Long Consolidation. 2110 - Saudi Cable

Closed at 169 (29-01-2026)

Getting Momentum. Took Support from 124 - 125.

Long Consolidation.

Currently there is a resistance zone from 170 - 177

Breaking Out from 178 - 180 with Good Volumes

may result in an upside move towards 314 - 315.

However, this is on a bigger tf.

Rsistrategy

Netflix More Downside? Always consider the MACRO.Hello. With Netflix's recent buzz, its a stock that everyone is hyperfixating on. With no surprise ofcourse, and like everyone else i do consider it now more than ever a stock to have our attentions on and observe.

Million dollar question literally. Is now the time to BUY? Being such a powerhouse many people DCA into this stock regardless. But i say WHY just DCA. Why not consider the most optimal area to buy? Maximize your capital....

So my opinion, i do believe it is a little too early to answer this question. From what i can gather on the Macro (1 week timeframe in this example).

We have reached a Support area for sure. But in order to consider this area as a potential Long area, we need more data in the form of solid bullish candle prints on 1 week timeframe.

I would also like a test of and breakout/confirmation of the resistance trendline pushing us down. This would ease me out of defence and into buy.

AND most importantly the RSI indicates a longer period of sell off as per PREVIOUS Price data or history of netflix. BUT do note that previous history is not an indication that price action will repeat exactly how it did before. BUT we do have to consider it.

WE have just pierced the 20 level, and technically RSI can get to lower levels.

Previously we continues to sell off for 188 days after piercing the 20 level.

This may hypothetically coincide with price moving towards and attempting to test support at the previous Major Support trendline.

Well all things considered. We must be patient, humble ourselves and CONSIDER EVERYTHING.

Tune in for more analysis as i continue to put attention on and observe Netflix.

RSI and MACD TogetherRSI and MACD are often paired together under the idea of confirmation. If both indicators point in the same direction, the trade feels safer. In practice, this combination frequently creates confidence without clarity. The reason is simple. Both indicators are derived from the same source, price, and they often respond to the same information at different speeds.

RSI reacts relatively quickly to changes in momentum. MACD responds more slowly, smoothing price action to highlight broader momentum shifts. When traders wait for both to align before entering, they are often reacting to a move that has already unfolded. The result is late entries, compressed risk-to-reward, and increased sensitivity to pullbacks.

Confluence adds value only when each tool is assigned a clear role. RSI can help assess the current momentum environment, showing whether price behavior supports continuation or suggests slowing participation. MACD can help keep traders aligned with the dominant swing, reducing the urge to exit positions prematurely during normal retracements. Used this way, the indicators support decision-making rather than replacing it.

The combination becomes misleading when it is used to anticipate reversals. Divergences lining up across RSI and MACD feel powerful, but they often appear multiple times during strong trends. Momentum can weaken and reaccelerate without price structure ever breaking. Traders who act on indicator-based anticipation usually enter before the market has resolved its internal balance.

Another issue is redundancy. When both indicators are used to trigger entries, they rarely provide independent information. Agreement between them does not necessarily increase probability. It often just reinforces an interpretation the trader already wants to believe.

RSI and MACD work best after structure and location are established. When price has already shown intent, indicators can help manage timing, confidence, and trade duration. When used in isolation, they tend to encourage reaction instead of understanding.

SILVER M30 Prior High Test and Momentum Exhaustion Setup📝 Description

TVC:SILVER has pushed back into the previous swing high, completing a full recovery from the prior corrective leg. While price has successfully reached this key resistance area, the move is increasingly corrective rather than impulsive. Momentum conditions suggest exhaustion near the highs rather than strong continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish

Preferred Setup:

• Entry: 84.3

• Stop Loss: 85.15 (Invalidation on RSI(14) acceptance above the 70 level)

• TP1: 82.91

• TP2: 81.93

• TP3: 80.96 (HTF draw / lower liquidity)

The displayed targets represent the primary downside objectives. However, if RSI(14) breaks and holds above the 70 region, this setup becomes invalid, signaling renewed bullish strength instead of exhaustion.

________________________________________

🎯 ICT & SMC Notes

• Price has tagged prior high liquidity (BSL)

• Current leg shows signs of momentum loss near resistance

• No strong impulsive continuation after the high test

________________________________________

🧩 Summary

TVC:SILVER is trading at a critical inflection point. While price has reached the previous high, momentum conditions do not currently support strong continuation. As long as RSI remains below overbought acceptance, the expectation favors a corrective pullback toward lower PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

Broader sentiment remains balanced, with no immediate macro catalyst forcing aggressive upside continuation. In such conditions, rallies into prior highs are more likely to resolve through consolidation or corrective pullbacks unless momentum and risk appetite expand decisively.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

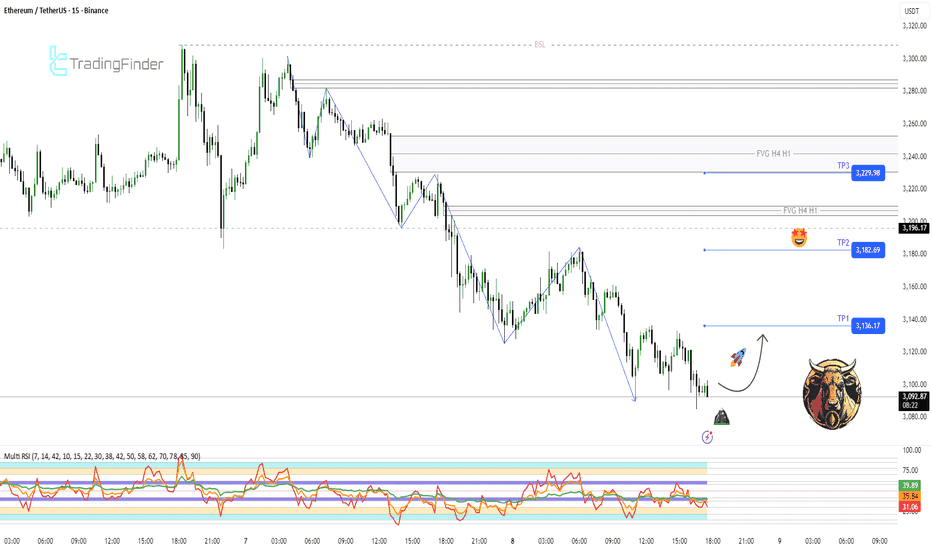

ETH M15 RSI Exhaustion and Mean Reversion Bounce Setup📝 Description

After a clear bearish leg, ETH has swept sell-side liquidity below recent lows and is now consolidating in a discount zone. The downside move looks liquidity-driven and corrective, not continuation. Price reaction at the lows suggests seller exhaustion and a short-term reversal potential.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish (Mean Reversion)

Preferred Setup:

• Entry: 3,090

• Stop Loss: Below 3,070

• TP1: 3,136

• TP2: 3,182

• TP3: 3,230

________________________________________

🎯 ICT & SMC Notes

• Clean SSL sweep of prior lows

• Price trading in HTF discount

• H4/H1 FVGs acting as upside magnets

________________________________________

🧩 Summary

Given the RSI condition and decreasing sell pressure, a short-term bullish reaction is expected. Risk management around the current low is key, and continuation depends on price reaction at higher PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

With no major high-impact news ahead, the market is mainly driven by technical flows. This environment supports a short-term technical bounce based on RSI and liquidity behavior.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Nasdaq MomentumFollowing the Federal Reserve’s rate cut decision, the ''RSI'' on the 4-hour chart is near the oversold zone. Price action has respected the key support area, as evidenced by multiple long lower wicks, indicating strong buying interest at these levels. Additionally, the ''Institution Radar'' indicator suggests that volume is well synchronized with price movement, implying transparent market participation and confirming the bullish momentum. Overall, these factors collectively support the likelihood of a near-term upward price continuation.

Mastering RSI: A Complete Guide to Momentum🔵 Mastering RSI: A Complete Guide to Momentum, Regimes, Reversals & Professional Signals

Difficulty: 🐳🐳🐳🐳🐋 (Advanced)

This article goes far beyond the basic idea of “RSI = overbought/oversold.” If you want to truly master RSI as a momentum gauge, trend filter, reversal tool, and structure confirmation model, this guide is for you.

🔵 WHY MOST TRADERS MISUSE RSI

Most traders use RSI in the simplest way:

RSI above 70 = sell

RSI below 30 = buy

This leads to shorting strong trends and catching falling knives.

RSI is not a reversal button. RSI is a momentum translator.

To master RSI, you must understand:

Trend regimes

Momentum pressure

Acceleration and deceleration

Failure swings

Divergences

Trend vs range behavior

Multi-timeframe alignment

Structure confirmation

RSI shows the strength behind price, not just extremes.

🔵 1. RSI TREND REGIMES (CORE FOUNDATION)

RSI moves in predictable zones depending on the type of market environment.

Bullish RSI Regime

RSI holds between 40 and 80

Pullbacks bottom around 40–50

Breaks above 60 show trend acceleration

Bearish RSI Regime

RSI holds between 20 and 60

Pullback tops form around 50–60

Breaks below 40 confirm bearish dominance

These regimes tell you who controls the market before you even look at candles.

🔵 2. MOMENTUM PRESSURE (RSI AS A SPEEDOMETER)

RSI measures the speed and pressure of price movement.

Rising RSI with rising price = trend acceleration

Falling RSI with rising price = momentum weakening

Rising RSI with falling price = early strength

Falling RSI with falling price = continuation pressure

This is not divergence. It is momentum pressure, the earliest sign of trend shift.

🔵 3. FAILURE SWINGS (THE MOST RELIABLE RSI REVERSAL SIGNAL)

Failure swings are powerful because they show internal momentum breaking before price reacts.

Bullish Failure Swing

RSI makes a low

RSI rallies

RSI dips again but stays above previous low

RSI breaks the previous high

Bearish Failure Swing

RSI makes a high

RSI pulls back

RSI rallies but fails to break the previous high

RSI breaks the previous low

Failure swings often appear at trend tops and bottoms before candles reveal anything.

🔵 4. DIVERGENCES (REGULAR AND HIDDEN)

Regular Divergence: Reversal Clue

Bullish: price lower low, RSI higher low

Bearish: price higher high, RSI lower high

Hidden Divergence: Trend Continuation

Bullish hidden: price higher low, RSI lower low

Bearish hidden: price lower high, RSI higher high

Hidden divergence is more powerful than regular because it confirms trend continuation.

🔵 5. RANGE RSI VS TREND RSI

RSI behaves very differently in ranges versus trends.

Range Environment

RSI oscillates between 30 and 70

Reversals at extremes have high accuracy

RSI 50 is the equilibrium

Trend Environment

RSI stays above 50 in bullish trends

RSI stays below 50 in bearish trends

30 and 70 extremes lose meaning

Always identify environment first. RSI signals change depending on regime.

🔵 6. RSI AS A STRUCTURE FILTER

RSI combined with structure improves trade selection dramatically.

Price makes higher highs + RSI rising = healthy trend

Price makes higher highs + RSI flat = weak breakout

Price makes higher highs + RSI dropping = exhaustion

Support retest + RSI 40–50 = strong continuation potential

Most false breakouts are avoided simply by checking RSI pressure.

🔵 7. MULTI-TIMEFRAME RSI ALIGNMENT

Use higher timeframe RSI to validate lower timeframe setups.

HTF RSI bullish + LTF RSI pullback = high-quality entry

HTF RSI bearish + LTF RSI bounce = premium short area

HTF RSI crossing 50 = long-term regime shift

This is one of the most powerful RSI confluences.

🔵 EXAMPLE TRADING FRAMEWORK

Bullish Setup Checklist

RSI in bullish regime (above 50)

Pullback into 40–50 zone

Hidden bullish divergence or failure swing

Structure forms a higher low

Bearish Setup Checklist

RSI in bearish regime

Rejection from 50–60 zone

Hidden bearish divergence or failure swing

Structure forms a lower high

🔵 COMMON RSI MISTAKES

Trading RSI extremes without trend context

Ignoring RSI regimes

Entering on regular divergences in strong trends

Not using RSI midline (50) as a regime filter

Relying only on overbought/oversold signals

🔵 CONCLUSION

RSI is one of the most powerful indicators when used correctly. It provides a complete framework for:

Reading trend strength

Tracking momentum pressure

Identifying early reversals

Trading continuation setups

Filtering breakout strength

Aligning multi-timeframe bias

Master RSI, and you gain a clearer view of momentum than most traders ever experience.

How do you use RSI? Do you prefer divergences, trend zones, or failure swings? Share your approach below!

XRP/USD – Compression Beneath the Trendline📉 Bias: NEUTRAL-to-SHORT

XRP trades near $2.50, consolidating just under the SMA200 ($2.53) after momentum cooled from the $2.55 zone. RSI at 48 signals balance, but repeated failures at resistance tilt risk lower.

A close below $2.48 may trigger continuation toward $2.42, while a break above $2.55 invalidates the short setup.

📊 Key Levels:

Resistance: $2.53 / $2.55 / $2.62

Support: $2.48 / $2.42

How to Use The Relative Strength Index (RSI) in TradingViewMaster RSI using TradingView’s charting tools in this comprehensive tutorial from Optimus Futures.

The Relative Strength Index (RSI) is one of the most widely used momentum indicators in technical analysis. It helps traders identify potential overbought and oversold conditions, spot divergences, and confirm the strength of trends.

What You’ll Learn:

Understanding RSI: a momentum oscillator plotted from 0 to 100

Key thresholds: how readings above 70 suggest overbought conditions and below 30 suggest oversold conditions

Why RSI signals are not automatic buy/sell triggers, and how strong trends can keep RSI extended for long periods

Spotting bullish and bearish price divergences

Using RSI to confirm trends

How to add RSI on TradingView via the Indicators menu

Understanding the default inputs and how changing them affects the indicator

Example on the E-mini S&P 500 futures: how RSI dipping below 30 and crossing back above can highlight momentum shifts

Combining RSI with other analysis for better confirmation

Practical applications across multiple timeframes, from intraday trading to swing setups

This tutorial will benefit futures traders, swing traders, and technical analysts who want to incorporate RSI into their trading strategies.

The concepts covered may help you identify momentum shifts, potential reversal points, and confirmation of trend strength across different markets

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting.

Aarti Industries at Solid Base – Potential Upside Loading!!Aarti Industries – Weekly Chart Update

Chart Pattern: Stock is trading within a shorter-timeframe parallel channel.

Support Zone: Strong support observed near ₹370 – ₹380 levels.

RSI Indicator: RSI is also taking support and moving upward, indicating positive momentum.

Trend Outlook: If this support zone sustains, the stock is likely to move into an uptrend.

Price Projection: Potential for higher levels at 500-521 in Aarti Industries.

Thank you!

Skeptic | RSI Masterclass: Unlock Pro-Level Trading Secrets!Hey traders, it’s Skeptic ! 😎 Ready to transform your trading? 95% of you are using the Relative Strength Index wrong , and I’m here to fix that with a game-changing strategy I’ve backtested across 200+ trades. This isn’t a generic RSI tutorial—it’s packed with real-world setups, myth-busting insights, and precise rules to trade with confidence. Join me to master the art of RSI and trade with clarity, discipline, and reason. Big shoutout to TradingView for this epic free tool! 🙌 Let’s dive in! 🚖

What Is RSI? The Core Breakdown

The Relative Strength Index (RSI) , crafted by Welles Wilder, is a momentum oscillator that measures a market’s strength by comparing average gains to average losses over a set period. Here’s the formula:

G = average gains over n periods, L = average losses.

Relative Strength (RS) = | G / L |.

RSI = 100 - (100 / (1 + RS)).

Wilder used a 14-period lookback , and I stick with it—it’s smooth, filters noise, and gives a crystal-clear read on buyer or seller momentum. Let’s get to the good stuff—how I use RSI to stack profits! 📊

My RSI Strategy: Flipping the Script

Forget what you’ve read in books like The Handbook of Technical Analysis by Mark Andrew Lim— overbought (70) and oversold (30) aren’t just for shorting or buying. I go long when RSI hits overbought, and it’s been a goldmine. I’ve backtested over 200 trades with this approach, and it’s my go-to confirmation for daily setups. Why does it work? When RSI hits overbought on my 15-minute entry chart, it signals explosive buyer momentum. Here’s what you get:

Lightning-Fast R/R: I hit risk/reward targets in 30 minutes to 2 hours on 15-minute entries (longer for 1-hour entries, depending on your timeframe).

Massive R/R Potential: An overbought RSI on 15-minute can push 1-hour and 4-hour RSI into overbought, driving bigger moves. I hold for R/Rs of 5 or even 10, not bailing early. 🚀

Rock-Solid Confirmation: RSI confirms my entry trigger. Take BTC/USD:

BTC bounces off a key support at 76,000, sparking an uptrend.

It forms a 4-hour box range, but price tests the ceiling more than the floor, hinting at a breakout.

Trigger: Break above the box ceiling at 85,853.57.

On 15-minute, a powerful candle breaks the ceiling, and RSI hits overbought—that’s my green light. I open a long.

Soon, 1-hour and 4-hour RSI go overbought, signaling stronger momentum. I hold, and BTC pumps hard, hitting high R/R in a short window.

This keeps trades fast and efficient—quick wins or quick stops mean better capital management and less stress. Slow trades? They’re a mental grind, pushing you to close early for tiny R/Rs. 😴

Pro Rules for RSI Success

Here’s how to wield RSI like a trading weapon:

Stick to the Trend : Use RSI in the direction of the main trend (e.g., uptrend = focus on longs).

Confirmation Only: Never use RSI solo for buy/sell signals. Pair it with breakouts or support/resistance triggers.

Fresh Momentum: RSI is strongest when it just hits overbought/oversold. If the move’s already rolling, skip it—no FOMO, walk away!

Customize Zones: Overbought (70) and oversold (30) can shift—it might show reactions at 65 or 75. Adjust to your market’s behavior.

Backtesting RSI: Your Path to Mastery

To make RSI yours, backtest it across at least 30 trades in every market cycle— uptrend, downtrend, and range. Test in volatile markets for extra edge. 😏 Key takeaways:

Range Markets Kill RSI: Momentum oscillators like RSI (or SMA) are useless in ranges—no momentum, no signal. Switch to ROC (Rate of Change) for ranges—I use it, and it’s a beast. Want an ROC guide? Hit the comments!

Overextended RSI Zones: On your entry timeframe (e.g., 15-minute), check higher timeframes (e.g., 4-hour) for past RSI highs/lows. These are overextended zones—price often rejects or triggers a range. Use them to take profits.

Final Vibe Check

This RSI masterclass is your key to trading like a pro—fast R/Rs, big wins, and unshakable confidence . At Skeptic Lab, we live by No FOMO, no hype, just reason. Guard your capital— max 1% risk per trade, no excuses. Want an ROC masterclass or more tools? Drop a comment! If this fired you up, smash that boost—it means everything! 😊 Got a setup or question? Hit me in the comments. Stay sharp, fam! ✌️

ATAIMS - BREAKOUT EMA 200 and CLOUD !ATAIMS - CURRENT PRICE : RM0.305

ATAIMS is bullish as the price is above EMA 50 and 200. The stock broke above EMA 200 and ICHIMOKU CLOUD on last FRIDAY (06 JUNE 2025) with high volume. Supported by technical reading in RSI heading upward, the stock may continue to move higher in the upcoming session.

ENTRY PRICE : RM0.300 - RM0.305

TARGET PRICE : RM0.340 and RM0.370

SUPPORT : RM0.270

ALong

A Different Way To Use the RSI To Trade Deceleration Patterns A deceleration pattern is a pattern that forms at the end of a directional move as it starts to lose steam. 2 good ones to learn are the rising/falling wedge & channel.

The problem wit these patterns however, is that it can sometimes be difficult to tell when that final reversal may come backing it hard to place stops.

Lately, and by that I mean for the past year or so, I've been tracking a very specific pattern on the RSI (Relative Strength Index) indicator to help me with these situations.

Please LIKE & SHARE and if you have any questions or comments, leave them below

Akil

Fartcoin: Is the Smell of a Downtrend in the Air? 📉 Fartcoin: Is the Smell of a Downtrend in the Air? 💨

🚨 Alert: The RSI is holding its nose... and so should we.

After a suspiciously bubbly rally, $FARTCOIN is now showing bearish RSI divergence on the 4H chart — and let’s be honest, it’s starting to stink. 🦨

The recent price action looks like someone tried to pump it... but forgot to ventilate. 💣💨

🧻 Support is about to get wiped.

💩 MACD says momentum is going down the drain.

🚽 Volume drying up like gas after Taco Tuesday.

TA Summary:

RSI Divergence ✅

Rising wedge (aka clogged pipes) ✅

Community still in denial? ✅

RSI 101: Revealing the Special Characteristics of RSIWhy does RSI have support and resistance levels at 40 and 60?

Why does divergence happen between RSI and price?

What is RSI momentum?

All the characteristics of RSI (that I know) will be explained here.

Formula and Meaning

If you are using TradingView, you probably already know what RSI is and what "overbought" and "oversold" mean. So, I won’t repeat it here. Instead, I’ll dive deeper into the true nature of RSI, giving you a different perspective.

You can skip the mathematical formula of RSI, it’s already discussed everywhere online. Just remember this ratio table:

Here’s how I explain the table:

At RSI = 50, the average gain equals the average loss (I'll call this the buy/sell ratio). This is a balanced point. Buyers and sellers are equally strong.

At RSI ~ 60 (66.66), the buy/sell ratio = 2/1. Buyers are twice as strong as sellers.

At RSI ~ 40 (33.33), the buy/sell ratio = 1/2. Sellers are twice as strong as buyers.

At RSI = 80, the buy/sell ratio = 4/1. Buyers are four times stronger.

At RSI = 20, the buy/sell ratio = 1/4. Sellers are four times stronger.

The formula shows that when RSI reaches 80 or 20, the buyer or seller is extremely strong — about four times stronger — confirming a clear trend.

At these levels, some Trading strategies suggest placing a Sell or Buy based on the overbought/oversold idea.

But for me, that’s not the best way. The right approach is: when a trend is clearly formed, we should follow it.

I'll explain why right below.

Look at this chart showing RSI changes with the buy/sell ratio:

When RSI > 50:

When RSI < 50:

You can see that the higher RSI goes, the slower it climbs, but the high buy/sell ratio makes price move up faster.

Similarly, when RSI goes lower, it drops slower but price drops faster.

That’s why at overbought (RSI=80) or oversold (RSI=20) areas, you need to be careful. Even a small RSI moving can lead to big price changes, easily hitting your stop loss.

On the other hand, if you follow the trend and wait for RSI to pull back, you will trade safer and more profitably.

RSI Key Levels

Here are some special RSI levels I personally find useful when observing FX:XAUUSD :

(These levels are relative. They might vary with different timeframes or trading pairs. Check historical data to find the right ones for you. On bigger timeframes like M15 or above, the accuracy is better.)

RSI = 20

When RSI hits 20, sellers dominate. This confirms a trend reversal to bearish.

RSI = 80

When RSI hits 80, buyers dominate. This confirms a trend reversal to bullish.

RSI = 40

This is a sensitive level. Sellers start gaining the upper hand (sell/buy = 2/1).

If buyers lose 40, they lose their advantage.

So RSI >= 40 is "buyer territory". In an uptrend, RSI usually stays above 40.

RSI = 40 acts as support in an uptrend.

RSI = 60

Same idea. RSI <= 60 is "seller territory".

RSI = 60 acts as resistance in a downtrend.

40 and 60 are considered the key levels of RSI.

Now you guys know why RSI has support/resistance around 40/60!

RSI Range

As you know, RSI moves between 0 and 100.

Since RSI >= 40 is buyer territory, we can see the relationship between price and RSI:

When RSI stays above 40, price tends to move in an uptrend:

When RSI stays below 60, price tends to move in a downtrend:

When RSI stays between 40 and 60, buyers and sellers are balanced, and price moves sideways in a box:

When RSI is moving, It creates a RSI Range.

Whenever the trend switches between the three states — uptrend, sideways, and downtrend — a Range Shift is formed.

At first, RSI moves in 40-60 range, price moves sideways. A strong price move pushes RSI to 80. Later, RSI stays above 50, helping price grow strongly. When momentum fades, RSI returns to 40-60 and price moves sideways again.

Note:

RSI reflects Dow Theory by showing the stages of accumulation, growth, and distribution.

And as you see, when RSI touches key levels, the trend often pulls it back.

RSI Momentum

Price momentum means how fast price changes.RSI momentum represents the change in the strength between buying and selling forces.

When RSI > 50:

If price falls, RSI shows high momentum — RSI drops fast but price drops slowly.

If price rises, RSI shows low momentum — RSI rises slowly but price rises fast.

For example, at first RSI is above 50.

Price drops from (a) to (b) by 44 units, RSI drops from (Ra) to (Rb) by 25 units.

Later, RSI drops from (Rb) to (Rc) (also 25 units) but price drops from (b) to (c) by 73 units.

When RSI < 50:

If price falls, RSI has low momentum — RSI drops slowly but price falls fast.

If price rises, RSI has high momentum — RSI rises fast but price rises slowly.

RSI and Price Divergence

Divergence happens when price and RSI move in opposite directions:

Price goes up but RSI goes down, or vice versa.

Why does divergence happen?

In a strong downtrend, price forms a bottom at point (1), and RSI drops to level (r1).

When a price pullback happens, price pushes up to a peak at point (2), and RSI also bounces back to level (r2).

Because the downtrend is strong, after completing the pullback (1-2), price continues to make a lower bottom at point (3).

At this point, remember the behavior of RSI momentum when RSI is below 50:

It takes a large price drop (from 2 to 3) to cause a small RSI drop (from r2 to r3).

Meanwhile, even a small price increase (from 1 to 2) causes a large RSI rise (from r1 to r2).

Since the distance (1-2) is smaller than (2-3), but the RSI move (r1-r2) is bigger than (r2-r3), divergence is created.

Divergence shows that the current trend is very strong, not a complete signal of a trend reversal.

(I might share with you how to spot a complete RSI reversal signal in future posts.)

As shown in the example above, after forming bottom (5) and creating a bullish divergence between (3-5) and (r3-r5), price still kept dropping sharply while RSI kept rising.

In these areas, if you keep trying to catch a reversal just based on divergence, you will likely need to DCA or cut your losses many times.

That’s why the most important thing in trading is always to follow the trend.

RSI Exhaustion

RSI Exhaustion happens when RSI keeps getting rejected by a resistance or support zone and can’t break through.

After a strong downtrend, RSI recovers but stalls around the 5x zone.

It tries many times but fails, showing buying power is weakening.

Then the downtrend continues:

Exhaustion near high or low RSI levels creates stronger divergences than exhaustion in the middle range:

Double or triple tops/bottoms on RSI (M or W shapes) basically indicate RSI exhaustion.

RSI Can Identify Trend Strength

In an uptrend:

If RSI pulls back to a higher level before going up again, the trend is stronger.

The pullback should not fall too deep (below 40).

Example:

First rally: RSI drops to 60 before rising again → strong rally (273 units).

Second rally: RSI drops to 50 before rising again → weaker rally (94 units).

Same idea for a downtrend:

If RSI pullbacks to 50 then drops again, the downtrend is stronger than if it pullbacks to 60.

RSI Support and Resistance

Besides 40-60 acting as support/resistance, RSI also reacts to old tops and bottoms it created.

Why does this happen?

RSI is calculated from closing prices.

On a higher timeframe, the candle close price is a high/low or support/resistance price on lower timeframes.

When RSI moves in a trend on a higher timeframe, it maintains a buy/sell ratio, forcing lower timeframe RSI to oscillate within a range.

Example:

On H4, RSI stays above 40 → uptrend.

It makes H1 RSI move between 30-80.

Sharp RSI tops/bottoms react even stronger because they show strong buying/selling forces.

Summary

When looking at the price chart, we can see that price can rise or fall freely without any defined boundaries.

However, RSI operates differently: it always moves within a fixed range from 0 to 100.

During its movement, RSI forms specific patterns that reflect the behavior of price.

Because RSI has a clear boundary, identifying its characteristics and rules becomes easier compared to analyzing pure price action.

By studying RSI patterns, we can make better assumptions and predict future price trends with higher accuracy.

I have shared with you the core characteristics of RSI, summarized as follows:

Besides overbought (80) and oversold (20), RSI respects 40 and 60.

40 is support level in an uptrend. 60 is resistance level in a downtrend.

In an uptrend, RSI stays above 40.

In a downtrend, RSI stays below 60.

An RSI Range-Shift leads to a trend change.

RSI Divergence shows strong trends.

Double or triple tops/bottoms show RSI exhaustion → potential reversals.

The higher the RSI level, the slower it moves, but the faster the price rises.

The lower the RSI level, the slower it moves, but the faster the price falls.

A strong uptrend can be identified when RSI moves within a higher range or shows continuous bearish divergences.

A strong downtrend can be identified when RSI moves within a lower range or shows continuous bullish divergences.

RSI reacts to its old tops and bottoms.

Sharper RSI peaks show stronger selling.

Sharper RSI bottoms show stronger buying.

In the next parts, I’ll show you how to apply these RSI's Characteristics to trend analysis, multi-timeframe analysis, and trading strategies, that you might have never seen before.

I trade purely with RSI. Follow me for deep dives into RSI-based technical analysis and discussions!

GOLD - Day Trading with RSI 04/02/2025

Weekly and Daily Timeframes (W & D):

GOLD is still in an uptrend, as the RSI's WMA45 is still hovering near the 70 level, and RSI remains above both of its moving averages.

H4 Timeframe:

This timeframe is currently showing a correction. However, it's not yet considered a downtrend because the WMA45 is still in the high region, close to the 70 level. But, RSI has dropped below the WMA45.

At present, the RSI on H4 is facing dynamic resistance from the WMA45 above and has support around the 4x level (43-48). The corresponding temporary price levels are approximately 3128 (resistance) and 3088 (support).

This end-of-uptrend correction on H4 could lead to high price volatility. GOLD may move within a 300–400 pip range (between the resistance from WMA45 and the RSI support around the 4x zone).

H1 Timeframe:

Currently in a downtrend, as RSI is moving below both of its MAs, and the WMA45 has a noticeable downward slope.

H1 also has RSI support at the 30 level (temporary price ~3086) and resistance at WMA45 above (temporary price ~3130).

Since we’re focusing on intraday trading, priority is given to the H1 trend.

Figure 1

Trading Plan: SELL

Entry Zone:

When RSI on M15 approaches upper resistance: levels 50–55 or 65–70.

Confirm Entry:

Conservative/Safe approach: when M5 ends its uptrend and reverses (see example in Figure 1 – M5 ends uptrend when RSI crosses below both MAs).

Or when bearish divergence appears on M5.

Or even earlier, when there’s divergence on M1 and M5's WMA45 flattens out.

Stoploss:

20–30 pips above M5’s recent peak.

Or if RSI on M5/M15 breaks through its previous high.

Take Profit:

100 pips or R:R >= 1:1.

Or when M5’s downtrend ends (when RSI crosses above both MAs).

You can check out the indicators I use here: www.tradingview.com

BTC 4H setup : Potential Long Opportunity

Trade Setup: Long (Buy) Position

📍 Entry:

Look for an entry between 85,500 - 86,300 USDT once the 4H RSI shifts back upward.

Price is currently testing the 200 MA as support, a potential bounce zone.

The 1H RSI is upward but likely to dip slightly before aligning with the 4H timeframe for a buy signal.

The dotted resistance line should be watched for confirmation.

🛑 Stop Loss:

If price breaks and closes below 85,000 USDT, cancel the trade.

Suggested stop loss around 84,700 USDT to manage risk.

🎯 Take Profit Targets:

88,500 USDT (previous resistance)

89,800 USDT (recent high)

📌 Trade Considerations:

Wait for the 4H RSI to cross into the buy zone before executing the trade.

Use the 12-hour chart for confirmation before entering.

Lower timeframes (15M, 1H) can refine the entry for an optimal position.

📢 Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading involves risk, and past performance is not indicative of future results. Always conduct your own research before making any decisions.

BTC 4h Trade Setup: Potential Long Opportunity

Use the 12-hour chart for additional buy confirmation. For optimal entry, refine your position using lower timeframes.

Trade Setup: Long (Buy) Position

📍 Entry:

Enter around 80,800 USDT or 81,800 USDT in the next few hours.

A recent BUY signal and RSI near oversold territory suggest a potential reversal.

🛑 Stop Loss:

Set a stop loss below 80,000 USDT, around 79,500 USDT, to limit downside risk.

If the price breaks below 80,000, the next support is at 78,252.1 USDT.

🎯 Take Profit Targets:

1st TP: 86,500 USDT

2nd TP: 88,000 USDT

📌 This setup offers a favorable risk-to-reward ratio, with potential gains outweighing risks.

On the higher timeframe, the 21 EMA is still below the 50 EMA, indicating a prevailing downtrend. Trade cautiously and ensure you take profits accordingly.

📢 Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading involves risk, and past performance is not indicative of future results. Always conduct your own research and consult with a professional before making any investment decisions.

USDJPYI don't usually trade using the RSI strategy, but for some reason, I decided to take a look at it. What I found was a very strong divergence on the 4-hour timeframe, which has been developing over 72 candles—a significant number. Based on this, I expect this candle to be the reversal candle signaling an upward move toward the targets mentioned above.

Trade safely