and Sell Pressure

XRP's large total supply of 100 billion tokens is a persistent point of concern for some investors, as it creates a different price dynamic than scarcer assets like Bitcoin. Additionally, after a significant run-up in price, a very large percentage of the circulating supply is often held at a profit. This raises the risk of significant sell-offs as the price climbs. Long-term holders and early investors may be tempted to take substantial profits at key psychological levels, creating persistent headwinds that could challenge sustained upward momentum toward extreme targets like $30.

Conclusion: A Possible Dream, An Improbable Reality

So, is a $30 XRP a real possibility for this bull cycle? The answer is nuanced. While not mathematically impossible, it resides firmly in the realm of extreme optimism and would require a confluence of events so perfect it borders on miraculous.

For XRP to reach a $30 valuation, the following would likely need to happen:

1. Massive Institutional Inflows: A spot XRP ETF would need not only to be approved but also to attract hundreds of billions of dollars in a short period, dwarfing the initial success of the Bitcoin ETFs and signaling a seismic shift in institutional asset allocation.

2. Explosive Utility Growth: The XRP Ledger would need to see an exponential, near-vertical increase in real-world adoption for payments, DeFi, and RWA tokenization. Its on-chain economic activity would need to grow by orders of magnitude to begin to justify a multi-trillion-dollar valuation.

3. Unprecedented Market-Wide Euphoria: The entire cryptocurrency market would likely need to swell to a valuation of $10 trillion to $15 trillion or more, with XRP simultaneously capturing a disproportionately large share of that new capital.

4. Sustained Macroeconomic Tailwinds: A continued global economic environment of high liquidity and strong investor risk appetite would be necessary to fuel such a speculative rally across all risk assets.

More conservative, yet still very bullish, price targets tend to fall in the $5 to $13 range. These projections, while less sensational, represent substantial gains from recent levels and are grounded in more realistic assumptions about market growth and adoption.

Ultimately, while the dream of a $30 XRP fuels excitement and captures the imagination, investors should remain grounded. The journey ahead will be defined by tangible progress in the Ripple ecosystem, the real-world utility of the XRP Ledger, and the broader health of the global financial markets. The leap from its current standing to a $3 trillion asset is not a single jump but a vast chasm that is exceptionally unlikely to be crossed in a single bull cycle.

XRP Consolidation pattern breakout imminentLooks to me like XRP is breaking out of a rectangle or consolidation pattern as we speak.

Pattern formed since NOvember 2024 and since then XRP has been trading in this range.

Our current weekly candle is clearly in the process of attempting a breakout above the upper band or resistance trendline of the consolidation pattern.

We still have a day for candle close of this week.

Look to see if a potential engulfing candle print occurs or not.

Also note, this is by no means confirmation of the pattern break. We would need a concise bullish candle pattern for the next week to print for COnfirmation.

If we do confirm breakout. XRP will be back in price discovery mode like BTC. And i personally wouldn't sleep on it.

Its one of the better performers in crypto and seems like to me with every passing day a major player like BTC. (Opinion based on TA)

I would also monitor the MACD indicator. Observe for increasing histogram bars and deep green color as well as bullish cross.

On Macro timeframes, being above the 0 line on MACD is always bullish until we cross below.

XRP Price Prediction: Is a Breakout to $15 Imminent? XRP Breakout Targets $15 — Analyst Says 'This Is Just The Start': Is XRP Set to Explode?

The cryptocurrency world is once again turning its attention to XRP, the token developed by Ripple Labs, as bullish analysts predict an imminent and explosive rally. After a strong run-up earlier in 2025, XRP has pulled back slightly and is now approaching a critical support zone. Some analysts are now calling for a $15 breakout target, even as the token hovers near $2.80, a level many see as a pivotal point for the next leg of the bull market.

Let's dive into the latest developments, technical analysis, and market sentiment surrounding XRP — and why some believe "this is just the start."

XRP Price Overview: Current Positioning

As of early August 2025, XRP is trading around the $2.85 mark, down from its recent high near $3.70. While this pullback may concern short-term traders, technical analysts argue that this retracement is healthy and necessary for the formation of a higher low, a common pattern in bullish market structures.

The key price levels to watch include a support zone between $2.80 and $2.95, resistance at $3.70, downside risk to $2.20 if $2.80 fails, and upside targets of $5 in the short term and $15 in the mid-term.

Why $2.80 Is So Important

The $2.80 support level is emerging as a make-or-break price zone. It aligns with multiple technical indicators including the 0.618 Fibonacci retracement from the previous rally, the Value Area High (VAH) from recent price accumulation zones, and Higher Time Frame (HTF) structure showing consistent support around this level in recent months.

If XRP manages to hold this level and establish a higher low, it could kick off a new bullish wave, potentially targeting $5 in the short term and beyond in the medium term.

Analysts Call for $15 XRP — Is It Possible?

Several key factors support the bull case. Institutional interest continues to grow as Ripple's partnerships with banks and financial institutions support long-term utility. Legal clarity has improved significantly after years of regulatory uncertainty, with the SEC lawsuit largely resolved, removing a major overhang. Technical indicators including bullish divergence on the RSI, MACD bullish crossover, and increasing volume all support upward momentum. Additionally, as Bitcoin stabilizes, funds are flowing into major altcoins, including XRP, as part of the typical altcoin rotation cycle.

August Rally Incoming? Bullish Divergence Signals 20% Upside

Technical analysts have identified a bullish divergence forming on the daily and 4-hour charts — a classic signal that often precedes a strong move upward. This divergence appears as the price makes lower lows while the RSI makes higher lows, suggesting momentum is shifting in favor of the bulls.

If confirmed, this divergence could catalyze a 20% rally in August, potentially pushing XRP back above $3.40 and testing the critical $3.70 resistance. A clean break above this level would likely open the floodgates for further gains.

$3.70: The Gatekeeper to Higher Highs

While there's excitement around the potential for XRP to hit $5 or even $15, the path forward must first go through $3.70. This resistance level has stalled price action multiple times in 2025 and will likely serve as a psychological and technical barrier.

Two scenarios are possible: a break above $3.70 would open the door to $5 and $7 targets quickly, while a rejection at $3.70 could lead to a pullback toward $2.20, especially if $2.80 fails.

Traders Hedge With New XRP Rival: Remittix

As XRP consolidates, some traders are diversifying their holdings into Remittix (RTX), a new cross-border payments token that promises enhanced scalability and compliance tools. RTX has gained traction recently, especially among DeFi-native traders seeking alternatives to XRP's centralized development model.

Remittix highlights include strong tokenomics with a deflationary model and staking rewards, a real-world use case targeting remittance markets in Asia and Africa, and a PayFi Wallet with beta slated for launch in Q3 2025, offering seamless integration with fiat on/off ramps.

While Remittix is gaining momentum, XRP's brand recognition, liquidity, and institutional partnerships still give it a significant edge in the payments space.

XRP Price Forecast: Short-Term and Long-Term Outlook

In the short term over the next 30 days, the bullish scenario involves holding $2.80 support, breaking $3.70, and rallying to $5. The bearish scenario would see XRP lose $2.80, drop to $2.20, and consolidate.

For the mid-term outlook in Q4 2025, if the bullish trend continues and macro conditions remain favorable, XRP could target $7 to $10 by the end of the year. In a full altseason scenario, $15 is not out of reach, according to some analysts.

Key Catalysts That Could Drive XRP Higher

Several catalysts could propel XRP higher. Institutional adoption continues to expand as Ripple's partnerships, especially in the Middle East and Asia-Pacific, lay the groundwork for long-term utility. CBDC integration presents another opportunity as Ripple works with multiple central banks on developing Central Bank Digital Currencies. Any progress here could significantly boost XRP's real-world use.

ETP listings could bring new inflows as XRP may benefit from exchange-traded products in Europe and Asia, especially if more crypto-based ETFs gain traction globally. The macro environment also favors growth, with a dovish Fed, weakening USD, and rising crypto adoption all creating a fertile environment for altcoins like XRP to thrive.

Community Sentiment: Is the XRP Army Ready?

The XRP community, also known as the XRP Army, remains one of the most passionate and active in the crypto space. Social media sentiment has turned increasingly bullish, with hashtags like #XRPToTheMoon and #XRP15 trending on X (formerly Twitter).

However, analysts caution against overexuberance, noting that market cycles can be volatile and unpredictable.

Risks to Watch

While the bullish case is compelling, it's important to consider the risks. Macro-economic shocks from a sudden shift in interest rates or recession fears could impact crypto markets broadly. Regulatory setbacks remain possible — although Ripple has gained legal clarity in the U.S., future regulations in Europe or Asia could cause volatility.

Network risks from any technical issues or security breaches could erode trust and trigger selloffs. Competition from new projects like Remittix, Stellar (XLM), and other payment-focused tokens could eat into XRP's market share.

Final Thoughts: Is XRP Set to Explode?

With XRP hovering near a critical support zone at $2.80, all eyes are on whether bulls can defend this level and push the token back into an uptrend. If successful, the next moves could be explosive, with analysts forecasting $5 in the short term and potentially $15 or higher before the end of 2025.

While risks remain, the technical setup, improving fundamentals, and renewed community optimism all point toward a bullish continuation — if key levels hold.

As always, investors should stay informed, manage risk, and avoid emotional decisions in this fast-moving market.

Summary

XRP currently trades around $2.85 with key support at $2.80 and major resistance at $3.70. Short-term targets point to $5 while mid-term projections suggest $10 to $15 is possible. Downside risk exists to $2.20 if support fails. Bullish catalysts include legal clarity, growing utility, and increasing adoption, while bearish risks encompass macro shocks, competition, and potential regulation.

Disclaimer

This article is for informational purposes only and is not financial advice. Cryptocurrency investments are highly volatile and involve significant risk. Always do your own research (DYOR) and consult with a financial advisor before making investment decisions.

Xrp - The final bullish breakout!💰Xrp ( CRYPTO:XRPUSD ) will create new all time highs:

🔎Analysis summary:

After a consolidation of an incredible seven years, Xrp is finally about to create new all time highs. With this monthly candle of +40%, bulls are totally taking over control, which means that an altcoin season is likely to happen. And the major winner will simply be our lovely coin of Xrp.

📝Levels to watch:

$3.0

🙏🏻#LONGTERMVISION

SwingTraderPhil

Bullish Signals Mount for XRP as Price Holds Weekend GainsXRP at a Crossroads: Technical Strength Meets Fundamental Catalysts in a High-Stakes Market

July 28, 2025 – In the volatile and ever-evolving world of digital assets, few tokens command as much attention, debate, and fervent community support as XRP. The digital asset, intrinsically linked with the fintech company Ripple, is currently navigating a period of intense market focus. After a period of consolidation, XRP is demonstrating renewed strength, holding onto recent gains and pressing against critical technical resistance levels. This price action is not occurring in a vacuum; it is the culmination of powerful undercurrents, including bullish chart patterns, significant accumulation by large holders, and a shifting landscape of regulatory clarity and institutional interest that could define its trajectory for years to come.

As of Monday morning, XRP has shown stability, trading around the $3.16 to $3.24 range. This follows a period where the token has been building momentum, with analysts closely watching key resistance zones between $3.30 and $3.40. A decisive break above these levels could signal the start of a new upward trend, while the ability to hold support, particularly around $3.15 to $3.20, is seen as crucial for maintaining the current bullish structure. This delicate balance has traders and long-term investors alike on high alert, as a confluence of technical indicators and fundamental developments suggests that XRP may be poised for its next significant move.

________________________________________

Chapter 1: Decoding the Charts: Bullish Patterns Emerge

For technical analysts, the recent XRP charts are a compelling study in bullish potential. Several classic patterns and indicators have emerged, suggesting that the path of least resistance may be upwards. These signals, watched closely by traders globally, are fueling a narrative of an imminent breakout.

One of the most discussed formations is the "Cup and Handle" pattern. This is a bullish continuation pattern that resembles a teacup on a chart. The "cup" is a U-shaped or rounded bottom that forms after a price run-up, indicating a period of consolidation and accumulation. This is followed by the "handle," a shorter and shallower downward drift in price, representing a final shakeout before a potential major upward move. Analysts have identified a large cup formation developing on XRP's long-term charts, with some pointing to a breakout zone around $3.64. A confirmed move above the handle's resistance could, according to technical theory, trigger an explosive rally, with some analysts projecting targets as high as $5.18, $7, or even a staggering $30 based on the pattern's depth.

Adding to this bullish thesis is the appearance of a "Golden Cross." This occurs when a shorter-term moving average (like the 50-day) crosses above a longer-term moving average (like the 200-day) on a price chart. It is widely regarded as a signal of a potential long-term uptrend. A golden cross was recently confirmed on XRP's daily chart around July 23, 2025, an event that historically has preceded significant price runs. The last major golden cross in late 2024 was followed by a rally of over 460% in two months. While past performance is not indicative of future results, the reappearance of such a powerful signal has undoubtedly bolstered investor confidence.

Furthermore, a rare golden cross has also been observed on the XRP/BTC trading pair, where XRP's price is measured against Bitcoin. This specific event, where the 23-day moving average crossed the 200-day, previously preceded a 158% surge in the pair's value in just two weeks. The near-identical structure of the current pattern has led analysts to suggest that XRP may be poised to outperform Bitcoin in the near term, especially as Bitcoin's price has been consolidating, shifting investor focus toward promising altcoins.

These technical signals—from the broad Cup and Handle to the precise Golden Cross—are painting a picture of a market coiling for a significant move. They suggest that underlying buying pressure is quietly building, setting the stage for a potential breakout if the market's fundamental drivers align.

________________________________________

Chapter 2: The Whale Effect: Following the Smart Money

Beyond the lines on a chart, the actions of the market's largest players—colloquially known as "whales"—provide another critical layer of insight. These are individuals or entities holding vast amounts of a cryptocurrency, and their trading activity can significantly influence market trends and sentiment. Recently, on-chain data has revealed a clear and compelling trend: XRP whales are accumulating.

In a remarkable show of force, wallets holding between 10 million and 100 million XRP have been steadily increasing their holdings, adding over 130 million XRP in a single day recently. These large-scale investors now control approximately 14% of the circulating supply, a historic high for this cohort. This accumulation is significant because it suggests that sophisticated, well-capitalized market participants are confident in XRP's future prospects and are positioning themselves for a potential price increase.

Simultaneously, the flow of XRP from whale wallets to exchanges has plummeted by over 93% since early July. This is a crucial indicator, as large transfers to exchanges often signal an intention to sell. The sharp decline suggests that whales are not only buying more XRP but are also holding onto their existing assets, reducing the available supply on the market and removing significant sell-side pressure. This behavior, often described as a "supply shock," can create a powerful tailwind for the price if demand continues to rise.

This intense accumulation has not gone unnoticed. In one instance, two identical transactions moved a combined 306.4 million XRP, worth nearly $1 billion, from an exchange to a private wallet within 60 seconds. Such large, coordinated movements are often interpreted as strategic positioning ahead of anticipated positive news or a market-wide rally. This activity, combined with reports of over 2,700 wallets now holding at least 1 million XRP each, paints a picture of broad-based accumulation among the asset's most significant backers. This "smart money" activity often provides a psychological boost to retail investors, reinforcing the belief that a major move could be on the horizon.

________________________________________

Chapter 3: The Fundamental Pillars: Regulation, ETFs, and Utility

While technicals and whale movements drive short-to-medium-term sentiment, the long-term value of any digital asset rests on its fundamental pillars. For XRP, these pillars are its evolving regulatory status, the tantalizing prospect of a spot Exchange-Traded Fund (ETF), and its core utility within Ripple's global payments network.

Regulatory Clarity on the Horizon:

The most significant overhang on XRP for years has been the lawsuit filed by the U.S. Securities and Exchange Commission (SEC) in December 2020, which alleged that Ripple conducted an unregistered securities offering. This legal battle has been a focal point for the entire crypto industry. However, recent developments have shifted sentiment dramatically. Key court rulings, including a partial victory for Ripple where a judge determined that some of its XRP sales did not qualify as securities, have bolstered institutional confidence.

Currently, the case is in a delicate phase, with both Ripple and the SEC having paused their respective appeals. While rumors of a final settlement swirl, legal experts caution that the process is subject to the SEC's internal bureaucratic procedures and a formal vote is still required. Nevertheless, the prevailing belief is that the worst of the legal uncertainty is over. A final resolution, which many hope will come before the end of the year, would remove the primary obstacle to XRP's full-scale adoption in the United States and could pave the way for its relisting on major exchanges and inclusion in institutional products.

The Race for a Spot XRP ETF:

Following the landmark approvals of spot Bitcoin and Ethereum ETFs, the crypto market is buzzing with anticipation for what comes next. XRP is widely considered a prime candidate for its own spot ETF. Asset management giants like Grayscale, Bitwise, Franklin Templeton, and WisdomTree have already filed applications with the SEC.

The approval of a spot XRP ETF would be a watershed moment, providing a regulated, accessible, and insured investment vehicle for both retail and institutional investors in the U.S. to gain exposure to XRP. The launch of XRP futures-based ETFs has been seen as a positive precursor, following the same playbook that led to the spot Bitcoin ETF approvals. Market analysts and prediction markets have placed the odds of a spot XRP ETF approval in 2025 as high as 92-95%, contingent on a favorable resolution of the SEC lawsuit. Such an approval could unlock billions of dollars in institutional inflows, dramatically increasing demand and market legitimacy for the asset.

Core Utility in Global Payments:

At its heart, XRP was designed for utility. It serves as the native digital asset on the XRP Ledger, a decentralized blockchain engineered for speed and efficiency. Its primary use case is powering Ripple's payment solutions, which are now part of the broader Ripple Payments suite.

Ripple's network is designed to challenge the legacy correspondent banking system, exemplified by SWIFT, which can be slow and costly for cross-border payments. By using XRP as a bridge currency, financial institutions can settle international transactions in seconds for a fraction of a cent, without needing to pre-fund accounts in foreign currencies. This utility is not merely theoretical. Ripple has forged partnerships with over 300 financial institutions across more than 45 countries, with a significant portion utilizing XRP for liquidity. In 2024 alone, over $15 billion was transacted via Ripple's liquidity solutions, and the XRP Ledger is now processing over 2 million transactions daily. This growing, real-world adoption provides a fundamental demand for XRP that is independent of market speculation and forms the bedrock of its long-term value proposition.

________________________________________

Chapter 4: The Retirement Dream: Audacious Predictions and Future Outlook

The convergence of bullish technicals, strong fundamentals, and growing market optimism has led to a wave of bold price predictions from analysts. While highly speculative, these forecasts illustrate the immense potential that many see in XRP, fueling a narrative that significant holdings could lead to life-changing wealth.

Price targets for the current cycle vary widely, reflecting different models and timelines. Short-term targets frequently center around the $4 to $7 range, with some analysts suggesting a move to $9 or $15 is possible if momentum continues. One analyst, citing a rare bullish chart pattern, sees a potential 60% rally to around $4.47.

Looking further out, the predictions become even more audacious. Projections based on historical cycles and technical models, such as Elliott Wave theory, have put forth long-term targets of $16, $24, and even $27. Some AI-driven prediction models forecast that XRP could reach the $10-$20 range by the end of 2025, especially if an ETF is approved. Longer-term forecasts extending to 2030 suggest prices could potentially climb to between $19 and $48, depending on the level of global adoption.

These predictions have given rise to the "retire on XRP" dream among its community. For instance, if XRP were to reach one analyst firm's high-end forecast for 2030 of $32.60, an investment of 10,000 XRP could be worth over $326,000. While tantalizing, it is imperative for investors to approach such forecasts with extreme caution. The cryptocurrency market is notoriously volatile, and such high-reward potential is invariably accompanied by high risk. Regulatory setbacks, macroeconomic downturns, or a failure to achieve widespread adoption could all significantly impact XRP's future price.

Conclusion: A Confluence of Forces

XRP currently stands at one of the most fascinating junctures in its history. The digital asset is being propelled by a powerful confluence of forces: bullish technical patterns are signaling a potential breakout, on-chain data shows undeniable accumulation by its largest holders, and its fundamental value proposition is being strengthened by increasing regulatory clarity, the imminent possibility of a spot ETF, and steadily growing real-world utility.

The journey ahead is fraught with both immense opportunity and significant risk. A decisive break above its current resistance could unleash the momentum that analysts and investors have been anticipating for months. However, the market remains sensitive to legal news and broader macroeconomic trends. For now, XRP remains a bellwether asset, its story a microcosm of the broader struggle and promise of the digital asset industry—a high-stakes battle for legitimacy, adoption, and a permanent place in the future of finance