Can #SNX Recover From Here or Will it Continue to Fall?Yello, Paradiser! Are you prepared for the moment when #SNXUSDT finally decides whether it will punish late bears or wipe out impatient longs? Let's look at the #Synthetix trade setup:

💎#SNX is currently trading around $0.418 on the 4H timeframe and remains stuck inside a clearly defined descending channel, respecting both the descending resistance and descending support with high precision. This type of structure tells us one thing very clearly: the market is compressing, and a decisive move is getting closer.

💎Price is now sitting just above a key demand zone around $0.38–$0.39, where buyers have already shown interest multiple times. This zone is crucial. As long as #SNXUSD holds above it, bulls still have a chance to regain control. The chart also highlights that a clean breakout above the descending resistance, combined with a reclaim of the 50 EMA as support, would significantly increase the probability of a bullish continuation.

💎If that bullish scenario plays out, the first upside target sits at the moderate resistance near $0.51, followed by a much more important strong resistance around $0.60–$0.61. A move toward those levels would likely happen fast, as many traders are currently positioned defensively and would be forced to react to a breakout.

💎However, this setup comes with a very clear invalidation. If price loses the $0.38 support zone decisively, the bullish idea is off the table. A breakdown below this level would confirm weakness and open the door for a deeper move toward the $0.33 support zone, where the next significant liquidity sits. That scenario would likely come with increased volatility and emotional selling from inexperienced traders.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

SNXUSD

SNX/USDT Golden Zone 0.87–0.75 — Accumulation or Breakdown AheadSNX has returned to the golden zone at 0.87–0.75, a level that has historically acted as the main battlefield between buyers and sellers.

Price is now retesting the same area that once served as the foundation of a strong accumulation phase earlier this year.

But this time, the context is different — after a sharp rejection from the 3.68 high, the market is testing whether this zone still holds real demand strength or not.

---

📊 Technical Structure & Price Pattern

On the 2D chart, SNX has formed a broad accumulation range between 0.75 and 1.23.

The spike to 3.68 looks like a classic liquidity sweep, where the market took out stop orders above resistance before quickly pulling back — often a sign of redistribution and preparation for the next move.

Now, the 0.87–0.75 zone becomes the decision point:

If it holds, the structure could evolve into a reaccumulation phase;

If it fails, the market may confirm a descending continuation pattern toward the previous low around 0.48.

---

🟩 Bullish Scenario — Reclaim & Relief Rally

For a bullish continuation:

Price must hold above 0.87 and establish a higher low above 0.80.

A confirmed reclaim of 1.05 and 1.23 will strengthen the bullish case, unlocking higher targets at 1.70 → 2.25 → 3.20.

Sustained buying pressure with volume could shape a major double bottom targeting the upper range near 3.20.

For swing traders, this yellow zone offers a low-risk accumulation opportunity, with clearly defined risk below 0.75 and potential multi-fold upside.

---

🟥 Bearish Scenario — Breakdown & Failed Retest

If price closes below 0.75, it would confirm a range breakdown.

Typical follow-up structure:

Failed retest (price retests 0.80–0.87 and gets rejected);

Bearish continuation toward 0.60–0.50, with possible extension to 0.48.

This scenario could represent a final capitulation phase before a major cycle bottom — so traders should monitor volume and market sentiment closely.

---

🔎 Analytical Perspective

The 0.87–0.75 zone isn’t just a technical level — it’s a psychological battleground.

Large players often define their next move here, either absorbing supply for accumulation or distributing before the next leg down.

Watch for bullish RSI or OBV divergences, as they often precede strong reversal setups before breakouts.

---

📈 Strategic Outlook

Key Zone: 0.87–0.75

Current Sentiment: Neutral / Wait for confirmation

Directional Bias: Bullish above 0.87, Bearish below 0.75

Main Bullish Targets: 1.05 → 1.23 → 1.70 → 2.25 → 3.20

Main Bearish Targets: 0.60 → 0.48

Keyword: “This zone will define SNX’s next market cycle.”

---

#SNX #SNXUSDT #CryptoTA #TechnicalAnalysis #PriceAction #SupportZone #Accumulation #CryptoMarket #BreakoutOrBreakdown #SwingTrading

#SNX/USDT — Recovery Mode?#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.20, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.30.

First target: 1.37.

Second target: 1.45.

Third target: 1.55.

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SNX Rebuy Setup (12H)Before anything else, pay attention to the timeframe.

From the point marked Start on the chart, it appears that a bullish phase has begun on SNX.

Currently, it seems we are at the end of Phase A. After some time correction and price consolidation, we can expect another bullish wave forming Wave C.

In the green zone, we can look for buy/long positions.

Targets are indicated on the chart.

If a daily candle closes below the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#SNX/USDT Fast Money Moves — SNXUSDT SCALP Setup#SNX

The price is moving in a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a major support area in green that pushed the price higher at 1.14.

Entry price: 1.21.

First target: 1.20.

Second target: 1.230.

Third target: 1.264.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

Can #SNX Bulls Sustain the Current Momentum? Watch it CloselyYello, Paradisers! Is this #SNX setup just another fakeout in disguise, or is the market quietly setting up for a major bullish momentum shift? Let’s dissect what’s really happening on #SNXUSDT:

💎After moving through a falling wedge pattern for months, #Synthetix has already broken out above the descending resistance, signaling an early shift in trend. However, the real move hasn’t yet begun—a proper retest of the support zone between $0.50–$0.54 is what we’re watching for now.

💎This support zone aligns with the prior wedge breakout and also overlaps with a visible demand area, making it a key region where buyers could step in again. If bulls defend this area successfully, we expect a renewed rally toward the moderate resistance level at $0.78.

💎From there, the next upside target lies at the strong resistance around $1.01—a level with heavy volume profile resistance and previous seller activity. But that level will only come into play if the bulls reclaim momentum with conviction.

💎On the flip side, if #SNXUSD breaks below $0.48, which is our bullish invalidation level, the setup collapses and opens the door for a deeper drop toward the $0.40–$0.35 zone, where short-sellers are likely to pile in.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

Fast Money Moves — SNXUSDT SCALP Setup"Alright fam, time for a quick sprint — dropping a fresh SCALP setup! 🏃💨

Today’s coin: #SNXUSDT.P, and yep, we’re talking futures plays here. 💥

Now, technically the flag target sits around $1.48–$1.50, but you know the drill — we’re locking profits around $1.45 and letting the rest ride. Gotta leave some juice for the next trader. 😉

Good luck, legends — hope it’s a green-filled day for everyone! 💚📈

Catch you in the comments!" 💬

Synthetix (SNX) SNXUSD 3d - 1 week mid/long term SNX rank: 192

SNX coin previously showed strong movements and was at the center of hype, with a significant rise from the bottom to the top.

If we stretch the Fibonacci retracement from the low to the high, we can see that the price came to the golden level 0.618, where the new accumulation zone started.

Typically, major players start accumulating positions in the 0.3–0.5 zone, then activity intensifies around 0.5–0.618, and they usually don’t go beyond 0.786.

However, safer entry levels are usually below 0.618.

The chart shows two channels:

Global channel — marked with multicolored lines.

Descending channel — red and green lines, where:

Red — selling zones;

Green — accumulation zones.

Additionally, I’ve added a channel drawn from the top through two key points, from which corrections occurred. This allows us to identify a potential strong bounce zone at $1.54. This is the same level where the previous accumulation took place before the sharp rise and where there was an intermediate high in December.

Further movement will depend on how the price reacts to the 0.618 zone and the retention of key levels.

SNX ; BEARISH!!!Hello friends

Given the growth we had, you can now see that the price ended the trend at the ceiling of a large candle and the sellers covered it with another large candle.

Now we have a resistance area in the middle of this candle from which the price is expected to correct and move to the specified targets.

*Trade safely with us*

SNX : Has the climb started?Hello friends🙌

👀According to the shoulder and shoulder pattern that was formed and then the price fell in the support area that we identified for you with Fibonacci, buyers entered and provided good support for the price, which also broke our resistance, which creates a good opportunity to buy, of course with risk and capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

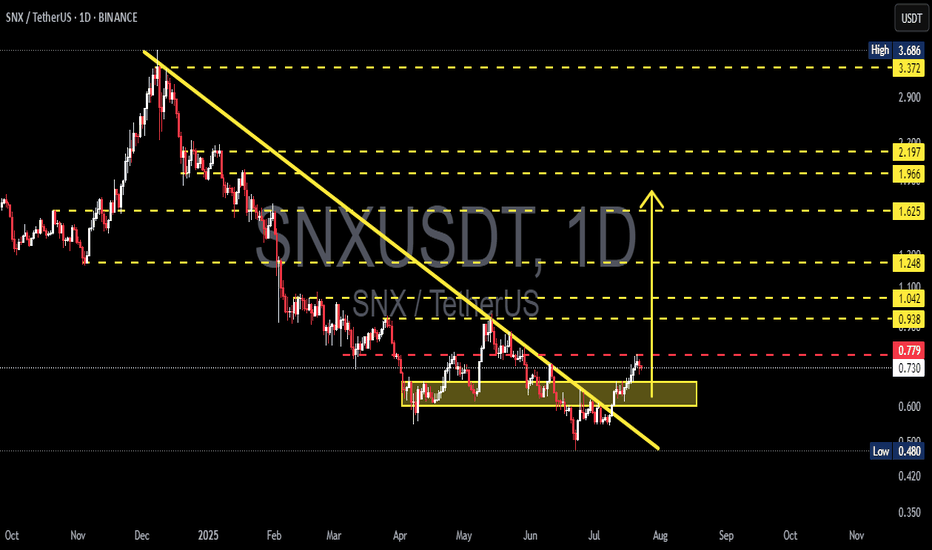

SNXUSDT Breakout Alert! Are We Witnessing the Early Stages?📌 🔍 Overview:

After months of relentless downward pressure, SNX has finally shown a strong technical breakout. The price has decisively broken above the long-term descending trendline, signaling a potential shift in structure from bearish to bullish. This could mark the beginning of a significant impulse wave to the upside.

📐 📊 Technical Structure & Key Pattern Breakdown:

🔻 Broken Downtrend Line: Price action has successfully broken above a descending trendline that has been in place since December 2024, effectively ending the bearish dominance.

🔺 Falling Wedge Pattern: A classic falling wedge has formed and recently completed with a confirmed breakout — a bullish reversal pattern that often precedes strong upside momentum.

🟨 Accumulation Zone (Base Support): The yellow box between $0.60 – $0.72 acted as a major accumulation zone and now flips into a strong demand/support area.

📈 Higher Lows Structure: The recent structure of higher lows signals a shift in market sentiment, showing early signs of accumulation and bullish interest.

✅ Bullish Scenario (Upside Continuation):

If price holds above the breakout zone and confirms strength:

🎯 Target 1: $0.938 (key horizontal resistance)

🎯 Target 2: $1.042 – $1.100 (historical resistance zone)

🎯 Target 3: $1.248 – $1.625

🎯 Target 4 (Mid-term rally): $1.966 – $2.197

🏁 Final Bullish Target (Longer term): $3.372 – $3.686

A strong continuation would require confirmation via increased trading volume and bullish momentum from the broader crypto market.

❌ Bearish Scenario (Failed Retest or Rejection):

However, if the price fails to sustain above the breakout level:

🚨 Risk of a false breakout emerges if price falls back below $0.724

🔻 Breakdown of the yellow support box could trigger a deeper correction toward:

Support 1: $0.60

Support 2 (Major Low): $0.480

This would form a classic bull trap and extend the consolidation phase.

⚠️ Validation & Risk Considerations:

Volume confirmation is key. A breakout without rising volume may lack follow-through.

Watch closely for price action in the coming days — will it hold above the breakout zone or fall back?

Strategy: Look for retest entries or enter with partial exposure, using tight risk management.

🧠 Conclusion:

SNXUSDT is at a pivotal turning point. The breakout from a falling wedge pattern combined with higher low formations is a textbook bullish reversal setup. If price holds and buyers step in, we may be witnessing the early stages of a major bull run for SNX.

#SNXUSDT #SNXBreakout #AltcoinSetup #BullishReversal #FallingWedge #CryptoSignals #CryptoTrading #ChartAnalysis #PriceAction

#SNX/USDT#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.827.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.880

First target: 0.900

Second target: 0.943

Third target: 0.977

#SNX/USDT#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.711.

We are seeing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.744

First target: 0.765

Second target: 0.785

Third target: 0.811

SNXUSDT Bouncing from Channel SupportSNXUSDT Technical analysis update

SNXUSDT has been trading inside a clear descending channel for the last 1700 days. Recently, the price touched the lower support of the channel and is now showing signs of a bounce.

If the current momentum continues, SNX could move upward toward the upper resistance of the channel. A breakout above the upper trendline would be a strong bullish signal. Until then, the price may stay within the channel.

Price could move 100%-250% in a few months.

SNX Analysis (1D)SNX has broken an old trigger line and is also forming a CP within a channel.

We are looking for buy/long positions in the Demand zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Technical Analysis of Synthetix Network Token (SNX/USD): Key LevThis analysis examines the price movement of Synthetix Network Token (SNX) on the weekly timeframe. The structure of the waves and key trendlines have been identified to help traders determine entry and exit points.

Key Highlights of the Analysis:

Strong Support Zone ($1.75–$1.429):

The price has recently reacted to a critical support zone between $1.75–$1.429, showing a strong rebound.

This zone is significant due to the completion of the fifth wave and its alignment with historical support levels, making it a crucial entry point for buyers.

Descending Trendline:

The price remains under the influence of a long-term descending trendline that has capped further upside movement.

Breaking above this trendline and holding above $2.5 could signal the beginning of a new bullish trend.

Key Resistance Level ($5.884):

The major resistance lies at $5.884, aligning with the peak of previous waves.

Reaching this level could serve as a medium-term target for buyers if the price successfully breaks the descending trendline.

Stochastic Oscillator:

The stochastic oscillator is moving toward the overbought region, suggesting a potential short-term correction.

However, further upward movement is possible, especially if the price consolidates above $2.5.

Potential Scenarios:

Bullish Scenario:

Breaking the descending trendline and surpassing the $2.5 resistance could push the price toward $5.884. This scenario is ideal for medium- to long-term traders.

Bearish Scenario:

If the price declines and retests the support zone at $1.75–$1.429, this area could provide another buying opportunity.

Breaking below this support zone could lead to further declines.

Conclusion:

With the technical structure and key levels outlined, Synthetix Network Token is at a critical juncture. Traders should closely monitor the price’s reaction to the descending trendline and the support zone.

#SNX/USDT#SNX

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 2.16

Entry price 2.20

First target 2.24

Second target 2.31

Third target 2.40

#SNX/USDT

#SNX

We have a bearish channel pattern on a 12-hour frame, the price moves within it, adheres to its limits well, and is expected to break it upwards strongly.

We have a support area at the lower border of the channel at $2.50 from which the price rebounded

We have a tendency to stabilize above moving average 100

We have a downtrend on the RSI indicator that is about to break higher, supporting the price higher

Entry price is 2.60

First goal 3.26

The second goal is 3.60

The third goal is 4.20

SNXUSDT Signals Bullish Move AheadSNXUSDT Technical analysis update

BINANCE:SNXUSDT has been ranging at the bottom for the last 120 days. The price has now broken out above the resistance line with high volume and is trading above the 100 EMA, signaling a bullish trend. This breakout indicates the potential for a strong bullish move in the coming days.

Buy zone : Below $1.77

Stop loss : $1.50

Take Profit 1: $1.99

Take Profit 2: $2.40

Take Profit 3: $3.30

Thank You

Hexa🧘♀️