NQ Power Range Report with FIB Ext - 1/28/2026 SessionCME_MINI:NQH2026

- PR High: 26148.00

- PR Low: 26111.25

- NZ Spread: 82.5

Key scheduled economic events:

08:30 | U.S. President Trump Speaks

10:30 | Crude Oil Inventories

14:00 | Fed Interest Rate Decision

- FOMC Statement

14:30 | FOMC Press Conference

25% AMP margins increase for expected FOMC volatility

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 359.39

- Volume: 27K

- Open Int: 260K

- Trend Grade: Long

- From BA ATH: -1.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Sessionopen

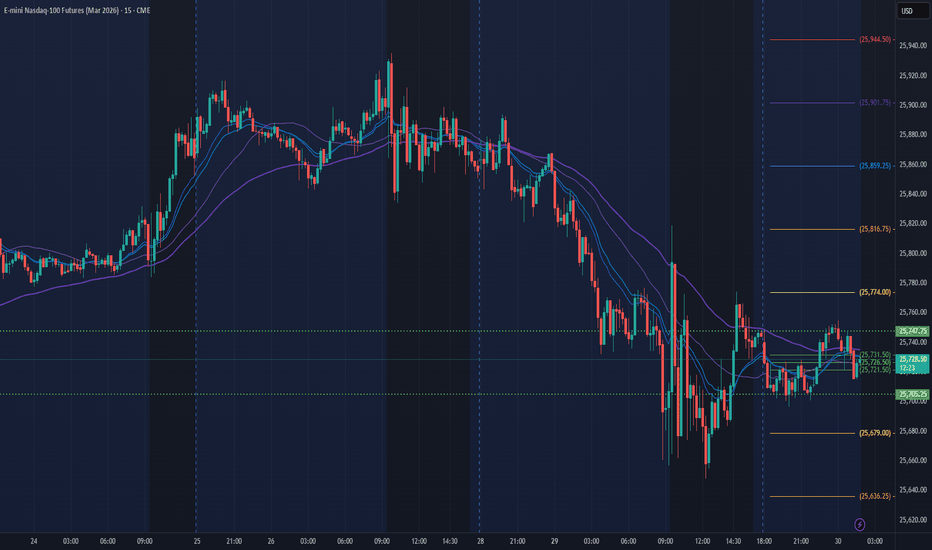

NQ Power Range Report with FIB Ext - 1/27/2026 SessionCME_MINI:NQH2026

- PR High: 25897.00

- PR Low: 25838.50

- NZ Spread: 131.0

Key scheduled economic events:

08:30 | U.S. President Trump Speaks

10:00 | CB Consumer Confidence

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 369.44

- Volume: 23K

- Open Int: 257K

- Trend Grade: Long

- From BA ATH: -2.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/23/2026 SessionCME_MINI:NQH2026

- PR High: 25629.25

- PR Low: 25575.50

- NZ Spread: 120.25

Key scheduled economic events:

09:45 | S&P Global Services PMI

- S&P Global Manufacturing PMI

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 358.84

- Volume: 24K

- Open Int: 256K

- Trend Grade: Long

- From BA ATH: -2.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/22/2026 SessionCME_MINI:NQH2026

- PR High: 25569.25

- PR Low: 25523.25

- NZ Spread: 103.0

Key scheduled economic events:

08:30 | Initial Jobless Claims

- GDP

10:00 | Core PCE Price Index (MoM|YoY)

12:00 | Crude Oil Inventories

Weekend gap filled, immediate response

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 364.30

- Volume: 26K

- Open Int: 258K

- Trend Grade: Long

- From BA ATH: -3.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/21/2026 SessionCME_MINI:NQH2026

- PR High: 25175.25

- PR Low: 25103.50

- NZ Spread: 160.5

Key scheduled economic events:

08:30 | U.S. President Trump Speaks

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 349.33

- Volume: 39K

- Open Int: 267K

- Trend Grade: Long

- From BA ATH: -4.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/20/2026 SessionCME_MINI:NQH2026

- PR High: 25405.00

- PR Low: 25367.25

- NZ Spread: 84.25

No key scheduled economic events

High volume open following holiday weekend

- Weekend gap down ~1.0% remains open

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 356.37

- Volume: 201K

- Open Int: 269K

- Trend Grade: Long

- From BA ATH: -3.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/16/2026 SessionCME_MINI:NQH2026

- PR High: 25750.75

- PR Low: 25704.25

- NZ Spread: 104.0

No key scheduled economic events

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 336.46

- Volume: 21K

- Open Int: 272K

- Trend Grade: Long

- From BA ATH: -2.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/15/2026 SessionCME_MINI:NQH2026

- PR High: 25615.25

- PR Low: 25563.50

- NZ Spread: 115.75

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Philadelphia Fed Manufacturing Index

08:45 | S&P Global Manufacturing PMI

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 331.29

- Volume: 29K

- Open Int: 273K

- Trend Grade: Long

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/14/2026 SessionCME_MINI:NQH2026

- PR High: 25913.75

- PR Low: 25886.50

- NZ Spread: 60.75

Key scheduled economic events:

08:30 | Retail Sales (Core|MoM)

- PPI

10:00 | Existing Home Sales

10:30 | Crude Oil Inventories

Temp 25% AMP margin requirement increase for expected economic news volatility

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 319.19

- Volume: 18K

- Open Int: 279K

- Trend Grade: Long

- From BA ATH: -1.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/13/2026 SessionCME_MINI:NQH2026

- PR High: 25954.00

- PR Low: 25893.50

- NZ Spread: 135.5

Key scheduled economic events:

08:30 | CPI (Core|MoM|YoY)

10:00 | New Home Sales

13:00 | 30-Year Bond Auction

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 329.14

- Volume: 26K

- Open Int: 277K

- Trend Grade: Long

- From BA ATH: -1.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/12/2026 SessionCME_MINI:NQH2026

- PR High: 25960.00

- PR Low: 25870.00

- NZ Spread: 200.75

Key scheduled economic events:

13:00 | 10-Year Note Auction

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 337.48

- Volume: 52K

- Open Int: 273K

- Trend Grade: Long

- From BA ATH: -2.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/9/2026 SessionCME_MINI:NQH2026

- PR High: 25727.25

- PR Low: 25671.75

- NZ Spread: 124.0

Key scheduled economic events:

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

Temp AMP Futures margins increase for pre-RTH news

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 323.62

- Volume: 23K

- Open Int: 267K

- Trend Grade: Long

- From BA ATH: -2.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/8/2026 SessionCME_MINI:NQH2026

- PR High: 25849.75

- PR Low: 25818.75

- NZ Spread: 69.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 327.27

- Volume: 21K

- Open Int: 273K

- Trend Grade: Long

- From BA ATH: -2.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/7/2026 SessionCME_MINI:NQH2026

- PR High: 25844.75

- PR Low: 25815.50

- NZ Spread: 65.25

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

10:00 | ISM Non-Manufacturing PMI

- ISM Non-Manufacturing Prices

- JOLTs Job Openings

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 331.18

- Volume: 21K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 1/6/2026 SessionCME_MINI:NQH2026

- PR High: 25598.75

- PR Low: 25560.75

- NZ Spread: 85.0

Key scheduled economic events:

09:45| S&P Global Services PMI

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 336.38

- Volume: 20K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -2.9% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/30/2025 SessionCME_MINI:NQH2026

- PR High: 25747.75

- PR Low: 25705.25

- NZ Spread: 95.0

Key scheduled economic events:

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 343.23

- Volume: 16K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -2.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/23/2025 SessionCME_MINI:NQH2026

- PR High: 25722.50

- PR Low: 25700.50

- NZ Spread: 49.0

Key scheduled economic events:

08:30 | Durable Goods Orders

- GDP

10:00 | CB Consumer Confidence

15:00 | New Home Sales

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 405.86

- Volume: 16K

- Open Int: 267K

- Trend Grade: Long

- From BA ATH: -2.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/22/2025 SessionCME_MINI:NQH2026

- PR High: 25675.00

- PR Low: 25632.25

- NZ Spread: 95.75

Key scheduled economic events:

10:00 | Core PCE Price Index (MoM|YoY)

Weekend gap up 0.23% (open)

Session Open Stats (As of 12:15 AM)

- Session Open ATR: 425.74

- Volume: 25K

- Open Int: 269K

- Trend Grade: Long

- From BA ATH: -2.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/19/2025 SessionCME_MINI:NQH2026

- PR High: 25257.50

- PR Low: 25209.75

- NZ Spread: 106.75

Key scheduled economic events:

08:30 | Core PCE Price Index (MoM|YoY)

10:00 | Existing Home Sales

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 430.77

- Volume: 35K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -4.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/18/2025 SessionCME_MINI:NQH2026

- PR High: 24999.00

- PR Low: 24925.00

- NZ Spread: 165.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

- CPI (Core|MoM|YoY)

- Philadelphia Fed Manufacturing Index

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 426.70

- Volume: 36K

- Open Int: 266K

- Trend Grade: Long

- From BA ATH: -5.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/17/2025 SessionCME_MINI:NQH2026

- PR High: 25363.00

- PR Low: 25294.25

- NZ Spread: 154.0

No key scheduled economic events

Session Open Stats (As of 12:25 AM)

- Session Open ATR: 414.92

- Volume: 32K

- Open Int: 246K

- Trend Grade: Long

- From BA ATH: -4.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/16/2025 SessionCME_MINI:NQH2026

- PR High: 25373.25

- PR Low: 25280.25

- NZ Spread: 208.0

Temp 25% AMP margin requirements increase

Key scheduled economic events:

08:30 | Average Hourly Earnings

Retail Sales (Core|MoM)

Nonfarm Payrolls

Unemployment Rate

09:45 | S&P Global Manufacturing PMI

S&P Global Services PMI

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 430.72

- Volume: 41K

- Open Int: 168K

- Trend Grade: Long

- From BA ATH: -4.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 12/12/2025 SessionCME_MINI:NQZ2025

- PR High: 25733.25

- PR Low: 25648.75

- NZ Spread: 189.5

No key scheduled economic events

Session gap -0.42%, open above 25833

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 404.03

- Volume: 27K

- Open Int: 295K

- Trend Grade: Long

- From BA ATH: -2.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone