IMX HOLDING THE MAIN TREND AND CAN RETURN HUGE - UPDATE 28-05IMX/USDT Trading Update

🔹 Main trend holding: IMX is holding its main trend support, which is a very important signal for keeping the broader uptrend intact.

🔻 It did lose the low time frame trend and corrected from $0.83 down to the $0.70–$0.75 zone.

🔄 However, holding the main trend gives strong potential that the low time frame trend may return in the coming sessions.

🎯 First target: If recovery continues, the first upside target is set at $1.00, marking a full rebound from this cycle.

📌 Summary:

Despite losing momentum on the low time frame, IMX remains positive as long as it holds the main trend. Expectation stays bullish with the next target toward $1.00.

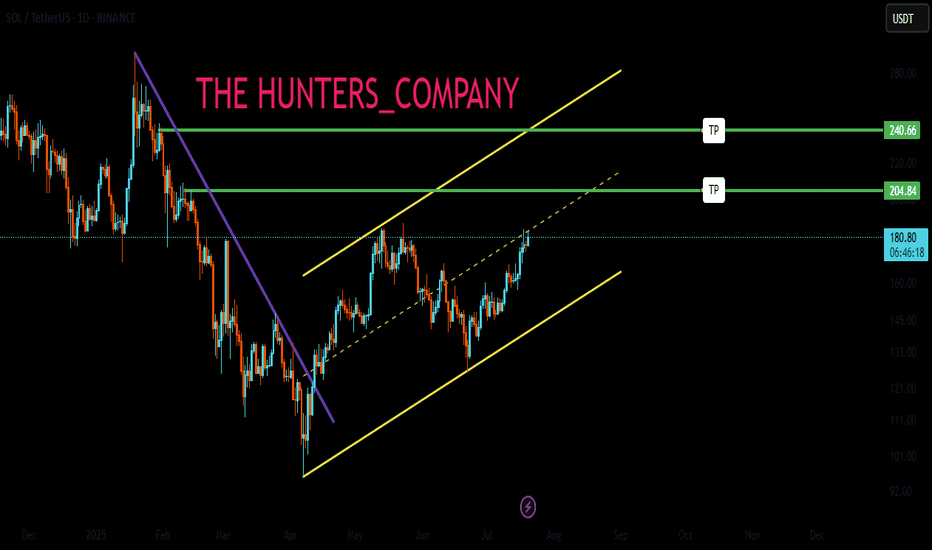

SOLUSD

Solana: Target Zone in FocusSOL has dropped more than 20% from last Thursday’s high. In light of this, we now believe that last week’s high—reached on Thursday—marked the top of wave i in orange, and that price is currently undergoing a wave ii corrective phase. This correction should play out as a downward, three-part move labeled - - in green, ultimately targeting our orange zone between $155.80 and $113.20. We expect the low of this wave ii to occur within that Target Zone, which should set the stage for a bullish reversal. The following wave iii in orange is projected to push SOL to new all-time highs, breaking through resistance at $295.31.

SOLUSD H4 | Could we see a bullish reversal?Based on the H4 chart analysis, we could see the price fall to the buy entry which is an overlap support that is slightly below the 78.6% Fibonacci retracement and could bounce from this levle to the upside.

Buy entry is at 187.96, which is an overlap support that is slightly below the 78.6% Fibonacci retracement.

Stop loss is at 174.58, which is a pullback support.

Take profit is at 216.92, which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SOLUSD H4 | Bearish dropSolana (SOL/USD) has rejected off the sell entry which is a pullback resistance and oculd potentially drop from this level to the downside.

Sell entry is at 217.255, which is a pullback resistance.

Stop loss is at 231.317, which is a pullback resistance.

Take profit is at 188.19, which acts as an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Solana - The sleeping giant waking up!🔦Solana ( CRYPTO:SOLUSD ) will still head higher:

🔎Analysis summary:

Yes, over the past four years, Solana has overall been just consolidating. But eventually, Solana will catch up with the entire crypto market and create a new all time high. Specifically with bulls picking up momentum lately, it becomes more and more likely that Solana will do exactly that.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

SOLUSD H4 | Bearish dropSOL/USD is rising towards the sell entry which is a pullback resistance and could reverse from this level to the downside.

Sell entry is at 230.926, which is a pullback resistance.

Stop loss is at 250.04, which is a swing high resistance.

Take profit is at 201, which is a pullback support that is slightly below the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SOLANA (SOL) – Major Breakout Setup BrewingSolana is showing one of the cleanest technical setups in the DeFi space right now. The daily chart reveals a textbook saucer formation, a pattern that often precedes strong upside moves.

🔍 Key Levels to Watch:

• Support: $215–$220 – This zone must hold to keep the bullish structure intact.

• Breakout Zone: $250–$260 – A close above this range confirms the saucer breakout.

• Target: $480–$500 – Based on the pattern’s depth and duration.

The path of least resistance is up, and with altcoin sentiment turning bullish again, this could be a precursor to alt season.

📈 Monitoring closely for a confirmed breakout.

#Solana #SOL #Altcoins #CryptoTrading #DeFi #ChartPatterns #TechnicalAnalysis #CryptoSetup #Altseason

SOLANA Is a 1D MA50 pull-back needed for a $310 rally?Solana (SOLUSD) has been trading within a Channel Up since the June 22 Low, which goes even further back on a Fibonacci Channel Up started on the April 07 market bottom.

The price is pulling back at the moment, having completed a +63.22% Bullish Leg, same as the previous one that then pulled back to its 1D MA50 (blue trend-line) and 0.5 Fibonacci retracement level before starting the next Bullish Leg.

As a result, we expect the current correction so seek validation on the 1D MA50 at least and then rebound for a medium-term +63.22% rally, targeting $310 at least.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

#SOL/USDT bullish structure formed at the chart#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward move.

There is a major support area in green at 216, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 218

First target: 227

Second target: 234

Third target: 244

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SOL AGAIN/;Hello friends

You see that the price is stuck in a trading range and you must know that 80% of failures in trading ranges are fake!

Now, as the trading range lengthens, we can finally wait for its failure, and if it fails, the price will move by the same amount as the trading range.

*Trade safely with us*

#SOL/USDT bullish structure formed at the chart#SOL

The price is moving in a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a major support area in green that pushed the price higher at 236.

Entry price: 240.

First target: 243.

Second target: 246.

Third target: 249.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#SOL/USDT bullish structure formed at the chart#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 233, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 236

First target: 238

Second target: 241

Third target: 244

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

DeGRAM | SOLUSD seeks to the $260 level📊 Technical Analysis

● SOL/USD maintains a rising channel, consolidating just below the $250 resistance after strong rallies from $200 support.

● Structure suggests a bullish continuation, with a breakout targeting $260 if buyers defend $235–$240 as short-term support.

💡 Fundamental Analysis

● Solana gains momentum as institutional flows and DeFi growth increase, while broader crypto sentiment improves with easing risk aversion.

✨ Summary

SOL/USD is consolidating below $250, with $235–$240 as support and upside potential toward $260 if momentum holds.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM |SOLUSD will test the support level📊 Technical Analysis

● SOL/USD is trading inside a rising channel, with price pulling back toward 227 support after rejecting 250 resistance.

● Structure shows continuation potential, with higher lows along the support line keeping momentum intact and targeting a retest of 250 if buyers hold.

💡 Fundamental Analysis

● Solana’s ecosystem strength is supported by growing NFT volumes and DeFi activity, while recent whale inflows highlight institutional interest in altcoins.

✨ Summary

Bullish above 227; targets 240 → 250. Invalidation on a close below 227.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

Signal Breakout as SOL Targets ATH and $300+Solmate’s $300M Launch in the UAE Sparks Solana Treasury Wave: Institutions Signal Breakout as SOL Targets ATH and $300+

The Solana ecosystem is entering a critical new phase of institutional adoption and capital formation, with multiple catalysts converging to form one of the strongest bullish narratives in crypto today. The headline development: Solmate has launched with a $300 million mandate to establish a Solana-focused treasury in the United Arab Emirates. This move, paired with growing institutional interest, potential ETF approvals, and increasingly favorable technicals, has set the stage for a potential breakout rally. Some market participants now see a credible pathway to $300+ for SOL, while others point to new all-time highs as fundamentals and momentum align.

This piece explores the strategic implications of Solmate’s treasury launch, the growing momentum behind Solana among institutions like Forward Industries, the macro tailwinds surrounding ETF approvals, and the technical structure that supports a bullish continuation. We’ll also assess the potential risks, the role of on-chain growth, and how the UAE’s regulatory and capital environment could accelerate Solana’s trajectory.

Solmate’s $300M UAE Treasury: Why It Matters

Solmate’s $300 million capital pool dedicated to establishing a Solana treasury in the UAE is more than a headline number—it’s a signal that institutional-grade asset management for crypto-native assets is globalizing beyond traditional finance hubs. The UAE, and particularly Abu Dhabi and Dubai, have positioned themselves as crypto-forward jurisdictions with clear regulatory sandboxes and proactive frameworks. Establishing a Solana treasury there creates:

• A regional liquidity hub: Concentrating capital in a friendly regulatory environment can improve market depth for SOL and Solana-native assets during aggressive expansion phases.

• Institutional standardization: A treasury framework can adopt disciplined risk controls, custody standards, and transparent rebalancing strategies, making it a template for other funds and corporates to emulate.

• On-ramp for Middle Eastern capital: Sovereign wealth funds, family offices, and regional asset managers have shown interest in digital assets. A Solana-focused treasury in the UAE lowers friction for capital allocation.

•

Mechanics of a Solana Treasury

Treasury operations are more than passive holdings. They typically involve:

• Core SOL accumulation: A base allocation that reflects long-term conviction in network value capture, staking yields, and governance.

• Liquidity provisioning: Deploying assets in DeFi protocols, AMMs, and order books to enhance liquidity and earn fees, subject to risk controls.

• Staking strategies: Validator diversification, slashing protection, and yield optimization through auto-compounding and programmatic rebalancing.

• Venture and ecosystem exposure: Strategic allocations to Solana-native projects, tokens, real-world asset (RWA) initiatives, and infrastructure plays (or via index-like baskets).

• Hedging overlays: Options and perp hedges to manage drawdowns while maintaining directional exposure.

By anchoring these flows in the UAE, Solmate not only signals conviction; it operationalizes a repeatable structure that can absorb larger institutional checks as compliance frameworks and counterparties mature.

Forward Industries Bets Big on Solana

Forward Industries’ publicized pivot toward SOL underscores a broader shift: institutions are no longer simply “diversifying” into Solana—they are actively rotating into it as a core position. The drivers include:

• Performance-to-throughput ratio: Solana’s execution environment continues to deliver high throughput and sub-second finality with low fees, supporting consumer-grade applications such as payments, on-chain order books, and gaming without UX compromise.

• DePIN, payments, and consumer apps: From real-time order execution to growth in tokenized assets and payments rails, Solana’s app layer is demonstrating product-market fit in areas where latency and cost matter.

• Developer momentum: Tooling, runtimes, and TypeScript-centric development are attracting teams that want to ship quickly with rich UX. Growth in Saga and mobile-focused experiments adds tailwind.

• Liquidity concentration: As more capital pools into SOL pairs and Solana’s native DEXs, slippage decreases and the market becomes more attractive for block-sized orders.

The “buying frenzy” moniker stems from combined flows across centralized exchanges, on-chain wallets, staking platforms, and prime brokers. Institutional trade sizes are up, and block liquidity providers report rising interest for SOL borrow and cross-margin facilities—both signposts that levered directional exposure and basis trades are heating up.

The ETF Wave: SEC Approvals Could Reshape Flows

A critical macro catalyst is the likelihood of multiple ETF approvals in the coming months. While much of the focus has been on Bitcoin and Ethereum, the structural changes triggered by ETF adoption—standardized custody, audited NAV calculations, and regulated market-making—create spillover effects across large-cap crypto assets.

Here’s why ETF approvals matter to Solana:

• Legitimacy funnel: When institutions obtain board approvals for crypto exposure via ETFs, internal compliance friction declines. From there, investment committees often explore other large-cap crypto assets with similar liquidity and adoption—enter SOL.

• Portfolio construction: Multi-asset crypto strategies reweight based on momentum, liquidity, and correlations. If BTC and ETH ETF flows stabilize, allocators often diversify into high-beta assets with compelling adoption narratives—again, SOL is a prime candidate.

• Derivatives market deepening: ETF market-making expands basis, options, and hedging activity. Robust hedging tools lower the barrier to building large SOL positions.

Even if a Solana ETF is not immediately approved, the institutional infrastructure and behavioral changes catalyzed by BTC/ETH ETFs provide a clear path for capital to migrate into SOL through other compliant vehicles.

Technical Structure: SOL Aligns for a Breakout

From a technical perspective, SOL’s setup reflects several bullish elements frequently observed in assets that break into new cyclical highs:

• Higher lows and a strong weekly structure: Persistent higher lows on the weekly timeframe suggest bid support from larger accounts. Breakouts from multi-month accumulation ranges often lead to trend extensions.

• Volume confirmation: Rising volume on up weeks and muted sell volume on retracements indicate absorption by patient buyers. This is often a hallmark of institutional accumulation.

• Moving average alignment: When the 50-day and 200-day moving averages turn up in tandem and compress beneath price, they function as dynamic support. Golden cross conditions on high timeframes historically reinforce trend persistence.

• Momentum oscillators: Constructive RSI behavior (staying in bullish regimes, respecting 50-55 on pullbacks) supports the case for sustained upside. MACD crossovers above the zero line add confirmation.

• Market structure breaks: If SOL clears prior supply zones with strong breadth in Solana ecosystem tokens, it often precedes a sharp expansion leg.

From a pure charting lens, the path to retest the all-time high (ATH) becomes plausible once prior resistance shelves are flipped to support with convincing retests. The next leg can extend if funding stays balanced and derivatives don’t overheat.

Why $300+ Is on the Table

Calling specific price targets in crypto is always probabilistic, but the $300+ scenario reflects a confluence of factors:

• Elastic demand: As SOL regains narrative dominance, every incremental institutional participant must source supply in a relatively illiquid float, especially with high staking participation. This creates reflexivity: higher prices attract more attention and flows.

• Ecosystem beta: When Solana majors rally, Solana ecosystem tokens and NFTs often follow, generating wealth effects that feedback into SOL via fees, staking, and treasury rebalancing.

• On-chain revenues and usage: Fees and MEV-like revenue capture, combined with consistent L1 usage, differentiate SOL as more than a speculative token. If fee markets remain healthy without compromising UX, valuations can adjust quickly.

• Capital markets maturity: Prime brokerage services, credit lines, and custodial lending for SOL increase leverage capacity for funds. Managed responsibly, this deepens liquidity and smooths volatility while supporting upside.

•

Institutional Signaling and Order Flow Dynamics

Institutions leave footprints:

• Options skew: A shift toward call dominance and tightening call spreads near key strikes suggests demand for upside exposure. Calendar spreads can hint at timing expectations around catalysts like ETF decisions or protocol upgrades.

• Basis behavior: Persistent positive basis with manageable funding indicates steady demand for levered long exposure without frothy excess. Sharp basis expansions often precede blow-off tops, but controlled elevations are constructive.

• Block trade prints: Larger fills on the offer with minimal price impact imply sophisticated execution algorithms are absorbing liquidity. VWAP-style participation in uptrends is a hallmark of fund flows.

•

Solana Fundamentals: Not Just Hype

The bullish case is reinforced by fundamentals:

• Throughput and reliability improvements: Ongoing client and scheduler upgrades have meaningfully reduced congestion and improved consistency, aligning the chain for mainstream-scale apps.

• Developer ecosystem: Grants, hackathons, and venture inflows are driving an uptick in deployment across DeFi, DePIN, payments, and consumer social. More apps mean more transactions, fees, and network effects.

• Staking and validator health: A broad validator set with improving decentralization metrics, plus liquid staking growth, provides both security and capital efficiency. Mature slashing protections and monitoring infrastructure reduce operational risk.

• Cross-ecosystem bridges and RWAs: Safer bridging architectures and the growth of tokenized real-world assets on Solana expand the total addressable market and institutional relevance.

The UAE Vector: Why Location Matters

The decision to anchor a Solana treasury in the UAE amplifies several advantages:

• Regulatory clarity: Entities can obtain approvals and operate with predictable oversight, facilitating custody, staking, and DeFi participation at institutional scale.

• Geographic diversification: Reduces dependence on US and EU regulatory cycles, creating a global liquidity map that supports 24/7 markets.

• Access to sovereign and family office capital: The region’s investor base is comfortable with alternative assets, infrastructure, and frontier technologies, making Solana’s high-throughput narrative particularly compelling.

• Talent and infrastructure: The UAE’s growing fintech and crypto workforce supports operational resilience for treasury and market activities.

Risk Factors and What Could Go Wrong

No thesis is complete without acknowledging risk:

• Regulatory shifts: Unexpected adverse rulings in key jurisdictions, or delays/denials around ETFs, could dampen flows and sentiment.

• Network incidents: Performance degradation or security issues would hurt adoption narratives and compress multiples.

• Liquidity shocks: If derivatives positioning becomes crowded, a deleveraging event could trigger cascading liquidations. Watch funding, OI, and CVI-like measures.

• Macro correlation: A sharp risk-off in global markets—driven by rates, growth scares, or geopolitical events—can compress crypto valuations, including SOL, even amid strong fundamentals.

• Competitive pressure: Advances from competing L1s or L2s, especially around modular architectures and data availability, could siphon developer and liquidity attention.

Signals to Track in the Coming Months

For investors and observers, keep an eye on:

• ETF decision timelines: Not just for SOL, but for broader crypto products. Watch S-1 updates, surveillance-sharing agreements, and authorized participant rosters.

• On-chain metrics: Daily active addresses, fee revenue, transaction success rates, and validator participation. Sustained growth here supports the fundamental re-rating.

• Derivatives health: Funding rates, options IV, skew, and term structure. Healthy markets allow trends to persist without disorderly squeezes.

• Treasury disclosures: Any public filings, attestations, or wallet monitoring from Solmate and similar entities. Evidence of steady accumulation bolsters the thesis.

• Ecosystem catalysts: Major app launches, RWA integrations, payments partnerships, and mobile distribution wins (e.g., Saga ecosystem) that translate to real usage.

Strategy Considerations for Different Participants

• Long-only funds: Dollar-cost averaging with disciplined rebalancing can mitigate timing risk. Consider partial hedges around known catalysts to manage drawdowns.

• Crypto-native funds: Use options to express directional views while capping tail risk. Calendar call spreads around ETF windows or ecosystem launches can be capital-efficient.

• Corporates and treasuries: For those inspired by Solmate’s model, start with staking policies, custody/vendor selection, and risk dashboards. Establish governance before deploying into DeFi strategies.

• Retail participants: Avoid over-leverage. Respect invalidation levels and maintain a cash buffer. Focus on time in market rather than perfect entries.

•

Why This Cycle Is Different for Solana

Cycles rhyme, but specific drivers evolve. For SOL, three differentiators stand out:

• Real usage at scale: Consumer-grade apps processing real volumes, with fee revenues that matter.

• Institutional-grade infrastructure: Custody, staking-as-a-service, credit lines, and compliance tooling that make large allocations feasible.

• Global capital alignment: The UAE initiative symbolizes a broader dispersion of crypto capital formation—less dependent on any single regulator or geography.

The Road to ATH and Beyond

Reclaiming all-time highs requires both narrative strength and structural support. Solana’s current setup has:

• Narrative: High-throughput chain powering next-gen consumer and financial apps, now validated by serious capital allocators.

• Structure: Disciplined treasury formation, institutional flows, deepening derivatives, and growing on-chain revenues.

A move to fresh ATHs could unfold in stages:

1. Clearance of major resistance with rising spot volume

2. Healthy consolidation with elevated but not extreme funding

3. Fresh leg higher fueled by ecosystem beta and positive macro catalysts (ETF approvals, corporate adoption)

4. Volatility expansion near psychological round numbers, followed by a volatility contraction if treasuries and market makers absorb flows

If these stages play out with controlled leverage and robust spot participation, the path toward $300+ becomes more than aspirational—it becomes a function of order flow and narrative reflexivity.

Bottom Line

• Solmate’s $300 million launch to build a Solana treasury in the UAE is a landmark institutional milestone that could catalyze regional and global capital into SOL and its ecosystem.

• Institutional players like Forward Industries are signaling a pronounced shift toward Solana, reinforcing a buying frenzy dynamic supported by liquidity and execution improvements.

• The likely approval of multiple crypto ETFs later this year is a macro tailwind that indirectly benefits SOL, even before any Solana-specific ETF comes to market.

• Technicals align with fundamentals: higher lows, constructive volume, favorable moving averages, and bullish momentum patterns support the case for an ATH retest and potential breakout toward $300+.

• Risks remain—regulatory, network, liquidity—but the balance of probabilities currently favors continued upside as on-chain usage, institutional infrastructure, and global capital alignment strengthen.

As always, this is not financial advice. Markets are volatile, and conditions can change quickly. But with treasury formation ramping, institutional flows accelerating, and technicals confirming, Solana’s next chapter is setting up to be its most consequential yet. If the current trajectory holds—anchored by the UAE treasury initiative and sustained by institutional adoption—SOL’s bid for new all-time highs and beyond looks not just plausible, but increasingly likely.

Solana: Selling Pressure Hits 6-Month High as SOL Price Nears $2Currently, Solana trades at $235, sitting just 6% below the $250 milestone. Over the weekend, SOL attempted to reach this target but failed. However, it has managed to hold steady above the $232 support level.

If bullish momentum continues, Solana could rebound from $232 and test resistance at $242. A successful breach, particularly if long-term holders slow their selling. This could push SOL toward reclaiming $250 in the near term.

However, if selling pressure from long-term holders accelerates, Solana may struggle to defend $232 as support. This scenario could result in a correction toward $221, undermining bullish momentum and invalidating near-term upward projections.

SOLUSD H4 | Bullish bounce offBased on the H4 chart analysis, we could see the price fall to the buy entry, which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to the take profit.

Buy entry is at 217.27, which is a pullback support that lines up with the 50% Fibonacci retracement.

Stop loss is at 200.35, which is a pullback support.

Take profit is at 244.30, which is a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SOL Parabolic Run Despite the recent chop, when you zoom out to the 1D timeframe there is a clear pattern being followed since the April crash.

From the sub $100 low Solana has posted progressively higher lows in a parabolic fashion. The highs on the other hand are in more of a linear fashion as shown by the diagonal S/R level, at first it provided support and now since March it has been resistance.

So for me there are two possible actionable trades:

- Continuation of the parabolic move, this would include flipping the Diagonal S/R level, currently at time of writing this resistance level is being tested, a close above gives a better possibility of the rally continuing.

- The rally becomes exhausted and fails to flip the Diagonal S/R and loses the parabolic support level. Should this support break $185 is the first target (light green zone), $160 as the second target (dark green zone).

Important to remember we have CPI & FOMC rapidly approaching that could provide the volatility to trigger either of these moves, lets see what happens next.

SOLANA UPDATEHello friends🙌

📉Given the decline we had, you can see that buyers came in and supported the price and were able to change the trend and create an ascending channel.

📈Now, considering that the price is hitting higher ceilings and floors, we can expect an ascending wave until the ceiling of the channel.

Don't forget risk and capital management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

Up or down?Hello friends

Well, considering the growth we had, the analysis of which we have already given you and it was full target, now we needed to go for another update.

Well, considering the price growth, there is an important resistance area on our way that they have determined for us.

If this resistance is validly broken, the price can move to the specified targets, but what if the price cannot break the resistance?

Well, don't worry, we have another scenario where if the price fails to break the resistance and falls, we have identified good support areas that if reached, the price can grow well to the set targets. Finally, it must be said that given the large number of buyers and the buying pressure we have in Solana, sooner or later, I think this resistance will be broken and we will see higher numbers.

*Trade safely with us*

SOLANA (SOL/USD) C&H TG: 295 → 341→ 370 → 450 → 475 → 523SOL/USD is building a multi-year Cup & Handle on the weekly chart, signaling the potential start of a major long-term bull cycle. Price has reclaimed the breakout trigger at 218.50 and is heading towards the key breakout zone at 260–295. A clean weekly close above this zone can confirm a structural breakout and shift the market structure bullish on the higher timeframe.

Once confirmed, the long-term measured move points to 341–370 initially, followed by extended targets at 450 → 475 → 523. Any sustained hold above 260–295 will likely flip this zone into a strong demand base, supporting a multi-month uptrend.

Ideal strategy for investors: Accumulate gradually on dips near 218.50–230, add on confirmed weekly close above 260, and hold for long-term trend targets with a protective stop below 206 to manage downside risk.