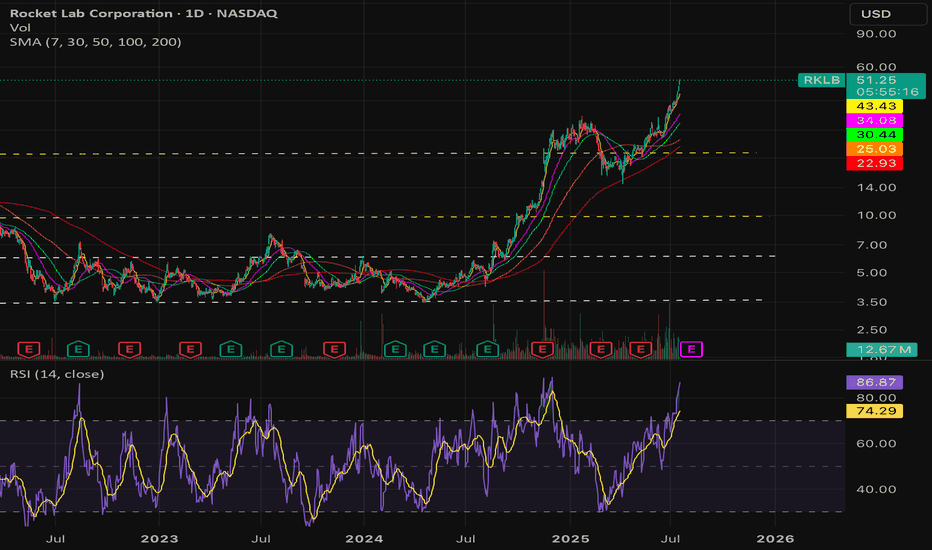

$RKLB – High Tight Flag as Space Sector Heats UpNASDAQ:RKLB – High Tight Flag After ATH Breakout | Space Trade Is Just Getting Started

The SpaceX IPO is going to pour gasoline on this entire sector — and NASDAQ:RKLB is already positioned perfectly for it. This stock has been on an absolute heater, and now it’s setting up a high tight flag right after breaking out to all-time highs.

🔹 The Setup:

Clean ATH breakout, followed by tight, orderly consolidation.

Price is respecting the EMAs, with volatility contracting — textbook high tight flag behavior.

This is exactly how leaders reload before the next leg higher.

🔹 Sector Momentum (Very Important):

Space stocks are going one after another:

NASDAQ:ASTS ripping

NYSE:RDW , NASDAQ:LUNR following

This is how sector-wide momentum phases start — once the market smells a big narrative (like a SpaceX IPO), money floods the whole group.

🔹 How I’m Playing It:

1️⃣ Entry: Looking to enter using the EMAs and the bottom of the flag as my guide.

2️⃣ Risk: Stop under the flag lows / EMA support — clean and mechanical.

3️⃣ Mindset: This is a trend continuation, not a chase.

🔹 Why NASDAQ:RKLB Is the One:

It’s a real company with real launches, not just hype.

Already a proven momentum leader in the group.

High tight flags at ATHs are where big trends extend.

🔹 Bonus Watch:

NASDAQ:ASTS is another potential beast if this sector keeps running — keep it on radar.

Space is becoming the next speculative momentum trade — and NASDAQ:RKLB is front and center.

Rklb

Can a Small-Sat Pioneer Become a Defense Superpower?Rocket Lab has transformed from a niche small-satellite launch provider into a strategic national security asset, closing 2025 with 21 successful Electron launches and a remarkable 175% stock surge. The company's evolution culminated in an $816 million Space Development Agency contract to build 18 satellites for hypersonic missile threat detection, signaling its emergence as a primary defense contractor. This vertical integration strategy positions Rocket Lab as a critical player in an era where supply chain sovereignty has become paramount for military readiness.

The technological centerpiece of Rocket Lab's 2026 ambitions is the Neutron rocket, a medium-lift vehicle capable of carrying 13,000 kilograms to low Earth orbit. Set for its maiden test flight in mid-2026, Neutron features the innovative "Hungry Hippo" fairing design and 3D-printed Archimedes engines, targeting the lucrative mega-constellation market currently dominated by SpaceX's Falcon 9. This technological leap, combined with over 550 global patents covering critical propulsion and structural innovations, creates a formidable intellectual property moat that competitors cannot easily replicate.

The financial trajectory underscores this transformation: analysts project 52.2% EPS growth for 2026, reaching $0.27 per share and dramatically outpacing traditional aerospace giants like Lockheed Martin (0.6%) and Northrop Grumman (-7.6%). A potential SpaceX IPO at $1.5 trillion valuation could trigger sector-wide revaluation, with Rocket Lab standing as the only publicly traded, vertically integrated alternative. Wall Street has responded accordingly, raising price targets to $90 as the company bridges the gap between startup agility and aerospace titan scale, with defense contracts poised to dominate its revenue mix.

Rocket Lab’s Strategic Ascent: Beyond the NumbersRocket Lab (NASDAQ: RKLB) has solidified its status as a cornerstone of the modern space economy. Following a turbulent period that saw shares retrace nearly 50%, the stock has staged a commanding recovery, rallying roughly 111% year-to-date. This resurgence is not merely a product of market speculation; it reflects a convergence of geopolitical necessity, operational maturity, and favorable macroeconomic shifts.

Geostrategy and Defense Dynamics

The company’s recent momentum is deeply rooted in shifting geopolitical realities. The successful STP-S30 mission for the U.S. Space Force, launched five months ahead of schedule, underscores Rocket Lab’s critical role in national security. In an era where orbital assets are vulnerable to kinetic and cyber threats, the ability to rapidly replace satellites is a strategic deterrent. Rocket Lab provides the "responsive space" capability that Western defense planners demand.

Furthermore, the dedicated launch for the Japan Aerospace Exploration Agency (JAXA) highlights a strengthening of allied aerospace integration. As nations like Japan seek to diversify launch providers away from domestic bottlenecks, Rocket Lab has emerged as the preferred neutral partner. This expands its total addressable market beyond U.S. borders, insulating it from single-market risks.

Industry Trends and Valuation Benchmarks

A massive sector-wide repricing is underway, catalyzed by reports of a potential SpaceX IPO in 2026 at a $1.5 trillion valuation. This news has fundamentally altered how investors assess the space industry’s long-term economics. SpaceX’s valuation serves as a powerful anchor, validating the orbital economy’s scale.

As the only other publicly traded, vertically integrated launch provider with a proven track record, Rocket Lab is the primary beneficiary of this sentiment shift. Capital that once flowed into speculative pre-revenue SPACs is consolidating into proven operators. Rocket Lab’s business model, which combines launch services with high-margin space systems, offers investors a tangible hedge against the capital-intensive nature of pure launch plays.

Operational Excellence and Culture

Corporate culture remains Rocket Lab’s hidden alpha. While the broader aerospace sector struggles with chronic delays, Rocket Lab’s delivery of the STP-S30 mission ahead of schedule speaks to a unique internal ethos. This "execution-first" culture sharply contrasts with competitors who rely on PowerPoint engineering.

Management’s ability to navigate high-tech manufacturing challenges while maintaining launch cadence has built a reservoir of institutional trust. This reliability is a defensive moat. In the launch business, reputation is currency; Rocket Lab’s consistency allows it to command pricing power and secure long-term government contracts that competitors cannot access.

Technology and the Neutron Horizon

The upcoming Neutron rocket represents a technological inflection point. Scheduled for its maiden flight in the first half of 2026, Neutron moves the company from a small-lift niche to medium-lift dominance. This vehicle targets the lucrative constellation deployment market, currently a SpaceX monopoly.

From a patent and science perspective, Neutron’s design—featuring unique carbon composite structures and reusable fairings—signals a leap in material science application. These proprietary engineering solutions create high barriers to entry. By securing intellectual property around rapid reusability and automated manufacturing, Rocket Lab protects its margins against commoditization.

Conclusion

Rocket Lab’s recovery is structural, not accidental. It is driven by a unique intersection of defense utility, superior execution, and a repricing of the space sector’s potential. As the company prepares for the Neutron era, it is shedding its label as a "small launch" provider and emerging as a diversified aerospace prime.

Learn from my mistake! Failing to buy $RKLB at $40I tend to take an interest in aerospace and defence stocks....and increasingly energy and space stocks. Which brings us to $RKLB.

Its led a charmed life the last 18 months - and has demonstrated the volatility that you'd expect from a small company in a new industry.

Price had recently rocketed north of $72 dollars, and having over-extended itself, it managed to to slide back rapidly. When it was fell back to $40 I where I started to get interested again. On the weekly chart price printed an inside bar spinning top. My view was that price would dip beneath $40, and flush out the recent lows, before reversing north. Which is when I planned to buy.

The best laid plans of mice and men. Price never came back below $0 before launching itself north and over the next two week traded as high as $64! My desire to get a perfect entry meant I missed out completely. So please learn from my mistake. There is no perfection in trading. Have a simple plan and execute well. And when you start trying to be a smart-arse and perfect an entry then have a word with yourself!

Anyway, overall I'm bullish on this stock.

RKLB | Overextended Into Supply | SHORTNASDAQ:RKLB

Ticker: RKLB (Rocket Lab)

Timeframe: 1H

Bias: Short / Mean Reversion

Author: SHKSPR

Summary

RKLB just printed a parabolic leg straight into a major institutional supply zone, with the final candle closing outside the upper Keltner Channel. This is a statistically powerful signal for exhaustion and mean reversion. Volume profile confirms a thin liquidity pocket below, making the downside path clean.

This move is not sustainable without a pullback — and the chart is flashing a clear short.

Bearish Confluence:

1- Price Closed Outside Keltner Channel

RKLB broke beyond the upper KC band — a sign of volatility blowout and potential exhaustion.

Moves outside the channel historically revert back toward the median band.

2- Rejection From Supply (62.75–63.00)

The candle wicked into a well-defined supply zone:

Prior imbalance

Strong seller presence

Immediate rejection

Absorption at the top of the move

This is the exact area where smart money distributes.

3- Volume Profile: No Acceptance Above

The profile shows a thin volume region above the supply block.

Price briefly visited and got rejected instantly — signaling:

No willingness to build value above

Buyers are exhausted

Sellers are defending levels aggressively

4- Clean Targets Below

TP1: 61.87 — micro HVN + structural retest

TP2: 60.48 — Keltner median + volume shelf

A break below TP1 accelerates the drop.

5- Structure: Parabolic → Stall → Wick Reversal

Classic blowoff pattern:

Vertical expansion

Micro topping wick

Shift in momentum

High R/R short window

Market psychology: buyers trapped at the top, sellers preparing to unwind the move.

Trade Plan:

Short Zone: 62.75–63.00

Stops: Above 63.50 high

Targets:

TP1: 61.87

TP2: 60.48

Invalidation: 1H candle close above supply zone

Final Outlook

RKLB is extended, rejected from supply, out of volatility bounds, and sitting above a liquidity vacuum. Unless buyers reclaim and hold above the supply zone, the path of least resistance is down.

This is a high-probability mean-reversion short setup backed by structure, volatility, and volume profile.

QuantSignals V3: RKLB Put Setup ActivatedRKLB QuantSignals V3 Weekly 2025-11-25

Ticker: RKLB

Signal Type: Weekly Short-Term Play

Direction: PUT (SHORT) — Contradicting Weekly Composite Guidance

Confidence: 60% (Moderate)

Current Price: $42.63

Entry: $0.29

Target 1: $0.58

Target 2: $0.87

Stop Loss: $0.15

Expiry: 2025-11-28 (3 days)

Weekly Momentum: BULLISH (+1.22%)

Options Flow: Neutral PCR 0.98, max OTM put volume indicates hedging

🧠 Key Technical & Chart Insights

Stock overextended at 87.3% of weekly range, RSI 90.3

Katy AI predicts sharp short-term decline (-14.73%) to $36.35 over 3 days

Support at $40.00, $39.00, $38.00; Resistance at $43.27

🎯 Trade Rationale

Katy AI’s high-precision 168-point prediction overrides bullish weekly composite score

Short-term reversal opportunity after +10.35% daily gain

Tight stop loss at $0.15 and conservative position size (2%) mitigate directional conflict

⚠️ Key Risks

Contradicts weekly composite bullish guidance (+2.0)

Moderate-high risk due to short 3-day horizon and potential news catalysts

Requires strict monitoring and potential scaling out at Target 1

Did You Buy The Dip? Heres What we bought!Today the SPX had an incredible morning selloff - met with and even more incredible rally.

The markets were in turmoil today up until the bulls stepped in and made a red to green reversal.

Days like today often create the biggest portfolio gains when you can buy stock at depressed levels.

We accumulated 6 position longs today.

Massive technicals were tested and defended today.

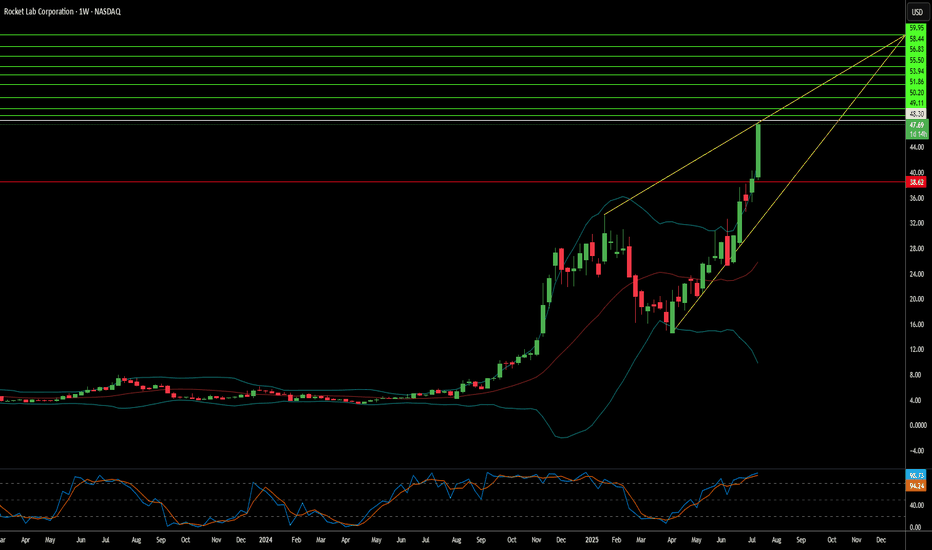

ROCKET LAB has topped. Sell signal on Bearish Divergence.Last time we took a look at Rocket Lab (RKLB) was more than 5 months ago (May 12, see chart below) where we gave a Buy Signal exactly on the 1D MA50 and the price instantly reacted with a rebound, easily hitting our $32.00 Target:

This time we are getting a Sell Signal on the chart as despite the stock's Higher Highs, its 1D RSI has been trading under Higher Lows since July 17, exhibiting a Bearish Divergence. The last similar Bearish Divergence was seen on January 24 2025, which was RKLB's previous Channel Up Top.

That signal triggered a correction that extended all the way back to the 0.382 Fibonacci retracement level and hit the 1D MA200 (orange trend-line) before bottoming. As a result, we are now turning bearish on Rocket Lab, targeting $40.00 (Fib 0.382).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

RKLB: the rocket is fueled and ready for orbitOn the daily chart of Rocket Lab (RKLB) , the price is trading at $44.38 after a confident breakout above key consolidation zones. Technically , the break of the $40 level confirmed the strength of the bulls and solidified the upward structure. The next target is $66 - a strong resistance aligned with the Fibo extension and if momentum holds, the market could extend toward $86.54, where long-term levels converge. EMA indicators remain below the price, reinforcing the bullish outlook.

Fundamentally , Rocket Lab stands as a leader in the small-launch vehicle sector, strengthened by contracts with NASA and consistent commercial demand. Amid growing interest in the aerospace industry and rising competition with SpaceX, the company benefits from diversified revenue streams and steady launch schedules. On the geopolitical side, increased defense programs in the U.S. and allied nations provide additional long-term support.

Tactically , the zone above $40 now acts as a support: as long as price holds above it, the bullish scenario remains intact. Targets are set at $66 and $86.54. Short-term corrections are possible if the market overheats, but the broader structure points upward, with institutional flows suggesting accumulation.

If this scenario plays out, Rocket Lab won’t just launch satellites - it’ll launch portfolios into orbit.

$RKLB Overvalued asf! - NASDAQ:RKLB is overvalued. I will either stay on the sidelines or short the heck out of this POS.

- Company sells hopium which doesn't have meaningful materialization as of now and not even in the distant future.

Fundamentally,

2025 | 2026 | 2027 | 2028

-0.32 | -0.08 | 0.17 | 0.47

Revenue:

576.83M | 905.01M | 1.21B | 1.69B

- Market cap of NASDAQ:RKLB currently sits at 24.61B as of July 17, 2025.

- People who are buying now are buying someone else bag and are in for a horrible ride.

- Consider buying it under $15 if you are super bullish

RKLB Earnings Bet: Will Rocket Lab Blast Off After August 7?

### 🚀 RKLB Earnings Bet: Will Rocket Lab Blast Off After August 7? 🚀

**🔥 75% Bullish Confidence | IV Rising | \$45C Looking Juicy!**

📊 **Earnings Play Breakdown – August 6, 2025**

🧠 **Model Summary:**

* ✅ *Revenue Growth: +32.1% YoY*

* 🚨 *Still Unprofitable (-44.3% margin)*

* 📉 *Oversold RSI: 30.10 (Bounce Setup?)*

* 🏗️ *Heavy R\&D Drag – But Long-Term Tailwinds*

💥 **Options Heat:**

* \$45C ➡️ Heavy Volume @ \$2.27

* Implied Move: \~5%

* Call/Put Flow: Bullish Lean

* IV Rank: 75% 🚨

📈 **Suggested Trade:**

> 🟢 **RKLB 45C (Aug 8 Expiry)**

> 🎯 Entry: \$2.27 | Exit Target: \$4.54+

> 📉 Stop: \$1.14 | RR: 3:1+

> 📆 Enter: Before Earnings (Aug 7, AMC)

---

🧠 **Why It’s Hot**

> RKLB is down, oversold, and loaded with short interest — but earnings could ignite a squeeze. High IV, sector tailwinds, and bullish flow = setup worth watching.

---

📌 **Hashtags (for visibility)**

`#RKLB #EarningsPlay #RocketLab #OptionsTrading #HighIV #BullishSetup #SpaceStocks #VolatilityPlay #CallOptions #TradingView`

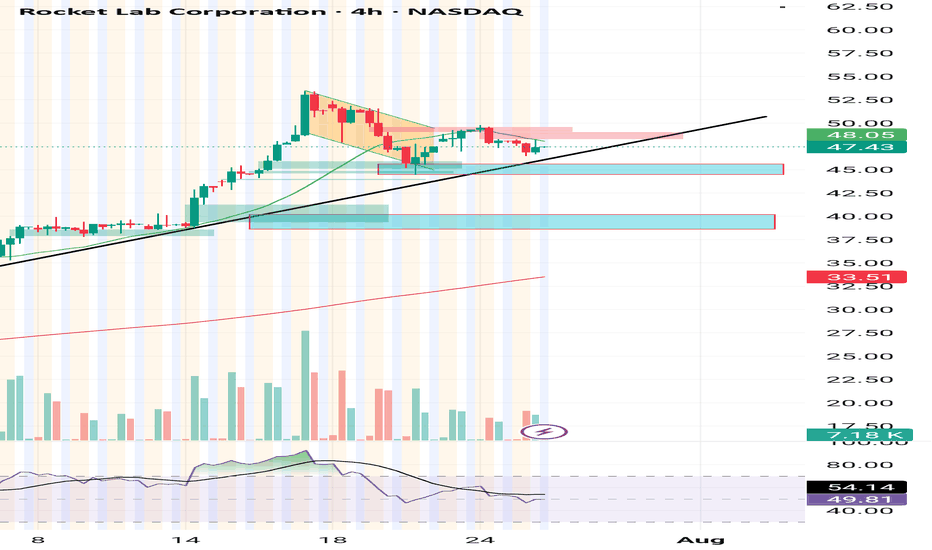

$RKLB – Momentum Pullback to 20 SMA with Trendline Break IncominRocket Lab ( NASDAQ:RKLB ) is setting up for a classic trend continuation move after a strong run. It just pulled back to the 20 SMA for the first time since breaking out over $35 — and it’s holding like a champ.

🔹 The Setup:

After peaking near $55, price pulled back in an orderly fashion on lower volume — a healthy correction.

Now we’ve got a hold at the 20 SMA, with a close back over the 9 EMA and a trendline break in progress.

This is where momentum tends to re-ignite.

🔹 Why It’s Powerful:

First 20 SMA test since the breakout = high probability bounce zone.

Lower volume on the pullback signals no panic selling.

A close over the 9 EMA + trendline = potential speed-up candle.

🔹 My Trade Plan:

1️⃣ Entry: Looking for confirmation over the 9 EMA and trendline.

2️⃣ Stop: Under the 20 SMA — tight structure, defined risk.

3️⃣ Target: Retest of highs near $55 with potential extension on breakout.

Why I Love This Chart:

NASDAQ:RKLB is a momentum name — when it moves, it moves fast.

The trend is intact, the pullback was clean, and now we have structure + volume setup.

Rocket Lab to new all time highs as more things go to spaceRocket Lab build rockets. CEO has an extremely bright aura. Hard to find a better story-driven pure space play with SpaceX being private. I like Rocket Lab and invested because as more and more things fly and go to space, it has the wind at its back.

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

Rocket (RKLB) From Launch Innovator to Space Systems PowerhouseCompany Evolution:

Rocket Lab NASDAQ:RKLB is transforming into a vertically integrated space and defense systems company, leveraging its launch heritage to build long-term, diversified revenue streams.

Key Catalysts:

Rapid Launch Cadence 🛰️

3 Electron launches in 24 days demonstrate operational agility and scalability.

Meets rising demand for high-frequency satellite constellation deployments.

Strategic GEOST Acquisition 🛡️

$275M deal expands into electro-optical and infrared payloads, key for defense/ISR.

Boosts margin profile, backlog durability, and government contract appeal.

Validated Execution & Recurring Revenue 💼

100% mission success rate and multi-launch contract with Japan's iQPS reinforce credibility.

Positions RKLB for long-term cash flow stability and multiyear contract wins.

Investment Outlook:

📈 Bullish above $23.00–$24.00, backed by high reliability and strategic expansion.

🎯 Price Target: $42.00–$43.00, reflecting an expanding TAM, defense sector momentum, and vertically integrated execution.

🌠 RKLB is no longer just reaching orbit—it's building the infrastructure of space. #RKLB #SpaceStocks #DefenseGrowth

These 2 Signals Made Members 80% Profit!NYSE:GE has had a massive rejection off of Monthly chart rejection.

We issued an alert to members om June 6th 2025. We entered a 245 Put (July 3) $5 con

We closed out our contracts today at $9 and roughly 80% gain.

This chart demonstrates the power of multiyear monthly chart resistance. Trades like these don't come around often but when they do you have to execute and forget about the noise!

This chart proves that technical trendlines do have power!

RKLB Weekly Options Trade Plan – 2025-06-07🚀 RKLB Weekly Options Trade Plan – 2025-06-07

Bias: Moderately Bullish

Holding Period: 3–5 trading days

Catalyst: Trump–Musk headline cycle + strong short-term momentum

Timeframe: Expiry June 13, 2025

🔍 Multi-Model Consensus Summary

Model Direction Strike Entry Stop Target(s) Confidence

Grok No Trade – – – – 0%

Claude Long Call $30 $0.76 $0.38 $1.50 75%

Llama Long Call $30 $0.76 $0.57 $1.14 70%

Gemini Long Call $31 $0.49 $0.24 $0.74–$0.98 65%

DeepSeek Long Call $30 $0.76 $0.38 $1.52 70%

✅ Consensus: Buy $30 call expiring 2025-06-13

💬 4 of 5 models bullish; 3 aligned on same strike and premium

⚠️ Max pain at $26 and overbought daily RSI are top risks

📈 Technical Snapshot

Price Trend: Bullish short-term (price > EMAs on 5-min & daily)

RSI: Nearing overbought (RSI ~69)

MACD: Bullish short-term, weakening daily

Resistance: $29.00–$29.50

Support: $28.70–$28.75

✅ Trade Setup

Parameter Value

Instrument RKLB

Direction CALL (LONG)

Strike $30

Entry Price $0.76

Profit Target $1.14 (≈50% gain)

Stop Loss $0.38 (≈50% loss)

Size 1 contract

Expiry 2025-06-13 (Weekly)

Confidence 70%

Entry Timing At market open

⚠️ Key Risks

Max Pain Gravity: $26 could act as price magnet by end of week

Overbought Setup: Daily RSI + Bollinger breach may cap further upside

Exhaustion Signs: Bearish MACD divergence could lead to snap pullback

Momentum Trade: Must act quickly; trail stops if resistance nears

GE Aerospace: How to go to the moon!GE's stock is soaring due to strong earnings and optimistic future guidance from its aerospace division.

1. Blowout Earnings: GE Aerospace reported earnings per share of $1.75, far exceeding analysts' expectations of $1.10.

2. Surging Orders: The company saw a 46% increase in orders last quarter, signaling strong demand for its products.

3. Revenue Growth: GE generated $10.8 billion in revenue, beating forecasts of $10 billion.

4. Wall Street Optimism: Analysts are raising price targets, with some predicting the stock could climb even higher.

5. Industry Momentum: The aerospace sector is experiencing a boom, with GE positioned as a key player.

I'm betting we are close to a pullback and then catapult to New ATH!