#SEI/USDT Looks Bearish (1H)#SEI

The price is moving in a descending channel on the 1-hour timeframe. It has reached the upper limit and is heading towards breaking it. A retest of the upper limit is expected.

We have an upward trend on the RSI indicator, which has reached near the upper limit. A downward reversal is expected.

There is a key support zone in green at 0.1342. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend of consolidation above the 100-period moving average, as we are moving close to it. This supports a downward move towards touching this level.

Entry price: 0.1300

First target: 0.1281

Second target: 0.1240

Third target: 0.1200

Stop loss: Above the resistance zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

SEI

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish bias in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.1146, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.1205

First Target: 0.1219

Second Target: 0.1248

Third Target: 0.1280

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

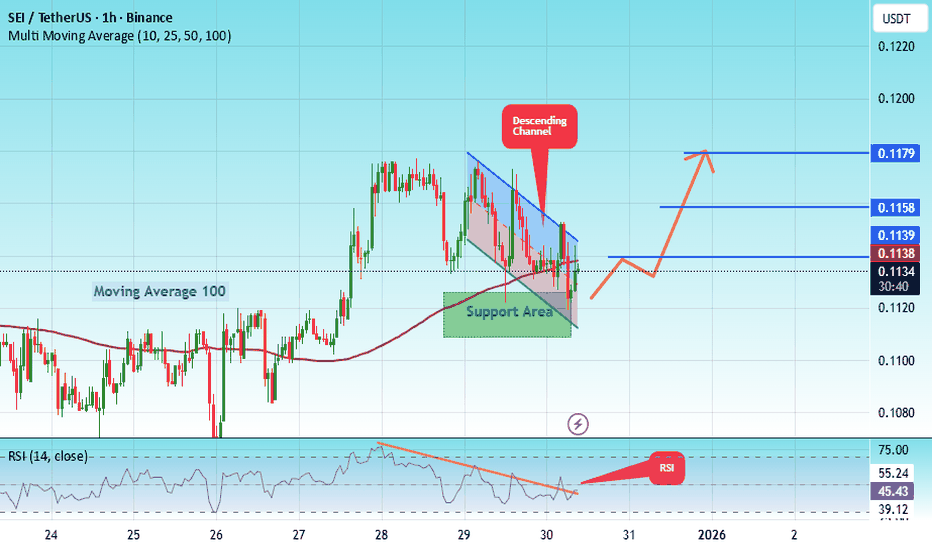

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1116. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1130

First target: 0.1139

Second target: 0.1158

Third target: 0.1179

Stop loss: Below the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1071. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1082

First target: 0.1094

Second target: 0.1112

Third target: 0.1135

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

SEI – Swing Trade Setup Near Major SupportSEI is currently testing a crucial support zone around $0.11–$0.115, which has historically acted as a strong demand area. We're watching closely for signs of a potential bounce, with momentum indicators showing early signs of reversal. This could offer a low-risk, high-reward swing trade opportunity if the support holds.

🔹 Entry Zone: $0.110 – $0.115

🔹 Targets: $0.15 / $0.20 / $0.25

🔹 Stop Loss: $0.08

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1330. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1342

First target: 0.1388

Second target: 0.1440

Third target: 0.1508

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

SEI/USDT — 0.11–0.092 Will Decide the Next Major Move?SEI is now approaching one of the most critical demand zones on the entire 5D chart: the 0.11–0.092 range.

This isn’t just another support area — it’s the structural base that previously triggered a major rally.

Now, price is retesting the same zone, but this time under a much weaker and clearly bearish trend.

At this moment, the market is sitting at a level where one decisive candle could determine SEI’s direction for the next several months.

---

📌 Key Structure & Pattern Highlights

Long-term downtrend: Consistent lower highs and lower lows since the 2024–2025 peak.

Descending trendline: Price is nearing a confluence between the trendline and the demand zone — a potential reversal zone.

0.11–0.092 demand zone: A historically strong base and arguably the most important support on the current multi-day chart.

Extreme liquidity wick to 0.064: Indicates heavy liquidity below — a potential magnet if a breakdown occurs.

In simple terms: SEI is standing at its final support before the cliff.

---

🎯 Bullish Scenario — Demand Zone Ambush

For the bullish case to be valid, SEI must show strong reaction signs within the 0.11–0.092 zone.

Bullish confirmation criteria:

Bullish engulfing or strong-body candle on 5D

Long lower wick rejection inside the zone

Rising buy volume on reaction

Upside targets if a reversal occurs:

1. Target 1: 0.18 — first resistance zone

2. Target 2: 0.22–0.30 — mid-range liquidity area

3. Target 3: 0.40+ — only if structure fully shifts bullish

Bullish summary:

The 0.11–0.092 demand zone could act as a launchpad if buyers step in aggressively.

No confirmation = no sustainable reversal.

---

⚠️ Bearish Scenario — Breakdown Opens Deeper Downside

If SEI fails to hold above 0.092, the long-term structure breaks completely.

Breakdown confirmation:

5D candle closes below 0.092

Failed retest (support flips to resistance)

Strong volume on breakdown

Downside targets if breakdown occurs:

Main target: 0.064 — previous extreme liquidity wick

Further downside possible if 0.064 fails, forming a new long-term low

Bearish summary:

Losing this zone triggers a capitulation leg, opening room for deeper decline.

---

The 0.11–0.092 zone is SEI’s last major defense.

A strong reaction here = potential multi-month bullish reversal.

A breakdown = continuation of the macro downtrend toward deeper lows.

This is the point where trend direction is decided.

---

#SEI #SEIUSDT #CryptoAnalysis #DemandZone #SupportLevel #BreakdownAlert #TechnicalAnalysis #PriceAction #SwingTrading

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish trend in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.1235, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.1262

First Target: 0.1295

Second Target: 0.1325

Third Target: 0.1362

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1205. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1222

First target: 0.1233

Second target: 0.1257

Third target: 0.1285

Don't forget a simple principle: money management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

SEI Looks Bearish (3D)First of all, pay attention to the timeframe | it’s the 3D timeframe.

It seems that, in the larger view, SEI is within a major corrective pattern, and wave D of this pattern has recently been completed.

It appears that wave E of the higher-degree corrective structure on SEI has begun. The price is expected to be rejected from the red zone for several months to form wave E.

A daily candle closing above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Sei need a volume for continuationIf we take a look on Weekly chart and volumes! It's so important to see new volume inflow!

Otherwise its can be long sideways till end of winter. BINANCE:SEIUSDT

The first key resistance for Sei will be Daily downtrend line (on a line chart we can cut all noise) and find out the key points!

Next resistance zone will be a Monthly full fill FVG.

All liquidity pools this is logical zones for uptrend where we can see the pullbacks!

Conservative target can be around psychological 1$ price level! There i think will be a lot of limits and seller pressure!

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.1280, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1321

First target: 0.1342

Second target: 0.1375

Third target: 0.1418

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.1460, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1488

First target: 0.1508

Second target: 0.1533

Third target: 0.1564

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.1600, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1646

First target: 0.1685

Second target: 0.1733

Third target: 0.1787

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

$SEI May be Gearing for A Bullish Move After Breaking Key LevelsThe price of NYSE:SEI might be gearing for a bullish move should the asset break above the 61.8% Fibonacci retracement. NYSE:SEI has been recording massive onchain tractions lately with a total Value lock (TVL) of $235.15m recored on the SEI blockchain as per data from DefiLama .

With the RSI at 54, there is more room for NYSE:SEI to capitalize and break the 61.8% Fib level.

About Sei

Sei is a high-performance Layer 1 blockchain that scales the EVM with parallelized execution, enabling faster transactions, low fees, and seamless smart contract deployment. Sei removes traditional blockchain bottlenecks while maintaining full Ethereum compatibility.

The upcoming Giga upgrade will deliver 50x improvements in EVM throughput, optimizing execution, consensus, and storage to push blockchain performance to web2 levels.

#SEI/USDT - Final Support Before a Major Reversal or Breakdown#SEI

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the 0.1600 price level, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1628

First target: 0.1628

Second target: 0.1680

Third target: 0.1719

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

SEI/USDT - Final Support Before a Major Reversal or Breakdown?🔍 Overview

SEI’s price is currently standing at the most crucial zone of the past year: 0.185–0.160 — an area that has repeatedly acted as a major reversal point in the past.

The recent movement shows a “liquidity sweep” below the yellow block, followed by a sharp recovery candle — a clear sign of aggressive buying reaction from traders viewing this area as a potential discount zone.

If this zone manages to hold once again, SEI could be forming a bottoming phase, potentially triggering a mid-term reversal. However, if it fails, the door toward a deeper structure around 0.12–0.09 will open widely.

---

📈 Technical Structure & Price Pattern

Primary trend: still in a medium-term downtrend, forming a sequence of lower highs since mid-2024.

Pattern formation: Accumulation Range / Potential Double Bottom at the 0.185–0.160 demand zone.

Reaction candle: a long lower wick indicates liquidity grab before a possible reversal.

Main demand zone (yellow block): 0.185 – 0.160.

Key resistance levels: 0.275 → 0.354 → 0.467 → 0.606.

Major psychological level: 1.00 as the macro target if a full reversal occurs.

---

🟢 Bullish Scenario — Reversal from the Discount Zone

1. Main key: the 0.185–0.160 zone must hold with a 3D candle close above 0.22.

2. Further confirmation: a breakout above 0.275 will shift the structure into higher highs.

3. Progressive targets:

Short-term: 0.275

Mid-term: 0.354

Extended target: 0.467 – 0.606

4. Increasing volume on breakout strengthens the bullish momentum, opening room for a potential 70–150% rally from current support levels.

5. Entry strategy: accumulate gradually within the demand zone, with a disciplined stop loss below 0.155.

---

🔴 Bearish Scenario — Deeper Breakdown

1. If the 3D candle closes below 0.160, the major support structure officially breaks.

2. Next correction targets: 0.12 – 0.09, aligning with previous lows.

3. Selling pressure may intensify as long-term holders panic on the breakdown of a major support zone.

4. Additional validation: failure to retest 0.185 after the breakdown → confirms a solid bearish continuation.

---

⚖️ Conclusion & Strategy

The 0.185–0.160 zone marks the line between hope and capitulation for SEI.

If it holds, a major reversal with significant upside potential could emerge. But if it fails, a final capitulation phase may occur before a deeper structural bottom forms.

Maintain a disciplined approach: buy only at support, cut losses quickly if invalidated, and wait for 3D candle confirmation for direction clarity.

---

#SEIUSDT #SEI #CryptoAnalysis #AltcoinBreakdown #SupportZone #SwingTrade #TechnicalAnalysis #CryptoMarket #SEITrading #MarketStructure #PriceAction

#SEI/USDT — Triangle Pattern Breakout Ahead?#SEI

The price is moving in a descending channel on the 1-hour frame and is expected to break it and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a major support area in green that pushed the price higher at 0.1790.

Entry price: 0.1916.

First target: 0.2000.

Second target: 0.2134.

Third target: 0.2257.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#SEI/USDT — Triangle Pattern Breakout Ahead?#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.1950, which represents a strong support point.

We are heading for stability above the 100 moving average.

Entry price: 0.2110

First target: 0.2210

Second target: 0.2324

Third target: 0.2456

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEI/USDT;BUY LIMITHello friends

Given that the price has reached the specified support and the price is supported by buyers within the specified range and the specified resistance has been broken, we can buy in steps with risk and capital management and move to the specified targets.

*Trade safely with us*

SEI/USDT — Bullish Flag at Demand Zone, Ready for Another Rally?📌 Overview

SEI/USDT recently completed a strong rally in mid-2025, forming a powerful flagpole. Since then, the price has been consolidating within a bullish flag pattern — a technical setup that often signals trend continuation after a healthy pause.

Currently, the price is trading around 0.2944 USDT, holding above key demand zones and Fibonacci levels. This suggests the market is in an accumulation phase, storing energy for its next major move.

---

📊 Pattern & Key Levels

Main structure: Bullish Flag (downward-sloping channel following a sharp rally).

Critical support:

0.2680 (Fib 0.5)

0.2437 (Fib 0.618)

These levels act as the structural foundation of the flag. As long as they hold, the bullish outlook remains intact.

Immediate resistance:

0.3462 – 0.3705 (intra-flag resistance, early breakout confirmation zone).

0.4727 – 0.5104 (major supply area, mid-term target).

Theoretical target:

A confirmed breakout projects the flagpole extension, pointing toward 0.60 – 0.73 in the medium term.

---

🚀 Bullish Scenario (Base Case)

1. Breakout confirmation: A 2D candle close above the upper flag trendline with strong volume.

2. Upside targets:

0.3462 – 0.3705 → breakout validation.

0.4727 – 0.5104 → significant supply zone.

0.60 – 0.73 → projected continuation target from the flagpole.

3. Healthy retest: A breakout followed by a pullback to retest the flag’s upper boundary and hold would strengthen the bullish case.

---

⚠️ Bearish Scenario (Risk Case)

If the price closes below 0.2437, the bullish flag structure will be invalidated.

Downside levels to watch:

0.21 (lower channel support).

0.13 (historical low and extreme demand zone).

This scenario remains less likely while the demand zone holds, but risk management is crucial.

---

✨ Conclusion & Insight

SEI is currently in a healthy consolidation phase after a strong rally, forming a textbook bullish flag.

The zone around 0.2680 – 0.2437 is the last line of defense for bulls.

If the breakout is confirmed, SEI could re-enter a strong uptrend with ambitious targets up to 0.73 USDT.

In other words: SEI is at a critical decision point. Traders and investors should closely monitor these levels, as the next move may define SEI’s trend into Q4 2025.

---

#SEI #SEIUSDT #CryptoAnalysis #BullishFlag #TechnicalAnalysis #Altcoin #PriceAction #ChartPattern

#SEI/USDT — Triangle Pattern Breakout Ahead?#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.2736, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.2756

First target: 0.2804

Second target: 0.2855

Third target: 0.2912

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.