Solana: Edging HigherSOL has edged slightly higher, but remains well within our green Target Zone ($155.80 – $113.20). If it hasn’t already, the altcoin is expected to establish the low for wave ii in orange within this range before turning higher. The subsequent wave iii in orange should then drive price above the resistance levels at $249.68 and $295.31.

Solanacoin

Solana vs USD – Bearish Playbook High-Probability Swing Setup🔹 Asset: SOL/USD – “SOLANA VS U.S. DOLLAR”

🔹 Trade Style: Crypto Market Opportunity Blueprint (Swing Trade)

🔻 Plan: Bearish Plan

📍 Entry Zone

You can enter at any price level according to your strategy and confirmation signals.

🛑 Stop Loss (SL)

This is Thief SL → @ 152.50

Dear Ladies & Gentleman (Thief OG’s), adjust your SL based on your own strategy & risk levels.

🔔 Important:

Place SL only after breakout confirmation.

I am not recommending to use only my SL. It’s your choice — you make money, you take money at your own risk.

🎯 Target (TP)

Market has strong support + oversold conditions + potential trap zones, so kindly exit with profits.

Our Target → @ 125.00

🔔 Important:

Dear Ladies & Gentleman (Thief OG’s), I am not recommending to use only my TP.

It’s your choice — you make money, you take money at your own risk.

📊 Related Pairs to Watch (Correlation Guide)

1️⃣ BITSTAMP:BTCUSD – Bitcoin

King of crypto; SOL often follows BTC’s direction.

If BTC breaks down, SOL bearish continuation becomes stronger.

2️⃣ BITSTAMP:ETHUSD – Ethereum

High correlation with major altcoins.

ETH weakness usually signals pressure on L1 chains like SOL.

3️⃣ COINBASE:AVAXUSD – Avalanche

Competitor L1 chain; often moves in similar sentiment flow.

If AVAX also shows bearish structure → confirms broad L1 weakness.

4️⃣ COINBASE:LTCUSD – Litecoin

Old major coin; used for risk-on/risk-off sentiment checks.

If LTC dumps → market-wide bearish confirmation.

5️⃣ CRYPTOCAP:TOTAL2 – Altcoin Market Cap

Measures overall altcoin health.

If TOTAL2 breaks its support → SOL likely accelerates toward bearish target.

🔍 Why These Pairs Matter? (Key Correlation Points)

BTC sets the tone – SOL follows the major trend 75–85% of the time.

ETH determines altcoin liquidity – if ETH dominance rises, SOL loses capital flow.

AVAX acts as sector correlation – L1 competitors weaken together during bearish cycles.

TOTAL2 confirms broad alt weakness, making SOL’s downside more reliable.

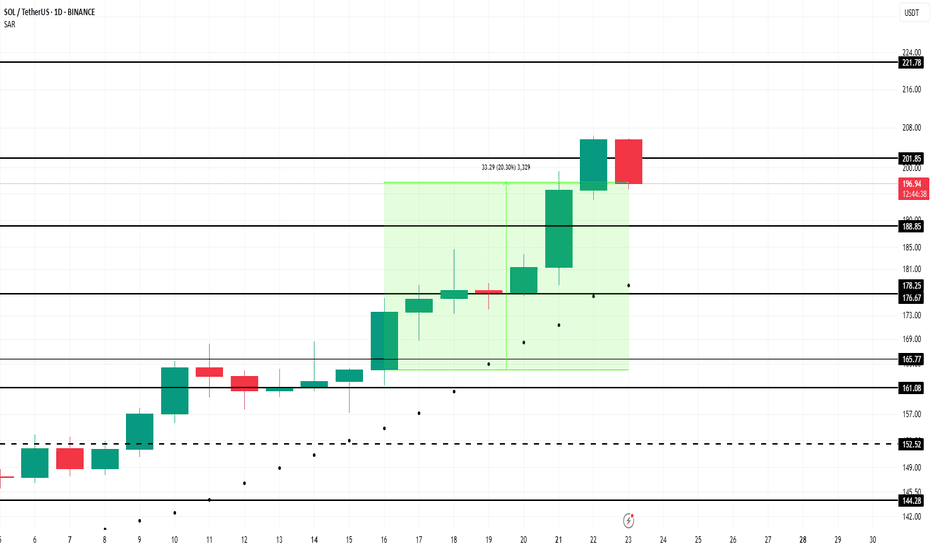

SOL/USDT Update — Bullish Trend Structure and Resistance Ahead“🚨 Solana vs Tether: Bullish Heist on SOL/USDT 💰”

📊 Description

Market: SOL/USDT

Bias: Bullish (Swing / Day Trade)

✅ Trade Plan

Entry: 🎯 Any good support / demand area — stay alert & flexible.

Stop Loss: 🛡️ “Thief SL” @ 160.00 USDT — this is my SL, not yours. Manage your own risk!

Targets (TP):

• 🎯 Target 1: 215.00 USDT

• 🏁 Target 2: 240.00 USDT

⚠️ Heads up: Use your discretion. Do not blindly follow my SL/TP — trade responsibly, at your own risk.

🔍 Key Insights / Logic

🚧 Expect resistance & traps near 215–240 — don’t get stuck in overbought zones.

📈 Momentum is building; structure is favorable on retests.

🔊 Watch volume on impulsive moves — rising volume = strength.

🔄 Related pairs / correlation watch:

• BINANCE:SOLBTC — strength vs BTC strengthens the bullish case.

• BINANCE:ETHUSDT — altcoin momentum may carry SOL upward.

• BINANCE:BNBUSDT — BNB strength can support ecosystem flow.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#SOL #SOLUSDT #Solana #CryptoSwing #CryptoDayTrade #AltcoinAnalysis #TradingViewIdeas #CryptoFun

SOLANA: Wave Energy on the Threshold of ImpulseSOLANA: Wave Energy on the Threshold of Impulse

Based on the current wave structure, Solana is completing its corrective phase and preparing to form a new movement. The chart shows a transition from sideways momentum to a more pronounced impulse, which could set the direction for the near term.

Primary scenario: After the correction ends, a downward impulse sequence is expected to develop. Alternative scenario: If the market consolidates above recent highs, it could continue to rise, delaying the start of a new downward wave.

Idea for traders: Watch for confirmation of the structure on lower timeframes and enter only after clear reversal signals appear.

Risk management: Use clear stop levels and adjust your plan as new impulses emerge.

Friends, more wave analysis is available in our profile.

Subscribe to stay up to date with wave analysis!

$SOLUSD Eyes Key Demand Zone Before Potential Macro BreakoutSolana (SOL/USD) is approaching a pivotal technical zone that could define its next major move. After an extended corrective leg from the $254 region, the price has retraced toward key demand areas, around $140, and around $120 where prior liquidity sweeps and structural reversals have historically emerged.

The chart reveals a repeating market behavior where Solana establishes a base within strong demand zones before launching decisive bullish impulses. An external structure Break of Structure (BOS) from previous swing highs, followed by an internal Change of Character (CHOCH) confirmation, after a retracement, suggests the broader bullish structure remains intact despite short-term weakness due to macro- economic challenges.

Should price hold the $120 range, a rebound toward the $295 previous highs appears probable. However, if sellers drive price lower, deeper liquidity could be collected near the $115–$120 region, aligning perfectly with the ascending trendline and long-term support base. This would likely create a high-probability accumulation phase before another impulsive leg higher.

Volume trends show healthy market participation during both expansions and pullbacks, reflecting consistent investor interest in Solana’s price action. Fundamentally, Solana’s growing adoption across DeFi, NFTs, and high-performance dApp ecosystems continues to strengthen the bullish bias.

A confirmed reversal from current levels could set the stage for a macro breakout toward the $295 zone, which represents a higher high of the external bullish structure and a psychological milestone for market participants.

In summary, Solana’s technical framework signals that the market is in a late-stage correction within a larger bullish cycle. A clean defense of the $140 zone would reinforce the bullish continuation narrative, while a brief dip into the $115 zone could form the final liquidity trap before another surge toward new highs

SOLANA: The last wave before takeoff or a deep pullbackSOLANA: The last wave before takeoff or a deep pullback

📈 Weekly Scenarios

Bullish scenario: SOL holds above ~$190, breaks through ~$260.83 → start of uptrend → target ~$300+.

Consolidation: price trades between ~$190 and ~$260, wave structure not defined until breakout.

Bearish scenario: breakout of support at ~$190 with volume → likelihood of a significant correction to ~$150–$160.

✅ Conclusion

Solana is at a key decision point for the coming week:

The ~$260.83 level is a benchmark for a bullish resumption.

The ~$190 level is a critical support level.

A breakout upward will provide upward momentum; a breakout downwards is likely a pullback. Follow price reactions at the highlighted levels and confirmation of the wave structure before making trading decisions.

Is Solana Ready for a Technical Breakout or Just a Fake Pump?🎯 SOL/USDT Wealth Strategy Map | The Gentleman Thief's Playbook 💎

📊 Market Overview

Asset: SOLANA/USDT (SOL/USDT)

Trading Style: Swing/Day Trade Hybrid

Market Sentiment: Bullish Pending Breakout Setup 🚀

🎭 The Setup (As Told by a Professional Thief)

Dear Ladies & Gentlemen, gather 'round for today's calculated heist...

🔓 The Entry Plan

Breakout Zone: $240

Entry Strategy: ANY price level AFTER confirmed breakout above $240

💡 Why this matters: We're watching for resistance to crack like a vault door. Once $240 breaks with volume, the path to riches opens.

🛡️ Risk Management (The Thief's Insurance Policy)

Stop Loss: $220

⚠️ Important Notice: This is my thief-style SL, but YOU are the master of your own vault. Set your risk tolerance based on YOUR capital and comfort level. Make money, take money — at your own calculated risk.

🎯 Profit Targets (Where We Cash Out)

Primary Target: $270 (Our recommended exit)

Technical Target: $280 (Strong resistance + overbought territory + potential trap zone)

📌 Strategic Exit Reasoning:

$270 offers a clean 12.5% gain from breakout

$280 presents multiple bearish factors: strong resistance, overbought conditions, and classic bull trap setup

Smart thieves escape with profits before the alarm sounds 🚨

⚠️ Important Notice: This is my thief-style TP, but only YOU can decide when to take profits. Your money, your rules, your risk.

🔍 Technical Analysis Deep Dive

Key Levels to Watch:

Resistance: $240 (current), $270 (target), $280 (danger zone)

Support: $220 (our safety net)

The Correlation Play 📈

Related Pairs to Monitor:

CRYPTOCAP:BTC (Bitcoin) - The market's king affects all. If BTC pumps, SOL typically follows with 1.5x volatility

CRYPTOCAP:ETH (Ethereum) - Direct competitor in smart contracts; inverse correlation on capital rotation

CRYPTOCAP:AVAX (Avalanche) - Similar L1 narrative; watch for sector rotation signals

SEED_DONKEYDAN_MARKET_CAP:MATIC (Polygon) - L2 competitor; check for broader altcoin momentum

💡 Correlation Strategy: If BTC holds above $65K while ETH consolidates, SOL historically outperforms due to capital flow seeking higher beta plays.

⚡ The Gentleman Thief's Trading Philosophy

This isn't gambling — it's calculated robbery from the market's inefficiencies. We enter with precision, manage risk like professionals, and exit before greed becomes our enemy.

Remember:

✅ Breakouts need volume confirmation

✅ Risk management is non-negotiable

✅ Profits aren't real until you take them

✅ The market doesn't care about your feelin

📢 Community Engagement

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚖️ Legal Disclaimer

IMPORTANT: This is a "thief-style" trading strategy shared purely for educational and entertainment purposes. This is NOT financial advice. Trading cryptocurrencies involves substantial risk of loss. Past performance does not guarantee future results.

You are solely responsible for your own trading decisions. Always:

Do your own research (DYOR)

Never invest more than you can afford to lose

Understand the risks before trading

Consider your personal financial situation

The author is not a registered financial advisor and assumes no liability for your trading outcomes.

Trade safe, steal smart, exit elegant. 🎩💰

#SOLUSDT #Solana #CryptoTrading #SwingTrading #DayTrading #TradingStrategy #Breakout #TechnicalAnalysis #CryptoSignals #AltcoinSeason #SOL #USDT #CryptoAnalysis #TradingView #PriceAction #CryptoChart #BullishSetup

SOLANA (SOL): Wave 5 awaits – upward momentum or bear trap?SOLANA (SOL): Wave 5 awaits – upward momentum or bear trap?

Weekly Scenarios

Bullish scenario: Price holds the ~$185-190 zone, breaks resistance at ~$260 → wave 5 starts up, target is approximately ~$300+.

Consolidation: Price moves in the ~$185-260 range without a significant breakout; energy is accumulating, waiting for a signal.

Bearish scenario: Break of support at ~$185 with volume → confirmation of the start of wave C correction → possible decline to ~$150-160.

✅ Conclusion

On the weekly timeframe, SOL is at a crossroads:

If it holds above ~$185 and manages to break ~$260, the chance of a strong rally increases.

If support fails to hold, the risk of a correction remains. Traders should watch for price reaction on levels, volume, and confirmation of wave structure before taking a position.

SOLANA Buying Opportunity Solana has established support at the daily trendline and successfully closed above the key daily resistance level at $191.32. The daily RSI is also indicating a potential buying opportunity, suggesting renewed bullish momentum. If this upward trend continues, the next potential target for Solana is around $250.

Solana Scenarios for the monthMonthly Scenarios

Bullish Scenario

SOL holds support in the $180-$184 range and breaks above $184-$190.

This will provide impetus to targets in the $230-$300+ range, especially if the market turns out favorable and there is positive news regarding SOL/ETF/on-chain activity.

Consolidation/Sideways

The price may remain stuck in the $180-$190 range without a clear direction, especially with light volume.

In this scenario, it is important to monitor reactions at the range boundaries.

Bearish Scenario

If SOL breaks below $180-$184 with volume, a decline to the lower support level of $143-$153 or even lower is possible.

Such a correction could serve as a "normalization" after a significant rise.

✅ Conclusion

The current monthly trend for SOL appears generally bullish, with strong potential for continued growth upon a breakout of resistance.

But the key area to watch is the $184–190 zone: if there's a breakout with volume, we expect an upward acceleration.

The $180 and especially $153–143 support zones are areas to monitor for trend stability.

The CoinCodex forecast (~3-5%) suggests moderate growth, but with the potential for strong momentum under favorable conditions.

Solana Weekly Forecast and ScenariosWeekly Forecast and Scenarios

Bullish scenario: SOL holds support near $200–$210 and breaks through the $245–$250 zone, leading to a directional move toward $270 and beyond (even to $300).

Consolidation: The price may fluctuate within the $200–$245 range, awaiting volume and news, without a clear trend.

Bearish scenario: A breakout from the support range (below ~$188–$200) could lead to a pullback to lower levels of $170–$180.

Solana: Target Zone in FocusSOL has dropped more than 20% from last Thursday’s high. In light of this, we now believe that last week’s high—reached on Thursday—marked the top of wave i in orange, and that price is currently undergoing a wave ii corrective phase. This correction should play out as a downward, three-part move labeled - - in green, ultimately targeting our orange zone between $155.80 and $113.20. We expect the low of this wave ii to occur within that Target Zone, which should set the stage for a bullish reversal. The following wave iii in orange is projected to push SOL to new all-time highs, breaking through resistance at $295.31.

Is This the Perfect Time for a Solana Bullish Heist?🔥🚨 THIEF TRADER’S SOL/USDT HEIST PLAN! 🚨🔥

Asset: SOL/USDT "Solana vs Tether" | Plan: BULLISH HEIST MODE! 💰🎯

🎯 ENTRY: THIEF LAYER STRATEGY (MULTI-LIMIT ORDERS!)

"STEAL AT EVERY LEVEL!" 🏴☠️

📍 Layer 1: 190.00

📍 Layer 2: 185.00

📍 Layer 3: 180.00 (Add more layers if you’re a greedy thief!)

🚨 Thief Pro Tip: The more layers, the bigger the loot! Adjust based on your risk appetite.

🛑 STOP LOSS: THIEF ESCAPE ROUTE!

"DON’T GET CAUGHT!" 👮♂️

🔻 SL @ 173.00 (OG Thieves adjust SL based on risk!)

⚠️ Warning: Bears might set traps—stay sharp!

🎯 TARGET: POLICE BARRICADE AHEAD!

"CASH OUT BEFORE THEY CATCH YOU!" 🚔💨

🎯 Main Target: 240.00 (But escape early at 235.00 to be safe!)

💰 Thief Rule: Take profits like a ghost—disappear before the cops arrive! 👻

⚡ THIEF TRADING RULES:

✅ Scalpers: Only LONG side heists! Use trailing SL to lock profits!

✅ Swing Thieves: Stack layers & hold for the big score!

✅ Risk Management: Never risk more than you can steal!

📢 THIEF ALERTS!

🚨 News = Trap Zone! Avoid new trades during high-impact news!

🚨 Trailing SL = Your Getaway Car! Protect your stolen cash!

💥 BOOST THIS IDEA TO SUPPORT THE THIEF SQUAD!

"More boosts = Bigger heists next time!" 🚀💸

❤️ **Like, Share, & Follow for more CRYPTO HEIST PLANS!

⚠️ DISCLAIMER: This is NOT financial advice—just a Thief’s Master Plan! Trade at your own risk! 🎭

🚀 NEXT HEIST COMING SOON… STAY TUNED, THIEVES! 🏴☠️🔥

Solana: Stay the Course!Solana started the week with a sharp pullback but quickly bounced back, breaking through resistance at $206.33 for the third time in just two weeks. Our primary outlook points to another push higher, with price expected to clear resistance at $229.22 and complete the ongoing green wave 3 near $295.31. From there, the broader green five-wave sequence should ultimately break above this level and finish the larger orange wave iii. We still assign a 30% probability to the alternative scenario, which calls for a fresh wave (ii) correction low within the blue downside Target Zone between $56.56 and $29.87.

SOLANA (SOL) Ready for Takeoff? | Bullish Trade Setup to $216🚀 SOL (Solana) Crypto Trade Setup – Aug 23, 2025 🚀

🔎 Market Direction

✅ Bias: Mildly Bullish → Price holding above key MAs (EMA9/EMA21/SMA20/SMA50).

⚠️ Caution: Momentum weakening + missing OI data → need tape confirmation (volume/OI).

📊 TRADE DETAILS (Quick View)

🎯 Instrument: SOL

📈 Direction: LONG

💵 Entry: 198.0

🛑 SL: 182.0

🎯 TP: 216.0 (with scaling)

📊 Size: 0.25

💪 Confidence: 70%

⏰ Timing: Market Open

🕒 Signal Time: 2025-08-23 17:09:22

Solana - Don't miss it General background and conclusions

Solana is showing a pre-split state - neutral with an upward slope, holding above MA-200 and receiving confirmation from structural patterns.

Technical signals point to the importance of the $188 level: its breakout will open the way to $200-206 and potentially to $247.

In the short term, growth to $180 is possible if the direction is confirmed.

In the absence of volumes and strength, a downward movement to the lower support of $160 and further is possible.

Recommendations

Strategy "buy on breakout": entry at the close and holding above $188 with a target of $200-206. Alternative: buy on dip to $160 in case of a technical rebound.

Stop loss: it is reasonable to place it just below $160.

Additional monitoring: It is important to monitor the dynamics of volumes, price behavior around $188, as well as the development of fundamental drivers (ETF, Firedancer, etc.) in order to clarify the movement scenario.

Solana: $178 to $200+ - The Next Level on the PathSOL/USD Technical Review

Support around $178 (20-day EMA) is holding the price, indicating high buying interest.

The key resistance level is $185–$189. A breakout of this range will open the way to targets of $200–206, possibly even $220 if the momentum continues.

Pattern formation: an upward reversal from the $160 zone (lower Bollinger band + Fibonacci) is recorded, which completes the ABC correction and launches a new wave impulse. Upside potential is towards $180.

Trend and on-chain indicators: a decrease in the balance on exchanges, an increase in TVL and growing institutional interest (ETF) create a solid base for moving higher.

Solana - is showing reversal signalsTechnical structure and patterns

On the daily chart, SOL has formed an inverse head and shoulders pattern, a classic reversal pattern. A breakout above the neckline with increasing volume could lead to a move to $247.71. However, weak demand could jeopardize this scenario, triggering a fall even to $138.05.

The asset has grown by 18% in a week, reaching $181, but there are liquidation clusters and strong resistance at $184–185. A breakout of this range could accelerate growth, with a possible surge to $256.

Support and resistance levels

Resistance:

The key zone is $180–184, a breakout of which would open the way to growth.

Support:

Important zones are $153–143, where cumulative activity was previously observed.

Network background and volume dynamics

The number of tokens on exchanges has decreased by almost 10%, which indicates a decrease in selling pressure. A "golden cross" is also forming between the 100- and 200-day EMAs - a bullish signal with target levels above $176.

Earlier, SOL rebounded from the support zone around $160 and is moving towards a breakout of $175. The further trajectory - growth or consolidation - will depend on how the price behaves at the border around $175.

Solana - The bullish background remains strongCurrent Technical Signals

SOL is trading around $180-$181, holding above the key 20-day EMA, which is around $178.25. A break below this level could open the way to support around $171.78, while holding above this level creates potential for a rise towards $186.40-$190.47.

A golden cross is forming between the 100- and 200-day EMAs on the daily chart - a classic bullish signal, strengthening the chances of a rise to $200.

Your network volume and balances on exchanges are showing a decline, which indicates a decrease in supply - easing pressure on the price and supporting bullish sentiment.

Support and Resistance

Support:

$178.25 (20‑EMA)

$171.78 — lower limit in weak market

The Currency analytics

Resistance:

$180–$190 zone — critical for further gains

Upper resistance at ~$200 — critical for rally continuation

Structural and Valuation Signals

A test of the daily bullish divergence on SOL indicates potential for further gains after correction.

SOL recently broke out of its ascending channel, indicating a possible reversal and the beginning of a new move higher.

Finance Feeds

Solana definition of movementSOL is in a squeeze phase: the price is holding above $163, but meets resistance around $183-186. Indicators show neutral, slightly weak momentum. A break above $186 with increasing volumes will open up potential at $190+; a break below $178 will lead to a deeper correction to $171-170. Until then, it is worth watching the 20-d EMA hold and reactions to it.

Solana Price Faces Reversal At $200 As Profits Hit 5-Month HighBINANCE:SOLUSDT price has risen 21% in the past week , now trading at $199. Despite breaching the $200 mark, Solana has failed to maintain this level, marking a five-month high.

The Net Unrealized Profit/Loss (NUPL) indicator for BINANCE:SOLUSDT shows that profits have reached a five-month high . This signals that many investors are in profit, raising concerns about a potential sell-off.

If these factors hold true, BINANCE:SOLUSDT price could decline toward the support levels of $188 or even drop to $176 . A move below these levels could erase a significant portion of the recent gains and shift the altcoin into a bearish trend.

However, if investor confidence remains strong and the market continues to show bullish signs, BINANCE:SOLUSDT could stabilize above $200 . Securing this level as support could propel the price back toward $221, invalidating the bearish outlook.

"Solana Heist in Progress! Will the Breakout Hold or Fake Out?"🔥🚨 "SOLANA HEIST ALERT: The Ultimate Bullish Raid Plan (Breakout or Fakeout?)" 🚨🔥

🌍👋 Greetings, Market Pirates & Profit Bandits!

(English, Spanish, Portuguese, French, German, Arabic—we speak MONEY.)

💎 STRATEGY BASED ON THIEF TRADING STYLE 💎

(High-risk, high-reward—steal the trend or get caught in consolidation!)

🎯 MISSION: SOL/USD (Solana vs. Dollar) CRYPTO HEIST

🐂 Direction: LONG (But watch for traps—cops & bears lurk nearby!)

🚀 Escape Zone: ATR line (High-Risk Profit-Taking Area)

⚠️ Warning: Overbought? Reversal? Police line at resistance? TAKE PROFITS EARLY!

📈 ENTRY: "THE BREAKOUT HEIST BEGINS!"

Trigger: Wait for candle close ABOVE 148.50 (MA)

Alternative Entry: Buy stop above MA OR buy limit on pullback (15m-30m TF)

🛎️ SET AN ALERT! Don’t miss the breakout—thieves strike fast.

🛑 STOP LOSS: "DON’T GET CAUGHT!"

Thief SL: 136.00 (2H Previous structure Swing Low) (Adjust based on your risk & lot size!)

⚠️ Warning: If you ignore this, you’re gambling—your loss, not mine.

🎯 TARGET: "LOOT & BOUNCE!"

🎯 167.00 (or escape earlier if the trend weakens!)

🧨 Scalpers: Only play LONG—use trailing stops to lock in gains!

📢 NEWS & RISK WARNING

🚨 Avoid new trades during high-impact news! (Volatility kills heists.

🔒 Use trailing stops to protect profits if the market turns.

💥 BOOST THIS HEIST! (More boosts = more profit raids!)

👉 Like ✅ | Follow 🚀 | Share 🔄

💬 Comment your take—bullish or bearish trap?

🚀 Next heist coming soon… Stay tuned, bandits! 🤑

Solana: Below ResistanceOur primary scenario for Solana is that the coin is already close to the top of the green wave 4. Therefore, we expect a bearish trend reversal below the resistance at $192.33, followed by a move toward our blue Target Zone (coordinates: $56.56 – $29.87) with the green wave 5. Down there, we see an opportunity for long trades with the low of the blue wave (ii), which should be followed by a fresh upward impulse. According to our alternative scenario (probability: 38%), however, we may have already seen the low with wave alt.(ii) in blue prematurely. To validate this alternative scenario, the price would have to rise directly above the resistance at $192.33 from here and extend the blue wave alt.(iii) .