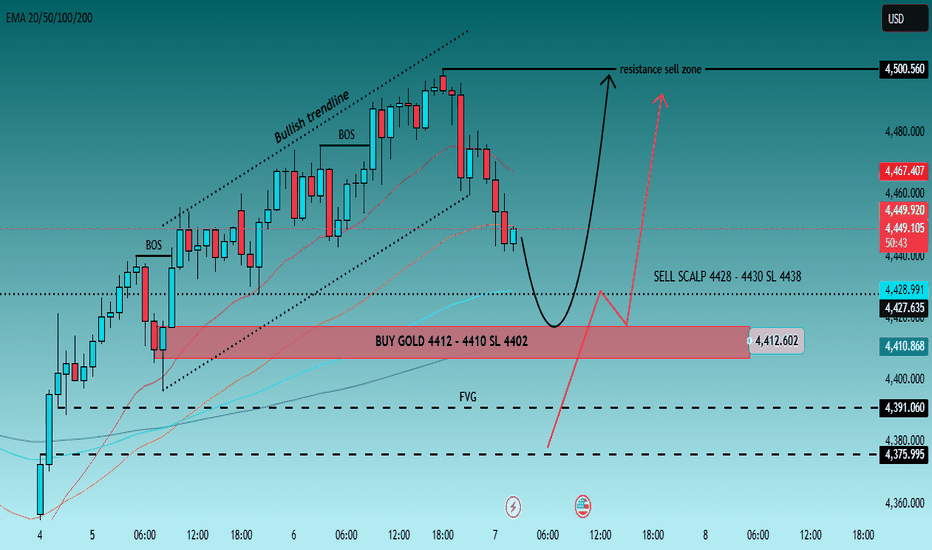

Gold Pauses After Expansion — Rotation, Not Continuation🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (07/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, following a strong impulsive expansion that delivered price deep into premium. However, recent price action signals a transition from expansion into distribution, with Smart Money beginning to engineer corrective rotations rather than chasing continuation.

As the market digests USD flows, U.S. yield sensitivity, and positioning ahead of upcoming U.S. data, Gold is currently rotating between internal liquidity zones. This environment typically favors liquidity sweeps, inducement, and mean reversion, rather than clean directional breakouts.

Today’s session is best approached with level-based execution, patience, and confirmation — not prediction.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with an active intraday corrective leg from premium.

Key Idea:

Expect Smart Money to react at internal supply (4428–4430) for short-term distribution, or at discount demand (4412–4410) for re-accumulation before the next leg.

Structural Notes:

• HTF bullish structure remains intact

• Clear BOS printed during the upside expansion

• Price rejected from premium and is rotating lower

• Internal supply at 4428–4430 acts as sell-sensitive zone

• Demand at 4412–4410 aligns with OB + EMA support + liquidity pocket

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4412 – 4410 | SL 4402

• 🔴 SELL SCALP 4428 – 4430 | SL 4438

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4412 – 4410 | SL 4402

Rules:

✔ Liquidity sweep into discount demand

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4425 — initial reaction

• 4435 — internal liquidity

• 4480–4500 — premium retest if momentum expands

🔴 SELL SCALP 4428 – 4430 | SL 4438

Rules:

✔ Price taps internal supply / EMA resistance

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4418 — first imbalance

• 4410 — demand interaction

• Trail aggressively (scalp setup)

⚠️ Risk Notes

• Premium zones favor stop hunts and fake continuations

• Volatility may expand during U.S. session

• No entries without MSS + BOS confirmation

• Scalp sells require strict risk control

📍 Summary

Gold remains structurally bullish, but today’s edge lies in Smart Money’s intraday rotation:

• A sweep into 4412–4410 may reload longs toward premium, or

• A reaction at 4428–4430 offers a controlled scalp sell back into demand.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

Smctradingstrategy

ZKPUSDT – Bearish Setup (SMC & Price Action)The market is clearly in a downtrend, with a bearish BOS confirming seller strength.

Because of this structure shift, we can start looking for short positions.

I’ve marked a bearish refined order block between 0.13000 – 0.13066.

Price has already taken the IDM, and we can also see previous rejection from this zone, which gives extra confidence for a downside move.

If price revisits this order block and shows rejection again, we can expect continuation to the downside.

Let’s wait for price to react at the zone and trade with proper risk management.

Hope for the best 🤞

XAUUSD Smart Money Levels: Demand at 4325, Supply at 4494🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, but current price action reflects a premium-side liquidity operation rather than clean continuation. After a strong upside leg, price is now rotating inside premium where Smart Money typically distributes positions before initiating corrective delivery.

Today’s focus revolves around USD strength, U.S. yield sensitivity, and ongoing Fed rate path speculation, with traders positioning ahead of upcoming U.S. macro releases and Fed commentary. As real yields fluctuate and risk sentiment remains fragile, Gold continues to attract safe-haven flows — but not without engineered pullbacks.

This environment favors liquidity sweeps, false continuation, and inducement above highs, rather than impulsive breakout buying.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish structure with an active short-term corrective leg from premium.

Key Idea:

Expect Smart Money interaction either at internal supply (4492–4494) for distribution, or HTF demand (4327–4325) for re-accumulation before the next expansion.

Structural Notes:

• HTF bullish structure remains valid

• Recent CHoCH confirms corrective rotation

• Buy-side liquidity above highs has been partially tapped

• Supply cluster at 4492–4494 acts as distribution zone

• Demand zone at 4327–4325 aligns with OB + liquidity pool

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4327 – 4325 | SL 4317

• 🔴 SELL GOLD 4492 – 4494 | SL 4500

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4327 – 4325 | SL 4317

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Strong upside BOS with impulsive candles

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4390 — initial displacement

• 4450 — internal liquidity

• 4490+ — premium retest if USD weakens

🔴 SELL GOLD 4492 – 4494 | SL 4500

Rules:

✔ Reaction into premium supply zone

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4455 — first imbalance fill

• 4395 — internal discount

• 4327 — HTF demand sweep

⚠️ Risk Notes

• Premium zones favor fake breakouts and stop hunts

• Volatility may spike around U.S. data and Fed remarks

• No entries without MSS + BOS confirmation

• Stops often triggered before real displacement

📍 Summary

Gold remains structurally bullish, but today’s edge lies in trading Smart Money’s range:

• A sweep into 4327–4325 may reload longs toward 4450–4490, or

• A reaction at 4492–4494 offers a sell opportunity back into discount.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD Smart Money Levels: Demand at 4312, Supply at 4436🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, yet short-term price action shows pullback pressure after premium liquidity was elected near 4440. As markets brace for ongoing USD direction from macro catalysts (Fed commentary, U.S. jobs data, Treasury yields), institutional participation is oscillating between liquidity hunts and controlled re-accumulation.

Global risk sentiment and safe-haven bids are intensifying as traders weigh inflation trajectory with central bank pivot expectations — leading Gold to exhibit rotational distribution behavior rather than clean continuation. Controlled swings and sweep-driven moves dominate price progression.

This environment favors engineered liquidity access and inducement, not blind breakout chasing.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish bias with short-term corrective displacement.

Key Idea:

Expect structural engagement near HTF demand (~4312–4314) or internal supply liquidity (~4434–4436) before meaningful displacement sequences.

Structural Notes:

• HTF bullish structure remains intact

• Recent CHoCH confirms corrective leg

• Buy-side liquidity above recent highs is targeted

• Supply cluster near 4436 acts as engineered lure

• Demand confluence aligns with institutional accumulation

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4314 – 4312 | SL 4304

• 🔴 SELL GOLD 4434 – 4436 | SL 4444

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → internal supply retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4314 – 4312 | SL 4304

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Clear upside BOS with impulse candles

✔ Entry via refined demand OB or FVG fill

Targets:

• 4370 — initial displacement

• 4410 — internal supply test

• 4440+ — extended run if USD weakens

🔴 SELL GOLD 4434 – 4436 | SL 4444

Rules:

✔ Reaction into internal supply cluster

✔ Bearish MSS / CHoCH confluence

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4390 — first discount zone

• 4350 — deeper pullback

• 4314 — HTF demand scan

⚠️ Risk Notes

• False breaks favored near thin Asian session volume

• Macro catalysts (U.S. data, Fed speakers) may spike volatility

• Avoid entries without MSS + BOS confirmations

• Stops triggered by engineered liquidity hunts

📍 Summary

Gold remains structurally bullish, but today’s edge lies in disciplined entries and liquidity awareness:

• A sweep into 4312–4314 may reload longs with targets up to 4410–4440, or

• A reaction near 4434–4436 provides a fade opportunity back into discount.

Let liquidity initiate the move. Let structure confirm.

Smart Money sets traps — retail chases them. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

Is Smart Money Reloading Gold After the Latest Liquidity Sweep?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (30/12)

📈 Market Context

Gold remains structurally supported on higher timeframes, but current price action reflects controlled volatility and liquidity engineering rather than trend continuation.

With markets reacting to fresh U.S. data expectations, USD yield fluctuations, and ongoing geopolitical uncertainty, Gold continues to attract safe-haven interest — yet extended intraday ranges suggest Smart Money is actively positioning rather than chasing price.

Recent headlines around Fed rate path uncertainty and mixed U.S. macro signals keep Gold bid on pullbacks, while thinning liquidity into the year-end session increases the likelihood of stop hunts and engineered traps on both sides of the range.

Smart Money behavior favors drawing liquidity first, confirming structure later — not clean breakouts.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with short-term corrective compression

Key Idea:

Expect liquidity interaction at discount (4320–4318) or reaction from internal supply (4465–4467) before any sustained displacement.

Structural Notes:

HTF bullish BOS remains valid

Prior CHoCH triggered a corrective leg

Price is compressing under bearish trendline

Discount zone aligns with potential accumulation

Buy-side liquidity rests above internal highs

Sell-side liquidity recently probed and absorbed

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4320 – 4318 | SL 4310

• 🔴 SELL GOLD 4465 – 4467 | SL 4475

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4320 – 4318 | SL 4310

Rules:

✔ Liquidity grab into discount zone

✔ Bullish MSS / CHoCH on M5–M15

✔ Clear upside BOS with impulsive displacement

✔ Entry via bullish FVG fill or refined demand OB

Targets:

4360

4400

4465 – extension if USD weakens and risk sentiment deteriorates

🔴 SELL GOLD 4465 – 4467 | SL 4475

Rules:

✔ Reaction into internal supply / premium imbalance

✔ Bearish MSS / CHoCH on LTF

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

4430

4385

4320 – extension if USD strengthens or yields rise

⚠️ Risk Notes

Compression favors false breakouts

No execution without MSS + BOS confirmation

Expect volatility during U.S. session

Reduce risk around USD yield spikes or Fed-related headlines

Thin liquidity amplifies stop hunts

📍 Summary

Gold remains bullish by structure, but today’s edge lies in patience, not prediction.

Smart Money is likely to engineer liquidity before committing:

• A sweep into 4320–4318 may reload longs toward 4400–4465, or

• A reaction near 4465–4467 could fade price back into discount.

Let liquidity move first. Let structure confirm.

Smart Money waits — retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – Smart Money Breakdown Targets 4040 Liquidity🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (30/12)

📈 Market Context

Gold has suffered a sharp breakdown following year-end positioning flows, marking its largest single-day drop in weeks. According to today’s hot ForexFactory update, bearish momentum is accelerating as price decisively breaks below key technical levels, with downside targets now aligning toward the $4040–4050 liquidity zone.

This move appears driven less by fresh macro catalysts and more by portfolio rebalancing, profit-taking, and thin liquidity conditions, typical of late-December trading. Despite some dip-buying interest emerging intraday, the broader flow suggests distribution rather than accumulation, keeping Gold vulnerable to further downside sweeps before any sustainable recovery.

Smart Money behavior in this environment favors sell-side continuation with corrective pullbacks, rather than impulsive trend reversals.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bearish displacement after HTF distribution

Key Idea: Sell premium pullbacks; buy only at deep discount liquidity

Structural Notes:

• Clear CHoCH confirmed after loss of prior bullish structure

• Strong bearish displacement created inefficiencies below

• Previous bullish trendline invalidated

• Price trading below equilibrium, attempting weak corrective retrace

• Internal liquidity partially cleared; external sell-side liquidity rests below

• Resistance zone aligns with prior supply and breakdown origin

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4480 – 4490 | SL 4500

• 🟢 BUY GOLD 4310 – 4320 | SL 4300

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → continuation

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4480 – 4490 | SL 4500

Rules:

✔ Pullback into premium resistance / supply

✔ Bearish MSS or CHoCH on M5–M15

✔ Downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

4420

4370

4310 – extension if bearish momentum persists

🟢 BUY GOLD 4310 – 4320 | SL 4300

Rules:

✔ Sell-side liquidity sweep into deep discount

✔ Bullish MSS / CHoCH confirms absorption

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

4370

4420

4480 – only if structure flips bullish

⚠️ Risk Notes

• Bearish momentum dominates after structural breakdown

• Year-end liquidity increases fake pullbacks and stop hunts

• No trade without MSS + BOS confirmation

• Expect volatility during U.S. session and around USD yield headlines

• Reduce position size if volatility expands unexpectedly

📍 Summary

Gold has transitioned from accumulation to distribution, with Smart Money now favoring downside continuation toward deeper liquidity pools. The plan is clear:

• Sell premium pullbacks at 4480–4490, or

• Buy only at deep discount 4310–4320 after confirmation

Let liquidity be engineered.

Let structure confirm intent.

Smart Money waits — retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – Institutions Play Liquidity Between 4530 & 4430🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (29/12)

📈 Market Context

Gold remains bullish by higher-timeframe structure, but current price action shows clear signs of compression and distribution after an extended impulsive rally. As price trades near recent highs into year-end, liquidity conditions are thinning — increasing the probability of engineered moves rather than clean continuation.

With USD flows mixed and no decisive macro catalyst dominating, Gold is vulnerable to Smart Money manipulation: attracting breakout buyers near resistance while forcing weak longs out at discount levels before revealing true directional intent.

In this environment, patience and confirmation are critical. Smart Money is likely to sweep liquidity on one side of the range before committing to the next expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: HTF bullish structure, short-term corrective distribution

Key Idea: Liquidity interaction expected at premium or discount before displacement

Structural Notes:

• Higher-timeframe BOS remains intact

• Short-term CHoCH signals corrective phase

• Price trades inside a rising corrective channel

• Premium conditions favor stop hunts

• Clear imbalance and demand sit below current price

• Defined range between resistance and correction lows

• Buy-side liquidity above 4528–4530

• Sell-side liquidity resting below 4430

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4528 – 4530 | SL 4540

• 🟢 BUY GOLD 4430 – 4432 | SL 4420

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (Matching Exact Zones)

🔴 SELL GOLD 4528 – 4530 | SL 4540

Rules:

✔ Sweep into resistance / buy-side liquidity

✔ Bearish MSS or CHoCH on M5–M15

✔ Downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

4500

4475

4430 – extension if downside momentum accelerates

🟢 BUY GOLD 4430 – 4432 | SL 4420

Rules:

✔ Liquidity grab into correction / demand zone

✔ Bullish MSS or CHoCH confirms demand control

✔ Upside BOS with strong displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

4460

4500

4528 – extension if bullish structure resumes

⚠️ Risk Notes

• Premium pricing increases fake breakout probability

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session

• Reduce risk in thin year-end liquidity conditions

📍 Summary

Gold remains bullish by structure, but current price action favors liquidity games inside a defined range. Smart Money is likely to engineer stops before expansion:

• A sweep above 4528–4530 may fade back toward 4475–4430, or

• A liquidity grab near 4430–4432 could reload longs toward 4500–4530+

Let price show intent — Smart Money waits, retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns._

Gold 1H – Liquidity Games Set Up Between 4532–4473🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (26/12)

📈 Market Context

Gold continues to respect a bullish higher-timeframe structure, supported by a rising trendline and a series of higher lows. However, recent price action shows clear hesitation near highs, suggesting short-term distribution rather than clean continuation.

With year-end liquidity thinning and USD flows remaining mixed, Gold is vulnerable to Smart Money manipulation — engineered stop hunts above resistance and liquidity grabs into demand before the next impulsive move.

This environment favors patience and confirmation-based execution, not chasing breakouts.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bullish HTF structure, short-term range engineering

Key Idea: Expect liquidity interaction at premium (4530–4532) or discount (4475–4473) before displacement

Structural Notes:

• HTF bullish BOS remains intact

• Short-term CHoCH hints at distribution near highs

• Price is trading above equilibrium, extended into premium

• Unmitigated demand rests around 4475–4473

• Clear liquidity pools above 4530 and below 4475

• Compression favors stop-driven moves before expansion

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4530 – 4532 | SL 4540

• 🟢 BUY GOLD 4475 – 4473 | SL 4465

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4530 – 4532 | SL 4540

Rules:

✔ Sweep above buy-side liquidity near highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

4510

4490

4475 – extension if USD strengthens or risk-off flows appear

🟢 BUY GOLD 4475 – 4473 | SL 4465

Rules:

✔ Liquidity grab into discount and prior demand

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

4495

4515

4530 – extension if USD weakens and bullish momentum resumes

⚠️ Risk Notes

• Trading in premium increases fake breakout probability

• No entries without MSS + BOS confirmation

• Expect volatility during U.S. session and thin year-end liquidity

• Reduce position size around unexpected USD or yield headlines

📍 Summary

Gold remains bullish by structure, but current price action suggests liquidity games inside a defined range. Smart Money is likely to run stops before revealing direction:

• A sweep above 4530–4532 may fade back toward 4490–4475, or

• A liquidity grab into 4475–4473 could reload longs toward 4515–4530+

Let price show intent — Smart Money waits, retail reacts. ⚡

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – Smart Money Traps Form Near 4540–4450 Range🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (23/12)

📈 Market Context

Gold remains structurally bullish on the higher timeframes, but price is now trading inside a compression zone after a clear impulsive expansion. With year-end liquidity thinning and traders positioning ahead of fresh Fed rate expectations and USD yield fluctuations, Gold is vulnerable to liquidity manipulation rather than clean continuation.

Recent USD softness and mixed macro headlines keep Gold supported, yet extended pricing near highs increases the probability of stop hunts on both sides before the next decisive move.

Smart Money behavior here favors range engineering — drawing in breakout traders above highs and shaking out impatient longs below key demand — before revealing true intent.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bullish HTF structure with short-term distribution

Key Idea: Expect liquidity interaction at premium (4540–4542) or discount (4450–4448) before displacement

Structural Notes:

• Higher-timeframe bullish BOS remains intact

• Recent CHoCH signals short-term distribution risk

• Price is trading in premium, extended from equilibrium

• Clear impulsive leg left unmitigated inefficiencies below

• A defined scalping range has formed between premium and discount

• Liquidity rests clearly above 4540 and below 4450

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4540 – 4542 | SL 4560

• 🟢 BUY GOLD 4450 – 4448 | SL 4440

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4540 – 4542 | SL 4560

Rules:

✔ Sweep above premium buy-side liquidity

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4510

2. 4485

3. 4450 – extension if USD strengthens or yields push higher

🟢 BUY GOLD 4450 – 4448 | SL 4440

Rules:

✔ Liquidity grab into discount and prior demand

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4480

2. 4510

3. 4540 – extension if USD weakens and bullish flow resumes

⚠️ Risk Notes

• Premium trading increases fake breakout probability

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session and thin year-end liquidity

• Reduce risk around Fed-driven or USD yield headlines

📍 Summary

Gold is still bullish by structure, but current price action signals liquidity games inside a defined range. Smart Money is likely to engineer stops before expansion:

• A sweep above 4540 may fade back toward 4485–4450, or

• A liquidity grab near 4450 could reload longs toward 4510–4540+

Let price show intent — Smart Money waits, retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – Liquidity Compression Sets Traps Around 4500–4420🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (23/12)

📈 Market Context

Gold is trading inside a strong bullish structure after a clean impulsive expansion, currently hovering in a premium zone near recent highs. With price extended from the mean, the market is vulnerable to liquidity engineering rather than immediate continuation.

CPI uncertainty and mixed USD flows continue to reduce directional conviction, favoring stop hunts at key psychological levels instead of clean breakouts. This environment often rewards patience and confirmation-based execution rather than anticipation.

Smart Money is likely to manipulate both sides of the range — sweeping late buyers above 4500 or shaking out weak longs into the 4420 discount before the next meaningful expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bullish structure with signs of short-term distribution

Key Idea: Expect liquidity interaction at 4500–4502 (premium) or 4420–4418 (discount) before displacement

Structural Notes:

• Higher-timeframe bullish BOS remains intact

• Price is trading deep in premium, extended from equilibrium

• Clear impulsive leg created unmitigated FVGs below current price

• Momentum is slowing near highs → distribution risk

• Liquidity is resting clearly above 4500 and below 4420

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4500 – 4502 | SL 4510

• 🟢 BUY GOLD 4420 – 4418 | SL 4410

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4500 – 4502 | SL 4510

Rules:

✔ Sweep above psychological 4500 buy-side liquidity

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4470

2. 4450

3. 4420 – extension if USD firms or risk-off accelerates

🟢 BUY GOLD 4420 – 4418 | SL 4410

Rules:

✔ Liquidity grab into discount and bullish structure support

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4450

2. 4475

3. 4500 – extension if USD weakens and bullish flow resumes

⚠️ Risk Notes

• Extended bullish moves increase fake breakout probability

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session

• Reduce risk around CPI-related or Fed-driven headlines

📍 Summary

Gold remains structurally bullish, but trading at premium levels where conviction is fragile. Smart Money is likely to engineer liquidity before the next expansion:

• A sweep above 4500 may fade toward 4450–4420, or

• A liquidity grab near 4420 could reload bullish flow toward 4475–4500+

Let price reveal intent — Smart Money waits, retail rushes. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – CPI Ambiguity Sets Liquidity Traps Near 4400🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (22/12)

📈 Market Context

Gold is trading near the upper boundary of a well-defined bullish channel as markets react to renewed uncertainty surrounding U.S. inflation data and the Fed’s policy outlook.

Recent CPI-related commentary has reignited debate over whether inflation is cooling fast enough to justify near-term easing, keeping USD flows unstable and risk sentiment mixed.

This macro backdrop favors liquidity engineering over clean continuation, with Smart Money likely targeting both premium and discount extremes to induce breakout traders before the next directional expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bullish structure approaching premium exhaustion

Key Idea: Expect liquidity interaction at 4400–4402 (premium) or 4340–4338 (discount) before meaningful displacement

Structural Notes:

• Higher-timeframe bullish BOS remains valid

• Price is pressing into buy-side liquidity near channel highs

• Clear impulsive leg up created an unmitigated FVG above 4370

• Rising structure shows signs of short-term distribution, not confirmed reversal

• Liquidity rests clearly above 4400 and below 4340

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4400 – 4402 | SL 4410

• 🟢 BUY GOLD 4340 – 4338 | SL 4330

🧠 Institutional Flow Expectation:

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4400 – 4402 | SL 4410

Rules:

✔ Sweep above psychological 4400 buy-side liquidity

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4370

2. 4350

3. 4340 – extension if USD strengthens on CPI reassessment

🟢 BUY GOLD 4340 – 4338 | SL 4330

Rules:

✔ Liquidity grab into discount and channel support

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4360

2. 4385

3. 4400 – extension if USD weakens amid CPI doubt

⚠️ Risk Notes

• CPI-driven uncertainty increases fake breakouts

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session

• Reduce risk around unexpected Fed or inflation headlines

📍 Summary

Gold is trading at a decisive premium within a bullish structure, but CPI ambiguity keeps conviction fragile. Smart Money is likely to engineer liquidity at the extremes before committing:

• A sweep above 4400 may fade toward 4350–4340, or

• A liquidity grab near 4340 could reload bullish flow toward 4385–4400+

Let structure confirm — Smart Money reacts, retail anticipates. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – CPI Data Uncertainty Fuels Liquidity Traps at Extremes🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (19/12)

📈 Market Context

Gold is trading in a tightly engineered range as markets digest the latest U.S. CPI print, which has drawn caution from economists over data reliability and seasonal distortions.

Despite headline inflation showing signs of cooling, analysts warn the data lacks clarity, keeping the Fed firmly data-dependent and USD flows unstable.

This uncertainty-driven backdrop favors liquidity manipulation over clean trends, with Smart Money likely probing both premium and discount zones to trigger stops before committing to expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Rising structure losing momentum near premium supply

Key Idea: Expect liquidity interaction at 4363–4365 (premium) or 4300–4298 (discount) before displacement

Structural Notes:

• Higher-timeframe bullish BOS remains valid but is pausing

• Multiple rejections near highs suggest distribution, not confirmed reversal

• Equal highs above 4360 and sell-side liquidity below 4300 are exposed

• Price is rotating inside a controlled liquidity channel

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4363 – 4365 | SL 4370

• 🟢 BUY GOLD 4300 – 4298 | SL 4290

Institutional Flow Expectation:

liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4363 – 4365 | SL 4370

Rules:

✔ Sweep above recent equal highs into premium

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4340

2. 4320

3. 4302 – extension if USD firms post-CPI reassessment

🟢 BUY GOLD 4300 – 4298 | SL 4290

Rules:

✔ Liquidity grab below sell-side lows / channel support

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4325

2. 4350

3. 4380 – extension if CPI skepticism weakens USD

⚠️ Risk Notes

• CPI-related uncertainty increases fake breaks — wait for structure

• No entry without MSS + BOS confirmation

• Expect volatility during U.S. session

• Reduce risk near unscheduled Fed or inflation commentary

📍 Summary

Today’s gold setup is driven by CPI-driven uncertainty and Fed caution, creating prime conditions for liquidity engineering:

• A sweep above 4365 may fade toward 4300–4320

or

• A liquidity grab near 4300 could reload bullish flow toward 4350+

Let structure confirm — Smart Money reacts, retail anticipates. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 4H – Is 4315 the Smart Money Reload Before 4400?🟡 XAUUSD – Weekly Smart Money Concept Plan

📈 Market Context

Gold starts the new week holding a clear 4H bullish market structure after a decisive BOS from the prior consolidation range. Price is now respecting a rising bullish trendline while consolidating beneath recent highs, suggesting controlled accumulation rather than distribution.

With USD-sensitive headlines and U.S. macro events ahead, Smart Money is likely to engineer a pullback into a discounted zone to rebalance positions before attempting another expansion leg. This environment favors patience and precision, not chasing breakouts.

🔎 Technical Analysis (4H / SMC View)

🟢 Buy Zone: 4316 – 4314

SL: 4306

TP Targets: 4350 → 4380 → 4420+

Rationale:

• Discounted pullback within a strong 4H bullish structure

• Confluence with rising bullish trendline support

• Prior consolidation high acting as demand flip

• Sell-side liquidity resting below 4310 likely to be swept

• High R:R alignment for trend-continuation longs

🔴 Sell Scenario (Conditional):

Only considered if a 4H bearish CHoCH forms below 4306 after a liquidity sweep. Otherwise, shorts are counter-trend and low probability.

⚠️ Risk Management Notes

• Execute only after M15–M30 ChoCH/BOS confirmation — no blind buys.

• Expect stop-hunts and fake breakdowns near London & New York opens.

• Scale out partials at each TP; trail runners only after structure confirms.

• Reduce risk exposure ahead of high-impact USD or Fed-related news.

Summary

Gold remains structurally bullish on the 4H timeframe. The 4316–4314 zone represents a Smart Money reload area where liquidity is likely to be swept before continuation higher.

Patience is the edge this week — let price come to value, let structure confirm, then execute with discipline.

Liquidity leads. Structure confirms. Entries follow.

🚀 Follow @Ryan_TitanTrader for more weekly SMC breakdowns

Gold 1H – Fed Signals Fuel Liquidity Games Around 4350–4300🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (18/12)

📈 Market Context

Gold is trading inside a controlled liquidity range as markets react to fresh speculation around the Fed Chair’s stance on rate timing and inflation persistence.

Recent headlines suggest the Fed remains data-dependent despite easing inflation narratives, keeping USD flows choppy and positioning fragile. This backdrop typically favors engineered stop-hunts rather than clean trend continuation, especially around well-defined premium and discount zones.

Smart Money is likely to probe both sides of liquidity before committing to directional expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Rising structure, pausing near premium after BOS

Key Idea: Expect liquidity interaction at 4350–4353 (premium) or 4302–4300 (discount) before displacement

Structural Notes:

• Higher-timeframe BOS keeps bullish context intact

• Recent range shows distribution near highs, not confirmed reversal

• Equal highs near 4350 and sell-side liquidity resting below 4300 are exposed

Liquidity Zones & Triggers:

• 🔴 SELL SCALP 4350 – 4353 | SL 4360

• 🟢 BUY GOLD 4302 – 4300 | SL 4290

Institutional Flow Expectation:

sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL SCALP 4350 – 4353 | SL 4360

Rules:

✔ Liquidity sweep above recent equal highs into premium

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4325

2. 4310

3. 4302 – extension if momentum builds

🟢 BUY GOLD 4302 – 4300 | SL 4290

Rules:

✔ Liquidity grab below sell-side lows / rising trend support

✔ Bullish MSS / CHoCH confirms demand control

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4320

2. 4350

3. 4380 – extension if USD softens on Fed commentary

⚠️ Risk Notes

• Fed-related headlines can trigger fake breaks — wait for structure

• Avoid entries without clear MSS + BOS alignment

• Expect higher volatility during U.S. session hours

• Reduce risk near unscheduled Fed headlines or speakers

📍 Summary

Today’s gold setup revolves around Fed-driven liquidity engineering:

• A sweep above 4353 may invite a pullback toward 4302–4310

or

• A liquidity grab near 4300 could reload bullish flow toward 4350+

Let structure confirm — Smart Money reacts, retail anticipates. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – Fed Chair Speculation Drives Smart Money Flow🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (16/12)

📈 Market Context

Gold is trading in a liquidity-driven range as markets focus on today’s hot topic: NFP expectations and Fed rate-path uncertainty.

Recent NFP previews highlight divergence between slowing headline job growth and still-sticky wage components, keeping DXY flows unstable. This environment typically favors stop-hunts and liquidity sweeps rather than clean directional moves ahead of confirmation.

As a result, Smart Money is likely to engineer price into clear premium and discount zones before committing to expansion.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Post-expansion, consolidating after a CHoCH within a broader bullish context

Key Idea: Expect a sweep into premium (4352–4354) or discount (4272–4270) before the next impulsive move

Structural Notes:

• Higher-timeframe BOS keeps bullish bias intact

• Recent pullback reflects distribution/profit-taking, not a confirmed reversal

• Equal highs above 4350 and sell-side liquidity below 4270 are clearly exposed

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4352 – 4354 | SL 4362

• 🟢 BUY GOLD 4272 – 4270 | SL 4262

Institutional Flow Expectation:

sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4352 – 4354 | SL 4362

Rules:

✔ Liquidity sweep above recent highs into premium

✔ Bearish MSS / CHoCH on M5–M15

✔ Downside BOS with strong bearish displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4325

2. 4300

3. 4285 – extension if momentum accelerates

🟢 BUY GOLD 4272 – 4270 | SL 4262

Rules:

✔ Liquidity grab below equal lows / dynamic support

✔ Bullish MSS / CHoCH confirms demand takeover

✔ Upside BOS with impulsive displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4285

2. 4310

3. 4350 – extension if USD weakens post-data

⚠️ Risk Notes

• NFP-related positioning can cause false breaks — wait for structure, not the first spike

• Avoid trades without clear MSS + BOS confirmation

• Expect higher spreads and volatility during the U.S. session

• Reduce risk if entering close to major data releases

📍 Summary

Today’s gold setup is defined by NFP-driven rate uncertainty:

• A sweep into 4354 may invite bearish structure back toward 4300–4285

or

• A liquidity grab near 4270 could reload bullish flow toward 4310–4350

Let structure confirm — Smart Money reacts, retail anticipates. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 1H – NFP in Control: 4355 Cap or 4260 Hold?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (16/12)

📈 Market Context

Gold is trading inside a high-volatility liquidity environment as markets digest the NFP Preview: Rate Path Divergence & Implications for DXY and Gold.

With the upcoming U.S. labor data set to shape expectations for the Fed’s 2026 rate path, USD flows remain unstable. Any surprise in employment or wage components could trigger sharp repricing in rate-cut expectations, directly impacting gold through DXY volatility.

In this context, institutions are unlikely to commit direction early. Instead, liquidity engineering and stop-hunts around key premium/discount zones are favored ahead of true displacement.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Post-expansion, now rotating inside a rising channel and pausing near equilibrium

Key Idea: Expect a liquidity sweep into premium (4353–4355) or discount (4262–4260) before the next impulsive move

Structural Notes:

• Prior BOS confirms bullish higher-timeframe context

• Recent pullback signals profit-taking, not full reversal

• Equal highs above 4350 and sell-side liquidity below 4260 are clearly exposed

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4353 – 4355 | SL 4363

• 🟢 BUY GOLD 4262 – 4260 | SL 4272

Institutional Flow Expectation:

sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4353 – 4355 | SL 4363

Rules:

✔ Liquidity sweep above recent highs into premium

✔ Bearish MSS / CHoCH on M5–M15

✔ Downside BOS with strong bearish displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4325

2. 4300

3. 4285 – extension if momentum accelerates

🟢 BUY GOLD 4262 – 4260 | SL 4272

Rules:

✔ Liquidity grab below equal lows / channel support

✔ Bullish MSS / CHoCH confirms demand takeover

✔ Upside BOS with impulsive displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4280

2. 4310

3. 4350 – extension if USD weakens post-data

⚠️ Risk Notes

• NFP-related positioning can cause false breaks — wait for structure, not the first spike

• Avoid trades without clear MSS + BOS confirmation

• Expect spreads and volatility to expand during U.S. sessions

• Reduce risk if entering close to news releases

📍 Summary

Today’s gold narrative is driven by NFP-led rate path uncertainty:

• A sweep into 4355 may invite bearish structure back toward 4300–4285

or

• A liquidity grab near 4260 could reload bullish flow toward 4310–4350

Let structure confirm — Smart Money reacts, retail anticipates. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Gold 4H – Will 4380 Liquidity Cap Price Before a Deep Pullback?🟡 XAUUSD – Weekly Smart Money Concept Plan

📈 Market Context

Gold enters the new week trading inside a well-defined 4H bullish structure, but price is now pressing into a premium liquidity zone where previous highs and resting buy-side liquidity converge.

With USD volatility expected around upcoming U.S. macro data and policy-related headlines, this environment favors liquidity engineering rather than clean continuation. Smart Money typically uses such premium zones to induce late buyers before delivering corrective moves toward discounted demand.

From an SMC perspective, the market is primed for external liquidity raids on both sides before a clearer weekly expansion unfolds.

🔎 Technical Analysis (4H / SMC View)

🔴 Sell Zone: 4380 – 4382

SL: 4390

TP Targets: 4350 → 4320 → 4285 → 4255

Rationale:

• Premium pricing above 4H structure highs

• Buy-side liquidity resting above equal highs

• Likely distribution after bullish leg exhaustion

• Mean-reversion pullback toward internal range liquidity

🟢 Buy Zone: 4233 – 4231

SL: 4223

TP Targets: 4265 → 4300 → 4340 → 4380+

Rationale:

• Discount zone aligned with rising 4H trendline

• Demand mitigation area after prior impulsive move

• Sell-side liquidity sweep expected before re-accumulation

• Favorable risk-to-reward for trend-continuation longs

⚠️ Risk Management Notes

• Wait for M15–M30 ChoCH or BOS confirmation before execution — no blind entries.

• Expect aggressive wicks and stop-hunts near session opens (London / New York).

• Reduce exposure ahead of high-impact USD news and Fed-related headlines.

• Secure partial profits at each TP; only trail runners after structure confirms continuation.

Summary

Gold remains in a 4H bullish framework, but price is currently trading at a level where Smart Money is incentivized to sweep premium liquidity near 4380 before delivering a corrective move into the 4230 demand zone.

The higher-probability play is patience: let liquidity be taken, let structure confirm, then align with institutional flow.

Liquidity first. Structure second. Entries last.

🚀 Follow @Ryan_TitanTrader for more weekly SMC breakdowns

Gold 1H - Will 4287 Liquidity Cap Price or 4248 Reload Demand?Gold 1H – Will 4287 Liquidity Cap Price or 4248 Reload Demand?

🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (12/12)

📈 Market Context

Gold remains highly sensitive to political and inflation narratives after former U.S. President Donald Trump stated he “inherited the worst inflation in history” but now sees prices cooling rapidly.

This rhetoric adds uncertainty to inflation expectations and future rate paths, keeping USD flows unstable intraday.

For gold, this environment favors engineered liquidity sweeps rather than clean directional continuation, as institutions exploit both inflation hedging demand and short-term USD strength.

On H1, price is trading inside a rising structure with clear liquidity resting above recent highs and demand stacked below the mid-range — a textbook Smart Money setup.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Expansion after BOS, now pausing into premium

Key Idea: Expect a liquidity sweep into premium (4285–4287) or discount (4250–4248) before true displacement

Structural Notes:

• Prior BOS + CHoCH confirms bullish context

• Price currently reacting inside a rising channel

• Liquidity is clearly defined on both edges

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4285 – 4287 | SL 4295

• 🟢 BUY GOLD 4250 – 4248 | SL 4240

Institutional Flow Expectation:

sweep → MSS/CHoCH → BOS → displacement → FVG/OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4285 – 4287 | SL 4295

Rules:

✔ Liquidity sweep above recent highs into premium

✔ Bearish MSS / CHoCH on M5–M15

✔ Downside BOS with strong bearish displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

1. 4270

2. 4258

3. 4250 – 4248

🟢 BUY GOLD 4250 – 4248 | SL 4240

Rules:

✔ Liquidity grab below channel support / equal lows

✔ Bullish MSS / CHoCH confirms demand takeover

✔ Upside BOS + impulsive displacement from discount

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4265

2. 4280

3. 4287 – extension if momentum holds

⚠️ Risk Notes

• Trump’s inflation comments can trigger sharp sentiment flips → wait for structure, not headlines

• Avoid entries without clear BOS + displacement

• Don’t trade mid-range noise inside compression

• Reduce size if volatility spikes during U.S. news hours

📍 Summary

Today’s gold setup is pure liquidity engineering:

• A 4287 sweep may trigger bearish structure back into 4250

or

• A 4248 liquidity grab could reload bullish flow toward 4280–4287

Let structure confirm — Smart Money reacts, retail predicts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

LONG ON UJ PART 2Possible push to the upside on UJ

Sell Side Liquidity taken and the high broken right after giving me the impression that big institutions may have forced the SSL in order to enter the market

1;55 rr, may seem far fetched but looks like a good trade to me

Second part of UJ trade i posted with a lightly different point of entry

Gold 1H – Will 4232 Liquidity Trigger Reversal or 4188 Hold Flow🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (10/12)

📈 Market Context

Gold trades inside a politically-driven liquidity landscape after former U.S. President Donald Trump signaled that rate-cut willingness will be his litmus test for selecting a new Fed Chair.

This comment injects uncertainty into interest-rate expectations, making markets sensitive to any shifts in forward guidance.

Higher-for-longer fears remain intact intraday, keeping gold capped below premium zones while liquidity builds on both edges.

On H1, price is compressing around mid-range with clean liquidity resting at 4232 above and 4188–4190 below—ideal sweep conditions before institutions commit to direction.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Sideways compression after BOS + CHoCH sequence

Key Idea: Expect a sweep above 4230–4232 or below 4190–4188 before true displacement

Liquidity Zones & Triggers:

• 🔴 SELL GOLD 4230 – 4232 | SL 4240

• 🟢 BUY GOLD 4190 – 4188 | SL 4180

Institutional Flow Expectation:

sweep → MSS/CHoCH → BOS → displacement → FVG/OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4230 – 4232 | SL 4240

Rules:

✔ Price sweeps the liquidity cluster above 4230

✔ Bearish MSS/CHoCH on M5–M15

✔ Downside BOS + clean bearish displacement

✔ Entry via FVG refill or refined OB retest

Targets:

1. 4212

2. 4200

3. 4190

🟢 BUY GOLD 4190 – 4188 | SL 4180

Rules:

✔ Liquidity grab under 4190–4188

✔ Bullish MSS/CHoCH confirms demand takeover

✔ Upside BOS + impulsive displacement from discount

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4205

2. 4220

3. 4230–4232

⚠️ Risk Notes

• Trump’s remarks may spark abrupt shifts in expectations → avoid entries without BOS + displacement

• Don’t chase candles inside the compression channel

• SL placement must respect structural invalidation

• Reduce exposure if volatility spikes during Fed-related headlines

📍 Summary

Today’s play revolves around two liquidity-driven scenarios:

• A 4232 sweep triggers bearish structure, delivering into 4200 → 4190

or

• A 4188 liquidity grab forms bullish MSS, expanding toward 4220 → 4232

Let structure confirm—SMC is reaction, not prediction. ⚡️

📌 Follow @Ryan_TitanTrader for more Smart Money breakdowns.

Gold 1H – Will 4210 Reject Again or 4166 Ignite the Rally?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (09/12)

📈 Market Context

Gold continues to soften under $4,200 as rising US Treasury yields pressure bullion, with markets positioning ahead of the upcoming Federal Reserve rate decision.

According to FXStreet, yields climbing intraday are capping gold’s upside, and sellers remain active below 4200 while participants wait for clarity on the Fed’s forward guidance.

This environment builds a liquidity-sensitive landscape, where institutions may engineer sweeps on both sides before committing to direction.

On H1, price oscillates cleanly between premium supply (4208–4210) and discount demand (4168–4166).

A valid push requires MSS → BOS → displacement from either extreme.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Sideways compression after consecutive CHoCH shifts

Key Idea: Expect liquidity grabs above 4210 or under 4166 before real movement

Liquidity Zones & Triggers

• 🔴 SELL GOLD 4208 – 4210 | SL 4218

• 🟢 BUY GOLD 4168 – 4166 | SL 4158

Institutional Flow Expectation:

sweep → MSS/CHoCH → BOS → displacement → FVG/OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4208 – 4210 | SL 4218

Rules:

✔ Price taps premium zone (4208–4210)

✔ Bearish MSS/CHoCH confirmed on M5–M15

✔ Strong downside BOS + displacement

✔ Enter on FVG fill or refined supply OB retest

Targets:

1. 4185

2. 4175

3. 4168 – 4166

🟢 BUY GOLD 4168 – 4166 | SL 4158

Rules:

✔ Sweep under 4167 to collect sell-side liquidity

✔ Bullish MSS/CHoCH forms from discount

✔ Clean BOS + impulsive displacement upward

✔ Entry via bullish FVG fill or demand OB retest

Targets:

1. 4184

2. 4200

3. 4210

⚠️ Risk Notes

• Rising yields may generate deceptive spikes—avoid entries without BOS + displacement

• Do not chase price inside the compression range

• Keep SLs at structural invalidation, not arbitrary points

• Reduce exposure ahead of Fed-related volatility this week

📍 Summary

Today’s setup revolves around two institutional scenarios:

• A 4210 liquidity sweep triggers bearish structure → downside delivery toward 4166

or

• A 4166 liquidity grab forms bullish MSS → upside expansion back toward 4210

Let structure confirm.

Patience pays the trader—SMC reacts, never predicts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money breakdowns.

Gold 1H – Will 4232 Trap Liquidity or 4170 Spark Expansion?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (08/12)

📈 Market Context

Gold trades inside politically-driven liquidity as Donald Trump signals that the current method of tariffing through the US Supreme Court is “more direct, less cumbersome, and much faster.”

This introduces fresh uncertainty for USD flows, increasing short-term volatility across commodities.

Expect engineered sweeps on both sides as institutions react to policy-sensitive sentiment shifts.

On H1, price compresses between premium supply (4230–4232) and discount demand (4170–4168).

A confirmed MSS + BOS + displacement is required before any directional leg becomes valid.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Liquidity-rich compression inside a minor bullish channel

Key Idea: Sweeps first, real move later

Liquidity Zones & Triggers

• 🔴 SELL GOLD 4230 – 4232 | SL 4240

• 🟢 BUY GOLD 4172 – 4170 | SL 4162

Bias shifts only via structural break + clean displacement.

Expected Institutional Sequence:

sweep → MSS/CHoCH → BOS → displacement → FVG/OB retest → expansion

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4230 – 4232 | SL 4240

Rules:

✔ Price taps 4231–4232 → bearish MSS/CHoCH on M5–M15

✔ BOS down + strong displacement candle

✔ Entry on bearish FVG fill / supply OB retest

Targets:

1. 4200

2. 4185

3. 4170

🟢 BUY GOLD 4172 – 4170 | SL 4162

Rules:

✔ Sweep below 4169 → bullish MSS/CHoCH

✔ BOS up + displacement from discount

✔ Entry on FVG fill or refined OB retest

Targets:

1. 4186

2. 4210

3. 4230 – 4232

⚠️ Risk Notes

• Headlines may induce fake sweeps; do not pre-commit without BOS + displacement

• No averaging inside compression

• SLs must sit at structural invalidation

• Reduce risk during tariff-related spikes

📍 Summary

Today’s playbook offers two institutional paths:

• 4231 sweep → bearish MSS → BOS → retest → delivery into 4170

or

• 4169 sweep → bullish MSS → BOS → retest → expansion back toward 4230+

Trade confirmations only.

Let gold show its hand — patience is your edge. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money breakdowns.