Will Solana reach $1400?After analyzing Solana’s complete data, it appears that a large diametric pattern is forming in the long term.

Currently, it seems we are in wave c of C.

If the key level of $187 is broken and price consolidates above it, we can be much more confident that we are indeed in wave c of C, confirming this scenario.

However, if the price fails to break and hold above $186 on higher timeframes like the 3D or weekly, and gets rejected downward, this scenario will be invalidated.

If confirmed, the targets for wave c of C are marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Solana

"Solana Heist in Progress! Will the Breakout Hold or Fake Out?"🔥🚨 "SOLANA HEIST ALERT: The Ultimate Bullish Raid Plan (Breakout or Fakeout?)" 🚨🔥

🌍👋 Greetings, Market Pirates & Profit Bandits!

(English, Spanish, Portuguese, French, German, Arabic—we speak MONEY.)

💎 STRATEGY BASED ON THIEF TRADING STYLE 💎

(High-risk, high-reward—steal the trend or get caught in consolidation!)

🎯 MISSION: SOL/USD (Solana vs. Dollar) CRYPTO HEIST

🐂 Direction: LONG (But watch for traps—cops & bears lurk nearby!)

🚀 Escape Zone: ATR line (High-Risk Profit-Taking Area)

⚠️ Warning: Overbought? Reversal? Police line at resistance? TAKE PROFITS EARLY!

📈 ENTRY: "THE BREAKOUT HEIST BEGINS!"

Trigger: Wait for candle close ABOVE 148.50 (MA)

Alternative Entry: Buy stop above MA OR buy limit on pullback (15m-30m TF)

🛎️ SET AN ALERT! Don’t miss the breakout—thieves strike fast.

🛑 STOP LOSS: "DON’T GET CAUGHT!"

Thief SL: 136.00 (2H Previous structure Swing Low) (Adjust based on your risk & lot size!)

⚠️ Warning: If you ignore this, you’re gambling—your loss, not mine.

🎯 TARGET: "LOOT & BOUNCE!"

🎯 167.00 (or escape earlier if the trend weakens!)

🧨 Scalpers: Only play LONG—use trailing stops to lock in gains!

📢 NEWS & RISK WARNING

🚨 Avoid new trades during high-impact news! (Volatility kills heists.

🔒 Use trailing stops to protect profits if the market turns.

💥 BOOST THIS HEIST! (More boosts = more profit raids!)

👉 Like ✅ | Follow 🚀 | Share 🔄

💬 Comment your take—bullish or bearish trap?

🚀 Next heist coming soon… Stay tuned, bandits! 🤑

Projected Harmonic Extension Into Key Demand Zone (157–152 WatchMacro to Micro Context

SOL is currently reacting off a short-term distribution zone between 164 and 168 after an impulsive run-up from early July. While no complete harmonic has printed yet, the structure forming resembles a potential Bearish Gartley. The CD leg shown is not yet confirmed, but represents a projected path derived from the local point of value and volume geometry on the 2H chart. The area between 157 and 152 remains the primary zone of interest, given historical demand and high-volume node alignment.

Structural and Momentum Breakdown

XABCD Estimate:

XA was impulsive, AB retraced 53.2%, and BC retraced 63.8% of AB

CD projection is speculative, drawn from the confluence of the BC extension (1.757), 0.786 retrace of XA, and the local value zone around 157.5–152

Volume Profile: Substantial volume shelf aligns with projected CD completion. Above 164, volume thins out sharply, indicating inefficiency and risk of rejection

Order Blocks: 2H bullish OB from July 1–3 sits directly inside the 157–152 range, adding further structural validity to this projected leg

Momentum Signals:

RSI is stalling below mid-band (50–60), suggesting loss of buyer momentum

Price Volume Trend (PVT) shows deceleration post-surge, potentially preceding distribution

Bollinger Bands are compressing, which often leads to volatility re-expansion following trend exhaustion

Trade Plan

At this stage, the CD leg remains a hypothesis based on value structure and harmonic geometry. The trade plan focuses on preparing for potential long entries if price moves into the estimated completion zone with supportive signals.

Watch Zone for Long Setup: 157.5 to 152.5

Invalidation: Clean break below 147 suggests breakdown and invalidates harmonic idea

Take-Profit Targets on Reversal:

TP1: 161.5 to 163.0

TP2: 165.5 to 168.0

Required Confirmation:

Bullish divergence on RSI or PVT bounce

Reclaim of 2H order block zone with impulse and follow-through

The 1.414 Fib – Smart Money’s Darkpool Fib📐💸 The 1.414 Fib – Smart Money’s Darkpool Fib 🔍🧠

Let’s talk about the 1.414 Fibonacci extension — also known as √2 — a subtle but deadly precise level that smart money uses to trap retail.

We saw this play out perfectly on Solana.

That ~$295 zone (close to 300$ but 'no cigar') ?

That was the 1.414 Fib , and it nailed the top before a brutal reversal — a textbook darkpool distribution move.

But Solana wasn’t alone.

🔁 This Isn't Just About SOL

The 1.414 (√2) level has repeated across the crypto market , quietly acting as a marker for institutional exit zones:

📉 It showed up on multiple altcoins in December 2024, just before the entire altcoin rejection

🟠 It’s even been visible recently on Bitcoin itself — yes, even the king of crypto respects this level

So no — this isn’t random. This level has a story to tell.

🤖 Why 1.414 Matters

Most retail traders fixate on the golden ratio: 1.618.

But the 1.414 (√2) is just as important — and arguably more manipulative.

It allows institutions to:

- Front-run major Fibs

- Exit quietly

- Trap late bulls

It’s less obvious, less crowded, and often more effective.

That’s why I call it the "Darkpool Fib."

💔 Why I’m Divorcing Altcoins — But Not Yet

Solana’s chart — and its story — are symbolic of a deeper shift in me as a trader.

I’ve made the decision: at the end of this cycle , I’ll be divorcing altcoins.

Not out of hate — but out of clarity. I won’t “believe” in them anymore. I’ll just trade them.

But let’s be clear:

That moment isn’t now.

Right now, I’m still bullish. I still see opportunity. I’m here to ride the structure — while it’s still giving, or at least going to give something back.

📍Take Solana...

🔹 It was built on Rust, a language praised for speed and performance — perfect for high-throughput, data-heavy blockchain architecture

🔹 It could have been the chain that led us into the future

🔹 Instead, it’s become a memecoin playground , with repeated outages and centralized concerns

I don’t hate it. I just don’t believe in it the way I used to.

Narratives die. Structure doesn’t.

So yes — I’m trading SOL. I respect its levels. But I’ve let go of the idea that it will “change the game.”

I’ll trade the rally. I won’t marry the story.

📊 The Technical Setup

[📍 Support Zone: $153.48 $140.44

Below that, deeper support at $130.17 and $112.12

📍 Current Price: ~$158

📍 Upside Targets:

Minor: $196.80

Mid-channel: $221.53

Structural resistance: $234.97

Upper red trendline: $271.07

Final Extension: ~$325–$362

Potential: 271$, 362$, 490$(close but no cigar of the 500$ mark), 593$ technically is the ultimate resistance.

If Solana reclaims its momentum, this setup gives plenty of upside. But let’s be surgical. We are traders first.

⚠️ Final Thought

We’re in the phase of the cycle where hope is expensive.

Structure is free — if you choose to follow it.

Buy over support

Exit near resistance

Trade the level — not the label

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

SOLUSDT → Countertrend correction and hunt for liquidityBINANCE:SOLUSDT looks quite promising on the bullish side. The price is testing one of the key resistance levels within the local trend rally. A correction is forming. Is it beneficial for us?

On the higher timeframe, we see a change in character, a breakout of the trend resistance, and the formation of an upward trend support line. Bitcoin is still bullish (locally) at this time, but it is consolidating, which generally provokes a correction in SOL as well. Focus on the 150-149 area. If the bulls are able to keep the price above this zone after the retest, followed by the formation of momentum, this can be considered a positive medium-term sign.

Locally, the price within the trading range of 149.36 - 158 is heading towards the area of interest and liquidity (eql) at 149.36. The current sell-off is most likely triggered by a large player seeking a more favorable entry into the market.

Resistance levels: 154.75, 156.8

Support levels: 149.36, 147.93

In the current situation, it makes the most sense to consider an intraday trading strategy. A countertrend correction and a retest of support could attract buyers...

Best regards, R. Linda!

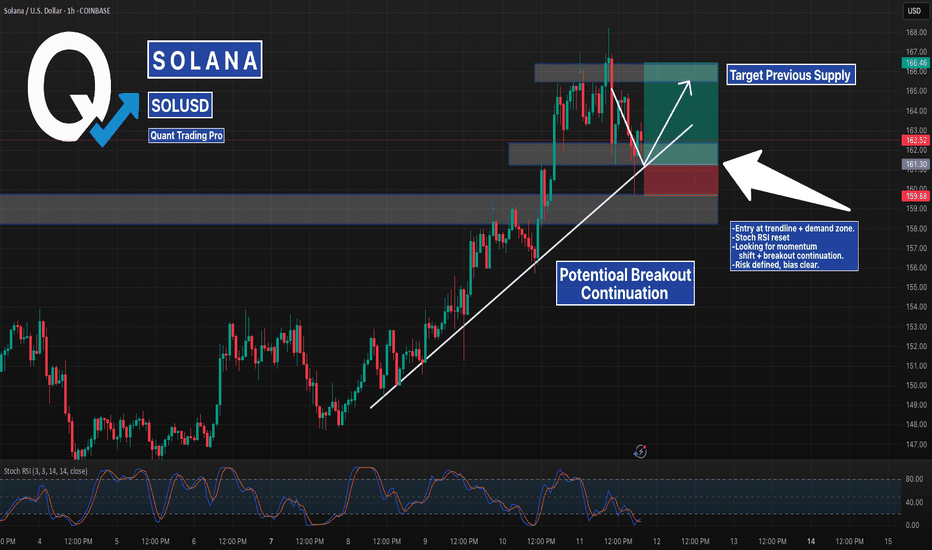

Solana Bounce Setup – Trendline + Demand Zone ConfluenceSOL is testing a confluence zone between rising trendline support and a key demand block around $161–$162. This zone has acted as a springboard for the last leg up and now overlaps with a full Stoch RSI reset on the 1H timeframe.

If price holds this structure, a continuation toward the previous supply zone at ~$166 is in play. Breakdown below $159.68 would invalidate the setup.

📉 SL: Below structural low

📈 TP: Prior high / liquidity zone

📊 Watching candle structure for entry confirmation

#SOLUSD #Solana #PriceAction #TrendlineSupport #CryptoSetup #QuantTradingPro #TradingView

BTC / ETH / SOL / XRP / HYPE: Potential Trend StructuresIn this video, I share my current daily and weekly analysis on the trend structures of BTC, ETH, SOL, XRP, and HYPE, highlighting key support and resistance zones to watch in the coming sessions.

Charts featured in the video:

BTC

ETH

SOL

XRP

HYPE

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking feel free to ask in the comments (just don’t forget to boost the idea first 😉).

LONG - I am going to add more position when this happensI currently have a small size of long position but I am planning to add more (please see my previous article for my first trade set up), but I am waiting for a certain set up to come up:

Daily:

1) all momentum indicators are entering the bull zone, so there is a plenty of room to move to the upside.

2) The candle has crossed and closed above both EMA 21 and 55, but EMA 200 is currently working as a resistance.

3) EMAs have not crossed and lined up for the bull trend - 21> 55> 200

4H:

1) EMA55 has finally crossed above EMA200!! But when they cross, the price very often has a decent pull back before taking off.

2) Stochastic and RSI are already in the overbought territory which tells me the pull back is likely to happen.

The chart is looking really good for the bull but I am going to wait for the price to retrace to Fib0.5-0.618 zone (see blue rectangular box in 4h chart).

If the price rebounces from that zone and momentum indicators reset to move to the upside, I am prepared to go big on long.

SOL Triangle Breakout + Fib Confluence – Aiming for $190+Solana (SOLUSD) just broke out of a multi-month triangle on the 8H chart, signaling a potential reversal and continuation toward previous highs.

Key Highlights:

🔹 Break of Structure (BOS): Price broke through descending resistance, flipping momentum in the bulls’ favor.

🔹 Fibonacci Confluence: Bounce came cleanly from the 0.5–0.618 zone ($129–$140), adding high-probability support.

🔹 Triangle Apex Break: Consolidation is over — the arrow is launched.

🔹 Targeting Previous Highs: $185–$190 range is in sight, with historical resistance marked.

🔹 Risk Defined: Stop idea near the previous low and triangle base (~$115).

⚠️ Watch for confirmation candle closes and volume follow-through — the move is just beginning.

$SOL | Triple Top or Launchpad?Macro to Micro Context:

SOL is now testing a third rejection in the upper 153s, forming a textbook triple top just under a multi-month descending trendline and major Fib resistance. This ceiling has held firm since late June, despite higher lows grinding up from below. Price is now squeezed tightly between compressing demand and stacked supply, with volatility contraction apparent across the board.

The structure is coiling hard but momentum and volume must confirm resolution before positioning aggressively.

Structural & Momentum Breakdown:

Resistance Layering (Reinforced):

Triple Top: Price has repeatedly failed to break above the upper 153s.

Fib Overlap: 50%–61.8% retracement range aligns with both trendline resistance and OB stack.

Order Block Stack: Resistance from mid-153s to low-154s is now reinforced across timeframes (30M → Daily).

Momentum Shifts:

RSI Divergence: Lower highs on RSI across 2H/1H, despite flat or slightly higher price.

PVT Flattening: No fresh accumulation during recent tests.

Volume Decline: Progressive volume deterioration on each retest distributional tone building.

Demand Shelf:

Key demand and support range from low-150s to mid-151s has held through three separate dips.

This is the immediate pivot zone — lose it and vacuum effect likely down into the upper 140s.

Updated Trade Plan:

Rejection Short Setup:

Entry: Breakdown through mid-151s with confirming sell volume.

Stop: Above low-154s to account for potential deviation wicks.

TP1: Upper 148s (first OB cluster).

TP2: Mid-146s (Fib + minor support).

TP3: Low 140s (macro demand + wedge base).

Bear Confirmation: RSI breakdown + volume expansion + OB flips into resistance.

Breakout Setup (Only on Clear Validation):

Entry: Strong candle close above low-154s with breakout volume.

Stop: Below low-151s — invalidation of reclaim.

TP1: Upper 157s (Fib zone).

TP2: Low 160s (swing high area).

TP3: Upper 160s (macro breakout expansion).

Bull Confirmation: RSI > 62 on 2H, strong PVT rise, and flip of local OB into demand.

Risk Warning:

Triple tops near macro resistance are high-risk unless clearly broken. This zone is overloaded with historical rejection. Don't front-run the breakout — volume will show you who's in control.

Closing Thoughts:

With a confirmed triple top now visible, SOL is facing its most important rejection zone in weeks. Bulls must reclaim with strength or this becomes a clean setup for rotation into the mid to low 140s. Patience and confirmation are key here. Keep risk asymmetric.

SOL/USD in Clear Downtrend – Short Setup in PlayHi traders! , Analyzing SOL/USD on the 30-minute timeframe, price is currently moving within a defined descending channel, respecting lower highs and lower lows. A recent rejection from the channel top suggests continuation to the downside.

🔹 Entry: 150.09

🔹 Take Profit (TP): 145.47

🔹 Stop Loss (SL): 154.51

The price failed to hold above the 200 EMA and has resumed its downward trajectory. The RSI shows a recent bounce from overbought levels, supporting the bearish momentum. This short setup offers a favorable risk-reward ratio within the context of the broader downtrend.

A clean rejection at resistance and confirmation of the trendline add confluence to this trade idea. Keep an eye on the 145.47 zone, where buyers may attempt to defend the support.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

SOLANA Loves THIS Pattern | BULLISHSolana usually increases alongside ETH. Possible because its a big competitor.

We can see SOL follows ETH very closely, with the exception of dipping earlier than ETH by a week:

In the 4h, we see a push to breakout above the neckline resistance:

In the daily timeframe, SOL is just about to break out above the moving averages - which would be the final confirmation of a bullish impulse to come:

Could this pattern be the confirmation of the start of another big pump for SOL?

_______________________

BINANCE:SOLUSDT

#SOL Update #3 – July 8, 2025🟠 #SOL Update #3 – July 8, 2025

Solana, much like Litecoin, is still undergoing corrections following its latest impulsive move. While it currently holds above a strong support level, two significant resistance zones are ahead.

The market is undecided, and Solana's direction remains uncertain, making it one of the riskiest assets to trade today.

If the $145 support fails, the price may drop toward $137. Conversely, a daily close above $159 could trigger a move toward $167. For now, it's best to stay on the sidelines and monitor the price action closely.

Solana Moving Averages: Patience is KeySolana is trading above EMA89 while at the same time trading below EMA55, we have a mixed situation. When in doubt, stay out. Anything is possible on this chart.

There was a major correction already that lasted 84 days. Solana lost more than 65% in this correction. A -67% drop. This correction removed all gains from 2024 sending prices back below $100. This is to say that Solana already went through a full and major flush.

The market could very easily continue lower and produce a lower low compared to 7-April, a major crash leading to August and I can easily see this scenario developing. Will it develop? Is it really necessary?

I can also see a slow but sure change of course. A few days red at the start of the week, as it is usual and then Boom!, the market turns green. And it grows day after day after day. It is already happening, patience is key. Better focus on the numbers.

» If Solana trades weekly above $142, we are bullish, strongly bullish and can expect additional growth.

» If Solana moves and closes weekly below $142, market conditions still remain bullish but we can approach this pair with caution.

» On a broader perspective, any trading above $95, the 7-April low, is bullish long-term. As long as this level holds, we can expect higher prices. The last low sits at $126...

It doesn't matter how you slice it, the price is good and is more likely than not to continue to increase. Patience is key.

Namaste.

Solana's fate: pump or dump ?Hello friends

You see that Solana, after its good growth, got stuck in a range and is gathering strength. Now, considering the strong upward trend of this currency, it can be said that this force can push the price upwards, but everything is possible in the market, so observe capital management and trade with your will and wisdom.

*Trade safely with us*

SOL – Compression at Resistance IISolana remains locked in a corrective sequence, unwinding from the mid-June $164 high. Price has now respected a clearly defined descending trendline, recently validating it with a third consecutive rejection—establishing it as dominant short-term resistance. Compression is now occurring just above a well-tested 2H order block near 144–139, where bulls must respond or risk cascading into inefficiency zones.

Structural and Momentum Breakdown:

Descending Resistance Structure: Three clean rejection wicks off the same trendline establish this as firm structural resistance. The latest failed bounce confirms this diagonal as active seller control.

Fib Cluster Rejection: Price has struggled below the 50–61.8% retracement (152–155 zone) from the June high, marking that cluster as distribution resistance.

Volume Profile (VRVP): Sitting atop a low-volume pocket between 144.88 and 139.71; below that lies high-acceptance around 132.

Volumized OB Zones: 2H OB between 144–139 overlaps with key support shelf—any breakdown from here opens path to 132–129 range sweep.

RSI: Persistently sub-40 with no bullish divergence—momentum continues to degrade.

PVT: Flat-to-declining, showing no inflow response to support retests—suggests buyers are stepping back even at local lows.

Example Trade Strategy:

Bullish Reclaim Setup:

Entry: Only with breakout and 2H close above 152–153 (above OB and breaking descending resistance).

SL: Below 144.50 (reclaim invalidation).

TP1: 158–160 (Fib 78.6%)

TP2: 164 (100% retrace)

Confirmation Criteria: RSI >50 + breakout volume + PVT uptick.

Bearish Continuation Setup (If OB breaks):

Entry: 2H close under 144.88, confirming OB loss and trend continuation.

SL: Above 148.

TP1: 140

TP2: 138

TP3: 132–129 (macro demand + HVN)

Confirmation Criteria: Momentum stays sub-40 RSI, increased sell volume, and continued PVT drop.

SOL – Compression at ResistanceAfter retracing up toward the 50% Fib level (around 154.3–154.4 on the daily chart), SOL/USDT has now stalled beneath key resistance and is rolling back into the reaction range. A close look at both the 1D and 2H charts reveals a clear case of a failed swing high rather than a trend reversal.

1. Structural Context

SOL remains inside its broader downtrend channel (green lines). The bounce off the June low carved out a higher low, but the subsequent rally ran into:

The daily descending trendline (red) from the June high

The 50% Fib retracement of the June down-leg (154.3–154.4)

A sell-side order block (red volume bars on the left VPVR)

The daily 20-period SMA and upper Bollinger Band

Because price could not clear these layers, the move shows the characteristics of a lower high inside a downtrend rather than a genuine breakout.

2. Multi-Timeframe Confirmation

Daily (1D) Chart

Retracement: Peaked at 50% Fib then reversed.

Volume Profile: Thick VPVR node at 154–156 acted as a supply shelf.

Bollinger Bands: Upper band contained the rally.

RSI: Pulled back from ~55 and printed a lower high as price challenged 50%.

PVT: Flat, indicating no real net buying during the bounce.

2-Hour (2H) Chart

Trendlines: A shorter-term red downtrend line capped the local rally near 154.

Order Blocks: Green buy-block around 137–140 held the low; red sell-block around 154–157 limited upside.

RSI: Printed a lower high on the second leg up, even as price revisited prior highs.

Volume: Tapered off on the approach into the 50% Fib zone, then increased on the pullback — a sign of distribution.

3. Key Levels & Next Moves

Immediate Support:

152.2–152.5 (38.2% Fib)

151.1–151.9 (23.6% Fib & daily BB midline)

Structural Support Zones:

146.1–144.6 (prior consolidation & lower Bollinger band)

141.5–140.9 (secondary order block)

134.0–137.0 (major demand cluster)

Immediate Resistance:

154.3–154.4 (50% Fib + daily trendline + SMA)

156–158 (78.6–100% Fib band + higher-timeframe supply)

If SOL fails to hold 152.2–152.5, look for a retest of the 146–144 zone. A breach below 144 opens the path back toward the 137–134 order block. Conversely, a sustained reclaim of 154.4 on volume would be needed to shift the short-term bias neutral.

4. Conclusion

This sequence—bounce into 50% Fib, capped by overlapping resistance, followed by divergence in momentum and rising volume on the pullback—confirms another lower high in SOL’s downtrend. Until price can clear 154.4 with conviction, the path of least resistance remains downward.

SOL/USDT : Strong Bullish Move Ahead?By analyzing the #Solana chart on the daily timeframe, we can see that the price is currently trading around $149.62. If the price holds above the key level of $146.28, we could expect the beginning of a strong bullish wave, potentially delivering over 25% short-term returns.

If this scenario plays out, the next bullish targets are $168.50, $187, $220, and $263.

(Personal research is strongly recommended for long-term investment decisions.)

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban