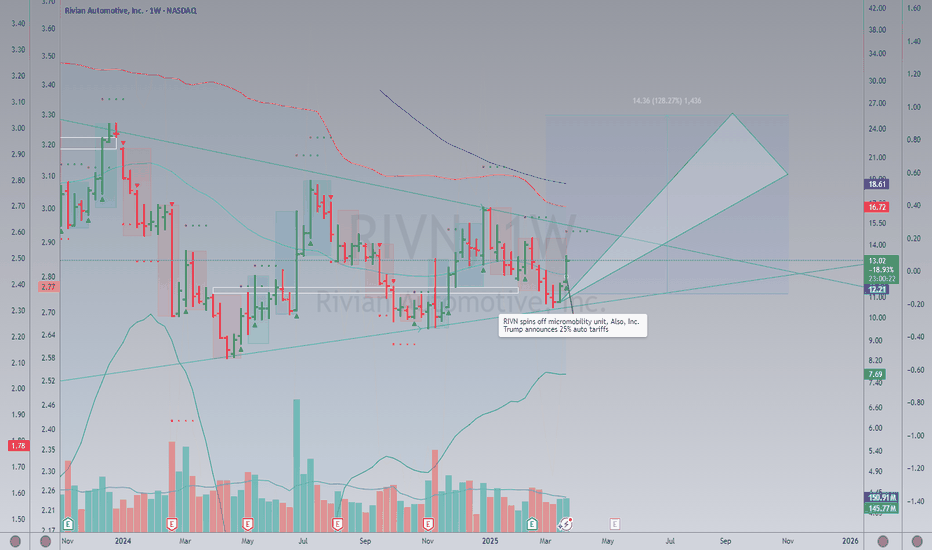

RIVN - Bullish Triangle Breakout SetupPrice action has formed a clear contracting bullish triangle , completing waves a–b–c–d–e and breaking above the upper trendline with strong momentum. This breakout suggests the market is shifting from consolidation to a new bullish phase.

As long as the breakout holds and price stays above the triangle resistance, I expect continuation toward the $30–$33 target zone , which aligns with the measured move of the pattern and the next major resistance area.

Rivian

Rivian Automotive (RIVN) — Scaling EVs with Software UpsideCompany Overview:

Rivian NASDAQ:RIVN builds adventure-ready electric trucks, SUVs, and commercial vans, giving investors clean exposure to the EV + sustainable transport megatrend.

Key Catalysts:

Record Quarter: 13,201 deliveries in Q3’25; revenue $1.56B (+78% YoY)—evidence of strong demand and improving operations.

Turning the Corner on Profit: First-ever positive gross profit: $24M, driven by cost reductions and a 324% surge in software & services—marking Rivian’s shift toward a software-enhanced platform.

Mass-Market Expansion: R2 at ~$45,000 slated for early 2026, broadening TAM and supporting multi-year volume growth.

Why It Matters:

✅ Proven ability to ramp production

✅ Improving unit economics with software tailwinds

✅ Clear catalyst with R2 launch

Investment Outlook:

Bullish above: $14.00–$15.00

Target: $23.00–$24.00, supported by volume growth, margin improvement, and platform monetization.

📌 RIVN — from premium adventurers to mass-market momentum.

RIVN 1D — It’s Time to Buy: Setup UpdateThe setup on Rivian (RIVN) just got upgraded from “interesting” to “strategically significant.” We’re looking at a textbook symmetrical triangle that’s been developing since July 2023, with a clean breakout and retest on the weekly trendline.

The breakout was followed by a bullish retest, right at the intersection of the triangle base and the key trendline. Volume kicked in, price held — and that’s what smart money calls confirmation.

Now, the Golden Cross is live: the 50-day MA just crossed the 200-day MA from below. Price is confidently holding above both — momentum is shifting hard. Fibs from the bottom (10.22) to the last local top (17.05) project the first target at $17, and the extended Fibonacci confluence gives us $25.64 as a long-range goal (2.618 extension).

The weekly trendline — which acted as resistance for over a year — has flipped to support. Price action respects it, bulls are loading, and structure is clean.

This is not just a bounce. It’s a technical rotation from accumulation to expansion.

The time to talk about potential is over — price action has spoken.

RIVIAN Triangle to give one more rally?Rivian Automotive (RIVN) has been trading within a 1.5 year Triangle pattern, with the price currently consolidating just below both the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line).

All previous Higher Lows of the pattern have been priced on at least the 0.786 Fibonacci retracement level, which is currently just below or when the 1D RSI approaches the 30.00 oversold level.

As a result, we expect a rebound near the bottom of the pattern, targeting its top (Lower Highs trend-line) at $15.75.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

$RIVN bottoming? Long term 10x+?The RIVN chart is starting to look good here. As you can see from the chart, we've broken out of a falling wedge. The next challenge is for price to flip the $15.27 resistance level as support and retest it.

If it can do that, then I think we can start to see a sustained uptrend. If it tests $15.27 or briefly breaks above it and rejects, then I think there's a possibility of one more retest of the lows prior to the move starting.

That said, the chart is starting to look really good over the long term. I think this has 10X+ potential over the coming years.

Rivian major consolidation coming to a decisionRivian is in my opinion coming closer to a decision on a breakout or breakdown. I personally love Rivian - I own one, and it's my favorite car I've ever owned. Next year they're planning on launching a much more affordable mid size SUV (R2) that I think will drastically increase their sales. It brings everything that is great about R1S/R1T to a more affordable platform without losing all the great technology and things we love about the more expensive R1.

I see that opportunity and want to be in on it, however as a trader, I need a deal and Rivian at $12 is not it. So I'm hoping this consolidation will break down for an opportunity at $7. There have been people holding this stock for so long betting on another Tesla, and with any luck some of them will finally throw in the towel if this obvious symmetrical triangle breaks down.

And if not, and it breaks up then I'm happy for all those loyal fans who've been holding for years. I love my SUV and am excited for Rivian to keep making even greater cars.

It's hard to predict how this pattern will play out, that's why I'm personally waiting on the sidelines.

Good luck!

Can Rivian Survive the Perfect Storm of Challenges?Rivian Automotive reported mixed Q2 2025 results that underscore the electric vehicle startup's precarious position. While the company met revenue expectations with $1.3 billion in consolidated revenue, it significantly missed earnings forecasts with a loss per share of $0.97 versus the anticipated $0.66 loss - a 47% deviation. Most concerning, gross profit returned to negative territory at -$206 million after two consecutive positive quarters, highlighting persistent manufacturing inefficiencies and cost management challenges.

The company faces a confluence of external pressures that threaten its path to profitability. Geopolitically, China's dominance over rare earth elements - controlling 60% of production and 90% of processing capacity - creates supply chain vulnerabilities, while new Chinese export licensing rules complicate access to critical EV components. Domestically, the impending expiration of federal EV tax credits on September 30, 2025, combined with the effective end of CAFE fuel economy standards enforcement, eliminates key demand-side and supply-side incentives that have historically supported EV adoption.

Rivian's strategic response centers on three critical initiatives: the R2 model launch, the transformative Volkswagen partnership, and aggressive manufacturing scale-up. The R2 represents Rivian's pivot from niche, high-cost premium vehicles to mainstream, higher-volume products designed to achieve positive gross margins. The $5.8 billion Volkswagen joint venture provides essential capital and manufacturing expertise, while the Illinois plant expansion to 215,000 annual units by 2026 aims to deliver the economies of scale necessary for profitability.

Despite maintaining a strong cash position of $7.5 billion and securing the Volkswagen investment, Rivian's widened EBITDA loss guidance of $2.0-2.25 billion for 2025 and target of EBITDA breakeven by 2027 represent a high-stakes race against time and capital burn. The company's success hinges on flawless execution of the R2 launch, achieving planned production scale, and leveraging its software capabilities and patent portfolio in V2X/V2L technologies to diversify revenue streams beyond traditional vehicle sales in an increasingly challenging regulatory and competitive environment.

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t bought RIVN before the previous earnings:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 10usd strike price Puts with

an expiration date of 2025-10-17,

for a premium of approximately $0.39.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Rivian Kicking Off Potential UptrendHey, all. I'll get down to it. Obviously NASDAQ:RIVN has been an incredibly tough stock to own. Fake out after fake out. It has been brutal - unless you have been nimble enough to buy the dips and sell the rips.

I would like to posit, however, that NASDAQ:RIVN is going to start marching back higher here over time. In the signal system I have been taught via the T@M strategy, Rivian is putting in a range expansion to the upside on the weekly time frame. If you take the range of the past monthly consolidation period, attach it to the "mode" (or central zone of the consolidation range), it gives you a target of $25 over the next few months. Now, whether this is another fake out just to reverse on us... again... remains to be seen of course. It is early in the idea. But potentially offers a decent risk/reward position here.

I just do not see Rivian really going away at all and, if they can keep refining their business, they could see some success going forward. Anyway, hope you enjoy this idea! As always, position carefully as the market is risky business.

Including the Daily Chart below for your reference as well.

RIVIAN Huge 1-year Triangle about to break. Trade the break-out.Rivian Automotive (RIVN) is trading within a 1-year Triangle pattern since the April 15 2024 Low. Right now the price is on the 1W MA100 (green trend-line), almost hitting the top (Lower Highs trend-line) of the pattern.

This is the second time ever that the 1W MA100 is tested, the previous on was on the last Lower High in late December 2024, giving slightly more probabilities for a bullish break-out above it.

If this is materialized, buy the break-out and target the 2.0 Fibonacci extension on the long-term at $26.50.

If it fails to break and instead is rejected back towards the Triangle's bottom, wait for a confirmed break of the Higher Lows trend-line and sell towards the -1.0 Fibonacci extension at $6.50.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Is the trend changing for Rivian?NASDAQ:RIVN 's stock price, which has dropped by nearly 80% since September 2022, has started to move upward again in November 2024 with renewed demand.

The possibility of retesting the trendline formed during the 2022-2024 period has strengthened with the demand seen in the past month.

If this upward movement continues, the initial price target could be $19. Should the trend persist, price movements could extend to $28 and even $41.

Tesla (TSLA) - The Big Short?Can Tesla save itself from the Big Short? With earnings coming up on April 29, the anticipated sales and earnings may be dismal. If hedge funds and retirement managers decide to lighten their exposure, this could lead to abrupt moves in the price of Tesla. Basically, if people want to sell and no one wants to buy at this price, then price has to go down. Also if Tesla hits a certain price on the way down, then all the loans like those used to purchase Twitter may margin call due to risk, more selling. This would not be good for Tesla or the market in general. Also keep in mind that April may be a pullback month for the S&P500 and Nasdaq anyway. So, what does Tesla need to do to combat this? 1. Deliver new products or announce the delivery of new product. 2. Deliver on full self driving along with the Robo Taxi service 3. Deliver on a new cheaper Tesla Model that can be used by individual owners to participate in the Robo Taxi network (Income for the buyer). 4. Deliver on a redesigned Cyber Truck. The current design in getting banned in European countries. Therefore, missing out on sells. 5. Deliver on mass productoin of humanoid robots and AI agents (someone has to be first). This will create excitement but can be tricky since it will unleash AI on the world which can be great but also introduce risk that have not been vetted. Such as, who controls the AI? Who is the AI 'loyal' to? What can people or Tesla ask AI to do? Are there morality rules? Is AI subject to the law? Who's laws based on the Country, State, or county/city it resides or where it was manufactured? 6. Advertise all the positive things about Tesla as a company and the cars as a product. Explain why someone should buy a Tesla over a BYD brand electric car in markets around the world.

These are just a few suggestions for Tesla to avoid The Big Short. What are some of your ideas?

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t sold RIVN after the recalls:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $0.93.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

2024 REVIEW MARKET STOCKS !! AND 2025 PROYECTIONS Why Stock Prices Tend to Rise Over Time

It's easy to get caught up in the ups and downs of the stock market, but zoom out, and you'll see a clear trend: stock prices generally increase over the long term. Here's why:

Economic Growth: As economies grow, so do corporate earnings. Companies expand, innovate, and become more profitable, which naturally pushes stock prices up.

Inflation: Over time, inflation erodes the value of money, but stocks can act as a hedge. As the price level increases, so do the nominal values of stocks.

Dividend Reinvestment: Many companies pay dividends, and when these dividends are reinvested into more shares, it compounds growth. This reinvestment can significantly boost the value of an investment over decades.

Market Sentiment: Optimism about the future can drive stock prices higher. When investors believe companies will do well, they're willing to pay more for stocks today.

Low Interest Rates: In recent decades, low interest rates have made borrowing cheaper for companies, fueling growth, and also made stocks more attractive than low-yield bonds or savings accounts.

Technological Advancements: Innovation leads to new industries and improves efficiency in existing ones, driving up stock values through increased productivity and new market opportunities.

APPLE 270 - 300 - 320 TP BY 2025 Apple's potential to reach a stock price of $320 by 2025 is significantly bolstered by its strategic shift towards artificial intelligence (AI). Here are key reasons why this could happen:

AI-Driven iPhone Upgrades: Apple is poised to enter what analysts describe as a "multi-year AI-driven iPhone upgrade cycle." This cycle is expected to drive significant hardware sales as consumers upgrade to newer models equipped with advanced AI capabilities. The introduction of Apple Intelligence, a suite of AI features, is anticipated to make the iPhone more compelling, encouraging upgrades even from users with relatively new devices.📷📷📷

Expansion in Services Revenue: With AI, Apple aims not just at hardware but also at enhancing its services ecosystem. Features like Apple Intelligence are expected to spawn new AI-driven apps and services, creating new revenue streams. This could lead to a multi-billion-dollar increase in services revenue, which traditionally accounts for a substantial portion of Apple's income.📷

Market Sentiment and Analyst Predictions: Recent analyst upgrades reflect a strong bullish sentiment on Apple's stock due to its AI strategy. For instance, Wedbush has raised the price target to $325, suggesting Wall Street might be underestimating Apple's growth potential in the

AI space. This optimism could drive investor confidence and stock value upwards.📷📷📷

Innovation and Market Positioning: Apple's focus on on-device AI, privacy, and security differentiates it from competitors. By integrating AI into its core products like Siri, Photos, and even the new iPhone SE expected in 2025, Apple can maintain or even increase its market share in both developed and emerging markets. This is particularly relevant as AI becomes more integral to everyday device usage.📷📷

Regulatory Adaptation: Despite facing regulatory challenges, Apple's ability to adapt and navigate these issues while continuing to innovate in AI could further solidify its market position. Compliance with new laws while maintaining innovation could be seen as a testament to Apple's strategic foresight, potentially boosting investor confidence.

RIVIAN LOOKS PRIMED! 120% UpsideNASDAQ:RIVN

Is it finally time for Rivian to break out of the multi-year downtrend?

-Falling wedge

-Symmetrical triangle

-Inverse H&S

-Williams CB formed

-H5 is GREEN

TRADE once we get B/O

Breakout: $16

SL: $9.52

Targets: $28/ $36

Risk/Reward ratio: 3

Not financial advice

$RIVN 15 DOLLARS AFTER EARNINGS ? NASDAQ:RIVN 15 DOLLARS AFTER EARNINGS ?

Rivian Automotive has confirmed that its next quarterly earnings report will be published on Tuesday, May 7th, 20241.

The earnings conference call is scheduled for 5:00 PM Eastern on the same day1.

Stock Price Movement:

As of now, Rivian’s stock price stands at $9.21 per share1.

The stock has been volatile, and investors are closely watching its performance.

Market Expectations

While Rivian has faced challenges, including supply chain disruptions and production delays, the market remains optimistic about its long-term prospects. The company’s plans to expand its fast-charging network and its innovative electric truck and SUV models have garnered attention.

Keep an eye on Rivian’s stock price after the earnings report. If the company delivers positive surprises, we might see movement toward your mentioned target of $15 per share. However, stock prices are influenced by various factors, so it’s essential to stay informed.

TESLA 300 AFTER EARNINGS ? 3 STRONG REASONS !!

Strong EV Market Position:

Tesla’s electric vehicles (EVs) remain popular, with the Model Y and Model 3 ranking among the top-selling vehicles in the U.S. in 2023. Even as legacy automakers enter the market, Tesla’s success suggests continued consumer preference for its vehicles.

Cybertruck:

Tesla’s long-awaited Cybertruck could be a game-changer. Pickup trucks have high gross profit margins, and if Tesla prices the Cybertruck right, it could boost their overall profitability1.

Regulatory Credits and Rebates: As Europe tightens regulations on internal combustion engine (ICE) cars, Tesla may receive more regulatory credits (from competitors like Fiat) going forward.

Full Self-Driving (FSD) Technology: Analysts estimate that Tesla’s FSD technology could potentially raise earnings per share by $1-$2 annually through the end of the decade.

LONG TERM INVESTMENTS FOR BIG COMPANIES !! LONG TERM !TRADING CAN CHANGE YOUR LIFE !!

META - APPLE - AMAZON - SPX - SPY - TESLA - NVIDIA - JP MORGAN - RIVIAN - LUCID

AVGO - HOOD - ROCKETLAB - AFFIRM - GOOGLE - SOFI - MICROSOFT - META -TSM - CRM - AMD

QCOM - BAC - AMEX - DISCOVER FOREX EURUSD - GBPUSD - USDJPY BTC

Key Considerations for Trading Forex, BTC, and Stocks

Trading in financial markets, whether it's Forex, Bitcoin (BTC), or stocks, involves a unique set of challenges and opportunities. Here are crucial points to keep in mind before diving into these markets:

For Forex Trading:

Leverage: Forex markets offer high leverage, which can amplify both gains and losses. Understand your risk tolerance and use leverage cautiously.

Market Hours: Forex markets are open 24/5, which means opportunities and risks are constant. Consider when you trade in relation to major market sessions (London, New York, Tokyo).

Volatility: Currency pairs can be highly volatile, especially around economic news releases or geopolitical events. Stay updated with economic calendars.

Interest Rates: Central bank policies can significantly affect currency values. Monitor interest rate decisions and monetary policy statements.

Pair Correlation: Understand how currency pairs correlate with each other to manage your portfolio risk better.

For Bitcoin (BTC) Trading:

High Volatility: Cryptocurrency, especially Bitcoin, is known for extreme price movements. Prepare for significant price swings.

Regulatory Environment: Keep an eye on global crypto regulations which can influence market sentiment and price.

Market Sentiment: Bitcoin's price can be heavily influenced by news, tweets from influencers, and market sentiment. Tools like sentiment analysis can be beneficial.

Security: Since BTC is digital, security of your wallet and trading platform is paramount. Use hardware wallets for long-term storage.

Liquidity: Ensure you're trading on platforms with good liquidity to avoid slippage, especially during volatile times.

For Stock Trading:

Company Fundamentals: Unlike Forex or BTC, stocks are tied to company performance. Analyze earnings, financial statements, and growth prospects.

Dividends: Some stocks offer dividends, providing an income stream which can be reinvested or taken as cash.

Market Trends: Stocks are influenced by broader market trends, sector performance, and macroeconomic indicators. Diversification across sectors can mitigate risk.

Brokerage and Fees: Stock trading can involve various fees like transaction fees, management fees, etc. Choose your broker wisely based on cost and services.

Long vs. Short Term: Decide if you're in for long-term investment or short-term trading. Each strategy requires different approaches to analysis and risk management.

General Tips for All Markets:

Education: Continuous learning about markets, new tools, and strategies is essential.

Risk Management: Never risk more than you can afford to lose. Use stop-loss orders, diversify, and only invest money you don't need for living expenses.

Psychology: Trading can be emotionally taxing. Manage stress, fear, and greed to make rational decisions.

Technology: Utilize trading platforms, analysis tools, and keep abreast of technological advancements that can impact your trading, like blockchain for crypto.

Regulation: Understand the regulatory environment of each market you're trading in to avoid legal pitfalls.

Community and Mentorship: Engage with trading communities or find a mentor. Learning from seasoned traders can provide shortcuts and insights.

Remember, every market has its nuances, and what works in one might not work in another. Tailor your strategies to each asset class while maintaining a cohesive risk management framework across all your trading activities. Good luck trading!

Rivian - Where is this truck running to? 100%+ Upside PotentialChart #29/ 40: NASDAQ:RIVN 🔋🛻

-Falling Wedge needs to breakout at $16

-H5 Indicator needs to flip to Green

-Williams Consolidation Box needs to break -80 and then create support for form the consolidation box.

-AVP Shelf to launch off with volume GAPs

🎯$28📏$36⏳ Before 2026

NFA

RIVIAN Is this EV maker dead??Rivian is bearish on its 1D technical outlook (RSI = 42.757, MACD = -0.170, ADX = 26.255) as it is extendint today yesterday's massive rejection on the 1D MA200. The long term pattern is a Channel Down and we are on the latest bearish wave and about to form a 1D MACD Bearish Cross. The two previous bearish waves of the pattern reached the 1.618 and 2.0 Fibonacci extension respectively, so a progressive lower low is identified there potentially. In any event, we expect at least the 2.0 Fibonacci level to be tested (TP = 8.65).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##