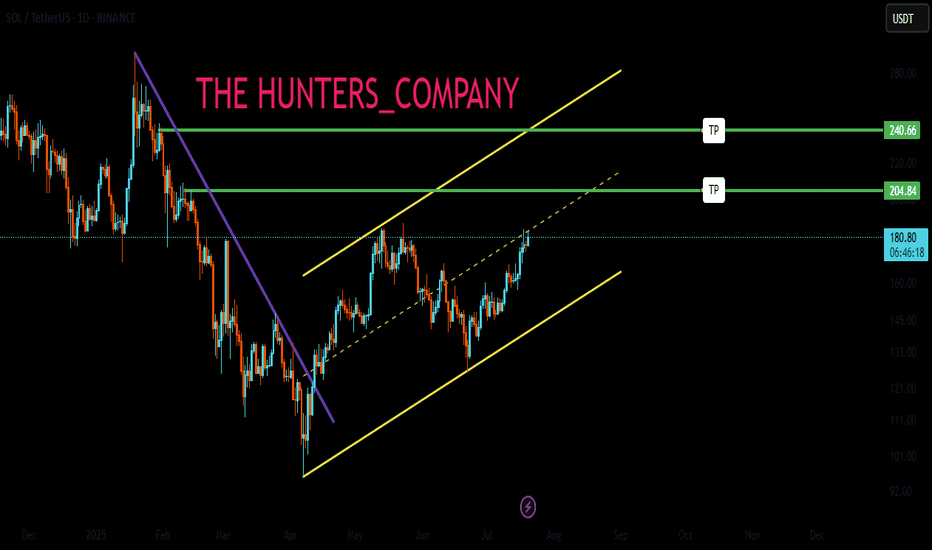

SOL/USDT: Pullback Toward Key Confluence Zone After Double TopSOL/USDT is currently retracing from the 250 resistance zone after forming a double top pattern, signaling near-term weakness. On the 4H chart, an upward channel intersects with a downward trendline, creating a critical confluence area between 200 and 210.

If the price rebounds from this zone, buyers may attempt a retest of 230, with potential to extend the move higher. The broader bullish structure remains intact as long as support at 200 holds, keeping the upside momentum in play

Solusdt

SOL Market Update📊 CRYPTOCAP:SOL Market Update

If SOL keeps retracing and arrives at the green support zone, watch for confirmation before entering long, as this is where buyers could step in and push the price up again.

🔹 Second important level is the red resistance zone — sellers are still active there. If the price returns to this zone, be aware of a possible retracement, but it could also be a potential short opportunity.

#SOL/USDT bullish structure formed at the chart#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward move.

There is a major support area in green at 216, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 218

First target: 227

Second target: 234

Third target: 244

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Crypto Market Weekly Review: Trend Structures and Key ExpectatioOverall trends continue to develop within the macro structures outlined in previous weekly reviews. Some assets (BNB, SOL, HYPE) are already in new uptrends, while others are only starting to form the first impulsive moves within broader bullish structures.

In the coming days, I expect local downside pressure to complete the ongoing September corrections, followed by a continuation of the uptrend toward target resistance zones. Another wave of Autumn consolidation is likely to follow afterward.

From a macro perspective, as long as prices hold above their key support zones, I continue to view the September lows as important macro higher-lows. Below these levels, most coins (possibly with the exception of ETH) are unlikely to fall and should instead continue forming higher lows ahead of a more sustainable rally into Q4.

⸻

BINANCE:BNBUSDT

Chart:

Support: 1000–930

Resistance: 1135–1150

⸻

BINANCE:BTCUSDT

Chart:

Support: 115–113.3K

Resistance: 120–122K

⸻

BINANCE:XRPUSDT

Chart:

Support: 2.97–2.91 / 2.85

Resistance: 3.30–3.40

⸻

BINANCE:ETHUSDT

Chart:

Support: 3380

Resistance: 5060–5235

⸻

BINANCE:SOLUSDT

Chart:

Support: 230–223

Resistance: 285–310

⸻

$HYPEHUSDT

Chart:

Support: 52.5–51

Resistance: 67–73

Feel free to comment which coins and assets you’re most interested in, and I’ll prepare a separate review on them.

Thank you for your attention, and wishing you a successful week ahead!

SOL AGAIN/;Hello friends

You see that the price is stuck in a trading range and you must know that 80% of failures in trading ranges are fake!

Now, as the trading range lengthens, we can finally wait for its failure, and if it fails, the price will move by the same amount as the trading range.

*Trade safely with us*

#SOL/USDT bullish structure formed at the chart#SOL

The price is moving in a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a major support area in green that pushed the price higher at 236.

Entry price: 240.

First target: 243.

Second target: 246.

Third target: 249.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#SOL/USDT bullish structure formed at the chart#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 233, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 236

First target: 238

Second target: 241

Third target: 244

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Solana Price Forecast | SOLUSDT Market OutlookSOLUSDT has completed a strong upward cycle and is now unwinding through a structured retracement. This phase is not showing disorderly selling but rather a controlled reset, where liquidity is being cleared to prepare for the next expansion.

The chart reflects a market that is cycling through accumulation, breakout, and pullback phases with consistency. Current downside movement is shaping a foundation zone that could serve as the springboard for renewed upward momentum.

Overall, the asset is displaying a constructive trajectory: corrections are functioning as fuel rather than weakness, pointing toward continuation of its broader growth path once this reset stabilizes.

Signal Breakout as SOL Targets ATH and $300+Solmate’s $300M Launch in the UAE Sparks Solana Treasury Wave: Institutions Signal Breakout as SOL Targets ATH and $300+

The Solana ecosystem is entering a critical new phase of institutional adoption and capital formation, with multiple catalysts converging to form one of the strongest bullish narratives in crypto today. The headline development: Solmate has launched with a $300 million mandate to establish a Solana-focused treasury in the United Arab Emirates. This move, paired with growing institutional interest, potential ETF approvals, and increasingly favorable technicals, has set the stage for a potential breakout rally. Some market participants now see a credible pathway to $300+ for SOL, while others point to new all-time highs as fundamentals and momentum align.

This piece explores the strategic implications of Solmate’s treasury launch, the growing momentum behind Solana among institutions like Forward Industries, the macro tailwinds surrounding ETF approvals, and the technical structure that supports a bullish continuation. We’ll also assess the potential risks, the role of on-chain growth, and how the UAE’s regulatory and capital environment could accelerate Solana’s trajectory.

Solmate’s $300M UAE Treasury: Why It Matters

Solmate’s $300 million capital pool dedicated to establishing a Solana treasury in the UAE is more than a headline number—it’s a signal that institutional-grade asset management for crypto-native assets is globalizing beyond traditional finance hubs. The UAE, and particularly Abu Dhabi and Dubai, have positioned themselves as crypto-forward jurisdictions with clear regulatory sandboxes and proactive frameworks. Establishing a Solana treasury there creates:

• A regional liquidity hub: Concentrating capital in a friendly regulatory environment can improve market depth for SOL and Solana-native assets during aggressive expansion phases.

• Institutional standardization: A treasury framework can adopt disciplined risk controls, custody standards, and transparent rebalancing strategies, making it a template for other funds and corporates to emulate.

• On-ramp for Middle Eastern capital: Sovereign wealth funds, family offices, and regional asset managers have shown interest in digital assets. A Solana-focused treasury in the UAE lowers friction for capital allocation.

•

Mechanics of a Solana Treasury

Treasury operations are more than passive holdings. They typically involve:

• Core SOL accumulation: A base allocation that reflects long-term conviction in network value capture, staking yields, and governance.

• Liquidity provisioning: Deploying assets in DeFi protocols, AMMs, and order books to enhance liquidity and earn fees, subject to risk controls.

• Staking strategies: Validator diversification, slashing protection, and yield optimization through auto-compounding and programmatic rebalancing.

• Venture and ecosystem exposure: Strategic allocations to Solana-native projects, tokens, real-world asset (RWA) initiatives, and infrastructure plays (or via index-like baskets).

• Hedging overlays: Options and perp hedges to manage drawdowns while maintaining directional exposure.

By anchoring these flows in the UAE, Solmate not only signals conviction; it operationalizes a repeatable structure that can absorb larger institutional checks as compliance frameworks and counterparties mature.

Forward Industries Bets Big on Solana

Forward Industries’ publicized pivot toward SOL underscores a broader shift: institutions are no longer simply “diversifying” into Solana—they are actively rotating into it as a core position. The drivers include:

• Performance-to-throughput ratio: Solana’s execution environment continues to deliver high throughput and sub-second finality with low fees, supporting consumer-grade applications such as payments, on-chain order books, and gaming without UX compromise.

• DePIN, payments, and consumer apps: From real-time order execution to growth in tokenized assets and payments rails, Solana’s app layer is demonstrating product-market fit in areas where latency and cost matter.

• Developer momentum: Tooling, runtimes, and TypeScript-centric development are attracting teams that want to ship quickly with rich UX. Growth in Saga and mobile-focused experiments adds tailwind.

• Liquidity concentration: As more capital pools into SOL pairs and Solana’s native DEXs, slippage decreases and the market becomes more attractive for block-sized orders.

The “buying frenzy” moniker stems from combined flows across centralized exchanges, on-chain wallets, staking platforms, and prime brokers. Institutional trade sizes are up, and block liquidity providers report rising interest for SOL borrow and cross-margin facilities—both signposts that levered directional exposure and basis trades are heating up.

The ETF Wave: SEC Approvals Could Reshape Flows

A critical macro catalyst is the likelihood of multiple ETF approvals in the coming months. While much of the focus has been on Bitcoin and Ethereum, the structural changes triggered by ETF adoption—standardized custody, audited NAV calculations, and regulated market-making—create spillover effects across large-cap crypto assets.

Here’s why ETF approvals matter to Solana:

• Legitimacy funnel: When institutions obtain board approvals for crypto exposure via ETFs, internal compliance friction declines. From there, investment committees often explore other large-cap crypto assets with similar liquidity and adoption—enter SOL.

• Portfolio construction: Multi-asset crypto strategies reweight based on momentum, liquidity, and correlations. If BTC and ETH ETF flows stabilize, allocators often diversify into high-beta assets with compelling adoption narratives—again, SOL is a prime candidate.

• Derivatives market deepening: ETF market-making expands basis, options, and hedging activity. Robust hedging tools lower the barrier to building large SOL positions.

Even if a Solana ETF is not immediately approved, the institutional infrastructure and behavioral changes catalyzed by BTC/ETH ETFs provide a clear path for capital to migrate into SOL through other compliant vehicles.

Technical Structure: SOL Aligns for a Breakout

From a technical perspective, SOL’s setup reflects several bullish elements frequently observed in assets that break into new cyclical highs:

• Higher lows and a strong weekly structure: Persistent higher lows on the weekly timeframe suggest bid support from larger accounts. Breakouts from multi-month accumulation ranges often lead to trend extensions.

• Volume confirmation: Rising volume on up weeks and muted sell volume on retracements indicate absorption by patient buyers. This is often a hallmark of institutional accumulation.

• Moving average alignment: When the 50-day and 200-day moving averages turn up in tandem and compress beneath price, they function as dynamic support. Golden cross conditions on high timeframes historically reinforce trend persistence.

• Momentum oscillators: Constructive RSI behavior (staying in bullish regimes, respecting 50-55 on pullbacks) supports the case for sustained upside. MACD crossovers above the zero line add confirmation.

• Market structure breaks: If SOL clears prior supply zones with strong breadth in Solana ecosystem tokens, it often precedes a sharp expansion leg.

From a pure charting lens, the path to retest the all-time high (ATH) becomes plausible once prior resistance shelves are flipped to support with convincing retests. The next leg can extend if funding stays balanced and derivatives don’t overheat.

Why $300+ Is on the Table

Calling specific price targets in crypto is always probabilistic, but the $300+ scenario reflects a confluence of factors:

• Elastic demand: As SOL regains narrative dominance, every incremental institutional participant must source supply in a relatively illiquid float, especially with high staking participation. This creates reflexivity: higher prices attract more attention and flows.

• Ecosystem beta: When Solana majors rally, Solana ecosystem tokens and NFTs often follow, generating wealth effects that feedback into SOL via fees, staking, and treasury rebalancing.

• On-chain revenues and usage: Fees and MEV-like revenue capture, combined with consistent L1 usage, differentiate SOL as more than a speculative token. If fee markets remain healthy without compromising UX, valuations can adjust quickly.

• Capital markets maturity: Prime brokerage services, credit lines, and custodial lending for SOL increase leverage capacity for funds. Managed responsibly, this deepens liquidity and smooths volatility while supporting upside.

•

Institutional Signaling and Order Flow Dynamics

Institutions leave footprints:

• Options skew: A shift toward call dominance and tightening call spreads near key strikes suggests demand for upside exposure. Calendar spreads can hint at timing expectations around catalysts like ETF decisions or protocol upgrades.

• Basis behavior: Persistent positive basis with manageable funding indicates steady demand for levered long exposure without frothy excess. Sharp basis expansions often precede blow-off tops, but controlled elevations are constructive.

• Block trade prints: Larger fills on the offer with minimal price impact imply sophisticated execution algorithms are absorbing liquidity. VWAP-style participation in uptrends is a hallmark of fund flows.

•

Solana Fundamentals: Not Just Hype

The bullish case is reinforced by fundamentals:

• Throughput and reliability improvements: Ongoing client and scheduler upgrades have meaningfully reduced congestion and improved consistency, aligning the chain for mainstream-scale apps.

• Developer ecosystem: Grants, hackathons, and venture inflows are driving an uptick in deployment across DeFi, DePIN, payments, and consumer social. More apps mean more transactions, fees, and network effects.

• Staking and validator health: A broad validator set with improving decentralization metrics, plus liquid staking growth, provides both security and capital efficiency. Mature slashing protections and monitoring infrastructure reduce operational risk.

• Cross-ecosystem bridges and RWAs: Safer bridging architectures and the growth of tokenized real-world assets on Solana expand the total addressable market and institutional relevance.

The UAE Vector: Why Location Matters

The decision to anchor a Solana treasury in the UAE amplifies several advantages:

• Regulatory clarity: Entities can obtain approvals and operate with predictable oversight, facilitating custody, staking, and DeFi participation at institutional scale.

• Geographic diversification: Reduces dependence on US and EU regulatory cycles, creating a global liquidity map that supports 24/7 markets.

• Access to sovereign and family office capital: The region’s investor base is comfortable with alternative assets, infrastructure, and frontier technologies, making Solana’s high-throughput narrative particularly compelling.

• Talent and infrastructure: The UAE’s growing fintech and crypto workforce supports operational resilience for treasury and market activities.

Risk Factors and What Could Go Wrong

No thesis is complete without acknowledging risk:

• Regulatory shifts: Unexpected adverse rulings in key jurisdictions, or delays/denials around ETFs, could dampen flows and sentiment.

• Network incidents: Performance degradation or security issues would hurt adoption narratives and compress multiples.

• Liquidity shocks: If derivatives positioning becomes crowded, a deleveraging event could trigger cascading liquidations. Watch funding, OI, and CVI-like measures.

• Macro correlation: A sharp risk-off in global markets—driven by rates, growth scares, or geopolitical events—can compress crypto valuations, including SOL, even amid strong fundamentals.

• Competitive pressure: Advances from competing L1s or L2s, especially around modular architectures and data availability, could siphon developer and liquidity attention.

Signals to Track in the Coming Months

For investors and observers, keep an eye on:

• ETF decision timelines: Not just for SOL, but for broader crypto products. Watch S-1 updates, surveillance-sharing agreements, and authorized participant rosters.

• On-chain metrics: Daily active addresses, fee revenue, transaction success rates, and validator participation. Sustained growth here supports the fundamental re-rating.

• Derivatives health: Funding rates, options IV, skew, and term structure. Healthy markets allow trends to persist without disorderly squeezes.

• Treasury disclosures: Any public filings, attestations, or wallet monitoring from Solmate and similar entities. Evidence of steady accumulation bolsters the thesis.

• Ecosystem catalysts: Major app launches, RWA integrations, payments partnerships, and mobile distribution wins (e.g., Saga ecosystem) that translate to real usage.

Strategy Considerations for Different Participants

• Long-only funds: Dollar-cost averaging with disciplined rebalancing can mitigate timing risk. Consider partial hedges around known catalysts to manage drawdowns.

• Crypto-native funds: Use options to express directional views while capping tail risk. Calendar call spreads around ETF windows or ecosystem launches can be capital-efficient.

• Corporates and treasuries: For those inspired by Solmate’s model, start with staking policies, custody/vendor selection, and risk dashboards. Establish governance before deploying into DeFi strategies.

• Retail participants: Avoid over-leverage. Respect invalidation levels and maintain a cash buffer. Focus on time in market rather than perfect entries.

•

Why This Cycle Is Different for Solana

Cycles rhyme, but specific drivers evolve. For SOL, three differentiators stand out:

• Real usage at scale: Consumer-grade apps processing real volumes, with fee revenues that matter.

• Institutional-grade infrastructure: Custody, staking-as-a-service, credit lines, and compliance tooling that make large allocations feasible.

• Global capital alignment: The UAE initiative symbolizes a broader dispersion of crypto capital formation—less dependent on any single regulator or geography.

The Road to ATH and Beyond

Reclaiming all-time highs requires both narrative strength and structural support. Solana’s current setup has:

• Narrative: High-throughput chain powering next-gen consumer and financial apps, now validated by serious capital allocators.

• Structure: Disciplined treasury formation, institutional flows, deepening derivatives, and growing on-chain revenues.

A move to fresh ATHs could unfold in stages:

1. Clearance of major resistance with rising spot volume

2. Healthy consolidation with elevated but not extreme funding

3. Fresh leg higher fueled by ecosystem beta and positive macro catalysts (ETF approvals, corporate adoption)

4. Volatility expansion near psychological round numbers, followed by a volatility contraction if treasuries and market makers absorb flows

If these stages play out with controlled leverage and robust spot participation, the path toward $300+ becomes more than aspirational—it becomes a function of order flow and narrative reflexivity.

Bottom Line

• Solmate’s $300 million launch to build a Solana treasury in the UAE is a landmark institutional milestone that could catalyze regional and global capital into SOL and its ecosystem.

• Institutional players like Forward Industries are signaling a pronounced shift toward Solana, reinforcing a buying frenzy dynamic supported by liquidity and execution improvements.

• The likely approval of multiple crypto ETFs later this year is a macro tailwind that indirectly benefits SOL, even before any Solana-specific ETF comes to market.

• Technicals align with fundamentals: higher lows, constructive volume, favorable moving averages, and bullish momentum patterns support the case for an ATH retest and potential breakout toward $300+.

• Risks remain—regulatory, network, liquidity—but the balance of probabilities currently favors continued upside as on-chain usage, institutional infrastructure, and global capital alignment strengthen.

As always, this is not financial advice. Markets are volatile, and conditions can change quickly. But with treasury formation ramping, institutional flows accelerating, and technicals confirming, Solana’s next chapter is setting up to be its most consequential yet. If the current trajectory holds—anchored by the UAE treasury initiative and sustained by institutional adoption—SOL’s bid for new all-time highs and beyond looks not just plausible, but increasingly likely.

Crypto Charts & Levels (Live Breakdown)All Charts & Levels From Today’s Live Breakdown 🎯📈

Here’s the complete walkthrough from today’s live session — a jam-packed review of everything on the radar. From majors like ETH to niche plays like KEETA, we’re covering support, resistance, and directional bias one by one 👇

🔹 ETHEREUM (ETH)

Support: 4,551

Target: 4,881 short-term — with potential to hit 5,500 later this month.

I’m bullish. ATH is back on the table.

🔹 BITCOIN DOMINANCE (BTC.D)

Levels: 54 and 56

Still looking good — dominance rotation in play.

🔹 ETHEREUM DOMINANCE (ETH.D)

Under resistance — watch smaller alts.

ETH remains bullish vs BTC — target: 0.06

🔹 XRP

Support: 0.32

Bias: Bullish — looking ready to move again.

🔹 ARBITRUM (ARB)

Resistance: 0.55–0.56

Break that, and 0.76 → 1.31 opens up.

🔹 GRT & STX

Slow. Uninspiring. Out for now.

🔹 WLD

Support: 1.49

Target: 2.52 — In this one. Clean chart.

🔹 TRX

Missed entry at 0.30

Potential: 0.38 → 0.46–0.47

Too volatile. Not chasing.

🔹 ICP & UNI

Breakout failures — I’m staying out.

🔹 AVAX

Support: 30

Resistance: 35

Target: 43 → 46

Already took profit. Caution on late entries.

🔹 SHIBA INU (SHIB)

Support: 13.05

Target: 16.16

Waiting for breakout over resistance. Still holding.

🔹 LITECOIN (LTC)

Support: 104

Target: 131 → 188

Watching. Not yet confirmed breakout.

🔹 DOGECOIN (DOGE)

Resistance: 0.30–0.309

We traded this channel well. No entry now — but staying alert.

🔹 TONCOIN (TON)

Support: 2.90

Resistance: 3.74

Breakout = target 6.00

Might wake up soon, but not entering yet.

🔹 INJECTIVE (INJ)

Support: 12

Resistance: 14.95 → 15.71

Middle of the range. I’ll pass.

🔹 OPTIMISM (OP)

Resistance: 0.88

Alert set — will enter on breakout only.

🔹 SNX

Resistance: 0.78

Same as OP — needs breakout before entry.

🔹 PYTH

Entry triggered live: Over 0.1739

Target: 0.2130

Stop loss at 0.172 — already long on this one.

🔹 H-BAR

Resistance-heavy around 0.26–0.28

Not touching it. Possible short setup only.

🔹 SUI

Resistance: 3.97

Buying either over resistance or deep at support. No trade now.

🔹 SEI

Targets on breakout: 0.603 → 0.75 → 1.10

Potential setup — needs patience.

🔹 PUMP

Big resistance: 0.0084

No trade right now. Staying out.

🔹 MYX

Possible short: Down to 11.81

We nailed previous shorts. Not chasing this one although tempted to shortagain..i am bulish today so no.

🔹 ENA (Amazing chart)

Support: 0.67

Targets: 0.91 → 1.05

Strong chart. I like this setup.

🔹 KEETA

Support: 0.77

Target 1: 1.18

Target 2: 1.54

Target 3: 1.82

Moon Target: 2.17

Below 0.77 → run. Below 0.49 = out completely.

Fundamentals unknown, but chart is clean. If traction comes, levels are clear.

🔁 Perspective Shift 🔄

“Even with a full board of setups, the best trades are the ones you don’t take. Clarity beats quantity — always wait for the right level, not the right feeling.”

Disclaimer: My posts reflect personal observations, not instructions to buy or sell. I am not a financial advisor. Trading carries risk, and only you are responsible for your results.

One Love,

The FXPROFESSOR 💙

SOL/USDT | Solana Correction Over? Big Rally Loading Soon!By analyzing the Solana chart on the daily timeframe, we can see that after a correction, the price is now trading around $234. In the short term, I expect a small pullback, followed by another strong bullish move from this coin.

The key demand zone is between $210–$220, while the possible upside targets are $250, $260, and $296.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Solana: Selling Pressure Hits 6-Month High as SOL Price Nears $2Currently, Solana trades at $235, sitting just 6% below the $250 milestone. Over the weekend, SOL attempted to reach this target but failed. However, it has managed to hold steady above the $232 support level.

If bullish momentum continues, Solana could rebound from $232 and test resistance at $242. A successful breach, particularly if long-term holders slow their selling. This could push SOL toward reclaiming $250 in the near term.

However, if selling pressure from long-term holders accelerates, Solana may struggle to defend $232 as support. This scenario could result in a correction toward $221, undermining bullish momentum and invalidating near-term upward projections.

$Sol Daily Bearish Divergence with Key Supports at $220Solana is flashing some important signals across multiple timeframes right now.

On the daily chart, a clear bearish divergence has formed while buying volume is steadily declining. This setup usually points toward a healthy correction phase. At the moment, SOL looks like it could slide toward the $225–$220 zone, where we might see the first reaction.

If SOL manages to hold above $200 support, this pullback could simply turn into a higher low, setting the stage for continuation upward. But here’s the caution: losing $200 means breaking the last structural support, which could flip the trend and open the doors for a new lower low — potentially triggering a much larger dump.

👉 In short: Watch the $225–$220 range for short-term correction targets. Keep a close eye on the $200 level, because that’s the line between a healthy pullback and a bearish breakdown.

Trade safe and don’t chase candles — let the levels confirm the story.

SOLANA UPDATEHello friends🙌

📉Given the decline we had, you can see that buyers came in and supported the price and were able to change the trend and create an ascending channel.

📈Now, considering that the price is hitting higher ceilings and floors, we can expect an ascending wave until the ceiling of the channel.

Don't forget risk and capital management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

Important resistance blocking the way to the ascent...Hello friends

Well, we have a downtrend, and you can see that we have drawn a resistance for it, and the price has hit this resistance twice.

After the second hit, the price has fallen to the specified support area, and in that area a double bottom pattern has formed, and the price has been supported. Now, considering the support in this price area, we need to see if the buyers can break the specified resistance or not?

If the resistance is broken, the price can move up to the two specified areas, but if the price falls, we need to see if the support that once supported the price and caused the price to grow can support it again or not?

So, follow capital and risk management

*Trade safely with us*

Up or down?Hello friends

Well, considering the growth we had, the analysis of which we have already given you and it was full target, now we needed to go for another update.

Well, considering the price growth, there is an important resistance area on our way that they have determined for us.

If this resistance is validly broken, the price can move to the specified targets, but what if the price cannot break the resistance?

Well, don't worry, we have another scenario where if the price fails to break the resistance and falls, we have identified good support areas that if reached, the price can grow well to the set targets. Finally, it must be said that given the large number of buyers and the buying pressure we have in Solana, sooner or later, I think this resistance will be broken and we will see higher numbers.

*Trade safely with us*

$SOL Skyrockets to 240: Catch the Bull Run! BINANCE:SOLUSDT

CRYPTOCAP:SOL Skyrockets to 240: Catch the Bull Run!

Entry Level: Marked at 1 (240.00 USDT), suggesting a potential buy point near the current price.

Take Profit (TP) Levels:TP1: 0.786 (228.33 USDT)

TP2: 0.618 (219.17 USDT)

TP3: 0.5 (212.73 USDT)

TP4: 0.185 (185.46 USDT)

Stop Loss (SL): Set at -1.272 (254.84 USDT), indicating a level to exit if the price moves against the trade.

Dead Cat Bounce (DCB): Marked at -1.135 (247.36 USDT), possibly indicating a minor reversal point.

RSI (Relative Strength Index)Current RSI: Around 80.93, which is in the overbought territory (above 70), suggesting the asset may be overvalued and could be due for a pullback or consolidation.

Trend: The RSI has risen sharply in recent days, aligning with the price surge, indicating strong momentum but also potential overextension.

Key ObservationsThe chart indicates a bullish breakout with significant upward momentum, but the overbought RSI suggests caution. Traders might consider taking profits at the marked TP levels or waiting for a pullback to the entry or lower TP levels.

The SL is set above the recent high, providing a buffer against a potential reversal.

The analysis appears to use a Fibonacci-based strategy, with levels derived from a recent swing high and low.

SOL/USDT | SOL Breaks 7-Month High – Still Bullish Above $218!By analyzing the Solana chart on the daily timeframe, we can see that the price is still pushing toward higher targets based on the main analysis. It has reached its highest level in the past 7 months and is currently trading around $225.

If the price holds above the key $218 level, we can expect further growth toward levels above $245. This analysis will be updated again. So far, the return from this setup has been more than 52% — I hope you’ve made the most of it!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

SOL & Memes | Is Solana season here ?From Weekend Hero to Market King

Sol szn is here ? YESS, We are 70% up since our last analysis and recent data strongly suggests we might be entering the early days of SOL mania, Here’s why

1.SOL Outperformed BTC and ETH This Weekend: Solana delivered significantly better returns compared to Bitcoin and Ethereum over the weekend. don't let me compare it with Eth cuz it will break Eth holders Soul

2.Market Cap Milestone: Solana's total market capitalization hit an all time high earlier today, now making up 3.53% of the entire cryptocurrency market with a valuation of $114.3 billion.

3.Dominating Daily Net Inflows: As of now, SOL tops the leaderboard for daily net inflows.

4.Revenue Growth: Last week, Solana’s Real Economic Value (the revenue it generates) doubled its previous all-time high.

5.Meme coins often choose the Solana blockchain for a variety of reasons, primarily due to its unique technical advantages and its growing ecosystem. Here’s why: Low Transaction Costs, High Throughput and Scalability, Fast Transaction Speed, Strong Community and Ecosystem,Developer-Friendly Environment, Early Mover Advantage...

6.Weekend Trading Volumes: Between Saturday and Sunday night, SOL trading volumes surpassed those of all major altcoins.

All of this recent movement is huge for two specific groups of people:

-My wife, who has been worried sick since I told her I invested 100% of my life savings in Solana!

-Our followers, who got worded up on SOL around this time last year and load the dip at 20$

But will these trends hold, especially after ETH and BTC ETFs wrap up their first trading day of the week? Probably not but it’s worth noting how impressive this is, given Ethereum’s market cap is 3.3x larger than Solana’s, and Bitcoin’s is a staggering 16x bigger!

As you can see Sol ready for correction and pullback then it gets ready for Sol Mania

SOLANA (SOL/USD) C&H TG: 295 → 341→ 370 → 450 → 475 → 523SOL/USD is building a multi-year Cup & Handle on the weekly chart, signaling the potential start of a major long-term bull cycle. Price has reclaimed the breakout trigger at 218.50 and is heading towards the key breakout zone at 260–295. A clean weekly close above this zone can confirm a structural breakout and shift the market structure bullish on the higher timeframe.

Once confirmed, the long-term measured move points to 341–370 initially, followed by extended targets at 450 → 475 → 523. Any sustained hold above 260–295 will likely flip this zone into a strong demand base, supporting a multi-month uptrend.

Ideal strategy for investors: Accumulate gradually on dips near 218.50–230, add on confirmed weekly close above 260, and hold for long-term trend targets with a protective stop below 206 to manage downside risk.

SOLUSDT Rallies: Heading Towards New HighsSOL is in a strong uptrend, with the support level at 225.00 USD having been tested and held. The price is currently aiming for 250.00 USD, with technical indicators signaling the continuation of this trend. The clear upward trendline and institutional inflows are strengthening SOL's bullish momentum.

Forecast:

If SOL maintains above the 225.00 USD support, there is a high probability it will continue to rise towards 250.00 USD.

Buy SOL when the price retraces to the 225.00 USD support zone.

Set a stop loss below 220.00 USD to protect your capital.

US Unemployment Claims data came in higher than expected, weakening the USD, which provides favorable conditions for SOL to increase in value. Additionally, Forward Industries completed a 1.65 billion USD fundraising deal to build the Solana Treasury, with participation from Galaxy Digital, Jump Crypto, and Multicoin Capital, providing a strong boost for the Solana ecosystem.

SOL/USDT – The Powerful Wave Isn’t Over YetSolana is showcasing its strength by holding firmly above the 200 USDT psychological level while also being backed by massive inflows, with open interest hitting record highs. This clearly shows strong market confidence in SOL’s breakout potential.

On the 12H chart, the bullish structure remains crystal clear: price is clinging to the trendline, holding above both the EMA34 and EMA89, and bouncing solidly from support zones. The next key destination the market is eyeing is 223 USDT – a crucial resistance. If broken, Solana could easily open the path to even higher levels.

In short, both news and technicals are in sync: SOL/USDT’s bullish momentum is far from over – in fact, it’s gearing up for an even more impressive breakout.