ROSEUSDT — Major Turning Point: Will the Downtrend Finally BreakAfter months of consistent decline, ROSE is now facing a critical moment — testing the descending trendline that has capped every rally since late 2024.

A strong rebound from the liquidity sweep around 0.0113 USDT suggests that selling pressure is fading and buyers are starting to show strength at the bottom. However, the descending yellow trendline remains the psychological barrier that separates a potential reversal from another failed rally.

Pattern & Structure

ROSE has maintained a clear sequence of lower highs and lower lows, reflecting sustained bearish control.

Currently, the price is attempting to challenge the upper boundary of this structure — a moment that could define the next macro direction.

If a breakout occurs and price closes a 2D candle above the trendline with strong volume, it would mark the first structural shift toward a mid-term bullish phase.

Failure to do so would confirm the trendline as strong resistance once again, and the downtrend could resume.

---

📈 Bullish Scenario

Confirmation: A decisive 2D close above the descending trendline with notable volume.

Upside Targets: 0.030 → 0.0345 → 0.0435 → 0.0610.

Narrative: A breakout could trigger a short-covering rally and shift sentiment toward accumulation, setting the stage for a larger move to the upside.

---

📉 Bearish Scenario

Confirmation: Rejection from the trendline or failure to sustain above 0.025.

Downside Targets: 0.017 → 0.0113 (liquidity retest).

Narrative: A failed breakout would signal continued weakness, keeping ROSE trapped in a broader bearish continuation pattern.

---

Conclusion

ROSE is standing at a make-or-break zone.

A confirmed breakout above the descending trendline could redefine the market structure and open the path toward recovery — but rejection here would reinforce the dominant downtrend and expose lower supports again.

> This is a critical decision point — the next few candles could decide whether ROSE begins a true reversal or sinks back into the depths of its downtrend.

#ROSE #ROSEUSDT #OasisNetwork #CryptoAnalysis #TechnicalAnalysis #BreakoutSetup #CryptoTrading #TrendlineBreak #TradingViewCommunity #AltcoinSetup

Roseusdtidea

ROSE/USDT — at the Fibonacci Demand Zone, Will Buyers Hold?Overview

ROSE is at a critical juncture. After months of sideways movement since March, the price is once again testing the strong demand zone at 0.02696 – 0.02616, perfectly aligned with the Fibonacci 0.5–0.618 retracement. This zone is not just numbers on the chart—it’s the real battlefield between buyers defending structure and sellers pushing for a breakdown back to the range lows.

---

Price Structure & Pattern

Mid-term sideways: ROSE has been trapped within a broad 0.019 – 0.046 range, indicating long accumulation/distribution phases.

Demand zone (yellow): The 0.026–0.027 region has acted multiple times as a launchpad for rallies. Fibonacci confluence makes it even stronger.

Layered resistances: Price faces a “ladder” of resistances at 0.03029 → 0.03238 → 0.03665 → 0.04238 → 0.04574 → 0.04696. Each level is a checkpoint for the bullish momentum.

---

Bullish Scenario

1. Successful rebound at demand: If daily candles hold above 0.02616, a new higher low could be confirmed.

2. Break confirmation: A daily close above 0.03029 signals early bullish momentum; stronger confirmation comes above 0.03238 with volume.

3. Upside targets:

0.03665 (key structural resistance)

0.04238 (upper range expansion)

0.04574–0.04696 (previous range high, potential breakout zone)

From the demand zone, the upside potential is +70% if 0.04696 is retested.

---

Bearish Scenario

1. Breakdown risk: A decisive close below 0.02616 would destroy the bullish setup and invalidate the demand.

2. Downside target: Price could drop toward 0.01917, a ~30% decline from current levels.

3. Fakeout risk: A short dip below 0.026 before pumping back up is possible, so volume confirmation is crucial to avoid traps.

---

Takeaway & Insights

The 0.026–0.027 zone is the most important area for ROSE in the coming weeks. As long as it holds, bulls maintain the upper hand.

A breakout > 0.03238 is the catalyst that could invite strong momentum buying.

On the flip side, a breakdown < 0.02616 could extend the range lower to 0.019.

For swing traders, this is a low-risk accumulation zone with high-reward potential, but strict risk management is mandatory.

---

ROSE is retesting the critical demand zone at 0.026–0.027 (Fibonacci 0.5/0.618 confluence). This area has repeatedly acted as a strong support and rally base. As long as it holds, bullish scenarios remain valid with targets at 0.032 → 0.036 → 0.042 → 0.046.

A breakdown below 0.02616, however, could trigger a drop toward 0.019.

The market is now watching closely: will buyers defend this zone again, or will sellers seize control?

Strategy: Look for buy-the-dip opportunities at demand with tight stops, or wait for a confirmed breakout above 0.03238 for safer long entries.

Note: This range offers big potential, but disciplined risk management is the key.

---

#ROSE #ROSEUSDT #OasisNetwork #CryptoAnalysis #Altcoins #PriceAction #SupportResistance #Fibonacci #CryptoTrading

Rose is cooking something!First, let's take a look at the BINANCE:ROSEUSDT market trend.

Right now, we're chilling near its all-time low (ATL). The price has found great support in this zone multiple times, which has pushed it up towards the descending trendline that's acting as resistance.

We've got two resistance trendlines: the main one, and what I call a "micro" one. The price has to break this micro one before it can even think about tackling the main one, and we've already seen a few failed attempts.

So, we can either wait and see if this recent pump breaks that descending trendline or if it gets rejected and falls back to the support line I've drawn. If it drops, that's a good place to buy in. The other option is to enter a long position after a confirmed breakout of the descending line.

Either way, I'm expecting a major move to the upside in the next few weeks.

Please do your own research !

ROSE/USDT — Critical Demand Zone to Define the Next Big Move!🔎 Full Analysis

ROSE/USDT is currently trading inside a critical demand zone (0.01920 – 0.02388) that has been tested multiple times since April 2025. This area has acted as a foundation of support, holding back heavy selling pressure for months. The more often this zone gets tested, the higher the probability of a major move — either a strong rebound or a deep breakdown.

Structurally, ROSE remains in a medium-term downtrend, shown by a series of lower highs and lower lows since early 2025. However, the market is now showing early signs of accumulation, as price is no longer printing significant new lows since June, but instead consolidating around the same support zone.

🟢 Bullish Scenario

A bounce from demand followed by a breakout above 0.02664 on strong daily close would be the first bullish confirmation.

A stronger signal comes with a break above 0.03249, which could open the way toward higher resistances: 0.03637 → 0.04620 → 0.06194.

Even a move from support to the first resistance already offers +36% upside, with potential for +150% to +300% if momentum extends further.

🔴 Bearish Scenario

Failure to hold the demand zone and a daily close below 0.01920 would flip the structure bearish.

Such a breakdown could trigger a sell-off wave, as long-term support collapses and the market seeks lower liquidity levels.

Downside risk from current price is about −20% or more, depending on where the next support is established.

📌 Chart Patterns & Key Levels

Demand Zone Retest: Yellow zone remains the key accumulation area.

Range Accumulation: Possible Wyckoff accumulation phase if breakout occurs to the upside.

Key Levels to Watch: 0.02664 (minor resistance), 0.03249 (major resistance), 0.01920 (last line of support).

📈 Notes for Traders

Aggressive Buyers: may accumulate near demand with a tight stop below 0.0190.

Conservative Traders: wait for a confirmed breakout above 0.02664 or 0.03249 to reduce false signal risk.

Risk Management: use smaller positions in high-risk zones. Aim for at least 1:2 risk-to-reward ratio when planning trades.

---

📝 Conclusion

ROSE is standing at a make-or-break level that will define the next major trend.

Bullish case: demand holds → rally potential toward 0.0325–0.0462 in the mid-term.

Bearish case: breakdown below 0.0192 → market could drop deeper to search for new support.

With price sitting at a crucial level, traders should watch volume spikes, rejection candles, and breakout confirmations closely — the market seems ready for a decisive move.

#ROSE #ROSEUSDT #Oasis #AltcoinAnalysis #CryptoTrading #SupportResistance #TechnicalAnalysis #Breakout #DemandZone #PriceAction

ROSEUSDT TRADE IDEA. ROSEUSDT – Smart Money Setup

✅ Bullish BOS Completed – Market structure shifted bullish after breaking recent highs.

📍 POI Marked for Pullback Entry – Demand Zone + FVG at 0.0290 aligns with structural support, making it our ideal buy zone.

🔍 Plan:

We will wait for price to retrace into the POI and show clear bullish confirmation before entering.

🎯 Targets: 0.0315 → 0.0320

❌ Invalidation: Break & close below 0.0290 POI

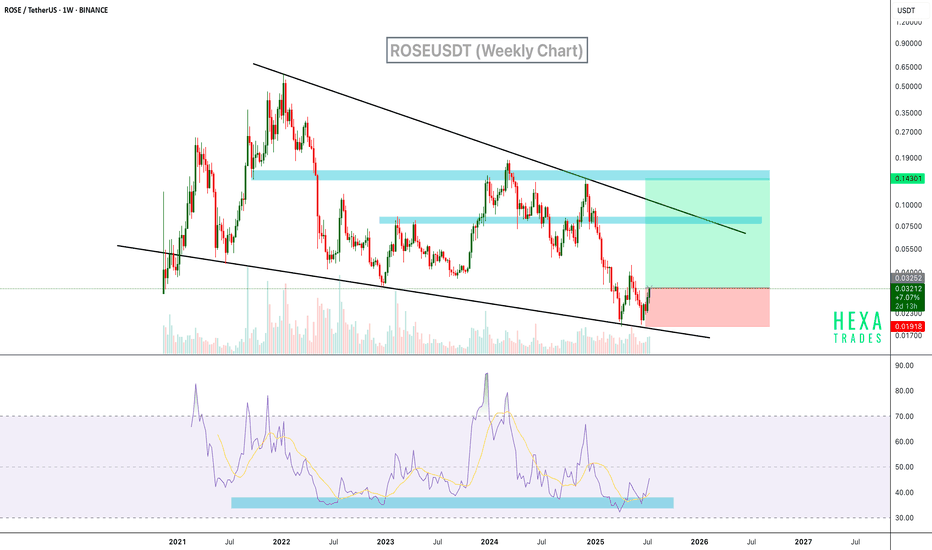

ROSEUSDT Rebounds from Wedge Support BINANCE:ROSEUSDT is currently trading within a long-term descending wedge on the weekly chart, a classic bullish reversal pattern. Price recently bounced off the lower wedge support with strong momentum. Additionally, the RSI indicator has rebounded from a historically strong support zone in the oversold region, which has previously signaled major bottoms.

Resistance 1: $0.048

Resistance 2: $0.075

Resistance 3: $0.145

Cheers

Hexa

ROSE/USDT Descending Triangle Breakout – Trend Reversal📊 Pattern Analysis – Descending Triangle at the End of Downtrend

ROSE/USDT has been forming a descending triangle pattern since late December 2024. This pattern features:

🔽 Downward sloping resistance: A descending trendline tested multiple times (5+ touches), showing strong validity.

🔲 Horizontal support zone: Price has held firm between $0.02200 - $0.02400, acting as a key demand area since March 2025.

Although descending triangles are often continuation patterns, in this context — appearing after a long-term downtrend — it increases the probability of a bullish reversal if the breakout confirms.

🚀 Bullish Scenario – Potential for Strong Rebound

If ROSE breaks above the descending trendline:

✅ Breakout Confirmation: Daily candle close above $0.02600 - $0.02800 with strong volume

📈 Bullish Targets (based on previous resistance zones & pattern projection):

$0.03140 – Minor resistance and former structure

$0.03477 – Previous high from May 2025

$0.04222 – February consolidation range

$0.04700 – Key prior distribution zone

$0.06191 – Primary target from triangle breakout (measured move)

$0.08453 and above – Potential extended rally if strong momentum follows

The reward-to-risk ratio is highly favorable on confirmation of a breakout.

🧨 Bearish Scenario – Breakdown Threat Looms

If ROSE fails to break out and instead closes below the horizontal support at $0.02200:

⚠️ This would signal a bearish continuation

📉 Potential drop to:

$0.01920 – The current multi-month low (key support level)

Breakdown of this level would mark a new lower low, confirming ongoing bearish trend

Caution is advised if volume increases during a breakdown.

🔍 Technical Insights:

Price is squeezing at the apex of the triangle — a breakout is imminent

Volume is still relatively low, suggesting accumulation or indecision

A volume spike will likely precede a confirmed breakout move

Market is at a decision point — either a trend reversal or continuation

🧠 Conclusion:

ROSE/USDT is on the edge of a major move. The descending triangle has matured, and a breakout in either direction could trigger a significant price reaction. Traders should monitor this setup closely as the breakout may occur within days.

#ROSEUSDT #CryptoBreakout #DescendingTriangle #TechnicalAnalysis #AltcoinSetup #ChartPattern #CryptoTrading #BullishReversal #BearishScenario #PriceAction #BreakoutAlert

Reversal Alert: $ROSE Clears Trendline, Next Stop $0.060?$ROSE/USDT is showing early signs of a potential trend reversal. After months of respecting a strong descending trendline, price has finally broken above it and is now consolidating just below a key resistance zone.

This area aligns with both the previous supply and the 50 EMA, making it a critical level to watch.

A confirmed close above this resistance, backed by strong volume, could trigger a bullish continuation toward the $0.044 and $0.060 levels.

DYOR, NFA

#ROSE Bouncing from Key Demand Zone!#ROSE Bouncing from Key Demand Zone!

ROSE just tested a strong support area and is showing signs of reversal. RSI is recovering from oversold levels—momentum could be shifting!

🔹 Current Price: $0.031

🔹 First Target: $0.05

Could this be the start of a major uptrend?

Retweet if you're bullish!

#Crypto #Altcoins

ROSEUSDT: Catching the Retracement for a Potential Big Move!!ROSEUSDT has shown promising signs of a potential bullish continuation. After a successful bounce from a major support level, the price consolidated briefly before a strong breakout yesterday, pushing through resistance. Today's retracement to the broken resistance level (now acting as support) presents a potential entry opportunity for traders. Always manage your risk and use appropriate position sizing.

BINANCE:ROSEUSDT Currently trading at $0.092

Buy level: Above $0.09

Stop loss: Below $0.076

Target : $0.18

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#ROSE/USDT Ready to go up#ROSE

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.07342

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.07588

First target 0.07983

Second target 0.08522

Third target 0.090258

ROSEUSDT Bullish Surge or a Risky Rejection? Key Levels Area!Yello, Paradisers! Could #ROSEUSDT be on the brink of a major breakout or facing a critical setback? Here's the breakdown:

💎#ROSE has formed a three white soldiers pattern, a classic and powerful bullish indicator. If it successfully breaks out of the descending channel, we could see the price push upward to the key resistance level, confirming a potential Cup and Handle formation. Should ROSE break this resistance, it would solidify the bullish case, with a significant move toward the supply zone as the target.

💎However, if ROSE gets rejected at the descending channel resistance, we might witness the price testing the support zone between $0.066 and $0.062. A rebound from this area would set the stage for another attempt at breaking out of the descending channel.

💎The situation turns concerning if ROSE fails to rebound from the support and breaks down further. This could lead the price to revisit the demand area or even test the major support zone between $0.0524 and $0.049. A rebound from this level and a reclaim of the $0.06 support would be crucial for maintaining the bullish scenario. Conversely, if ROSE breaks below this major support with a daily close under it, it would confirm a bearish shift, potentially pushing the price into a deeper dip.

Consistency is key, Paradisers! Focus on strategic planning, disciplined trading, and the highest probability setups to stay ahead. Keep your eyes on these critical levels and trade smart!

MyCryptoParadise

iFeel the success🌴

ROSEUSDT Bounces Back, Targeting $0.10 After Strong Support TestAfter successfully testing key support levels, ROSE/USDT is showing bullish momentum as it begins to bounce back. With strong buying interest emerging, the price action suggests a potential rally towards the $0.10 mark. Traders should watch for confirmation of this trend, as further upward movement could present profitable opportunities.

ROSEUSDT Currently trading at $0.069

Buy level: Above $0.069

Stop loss: Below $0.0615

TP1: $0.072

TP2: $0.082

TP3: $0.09

TP4: $0.1

Max Leverage 5x

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

ROSE/USDT: Potential Big Breakout LoadingThe ROSE/USDT pair is showing signs of a breakout on the daily timeframe. If the breakout is successful, I anticipate a strong bullish movement of 50-100% in the coming days.

Remember, this is not financial advice—always do your own research (DYOR) before making any trades.

Considering 5x potential move on ROSE!As you can see BINANCE:ROSEUSDT made a move with huge potential early this year. There are a few factors that I loved to see and consider the long-term position of this coin. BINANCE:ROSEUSDT made a higher high last March, MACD is making a huge divergence and now I think we found a new higher low around the 0.05 area. There are a few crucial zones to break to make a higher high. BINANCE:ROSEUSDT must close a candle above the first resistance zone (1) in a weekly TF. The second resistance zone (2) is around 0.117 which is a very crucial zone and can decide if we can break the last high or not. The first 4 orange areas are minor TP points, in the long run, we are aiming for 0.35.

ROSEUSDT Primed for Major Bullish Surge:75% Upside Potential!The ROSEUSDT trading pair is showing strong signs of an impending bullish wave, presenting a compelling buying opportunity for traders. With technical indicators aligning, there is a potential target upside of 75%. As always, it’s crucial to implement a stop-loss strategy to manage risks effectively.

ROSEUSDT (1D Chart) Technical analysis

ROSEUSDT (1D Chart) Currently trading at $0.105

Buy level: Above $0.104

Stop loss: Below $0.89

TP1: $0.115

TP2: $0.135

TP3: $0.155

TP4: $0.185

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

OASIS Rose Technical Analysis and Trade IdeaOn the daily timeframe, we observe a double bottom formation that has experienced a spike below into liquidity. This situation suggests the potential for a trend reversal. If this scenario unfolds, there's an opportunity to buy at a substantial discount and capitalize on an early entry before a bullish rally (assuming my analysis proves accurate). In the video, we delve into trend analysis, market structure, price action, and other critical aspects of technical analysis. I share my perspective on accumulating and entering this market, emphasizing the importance of prudent risk management. Remember, this content is purely educational and not financial advice. 📈🚀🔍