ROSEUSD

ROSEUSDT — Major Turning Point: Will the Downtrend Finally BreakAfter months of consistent decline, ROSE is now facing a critical moment — testing the descending trendline that has capped every rally since late 2024.

A strong rebound from the liquidity sweep around 0.0113 USDT suggests that selling pressure is fading and buyers are starting to show strength at the bottom. However, the descending yellow trendline remains the psychological barrier that separates a potential reversal from another failed rally.

Pattern & Structure

ROSE has maintained a clear sequence of lower highs and lower lows, reflecting sustained bearish control.

Currently, the price is attempting to challenge the upper boundary of this structure — a moment that could define the next macro direction.

If a breakout occurs and price closes a 2D candle above the trendline with strong volume, it would mark the first structural shift toward a mid-term bullish phase.

Failure to do so would confirm the trendline as strong resistance once again, and the downtrend could resume.

---

📈 Bullish Scenario

Confirmation: A decisive 2D close above the descending trendline with notable volume.

Upside Targets: 0.030 → 0.0345 → 0.0435 → 0.0610.

Narrative: A breakout could trigger a short-covering rally and shift sentiment toward accumulation, setting the stage for a larger move to the upside.

---

📉 Bearish Scenario

Confirmation: Rejection from the trendline or failure to sustain above 0.025.

Downside Targets: 0.017 → 0.0113 (liquidity retest).

Narrative: A failed breakout would signal continued weakness, keeping ROSE trapped in a broader bearish continuation pattern.

---

Conclusion

ROSE is standing at a make-or-break zone.

A confirmed breakout above the descending trendline could redefine the market structure and open the path toward recovery — but rejection here would reinforce the dominant downtrend and expose lower supports again.

> This is a critical decision point — the next few candles could decide whether ROSE begins a true reversal or sinks back into the depths of its downtrend.

#ROSE #ROSEUSDT #OasisNetwork #CryptoAnalysis #TechnicalAnalysis #BreakoutSetup #CryptoTrading #TrendlineBreak #TradingViewCommunity #AltcoinSetup

ROSE/USDT — at the Fibonacci Demand Zone, Will Buyers Hold?Overview

ROSE is at a critical juncture. After months of sideways movement since March, the price is once again testing the strong demand zone at 0.02696 – 0.02616, perfectly aligned with the Fibonacci 0.5–0.618 retracement. This zone is not just numbers on the chart—it’s the real battlefield between buyers defending structure and sellers pushing for a breakdown back to the range lows.

---

Price Structure & Pattern

Mid-term sideways: ROSE has been trapped within a broad 0.019 – 0.046 range, indicating long accumulation/distribution phases.

Demand zone (yellow): The 0.026–0.027 region has acted multiple times as a launchpad for rallies. Fibonacci confluence makes it even stronger.

Layered resistances: Price faces a “ladder” of resistances at 0.03029 → 0.03238 → 0.03665 → 0.04238 → 0.04574 → 0.04696. Each level is a checkpoint for the bullish momentum.

---

Bullish Scenario

1. Successful rebound at demand: If daily candles hold above 0.02616, a new higher low could be confirmed.

2. Break confirmation: A daily close above 0.03029 signals early bullish momentum; stronger confirmation comes above 0.03238 with volume.

3. Upside targets:

0.03665 (key structural resistance)

0.04238 (upper range expansion)

0.04574–0.04696 (previous range high, potential breakout zone)

From the demand zone, the upside potential is +70% if 0.04696 is retested.

---

Bearish Scenario

1. Breakdown risk: A decisive close below 0.02616 would destroy the bullish setup and invalidate the demand.

2. Downside target: Price could drop toward 0.01917, a ~30% decline from current levels.

3. Fakeout risk: A short dip below 0.026 before pumping back up is possible, so volume confirmation is crucial to avoid traps.

---

Takeaway & Insights

The 0.026–0.027 zone is the most important area for ROSE in the coming weeks. As long as it holds, bulls maintain the upper hand.

A breakout > 0.03238 is the catalyst that could invite strong momentum buying.

On the flip side, a breakdown < 0.02616 could extend the range lower to 0.019.

For swing traders, this is a low-risk accumulation zone with high-reward potential, but strict risk management is mandatory.

---

ROSE is retesting the critical demand zone at 0.026–0.027 (Fibonacci 0.5/0.618 confluence). This area has repeatedly acted as a strong support and rally base. As long as it holds, bullish scenarios remain valid with targets at 0.032 → 0.036 → 0.042 → 0.046.

A breakdown below 0.02616, however, could trigger a drop toward 0.019.

The market is now watching closely: will buyers defend this zone again, or will sellers seize control?

Strategy: Look for buy-the-dip opportunities at demand with tight stops, or wait for a confirmed breakout above 0.03238 for safer long entries.

Note: This range offers big potential, but disciplined risk management is the key.

---

#ROSE #ROSEUSDT #OasisNetwork #CryptoAnalysis #Altcoins #PriceAction #SupportResistance #Fibonacci #CryptoTrading

Rose is cooking something!First, let's take a look at the BINANCE:ROSEUSDT market trend.

Right now, we're chilling near its all-time low (ATL). The price has found great support in this zone multiple times, which has pushed it up towards the descending trendline that's acting as resistance.

We've got two resistance trendlines: the main one, and what I call a "micro" one. The price has to break this micro one before it can even think about tackling the main one, and we've already seen a few failed attempts.

So, we can either wait and see if this recent pump breaks that descending trendline or if it gets rejected and falls back to the support line I've drawn. If it drops, that's a good place to buy in. The other option is to enter a long position after a confirmed breakout of the descending line.

Either way, I'm expecting a major move to the upside in the next few weeks.

Please do your own research !

ROSE/USDT — Critical Demand Zone to Define the Next Big Move!🔎 Full Analysis

ROSE/USDT is currently trading inside a critical demand zone (0.01920 – 0.02388) that has been tested multiple times since April 2025. This area has acted as a foundation of support, holding back heavy selling pressure for months. The more often this zone gets tested, the higher the probability of a major move — either a strong rebound or a deep breakdown.

Structurally, ROSE remains in a medium-term downtrend, shown by a series of lower highs and lower lows since early 2025. However, the market is now showing early signs of accumulation, as price is no longer printing significant new lows since June, but instead consolidating around the same support zone.

🟢 Bullish Scenario

A bounce from demand followed by a breakout above 0.02664 on strong daily close would be the first bullish confirmation.

A stronger signal comes with a break above 0.03249, which could open the way toward higher resistances: 0.03637 → 0.04620 → 0.06194.

Even a move from support to the first resistance already offers +36% upside, with potential for +150% to +300% if momentum extends further.

🔴 Bearish Scenario

Failure to hold the demand zone and a daily close below 0.01920 would flip the structure bearish.

Such a breakdown could trigger a sell-off wave, as long-term support collapses and the market seeks lower liquidity levels.

Downside risk from current price is about −20% or more, depending on where the next support is established.

📌 Chart Patterns & Key Levels

Demand Zone Retest: Yellow zone remains the key accumulation area.

Range Accumulation: Possible Wyckoff accumulation phase if breakout occurs to the upside.

Key Levels to Watch: 0.02664 (minor resistance), 0.03249 (major resistance), 0.01920 (last line of support).

📈 Notes for Traders

Aggressive Buyers: may accumulate near demand with a tight stop below 0.0190.

Conservative Traders: wait for a confirmed breakout above 0.02664 or 0.03249 to reduce false signal risk.

Risk Management: use smaller positions in high-risk zones. Aim for at least 1:2 risk-to-reward ratio when planning trades.

---

📝 Conclusion

ROSE is standing at a make-or-break level that will define the next major trend.

Bullish case: demand holds → rally potential toward 0.0325–0.0462 in the mid-term.

Bearish case: breakdown below 0.0192 → market could drop deeper to search for new support.

With price sitting at a crucial level, traders should watch volume spikes, rejection candles, and breakout confirmations closely — the market seems ready for a decisive move.

#ROSE #ROSEUSDT #Oasis #AltcoinAnalysis #CryptoTrading #SupportResistance #TechnicalAnalysis #Breakout #DemandZone #PriceAction

Triple Bottom Power – ROSE Eyes Explosive Upside!$ROSE/USDT has formed a triple bottom pattern, signaling strong buying interest at the support zone. Price is now testing the key descending resistance line.

If it manages to close decisively above this level, we could see a strong upside move.

Until then, keep it on your watchlist and monitor closely for a breakout confirmation.

DYOR, NFA

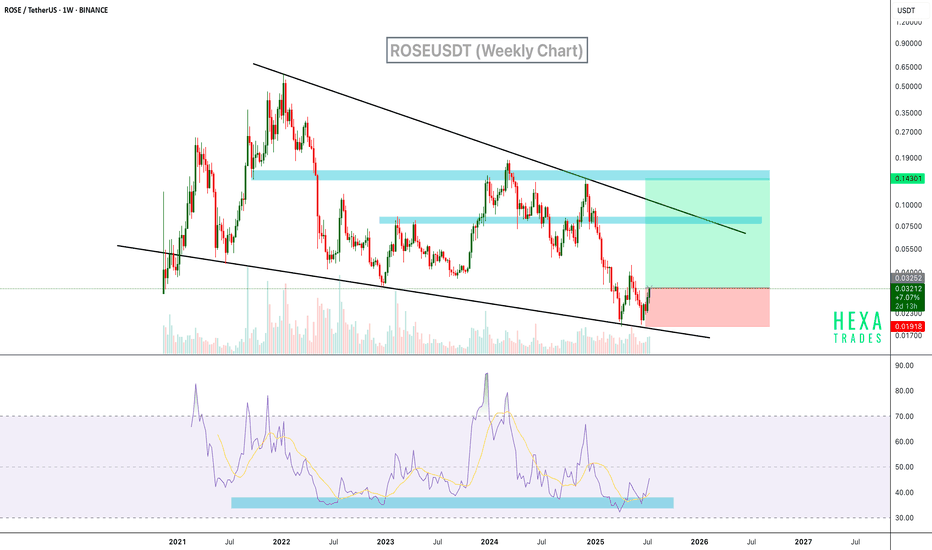

ROSEUSDT Rebounds from Wedge Support BINANCE:ROSEUSDT is currently trading within a long-term descending wedge on the weekly chart, a classic bullish reversal pattern. Price recently bounced off the lower wedge support with strong momentum. Additionally, the RSI indicator has rebounded from a historically strong support zone in the oversold region, which has previously signaled major bottoms.

Resistance 1: $0.048

Resistance 2: $0.075

Resistance 3: $0.145

Cheers

Hexa

ROSE/USDT Descending Triangle Breakout – Trend Reversal📊 Pattern Analysis – Descending Triangle at the End of Downtrend

ROSE/USDT has been forming a descending triangle pattern since late December 2024. This pattern features:

🔽 Downward sloping resistance: A descending trendline tested multiple times (5+ touches), showing strong validity.

🔲 Horizontal support zone: Price has held firm between $0.02200 - $0.02400, acting as a key demand area since March 2025.

Although descending triangles are often continuation patterns, in this context — appearing after a long-term downtrend — it increases the probability of a bullish reversal if the breakout confirms.

🚀 Bullish Scenario – Potential for Strong Rebound

If ROSE breaks above the descending trendline:

✅ Breakout Confirmation: Daily candle close above $0.02600 - $0.02800 with strong volume

📈 Bullish Targets (based on previous resistance zones & pattern projection):

$0.03140 – Minor resistance and former structure

$0.03477 – Previous high from May 2025

$0.04222 – February consolidation range

$0.04700 – Key prior distribution zone

$0.06191 – Primary target from triangle breakout (measured move)

$0.08453 and above – Potential extended rally if strong momentum follows

The reward-to-risk ratio is highly favorable on confirmation of a breakout.

🧨 Bearish Scenario – Breakdown Threat Looms

If ROSE fails to break out and instead closes below the horizontal support at $0.02200:

⚠️ This would signal a bearish continuation

📉 Potential drop to:

$0.01920 – The current multi-month low (key support level)

Breakdown of this level would mark a new lower low, confirming ongoing bearish trend

Caution is advised if volume increases during a breakdown.

🔍 Technical Insights:

Price is squeezing at the apex of the triangle — a breakout is imminent

Volume is still relatively low, suggesting accumulation or indecision

A volume spike will likely precede a confirmed breakout move

Market is at a decision point — either a trend reversal or continuation

🧠 Conclusion:

ROSE/USDT is on the edge of a major move. The descending triangle has matured, and a breakout in either direction could trigger a significant price reaction. Traders should monitor this setup closely as the breakout may occur within days.

#ROSEUSDT #CryptoBreakout #DescendingTriangle #TechnicalAnalysis #AltcoinSetup #ChartPattern #CryptoTrading #BullishReversal #BearishScenario #PriceAction #BreakoutAlert

#ROSE/USDT#ROSE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.02800, which acts as strong support from which the price can rebound.

Entry price: 0.03023

First target: 0.03100

Second target: 0.03200

Third target: 0.03300

#ROSE Bouncing from Key Demand Zone!#ROSE Bouncing from Key Demand Zone!

ROSE just tested a strong support area and is showing signs of reversal. RSI is recovering from oversold levels—momentum could be shifting!

🔹 Current Price: $0.031

🔹 First Target: $0.05

Could this be the start of a major uptrend?

Retweet if you're bullish!

#Crypto #Altcoins

You won’t believe how bearish ROSE is! (1W)A lot of data is now available on the rising pattern of ROSE. It appears that a large triangle has been completed, which was our wave B.

With the break of the B-D trendline, the triangle is now finished, and we are currently in wave C. Wave C is bearish and should take more time than the large wave A.

ROSE is expected to remain bearish for the next few months, but keep in mind that before the drop, it may pull back to the multi-week supply zone.

Let’s see how it plays out.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#ROSE Ready for a Bullish Breakout or Not? Key Levels to WatchYello, Paradisers! Is #ROSEUSDT preparing for a bullish breakout, or will we witness a deeper correction? Let’s dive into this crucial setup for #Oasis:

💎#ROSE has been trading within a well-defined descending channel on the 8-hour chart, a structure that often precedes significant market moves. Price is currently hovering near the resistance of this descending channel, and a breakout here could be the game changer bulls have been waiting for.

💎If #ROSEUSD breaks above the descending resistance, the first major hurdle will be the resistance at $0.1159. A clean and sustained breakout above this level could signal the start of a strong bullish rally. The next target would then lie within the major resistance zone between $0.1597 and $0.1671, representing a potential upside. However, you must watch for confirmation with strong volume and clear bullish candles to avoid falling for a fake breakout.

💎On the downside, the $0.074 level serves as critical support and has been a stronghold for buyers so far. If LSE:ROSE fails to break the resistance and bears regain control, we could see the price revisit this support zone. If this level also fails, the last line of protection for bulls is the underlying strong support at $0.056.

💎A daily close below $0.0563 would invalidate the bullish setup and open the door to further downside toward the $0.0400 region, where stronger demand could be tested. However, discipline and risk management remain essential as we await confirmation of the next move.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

ROSEUSDT: Catching the Retracement for a Potential Big Move!!ROSEUSDT has shown promising signs of a potential bullish continuation. After a successful bounce from a major support level, the price consolidated briefly before a strong breakout yesterday, pushing through resistance. Today's retracement to the broken resistance level (now acting as support) presents a potential entry opportunity for traders. Always manage your risk and use appropriate position sizing.

BINANCE:ROSEUSDT Currently trading at $0.092

Buy level: Above $0.09

Stop loss: Below $0.076

Target : $0.18

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#ROSEUSDT: Breakout Imminent or Bullish Momentum Fading?Yello, Paradisers! Are we on the brink of a massive breakout on #ROSEUSDT, or will the bulls lose their steam? Let’s break down the analysis and find out.

💎#ROSEUSDT is showing encouraging signs of a bullish continuation from the key support level at $0.06727. If the price manages to stay steady at this level, we could be looking at a breakout above the descending resistance of the ongoing channel. Momentum is the driving force here if it sustains, a significant price move could be just around the corner.

💎However, we aren’t in full breakout mode just yet. For a confirmed move, we need a decisive break above the internal resistance at $0.08367, supported by strong engulfing candles and consistent momentum. Until that happens, it’s wise to stay cautious and avoid entering positions too soon.

💎But what if the bulls lose their momentum? If #ROSEUSDT fails to break above $0.08367 and starts to show signs of weakening, sellers may step in. The critical support to watch is $0.04892, a level that has proven resilient in the past. A bounce from here would keep the bullish outlook alive, but a break below $0.04892 would invalidate the bullish setup and could lead to a sharp decline.

💎The next move will be pivotal, Paradisers. Whether we see a breakout or face a reversal, sticking to a strategic approach and disciplined risk management will keep us ahead of the game. Patience and a well-executed plan will separate the winners from the rest.

Trade smart, Paradisers. Consistency and discipline are key focus on the bigger picture and let the market come to you. Stay sharp, and let's see how this unfolds!

MyCryptoParadise

iFeel the success🌴

$ROSE is preparing to fly!ROSE is a good project, with top investors. Unlocked coins for investors are coming to an end and I expect final distribution soon. From a technical point of view we are above 50 EMA, also we have finished the accumulation phase and now is a great opportunity to ride up to Fibonacci level 2! The zone of interest for selling is around 0.3-0.32$.

Best regards, Horban Brothers.

#ROSE/USDT Ready to go higher#ROSE

The price is moving in a descending channel on the 30-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.1254

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.1290

First target 0.1343

Second target 0.1387

Third target 0.14424

#ROSE/USDT Ready to go up#ROSE

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.07342

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.07588

First target 0.07983

Second target 0.08522

Third target 0.090258

#ROSE/USDT#ROSE

The price is moving in a descending channel on the 4-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have an upward trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.06500

Entry price 0.07200

First target 0.08240

Second target 0.08299

Third target 0.09000

ROSEUSDT Bullish Channel Breakout!ROSEUSDT Technical analysis update

BINANCE:ROSEUSDT has formed a descending channel, and the price is now moving toward the channel resistance for a potential breakout. The price is trading above the 100 and 200 EMAs on the daily chart, indicating a bullish signal. A breakout above the channel could lead to a strong upward move.

Entry level: Below $0.086

Stop Loss: $0.068

Regards

Hexa